Transcription

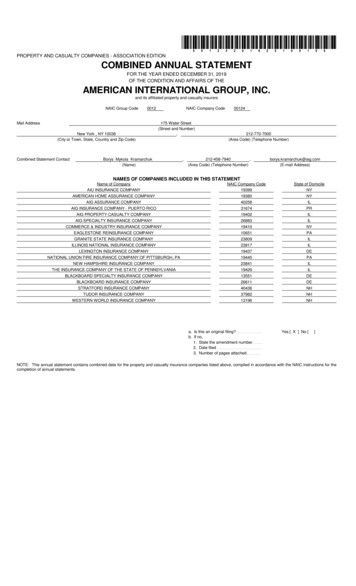

*00124201920100100*PROPERTY AND CASUALTY COMPANIES - ASSOCIATION EDITIONCOMBINED ANNUAL STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2019OF THE CONDITION AND AFFAIRS OF THEAMERICAN INTERNATIONAL GROUP, INC.and its affiliated property and casualty insurersNAIC Group Code0012Mail AddressNew York , NY 10038(City or Town, State, Country and Zip Code)Combined Statement ContactNAIC Company Code175 Water Street(Street and Number),Borys Mykola Kramarchuk(Name),00124212-770-7000(Area Code) (Telephone Number)212-458-7940,(Area Code) (Telephone Number)borys.kramarchuk@aig.com(E-mail Address)NAMES OF COMPANIES INCLUDED IN THIS STATEMENTName of CompanyAIU INSURANCE COMPANYNAIC Company Code19399State of DomicileNYAMERICAN HOME ASSURANCE COMPANY19380NYAIG ASSURANCE COMPANY40258ILAIG INSURANCE COMPANY - PUERTO RICO31674PRILAIG PROPERTY CASUALTY COMPANY19402AIG SPECIALTY INSURANCE COMPANY26883ILCOMMERCE & INDUSTRY INSURANCE COMPANY19410NYEAGLESTONE REINSURANCE COMPANY10651PAGRANITE STATE INSURANCE COMPANY23809ILILLINOIS NATIONAL INSURANCE COMPANY23817ILLEXINGTON INSURANCE COMPANY19437DENATIONAL UNION FIRE INSURANCE COMPANY OF PITTSBURGH, PA19445PANEW HAMPSHIRE INSURANCE COMPANY23841ILTHE INSURANCE COMPANY OF THE STATE OF PENNSYLVANIA19429ILBLACKBOARD SPECIALTY INSURANCE COMPANY13551DEBLACKBOARD INSURANCE COMPANY26611DESTRATFORD INSURANCE COMPANY40436NHTUDOR INSURANCE COMPANY37982NHWESTERN WORLD INSURANCE COMPANY13196NHa. Is this an original filing?b. If no,1. State the amendment number2. Date filed3. Number of pages attachedYes [ X ] No []NOTE: This annual statement contains combined data for the property and casualty insurance companies listed above, compiled in accordance with the NAIC instructions for thecompletion of annual statements.

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.ASSETS1.Bonds (Schedule D)2.Stocks (Schedule D):3.Current Year2AssetsNonadmitted Assets3Net Admitted Assets(Cols. 1 - 2)040,779,619,44140,779,619,441Prior Year4Net AdmittedAssets44,017,930,6942.1 Preferred stocks24,334,113024,334,11356,087,0332.2 Common gage loans on real estate (Schedule B):3.1 First liens3.2 Other than first liens4.1Real estate (Schedule A):04.1 Properties occupied by the company (less encumbrances)4.2 Properties held for the production of income (less0 encumbrances) 04.3 Properties held for sale (less encumbrances)5.Cash ( 371,932,138 , Schedule E - Part 1), cash equivalents658,273,797 , Schedule E - Part 2) and short-term119,990,299 , Schedule DA)investments ( ( 0 premium notes)6.Contract loans (including 7.Derivatives (Schedule DB)8.Other invested assets (Schedule BA)9.Receivable for securities10.Securities lending reinvested collateral assets (Schedule DL)00011.Aggregate write-ins for invested assets000012.Subtotals, cash and invested assets (Lines 1 to ,35313.Title plants less 0 charged off (for Title 917,112,0571,399,652,8621,460,624,92416.1 Amounts recoverable from reinsurers986,591,4680986,591,468913,025,00816.2 Funds held by or deposited with reinsured 7,356,418387,806,571only)14.Investment income due and accrued15.Premiums and considerations:15.1 Uncollected premiums and agents' balances in the course of collection15.2 Deferred premiums and agents' balances and installments booked but0deferred and not yet due (including earned but unbilled premiums)15.3 Accrued retrospective premiums ( contracts subject to redetermination ( 16.1,399,652,862 ) and0 )Reinsurance:16.3 Other amounts receivable under reinsurance contracts17.Amounts receivable relating to uninsured plans18.1 Current federal and foreign income tax recoverable and interest thereon18.2 Net deferred tax asset19.Guaranty funds receivable or on deposit20.Electronic data processing equipment and software21.Furniture and equipment, including health care delivery assets22.Net adjustment in assets and liabilities due to foreign exchange rates23.Receivables from parent, subsidiaries and affiliates( 0 )0 ) and other amounts receivable24.Health care ( 25.Aggregate write-ins for other than invested assets26.Total assets excluding Separate Accounts, Segregated Accounts andProtected Cell Accounts (Lines 12 to 25)27.From Separate Accounts, Segregated Accounts and Protected CellAccounts28.Total (Lines 26 and 43,516,033DETAILS OF WRITE-INS1199.Totals (Lines 1101 thru 1103 plus 1198)(Line 11 above)00002599.Totals (Lines 2501 thru 2503 plus 2598)(Line 25 above)898,897,30037,527,395861,369,905720,522,9152

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.LIABILITIES, SURPLUS AND OTHER FUNDS1Current Year2Prior Year26,219,961,7161.Losses (Part 2A, Line 35, Column 8)2.Reinsurance payable on paid losses and loss adjustment expenses (Schedule F, Part 1, Column 6)3.Loss adjustment expenses (Part 2A, Line 35, Column 9)4.Commissions payable, contingent commissions and other similar charges5.Other expenses (excluding taxes, licenses and fees)6.Taxes, licenses and fees (excluding federal and foreign income 1,992011.1 Stockholders0011.2 6,209,509,8990 on realized capital gains (losses))7.1 Current federal and foreign income taxes (including 7.2 Net deferred tax liability1,700,000 and interest thereon 08.Borrowed money 9.Unearned premiums (Part 1A, Line 38, Column 5) (after deducting unearned premiums for ceded reinsurance of 2,228,931,230 and including warranty reserves of 172,215,054 and accrued accident and0 for medical loss ratio rebate per the Public Healthhealth experience rating refunds including Service Act)10.Advance premium11.Dividends declared and unpaid:12.Ceded reinsurance premiums payable (net of ceding commissions)13.Funds held by company under reinsurance treaties (Schedule F, Part 3, Column 20)14.Amounts withheld or retained by company for account of others15.Remittances and items not allocated16.Provision for reinsurance (including 17.Net adjustments in assets and liabilities due to foreign exchange rates18.Drafts outstanding19.Payable to parent, subsidiaries and affiliates20.Derivatives21.Payable for securities22.Payable for securities lending23.Liability for amounts held under uninsured plans1,145,913 certified) (Schedule F, Part 3, Column 78)0 and interest thereon 24.Capital notes 25.Aggregate write-ins for liabilities26.Total liabilities excluding protected cell liabilities (Lines 1 through 25)27.Protected cell liabilities28.Total liabilities (Lines 26 and 27)29.Aggregate write-ins for special surplus 52,478,972,4522,882,920,9512,691,606,337Common capital stock108,445,015106,139,85331.Preferred capital stock0032.Aggregate write-ins for other than special surplus funds0033.Surplus notes0034.Gross paid in and contributed surplus14,997,900,32915,885,573,16035.Unassigned funds (surplus)36.Less treasury stock, at cost:(549,832,539)36.10 shares common (value included in Line 30 0 )36.20 shares preferred (value included in Line 31 0 )0(1,218,775,770)00037.Surplus as regards policyholders (Lines 29 to 35, less 36) (Page 4, Line 39)17,439,433,75517,464,543,58138.TOTALS (Page 2, Line 28, Col. 3)65,681,283,52669,943,516,033DETAILS OF WRITE-INS2599.Totals (Lines 2501 thru 2503 plus 2598)(Line 25 above)625,765,231793,464,0332999.Totals (Lines 2901 thru 2903 plus 2998)(Line 29 above)2,882,920,9512,691,606,3373299.Totals (Lines 3201 thru 3203 plus 3298)(Line 32 above)003

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.STATEMENT OF INCOME1Current Year2Prior YearUNDERWRITING INCOME1.Premiums earned (Part 1, Line 35, Column TIONS:2.Losses incurred (Part 2, Line 35, Column 7)3.Loss adjustment expenses incurred (Part 3, Line 25, Column 1)4.Other underwriting expenses incurred (Part 3, Line 25, Column 2)5.Aggregate write-ins for underwriting deductions6.Total underwriting deductions (Lines 2 through 5)7.Net income of protected cells8.Net underwriting gain or (loss) (Line 1 minus Line 6 plus Line 7)9.Net investment income earned (Exhibit of Net Investment Income, Line 17)INVESTMENT INCOME10.136,976,770 (Exhibit of CapitalNet realized capital gains or (losses) less capital gains tax of 431,542,905Gains (Losses) )11.Net investment gain (loss) (Lines 9 10)12.Net gain (loss) from agents’ or premium balances charged off (amount recovered13.Finance and service charges not included in premiums14.15.16.Net income before dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes(Lines 8 11 15)17.Dividends to policyholders18.Net income, after dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes(Line 16 minus Line ER INCOMEAggregate write-ins for miscellaneous 3,936)Total other income (Lines 12 through 14)(287,167,174)(429,982,438) 0 amount charged off 2,604,937 )1,432,046,0740(1,060,417,177)0Federal and foreign income taxes 5,173,125)Net income (Line 18 minus Line 19)(to Line ,110)(13,538,198)000CAPITAL AND SURPLUS ACCOUNT21.Surplus as regards policyholders, December 31 prior year (Page 4, Line 39, Column 2)22.Net income (from Line 20)23.Net transfers (to) from Protected Cell accounts7,439,92724.Change in net unrealized capital gains or (losses) less capital gains tax of 25.Change in net unrealized foreign exchange capital gain (loss)26.Change in net deferred income tax27.Change in nonadmitted assets (Exhibit of Nonadmitted Assets, Line 28, Col. 3)28.Change in provision for reinsurance (Page 3, Line 16, Column 2 minus Column 1)29.Change in surplus notes30.Surplus (contributed to) withdrawn from protected cells31.Cumulative effect of changes in accounting principles32.Capital changes:2,305,1620032.1 Paid in32.2 Transferred from surplus (Stock Dividend)32.3 Transferred to surplus33.000Surplus adjustments:33.1 Paid in33.2 Transferred to capital (Stock Dividend)33.3 Transferred from capital34.Net remittances from or (to) Home Office35.Dividends to stockholders36.Change in treasury stock (Page 3, Lines 36.1 and 36.2, Column 2 minus Column 1)37.Aggregate write-ins for gains and losses in surplus38.Change in surplus as regards policyholders for the year (Lines 22 through 37)39.Surplus as regards policyholders, December 31 current year (Line 21 plus Line 38) (Page 3, Line LS OF WRITE-INS000599.Totals (Lines 0501 thru 0503 plus 0598)(Line 5 above)1499.Totals (Lines 1401 thru 1403 plus 1498)(Line 14 above)(284,562,237)(421,783,936)3799.Totals (Lines 3701 thru 3703 plus 3798)(Line 37 above)(167,940,543)(69,778,412)4

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.CASH FLOW12Current YearPrior YearCash from 52,443,871,69833,134,92918,601,256Total (Lines 1 through 3)17,299,657,60218,130,070,5235.Benefit and loss related payments12,790,443,64314,073,213,2966.Net transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts007.Commissions, expenses paid and aggregate write-ins for deductions7,290,805,0597,725,982,3148.Dividends paid to policyholders9.Federal and foreign income taxes paid (recovered) net of 1.Premiums collected net of reinsurance2.Net investment income3.Miscellaneous income4.00 tax on capital gains (losses)(45,976,241)0(247,006,207)10.Total (Lines 5 through 9)20,035,272,46021,552,189,40411.Net cash from operations (Line 4 minus Line 10)(2,735,614,858)(3,422,118,881)12.1 Bonds12,536,769,71515,806,991,67012.2 22267,81611,470,3213,367,398,5063,140,363,563Cash from Investments12.Proceeds from investments sold, matured or repaid:12.3 Mortgage loans12.4 Real estate12.5 Other invested assets721,14712.6 Net gains or (losses) on cash, cash equivalents and short-term investments(35,154,518)12.7 Miscellaneous 1 Bonds9,767,761,05111,932,310,58213.2 4,766,820,8510012.8 Total investment proceeds (Lines 12.1 to 12.7)13.(5,787,638)Cost of investments acquired (long-term only):13.3 Mortgage loans13.4 Real estate13.5 Other invested assets13.6 Miscellaneous applications13.7 Total investments acquired (Lines 13.1 to 13.6)14.Net increase (decrease) in contract loans and premium notes15.Net cash from investments (Line 12.8 minus Line 13.7 minus Line 14)Cash from Financing and Miscellaneous Sources16.Cash provided (applied):16.1 Surplus notes, capital notes16.2 Capital and paid in surplus, less treasury stock(341,259,065)(414,745,523)16.3 Borrowed 114)16.4 Net deposits on deposit-type contracts and other insurance liabilities558,533,78016.5 Dividends to stockholders(8,562,849)16.6 Other cash provided (applied)17.Net cash from financing and miscellaneous sources (Lines 16.1 to 16.4 minus Line 16.5 plus Line 80,887)RECONCILIATION OF CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS18.Net change in cash, cash equivalents and short-term investments (Line 11, plus Lines 15 and 17)19.Cash, cash equivalents and short-term investments:19.1 Beginning of year19.2 End of period (Line 18 plus Line 19.1)Note: Supplemental disclosures of cash flow information for non-cash transactions:20.0001. Capital Contribution from Parent20.0002. Decrease in Funds Held Liability20.0003. Decrease in Funds Held asset20.0004. Increase in Funds Held Asset20.0005. Increase in Funds Held liability20.0006. Investment transferred as dividends20.0007. Investments received in settlement of affiliated receivable balances20.0008. Investments transferred in settlement of affiliated payable 03,726,794

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.Note: Supplemental disclosures of cash flow information for non-cash transactions:20.0009. Return of capital20.0010. Securities received20.0011. Securities 11,744,892,89800

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.UNDERWRITING AND INVESTMENT EXHIBITPART 1 - PREMIUMS EARNED1Line of BusinessNet PremiumsWritten perColumn 6, Part 1B2Unearned PremiumsDec. 31 Prior Year per Col. 3,Last Year’s Part 13Unearned PremiumsDec. 31 CurrentYear - per Col. 5Part 1A4Premiums EarnedDuring Year(Cols. 1 2 - ,4582.Allied .Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage 08,052154,967,366Ocean land ,495020,63120,631010.Financial guaranty11.1Medical professional liability - .2Medical professional liability - 49,95613.Group accident and 3514.Credit accident and health (group and individual)000015.Other accident and .Workers' 42,687,52417.1Other liability - ,422,779,26217.2Other liability - 2,876,901,28017.3Excess workers' 18.1Products liability - 0018.2Products liability - 319.1, 19.2 Private passenger auto 75419.3, 19.4 Commercial auto 94321.Auto physical 22.Aircraft (all 826.Burglary and iler and ,622,77940,079,78131.Reinsurance - nonproportional assumed ance - nonproportional assumed liability33.Reinsurance - nonproportional assumed financial lines000034.Aggregate write-ins for other lines of 61,388)42,264,016DETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus 3498)(Line 34 above)6

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.UNDERWRITING AND INVESTMENT EXHIBITPART 1A - RECAPITULATION OF ALL PREMIUMSLine of Business123Amount Unearned(Running One Yearor Less from Dateof Policy) (a)Amount Unearned(Running More ThanOne Year fromDate of Policy) (a)Earned But UnbilledPremium4Reserve for RateCredits andRetrospectiveAdjustments Basedon Experience5Total Reserve forUnearned PremiumsCols. 1 2 3 41.Fire287,233,023190,387,81500477,620,8382.Allied s multiple peril0221002214.Homeowners multiple peril674,175,217000674,175,2175.Commercial multiple peril206,354,08215,046,30900221,400,3916.Mortgage guaranty109,891,8117,416,24100117,308,0528.Ocean marine78,942,1562,894,6140081,836,7709.Inland 0,6314,902,2370004,902,237Medical professional liability - ,72900394,393,4560000010.Financial guaranty11.1Medical professional liability - occurrence11.212.13.Group accident and health14.Credit accident and health (group 709,393,5710009,393,571Products liability - occurrence41,458,6165,184,5680046,643,184Products liability - claims-made16,117,2201,590,5130017,707,73319.1, 19.2 Private passenger auto liability355,900,6107,204,91500363,105,52519.3, 19.4 Commercial auto 948245,71700259,874,665170,3340060,340,07715.Other accident and health16.Workers' compensation17.1Other liability - occurrence17.2Other liability - claims-made17.3Excess workers' compensation18.118.221.Auto physical damage22.Aircraft (all 6.Burglary and theft10,048,504722,7800010,771,28427.Boiler and ty1,995,416107,627,36300109,622,77931.Reinsurance - nonproportional assumedproperty07,758,280007,758,28032.Reinsurance - nonproportional assumedliability00033.Reinsurance - nonproportional assumedfinancial lines0000034.Aggregate write-ins for other lines of 8,852,504,00236.Accrued retrospective premiums based on experience037.Earned but unbilled premiums038.Balance (Sum of Line 35 through 37)(461,388)(461,388)8,852,504,002DETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus 3498)(Line34 above)(a) State here basis of computation used in each case00PRO RATA7000

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.UNDERWRITING AND INVESTMENT EXHIBITPART 1B - PREMIUMS WRITTEN1Line of Business1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple perilReinsurance Assumed23Direct Business (a)From AffiliatesReinsurance Ceded45From Non-AffiliatesTo AffiliatesTo Non-Affiliates6Net PremiumsWrittenCols. 1 2 086,971,1166.Mortgage guaranty8.Ocean 4,645,884342,969,7379.Inland 9)456,218,9221,317,568,11900000010.Financial guaranty11.1Medical professional liability 0,04311.2Medical professional liability 17,009,370(962,188)31,364,666113,809,58213.Group accident and 1,9811,031,538,68014.Credit accident and health (groupand ,675,2124,489,241414,821,58515.Other accident and health16.Workers' 90,842)471,290,7331,177,097,72817.1Other liability - 5,704)1,235,128,9421,472,088,33617.2Other liability - 24,610429,969,4452,806,616,32717.3Excess workers' compensation18.1Products liability - 406Products liability - ,044,42528,267,76119.1, 19.2Private passenger auto 742,113,166851,606,81819.3, 19.4Commercial auto )342,188,280313,335,41321.Auto physical 9,597653,728,73822.Aircraft (all 818,91326.Burglary and theft27.Boiler and surance - nonproportionalassumed propertyXXX858,13500858,134Reinsurance - nonproportionalassumed ance - nonproportionalassumed financial Aggregate write-ins for other lines ofbusinessTOTALS(1)DETAILS OF WRITE-INS3499.Totals (Lines 3401 thru 3403 plus3498)(Line 34 above)(a) Does the company's direct premiums written include premiums recorded on an installment basis?If yes: 1. The amount of such installment premiums Yes [] No [ X ]02. Amount at which such installment premiums would have been reported had they been reported on an annualized basis 80

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.UNDERWRITING AND INVESTMENT EXHIBITPART 2 - LOSSES PAID AND INCURREDLosses Paid Less 16.17.117.217.318.118.219.1, 19.219.3, .Line of BusinessFireAllied linesFarmowners multiple perilHomeowners multiple perilCommercial multiple perilMortgage guarantyOcean marineInland marineFinancial guarantyMedical professional liability - occurrenceMedical professional liability - claims-madeEarthquakeGroup accident and healthCredit accident and health (group and individual)Other accident and healthWorkers' compensationOther liability - occurrenceOther liability - claims-madeExcess workers' compensationProducts liability - occurrenceProducts liability - claims-madePrivate passenger auto liabilityCommercial auto liabilityAuto physical damageAircraft (all perils)FidelitySuretyBurglary and theftBoiler and machineryCreditInternationalWarrantyReinsurance - nonproportional assumed propertyReinsurance - nonproportional assumed liabilityReinsurance - nonproportional assumed financial linesAggregate write-ins for other lines of businessTOTALSDETAILS OF WRITE-INSTotals (Lines 3401 thru 3403 plus 3498)(Line 34 above)ReinsuranceAssumedDirect 307567Net Losses UnpaidCurrent Year(Part 2A , Col. 8)Net Losses UnpaidPrior YearLosses IncurredCurrent Year(Cols. 4 5 - 6)ReinsuranceRecoveredNet Payments(Cols. 1 2 -3 ,531030,305,314,810000000XXXXXXXXX8Percentage ofLosses Incurred(Col. 7, Part 2) toPremiums Earned(Col. 4, Part 056.80.0

COMBINED STATEMENT FOR THE YEAR 2019 OF THE American International Group, Inc.UNDERWRITING AND INVESTMENT EXHIBITPART 2A - UNPAID LOSSES AND LOSS ADJUSTMENT EXPENSESReported Losses10Line of BusinessFireAllied linesFarmowners multiple perilHomeowners multiple perilCommercial multiple perilMortgage guarantyOcean marineInland marineFinancial guarantyMedical professional liability - occurrenceMedical professional liability - claims-madeEarthquakeGroup accident and healthCredit accident and health (group and individual)Other accident and healthWorkers' compensationOthe

NAIC Group Code 0012 NAIC Company Code 00124 Mail Address 175 Water Street (Street and Number) New York , NY 10038 , 212-770-7000 . Name of Company NAIC Company Code State of Domicile AIU INSURANCE COMPANY 19399 NY AMERICAN HOME ASSURANCE COMPANY 19380 NY AIG ASSURANCE COMPANY 40258 IL AIG INSURANCE COMPANY - PUERTO RICO 31674 PR .