Transcription

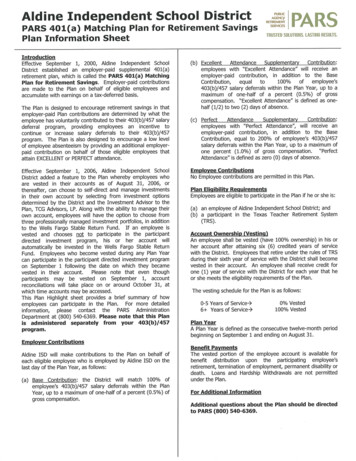

Frisco ISDSummary Plan DescriptionPlan TypeInternal Revenue CodeSection 401(a)Plan AdministratorJEM Resource PartnersEligible EmployeesEmployees who contribute to a403(b) or 457(b) with Frisco ISDOnline Account AccessTo view your account online:- go to www.region10rams.org- click “Login” and select your Employerfrom the navigation bar- Under the 401(a) tab, click “Login”- The User ID is your SSN; the Passwordis the last 4 digits of your SSNWritten Plan Effective Date9/1/2006Plan Year End12/31Matching Contribution RulesEffective September 1, 2011, the Employer will match any contribution made to a 403(b) or 457(b) on behalf of theparticipant into the 401(a)Base Match is 25% of contribution up to 1% of Base Salary.qVestingContributions made to a Plan Participant’s account are subject to vesting requirements (the ownership of the contributionsand earnings). The following schedule shows when a Participant will become the owner of the account balance.Years of Service – Vesting %Yr 1 Yr 2 Yr 3 Yr 4 Yr 50%0% 50% 75% 100%DistributionsAvailable for the following conditions:Separation of Service, Death, Disability, orRetirementHardshipNot AvailableAdministrative FeesJEM Resource Partners - Record Keeper 1.40 per participant per monthPaid by Frisco ISDWilmington Trust - Custodian .10% ofassets paid by plan assetsLoansNot AvailableAutomatic DistributionsNot AvailableDisabilityDetermined by TRSBeneficiariesRecord Keeper - JEMTCG Advisors, LP –Investment AdvisorSliding Scale (.45%-.25% ofassets) Currently .40%Paid from plan assetsESC Region 10 - Plan Coordinator .10 per participant per month, paidby participantDistribution Fee 25, paid by the participantFor more information please contact JEM Resource Partners, the Plan Administrator, at 1-800-943-9179This document is designed to inform Participants about the Plan in non-technical language. Every attempt is made to convey the Planaccurately. If anything in this Summary Plan Description varies from the Plan Documents, Plan Documents govern.

Jasper ISDSummary Plan DescriptionPlan TypeInternal Revenue CodeSection 401(a)Plan AdministratorJEM Resource PartnersEligible EmployeesEmployees who contribute to a403(b) or 457(b) Plan with JasperISDOnline Account AccessTo view your account online:- go to www.region10rams.org- click “Login” and select your Employerfrom the navigation bar- Under the 401(a) tab, click “Login”- The User ID is your SSN; the Passwordis the last 4 digits of your SSNWritten Plan Effective Date9/1/2013Plan Year End8/31Matching Contribution RulesThe Employer will match any contribution made to a 403(b) or 457(b) on behalf of the participant into the 401(a):Base Match - .50 for every 1.00 of Participant Contribution up to a maximum of 2.00% of Base Salary forEmployees not exceeding seven (7) absences during the Plan Year.Excellent Attendance (2 or fewer) - .75 for every 1.00 of Participant Contribution up to a maximum of 3.00% ofBase SalaryPerfect Attendance (0 absences) - 1.00 for every 1.00 of Participant Contribution up to a maximum of 4.00% ofBase SalaryqVestingContributions made to a Participant’s Plan account are subject to vesting requirements (the ownership of the contributionsand earnings). The following schedule shows when a Participant will become the owner of the account balance.Years of Service – Vesting %Yr 1 Yr 2 Yr 3 Yr 4 Yr 50%0% 50% 75% 100%DistributionsAvailable in the following events:Separation of Service, Death, Disability, orRetirementHardship DistributionsNot AvailableAdministrative FeesJEM Resource Partners - Record Keeper 1.15 per participant per monthPaid by participantWilmington Trust - Custodian .10% of assetspaid by plan assetsLoansNot AvailableAutomatic DistributionsNot AvailableDisabilitySame as TRS RulesBeneficiariesRecord Keeper - JEMTCG Advisors, LP –Investment AdvisorSliding Scale (.45%-.25% of assets)Currently .40%Paid from plan assetsESC Region 10 - Plan Coordinator .10 per participant per month, paid byparticipantDistribution Fee 25, paid by the participantFor more information please contact JEM Resource Partners, the Plan AdministratorThis document is designed to inform Participants about the Plan in non-technical language. Every attempt is made to convey the Planaccurately. If anything in this Summary Plan Description varies from the Plan Documents, Plan Documents govern.

Klein ISDSummary Plan DescriptionPlan TypeInternal Revenue CodeSection 401(a)Plan Password for Enrolling OnlineOnline Enrollment Not AvailablePlan AdministratorJEM Resource PartnersWritten Plan Effective Date9/1/2002Eligible EmployeesEmployees who contribute to a403(b) or 457(b) with Klein ISDPlan Year End12/31Matching Contribution RulesTier I- the Employer will make a contribution for employees who put at least 200 annually* into 403(b) or457(b) on behalf of the participant** into a 401(a) based upon the following schedule.Used Sick/Personal Days ( 0-3) Contributions (3 days of Credit)Teachers and Professional- Credit Value, 100Other Employees- Credit Value, 50*403(b) and 457(b) must be made prior to 8/31 ** Must be employed on the first and last day of Plan YearTier II- Eligible Employees can choose either the New Accumulated Leave Plan or the “Grandfathers”Accumulated LeaveNew Accumulated Leave Plan: A contribution equal to the number of state or local days at the following rateCertified Teachers and Professional Employees- One half (1/2)the daily rate for Long Term CertifiedSubstitutesAll other personnel- One half (1/2) the daily rate for Long Term Non-Certified Substitutes“Grandfathered” Accumulated Leave Plan: A contribution in the amount calculated under District Policyand value of unused accumulated leave in excess of the maximum allowable contribution to the 457(b)VestingContributions made to a Plan Participant’s account are subject to vesting requirements (the ownership of the contributionsand earnings). The following schedule shows when a Participant will become the owner of the account balance.Tier I: Years of Service – Vesting % ForYr 1 Yr 2 Yr 330%60% 100%*Participants become 100% vested upon retirement, death, or total disabilityTier II: 100% vested upon retirement.DistributionsAvailable for the following conditions:Separation of Service, Death, Disability, orRetirementHardshipNot AvailableAdministrative FeesJEM Resource Partners - Record Keeper 1.25 per participant per monthPaid by Klein ISDESC Region 10 - Plan Coordinator .10 per participant per month, paid byKlein ISDLoansNot AvailableAutomatic DistributionsNot AvailableDisabilityDetermined by TRSBeneficiariesRecord Keeper - JEMTCG Advisors, LP –Investment AdvisorSliding Scale (.45%-.25% ofassets) Currently .40%Paid from plan assetsWilmington Trust - Custodian .10%of assets paid by plan assetsDistribution Fee 25, paid by the participantFor more information please contact JEM Resource Partners, the Plan AdministratorThis document is designed to inform Participants about the Plan in non-technical language. Every attempt is made to convey the Planaccurately. If anything in this Summary Plan Description varies from the Plan Documents, Plan Documents govern.

Paid by Klein ISD ESC Region 10 - Plan Coordinator .10 per participant per month, paid by Klein ISD TCG Advisors, LP - Investment Advisor Sliding Scale (.45%-.25% of assets) Currently .40% Paid from plan assets Wilmington Trust - Custodian .10% of assets paid by plan assets Distribution Fee 25, paid by the participant