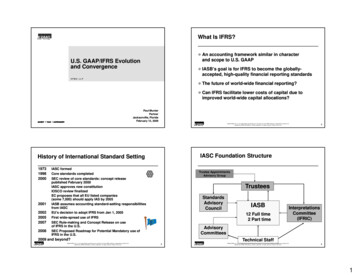

Transcription

Pensions, Actuaries and ConvergencePrepared by Kevin Wesbroom, Senior Partner, Aon HewittAon HewittRetirement and Investment

The UK Pensions System – Events, dear boy, events Events, dear boy, events– Response to a journalist when asked what is most likelyto blow governments off course. Most of our people have never hadit so good– But inflation was the country's most important problem ofthe post-war era.2

Changing Pension DesignsTypes of Scheme by Number10090Salary range8070Fixed amount605040Final Salary3020Other eg DC10019631971Source – UK Government Actuaries Surveys3197919871991

Never had it so good?Source: McKinsey Global Institute: Diminishing returns: Why Investors may need to lower their expectations4

Some events and pension changesActive members of occupational schemes61997ACT raid(millions)5.55.55.42001FRS175.4554.74.61989New IR ootsdoesBonds1985Anti-frankinglegislation2002Debt on employermoves to buy out1995MFR, MNT anddisclosure regs2.72.62006A-day 2199419961998Source: National Association of Pension Funds – now Pensions and Lifetime Savings Association532005PPF andtPR103.720002002200420062008

AccountantsWeapons of mass destructionof defined benefit pensions6

Final Salary Problems Low interest rates Low investment returns Pensioners living longer Tax burden Compliance costs Discretions to guaranteesPension Risk became the order of theday 7

Pensions became all risk Forget about an employee benefit! Recruit and retain? An increasing focus from: Investors, analysts and corporatemanagement Scheme members The Pensions Regulator Ratings agencies Companies, trustees and membersall punished for poor riskmanagement"Since mid-2007, we have changedratings or outlooks as a result ofour view of their risk appetite, riskmanagement, or both“Standard & Poor’s May 20078

Tools to quantify pension riskBalance SheetVulnerabilityEarnings VulnerabilityHewitt launches the Pension Risk Index9

UK Quicker to close and freeze22%44%72%89%30%26%Closed to new entrants61%62%Frozen to all membersSource – Aon Hewitt Global Pension Risk Survey – 20131010

Investment – the Three DsDe-risking, diversification and dynamismDomestic equitiesGlobal equitiesFixed government bondsIndex linked government bondsCorporate bondsAlternative assetsGuaranteed/structured productsDerivatives to match the risk profile of the liabilityActive asset allocation-30%-20%Source – Hewitt Global Pension Risk Survey – UK 200911-10%0%10%Change in asset allocation20%30%

Average UK DB asset 9201020112012EquitiesGilts and fixed interestInsurance policiesPropertyHedge Funds'Other'Source: TPR, The Purple Book20132014Cash and deposits2015

And we all want out from UK DB .The vast majority of UKprivate sector DB planswant a quiet life . but the future justkeeps gettingfurther awaySource – Aon Hewitt Global Pension Risk Survey – UK 201513

But beware the Changing face of Risk 2017Corridor for New Interest Rates (based on a 25-year average of interest rates)Estimated New Law Interest Rates (must be within the corridor)Prior Law Interest RatesRisk – and the perception of risk – can changeThink – inflation linked government bonds or infrastructure?14

Exit planning - convergence with insurance .Traditional PlayersNew Monoline InsurersTraditional InsurersPRE Insurers15

Exit planning – convergence with individuals?TLAs rule – PIE, FRO, ETVSource – Aon Hewitt Global Pension Risk Survey – UK 201516

Enhanced Transfers – a UK mis-selling story ?Source: Daily Mail, 10 October 200717

Being fair to members? Weeding our the worst practices– Cash, cash before Xmas But do we know better thanmembers?– Personal circumstances – single, poorhealth– UK balanced deal based on interestrates of around 4-6%– A Money Advice service report foundthat 20% of people say they wouldrather have 200 today than 400 inone months time?– 400,000% per annum – call ithyperbolic!18

Behind all of these changes .Male life expectancy at age 65 by country, 00Canada20102020France2030Japan2040UKUS2050Source: Historical data on life expectancy OECD Health database 1960-95. Recent data and projections of life expectancy Future based on the UnitedNations Population Division database, World Population Prospects – The 2008 Revision.By 2025 the population of China over age 60 will be 288 million.This is more then the population of the US. By 2050 China willhave 437 million people over age 60. Old China will have abigger population than any other country in the world, apart fromIndia19

The Toxic Triangle of Pension Compromisesave moreget less20get it later

Personal Life Expectancy – Place the StoneYour namehere6521758595105

Does this Help ?25 gone by 8940 gone by 9545 gone by 996575Assumptions: S2PMA – CMI 2013 M YOB 1950 1.5 long term improvement228595105

DC - Threat or Opportunity?23

The Changing Role of Actuaries in a DC World Skill SetsThreats & Opportunities - OtherThe move from DB to DC will inevitably changeprofessionsthe skills required by a pensions actuary. OneProfessions other than the actuarial professionwould expect the changes to be evolutionaryare also able to advise on many of the needsrather than revolutionaryassociated with DC schemes. The challenge totheactuarialprofessionwillbetodemonstrate the unique added value thatactuaries can bring to the processHow do individuals invest?Behavioural Finance - psychology applied tofinance. Gives rise to the new paradigm for DCinvestment - prospect theory, regret, illusion ofcontrol, overconfidence24Threat & Opportunity - Clarity &SimplicityActuaries should be seen to champion thepublic interest by seeking clarity &simplification

Behavioural Finance and ActuariesThe field of behavioural finance looks at how a variety of mental biases anddecision making errors affect financial decisions. It relates to the psychologythat underlies and drives financial decision making behaviour. Institute of Actuaries examiners report 2012A veritable host of new ideas and concepts Heuristics and Bias Prospect Theory and LossAversion Representativeness Availability OverconfidenceStatus Quo BiasHindsight BiasFramingAnchoringA simple example, of anchoring – fold a piece of paper in half 25

The UK (private sector) future is now firmly DC 26

But did the UK miss a trick with Defined Ambition ? Ten Years too Early or Ten Years too Late? Legislation on the Statute books – but not enacted We could have opted for DB style benefits– Target Pension Plan– Collective Defined Contribution plan The employer pays a fixed contribution rate The member gets a Defined Ambition (DB like) Pension– Think 1% CARE from State Pension Age We square the circle because the DA Pensionis conditional– Indexation is not guaranteed but targeted (CPI)– Even the basic pension is not guaranteed– Adjusted to ensure cost stays constant– Including benefit cuts27

What does DA offer? Economies of scaleEconomies of thinkingBenefits of longevity poolingBenefits of timescaleAddressing the decumulation issueAddressing account blindnessEliminating the weak link – the member !!! And it offers No gauarantees!Intergenerational solidarity (?)Sharing (?)28

Defined Ambition – better member outcomes?Pension on retirement after 25 years’ contributions of 10% of pay to a plan invested in the way shown29

George Osborne – pensions surprise merchant 100 years of “compulsory“ annuitypurchase blown away at a stroke “Let them buy Lamborghinis” Give them 40 minutes of guidance(not advice)Drawdown IncomeBase Annuity IncomeDrawdownIncomeLater Life(Deferred)AnnuityCombined drawdown and annuity strategies may offeroptimal at retirement optionsSource: Evalue30

The UK goes from one end of the scale .Source: UK National Employee Superannuation Trust31

At retirement options – what do members want? What do they need?How members want to spend their retirement income, compared to how they need to spend their retirement incomeSource: UK Aon Hewitt survey with Cass Business School32

Changes to DC investment strategy“To & Through” strategyTo &ThroughDeferredannuitiesUnderpin /ValueProtectionIncomeGuaranteesThe market is continuing to innovateSource: Aon UK Delegated DC service33Longguaranteeperiod

UK Budget 2016 – he’s at it again Even nontaxpayersget 25% upliftIf you save toage 60 tax freewithdrawal34Bonus stopsat age 50Penalty beforeage 60 if notused for firsttime housepurchase

A Pensions dashboard – or better still a savings dashboardThe government will “ensure the industry designs, funds and launches apensions dashboard by 2019.”35

Recent market factors have been quite extraordinary .Source: Bloomberg, DatastreamBondyieldshave beenfalling formore than20 years.The volume ofbonds tradingwith negativeyields reached 6.9 Trillion as atApril 2016.Source: ECB, J.P. Morgan.36

And now events rear the ugly head again .11,000 jobs20,000 pension fund members3715,000 jobs130,000 pension fund members

I remain optimistic about our future .TOTHEFUTURE38

Biography and DisclaimersKevin is an experienced pension consultant who has been advising high profile clients for over 40 years. He is a qualified schemeactuary who has been involved with many different aspects of pension, investment and broader employee benefits, including theestablishment of the Aon Hewitt UK Defined Contribution team. He was the inaugural UK lead for Global Risk Services, a fusion ofactuarial and investment skills designed to help clients make sense of rapidly changing investment markets and new risk drivensolutions, as they guide their plans to a more stable future.He continues to act as pension adviser on a limited number of client assignments and one off references. He is practicing what he hasbeen preaching about phased retirement by working four days a week. He still harbours an ambition to transform the UK pensionslandscape, by making Collective Defined Contribution plans a reality; but just in case they do not materialise, he is also working onintroducing a DC mastertrust with an in-built decumulation solution to the market.The author’s views are his alone and Aon Hewitt reserves the right to dissociate itself completelyfrom any old drivel he spouts kevin.wesbroom@aonhewitt.comD 44 20 7086 9350M 44 77 11 666 0 77Aon Hewitt LimitedAon Hewitt Limited is authorised and regulated by the Financial Conduct Authority.Registered in England & Wales No. 4396810Registered office:The Aon Centre The Leadenhall Building 122 Leadenhall Street London EC3V 4ANTo protect the confidential and proprietary information included in this material, it may not be disclosed or provided to any third parties without the priorwritten consent of Aon Hewitt Limited.Aon Hewitt Limited does not accept or assume any responsibility for any consequences arising from any person, other than the intended recipient, usingor relying on this material.Copyright 2016 Aon Hewitt Limited. All rights reserved.39

Aon Hewitt Retirement and Investment Pensions, Actuaries and Convergence . - A Money Advice service report found that 20% of people say they would rather have 200 today than 400 in . 20,000 pension fund members. 15,000 jobs. 130,000 pension fund members. 38 TO. THE. FUTURE.