Transcription

Connected Vehicle TechnologyIndustry Delphi StudySeptember, 2012This document is a product of the Center for Automotive Research under a State Planningand Research Grant administered by the Michigan Department of Transportation.

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYTable of ContentsExecutive Summary . 3Highlights of Findings . 3I. Introduction . 5Delphi Survey Procedure . 5II. Automotive Sector Connected Vehicle Survey Results . 7Type of Technology . 7DSRC and Cooperative, Active Safety Systems . 73G and 4G for All Other Applications . 7Embedded Equipment . 7Embedded (Built-In) vs. Brought-In . 8Built-In vs. Brought-In Equipment . 9Component Technologies as Standard Equipment . 10Sensor and Connected Vehicle Systems Integration Forecast . 10V2V vs. V2I Technology . 11V2V-Only System . 12DSRC for V2V versus V2I Applications . 13Estimated Costs of Connected Vehicle Technology . 13Cost to Vehicle Manufacturers of Embedded DSRC . 13Cost Added to Base Vehicle Price for Connected Vehicle Technology . 13Consumer Cost to Add DSRC as Aftermarket Equipment. 14NHTSA Regulatory Decision . 14NHTSA’s 2013 Notice of Regulatory Intent . 14Percentage of Top 50 Metropolitan Areas Deployment Needed for V2V Systems . 15NHTSA Mandate and Standard Equipment Requirements . 15Mandate for Aftermarket V2V Retrofits. 16Type of Aftermarket Device if Mandated . 16NHTSA Mandate and Automakers Pursuing V2V . 16Other Governmental Mandates . 17Forecast for Mandated Connected Vehicle Applications . 17Additional Safety Application Mandates . 18Challenges to Broad Adoption . 18Top Challenges to Broad Adoption of the Technology . 18Autonomous Technology . 19Autonomous Technology and Safety. 19Autonomous vs. Connected Vehicle Technology . 19Safety Features and Autonomous vs. Connected Vehicle Technology . 19III. Conclusions . 20References. 21Appendix A: First- and Second-Round Industry Delphi Survey Questions . 222MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYEXECUTIVE SUMMARYThe automotive industry continues to transform from being predominantly mechanicallybased to increasingly electronically-based.This transformation is critical to the State ofMichigan as it seeks to maintain its positionas a global leader in the automotive sector.The Michigan economy lost more than460,000 jobs from 2007 to 2010; however, itappears to be headed towards a recovery,gaining more than 140,000 jobs between2011 and 2012 to-date (Bureau of Labor Statistics, 2012). Connected vehicle technologydevelopment offers Michigan a growing hightech industry where Michigan companies already have a competitive advantage. Michigan is also home to the Michigan Department of Transportation (MDOT) and otherpublic-sector agencies that have demonstrated national leadership in connected vehicles. MDOT is pursuing a strategy for supporting the testing and development of connected vehicle technologies that keep driversconnected, save lives, improve mobility, protect the environment, and employ Michiganresidents.MDOT asked the Center for Automotive Research (CAR) to perform surveys of expertopinion, with panelists from the automotiveand public sectors, to help forecast the futureof connected vehicle technology researchand deployment. In response to this request,CAR conducted a follow-up to its expert panel surveys from 2005 and 2008 to ascertainchanges in the strategic direction of the connected vehicle and wireless communicationtechnology industries. This follow-up studyalso discerns new technical and businesstrends emerging in this field.This report summarizes the automotive industry survey results. In particular, it providesa general overview of user services and survey results in several categories: Type of Technology Embedded Equipment Vehicle-to-Vehicle (V2V) vs. Vehicle-toInfrastructure (V2I) Technology Estimated Costs of Connected VehicleTechnology National Highway Traffic Safety Administration (NHTSA) 2013 Notice of Regulatory Intent Other Government Policy Implications Challenges to Broad Adoption of Technology Autonomous VehiclesHIGHLIGHTS OF FINDINGSRespondents overwhelmingly reaffirmed theconsensus that Dedicated Short RangeCommunication (DSRC) is needed for cooperative, active safety systems, while thirdgeneration (3G) and fourth generation (4G)cellular communications tend to be thoughtof as appropriate for other applications. Also,DSRC was commonly viewed as beingstandard equipment by 2017. By 2022, respondents indicated that Global PositioningSystem (GPS) receivers, satellite radios, andWi-Fi transceivers also will be included asstandard equipment. Mobility and PersonalConvenience applications were forecasted tobe widely available on new vehicles by 2017through brought-in (as opposed to built-in ororiginal equipment) communication devices,and all applications will be widely availableby 2022. The majority think the applicationswill be built-in by that point.V2V-only systems are considered valuable,but respondents view a complimentary V2Isystem as necessary to maximize full publicbenefits of connected vehicle technology.Respondents also think a V2V system ispossible using DSRC technology only, usinganother communication technology for V2Isystems.The estimated costs to manufacturers forembedding DSRC, the overall added costs tobase vehicle price to the consumers, andadding DSRC as aftermarket equipment areMICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH3

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYall higher in 2017 and then drop significantlyby 2022. However, the forecasted additionalcosts to the consumer for adding the technology to a vehicle is the highest at 350 in2017 and drops to only 300 in 2022.Regarding the possible 2013 NHTSA Noticeof Regulatory Intent on mandating V2V safety systems for vehicles, most respondentsexpressed the view that NHTSA will announce that it does intend to mandate V2Vsafety. Respondents further indicated that, ifthis proves to be correct, by 2022 all new vehicles sold in the U.S. will be required tohave V2V communication equipment asstandard equipment. Aftermarket retrofitmandates are less certain, but if there is amandate, the device will likely be broadcastonly or a device not connected to the vehicle’s data bus. If NHTSA does not mandate asafety system (and it has options of callingfor a voluntary program, indicating that more4research is needed, or doing nothing at all),respondents are mixed on whether automakers will continue to pursue V2V technologyfor safety systems.Most respondents do not think many otherconnected vehicle applications will be mandated by 2017, but a few, such as intersection control and work-zone alert, may bemandated by 2022. Also, respondents do notforesee additional safety mandates comingby 2022.One of the biggest challenges respondentssee to the broad adoption of connected vehicle technology is funding for roadside infrastructure.Autonomous vehicles have strength, but respondents believe the most significant publicbenefit will come from a combination of autonomous and connected vehicles.MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYI. INTRODUCTIONRoad transportation continues to undergosignificant technological transformations aswireless communication increasingly enablesvehicles to communicate with each other andwith the infrastructure. This has multiplebenefits, including improved safety, mobility,personal convenience, and economic development. To make the most of this opportunity, public and private entities must collaborate to develop a system that actively engages the automotive, telecommunications, andconsumer electronics industries. The challenge lies in building enough confidence onboth the public and private sides of the issueto bring them together to cooperate andachieve an integrated outcome.One of the primary benefits of connected vehicle technology is the potential for vastly improved vehicle safety. Both vehicle-to-vehicle(V2V) and vehicle-to-infrastructure (V2I)communication promise significant safetyimprovements. Assuming a Dedicated ShortRange Communications (DSRC)-based safety system, vehicles continuously (ten timesper second) broadcast a basic safety message that includes information such as vehicle speed, heading and location. This information is used by other equipped vehicles sothat, cooperatively, crashes are avoided. Inthe V2I realm, safety is enhanced via broadcast of signal phase and timing (SPaT) information at signalized intersections, and thisinformation is used for vehicle speed management to promote green waves and fordriver warnings and possibly active crashavoidance in red-light-running scenarios. V2Ican also be used for traffic queue detectionat controlled intersections.In addition to safety benefits, connected vehicle technology also helps with traffic mobility. Vehicles already serve as traffic probesbased on cellular data and DSRC-based V2Ialso supports this application. In such applications, vehicles communicate informationabout travel speed to assist in the detectionof congestion and incidents—information thatthen can be shared with vehicles that are notyet in the traffic stream, allowing drivers tochoose a different route.The connected vehicle is a central component of the public-private partnership in sustaining technological development in theMichigan automotive sector. Consumers areconnected in almost every domain of life,from home to work, or any other locationwhere there is access to cell phones and WiFi communication.The Michigan Department of Transportation(MDOT) asked the Center for AutomotiveResearch (CAR) to perform Delphi studies toaugment previous research done on connected vehicle technology. The two studiesfocused on the public sector and the automotive sector. This report documents the automotive sector study.DELPHI SURVEY PROCEDUREAlthough several more were asked to andagreed to participate, ultimately twelve respondents participated in the study. Automotive sector panelists come from automakers,Tier 1 suppliers, and wireless communicationsuppliers. The panelists were told that theprocess is anonymous, and that their participation and their specific answers tied to theiridentity would not be shared with anyoneoutside the research team. Additionally, inlieu of compensation for participating in thestudy, respondents were given the raw,unanalyzed results for each survey in whichthey participated. Participants were drawnfrom the following organizations: Connected Vehicle Trade Association DENSO Johnson Controls P3 Qualcomm Siemens SprintMICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH5

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDY Toyota Vector CANtech Visteon Volkswagen Wilson ConsultingThe respondents, or panelists, were giventwo, iterative surveys to complete, with thesecond survey arriving several weeks afterthe first. The questions included in the sur-6veys addressed a broad range of topics, including communication technologies for various applications, possible governmental influence, and the years in which various levelsof DSRC deployment will be reached. Other,more technology-specific, topics includedwhen vehicles will have a certain componentas standard equipment, how V2V and V2Isystems compare, and how applications willbe implemented on the vehicle.MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

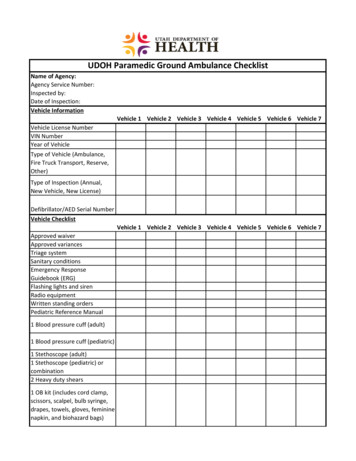

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYII. AUTOMOTIVE SECTOR CONNECTED VEHICLE SURVEY RESULTSThe results of the survey include responsesfor questions asked in only one of the twosurvey rounds, as well as responses to questions asked in both rounds, and include arange of technology topics. For questionsthat were included in both survey rounds, thediscussion below tends to focus on the second-round results, though the first-roundoften is used to extend the discussion.TYPE OF TECHNOLOGYOne common discussion in the connectedvehicle realm concerns which types of technology are most fitting for different types ofapplications. Respondents reaffirmed theapparent consensus that Dedicated ShortRange Communication (DSRC) is needed forcooperative, active safety systems, whilethird-generation (3G) and fourth generation(4G) cellular communications tend to bethought of as appropriate for other applications.DSRC AND COOPERATIVE, ACTIVE SAFETYSYSTEMSMore than 80 percent of respondents thinkDSRC is needed for cooperative, active safe-ty systems (see Figure 1).3G AND 4G FOR ALL OTHER APPLICATIONSRespondents showed less agreement, however, regarding 3G or 4G cellular technologies and other applications. When it comesto whether 3G and 4G cellular technologycan handle most other connected vehicleapplications, about 58 percent agreed orstrongly agreed, and 25 percent disagreed orstrongly disagreed (see Figure 2).EMBEDDED EQUIPMENTAs connected vehicle technology evolves,many wonder whether certain types ofequipment will primarily be built into the vehicle (in other words, automakers embed theequipment in vehicles as original equipment)or brought-in via mobile devices such assmartphones. Overall, respondents believeDSRC transceivers are the most likely typeof equipment to be embedded in vehicleswithin the next ten years.DRSC as Standard EquipmentMost respondents expressed the view thatembedded DSRC transceivers will be standard equipment on at least 10 percent of vehi-Figure 1: DSRC and Cooperative, Active Safety SystemsSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH7

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYcles sold in the U.S. on or before 2020, andall believe it will be standard equipment by2025 (see Figure 3).EMBEDDED (BUILT-IN) VS. BROUGHT-INA strong majority of respondents indicatedthat mobility and personal convenience(through brought-in equipment) connectedvehicle applications, as well as vehicle diagnostics (through built-in equipment), wouldbe widely available by 2017, and a slight ma-jority reported that safety (through built-inequipment) and environmental (throughbrought-in equipment) applications would bewidely available by 2017.By 2022, strong majorities think all applications will be widely available, and most, asidefrom mobility and personal convenience applications, will handled through built-inequipment (see Figure 4 and Figure 5).Figure 2: 3G and 4G Cellular Technology and Connected Vehicle ApplicationsSource: CAR 2012Figure 3: DRSC as Standard EquipmentSource: CAR 20128MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYBUILT-IN VS. BROUGHT-IN EQUIPMENTIn the first round, respondents indicated theythink many connected vehicle applicationssuch as Personal Convenience, Mobility, andVehicle Diagnostics, would be built-in by2022. Given that it is currently so easy toFigure 4: Connected Vehicle Application ForecastSource: CAR 2012Figure 5: Built-In vs. Brought-in Communication Hardware ForecastSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH9

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYbring in mobile devices to perform thesefunctions, the second survey asked respondents why they think the trend would reverse.Some of the most common answers were: Automakers are in control of the userexperience and data Offers automakers customer relationshipopportunities Product lifecycle, because vehicles mustlast longer therefore it is better for automakers to have them under control forlong-term secure services Easier to implement the technology SecurityCOMPONENT TECHNOLOGIES AS STANDARDEQUIPMENTRespondents felt most strongly that DSRCtransceivers, as opposed to other forms oftechnology, would be standard equipment by2017 (see Figure 6). In 2022, in addition toDSRC transceivers, more equipment wasconsidered likely to be standard equipment,including GPS receivers, satellite radios, andWi-Fi transceivers (see Figure 7).SENSOR AND CONNECTED VEHICLESYSTEMS INTEGRATION FORECASTThe majority of respondents (85 percent) ex-Figure 6: Component Technologies as Standard Equipment by 2017Source: CAR 2012Figure 7: Component Technologies as Standard Equipment by 2022Source: CAR 201210MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYpect to see significant integration of sensorsystems (e.g., camera, RADAR, LiDAR) andconnected vehicle communication systemsby 2022 (see Figure 8).V2V VS. V2I TECHNOLOGYAnother discussion in the connected vehiclerealm is which is most valuable and realistic:V2V communication, where vehicles communicate directly with each other, or V2Icommunication, where vehicles communicate with roadside infrastructure. Most respondents think the best system to maximizepublic good is V2V and V2I working cooperatively.Figure 8: Sensor and Connected Vehicle Systems Integration ForecastSource: CAR 2012Figure 9: DSRC for V2V versus V2I ApplicationsSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH11

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYV2V-ONLY SYSTEMRespondents were asked an open-endedquestion of whether a V2V-only system isdesirable. Many respondents suggested thatyes, V2V alone is valuable. Others suggest-ed that there is only limited value in V2V only, and that V2I is required to achieve fullbenefits. Early customers may not be willingto pay for a connected vehicle system thatdoes not yet have enough users to be useful,which is a risk especially in a V2V-only sce-Figure 10: Cost to Vehicle Manufacturers of Embedded DSRCSource: CAR 2012Figure 11: Cost Added to Base Vehicle Price for Connected VehicleTechnologySource: CAR 201212MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYnario.DSRC FOR V2V VERSUS V2I APPLICATIONSCOST TO VEHICLE MANUFACTURERS OFEMBEDDED DSRCIn the first round, slightly more than halfagreed that a V2V-only system is possible,but thought it would be somewhat limited anda V2I system in addition to V2V would offermore functionality. Given this, a vast majorityof respondents (92%) believe a connectedvehicle system is possible using DSRC technology only for V2V applications and anothertechnology for V2I applications (see Figure9).In both rounds, when asked how much it willcost vehicle manufacturers (in US ) to add aDSRC radio as embedded equipment, respondents gave a median response of 175for 2017 and 75 for 2022. The secondround means were 148 for 2017 and 73 for2022. In Figure 10, six respondents selected 175 as the 2017 cost, but that is not visuallyreflected in the graph because those pointsare stacked.ESTIMATED COSTS OF CONNECTED VEHICLE TECHNOLOGYAdding connected vehicle technology will inevitably add costs to the vehicle. Respondents were asked how much various degreesof implementation would add to the baseprice of a vehicle, as well as includingequipment as aftermarket.COST ADDED TO BASE VEHICLE PRICE FORCONNECTED VEHICLE TECHNOLOGYRegarding what connected vehicle technology will add to the base cost (in US ) of a newvehicle for the consumer, the median in bothrounds was 350 for 2017 and 300 for 2022(see Figure 11). The second round meanswere 335 for 2017 and 260 for 2022.Figure 12: Consumer Cost to Add DSRC as Aftermarket EquipmentSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH13

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYCONSUMER COST TO ADD DSRC ASAFTERMARKET EQUIPMENTFor what it will cost the consumer (in US ) toadd DSRC as aftermarket equipment, themedian for both rounds was 200 for 2017and 75 for 2022 (see Figure 12). The second round means were 233 in 2017 and 113 in 2022.NHTSA REGULATORY DECISIONOne of the most impactful decisions on thehorizon is whether the National HighwayTraffic Safety Administration (NHTSA) willdecide to mandate V2V communication systems for safety applications in 2013. It iswidely believed that if they do, it will spur deployment of the technology.NHTSA’S 2013 NOTICE OF REGULATORYINTENTThe majority of respondents (79%) thinkNHTSA’s 2013 notice of regulatory intent willbe affirmative (i.e., that it does intend toFigure 13: NHTSA’s 2013 Notice of Regulatory IntentSource: CAR 2012Figure 14: Percentage of Top 50 Metropolitan Areas Deployment Neededfor V2V SystemsSource: CAR 201214MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYmandate V2V communication systems forsafety applications), as seen in Figure 13.This bodes well for those in the industry whoare working to make the technology moreubiquitous.only 10 to 20 percent needed to deploy (seeFigure 14).PERCENTAGE OF TOP 50 METROPOLITANAREAS DEPLOYMENT NEEDED FOR V2VSYSTEMSThe majority of round one responses indicated that if NHTSA announces it does intend tomandate V2V safety technology within fiveyears, all new light vehicles will be requiredto have this technology as standard equipment. More specifically, more than 80 percent of respondents indicated the belief thatall new vehicles sold in the U.S. will be required to have this technology as standardequipment (if NHTSA intends to mandate it)Answers are very mixed on what percent ofthe top 50 metropolitan areas would need todeploy V2I roadside equipment to make aV2V system viable. A quarter thought 90 to100 percent of the areas would need to deploy equipment, but a quarter also thoughtNHTSA MANDATE AND STANDARDEQUIPMENT REQUIREMENTSFigure 15: NHTSA Mandate and Standard Equipment RequirementsSource: CAR 2012Figure 16: Mandate for Aftermarket V2V RetrofitsSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH15

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYResponses are somewhat mixed as towhether a mandate for aftermarket retrofits ofV2V communication is necessary for significant safety benefits by 2022, though the majority (58%) think they are not (see Figure16).NHTSA announces it intends to mandateV2V safety technology, it will be very unlikelythat NHTSA will also require existing vehiclesto be retrofitted with an aftermarket V2Vsafety device. If, however, NHTSA does introduce an aftermarket mandate, exactly halfof respondents believe the vehicle aftermarket device will be for vehicle awareness(broadcast only), and half believe the devicewill not be connected to the vehicle’s databus (see Figure 17).TYPE OF AFTERMARKET DEVICE IFMANDATEDNHTSA MANDATE AND AUTOMAKERSPURSUING V2VMost first round respondents indicated that ifIf the NHTSA does not intend to mandateby 2020, and 100 percent think it will happenby 2022 (see Figure 15).MANDATE FOR AFTERMARKET V2VRETROFITSFigure 17: Type of Aftermarket Device if MandatedSource: CAR 2012Figure 18: Forecast for Mandated Connected Vehicle ApplicationsSource: CAR 201216MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYV2V safety technology, answers remain relatively mixed as to whether automakers willcontinue to pursue V2V technology for safetysystems. For the 33 percent that believe it isvery likely automakers will continue, the following reasons were given: These technologies offer real safety benefits Europe is doing it and we will follow Political, marketing and technological benefits for automakers Can't sell cars if congestion is too bad Can provide functionality for tolling and other connected vehicle apps that will happenFor those who said it was not at all likely (42percent), several commented that it is onlyvaluable if there is mass adoption of thetechnology. Without it, automakers do notdesire to add costs to vehicles.OTHER GOVERNMENTAL MANDATESAnother big question for the industry iswhether governmental entities will mandatecertain types of technology and applications.In general, respondents do not believe manyconnected vehicle applications will be mandated by 2017, but believe a few, especiallyrelating to intersections and higher-alertzones, will likely be mandated by 2022.FORECAST FOR MANDATED CONNECTEDVEHICLE APPLICATIONSThe majority of respondents to Round Oneindicated that the following connected vehicleapplications will likely not be mandated by2017 (see Figure 18): Intersection control violations Stop sign movement assist, violation warning, and highway/rail crossings Lane/road departure warning Curve speed/rollover warning Work-zone, school-zone, exit facility, icybridges, low clearance warning Left-turn across path and lateral gap acceptanceHowever, respondents did think the followingwill likely be mandated by 2022: Intersection control violations Stop sign movement assist, violation warning, and highway/rail crossings Curve speed/rollover warning Work-zone, school-zone, exit facility, icybridges, low clearance warningFigure 1: Top Challenges to Broad AdoptionSource: CAR 2012MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH17

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYADDITIONAL SAFETY APPLICATIONMANDATESMost respondents indicate no additionalsafety applications will be mandated by2022, though some thought the followingcould be mandated: Forward collision warning Electronic emergency brake lights Road conditions ahead Emergency vehicle, train, school bus stopwarningsHowever, one respondent suggested thatthere is no need for the government to man-date any applications, just which technologyto use.CHALLENGES TO BROAD ADOPTIONWhen asked what the biggest challenges tobroad adoption of connected vehicle technology are, respondents placed infrastructurefunding at the top of the list.TOP CHALLENGES TO BROAD ADOPTION OFTHE TECHNOLOGYThe majority of respondents in Round Oneindicated that funding infrastructure build-outand driver distraction are the primary challenges to broad adoption of connected vehi-Figure 20: Autonomous vs. Connected Vehicle TechnologySource: CAR 2012Figure 21: Safety Features and Autonomous vs. Connected VehicleTechnologySource: CAR 201218MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDYcle technology. In Round Two, infrastructurefunding remains the top perceived challenge,followed by vehicle equipment costs anddriver distraction (see Figure 19).AUTONOMOUS TECHNOLOGYAutonomous technology describes vehiclesthat operate without drivers and instead usesensors and potentially V2V and V2I applications to navigate their surroundings (Silberg,Wallace et al., 2012). But because this technology does not rely upon other vehicles being equipped with similar communication devices, there is much research happening inthis arena. Google, for example, has a fullyautonomous vehicle that drives on roadwaysas part of a testing effort, albeit with a humandriver present in the vehicle

CONNECTED VEHICLE TECHNOLOGY INDUSTRY DELPHI STUDY 4 MICHIGAN DEPARTMENT OF TRANSPORTATION & THE CENTER FOR AUTOMOTIVE RESEARCH all higher in 2017 and then drop significantly by 2022. However, the forecasted additional costs to the consumer for adding the tech-nology to a vehicle is the highest at 350 in