Transcription

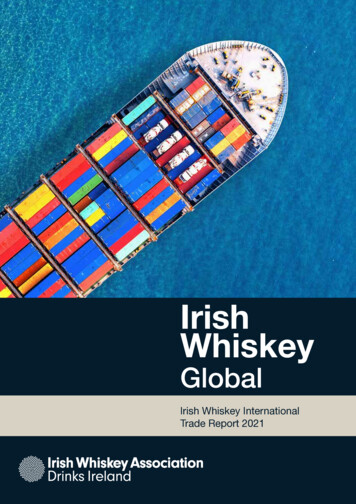

IrishWhiskeyGlobalIrish Whiskey InternationalTrade Report 2021

1ContentsForeword. 2Summary of policy objectives. 4Irish Whiskey Global Sales. 6Tariff-free trade with the United States. 8Post-Brexit Rules of Origin . 10The Irish Whiskey Association is therepresentative voice within Drinks IrelandRatifying and implementing trade agreements with Canada. 12working to promote, protect and representthe Irish Whiskey category globally.Definitions of Whiskey. 14www.irishwhiskeyassociation.ieProtecting Irish Whiskey. 15@IrishWhiskeyAsc #IrishWhiskeyGlobalSupporting market diversification. 16This report has been compiledPromoting Irish whiskey in international markets. 18by William Lavelle,Head of the Irish Whiskey Association,with support from theInternational Trade Committee.Our Members. 19

23ForewordIreland may be a small island, but we make quite a lotof whiskey. Strikingly, 96% of all Irish whiskey salesare to markets outside of Ireland. In 2019, before theon-set of Covid-19, exports of Irish whiskey wereworth 890 million to our shared economy across theisland of Ireland. Despite a slight drop, sales in 2020still managed to exceed expectations, with categoryperformance holding up or increasing in manymarkets. Trends in 2020 also confirmed the recentacceleration in market diversification. Looking tothe future, the Irish whiskey industry can confidentlytarget more growth in more markets, across moreClaire MacCarricksales channels and among more consumer segments.But now, more than ever, international trade policy will increased interaction with Ministers, Commissionersbe critical to supporting growth and diversification.and officials in Dublin, London, Belfast and Brussels, aswell as in Washington and other international capitals.Irish whiskey has benefited greatly from decades of bothMore recently, this work has been supported by the newmulti-lateral and bilateral developments in international tradeInternational Trade Committee which I am honoured to chair.which have resulted in the elimination of tariffs, the removalof non-tariff barriers to trade, and new and increasedThis report seeks to capture and present both our recentprotections for the Irish whiskey geographic indication.work and ongoing priorities on the international trade front.However, a supportive global environment for internationaltrade is not something we should take for granted.On behalf of the Irish Whiskey Association, I wish to thankthe various Ministers, Commissioners, Ambassadors andDevelopments in international trade have been makingofficials of both Irish and UK Government departments andthe headlines recently. We have seen threats of new tariffsof the European Commission for their strong support forand some tariffs have actually been imposed as a resultIrish whiskey in international trade policy. We look forward toof trade disputes. At the same time, our all-island industryworking with our stakeholders to continue to enhance thehas had to face the new reality of trading out of twointernational trading environment for Irish whiskey and todifferent customs territories, bringing both challenges andfoster more growth in more markets.opportunities.This context is the backdrop to the ongoing developmentof our association’s International Trade and Market AccessClaire MacCarrickChair, International Trade Committeefunction. Over the past three years, the association hasgreatly expanded its monitoring, policy developmentand stakeholder engagement activities. There has beenJameson Distillery, Midleton

Summary of policy objectives5The Irish Whiskey Association calls for:Reform of the rules-of-origin forwhiskey and territoriality rules in all EU& UK trade agreements to protect andfacilitate the Irish whiskey industry’scross-border supply chains on theisland of Ireland.Elimination of outstandingdiscriminatory levies andmark-ups in Canadain accordance withAnnex 30(c) of the CETAagreement.Ratification of the CETAagreement by Dáil Éireann.A permanent end to alltransatlantic trade disputes,building on recent positivedevelopments.Continuedimplementationin full of theProtocol onIreland/NorthernIreland.Recognition and protectionof Irish whiskey productionand labelling practices in allinternational definitions ofwhiskey.Protection for Irishwhiskey in Russia.Enhanced protectionfor Irish whiskey in USTTB rules similar to thatcurrently afford to Scotch.Inclusion of GI protectionin all future trade agreementnegotiations.Expansion of tariff-free tradeto more African markets,particularly markets inboth the Eastern AfricanCommunity (EAC) andEastern and Southern Africa(ESA) bloc.International tradepolicy is critical tosupporting the Irishwhiskey industry’sstrategy of moregrowth in moremarkets, acrossmore sales channelsand among moreconsumer segments.Conclusion and ratificationof the EU-Mercosur tradeagreement.Inclusion oftariff reductionsin both EUand UK tradenegotiations withIndia.Progression oftrade agreementnegotiations withThailand.Inclusion of measures tofacilitate spirits e-commercein future trade agreements.Conclusion of an EU tradeagreement with Australia,including tariff elimination.

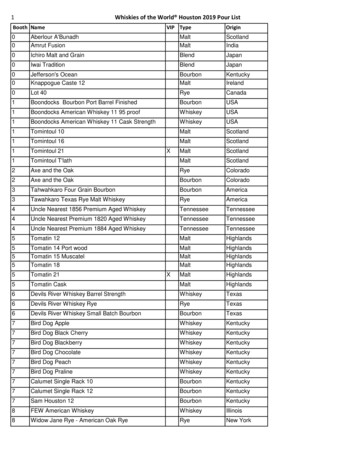

67Top 20 Irish whiskey markets 2020Cases SoldMarket(1,000s)1United States2Ireland591.03Russia534.34United rish whiskey was officially the fastest growing spirits8South Africa347.0category in the world over the past decade, with9Canada337.7140% growth in sales from 2010 to 2020. In February10Australia247.32020, just before the onset of the Covid-19 pandemic,11Ukraine168.0the 12-month rolling total for Irish whiskey global12Czech sh whiskey sales held-up or increased across some of19Netherlands74.8our most important markets including in Ireland, United20Latvia70.5Irish WhiskeyGlobal Salessales broke 12 million cases. For the calendar year of2020, 11.4 million cases were sold, a slight decreaseon 2019, but still exceeding expectations for what wasa challenging year. The decline in 2020 was primarilydue to a collapse of Irish whiskey sales in global travelretail as a result of the Covid-19 pandemic.Kingdom, United States and Canada. Strong growth was4,928.5Source: The IWSRrecorded in a number of markets in the important Central/India, Japan, New Zealand and Zambia all recorded stronggrowth.of spirits, with e-commerce here to stay as an important9msales channel for Irish whiskey.8m7mLooking forward, Irish whiskey can confidently target more6mgrowth, in more markets, across more sales channels and5mamong more consumer segments. Having a supportive4minternational trade policy will be critical to achieving this.Source: The IWSR2020more than doubling over the course of the year. Australia,10m2019fastest-growing market for Irish whiskey in 2020 with salesa transformational pivot by consumers to online purchasing2018Africa and the Asia-Pacific region. Nigeria proved to be the11m2017continued rise in sales in emerging markets, particularly inadded to the category. The onset of the pandemic also saw2016approximately 84% of all Irish whiskey sales, 2020 saw a12m2015While North America and Europe continues to account foryears. This has the potential to deliver substantial value-13m2014result of restrictions and the collapse in tourism.strong growth at higher price points expected in coming2013markets in Southern European saw declines in sales as a(9 litre cases) 2010-2020trend towards premium-and-above Irish whiskey, with2012led by impressive growth in Sweden. In contrast manyAcross all major markets, 2020 saw a continuation in the2011Ukraine. Steady growth was also recorded in the Nordics,Global sales of Irish whiskey2010Eastern Europe region, including Germany, Poland and

89Tariff-free tradewith theUnited StatesThe United States remains the largest market for IrishUS support to each of Airbus and Boeing respectively. Inwhiskey, with approximately five million case sales2019, the United States listed Irish whiskey for the possiblein each of 2019 and 2020, accounting for 43% of allimposition of tariffs in the Airbus dispute. The Irish WhiskeyIrish whiskey sales. The current growth trajectory isAssociation lobbied intensively to avoid tariffs, including inexpected to continue and will be further aided by theWashington. Our industry received substantial support fromincreasing availability to premium consumers of morethe Irish Embassy in Washington and from a number of keyaged Irish whiskey, as well as the rise in e-commerce.Irish-American political figures. Over 99.9% of Irish whiskeyWilliam Lavelle, Head of the Irish Whiskey Association, with colleagues from spiritsEUROPE and the Distilled SpiritsCouncil of the United States at Capitol Hill in Washington, September 2019.were excluded from tariffs. Regrettably a small number ofGiven the current importance and future potential of the USNorthern Irish single malts were tariffed. The associationmarket, protecting tariff-free trade with the United Statescontinued to lobby intensively for an end to these tariffs;remains the No. 1 priority for Irish whiskey internationaland received support from the UK Government, particularlytrade policy. Regrettably, this ambition has been met withfrom Rt. Hon Greg Hands MP, Minister for Internationalchallenges in recent years with the spirits sector beingTrade Policy. In June 2021, the United States agreed newtargeted in number of transatlantic trade disputes focussedframeworks with each of the EU and UK to seek resolutions“We welcome suspension of tariffs onon unrelated sectors.of the long-running aviation disputes. As part of this, allBushmills’ single malts in the Unitedsides agreed to suspend tariffs for five years, until JulyStates, the largest single malt marketIn 2018, the Trump administration imposed section 2322026. We hope this welcome development will lead to apermanent end to transatlantic trade disputes.globally, and hope for a positive long-tariffs on imports of European steel and aluminium. Inresponse, the European Union imposed a 25% tariff on arange of US imports, including US whiskeys. These tariffsWhile Irish whiskey was less impacted than many otherimpacted on a number of our association members whospirits categories, the Irish Whiskey Association was activealso have US whiskeys in their global portfolio. A proposedthroughout the disputes in calling for de-escalation. Indoubling of these tariffs by the EU on 1 July 2021 has beendoing so, the association worked closely with colleagues atdeferred until 1 December to allow for negotiations onhome in the Irish cream liqueur sector; and internationallyresolving the broader dispute. The UK is currently holding awith colleagues in spiritsEUROPE and the Distilled Spiritsconsultation on its future approach to this dispute.Council of the United States, including as part of the#ToastsNotTariffs coalition.Further tariffs on a range of spirits categories followed aspart of the separate, but similar, disputes over EU andNorthern Irish single maltproducers welcome liftingof US tariffsterm conclusion to the negotiations in duecourse”Colum Egan,Master Distillers, BushmillsPolicy Objective:The Irish Whiskey Associationcalls for a permanent end toall transatlantic trade disputes,building on recent positivedevelopments.Bushmills Distillery

1011Post-BrexitRules ofOriginor processing have now lost access to zero or reducedtariffs provided for by EU trade agreements with a range ofmarkets including South Africa, Switzerland, Serbia, SouthKorea, Colombia, Vietnam and Botswana. The scale oftariff can be significant. For example, the tariff differentialbetween Irish whiskeys which are deemed EU-originatingand non-originating is zero versus 154 cents/litre in SouthAfrica; and zero versus 20% in South Korea.While the Protocol on Ireland/Northern Ireland protectsThe island of Ireland is the home of whiskey. Irishcross-border supply chains on the island of Ireland fromwhiskey has always been an all-industry industry –tariffs and checks at the border, the failure to act on rulesthe embodiment of our shared economy. Over 10%of origin effectively makes many such cross-border supplychains problematic when it comes to exporting to certainof Irish whiskey sold around the world last year wasmarkets. This very much works against the concept of ablended Irish whiskey containing component whiskeyshared all-island economy.originating from distilleries on both sides of theborder.The Irish Whiskey Association has asked the EuropeanTullamore DistilleryCommission to consider new rules-of-origin which protectHowever, since the end of Brexit transition period on 31cross-border supply chains on the island of Ireland. WeDecember 2020, Irish whiskeys produced primarily inhave proposed this should apply to all future EU trade dealsIreland, but containing some level of Northern Irish inputsbeginning with the current Australia negotiations, as well inor processing, have lost their EU originating status underreviews of existing FTA as they arise.certain EU trade agreements with markets around theworld. This results from the fact that the rules-of-origin in theRegrettably, the responses to date have been disappointing.relevant EU trade agreements do not recognise inputs orThe association has also conducted extensive engagementprocessing from outside of the European Union.on this matter with the Irish Government and with membersof both the European Parliament and Oireachtas. In JuneFor example, the standard rules-of-origin for whiskey in EU2021, the association joined with both Dairy Industrytrade agreements requires all the whiskey, or its originalIreland and the Northern Irish Dairy Council in making aunmatured whiskey spirit, to originate from within the EU.joint presentation to the Seanad Éireann Special SelectThis means Irish whiskey produced exclusively in this stateCommittee on the Withdrawal of the United Kingdom fromcan qualify for any zero or reduced tariff provided for by anthe European Union.EU trade agreement, but an Irish whiskey with componentwhiskey which was distilled in Northern Ireland will not.In their continuity trade agreements, the United KingdomFurthermore, trade agreement rules on ‘territoriality’ meanshave agreed that EU inputs shall continue to have UKIrish whiskey produced in this state, but bottled in Northernoriginating status. The agreement-in-principle betweenIreland, could also lose out on originating status in certainthe UK and Australia for a new FTA includes welcomecases.provisions on the reform of rules-of-origin. The associationhas had substantial engagement on this matter with theAs a result, Irish whiskeys containing Northern Irish inputsDepartment of International trade and with DEFRA.Powerscourt DistilleryPolicy Objective:The Irish Whiskey Associationcalls for: Continued implementationin full of the Protocol onIreland/Northern Ireland. Reform of the rules-of-originfor whiskey and territorialityrules in all EU & UK tradeagreements to protect andfacilitate the Irish whiskeyindustry’s cross-bordersupply chains on the islandof Ireland.

12Ratifying andimplementingtradeagreementswith CanadaJameson is the largest-selling brand ofon foot of audits carried out at the request of the EU underIrish whiskey across Canada.the terms of the CETA agreement. The reductions werewarmly welcomed by our association members who haveoften cited the very tight margins on Irish whiskey sales inCanadian provinces. Members reported their intentions toreinvest savings in increased A&P activity in Canada.“Sales of Jameson Irish Whiskey in Canadagrew in value by 34% from 2017 to 2020,While there are several factors that havecontributed to this success, we believe thatHowever, there remains a number of outstanding casesopen trade and levy reductions betweenof discriminatory levies and mark-ups on Irish whiskey inIreland and Canada has greatly supported theCanadian provinces. For example, the mark-up on importedsuccess of Irish whiskey there in recent years”Simon Fay,spirits on sale in Nova Scotia is an excessive 160%,Business Acceleration Director,compared to the 50% mark-up on domestic spirits sales.Irish DistillersIn recent years, Canada has emerged as anThe Irish Whiskey Association has worked closely withincreasingly important market for Irish whiskey. In thespiritsEUROPE, the French Federation of Wine and Spiritsfour years from 2017 to 2020, sales of Irish whiskey inExporters and Comité Européen des Entreprises Vins toOne of the Irish whiskey brands toCanada increased by 66%, to over four million bottles.press the European Commission to seek action underbenefit from CETA has been Writer’sAnnex 30(c) of the CETA agreement to address theseTears from Walsh Whiskey. Sales ofoutstanding discriminatory levies and mark-ups.Writer’s Tears in Canada increased byA major contributor to this growth has been the reform oflevies, known as the cost-of-service-differential, which are84% from 2017 to 2020.imposed by provincial liquor retail monopolies in OntarioWhile CETA offers the best way forward to addressing theseand Quebec, the two most populous provinces in Canada.matters, the Irish whiskey industry’s capacity to press for“Canada has long been one of our mostThese reforms flowed from the Comprehensive Economicaction is being held-up by the failure to date of Ireland topromising markets, but the application ofand Trade Agreement (CETA) between the European Unionratify the CETA agreement. Dáil Éireann is expected to voteCETA since 2017 has seen provincial leviesand Canada, which came into ‘provisional effect’ in 2017.on ratification of the agreement later this year and the Irishreduced and this has greatly helped usWhiskey Association will continue to campaign for a positiveIn 2018, initial reforms were implemented under Annex 30(b)vote for ratification.of CETA which saw the cost-of-service-differential (COSD)in achieving our potential. Our sales havepractically doubled and Writers’ Tears hasbecome the top-selling super-premiumlevies in Ontario and Quebec being reformed from anThe United Kingdom has put in place an interim continuityad-valorum basis to a flat per-volume fee. These changestrade agreement with Canada ahead of negotiations on aIrish whiskey in Ontario, Canada’s largestgreatly benefited sales of premium Irish whiskey.new free trade agreement. The Irish Whiskey Associationprovince.”will continue to engage with UK Ministers and officials onIn 2021, further reforms saw the Liquor Control Board ofthis proposed agreement, with a particular focus on seekingOntario reduce their levies on EU and UK spirits by 42%,action on outstanding discriminatory levies and mark-ups.while Société des alcools du Québec reduced their levieson imported spirits by 16.4%. These latest reductions came13Irish whiskey brands arebenefiting from CETABernard Walsh,Managing-Director,Walsh WhiskeyPolicy Objectives:The Irish Whiskey Associationcalls on: The EU Commission and UKGovernment to insist on theelimination of outstandingdiscriminatory levies andmark-ups in accordancewith Annex 30(c) of the CETAagreement. Dáil Eireann to ratify theCETA agreement.

1415Definitions ofWhiskeyProtecting IrishWhiskeyOver the past year, the Irish Whiskey Association hasof malt and grain whiskey, as is the norm inBilateral trade agreements have played an importantactively monitored and commented on proposalsScotch; but potentially posing difficulties forrole in delivering protection to the Irish whiskeyto introduce new or update existing definitionsblended Irish whiskey which contains pot stillgeographical indication (GI) in new markets, inof whiskey in markets including Brazil, China andwhiskey and which may not contain either maltvaluable addition to the work of our association inRussia, as well as proposals to introduce definitionsor grain.directly applying for such protection. As of June 2021,89% of global sales of Irish whiskey sales are subjectof whiskey in Australia linked to the new UK FTA.to some form of legal protection.Defining whiskey in national market rules can haveIn recent years, bilateral agreements have delivered Irishbenefits, such as requiring all whiskeys to have undergonewhiskey GI protection in markets including China, Japan,a minimum of three years maturation in wooden barrels,Singapore, South Korea and Vietnam. Future protection isthereby protecting the quality character of whiskey andon offer from the proposed agreements with New Zealandavoiding unfair competition from immature spirit products.and from the draft EU agreement with Mercosur bloc,including Brazil and Argentina.However, defining whiskey can also pose challenges,particularly if the definition is too narrowly crafted, possiblyIrish whiskey is protected in the United States via the 1994with reference to the most popular whiskey categories inExchange of Letters on the mutual recognition of certainthat market. The Irish Whiskey Association has identifieddistilled spirits/spirit drinks. However, the level of protectiona number of recent examples whereby proposed newPolicy Objective:definitions of whiskey may be supportive of production andlabelling practices of Scotch whisky, but not of Irish whiskey.The two most common issues which arise relate to Limiting the maturation of whiskey to takingplace in oak casks, as Scotch rules requires,thereby prohibiting maturation or finishingin casks of other wood types e.g. chestnut,cherry, acacia, etc which is permitted by Irishwhiskey rules; Strictly defining blended whiskey as a blendThe Irish WhiskeyAssociation calls forthe recognition andprotection of Irishwhiskey production andlabelling practices in allinternational definitions ofwhiskey.Policy Objective:The Irish Whiskey Association callsfor: Inclusion of GI protection inall future trade agreementnegotiations. Enhanced protectionfor Irish whiskey in USTTB rules similar to thatcurrently afford to Scotch. Protection for Irish whiskeyin Russia.afforded to Irish whiskey under US Alcohol and TobaccoTax and Trade Bureau (TTB) rules is currently inferior to thatafforded to Scotch whisky. The Irish Whiskey Associationcontinues to press for enhanced protection for Irish whiskeyin TTB rules to provide that “the words “Irish”, “Ireland”,“Eire”, and similar words and symbols connotating,indicating or commonly associated with Ireland, may onlybe used to designate distilled spirits wholly manufactured inIreland.Russia remains the largest export market in which Irishwhiskey does not have protection. All opportunities tosecure protection will continue to be pursued.

141617SupportingmarketdiversificationInternational trade policy continues to play ain what is the world’s largest whiskey market. Beyond thesesignificant role in supporting the ongoing marketagreements, Northern Irish whiskey could stand to benefitdiversification of Irish whiskey. The elimination offrom the UK’s proposed accession to CTPTP comprising 11tariffs has proven highly effective in aiding the moreAsia-Pacific markets.competitive pricing of Irish whiskey in emergingIrish whiskey brandsare benefiting from tariffreductions:Policy Objective:The Irish Whiskey Association callsfor:markets. This is particularly so in markets with a highThe Irish Whiskey Association has identified Thailandlevel of price elasticity where small reductions inas a further Asian market where we would encourage“A concerted effort to remove tariff andprices can lead to greatly increased sales; and viceboth the EU and UK to seek free trade agreements. Innon-tariff barriers to the global trade in Irishversa.terms of Africa, the association supports proposals for anWhiskey, particularly in emerging markets,African Continental Free Trade Agreement which wouldwill support future growth as the industryOver recent years, trade agreements have led to thefacilitate tariff-free trade. In term of specific African regions,emerges from the Covid-19 pandemic.in both EU and UK tradeelimination or phasing-out of tariffs across the Southernthe association has identified both the Eastern AfricanFor example, the reduction in tariffs innegotiations with IndiaAfrican Development Community and in other markersCommunity (EAC) and Eastern and Southern Africa (ESA)including Colombia, South Korea and Vietnam. Thebloc as specific priorities in terms of lobbying for future tariffrecently-announced UK FTA with Australia will seereductions, building on existing agreements.elimination of the 5% tariff on whiskey; and it is hoped thiswill be matched in the planned EU FTA with Australia.In addition to tariff elimination, the Irish Whiskey Associationlobbies on a range of other market access issues inLooking to the future, two sets of agreements offeremerging markets. For example, over the past year theprospects for substantial tariff reductions in key emergingAssociation has lobbied on the use of bonded warehousesmarkets. Firstly, the draft EU agreement with the Mercosurin Kenya, illicit trade in Jordan; and excise-related matters inbloc proposes the phasing-out over four years of tariffs onHong Kong, Nigeria and Turkey.Colombia is a very welcome development of the EU-Mercosur tradeagreement Outside of market-based priorities, the association willboth the EU and UK have agreed to commence new tradework with spiritsEUROPE to press for facilitation of spiritsnegotiations with India, potentially offering the prospect fore-commerce in future trade policy developments.reductions to the current 150% duty on imported whiskeyProgression of trade agreementExpansion of tariff-free tradeestablished taste for whiskey, given the sizeto more African markets,of the Scotch business.”particularly markets in both theJohn Quinn,Chairman of the Irish Whiskey AssociationEastern African Community(EAC) and Eastern andGlobal Brand Ambassador, Tullamore D.E.W.Southern Africa (ESA) bloc Teeling Whiskey recorded 125% exportgrowth to Vietnam market in 2020while also recently securing a newInclusion of measures tofacilitate spirits e-commerce inspirits in Brazil and Argentina, both of which offer strongprospects for the future growth for Irish whiskey. Secondly,Inclusion of tariff reductionsnegotiations with Thailandand opens up great possibilities for thecategory in a market which already has anConclusion and ratificationfuture trade agreements Conclusion of an EU tradelisting in GS25, one of Korea’s largestagreement with Australia,retailers with 13,000 stores nationally.including tariff elimination.

18PromotingIrish whiskeyin internationalmarkets#DiscoverIrishWhiskeyIn 2021, the Irish Whiskey Association launched the#DiscoverIrishWhiskey campaign featuring a range ofmember-developed online content, including a newnarrative and booklet on the depth and diversity of Irishwhiskey, content on ‘Ireland: Home of Whiskey’ and recipesand a booklet to promote Irish whiskey cocktails. Work iscontinuing to develop content on Irish whiskey and food, tosupport the on-trade and to spotlight Northern Irish brands(in conjunction with NI/UK agencies). To date the campaignhas featured significant social media activity includingsharing of video content. The #DiscoverIrishWhiskey will beused to support future domestic and international promotionactivity.Activating international mediaThe Irish Whiskey Association has developed a strongrecord of successfully engaging with international media.In 2019, the association partnered with the Distilled SpiritsCouncil of the United States (DISCUS) on a St. Patrick’sDay media event in New York, hosted by Ireland’s ConsulGeneral. Later in 2019, the association hosted a DISCUSmedia trip featuring 10 leading US spirits writers. Followingthe onset of Covid-19, the association innovated a newmodel for online media tastings. To date, seven eventshave been held, five as part of the #DiscoverIrishWhiskey19campaign. In total over 30 top spirits writers and bloggersfrom the US and Canada have participated with a largenumber of member companies having been given theOur Membersopportunity to showcase their brands. We have partneredwith DISCUS and Tourism Ireland in planning these eventsand we have been honoured to have been joined at differentevents by all four of the Irish and UK Ambassadors to the1.Altech Beverage Division Ireland32.Niche DrinksUS and Canada. A further webinar was hosted by the Irish2.Beam Suntory33.O’Shaughnessy DistillingEmbassy in Mexico to mark World Whiskey Day 2021.3.Blacks of Kinsale34.Powerscourt Distillery4.Blackwater Distillery35.Protégé InternationalEngaging with control states5.Boann Distillery36.Quintessential Brands IrelandSince 2017, the association has hosted visits to Ireland6.Brown Forman37.Rademon Estate Distilleryby senior spirits buyers from the liquor control boards in7.Bushmills38.Sazerac of Ireland8.Clonakilty Distillery39.The Shed Distillery9.Connacht Whiskey Co.40.Sliabh Liag Distillers10.Diageo41.Skellig Six 18 Distillery11.Dingle Distillery42.Teeling Whiskey CompanyBritish Colombia, Ontario and Pennsylvania. The associationhas also hosted or co-hosted follow-up events in each ofPittsburgh, Philadelphia and Toronto. This engagement hasproven valuable in securing expanded listings and increased12.Donohoe Drinks43.Terra Spirits & Liqueurssales of Irish whiskey.

Irish whiskey has benefited greatly from decades of both multi-lateral and bilateral developments in international trade which have resulted in the elimination of tariffs, the removal of non-tariff barriers to trade, and new and increased protections for the Irish whiskey geographic indication.