Transcription

HEALTHCARE COMPLIANCE NETWORKING INC.BILLING COMPLIANCE CONSULTING

Our DisclosureThese slides and presentation are to be used onlyas informational tools , for official rules andregulation please visit CMS website athttp://www.cms.gov/BILLING COMPLIANCE CONSULTING

Healthcare Compliance and Networking Inc.www.HCAN.net Billing for Outpatient Rehab, DME, HHA and Physicians Provided Enrollment and Revalidation services for all typesof Facilities and physicians group and Individual Compliance programs HIPPA, CMS and OSHA Offer an EMR application for our billing clients Preparation of the Medicare Cost Reports Based in Jacksonville Florida for over 12 yearsBILLING COMPLIANCE CONSULTING

Update on CMSRevalidation ProjectBILLING COMPLIANCE CONSULTING

The Latest on Medicare Revalidation Section 6401 (a) of the Affordable Care Act established a requirement for allenrolled providers and suppliers to revalidate their enrollment informationunder new enrollment screening criteria. This revalidation effort applies tothose providers and suppliers that were enrolled prior to March 25, 2011.Newly enrolled providers and suppliers that submitted their enrollmentapplications to CMS on or after March 25, 2011, are not impacted. Between now and March 23, 2015, MACs will send out notices on a regularbasis to begin the revalidation process for each provider and supplier.Providers and suppliers must wait to submit the revalidation onlyafter being asked by their MAC to do so. Please note that 42 CFR424.515(d) provides CMS the authority to conduct these off-cyclerevalidationsBILLING COMPLIANCE CONSULTING

The Why for the RevalidationRevalidation is the process by which the Centers forMedicare & Medicaid Services (CMS) requires a providerto certify the accuracy of his or her existing enrollmentinformation with Medicare.Complying with revalidation requests within the specifiedtime is necessary to avoid loss of billing privileges anddisruption of Medicare reimbursements.BILLING COMPLIANCE CONSULTING

Revalidation is not a new thingMedicare requires revalidation every five years, but also may perform off cyclerevalidations (including possible site visits).Revalidations may be triggered by: Health care fraud problems Random checks Complaints, or other reasons that cause CMS to question theprovider's/supplier's compliance with Medicare enrollment requirementsCMS is actively targeting the following types of providers for revalidation: Providers who are not registered in the Medicare Provider Enrollment,Chain, and Ownership System (PECOS) Providers who have not updated their enrollment within the last five years Providers located in historically high-risk areas for Medicare fraud Providers who do not receive electronic funds transfer (EFT) paymentsBILLING COMPLIANCE CONSULTING

A massive re-enrollment effortMedicare plans to revalidate the enrollments of more than 1.4 million individualsand facilities by 2015. Physicians account for more than half the list.BILLING COMPLIANCE CONSULTING

Thousands lose Medicare billing rights during revalidationCMS has removed health professionals with outdated and invalidenrollment records as it works to strengthen Medicare participation rules. Washington Medicare has revoked or deactivated the billingprivileges of more than 23,000 health professionals and equipmentsuppliers during the initial stages of a nationwide enrollmentrevalidation effort. The Centers for Medicare & Medicaid Services has enrolled orrevalidated more than 275,000 professionals since March 25, 2011,when the agency began using strengthened measures to rescreen 1.5million participants.BILLING COMPLIANCE CONSULTING

Notification From Your MACCMS has instructed the MACs to send revalidations lettersin a colored envelope so it stands out among all the othercorrespondence that one may receive.Only submit your application once you have received thenotification from you MACBILLING COMPLIANCE CONSULTING

Revalidation LetterYou will have 60 days from the date on the letter tosubmit your revalidation application, if you don’trespond you may be a risk of having your Medicarenumber suspended, if you need an extension , youmust contact your servicing MAC and justify thereason promptly.BILLING COMPLIANCE CONSULTING

Enrollment Forms CMS 855A--Medicare Enrollment Application for Institutional ProvidersCMS 855B--Medicare Enrollment Application for Clinics, Group Practices, andCertain Other SuppliersCMS 855I --Medicare Enrollment Application for Physicians and Non-PhysicianPractitionersCMS 855R--Medicare Enrollment Application for Reassignment of Medicare BenefitsCMS 855O--Medicare Enrollment Application for Eligible Ordering and ReferringPhysicians and Non-physician PractitionersCMS 855S--Medicare Enrollment Application for Durable Medical Equipment,Prosthetics, Orthotics, and Supplies (DMEPOS) SuppliersThe following forms are routinely submitted with an enrollment application:– Electronic Funds Transfer (EFT) Authorization Agreement (Form CMS 588)– Medicare Participating Physician or Supplier Agreement (Form CMS 460)BILLING COMPLIANCE CONSULTING

Exception to the Rule on RevalidationProviders and suppliers, including physicians, arerequired to revalidate their information every five years,durable medical equipment (DME), are required torevalidate their information every three years.CMS is currently undertaking an "off-cycle" revalidationprocess now for all providers, meaning a revalidationrequest could happen sooner than five years.BILLING COMPLIANCE CONSULTING

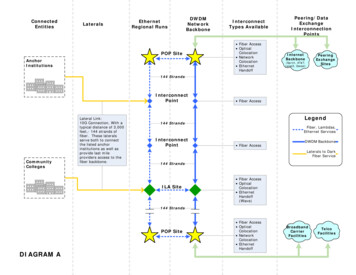

The Phased Approach The phased approach will allow MAC to manage the workloadand ease the burden. This should avoid a bottleneck at thecontractors side. CMS is moving a lot of the larger groups back into the laterphases to leverage the enhancements that are being made tothe Provider Enrollment, Chain and Ownership System(PECOS). The phased approach will allow contractors the ability toprovide plenty of education and outreach.BILLING COMPLIANCE CONSULTING

Sample of Common ErrorsNPI number missing.NPI documentation does not match name or address on 855A.EFT (CMS Form 588) agreement and/or documentation is missingThe NPI reported is for a physician and not the facilityMedicare number reported is not a Part A or OSCAR numberFailure to complete section for the authorized and/or delegated official.Failure to complete this section for the Administrator or CEO of thehome office in Section 7. Missing or incorrect Social Security numbers or dates of birth Reporting NPI and Medicare number that do not belong to theindividual Missing date when signing BILLING COMPLIANCE CONSULTING

MANDATORY FOR ALLPROVIDER/SUPPLIER TYPES Completed Form CMS-588, for Electronic Funds Transfer AuthorizationAgreement. NOTE: If a supplier already receives paymentselectronically and is not making a change to his/her bankinginformation, the CMS-588 is not required. (Moreover, physicians andnon-physician practitioners who are reassigning all of their payments toanother entity are not required to submit the CMS-588.) Written confirmation from the IRS confirming your Tax IdentificationNumber with the Legal Business Name (e.g., IRS form CP 575) provided inSection 2. (NOTE: This information is needed if the applicant is enrollingtheir Professional Corporation, professional association, or limited liabilityCorporation with this application or enrolling as a sole proprietor using anEmployer Identification Number.)BILLING COMPLIANCE CONSULTING

MANDATORY, IF APPLICABLE Copy of IRS Determination Letter, if provider is registered with theIRS as non-profit. Copy(s) of all final adverse action documentation (e.g.,notifications, resolutions, and reinstatement letters). Completed Form CMS-460, Medicare Participating Physician orSupplier Agreement. Completed Form CMS-855R, Individual Reassignment of MedicareBenefitsBILLING COMPLIANCE CONSULTING

MANDATORY, IF APPLICABLE Statement in writing from the bank. If Medicare payment due a supplierof services is being sent to a bank (or similar financial institution) wherethe supplier has a lending relationship (that is, any type of loan), then thesupplier must provide a statement in writing from the bank (which mustbe in the loan agreement) that the bank has agreed to waive its right ofoffset for Medicare receivables. Written confirmation from the IRS confirming your Limited LiabilityCompany (LLC) is automatically classified as a Disregarded Entity (e.g.,Form 8832). (NOTE: A disregarded entity is an eligible entity that istreated as an entity not separate from its single owner for income taxpurposes.) Copy of current CLIA and FDA certification for each practice locationreported.BILLING COMPLIANCE CONSULTING

Significant Revisions to the MedicareEnrollment Applications Example - CMS-855A In Section 2B1 added check boxes to indicate if provider is Proprietary orNon-Profit. In Section 2B1 added the question asking for “Year-End” cost reportdate. In Section 2D added “Expiration Date of Accreditation.” Total revision of Section 5 based on ACA requirements to collect highlydetailed information on ownership. Total revision of Section 6 based on ACA requirements to collect highlydetailed information on ownership.BILLING COMPLIANCE CONSULTING

Significant Revisions to the MedicareEnrollment Applications Example - CMS-855A In Section 8 added data field for “Date of Birth” if billing agent is anindividual. In Section 13 added data field for “Suffix” after Last Name. In Section 17 added language to allow contractor ask for documents other thanthose listed in Section 17. In Section 17 added “Copy of IRS determination letter” under Mandatory ifApplicable. In Section 17 added “Written confirmation from the IRS confirming yourLimited LiabilityBILLING COMPLIANCE CONSULTING

Significant Revisions to the MedicareEnrollment Applications Example - CMS-855A Company (LLC) is automatically classified as a disregarded entity”under Mandatory if Applicable. Added NEW Attachment 1 titled “Organizational and IndividualOwnership/Investment Interest and/or Managing Control Information – Physician-OwnedHospitals ONLY” to be Completed by physician owned hospitals.BILLING COMPLIANCE CONSULTING

Significant Revisions to the MedicareEnrollment Applications All Forms /TDL11429 Attachment CMS855 Changes.pdfBILLING COMPLIANCE CONSULTING

Tips to Facilitate the MedicareEnrollment Process Consider using Internet-based Provider Enrollment, Chain and OwnershipSystem (PECOS) to enroll or make a change in your Medicare enrollment if itis available for your provider or supplier type. Submit the current version of the Medicare enrollment application (CMS855). Submit the correct application for your provider or supplier type to theMedicare fee-for-service contractor servicing your State or location. Submit a complete application Submit the Electronic Funds Transfer Authorization Agreement (CMS-588)with your enrollment application, if applicable.BILLING COMPLIANCE CONSULTING

Tips to Facilitate the MedicareEnrollment Process Submit all supporting documentationSign and date the application.Respond to fee-for-service contractor requests promptly and fully.Provider should keep an electronic copy of all the papers filedIRS document (CP-575) shall match (exactly) the corporation name as registeredin the corresponding Department of StateNPI name must then match IRS & Department of state nameIndividual’s name must match exactly the name as it appears in his/her SS card.Have your NPI registry login information Login and passwordFollow up . Follow up the applicationBILLING COMPLIANCE CONSULTING

Great Tools/LinksTo help with the Process FCSO Website - Revalidation information http://medicare.fcso.com/Landing/139786.asp FCSO Website - check if your letter was mailed http://medicare.fcso.com/PE Revalidation/ http://medicare.fcso.com/Enrollment/PEStatus.asp http://medicare.fcso.com/PE Applications and forms/ Palmetto GBA J1 Providers docsCat/Providers Jurisdiction%201%20Part%20A Resources Provider%20Enrollment?open&Cat RevalidationBILLING COMPLIANCE CONSULTING

CMS Link and Tools Revalidation on CMS ions.html Medicare Learning Network Articles Learning-Network-MLN/MLNMattersArticles/ The provider or supplier must pay the applicationfee electronically by going to doBILLING COMPLIANCE CONSULTING

CMS Link and Tools PECOS Login Website https://pecos.cms.hhs.gov/pecos/login.do NPPES Registry Website https://nppes.cms.hhs.gov/NPPES/Welcome.do CMS Extract Files of Revalidation sent by all MAC ions.htmlBILLING COMPLIANCE CONSULTING

Contacts InformationNational Plan and Provider Enumeration System(NPPES)1-800-465-3203 (NPI Toll-Free)1-800-692-2326 (NPI TTY)customerservice@npienumerator.comPECOS EUS Contact InformationPhone: 1-866-484-8049 , TTY: 1-866-523-4759Email: EUSSupport@cgi.comMailing AddressExternal User ServicesPO Box 792750San Antonio, Texas 78279BILLING COMPLIANCE CONSULTING

Contact UsHealthcare Compliance & Networking Inc.4940 Emerson Street, Suite 200Jacksonville, FL 32207Phone (904) 398-0506, Toll Free (888) 398-0506Toll Free Fax (866) 397-4057Email us jorge@hcan.net or tmatos@hcan.netOr visit us at www.hcan.netBILLING COMPLIANCE CONSULTING

CMS 855I --Medicare Enrollment Application for Physicians and Non-Physician Practitioners CMS 855R--Medicare Enrollment Application for Reassignment of Medicare Benefits . (EFT) Authorization Agreement (Form CMS 588) - Medicare Participating Physician or Supplier Agreement (Form CMS 460) BILLING COMPLIANCE CONSULTING.