Transcription

Wholesale VA and VA IRRRL ProductsTopicProduct GuidelineProgram DescriptionThis is base VA mortgage parameters for primary residence only. The borrower must be a veteran witheligibility documented with a Certificate of Eligibility, which indicates the Veteran’s Entitlement. Theseproducts adhere to the automated underwriting systems “Loan Prospector” and “DesktopUnderwriter” along with overlays that are created to the secondary market.Do not run AUS on the VA IRRRL productProductsVA 30 yr fixed, 25 yr fixed, 20 yr fixed, 15 yr fixed, and 10 yr fixedVA 5/1 armAUS methodThese products adhere to the automated underwriting systems “Loan Prospector” and “DesktopUnderwriter” along with overlays that are created to the secondary market. Loans must have a resultof DU “Approve/Eligible” or LP “Accept”Manual underwrite is permitted on the loans receiving a “Refer/Eligible” status – refer to the manualunderwriting guideProgram CodesVA51T10, and VA51TJ10VF3010, VF2510, VF2010, VF1510, VF1010, and VF30HP10 (High Priced), VF30IR10, VF30IRHP10 (HighPriced),VF25IR10, VF20IR10, VF15IR10, VF10IR10, VF30J10, VF25J10, VF20J10, VF15J10, VF10J10,VF30JIR10, VF25JIR10, VF20JIR10, VF15JIR10, and VF10JIR10Manual Underwrite:VF30MU10, VF30JMU10, VF30MUHP10, VF15MU10, and VA51TMU10Eligible StatesAll continental states, Alaska, and HawaiiGeographic restrictions are listed under property typesMaximumConforming LoanAmounts(This is inclusive ofFunding fee)VA Guaranty mustcover at least 25% ofthe total loanamountMaximum JumboLoan Amounts(This is inclusive ofFunding fee)1-4 Units:Continental U.S417,000Alaska and Hawaii625,5001-Unit includes Condos and PUDs1-Unit includes Condos and PUDsVA Loan Limits by geographic region can belocated at: Current VA Loan LimitsVA Loan Limits by geographic region can be locatedat: Current VA Loan LimitsGreater than 650,000 requires a 2nd signaturefrom BHL underwriting prior to closing.Greater than 650,000 requires a 2nd signature from BHLunderwriting prior to closing.1-4 Units:Continental U.S625,5001-4 Units:Alaska and Hawaii938,2501-Unit includes Condos and PUDs1-Unit includes Condos and PUDsVA Loan Limits by geographic region can belocated at: Current VA Loan LimitsVA Loan Limits by geographic region can be locatedat: Current VA Loan LimitsGreater than 650,000 requires a 2nd signaturefrom BHL underwriting prior to closing.03/30/20151-4 Units:Greater than 650,000 requires a 2nd signature from BHLunderwriting prior to closing.Page 1

Wholesale VA and VA IRRRL ProductsMaximum FixedLTV/CLTVStandard and Jumboloan amountsTexas Equity 50 (a)(6) is not availablePrimaryPurchase1-4 Units:100/100%Rate and Term Refi*N/ACash Out RefiMaximum ARMLTV/CLTVStandard loanamounts onlyTexas Equity 50 (a)(6) is not available1-4 Units:100%/125%PrimaryPurchase1-4 Units:Funding FeeInvestment/Non-OwnerPurchaseN/AN/ARate and Term Refi*Rate and Term Refi*N/AN/ACash Out RefiCash Out RefiN/ASecond eN/AN/ARate and Term Refi*Rate and Term Refi*Rate and Term Refi*N/AN/AN/ACash Out RefiCash Out RefiCash Out RefiN/AN/A1-4 Units:Refinance NoteSecond HomePurchase90/90%*Veteran has a conventional loan and is refinancing to a VA loan – no cash in hand90.01 – 100% - no cash in hand – debt consolidation onlyVeteran is required to pay the VA Funding Fee and it can be included in the loan amountLoan TypeFunding FeeReservist Funding FeePurchase Loan - Zero Down*2.15%2.40%Purchase Loan - 5% Down1.50%1.75%Purchase Loan - 10% Down1.25%1.50%Cash-Out Refinance Loan*2.15%2.40%IRRRL.50%.50%*Re – use – 3.3%The following persons are exempt from paying the funding fee: Veterans receiving VA compensation for service-connected disabilities. Veterans who would be entitled to receive compensation for service-connecteddisabilities if they did not receive retirement pay. Veterans who are rated by VA as eligible to receive compensation as aresult of pre-discharge disability examination and rating or on the basis of apre-discharge review of existing medical evidence (including servicemedical and treatment records) that results in issuance of a memorandumrating.03/30/2015Page 2

Wholesale VA and VA IRRRL Products Minimum CreditScoreMinimum LoanAmountBorrower Cash OutVeterans entitled to receive compensation, but who are not presently inreceipt because they are on active duty. Surviving spouses of veterans who died in service or from service connecteddisabilities (whether or not such surviving spouses are veteranswith their own entitlement and whether or not they are using their ownentitlement on the loan).Verification of exempt status must be obtained by one of the following: a properly completed and signed VA Form 26-8937, Verification of VABenefits, indicating the borrower’s exempt status, for a veteran who elected service retirement pay instead of VAcompensation, a copy of the original VA notification of disability rating anddocumentation of the veteran’s service retirement income, or indications on the Certificate of Eligibility (COE) that the borrower isentitled as an unmarried surviving spouse.Consult VA if the borrower’s status is unclear after reviewing the appropriate documents Purchase/ Rate and Term/ IRRRL 500 min credit score Purchase/IRRRL 1 mil 1.5 mil min score 700 Cash-out 500 min credit score Cash-out 700k 1 mil min score 660 Cash-out 1 mil 1.5 mil min score 700 Credit scores for all transactions with FICOs 600 require AUS Approval. No ManualUnderwrites. 50,000*due to Section 32 and pricing concerns please consult with Management and Secondary beforerequesting a loan less than 50,000. Must be a veteran who served the minimum duty with other than a dishonorable discharge Active duty with at least 181 days of duty Un-remarried surviving spouse of eligible veteran (COE) Reservists/National Guard Certificate of Eligibility must have sufficient entitlement to meet minimum 25% guarantee Resident alien permitted as long as primary borrower is a veteran Joint loans involving two unmarried veterans – veteran borrower plus spouse co-borrower isnot considered a joint loan – Must be sent to VA for approvalProperties currently listed for sale are ineligible for financingCash-out properties listed for sale within the previous 6 months are ineligibleLast PageProperties currently listed for sale are ineligible for financingPermitted when there is greater than 6 months of ownership/titleNo maximum on dollar amount on cash out – must be an existing lien against the propertyTexas Equity 50 (a) (6) not eligibleEligible PropertyTypesDetached/Attached SFR and PUDs, VA Approved Condos –Link to VA Approved Condo, Factory Built Modular/Pre-Cut/Panelized Housing covered by the HUD Structural engineering bulletin, and 2-4 UnitpropertiesIneligible PropertyTypesNon-VA Approved Condos, Condotels, Manufactured Housing, Co-op, Mixed-Use, Dome, Straw/Bale,Log, Earth, Working Farms/Ranches, Mobile Homes, Commercial (income producing), VA IndianLeasehold properties, Energy Efficient Loans, Life Estates, and Construction properties03/30/2015Page 3

Wholesale VA and VA IRRRL ProductsSpecial PropertyTypesLeasehold Estates: Permitted if marketable for area, and lease term require underwriting manager’sapprovalDeed Restrictions: Permitted if marketable for area, and require prior approval by VAIL Land Trust is an institutional corporate entity; individuals are not acceptable. Beneficiary mustexecute Note and Guarantee Payment of MortgageNewly completed construction properties (completed less than 1 yr and never owner occupied) followVA guidelines.Rural Properties:They are generally acceptable with the following conditions: Maximum 40 acres. Non-income producing only. The appraisal and comparables must support the land/site-to-value ratio. The appraiser mustdetermine if the property’s land/site-to-value ratio is typical for the area. The land is to be considered residential and not for potential future development.Recast OptionN/APrepayment PenaltyOptionConversion optionN/ATermsFixed :360 months, 300 months, 240 months, 180 months, and 120 monthsARM: 360 monthsAmortizationFully Self amortizing,Buy down,TemporarySpecial Features andSpecificationsNot PermittedEscrow WaiverNot Available – Escrows RequiredAssumabilityOn arms only. 3/1 arm any time, all other ARMs post fixed rate periodFixed: not permittedUnderwritingProcedureRun DU or LP For approvalNo non-traditional creditTax Deductions – Use this calculatorPrincipalCurtailmentA refund is appropriate if an exempt veteran paid a funding fee, or a miscalculation of the fee causedan overpayment. If the veteran was overcharged, the following applies: A veteran who paid cash for the funding fee received a cash refund for the amount of theoverpayment In the case of a veteran who paid the funding fee out of loan proceeds, the lender must applythe overpayment against the loan balance. Submit evidence to VA that the refund wasapplied to the loan’s principal balance.03/30/2015N/AConstruction to Perm post construction financing allowed. (Single close construction loans ineligible.)Revocable Inter-Vivos trust: Permitted on Underwriting management approvalHPML: Permitted 30yr onlyMCCs: Loans with an MCC are permitted and the certificate must be obtained prior to close. CalHFAMCC is not eligible for use.Page 4

Wholesale VA and VA IRRRL ProductsDocumentationRequirementsFull DocumentationStandard VA documents applyTax Transcripts are required for the number of years of income documented required by AUSCredit HistoryAcceptable credit history (Approve/Eligible) determined by AUS. If AUS provides a Referrecommendation, 0x30 mortgage lates in most recent 12 monthsBankruptcy, Foreclosures, and Deed-in-Lieu must be recognized by the DU AUS system.EventBK 7 or 11BK 13ForeclosureDeed-in-Lieu, Preforeclosure, Short SaleWaiting Period2 yearsOn AUS Accept/ApprovePermitted with a min of 12months timely payments onthe payout and a courtapproval to enter into amortgage transaction2 years2 yearsMortgage InsuranceNo mortgage Insurance is required regardless of LTV on a VA loan.SubordinateFinancingPermitted for closing costs and/or down payment, but must conform to the above CLTV limitations.Texas – Payoff of subordinate financing used for purchase or home improvements or the subordinationof a second can be done as long as the first mortgage was not a home equity/cash-out Section 50(a)(6)loan Project EligibilityNo negative amortization on the subordinate financing. The repayment terms of thesubordinate must provide for regular payments that cover no less than interest due.The interest rate on the subordinate should be less than the rate on the firstShould not restrict the Veteran from selling the propertyNo cash back to borrowerCondominium: Must meet VA e/condopudsearchCo-ops: Not PermittedAppraisalQualifying RatiosStandard Full Appraisal is requiredAll Appraisals must be ordered by the Appraisal order desk The standard VA Appraisal is required including interior and exterior of the subject property The notice of value is issued by VA and valid for 6 months – rapidly changing market conditions coulddictate the use of a shorter validity periodMaximum Qualifying Ratio: AUS determinationAUS Refer loans – 41%AUS Refers will be reviewed and considered on a case by case basisAny allotments reflected on the LES or paystubs must be investigated to determine if the allotmenthas an affiliate debtIn community property states – the non borrowing spouse’s debts and obligations must be considered03/30/2015Page 5

Wholesale VA and VA IRRRL Productsin qualifying ratiosResidual Income qualification:For loan amounts below 80,000FAMILY SIZE*12345NORTH EAST 390 654 788 888 921MIDWEST 3 82 641 772 868 902SOUTH 382 641 772 868 902WEST 425 713 859 967 1004SOUTH 441 738 889 1003 1039WEST 491 823 990 1117 1158*Add 75 for each additional member up to a family of 7For loan amounts of 80,000 and aboveFAMILY SIZE*12345NORTH EAST 450 755 909 1025 1062MIDWEST 441 738 889 1003 1039*Add 80 for each additional member up to a family of 7Contributions toClosing CostsContributions may not exceed 4% of the value of the property as indicated on the NOV (Notice ofValue)Down Payment/GiftRulesNormal discount points and payments of buyer's closing costs will not be considered a concession forpurposes of determining total concessionMinimum Borrower Contribution: No minimumGift Funds: PermittedReservesNon-Occupying CoBorrowerTrailing Co-BorrowerForeign BorrowerMultiple Properties03/30/2015Per AUS findings.Not PermittedNot permittedNon-residents not permittedNo limitPage 6

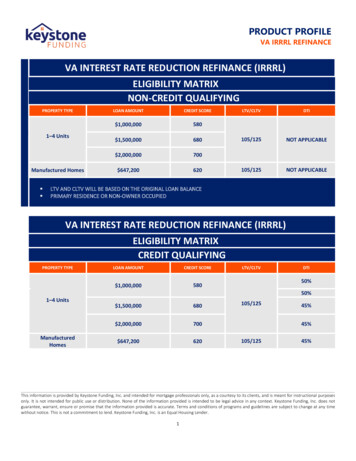

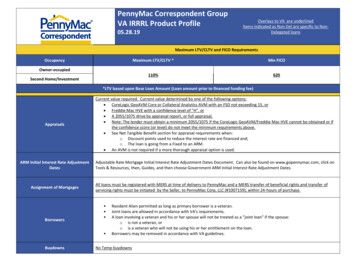

Wholesale VA and VA IRRRL ProductsVA IRRRLMaximum FixedLTV/CLTVStandard and Jumboloan amountsMaximum ARMLTV/CLTVStandard loanamounts onlyIRRRLPrimary1-4 Units125/125%Primary1-4 Units90/90%Second HomeInvestment/Non-Owner1 Unit:105/105%with certification of previousoccupancy1 Unit:105/105%with certification of previousoccupancySecond HomeInvestment/Non-OwnerN/AN/AFollow VA standard underwriting guidelines.The IRRRL may only include the following: Texas – R/T originated to pay off an existing home equity/cash-out mortgage is ineligible Maximum cash back to the borrower is limited to 500 Per Ch 6 Sec F VA Lenders Handbook The payoff of the outstanding VA loan balance of an existing first mortgage. Secondary financing must re-subordinate to the new first mortgage within the CLTV limitslisted in the maximum LTV/CLTV section of these guides 0x30 in the last 12 months on all mortgages DTI is not calculated Conventional 2055 Exterior Appraisal. Health/safety repairs must be completed. Propertymust be rated Average Condition or better. LTV 95% and a Loan Amount 1MM must have a minimum full appraisal The borrower must be the same except:o The addition of a new spouse The P&I on the IRRRL must be less than the loan being refinanced unless:o The IRRRL is refinancing and ARMo Term of the IRRRL is shorter than the term of the loan being refinancedo The PITI increases by 20% or more; loan must credit qualifyHPML Allowed only with complete credit qualifyingAnything not specifically addressed here, follow the VA guidelines2015 NewRate Lending. All Rights Reserved. Product parameters are subject to change without forward notice. This documentis used for reference for Mortgage Professionals Only. Not intended for the general public.03/30/2015Page 7

Wholesale VA and VA IRRRL Products 03/30/2015 Page 2 Maximum Fixed LTV/CLTV Standard and Jumbo loan amounts Texas Equity 50 (a) (6) is not available Maximum ARM LTV/CLTV Standard loan amounts only Texas Equity 50 (a) (6) is not available Primary Purchase 1-4 Units: 100/100% Rate and Term Refi* N/A Cash Out Refi