Transcription

VA loan programs offer exceptional financing options for activeduty military personnel, veterans and their families.100% financing on purchase and refinance transactionsNo down payment required on loan amounts 417,000High Balance loan amounts up to 1,500,000No monthly mortgage insuranceNo reserves required on 1-unit propertiesLimitations on fees charged to borrowerSeller allowed to contribute up to 4% of the loan amount for closingcosts. Seller is allowed to pay 100% of the discount points and theborrower’s non-recurring closing costs.– Assumable–––––––

Purchase 100% LTV/CLTVCash-out refinance up to 100% LTV/115% CLTV580 minimum credit score1-4 unit primary residenceSingle family residence, PUDs and condominiums in VA approvedprojects DTI per DU with 640 credit score Gift funds, grants and DPA Funds eligible for closing costs and/ordown payment (if required) Products: – Fixed rate: 15, 20, 25 and 30 year– ARM: 3/1 and 5/1; Treasury index; 1/1/5 caps; 2.00 margin; qualify atNote rate

Who is eligible for a VA loan?– Active duty military personnel– Any veteran who served active duty in the Army, Navy, Air Force,Marine Corp or Coast Guard and was discharged under conditionsother than dishonorable– Reservists or National Guard with 6 years of service– Unmarried surviving spouse of an eligible service member who diedas a result of service or serviced-related injuries

The VA entitlement is the amount the VA will guaranty thelender against loss. The entitlement is based on 25% of thetotal loan amount (including the funding fee, if financed). The total loan amount, including the funding fee can neverexceed the VA county loan limit without a down payment fromthe veteran. The Certificate of Entitlement (COE), issued by the VA, providesthe amount of the veteran’s entitlement. – The entitlement is available for all veterans. The basic entitlementis 36,000 for loan amounts 144,000. Bonus entitlement isavailable for loan amounts 144,000 up to conforming loan limits.

The Certificate of Entitlement (COE), issued by the VA, providesthe amount of the veteran’s entitlement.– The entitlement can be affected if the veteran has used it beforeand whether or not the entitlement has been restored– There is no limit on the number of times the entitlement may beused– The entitlement can be restored when a prior VA loan obtained bythe veteran is paid in full, or– An eligible veteran assumes the outstanding loan on a property andsubstitutes their entitlement for the same amount originally used onthe loan.

The Certificate of Eligibility can be obtained by going to the VAwebsite at https://vip.vba.va.gov/portal/VBAH/Home andaccessing WebLGY.Sample COE:

A minimum 25% guaranty is required for all VA loans– The 25% guaranty is based on the lesser of the purchase price orappraised value– The maximum VA will guaranty is the lesser of the veteran’savailable entitlement or the maximum potential guaranty– Maximum VA Guaranty: Loan amount 144,000: maximum 36,000 Loan amount 144,000 to 417,000: 25% of loan amount Loan amount 417,000: Lesser of 25% of the VA county loanlimit or the loan amount

The following are examples of how to calculate the VA Guarantee.These examples are not all inclusive:– Veteran has full entitlement available and is purchasing a home for 300,000 wherethe county loan limit is 417,000. 417,000 X 25% 104,250 Maximum Guaranty and Available Entitlement 300,000 X 25% 75,000 Guaranty and Down Payment Combination RequiredSince VA’s guaranty is limited to the lesser of 25% of the county loan limit or 25% ofthe loan amount, VA will guaranty 75,000 an Veteran’s 300,000 loan in this county.A down payment should not be required. – Veteran has used 48,000 of entitlement on a prior loan, which may not be restored,and is purchasing a home for 320,000 where the county loan limit is 625,000. 625,000 X 25% 156,250 Maximum Guaranty 156,250 - 48,000 108,250 Entitlement AvailableSince the proposed loan amount will be less than 433,000, the lender will receive25% VA Guaranty on the loan of 320,000. A down payment should not be required.

Additional examples:– Veteran has full entitlement available and is purchasing a home for 480,000where the county loan limit is 417,000. 417,000 X 25% 104,250 Maximum Guaranty and Entitlement Available 104,250 / 480,000 21.72% GuarantySince VA’s Guaranty will be less than 25%, a down payment will likely berequired to meet investor requirements. 480,000 X 25% 120,000 120,000 - 104,250 15.750% Down Payment– Veteran has used 36,000 of entitlement on a prior loan, which may not berestored, and is purchasing a home for 120,000 where the county loan limit is 417,000.Since the loan amount will not be over 144,000, the veteran’s additionalentitlement cannot be used. Therefore, the guaranty would be 0%: 0 / 120,000

VA does not have a maximum loan amount however the VAcounty loan limits are used to determine the maximumguaranty by county To view VA’s county loan limits go to VA County Loan Limits Counties not identified on the VA loan limit list are limited to 417,000 Planet Home Lending limits the maximum loan amount on VAloans to 1,000,000 excluding Hawaii Maximum loan amount in Hawaii is 1,500,000

VA loans require a VA funding fee which is paid directly to VA– Funding fee can be financed into the loan amount– Veteran may be exempt from the funding fee; the COE will identify ifveteran is exempt.– The base loan amount plus the financed funding fee cannot exceed theconforming loan limit or the VA county limit or a down payment will berequired to ensure a 25% guaranty– The funding fee is calculated using the base loan amount– The funding fee can be paid by: Property seller Realtor Broker Lender

The funding fee is based on type of service, use and down payment as detailed in the chart below:VA Funding Fee*Regular MilitaryDown PaymentFirst Time UseSubsequent UseNone2.15%3.30% 5% (up to 10%)1.50%1.50% 10%1.25%1.25%Reserves/National GuardDown PaymentFirst Time UseSubsequent Use None2.40%3.30% 5% (up to 10%)1.75%1.75% 10%1.50%1.50%Refinance TransactionsType of VeteranFirst Time UseSubsequent UserRegular Military2.15%3.30%Reserves/National Guard2.40%3.30%Type of Loan% for All VeteransLoan Assumptions0.50%

VA has specific requirements regarding fees to the borrower.VA requirements are:– 1% origination fee based on the total loan amount. Unallowablefees cannot be charged, OR– 1 % of the unallowable fees based on the total loan amount. Anorigination fee cannot be charged, OR– 1% blend of origination fee and unallowable fees based on the totalloan amount. Combined fees cannot exceed 1% of the total loanamount.

Per VA, the veteran cannot pay any of the following fees:––––Attorney fees (unless the veteran independently retains an attorneyPre-payment feesReal estate broker feesTermite inspection (allowed on refinance transactions only)

The following fees are unallowable and cannot be charged to the veteranif a 1% origination fee is charged:- Lender’s Inspection- Lender’s Appraisal- Closing/Settlement Fee- Doc Prep Fees- Conveyance Fee- Underwriting Fee- Pest Inspection Fee- Well/Septic Fee- Escrow Fees- Notary Fee- Commitment Fee- Trustee Fee- Interest Rate Lock Fee- Postage/Mail Charges- Amortization Schedule- Tax Service Fee- Attorney’s Services other than title work- Loan Application/Processing Fee- Fees for preparing Truth-in-Lending- Prepayment Penalties (refinance)- Any other fee not listed as allowable by VA- Fees to Loan Brokers, Finders or other 3rd party fees Note: The above list may not be all inclusive.Refer to the VA Lender’s Handbook 4155 for complete VA requirements.

The following are allowable closing costs:- Loan Origination Fee- Reasonable Discount Points- Appraisal Fee/Compliance Inspection- Credit Report Fee (actual)- Title Examination/Title Insurance Fees- Recording Fees & Taxes- Prorated Taxes- Hazard Insuarnce- Flood Insurance- Flood Determination- Federal Express/Express Mail (Refi only)- Closing Protection Letter- VA Funding Fee- MERS Registration- Survey/Plot Plan

Eligible Property Types:– 1-4 unit primary residence– Townhome/PUD one unit Project reviews not required– Condo Must be in a VA approved project Site condos require VA Project Approval– Modular– New Construction (completed 1 year and never occupied) 1 year VA Builder Warranty OR enrolled in a 10 year protectionplan, and Construction must be 95% complete

Ineligible Property le homesProposed constructionNon-VA approved condo projectsLeasehold properties (unless prior VA approval is obtained)Properties located within electrical line easementsSecond home and investment propertyProperties subject to regular floodingRural properties 10 acresProperties located in an unacceptable noise zone (e.g. airport)

Owner-occupied primary residence only VA requires the borrower to certify that they intend topersonally occupy the home as their primary residence. The borrower(s) must generally occupy the property within 60days of loan closingNOTE: Borrowers currently on active duty are not required tomeet this timeframe although the spouse, if not also on activeduty would need to occupy the property.

All loans must be run through DU and receive an “Approve/Eligible” or“Refer/Eligible” Finding. “Refer/Eligible” requires a manual underwrite An “Approve/Eligible” Finding must be downgraded to a manualunderwrite when:– The mortgage history has a 1x30 in previous 12 months– Subject loan was previously restructured/modified Minimum 12 months of 0x30 payments on restructured/modified loan Mortgages in default at time of restructure/modification are not eligible– Disputed tradelines: Manual downgrade not required if disputed tradeline meets all of thefollowing: – Disputed account has a zero balance, and– The disputed account is marked paid in full or resolved, and– The disputed account is both 500 and is 24 months old.

Appraisal must be performed by a VA appraiser. Appraisals areordered through VA. The Notice of Value (NOV) must be provided to the veteranwithin 5 business days of receipt of appraisal. The NOV must be issued at the appraised value reflected onthe appraisal report.

Assets are generally not required to be documented.NOTE: Purchase transactions with a borrower credit score of 580-599 require 2months bank statements to document 10% borrower own funds requirement. If the earnest money deposit is 2% or more than the purchaseprice or appears excessive based on the borrower’s history ofaccumulated savings, source of funds documentation will berequired If assets are required to close the following is required toindicate sufficient funds: – 2 months bank statements or per DU Findings (all pages)

Minimum 580 credit score regardless of DU Findings Minimum 600 credit score required on cash-out 90.01% to 100%LTV All credit inquiries in the previous 120 days must be addressed andthe result of the inquiry explained. 580-599 credit score subject to the following:– Purchase transactions: Max. 90% LTV/CLTV, 0x30 in previous 12 monthsdocumented housing history, no DPA or gift funds for down payment, 1unit only, max. 31%/43% DTI, maximum payment shock 100% withadditional restrictions if 50%.– Refinance transactions: Max 90% LTV/CLTV, 0x30 in previous 24 monthsdocumented housing history (on loan being refinanced), 1- unit only,max. 31%/43% DTI Refer to the VA Program guidelines for complete requirements.

A DTI 41% requires additional documentation/justification(compensating factors) unless:– The ratio is 41% is due solely to the existence of tax-free income,or– Residual income exceeds the guidelines by at least 20% Max DTI 31%/43% with a 580-619 credit score Max DTI 45% with a 620-639 credit score; 45% DTI may beeligible subject to Planet Home Lending prior approval Per DU Findings with a 640 credit score and“Approve/Eligible” Illinois 2-4 units, New Jersey and New York 3-4 units maximum45% DTI.

VA considers the following when considering compensatingfactors: Excellent credit history Conservative use of consumercredit Minimal consumer debt Long-term employment Military benefits High residual income Low DTI ratio Significant liquid assets Sizable down payment The existence of equity inrefinance loans Little or no payment shock Satisfactory homeownershipexperience Tax credits for child care Tax benefits of home ownership

A two year employment history is required. A verbal verification of employment (VVOE) is required within10 calendar days of loan closing. A military Leave and Earnings Statement (LES) is required foractive duty military in lieu of a VVOE. The LES must be anoriginal or certified copy of original. The LES must be no morethan 120 days old (180 days for new construction).

Escrow/Impound Account– Required on all loans, no exceptions Financed Properties– Owner-occupied properties: No limit.– Planet Home Lending limits its exposure to a maximum of 2 loansper borrower, one of which must be a primary residence

Gifts, grants, and down payment assistance programs areeligible per VA guidelines. There must be no expected orimplied repayment requirement of the gift funds.– A gift is acceptable if the donor is: A relative of the borrower. A government agency or public entity that has a programproviding home ownership.– Gift funds must be evidenced by a gift letter, signed by the donor.– The gift donor may not be a person/entity with an interest in thesale of the property.

A termite inspection is required in all states where termitesare present or when the appraiser has indicated a need for atermite review due to wood-destroying insect damage or anactive insect infestation. Refer to VA.gov Local Requirementsfor additional details. Well inspections are required in all cases (private or shared). Septic inspection is required when the appraiser indicated theneed for one.

0 x 30 in 12 months. A manual downgrade is required for anymortgage debt with 1 x 30 in 12 months. Mortgage must be current and due for the month closing. Verification of Mortgage (VOM) or Verification of Rent (VOR)are required if an “Approve/Eligible” Finding is not received.

Planet Home Lending will accept a Power of Attorney (POA) onVA transactions subject to the following:– General/Military Durable POA acceptable if veteran signed the salescontract and loan application and the veteran’s intention to obtain aVA loan is indicated in the sales contract and/or loan application.– A specific POA is required if both contract and application not signedby the veteran and must contain the following information: ––––Clear intention to use their entitlement to obtain the loanProperty addressTerms of the loanVeteran intends to occupy the property as primary residence– An Alive and Well statement is required if the veteran is not atclosing.

1-unit property: Not required 2-4 unit property: 6 months PITI Other rental real estate owned: 3 months PITI for eachadditional property owned.NOTE: Reserves not required if rental income is not usedfor qualifying

Residual income is required by VANOTE: Residual income requirement can be reduced by 5% if the veteran is on Active Duty.Loan Amounts 79,999Family SizeNortheastMidwestSouthWest1 390 382 382 4252 654 641 641 7133 788 772 772 8594 888 868 868 9675 921 902 902 1,004Over 5Add 75.00 for each additional family member up to 7. Loan Amounts 80,000Family SizeNortheastMidwestSouthWest1 450 441 441 4912 755 738 738 8233 909 889 889 9904 1,025 1,003 1,003 1,1175 1,062 1,039 1,039 1,158Over 5Add 80.00 for each additional family member up to 7.

EEM (Energy Efficient Mortgage) MCC (Mortgage Credit Certificates) – Borrower allowed to do anMCC after closing, but MCC cannot be used to qualify. Texas Section 50(a)(6)

Cash-out Refinance 90% LTV Requirements:– Maximum loan amount is 417,000 ( 625,500 for properties inAlaska/Hawaii or 721,050 in Honolulu county, HI)– Minimum credit score is 600– 30 year fixed loan term only– Minimum monthly residual income required:Family SizeMinimum Residual IncomeVeteran Only 1,000.00Veteran 1 1,500.00Veteran 2 2,000.00Veteran 3 2,250.00Veteran 4 2,500.00Veteran 5 3,000.00Over 6 250.00 for each additional

IRRRL General Information: An IRRRL is a VA guaranteed loan made to refinance anexisting VA guaranteed loan. The PITI payment on the newloan must be less than on the existing loan unless one of thefollowing applies:– The loan term is reduced, or– The veteran is refinancing to a more stable product (i.e. ARM or GPMto fixed rate

Highlights of an IRRRL include:– VA to VA refinance– No income– No assets (unless borrower needs funds to close, then assetverification required)– No reserves– No ratios– No termite inspection– No monthly MI– Maximum loan term is the original term of the VA loan beingrefinanced plus 10 years. New loan term can never exceed 30 yearsand 32 days.

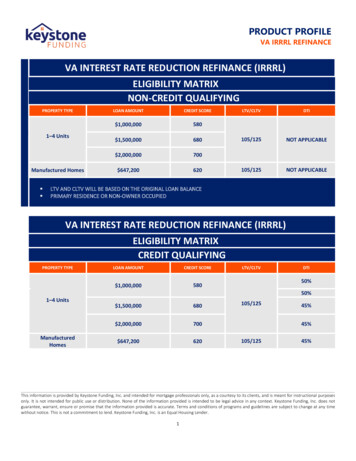

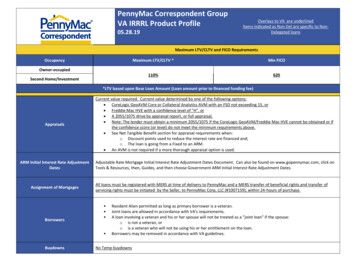

Primary Residence (1.2)Transaction TypeUnitsLTVCLTVCredit Score (3.5)IRRRL190%90%570 (7)IRRRL1-4 (6)125%Unlimited600Second Home (2.4)Transaction TypeUnits1LTV125%CLTVUnlimitedCredit Score580 (8)Investment (2.4)Transaction TypeIRRRLUnits1-4 (6)LTV125%CLTVUnlimitedCredit Score580 (8)Footnotes:1. Minimum loan amount is 60,000; maximum loan amount 1,000,000 with the exception of Hawaii. Maximum loan amount in the state of Hawaii is 1,500,000.2. Base loan amounts 417,000 (Alaska/Hawaii 625,500 or 721,050 in Honolulu county, HI) require AVM or 2055. Refer to the Appraisals topic for specific requirements.3. Non-credit qualifying requires minimum 640 credit score.4. Conforming loan amount only for second home and investment. High balance ineligible.5. Base loan amounts 417,000 (Alaska/Hawaii 625,500 or 721,050 in Honolulu county, HI)subject to the following: Credit score requirements:- 580-639 credit score requires credit qualifying- 640 non-credit qualifying eligible 1-unit owner-occupied only; 2-4 unit owner-occupied, second home and investment ineligiblewith high balance loan amount. AVM or 2055. Refer to the Appraisals topic for specific requirements. Maximum LTV is 100% Mortgage history requirements:- 0x30 in12 months for credit qualifying transactions- 0x30 in 24 months for non-credit qualifying transactions Full credit report required on both credit and non-credit qualifying to verify mortgage history6. Non-credit qualifying permitted on 1-unit properties only. 2-4 units require credit qualifying.7. Credit qualifying required. Refer to the Credit Score 580-599 topic for requirements8. Transactions with 580-599 credit score are subject to the restrictions outlined in the Credit Score 580-599 topic. A minimum 640 credit score is required for non-credit qualifying.

Appraisals– The base loan amount is used to determine appraisal requirement.– An AVM or 2055 is required: A CoreLogic GeoAVM with a standard deviation 18 for all loanamounts. If the confidence score is 18% a 2055 is required,or Loan amount 417,000 ProTeck AVM with a confidence scoreof 80% or more. If the confidence score is 80% a 2055 isrequired; 417,000 requires a confidence score of 90% or a2055 is required, or A 2055

Assets– Not required unless funds are needed to close. Documentation is notrequired if funds needed to close is 500.00. AUS– Manual underwrite only. Cash Back to Borrower– Maximum 500.00.

Credit Report– Conforming Loan AmountsA mortgage only credit report with credit scores is acceptable unlessthe PITI payment is increasing by more than 20% or a spouse isbeing removed from the new loan then a tri-merge credit report isrequired.– High Balance Loan AmountsFull credit report to verify no major derogatory credit with the past12 months. Major derogatory credit is defined as any payment 60days delinquent, collections and/or judgments (excludesmedical/utilities).

Credit Score– Minimum 580 required for: 1-unit credit qualifying conforming and high balance loan amountNOTE: Maximum 90% LTV/CLTV– Minimum 580 required for: 1-4 units credit qualifying conforming and high balance loan amount– Minimum 640 required for: 1-unit non-credit qualifying conforming and high balance loanamounts NOTE: Credit qualifying required: The borrower’s PITI payment will increase by more than 20% A spouse will be removed from the original loan, Credit score 580-639 regardless of loan amount

Documentation– Credit Qualifying Fully completed 1003– Non-Credit Qualifying Abbreviated 1003 allowed. Section IV - Employment Information andSection VI - Assets and Liabilities of the 1003 are not required (assetsmust be included if needed to close the transaction).NOTE: Income should never be indicated on the application for non-creditqualifying transactions – All Loans Legible photo ID and social security card Most recent mortgage statement Copy of existing Note Payoff statement with valid expiration

Eligible Borrowers– Veteran or veteran and spouse. Must currently occupy the property.– A spouse may only be deleted from the new loan if the loan iscredit qualified. Funding Fee– 0.50%. The Certificate of Eligibility, issued by VA, will indicate if theveteran is exempt, or non-exempt from paying the VA Funding Fee. Guaranty– A minimum 25% guaranty is required.

Maximum Loan Amount– Maximum Base Loan Amount 417,000Lesser of: Existing VA loan pay off - Unpaid principal balance, plus allowable VAclosing costs, plus VA funding fee (if applicable), plus up to 2 discountpoints, or The appraised value (AVM or 2055) x 125%. – Maximum Base Loan Amount 417,001Lesser of: Existing VA loan pay off – Unpaid principal balance, plus allowable VAclosing costs, plus VA funding fee (if applicable), plus up to twodiscount points, or The appraised value (full conventional appraisal required) x 100% asapplicable.

Mortgage History/Seasoning– 0 x 30 in previous 12 months on loan amounts 417,000– 0 x 30 in previous 24 months for loan amounts 417,001( 625,500 in Alaska/Hawaii or 750,000 in Honolulu county, HI).If 24 months on current mortgage for subject property, priormortgages may be used to meet the 24 month history requirement.– No increase from current housing payment allowed.– Mortgage must be current and due for the month closing.– Borrower must have made a minimum of 12 mortgage paymentsprior to application.

Occupancy– 1-4 owner-occupied primary residence (2-4 unit ineligible on highbalance)– 1-unit second home (ineligible on high balance)– 1-4 unit investment (ineligible on high balance) Properties Listed for Sale Within the Previous 12 months – Properties that were listed for sale in the previous 12 months mustbe taken off the market prior to the application date.– A property listed for sale will be considered as long as the listing hasbeen cancelled, expired or withdrawn.– A letter of explanation is required.

Refinance Transactions– Continuity of obligation requires that at least one of the borrowerson the refinance transaction is currently on the title of the propertybeing refinanced. Reserves– Not required. Subordinate Financing – New loan proceeds cannot be used to pay off any existingsubordinate financing. Existing subordinate financing mustsubordinate to the new loan. Temporary Buy-downs– Not allowed.

- Any other fee not listed as allowable by VA - Fees to Loan Brokers, Finders or other 3rd party fees Note: The above list may not be all inclusive. Refer to the VA Lender's Handbook 4155 for complete VA requirements.