Transcription

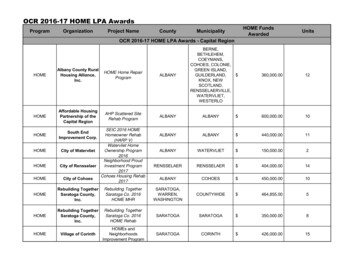

NYS HOME Local Program Administrative PlanHomebuyer Down Payment AssistanceWith or Without Housing RehabilitationThis Administrative Plan (Plan) describes the policies and procedures that must be followed byLocal Program Administrators (LPAs) in the administration of a NYS HOME Local Program fundedhomebuyer assistance program with or without housing rehabilitation that may include rental units.If homebuyers are purchasing a 2 to 4 unit property.This Plan contains both Federal and State HOME Program requirements that LPAs must follow inthe administration of a HOME Local award and contract.HTFC approval of the responses submitted to questions regarding this Plan is required prior toexecution of a contract for a HOME Local award. Changes to this Plan are subject to priorapproval by HTFC.Policies and procedures contained in this Plan must be followed and will be enforceable alongwith all aspects of the contract and Federal HOME Investment Partnership Program regulations at24 CFR Part :OCR:Housing and Urban DevelopmentNYS Homes and Community RenewalHousing Trust Fund CorporationLocal Program AdministratorPeriod of AffordabilityMinority/Women Owned Business EnterpriseIntegrated Disbursement and Information SystemNYS HCR Weatherization Assistance ProviderHCR’s Environmental Analysis UnitOffice of Community Renewal NYS HOME Local Program Manager: is assigned to the LPA at contract execution and is theHTFC OCR staff representative that will assist the LPA to administer the contract with HTFC. For the purposes of this Plan, homebuyer assistance with or without housing rehabilitationdoes not include homebuyer development projects, which is covered under the separateHomebuyer Development Administrative Plan. ALL FORMS and related documents referred to in this Plan are available on the HCR HOMEProgram website at: https://hcr.ny.gov/nys-home-program.NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.19

NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.19

Contents1General Program Administration Requirements . 61.1Use of Funds . 61.1.1Eligible Activities . 61.1.2Market Need: . 61.1.3Form(s) of Assistance . 61.1.4Program Budget . 61.1.5Program Schedule . 71.1.6Eligible Administrative and Project Delivery . 71.2Environmental Review: . 81.2.1Tier 1 (Programmatic) Clearance . 81.2.2Tier 2 (Individual Site Specific) Clearance . 91.3Other Federal Requirements . 91.3.11.4Non-Discrimination and Equal Access . 9Workplace Requirements . 91.4.1Affirmative Marketing . 101.4.2Accessibility to Apply to the Program . 111.5Written Agreements & Legal Documents. 121.6Recordkeeping . 131.7Reporting . 141.7.1Project set-up report . 141.7.2Project Completion Report – Closing Report . 141.7.3Bi-Annual Report. 151.7.4Program Closeout Report . 151.8LPA Project Monitoring . 151.8.1Project Records . 151.8.2Post-Completion Monitoring . 151.8.3Rental Unit Monitoring . 161.91.10HTFC Monitoring of LPAs. 16Attachments . 181.10.1LPA Homebuyer Assistance With or Without Housing Rehabilitation . 19Program File Checklist . 19NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.193

1.10.2LPA Homebuyer Assistance With or Without Housing Rehabilitation . 20Project File Checklist . 202Project Requirements . 222.1Eligible Project Costs & Maximum Subsidy . 222.1.1Eligible Project Costs . 222.1.2Project Assistance Limits . 232.2Homebuyer Eligibility, Underwriting Guidelines and Subsidy Layering . 232.2.1Preferences and Priorities. 242.2.2Applicant Fees - Charges to Homebuyers . 252.3Applicant Eligibility . 262.3.1Applicant Intake & Waiting List . 262.3.2Income Eligibility . 262.3.3Conflict of Interest . 272.3.4Other Homebuyer Eligibility Requirements . 272.3.5Feasibility Determination – Denial of Assistance . 272.3.6Homebuyer Counseling . 282.4Forms of Ownership . 292.4.1Eligible Forms of Ownership . 292.4.2Ineligible Forms of Ownership . 292.5Property Eligibility . 292.5.1Eligible Property Types . 292.5.2Maximum Sales Price and After Rehab Value Limits . 302.6Property Standards . 312.6.1Reasonable Accommodations and Modifications . 312.6.2Project Commitment and Set Up. 312.6.3First File Review by OCR . 322.7Relocation . 342.7.1Notices to the Seller (and Tenants). 342.7.2Permanent Displacement. 342.7.3Temporary Relocation. 352.8Project Completion . 352.9Insurance Requirements . 36NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.194

345Financial Management Requirements . 373.1Uniform Administrative Requirements for Financial Management . 373.2Disbursements and IDIS. 383.3Match. 393.4Program Income . 393.5Audit . 393.6Contract Closeout . 40Homebuyer Properties with Rental Units . 414.1Cost Allocation & Determination of Assistance to Rental Unit(s) . 414.2Property Eligibility . 414.3Homebuyer Underwriting with Rental Units . 424.4Ongoing Rental Unit Requirements . 424.4.1Tenant Income Eligibility . 424.4.2Written Agreement . 434.4.3Note & Mortgage . 434.4.4Written Agreement Rental Unit Addendum . 434.4.5Note & Mortgage Rental Unit Addendum . 434.5Initial Project Approval . 434.6Eligible Administrative and Project Delivery for Rental Units . 454.7Recordkeeping . 454.8Project Monitoring – Rental Units . 454.9Attachments . 464.9.1Cost Allocation Worksheet . 474.9.2LPA Homebuyer Assistance With or Without Housing Rehabilitation . 48Rehabilitation of Homebuyer and/or Rental Units) . 495.1Rehabilitation Scope of Work & Cost Estimate. 495.1.1Lead Based Paint (LBP) . 505.1.2Energy Audit Requirements . 515.2Procurement . 515.2.1Required Construction Contract Provisions . 515.3Project Commitment and Set Up . 525.4Construction Management . 52NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.195

1 General Program Administration Requirements1.1 Use of Funds1.1.1 Eligible Activitiesi.Homebuyer Purchase Assistance: funds may be used to assist a homebuyer toprovide down payment and/or closing cost assistance to purchase a single family (1-4)unit, non-HOME assisted existing home or newly constructed home.ii.Homebuyer Purchase Assistance with Housing Rehabilitation: funds may be used toassist a homebuyer to provide down payment and/or closing cost assistance and fundsfor housing rehabilitation, to purchase a single family (1-4) unit, non-HOME assistedexisting home. The housing rehabilitation must be complete within 6 months ofpurchase by the homebuyer.iii.LPAs may assist HOME eligible applicants making less than 80% of Area MedianIncome (AMI). There is no requirement that the applicant be a first-time homebuyer,however, the applicant must not own a home at the time of application for assistance.iv.If the LPA is going to assist homebuyers to purchase a 2 to 4 unit property, the sectionon Rental Unit Requirements of this Plan is applicable.1.1.2 Market Need:LPAs must conduct and document a market analysis to support there is a need for thespecific type of HOME assisted homebuyer program to be offered in the service area.This analysis must be based on current relevant data from the service area thatdemonstrates a local market need for HOME funded down payment and closing costassistance and if applicable, the need for funds for housing rehabilitation.1.1.3 Form(s) of AssistanceA. HTFC requires that the HOME assistance be secured with the HTFC Note andMortgage. The LPA will be given the template for this document at contract execution.No other forms to secure the HOME investment will be accepted. The note andmortgage requires execution and public recording.1.1.4 Program BudgetA. The Program Budget is approved prior to contract execution and is included as anattachment to the contract and this Plan. It is enforceable along with all contractprovisions. The budget must be in compliance with the NYS HOME Local ProgramBudget Policy available on the HCR HOME Program website.NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.196

B. The total budget cannot be exceeded. HOME funds will not be disbursed over theamount originally approved.C. A variation from this budget in any line item by more than 10% requires HTFC priorapproval. Offsetting decreases to HOME funds from another line item is required.D. Reimbursement for amounts over any line item will be withheld until approved byHTFC.E. Requests for budget revisions should be submitted to the LPAs assigned NYS HOMELocal Program Manager.F. Requests for reimbursement must include a status of line items against the programbudget.G. Other funds provided as HOME Match cannot be reduced in the budget without priorHTFC approval.1.1.5 Program ScheduleA. The Program Schedule is approved prior to contract execution and is included as anattachment to the contract and this Plan. It is enforceable along with all other contractprovisions.B. A sample Schedule format is available on the HCR HOME Program website.C. The Schedule contains progress milestones that the LPA must report to HTFC. Failureto achieve milestones could result in suspension of funds, increased monitoring andpossible required changes to program administration. Changes to the milestonesrequire HTFC approval.D. The term of the contract is 2 years from the date of execution of the contract.E. Requests for extended time to complete the program must be approved by HTFC andwill be limited or not approved.1.1.6 Eligible Administrative and Project DeliveryA. Administrative costs are costs that the LPA incurs in order to administer or manage itsoverall HOME program. LPAs may use up to 5% of their award for eligibleadministration costs.NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.197

B. Project delivery are costs that the LPA incurs to pay staff to implement activities forspecific units. LPAs may use up to 13% of their award for eligible project delivery.C. Eligible staff costs for administration and LPA project delivery are described in theNYS HOME Local Program Budget Policy, available on the HCR HOME Programwebsite.D. LPA project delivery is required to be tied to a specific address, includingdocumentation of specific projects in timesheets. The LPA must certify that it iskeeping timesheets allocating time to specific projects to be able to invoice and mustprovide documentation of time sheets when requesting payment.E. LPA staff costs charged as project delivery may not be charged as Administrativecosts.F. If a project is not completed, the LPA staff costs of project delivery may not be chargedas project delivery, and may only be charged as an Administrative cost.G. All project delivery costs are subject to the maximum per unit assistance limits.H. Administrative and Project Delivery paid with HOME funds may not be charged to thehomebuyer or included in the homebuyer’s note and mortgage.1.2Environmental Review:A. 24 CFR 58.22 prohibits the commitment or expenditure of HOME funds or other fundsuntil the programmatic environmental review (Tier1) process is completed and theenvironmental clearance and subsequent release of funds has been received. Ifprohibited activities are undertaken by an LPA prior to receiving the approval orrelease of funds, the applicant is at risk for the denial of assistance and repayment ofHOME funds.B. Individual properties (units) will need to have site specific (Tier 2) environmentalclearance before funds can be committed or set up in IDIS.1.2.1 Tier 1 (Programmatic) ClearanceA. After Award, the HTFC and the LPA conduct a programmatic Tier 1 review, whichgenerally approves that program activities would not harm the environment in theservice area. As a part of this process, the LPA must maintain a copy of theEnvironmental Review Record (ERR) and make it available for public review. It shouldNYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.198

contain the program description and all environmental analysis, findings andcomplaints.B. LPA instructions to complete the programmatic review are available on the HCRHOME Program website.1.2.2 Tier 2 (Individual Site Specific) ClearanceA. Individual properties (units) will need to have Tier 2, site specific environmentalclearance before the LPA can commit funds and set up the unit in IDIS.B. Entering into a purchase contract prior to receiving Tier 2 approval is a considered achoice limiting action unless the guidelines for option contracts or conditional contractsare followed. 8/1.3Other Federal Requirements1.3.1 Non-Discrimination and Equal AccessA. No person in the United States shall, on the grounds of race, color, national origin,religion, or sex be excluded, denied benefits, or subjected to discrimination under anyprogram funded in whole or in part by HOME funds. LPAs are subject to all federaland State fair housing and equal opportunity laws and orders, as referenced in 24CFR Parts 92.350 and 92.351 to include: Title V of the Civil Rights Act of 1964, asamended (42 U.S.C. 2000d et seq.), The Fair Housing Act (42 U.S.C. 3601-3620.),Equal Opportunity in Housing (Executive Order 11063, as amended by ExecutiveOrder 12259), Age Discrimination Act of 1975, as amended (42 U.S.C. 6101-6107.)B. LPAs should refer to the HOME Local Program Fair Housing-Equal OpportunityAffirmative Marketing Policy available on the HCR HOME Program website.1.4Workplace RequirementsA. LPAs are subject to the Equal Employment Opportunity requirements related tonondiscrimination and equal access: The LPA shall comply with the following, asapplicable. LPAs must not discriminate in hiring and employment practices. To comply,LPAs must:NYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.199

i.Post an Equal Employment Opportunity Poster in a conspicuous place (posteravailable at: .pdf);ii.Include the EEO tagline in all employment advertising: “All qualified applicants willreceive consideration for employment without regard to race, color, religion, sex,sexual orientation, gender identity or national origin.”iii.Keep records of all employment actions and decisions, including job descriptions,postings, applications/resumes, interviews, tests, offers, written employmentpolicies and procedures, and personnel files, and make available for inspectionby state and federal agencies if requested.iv.If the LPA has 50 or more employees and a contract in excess of 50,000, submitan annual EEO-1 Report (report form available at:http://www.eeoc.gov/employers/reporting.cfm.B. LPAs with contracts in excess of 100,000 are subject to the Drug-Free Workplace Act of1988, which requires:i.Distribution of a policy statement to all employees that the unlawful manufacture,distribution, dispensation, possession or use of a controlled substance isprohibited in the covered workplace and specifying the actions that will be takenagainst employees who violate the policyii.Notification of employees that as a condition of employment on a Federal contractor grant, the employee must a) abide by the terms of the policy statement; and b)notify the employer, within five calendar days, if he or she is convicted of acriminal drug violation in the workplaceiii.Establishment of a drug-free awareness programiv.If a covered employee is convicted of a criminal drug offense in the workplace,notify HTFC within 10 days, and require the employee to participate in drugabuse assistance or rehab program.1.4.1 Affirmative MarketingAffirmative marketing steps consist of actions to provide information and otherwiseattract eligible persons in the housing market area to the available housing withoutregard to race, color, national origin, sex, religion, familial status or disability.A. LPAs should refer to the HOME Local Program Fair Housing-Equal OpportunityAffirmative Marketing Policy available on the HCR HOME Program website forNYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.1910

additional information as a basis for the creation of the LPAs Affirmative MarketingPlan.B. Each LPA HOME-funded program must have and follow an affirmative marketing planconsistent with the HOME regulations at 24 CFR 02.351. The plan must define theaffirmative marketing procedures that will take place to provide information andotherwise attract eligible persons in the program service area to the available housingor assistance without regard to race, color, national origin, sex, religion, familial statusor disability. Required elements of the plan include:i.Identification of those persons across the protected classes that are expected tobe least likely to apply.”ii.Description of how the LPA will inform potential participants about fair housingand affirmative marketing policy.iii.Description of specific procedures or activities that will be used to inform andsolicit applications from those "least likely to apply” without special outreach.iv.Delineation of the records that will be kept to document the affirmative efforts.v.Description of how the LPA will assess the results of the affirmative actions andmake corrective actions if necessary.A. If the program is targeted to a special need or population, the Plan should describe:i.How the program will be marketed across all protected classes within the specialneed preference.ii.If the program targets persons with disabilities, how the program will be marketedto all disabilities (however, advertisements can identify the specific servicesavailable based on the targeted disability).1.4.2 Accessibility to Apply to the ProgramA. HOME regulations require adherence to the following three regulations governing theaccessibility of Federally-assisted buildings, facilities and programs: Americans withDisabilities Act (42 U.S.C. 12131; 47 U.S.C. 155,201,218, and 225.), The Fair HousingAct and Section 504 of the Rehabilitation Act of 1973.B. All HOME projects are subject to accessibility requirements of 92.251(b) (1) (iv). Forhomebuyer assistance, reasonable accommodations are required to make theNYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.1911

program accessible to persons with disabilities, including affirmative outreach,accessible office locations and assistance with applications.1.5 Written Agreements & Legal DocumentsA. All households receiving assistance must execute a written agreement for HOMEprogram assistance with the LPA and contractor (if applicable) that is consistent withHOME requirements at 92.504(c) (4). The template for this agreement must beapproved by HTFC at contract execution. This agreement must be executed with thehomebuyer prior to setting up the unit in IDIS.B. LPAs must secure the HOME funds invested with a recapture note and mortgage, noother form will be accepted. The template for this document will be made available toLPAs at contract execution and is in compliance with the NYS HOME Local ProgramHomebuyer Recapture/Resale Provisions Guidelines available on the HCR HomeProgram website.C. The Period of Affordability (POA) is based on the amount of HOME funds invested inthe unit as follows: less than 15,000 5 year POA, between 15,000 and 40,000 10 year POA, 40,000 and over 15 year POA.D. LPAs must record the note and mortgage and have the original document returned tothe HTFC at the following address:Housing Trust Fund Corporation (HTFC)Office of Community Renewal - NYS HOME Local ProgramHampton Plaza 4th Floor South38-40 State StreetAlbany, New York 12207E. The HTFC will provide LPAs with an affidavit of exemption at contract execution thatwill exempt State filing fees for recording the note and mortgage.F. For the note and mortgage, the lien is at zero percent interest and the principalbalance is reduced annually, on the anniversary date of when the unit was closed inIDIS. No repayment is required if the homebuyer remains as principal residentthroughout the POA. If the home is sold or the owner no longer resides as principalresident, the pro-rated portion of the lien must be repaid to the HTFC in compliancewith the NYS HOME Local Program Homebuyer Recapture/Resale ProvisionsGuidelines available on the HCR Home Program website.G. The note and mortgage must be prepared by the LPA and must be executed andrecorded at the closing/sale of the unit to the HOME eligible buyerNYS HOME Local Administrative PlanHomebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.1912

H. LPAs should refer to the HOME Local Memo “Guidance on what to include in the lienamount” available on the HCR HOME Program website.I. If no funds for housing rehabilitation are included, the unit must be documented tomeet NYS and/or Local Code before the sale of the unit to the HOME eligible buyer.J. The note and mortgage terms and conditions are assumable by a new HOME eligiblebuyer during the POA.1.6 RecordkeepingA. Program files must be kept to document compliance with all of the requirements of thecontract and this Administrative Plan. Project files must be kept to meet therequirements of 92.508(a)(3).B. The LPA shall retain all applicable administrative and project records to includeunderwriting guidelines and evaluation, property description and location, copies ofwritten agreements, records regarding project requirements, subsidy layering analysis,maximum subsidy determination, compliance with property standards and on-goinginspections, information about contractors and vendors to include verification of nondebarment, verification of qualifications and experience, invoices and paymentrecords, related correspondence, audits, indirect cost analysis, operating budgets anda schedule for completion or other information as requested by HTFC. The ProgramFile Checklist and Project File Checklist is included in this Plan and are also availableon the HCR HOME Program website.C. The LPA will maintain records of the use of funds pursuant to the c

NYS HOME Local Administrative Plan Homebuyer Down Payment Assistance With or Without Housing Rehabilitation 9.23.19 . NYS HOME Local Program Administrative Plan . Homebuyer Down Payment Assistance . With or Without Housing Rehabilitation . This Administrative Plan (Plan) describes the policies and procedures that must be followed by