Transcription

Pricing innovation inretail bankingThe case for value-based pricingResearch from the Deloitte Center for Financial Services

Pricing innovation in retail bankingAbout the Center for Financial ServicesThe Deloitte Center for Financial Services (DCFS), part of the firm’s US Financial Servicespractice, is a source of up-to-the-minute insights on the most important issues facingsenior-level decision makers within banks, capital markets firms, mutual fund companies,investment management firms, insurance carriers, and real estate organizations.We offer an integrated view of financial services issues, delivered through a mix ofresearch, industry events, and roundtables, and provocative thought leadership—alltailored to specific organizational roles and functions.

The case for value-based pricingCONTENTSIntroduction 2Price check! 5Credit card resurgence 10A new mortgage paradigm 15The need for customer value-based pricing innovationin retail banking 19Appendix A: Methodology 20Appendix B: Product attributes and levels 21Endnotes 24

Pricing innovation in retail bankingIntroduction“Price is what you pay. Value is what you get.”1 — Warren Buffetliquidity standards (for example, Basel III), bankshave generally reacted by modifying their pricingtactics to focus more on costs and risks (see figure 1).With all the talk of disruption and innovation in retail banking today, one topic does not get the attention it deserves: strategic pricing. Bankers rarelydiscuss pricing innovation as a tool for competitivedifferentiation and raising profitability. This reportwill argue why they should, and how.Meanwhile, other industries such as airlines, ridesharing services, hotels, and digital media continueto experiment with innovative pricing strategies,and their customers seem to have accepted the newpricing schemes with little resistance.In the past decade, pricing in banking has capturedattention for all the wrong reasons, inviting intenseregulatory and public scrutiny. Faced with new regulations on product structures (for example, qualified mortgages), fee income (for example, the CARDAct2 or the Durbin Amendment), and capital andEffective pricing “cannot be reactive and simplistic.”3 We believe it is high time that retail banks inthe United States innovate pricing to reflect the waythat consumers actually perceive and receive value.Of course, the notion of value-based pricing in retailbanking is not new, at least in the credit card business.4 A few banks made strategic pricing a core discipline, and have become dominant players in theindustry.In this report, we suggest how banks may consideradopting and refining value-based pricing strategiesfor three products—checking accounts, credit cards,and mortgages. First, we quantify the potential impact of different product and price attributes onconsumer choice. We then identify gaps in the communication of value regarding these attributes, andhighlight differences in choice behavior across demographic and credit segments. These insights arebased on choice experiments and a survey among2

The case for value-based pricingINTERPRETING THE RESULTS OF THE DISCRETE CHOICE ANALYSISIn our study, each respondent participated in choice experiments for two of three products—checkingaccounts, credit cards, and mortgages. They were presented and asked to choose between threerandomized product configurations (and a “none” option). Respondents repeated this task four times foreach product.We analyzed the data from this exercise using discrete choice modeling, a method of conjoint analysis,to infer the trade-offs consumers make between different attributes (and specific levels within eachattribute). We also estimated shifts in consumers’ likelihood of choosing an offering with changes inproduct configuration.To illustrate the key insights from this analysis, we first present the overall choice probability fora “test” product, one roughly replicating a standard market offering. We then show shifts in thischoice probability as the levels of each product attribute are changed, and focus our discussion onthe key attributes that contribute the most variation in choice probability. Finally, we offer somerecommendations for new pricing approaches.A detailed description of the modeling methodology, along with a full list of product attributes andattribute levels, are shown in the appendix.3,001 bank consumers (see sidebar, “Interpretingthe results of the discrete choice analysis”).der differences, and the general ineffectiveness offee waivers.Our research reveals that price attributes dominate consumer choice, and the trade-offs consumers make among price and non-price attributes aresomewhat counterintuitive. Value perceptions varystarkly across products and affect choices differently across demographic segments and credit profiles,but we also observed consistencies in behavior. Wewere surprised by some results, such as the strongcorrelation between price sensitivity and age, gen-In the following sections, we present the results ofour choice experiments and compare these findings with consumers’ stated preferences for choosing checking accounts, credit cards, and residentialmortgages. We also run simulations to assess consumers’ sensitivity to certain key product attributes,and then offer suggestions for ways that banksshould rethink their pricing strategies based on customers’ choice trade-offs and value perceptions.3

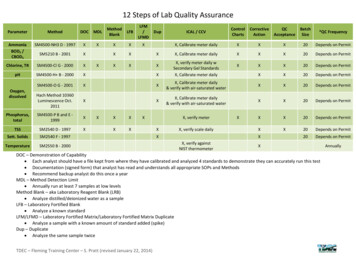

Pricing innovation in retail bankingFigure 1. Current state of pricing in retail bankingChecking accountsTraditionalpricing leversPricingobjectivesPricingstrategiesKey inputcostsExtent ofdifferentiationamongofferingsTop driversof consumerchoice FeesInterest rateFee waiversIntroductory offersCredit cards FeesInterest rateFee waiversIntroductory offers andrewardsMortgages Interest ratesOrigination feesCross-product special offersOther service fees Attract and retain activeaccounts Cover costs of inactive ordormant accounts Create a platform for crossselling and up-selling Maximize revenues throughconsumers’ spend volumesand wallet share Maximize risk-adjustedinterest margins Drive revenues throughannual fees, partnerships,and co-branding Maximize risk-adjustedinterest margins Earn up-front incomethrough origination fees Cross-sell productsto increase customerprofitability Cost-plus (e.g., feescovering costs of servicingactive and inactiveaccounts) Bundling of basic services Unbundling of value-added/ancillary services (e.g.,certified checks, non-bankATM use) Usage-based (differentprice tiers based on usage;e.g., wire transfers) Risk-based Value-based (e.g., cobranded offerings, rewards) Bundling of basic services(e.g., insurance, rewards) Co-branded offers ordiscounts Risk-based Cost-plus (to cover fundingand capital costs) Bundling (e.g., “all-inone” special offers linkedto other products, ratediscounts) Fixed costs of servicing,branch operations, andmaintaining distributionchannels Variable costs of valueadded services Fixed costs of regulatoryand tax compliance Cost to carry excess balancesheet liquidity in slow-loangrowth environment Cost of capital allocated tomanage default risk Costs of funding Fixed costs of distributionand payments processingoperations Cost of capital allocated tomanage default risk andinterest rate risk Costs of funding (withadditional liquidity costs fornon-conforming mortgages) Fixed costs of distributionnetwork, servicing, andregulatory compliance Low level of differentiation,except for online-onlyofferings Largely undifferentiatedofferings Some niche/tailoredofferings Online-only offers competeon price by offering freeaccounts and payinginterest Relatively high level ofdifferentiation Wide variety of productofferings Core set of points-basedand cashback offeringsfrom most major banks andcredit card issuers Innumerable, differentiatedand co-branded offeringstargeted at micro-segments Low level of differentiation Largely plain-vanillaofferings that primarilydiffer on price Product structureconstrained by regulationand acceptance insecondary market Borrower optionsexpanding graduallyfollowing post-crisisclampdown Rate structure (fixed vs.variable) Interest rate Loan term Origination feesMonthly feesType of bankMonthly fee waiversBranch proximityAnnual feeInterest ratePrimary rewardsIntroductory offer4

The case for value-based pricingPrice check!CHECKING accounts are the most essentialfinancial tool in modern American society. In2013, 92 percent of US households, roughly115 million, had access to a checking or savingsaccount.5 Demand deposits, a reasonable proxy forchecking account deposits, totaled more than 1.5trillion at the end of March 2016.6 While this sumrepresents only about 14 percent of US domesticdeposits,7 checking accounts are fundamentalanchors of customer relationships in several ways.They help banks access funds at low cost andsupport cross-selling. Checking account customersare also quite loyal: Our survey showed that morethan one-half of all respondents had their primarychecking account with their current bank for morethan 10 years.Checking accounts arefundamental anchors ofcustomer relationships.Consumers’ survey responses also underscored thesensitivity to fees (see figure 4). More than seven inten stated that “no monthly fees” are a “must have”when choosing a checking account. The aversionto fees was particularly pronounced among olderrespondents and women, trends we witnessed acrosscredit cards and mortgages as well. Also, consumerswith high credit scores showed a greater preferencefor no fees.11 And, not surprisingly, consumersinsisting on “no minimum deposit required” and“no monthly fees” overlapped significantly.Pricing of checking accounts has a checkeredhistory in the United States. Overdraft fees, inparticular, have been subject to intense scrutinyin recent years.8 When banks attempted to raisemonthly fees in the past, consumer backlash forcedsome banks to backtrack on fee increases.9 However,checking account fees have peaked recently, as “free”accounts have become rarer than ever.10Figure 2. Test checking accountChoice probability: 53.5%Large national bank with branchesacross the USConsumers are obsessed withmonthly fees. 10 monthly fee, waived with 1,000 in monthly direct depositsNo interest earnedWhen presented with a test checking account that isquite common in the market today (figure 2), 53.5percent of study respondents chose this product.Foremost, our modeling simulations show thatmonthly fees are by far the most significant driverof consumer choice for checking accounts (figure 3),with consumer preference dropping dramaticallyas fees increase. For instance, raising the fee onour test checking account from 10 to 25 causedchoice probability to drop by 26 percent; dropping itto “zero” (that is, “free”) increased customer choicelikelihood by 36 percent.Branch within 5 minutes ofhome or workIntroductory offer with a 150 cash bonusfor a 500 minimum initial depositStandard overdraft coverage, with 35 fees foreach useNo other special offerGraphic: Deloitte University Press DUPress.com5

Pricing innovation in retail bankingFigure 3. Checking accounts: The most important attributes that influence consumer choiceChange in choice probability due to variations in attribute levels63%Monthly fees35%Type of bank14%Monthly fee waiverBranch proximity13%Interest rate12%Type of new account offer10%Requirements of newaccount offer7%Special offers4%ATM network and fees4%Overdraft protectionand coverageAmount of newaccount offer3%1%Source: Deloitte Center for Financial Services.Graphic: Deloitte University Press DUPress.com Even though mostconsumers don’t paythese fees!satisfy were decidedly more popular. Changing thetest product’s waiver requirement of “ 1,000 inmonthly direct deposits” to “ 20,000 in deposits atthe bank” reduced choice probability by 14 percent.Consumer focus on fees is puzzling because nearly80 percent of our respondents hadn’t paid monthlyfees in the last year, consistent with other researchon this topic.12 Banks generally make it easy to avoidpaying fees, with minimum cash-flow or depositrequirements.Bank size and brands matterAmong non-price attributes, bank size had the mostinfluence on choice in our test checking account.Survey respondents did not think a bank “with arecognizable brand” and “many branches” was thatimportant. But when we changed the bank type inour test product from a large national bank to asmall community bank, choice probability declinedby 8 percent. These results mirror what’s happeningin the industry today: As large banks step up theirdigital offerings, customer satisfaction is indeedimproving,14 and the 10 largest banks by depositsin the United States control over half the depositmarket.15Equally perplexing is that Millennials are leastaverse to paying fees, despite the fact nearly four inten of them did pay fees in the last year. We believeolder age groups’ price sensitivity is due to the factthat they were accustomed to free checking accountsfor a long time.13 Our survey findings support thistheory—respondents who paid fees in the past weremore tolerant of fees. Of those who paid monthlyfees in the last one year, only 40 percent insist onno fees, compared to nearly 80 percent of those whodidn’t.The preference for bigger banks held for midsizebanks and community banks as well—respondentspreferred the larger institutions here as well.Importantly, we found that consumers are not somuch into online-only banks, yet; changing the banktype to online-only drove choice probability downAs for fee waivers, which are ubiquitous in theindustry, our study shows that they materiallyimpact choice, although not nearly as much asmonthly fees. Requirements that are “easier” to6

The case for value-based pricingFigure 4. How important is each of the features below when choosing a bank for your checkingaccount?No monthly fees71%Online

We analyzed the data from this exercise using discrete choice modeling, a method of conjoint analysis, to infer the trade-offs consumers make between different attributes (and specific levels within each attribute). We also estimated shifts in consumers’ likelihood of choosing an offering with changes in product configuration. To illustrate the key insights from this analysis, we first .