Transcription

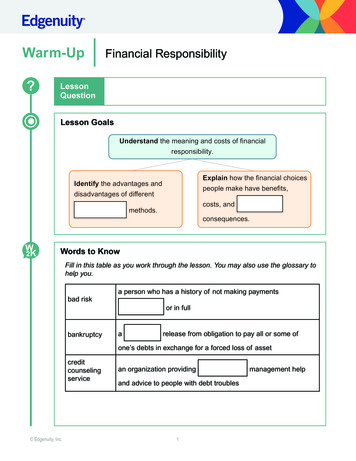

Warm-Up?Financial ResponsibilityLessonQuestionLesson GoalsUnderstand the meaning and costs of financialresponsibility.Explain how the financial choicespeople make have benefits,Identify the advantages anddisadvantages of differentcosts, andmethods.W2Kconsequences.Words to KnowFill in this table as you work through the lesson. You may also use the glossary tohelp you.bad riska person who has a history of not making paymentsor in fullbankruptcyarelease from obligation to pay all or some ofone’s debts in exchange for a forced loss of assetcreditcounselingservice Edgenuity, Inc.an organization providingand advice to people with debt troubles1management help

Warm-UpW2KFinancial ResponsibilityWords to Knowcreditworthya person who can be trusted to fulfill a contractual promise topay back a loan in agarnishment Edgenuity, Inc.mannerautomatic removal of funds from a paycheck forowed2

InstructionFinancial ResponsibilitySlide2Tracking FinancesJacob has finished school and moved into his own apartment. He is creating abudget to track his income and expenses.What must Jacob know about each expense to make sure he has enough moneyto pay his bills?Amount Owed Rent: 5251st15th Utilities: Edgenuity, Inc.Due Date Cell Phone: 63.99 Internet: 32.50321st

InstructionFinancial ResponsibilitySlide2Bill Payment OptionsJacob must submit cash or a check on the first of every month to pay his rent.Jacob has several payment options for his utilities. Mail: Online:No worry about mailIt’s prettyprocess 1–5 8 days Automatic Withdrawal: Phone:The company charges a 3 fee.You’re payingyou owe.The company offers a 0.50than.SubmitYou get to pay itNeed to make sure you haveenough money in the account. Edgenuity, Inc.days4

InstructionFinancial ResponsibilitySlide4Debit Versus CreditJacob is researching his choices forpurchasing a computer. Debit:1200 1160 The computer Jacob wants topurchase costs 1,160. Jacob has 1,200 in savings. Jacob can either use adebit card or a credit card topurchase the computer.He would be left with only 40 in hisaccount. Credit:He will have to pay it back, possiblyat anHe couldhistory.6rate.his creditBill Payment ConsequencesJacob signed up to pay his utility bills with automatic payments, whichautomatically withdraws the amount due from his checking account on the 15th ofevery month.One month, he forgot to make a payment on a credit card, which was due on the12th of the month. After calling in a late payment on the 16th, he checked his bankaccount online and noticed fees had been Edgenuity, Inc.5from his account.

InstructionFinancial ResponsibilitySlide6The Cost of CreditAfter making a late payment on a credit card, and neglecting to take into accounthis automatic payments, Jacob learned an important lesson about some of thecosts of not keeping track of his.In addition to paying interest on thecredit card balance, Jacob had to paypayment a 35Total fees: 35 fee for his credit card, and an overdraft fee of 25 forHe had to pay an additional 60 fornot being financially responsible.withdrawalthat resulted in a negativebalance.9Understanding Credit HistoryA person’s record of borrowing and repaying loans is called ahistory. A credit history can help determine if a person is creditworthy.What makes a person creditworthy?It means that a person that borrows money pays the money makes shows Edgenuity, Inc.on time.than the minimum payment.income.6

InstructionFinancial ResponsibilitySlide9Benefits of Good ChoicesSome purchases made with creditare good investments.Acredit history hasbenefits.Examples: education,It provides: interest rates. financial. qualify for more.It is important that when you borrow money, you pay back the lender according tothe agreement in order to maintain good credit history.11Credit RiskPeople who are deemed credithave credit histories that showrepeated troubles with finances. From a lender’s standpoint, these people are badrisks because they might notback loans in a timely manner.What are some unwise financial choices? late and making Edgenuity, Inc.paymentsthan promised paymentsloans7

InstructionFinancial ResponsibilitySlide11Consequences of Bad Financial ChoicesMaking late payments, making less than the minimum promised payment, andborrowing too much money can have consequences.Long-Term Consequences:Initial Consequences: paying feestime in debt risk higher higher in debt/13savingsDrastic Consequences and SolutionsPeople who borrow and promise to pay back more money than theyeventually face major financial troubles. garnishment Bankruptcycredit counseling service.One way to get help is to contact a Edgenuity, Inc.8

Summary?LessonQuestionFinancial ResponsibilityWhat does it mean to be financially responsible?AnswerUse this space to write any questions or thoughts about this lesson. Edgenuity, Inc.9

Jacob has 1,200 in savings. Jacob can either use a debit card or a credit card to purchase the computer. Debit: 1200 1160 He would be left with only 40 in his account. Credit: He will have to pay it back, possibly at an rate. He could his credit history. Bill Payment Consequences