Transcription

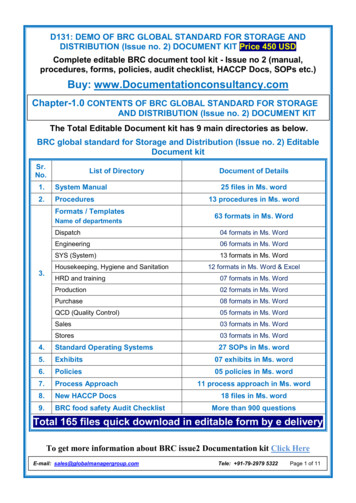

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing SurvivorshipTABLE OF CONTENTSParagraph and SubjectPageDateTrans. No.123456789Table of Contents. . . . . . . . .Purpose and Scope. . . . . . . . .Policy . . . . . . . . . . . . . .Eligible Survivors . . . . . . . .Filing a Claim forSurvivor Benefits. . . . . . . .Establishing Employee’s Death. . .Linking Employee’s Death to anOccupational or Covered Illness.Surviving Spouse. . . . . . . . .Surviving Child. . . . . . . . . .Parents, Grandchildren,Grandparents. . . . . . . . . .Potential for AdditionalSurvivors. . . . . . . . . . . .Claims Involving MultipleClaimants. . . . . . . . . . . .Issues during the Payment Process.Alternative to Filing a SurvivorClaim, Part E. . . . . . . . . 08/1010-09pers10ededChapter 2-1200 Establishing Survivorship111213Exhibits1Su23Sample Letter to Potential SurvivorAdvising of Right to File ClaimSample Acknowledgement LetterSample Determination LetterEEOICPA Tr. No. 10-09August 2010i

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipeded1.Purpose and Scope. This chapter contains procedures forthe development and review of survivor claims under the EnergyEmployees Occupational Illness Compensation Program Act(EEOICPA). It also describes the process followed when a noncovered spouse or child opts for the alternative to filing aPart E claim.2.Policy. The Claims Examiner (CE) is responsible forprocessing survivor claims and ensuring that benefits areproperly paid to eligible survivors under the provisions of 42U.S.C. 7384s(e) and 7384u(e) for Part B and 42 U.S.C. 7385s1(2), and 7385s-3 for Part E.pers3.Eligible Survivors. If an employee eligible for EEOICPAbenefits is deceased, one or more of the employee’s survivorsmay file a claim for compensation under the EEOICPA. Along witha completed Form EE-2, the claimant must document his or herrelationship to the covered employee. If documentation is notsubmitted with the claim, the CE writes to the claimantrequesting the necessary evidence. When developing asurvivorship claim, the CE sends letters to all survivorsclaiming benefits, requesting medical and employment evidencesufficient to establish eligibility of the deceased employee.However, a request for documentation necessary to support theeligibility of a specific claimant is only to be sent to thatclaimant.When a survivor files a claim, the CE is responsible foradjudicating the claim(s) and for processing any compensationwhich may be payable in the order of eligibility outlined below.Sua.Part B. Compensation may be payable to eligiblesurvivors in the following order: spouse, children,parents, grandchildren, and grandparents of the deceasedcovered Part B employee.b.Part E. Compensation may be payable to eligiblesurvivors in the following order: spouse; then children whowere under the age of 18 years at the time of theemployee’s death, or under the age of 23 years andcontinuously enrolled as a full-time student at the time ofthe employee’s death, or were any age and incapable ofself-support at the time of the employee’s death.EEOICPA Tr. No. 10-09August 20101

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing SurvivorshipUnlike Part B, the following claimants are not eligible forsurvivor benefits under Part E: adult children (with theexception of those incapable of self-support at the time ofthe covered employee’s death), parents, grandchildren, andgrandparents of the deceased covered Part E employee.ededc.Conviction of Fraud. A person convicted of fraud inthe application for or receipt of benefits under theEEOICPA or any other federal or state workers’ compensationlaw forfeits any entitlement to the EEOICPA benefits forany occupational illness or covered illness due to anexposure on or before the date of the conviction.pers4.Filing a Claim for Survivor Benefits. A claim for survivorbenefits must be in writing. Any written communication thatrequests survivor benefits under the Act will be considered aclaim for purposes of case creation and claim development.However, a completed and signed Form EE-2 must be submitted forDEEOIC to fully adjudicate the claim and issue a recommended andfinal decision to that survivor.a.Acting on Survivor’s Behalf. Any person acting onbehalf of a survivor may file a claim under the EEOICPA forthat survivor. In the case of a minor child, it ispreferable that a parent or legal guardian complete theform on the child’s behalf. A legal guardian is a personwith the responsibility for providing care and managementof a child and his or her affairs.Sub.No New Claim Needed for Part E. There is no need fora survivor to file a new claim for benefits under Part Ewhen there is an existing, accepted Part B claim, or whenthe survivor filed a Part D claim (Form 350.2) with DOE aslong as the accepted condition under Part B was causallyrelated to the employee’s death.c.Excluding Claims Due to Tort or State Workers’Compensation Benefit. A survivor may choose to excludefrom his or her claim any condition caused by an exposurefor which there has been a settlement from a tort actionor, under Part E, any condition leading to receipt of apayment under a state workers’ compensation program. Thismay preclude any need to reduce payable benefits. (Refer toPM Chapter 3-0400, Tort Action and Election of Remedies andEEOICPA Tr. No. 10-09August 20102

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing SurvivorshipPM Chapter 3-0500, Coordinating State Workers’ CompensationBenefits.)eded5.Establishing Employee’s Death. For any survivor claim, theinitial action to be taken by the CE is the confirmation of theemployee’s death.a. Death Certificate. The document used to verify the deathof an employee is a death certificate, typically issued byan official state or local governing agency. For the mostpart, a death certificate lists the name of the decedent,date of death, his or her marital status at time of death,usual occupation, and cause of death certified by aphysician or some other official. A death certificate isrequired to be submitted to confirm the death of anemployee in a survivor claim filed under Parts B and E.(1) An official copy (stamped) of an employee’s deathcertificate is not required. A copy can be accepted.pers(2) Some states have implemented the use ofelectronic death certificates, which may be used toestablish the death of the employee. To beacceptable, a printed copy of the electronic recordmust be obtained that identifies the certifyingofficial. If a physician is the certifying official,his or her license number must also be included.Su6. Linking Employee’s Death to an Occupational or CoveredIllness. For a compensable claim under Part B, it must be shownthat the employee was diagnosed with an occupational illnessincluding: cancer, chronic beryllium disease or chronicsilicosis. The evidence does not need to show that any one ofthese conditions was linked to the employee’s death, merely thatone or more was diagnosed. This also applies to a coveredillness that develops over the course of the employee’s life andresolves by way of medical treatment. However, for a compensableclaim under Part E, the evidence must establish that anoccupational exposure to a toxic substance was at least aslikely as not a significant factor in causing, contributing to,or aggravating the death of the employee.7.Surviving Spouse. For either a Part B or Part E claim forspousal survivorship, the necessary documentation to establish aviable claim usually consists of a copy of the marriageEEOICPA Tr. No. 10-09August 20103

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipededcertificate issued or recognized by a State Authority or anIndian Tribe Authority. A “Certificate of Blessing of Marriage”from a church is not considered the equivalent of a marriagecertificate. A marriage license is also unacceptable. To be aneligible surviving spouse, the spouse must have been married tothe employee for one year immediately prior to the death of theemployee. This prior year includes the date of marriage,through the day prior to the date of death. For example, if anemployee married on September 4, 2004 and died on September 3,2005, the CE does not include September 3, 2005 when calculatingthe required 365-day term. The CE counts each calendar day fromSeptember 4, 2004 up through and including September 2, 2005.persa. In cases where evidence shows that the employee waspreviously married, it is not necessary to obtain proof ofdivorce. However, in the event that the evidence in a caseraises concern as to the legitimacy of the marriage forwhich survivorship is being established, the CE shoulddevelop further and obtain a copy of the divorce decree (ordeath certificate if marriage ended due to death of spouse)validating that the marriage was dissolved.Sub. In some instances a common-law marriage may existbetween the employee and the surviving partner. When theevidence does not sufficiently establish that the claimanthad a licensed/certified marriage with the employee for the365 days immediately prior to the employee’s death – orwhere there is some evidence to suggest that the marriagewas not valid – the CE may have to gather sufficientevidence to make a determination as to whether the partiesestablished a common-law marriage in a state or otherterritory which authorizes such marriages. As a generalrule, the existence of a common-law marriage is determinedby the law of the state that has the most significantrelationship to both spouses and to the alleged marriage.If full development of the claim results in evidence thatthe alleged common-law marriage occurred in a state thatdoes not allow the creation of such marriages within itsborders – and no other state is involved – the inquiry mayend there.(1) The CE must develop evidence sufficient toestablish that any claimed (or potential) common-lawmarriage meets two threshold issues. The first is whenEEOICPA Tr. No. 10-09August 20104

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipthe common-law marriage was entered into, and thesecond is where it was entered into.eded(2) Once the “when and where” elements have beenestablished, the CE should proceed with additionaldevelopment to document the five standard elements ofa common-law marriage outlined in the Common-LawMarriage Handbook.(3) Evidence which may be used to document a commonlaw marriage may consist of the following items, asdelineated in the handbook: affidavits, marriage anddivorce documents, death certificates, children’srecords, real estate documents, tax records, bankingand loan documents, contracts including insurancedocuments, employment documents, medical records,tribal documents, wills, trusts, power of attorneydocuments, utility bills, letters, and/or othersignificant formal or informal documents.Supers(4) The burden to produce all necessary evidence andto establish each element of their eligibility by apreponderance of the evidence rests with theclaimant(s). The purpose of development regarding aclaimed common-law marriage is to obtain sufficientinformation and probative evidence to support adetermination regarding whether a common-law marriagewas ever created, and if so, its duration. If theevidence is sufficient to reach a decision, the CE mayproceed with adjudication. If the evidence is notclear, or is in dispute, guidance may be obtained bythe Policy Branch, by referring the case file alongwith a memorandum of explanation.8.Surviving Child. A “child” of an individual under bothParts B and E of the EEOICPA can only be a biological child, astepchild, or an adopted child of that individual. A person whois or was a dependent of the employee but does not fit withinthe definition of a qualifying “child” is not an eligiblesurvivor. In the vast majority of situations, a birthcertificate showing the employee as the parent of a child issufficient to establish survivorship. Where the claimant claimsto be a child of the deceased employee and the birth certificatedoes not list the deceased employee as the father or mother ofthe claimant, the CE must undertake development to ascertain theEEOICPA Tr. No. 10-09August 20105

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipcircumstances of the claim. Development is also necessary in anyinstance where the paternity of a child or his or her connectionto the employee is challenged. The CE must use discretion whenevaluating evidence in support of a survivorship claim and weighall evidence received in its totality.Categories of eligible children.ededa.pers(1) Biological Child. The term “biological child” isbroad and refers to all persons with either a presumedor established genetic link to a deceased employee.Because a recognized natural child is presumed to havea genetic link to a deceased employee, a recognizednatural child is one type of biological child.Another type of biological child is a person whosebirth certificate lists the deceased employee as theirmother or father, because these persons are alsopresumed to have a genetic link to their listed motherand father. However, these two presumptions may berebutted if substantial evidence exists that rebutsthe existence of the genetic links, consistent with 20C.F.R. § 30.111(d). The final type of biologicalchild is any person who can establish an actualgenetic link to a deceased employee through thesubmission of probative DNA evidence that shows such alink.SuA person who either is or was only a “dependent” of adeceased employee, but does not fit within the abovecomprehensive definition of a “child” of that deceasedemployee, is not a “child” of the employee for thepurposes of EEOICPA.(2) Stepchildren. Claims for eligibility as astepchild will be decided by the District Offices (DO)unless there is an issue that cannot be determined bythe CE. In circumstances where the status of astepchild as a potentially eligible survivor cannot bedetermined, the matter should be referred to theNational Office Policy Branch.(a) A stepchild is defined as any individual whoestablishes a parent-child relationship with theemployee through the marriage of their parent tothe employee. This determination is made once theEEOICPA Tr. No. 10-09August 20106

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing SurvivorshipCE receives documentation from the stepchild insupport of their claimed relationship.eded(b) Documentation supporting a regular parentchild relationship may include school records(e.g., report card) listing the employee ashaving a familial relationship to the stepchild,employment or tax returns showing that thecovered employee claimed the stepchild as adependent, photographs taken at familygatherings, newspaper articles, obituaries,insurance policies listing the stepchild as theson or daughter of the covered employee, wills,and/or any other documents that refer to thestepchild and the deceased employee in a familialway.Supers(c) Under Part B, where a stepchild was an adultat the time of the deceased employee’s marriage,the evidence will be considered on a case by casebasis. Evidence that may document eligibilityincludes records that the stepchild was theprimary contact in medical dealings with thedeceased employee, that the stepchild providedfinancial support for the deceased employee,and/or provided housing for the deceasedemployee, etc. Evidence consisting of medicalreports, letters from the physician, or receiptsshowing that the stepchild purchased medicalequipment, supplies or medication for theemployee may be helpful. These items of evidencewill be considered on a case-by-case basis andeach should be weighed together to fully evaluatethe eligibility of the survivorship claim.(d) There is no minimum time requirement for astepchild to have lived in the same household asthe covered employee, merely that a parent-childrelationship existed. To determine if a parentchild relationship existed, the CE/FABrepresentative must consider the aboveinformation in conjunction with the following:Did the stepchild visit the employee during theholidays?; Did the stepchild take care of theemployee for days at a time?; and is it logicalEEOICPA Tr. No. 10-09August 20107

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipthat the stepchild and employee stayed at oneanother’s home at any given time? As long as areasonable basis exists to show that a parentchild relationship existed, the CE can make anaffirmative finding.eded(e) For claims involving a divorce between thebiological parent and the stepparent, thedissolution of the marriage does not terminatethe parent-child relationship for eligibilitypurposes. As such, because a parent-childrelationship did exist at one time, the child isconsidered an eligible stepchild. An ongoingparent-child relationship following divorce isnot necessary.pers(f) The CE or FAB representative must considerthe totality of the evidence when determiningwhether the stepchild qualifies, and must providethe rationale supporting whatever outcome in theRecommended and/or Final Decision.(3) Adopted Child. An adopted child is defined as achild that is not biologically related to theemployee, but whose parental responsibilities havebeen permanently transferred by a legal mechanism tothe employee. The CE obtains the relevant legaldocument(s), whether state, tribal, or otherwise,confirming the transfer of responsibility to theemployee.Qualifications for eligibility under Part B vs. E.Sub.(1) Part B Surviving Child. A surviving child is abiological, stepchild, or adopted child of theemployee regardless of age.(2) Part E Surviving Child. Under Part E, a “covered”child must also have been, as of the date of theemployee’s death: either under the age of 18 years,under the age of 23 years and a full-time student whowas continuously enrolled in one or more educationalinstitutions since attaining the age of 18 years, orany age and incapable of self-support regardless oftheir marital status.EEOICPA Tr. No. 10-09August 20108

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipeded(a)Student Status. To be considered a full-timestudent at the time of the employee’s death, thechild must have been continuously enrolled as afull-time student in one or more educationalinstitutions since attaining the age of 18 yearsand must not have reached the age of 23 years,regardless of marital status or dependency on theemployee for support.(1) Enrollment as a full-time studentgenerally consists of a 12-month period,with a break of no more than four months,during each year of post high schooleducation.pers(2) If the child’s status as a full-timestudent is uncertain, the CE consults theacademic institution to determine what wasconsidered to be the minimum number of hoursrequired to qualify as “full-time” (versuspart-time), at the time of the child’senrollment, as this may vary from oneinstitution to another.Su(3) With certain programs such as co-op,intern, or graduate school programs, whilethe student might not actually be enrolledin any courses for a particular term, he/shecould still be “registered” as a full-timestudent while fulfilling other requirementsof the program.(4) If a student is prevented by reasonsbeyond his or her control from continuingeducation for a period of reasonableduration, (such as a brief butincapacitating illness,) the CE hasdiscretion to determine whether thestudent’s status as a continuously enrolledfull-time student should be preserved. Asuspension from school for a limited periodshould not affect the child’s status as acontinuously enrolled full-time student.EEOICPA Tr. No. 10-09August 20109

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipeded(5) Leaving school to care for a sickparent/employee, lack of funds to pay forschool as a result of a parent/employee’sillness, or dropping/failing out of schoolis not a sufficient basis to maintain thechild’s status as a continuously enrolledfull-time student.(6) Documentation to support eligibilityincludes transcripts from the accreditededucational institution(s), school records,and affidavits.pers(b) Incapable of Self-Support. To establisheligibility for benefits as a covered child whowas incapable of self-support at the time of theemployee’s death, the child must have beenphysically or mentally incapable of self-support,regardless of marital status or dependency on theemployee for support, regardless of the temporaryor permanent nature of the incapacity.Su(1) A child is incapable of self-supportif, at the time of the employee’s death,his/her physical or mental condition wassuch that he/she was unable to obtain andretain a job or engage in self-employmentthat could provide he/she with a sustainableliving wage.(2) Medical evidence must show that thechild was diagnosed with a medical conditionestablishing that he/she wasphysically/mentally incapable of selfsupport at the time of the employee’s death.(3) Documentation to support theincapability of self-support can includemedical records, social security disabilityrecords, tax returns showing that thecovered child was claimed as a dependent,state guardianship documents, andaffidavits.EEOICPA Tr. No. 10-09August 201010

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing SurvivorshipededSSA or State disability records alone,showing lack of self support, should not beused to establish that the child isincapable of self-support. The CE mustconsider the evidence as a whole todetermine if it demonstrates that the personwas/is incapable of self-support forpurposes of the EEOICPA.(4) When medical evidence demonstratesincapacity for self-support, thisdetermination will stand unless refuted bysustained work performance.(5) A child ismerely becauseemployment dueof job skills,not incapable of self-supportof an inability to obtainto economic conditions, lackincarceration, etc.pers(6) There is no specific timeframe requiredto establish that a child was incapable ofself-support prior to the death of theemployee (e.g. accident). It is onlynecessary to establish that the child wasincapable of self-support on the day theemployee died.Suc.Non-spousal children. In certainsituations, a special provision of the Act allowsfor the division of benefits between an eligiblespouse and an employee’s child who is not relatedto the spouse.(1) Under Part B only. If there is at leastone child of the employee who is a minor atthe time of payment, and who is not arecognized natural child or adopted child ofthe spouse, half of the payment is made tothe covered spouse and the other half ismade in equal shares to each child of theemployee who is a minor at the time ofpayment, without regard to whether the childis a spousal child, or non-spousal child. Arecognized natural child is a childacknowledged by the employee as their ownEEOICPA Tr. No. 10-09August 201011

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipduring their lifetime. The RD and FD mustfully explain the distribution ofcompensation to the spouse and all childrenwho have filed a claim.perseded(2) Under Part E only. If there is at leastone child of the employee who is living atthe time of payment, who qualifies as a“covered child” (i.e., under the age of 18at the time of the employee’s death, betweenthe ages of 18 and 23 and continuouslyenrolled as a full-time student sinceattaining the age of 18, at the time of theemployee’s death, or any age and incapableof self-support at the time of theemployee’s death) and who is not arecognized natural or adopted child of thespouse, half of the payment is made to thecovered spouse, and the other half is madein equal shares to each “covered child” ofthe employee, who is living at the time ofpayment, without regard to whether the childis a spousal child or non-spousal child.Refer to the definition of a recognizednatural child found under Part B above.The RD and FD must fully explain thedistribution of compensation to the spouseand all children who have filed a claim.Su9.Parents, Grandchildren and Grandparents. Under Part Bonly, parents, grandchildren (including biological, adopted andstep-grandchildren), and grandparents may be eligible forsurvivor benefits provided there is no surviving spouse orliving child who is eligible to receive compensation. Whenadjudicating a survivorship claim for a parent, grandchild, orgrandparent, documentation must establish the relationship ofthe survivor to the deceased employee (i.e. employee’s birthcertificate listing parent’s name, parent’s birth certificateshowing grandparent’s name, etc.). Parents, grandchildren andgrandparents are not eligible for survivor benefits under PartE.10. Potential for Additional Survivors. When an additionalpotential survivor is identified on Form EE-2 or through someother development action, the CE contacts the individual byEEOICPA Tr. No. 10-09August 201012

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipededletter explaining their right to file a survivor claim (Exhibit1).a. Letter to Survivor. The letter to the survivor does notindicate whether the individual is qualified to receivebenefits, as this is a function of the claims process aftera Form EE-2 has been filed. Rather, the letter outlinesthe general requirements for survivor eligibility. The CEexplains that filing a claim does not guarantee thatbenefits will be payable, as both statutory and regulatoryrequirements must still be met before compensation can beawarded.persb. Form EE-2. A blank Form EE-2 is enclosed with thecorrespondence. The potential survivor is asked to completeand submit the form within 30 days. If the claim is notreceived within the 30-day time period, the CE can proceedto adjudicate the case on the assumption that a claim isnot forthcoming. Additional information on handling nonfiling claimants can be found in the PM Chapter 2-1600,Recommended Decisions.c.Additional Documentation. To ensure that compensationis paid to eligible survivors of the deceased employee, theCE may require the survivor to provide documents,affidavits, or records sufficient to substantiate theveracity of their claim.Su11. Claims Involving Multiple Claimants. When a claim isfiled, it is created in ECMS B, ECMS E, or both based on claimedemployment and claimed illness(es). In some cases, multipleclaimants will file a claim for one or more illnesses. And insome of these cases, not all claimants will claim the sameillness(es). Therefore, in cases involving multiple claimants,an illness claimed by one claimant will be considered claimed byall parties to the case (unless the claimant specifically statesthey do not wish to claim the additional illness) and should beentered in the appropriate ECMS system for each claimant. Thismeans that all illnesses will be addressed for all claimantswithout the request for additional claim forms.a.Findings for Each Survivor. Once appropriatedevelopment is completed and review of evidence undertaken,one comprehensive RD addressing the claims of all filingparties may proceed. Each party to the claim must receivean individual finding in the decision with respect to hisEEOICPA Tr. No. 10-09August 201013

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorshipor her eligibility. The decision references each survivorwho has filed a claim and specifies whether they areentitled to receive compensation, the amount ofcompensation payable to each eligible survivor, and thebasis for the conclusions reached.ededb. One Comprehensive Decision - Given the procedurerequiring each individual in a multi-claimant case be partyto a decision on entitlement of benefits, all claimsassociated with the case must be reopened before a newdecision can be issued (Refer to PM 2-1900, ReopeningProcess).b.Individual Addresses. The RD does not include theaddresses of the various claimants. Instead, a coverletter is addressed to each claimant and a copy of the RDis sent to all filing parties.persc.Lack of Form EE-2. The CE may encounter a situationwhere a survivor has made a claim for benefits in writingbut has not filed Form EE-2. Alternatively, the CE may haveevidence indicating the existence of a potentially eligiblesurvivor but is unable to contact the survivor to obtain acompleted Form EE-2. Under these circumstances, the CEproceeds to issue an RD (See PM Chapter 2-1600, RecommendedDecision).12.Issues During the Payment Process.Sua.Death Before Payment. If the employee/survivor isalive when the FD is issued but dies before payment isreceived, the employee/survivor’s claim must beadministratively closed in ECMS. Receipt of payment isdefined as the date the Electronic Funds Transfer (EFT) isreceived at the payee’s bank or the date the paper check isreceived by the payee or someone legally able to act forthe employee in receiving the payment.(1)Any compensation payment (whether check or EFT)received after the employee/survivor’s death mustbe returned to the Treasury Department, and thepayment must be cancelled in ECMS. (Refer to PM3-0600 Compensation Payments for the paymentcancellation steps.)EEOICPA Tr. No. 10-09August 201014

FEDERAL (EEOICPA) PROCEDURE MANUALChapter 2-1200Part 2 – ClaimsEstablishing Survivorship(2)Survivor claims are appropriately developed and anew RD is issued to all survivors who have fileda claim.ededb.Death Due to Non-Covered Illness, Part E. If acovered Part E employee dies after filing a claim butbefore any payment is received, and if the employee’s deathwas caused solely by a non-covered illness,

Benefits.) 5. Establishing Employee's Death. For any survivor claim, the initial action to be taken by the CE is the confirmation of the employee's death. a. Death Certificate. The document used to verify the death of an employee is a death certificate, typically issued by an official state or local governing agency. For the most