Transcription

USER MANUALFinancial Monitoringand Planning Staff Cost(Document 27e)Copyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.

WebSAMSUser ManualVersion 1.9Table of Contents1Module Overview . NTRODUCTION . 1Objective . 1Highlights . 1FUNCTION CHART . 4FLOW DIAGRAM . 7Inter-FMP Modules Flow Diagram . 7Monthly Payroll Flow Diagram . 8Tax Return Flow Diagram . 10INTERACTIONS WITH OTHER MODULES . 11Interactions with Other Modules – From Modules Level . 11Interactions with Other Modules – From Staff Cost Functions Level . 14Operation Procedures . 222.1SETUP . 222.1.1Provident Fund Setup. 22Maintain Grant / Subsidized Schools Provident Fund Scheme General Setting. 22Add Grant / Subsidized Schools Provident Fund Scheme Fund Rate Setting . 25Maintain Grant / Subsidized Schools Provident Fund Scheme Fund Rate Setting . 28Maintain ORSO Scheme General Setting . 31Add ORSO Scheme Fund Rate Setting. 33Maintain ORSO Scheme Fund Rate Setting . 36Maintain MPF Scheme General Setting. 39Add MPF Scheme Fund Rate Setting . 41Maintain MPF Scheme Fund Rate Setting . 452.1.2Payroll Setup . 48Add Payroll Item . 48Maintain Payroll Item . 51Maintain Provident Fund Contribution Account Code . 55Add Reimbursement Item . 57Maintain Reimbursement Item. 592.1.3Tax Information Setup. 612.1.4Autopay Setup . 632.2STAFF MASTER . 672.2.1Maintain Staff Master . 682.2.2Create Staff for Temporary Payroll . 752.2.3Maintain Personal Information of Staff . 792.2.4Maintain Staff Employment . 82Add New Staff Employment . 82Maintain Staff Employment . 852.2.5Maintain Staff Provident Fund Setting . 892.2.6Maintain Staff Payroll Item Account Codes and Maintain Staff Reimbursement ItemSetting952.2.7Maintain Staff Payroll Item Amount and Maintain Staff Payment Setting . 1002.2.8Maintain Staff Cost Allocation . 1032.2.9Copy Staff Payroll Setting . 1062.2.10Staff Mapping . 1102.2.11Staff Synchronization . 1122.2.12Print Log . 1172.3PAYROLL . 1222.3.1Prepare Payroll. 123Capture Staff for Payroll . 123Delete Staff from Payroll . 128Copyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.

WebSAMSUser ManualVersion 1.9Maintain Payroll Item in Batch . 130Export All Payroll Items and Import All Payroll Items . 133Maintain Provident Fund Contribution in Batch . 140Export Provident Fund Contribution and Import Provident Fund Contribution . 145Maintain Reimbursement Item in Batch . 155Maintain Payment and Provident Fund Contribution for Individual Staff . 157Maintain Payroll Items for Individual Staff . 162Maintain Reimbursement Item for Individual Staff . 165Maintain Cost Allocation for Individual Staff . 1702.3.2Payroll Voucher . 173Validate Payroll Entries . 173Generate Payroll Voucher . 177Delete Payroll Voucher . 185Validate Payroll Voucher . 187Freeze Payroll Voucher. 190Unfreeze Payroll Voucher . 193Print Payroll Voucher . 196Generate Autopay File . 199Print Cheque for Payroll Voucher . 2022.3.3Provident Fund Voucher . 208Generate Provident Fund Voucher . 208Delete Provident Fund Voucher . 216Validate Provident Fund Voucher. 218Print Provident Fund Voucher . 221Print Cheque for Provident Fund Voucher. 2242.3.4Voucher Posting . 230Payroll Voucher Posting . 230Provident Fund Voucher Posting . 2342.3.5Voucher Enquiry . 2382.3.6Maintain Payroll Month. 2432.4PROVIDENT FUND REGISTER. 2462.4.1Maintain Provident Fund Register . 2462.5TAX RETURN . 2592.5.1Maintain and Generate Tax Return . 2592.6ENQUIRY . 2692.7REPORT . 2712.7.1Generate Report . 2712.7.2FSC 1 – Voucher and Others . 277Aided School Monthly Paysheet (R-FSC020-E) . 277List of Deleted Vouchers (R-FSC028-E) . 280MPF Remittance Advice (R-FSC004-E) . 281Payroll Voucher / Provident Fund Voucher (Unposted / Posted) (R-FSC026-E). 282Posted Payroll Voucher / Provident Fund Voucher Transaction List (R-FSC014-E). 283Summary of Cheques Used (R-FBK044-E) . 2842.7.3FSC 2 – Payroll. 285Autopay Report (R-FSC002-E) . 285Control Report for Staff Change (Group by Payroll Month) (R-FSC021-E). 286Interface Log File (Transaction from Staff / Staff Deployment Module) (R-FSC015-E) . 287Monthly Salary Control Report (R-FSC023-E) . 288MPF Contribution Proforma Report (R-FSC027-E) . 289Pay Slip (R-FSC005-E) . 290Payroll Item Detail - Payment and Cost Allocation (R-FSC016A-E) . 291Payroll Item Detail - Working on Payroll Net Payment (R-FSC016B-E) . 292Payroll Item Detail - Working on Provident Fund Contribution (R-FSC016C-E) . 293Copyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.

WebSAMSUser ManualVersion 1.9Payroll Report (Group by Payment Method) (R-FSC003-E). 294Payroll Report (Group by Payroll Month) (R-FSC022-E) . 295Payroll Validation Report (R-FSC001-E) . 296Staff Master Listing (R-FSC006-E) . 2972.7.4FSC 3 – Provident Fund . 298Grant / Subsidized School Provident Fund Register (R-FSC009-E) . 298List of Staff with No Provident Fund Contribution (R-FSC012-E) . 299ORSO / Mandatory Provident Fund Register (R-FSC017-E) . 3002.7.5FSC 4 – Cost Allocation. 301Programme Time Spent Report (Group by Programme Code) (R-FSC010A-E) . 301Programme Time Spent Report (Group by Staff Code) (R-FSC010B-E) . 302Staff Cost Control Report (Group by Account Code) (R-FSC024B-E). 303Staff Cost Control Report (Group by Programme Code) (R-FSC024A-E) . 3042.7.6FSC 5 – Annual Accounts . 305Salary for Non-teaching Staff (R-FSC019-E) . 305Salary for Teaching Staff (R-FSC018-E). 3072.7.7FSC 6 – Taxation . 308Payroll Summary for Tax Return (R-FSC013-E) . 308Copyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.

WebSAMSUser ManualVersion 1.91Module Overview1.1Introduction1.1.1 ObjectiveThe FMP – Staff Cost (FSC) Module in WebSAMS provides effective tools forthe schools to (i) manage information on staff cost, (ii) monitor allocation of staffcost, (iii) prepare staff payroll payment via bank’s autopay or system-generatedcheque, (iv) maintain provident fund register for individual staff, (v) submitemployer’s tax return (IR56B) data file to the Inland Revenue Departmentelectronically and (vi) receive staff information from Staff / Staff DeploymentModule for staff master records.Necessary system checking is incorporated to guard against faults and errors.This document provides information on Staff Cost Module functions and thecorresponding procedural guide.1.1.2 HighlightsFunctions in Staff Cost Module are organized in the following seven groupings:(i) Setup, (ii) Staff Master, (iii) Payroll, (iv) Provident Fund Register, (v) TaxReturn, (vi) Enquiry and (vii) Report.The followings are some of the key features of the FMP – Staff Cost Module:1. Users are allowed to maintain basic provident fund rate setting of Grant /Subsidized Schools Provident Fund Scheme for teaching staff, ORSOScheme for non-teaching staff and MPF Scheme for non-teaching staff.2. Users can maintain earning and deduction payroll items.3. Users can maintain reimbursement items.4. Users can maintain tax information setup.5. Users can maintain autopay setting for autopay services of three banks,namely: Hong Kong and Shanghai Bank (MRI), Hang Seng Bank (MRI) andBank of East Asia (MAS (Payroll)).6. The system is able to synchronize staff master records from Staff / StaffDeployment Module.7. Users can create staff master records for temporary payroll purpose forwhom the corresponding staff record has not yet been created in Staff / StaffDeployment Module.8. Users can maintain staff profile, employment, brought forward balance ofprovident fund contribution, payroll settings for the purpose of updating staffpayroll, provident fund register and tax return for individual staff.9. Users can transfer records of staff created in Staff Cost Module to the samestaff created in Staff / Staff Deployment Module.10. Users can copy staff payroll setting from one staff to another staff.11. Users can prepare monthly payroll for staff.12. Users can maintain payroll and provident fund contribution.Copyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 1

WebSAMSUser ManualVersion 1.913. Users can export payroll and provident fund contribution to an XLS formattedfile for bulk updating and then import it back to the system.14. Users can generate payroll voucher for three different payment methods:“Autopay”, “Cheque – With Printing” and “Cheque – Without Printing”.15. Users can generate bank-specified autopay file of staff payroll information inStaff Cost Module and then incorporate the file generated into the autopayprogramme provided by the bank.16. Users can issue system-printed cheque to staff for staff payroll payment.17. Users can generate provident fund voucher for three types of provident fundschemes: (i) Grant / Subsidized Schools Provident Fund Scheme – JournalVoucher, (ii) ORSO Schemes – Payment Voucher and (iii) MandatoryProvident Fund Scheme – Payment Voucher.18. Users can issue cheque through the system to trustee for provident fundcontribution.19. Posting of payroll voucher and provident fund voucher in Staff Cost Modulewill post to General Ledger in Bookkeeping Module.20. The system is able to capture payroll amounts for staff’s income accruing forthat taxation year in Tax Return.21. The system is able to register provident fund contributions of individual staff.22. Users can adjust individual staff's tax return information and taxable items forfiling tax return purpose.23. Users can generate employer’s tax return (IR56B) or revised IR56B data fileand then submit it to the Inland Revenue Department by uploading throughEmployer’s Return e-Filing Services or by submission through a portablestorage device (e.g. CD-rom).24. Users can generate Mandatory Provident Fund remittance advice.25. Users can generate reports such as Payroll Slip, Payroll Voucher andProvident Fund Voucher with four available formats (PDF, WORD,RICHTEXTand EXCEL) in Chinese and English versions.26. Staff Cost Module is one of the seven modules in FMP. Users may choose touse Staff Cost Module only or any combination of FMP Modules at any time.27. If users do not use Budgeting Module, all unposted payroll vouchers andprovident fund vouchers generated in Staff Cost Module will not carry outbudget check. If users set the effective date of Budgeting Module later thanthat of Staff Cost Module, then all the unposted vouchers generated beforethe effective date will not go through budget check.28. If Bookkeeping Module is not set to be effective, month-end and year-endprocesses will not be available because these processes are functions ofBookkeeping Module. Consequently, opening and closing of accountingmonth in Common Setup will be directly linked to payroll month in Staff CostModule. If users close the payroll month in Staff Cost Module, the system willclose the corresponding accounting month in Common Setup Module. To reopen the payroll month in Staff Cost Module, users are required to re-openthe corresponding accounting month in Common Setup Module beforehand.29. Before performing month-end and year-end processes in BookkeepingModule, the system will check whether the related payroll month(s) in StaffCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 2

WebSAMSUser ManualVersion 1.9Cost Module have been closed if both Staff Cost Module and BookkeepingModule are effectiveCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 3

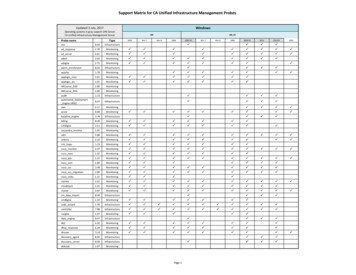

WebSAMSUser Manual1.2Version 1.9Function ChartThis chart shows all available functions of FMP – Staff Cost (FSC) Module.FMP- Staff Cost (FSC)SetupProvident FundSetupPayroll SetupStaff MasterGrant / SubsidizedSchools P FundScheme Maintain General Setting Add Fund Rate Setting Maintain Fund Rate SettingORSO Scheme Maintain General Setting Add Fund Rate Setting Maintain Fund Rate SettingMPF Scheme Maintain General Setting Add Fund Rate SettingMaintain Fund Rate SettingPayroll Items Add Payroll Item Maintain Payroll ItemProvident Fund Maintain Provident FundContribution Account CodeReimbursementItems Add Reimbursement Item Maintain ReimbursementItemTax InformationSetup Maintain Tax informationAutopay Setup Maintain Autopay SettingAdd Create Staff for TemporaryPayrollSearchStaff Mapping Staff MappingPrint Log Print Log of Transactionfrom STF and STD ModulesCopy To Copy Staff Payroll SettingSave Select Staff to Capture forPayrollDelete Delete Staff in FMPPersonal Maintain PersonalInformation of Staff Staff SynchronizationEmployment Add New Staff Employment Maintain Staff EmploymentProvident Fund Maintain Staff ProvidentFund SettingPayroll AccountCode Maintain Staff Payroll ItemAccount Codes Maintain StaffReimbursement ItemSetting Copy Staff Payroll SettingPayroll Amount Maintain Staff Payroll ItemAmount Maintain Staff PaymentSetting Copy Staff Payroll SettingCost Allocation Maintain Staff CostAllocation Copy Staff Payroll SettingLink toIndividualStaffCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 4

WebSAMSUser ManualVersion 1.9PayrollPrepare PayrollStaff ListLink toIndividualStaffPayroll ItemsProvident FundReimbursementPayroll VoucherProvident FundVoucherVoucher PostingAdd Staff Capture Staff for Payroll Staff Mapping Print Log of Transactionfrom STF and STD ModulesDelete Staff Delete Staff from PayrollPayment Maintain Payment andProvident FundContribution for IndividualStaffPayroll Items Maintain Payroll Items forIndividual StaffReimbursement Maintain Reimbursementfor Individual StaffCost Allocation Maintain Cost Allocation forIndividual Staff Maintain Payroll Item inBatch Export All Payroll Items andImport All Payroll Items Maintain Provident FundContribution in Batch Export Provident FundContribution and ImportProvident FundContribution Maintain ReimbursementItem in BatchPayroll Voucher NotGenerated Print “Payroll Item Details(R-FSC016)” report Generate Payroll VoucherPayroll VoucherGenerated Print “Payroll ValidationReport (R-FSC001-E)”(Payroll Voucher) Freeze Payroll Voucher Unfreeze Payroll Voucher Generate Autopay File Print Cheque (PayrollVoucher) Delete Payroll VoucherProvident FundVoucher NotGenerated / NotRequired Generate Provident FundVoucherProvident FundVoucher Generated Print “Payroll ValidationReport (R-FSC001-E)”(Provident Fund Voucher) Print Cheque (ProvidentFund Voucher) Delete Provident FundVoucherPayroll Voucher Payroll Voucher PostingProvident FundVoucher Provident Fund VoucherPostingVoucher Enquiry Voucher EnquiryPayroll Month Maintain Payroll MonthCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 5

WebSAMSUser ManualVersion 1.9P Fund RegisterTax ReturnLink toIndividualStaffStaff Mapping Staff MappingPrint Log Print Log of Transactionfrom STF and STD ModulesSearch Search Staff ProvidentFund Register Records Maintain Staff ProvidentFund Register AdjustmentRecordsStaff Mapping Staff MappingPrint Log Print LogStaff BasicInformation View Staff BasicInformation for Tax Return Maintain Capacity (StaffRank) for Tax Return Staff SynchronizationTax Return BasicInformation Maintain Staff Tax ReturnBasic Information Maintain Particulars ofincome accruing for thetaxation yearResidence andOther Information Maintain Staff Tax ReturnResidence and OtherInformationFreeze / Unfreeze Freeze / Unfreeze TaxationYearSave Select Staff for Tax ReturnGenerate IR56B Generate List of employeeswith IR56B Filed viaComputerized Format to befiled to IRD; Soft Copy ofIR56B to be filed to IRD;Employer's Tax Return(IR56B).Enquiry Staff Cost Control EnquiryReport Print and Preview StaffCost Report Save Staff Cost Report toReport ManagementRepositoryCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 6

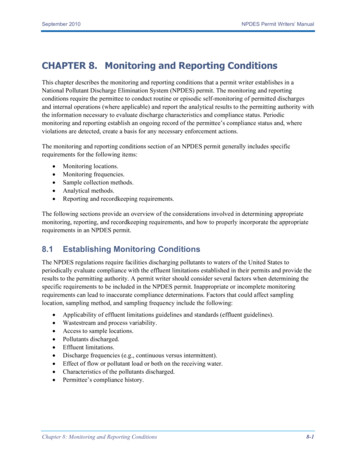

WebSAMSUser Manual1.3Version 1.9Flow Diagram1.3.1 Inter-FMP Modules Flow DiagramThis diagram shows the flow between FMP – Staff Cost (FSC) Module and otherFMP Modules.FCSBeginning ofAccountingYearFBGFSCFBKCreate Accounting YearSet up Chart of AccountSet up Voucher TypeReceive EMB GrantIf FBG module is effectivePrepare Annual BudgetIf FBG module is effectiveApprove Annual BudgetIf FBG module is effectiveBeginning ofPayroll MonthOpen Accounting MonthMaintain SetupMaintain Staff MasterEnd of PayrollMonthPrepare Monthly PayrollProvident Fund RegisterPerform Month EndIf FBK module is effectiveMaintain Tax ReturnEnd ofTaxation YearGenerate Employer’sTax Return to the Inlandand RevenueDepartmentEnd ofAccountingYearGenerate AnnualReportsPerform Year EndIf FBK module is effectiveCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 7

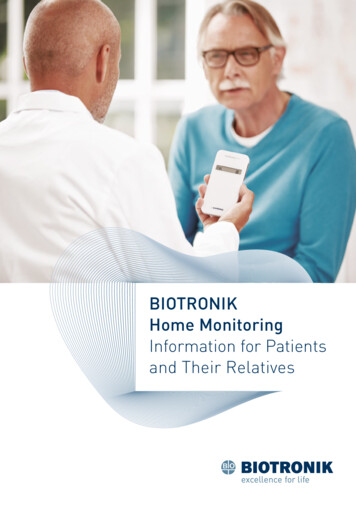

WebSAMSUser ManualVersion 1.91.3.2 Monthly Payroll Flow DiagramThis diagram illustrates the workflow of preparing monthly payroll.Begin PreparingMonthly PayrollOpen Payroll MonthR-FSC015 -EInterfaceTransaction LogCapture forPayroll Staff ListYESTransfer StaffRecordsIdentical Staff Masterrecord exists in STF/STD?Staff Not in Capturefor Payroll Staff List?NOYESNODelete Staff fromPayrollCapture Staff forPayroll Maintain Payment Method, Payroll Item, ProvidentFund Contribution, Reimbursement Item and CostAllocation for the selected payroll month. Import/Export Payroll Items and Provident Fund Prepare PayrollContribution for the selected payroll month.NOAll PayrollCorrectly Prepared?YESThe system performs budget check.Delete PayrollVoucherNO1. Issue ChequeManually.YESFill in Cheque No.in Payroll VoucherR-FSC001-EPayroll ValidationReport (PayrollVoucher)R-FSC026 -EPayroll VoucherUnfreeze PayrollVoucherFreeze PayrollVoucherCheque – Without PrintingNOPayroll ItemDetailsPayroll VoucherCorrectly Generated?Cheque – With PrintingPrint SystemChequeR-FSC016-EGenerate PayrollVoucherYESConfirm SystemCheque?Create Staff forTemporary Payroll1.Import the exported file tobank autopay programme2.Validate autopay data3.Encrypt autopay data bybank autopay programme4.Generate/fill in submissionform5.Submit the submissionform and the encryptedautopay file to bankAutopayGenerate AutopayFileAutopayFileR-FSC002 -EAutopay FileCorrectly Generated?AutopayReportNOYESRequire to generateProvident Fund VoucherCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 8

WebSAMSUser ManualVersion 1.9Set as “NotRequired” togenerate ProvidentFund VoucherNORequire to generateProvident Fund VoucherYESThe systemperforms budgetcheck.Delete ProvidentFund VoucherNOR-FSC001-EPayroll ValidationReport (ProvidentFund Voucher)R-FSC026-EProvident FundVoucherGenerate ProvidentFund VoucherProvident Fund VoucherCorrectly Generated?YESCheque – With Printing1. Issue ChequeManually.Print SystemChequeConfirm SystemCheque?Pay SlipR-FSC005-ECheque – Without PrintingNOFill in Cheque No.in Provident FundVoucherYESPost PayrollVoucherAided SchoolMonthly PaysheetMPF RemittanceAdviceThe system accumulates taxable payroll item tostaff’s particulars of income accruing from thecorresponding taxation year in Tax ReturnR-FSC020-ER-FSC004-EPost ProvidentFund VoucherThe system creates a relevant provident fundregister record in Provident Fund RegisterClose PayrollMonthFinish PreparingMonthly PayrollCopyright 2020. Education Bureau. The Government of the HKSAR.All Rights Reserved.Page 9

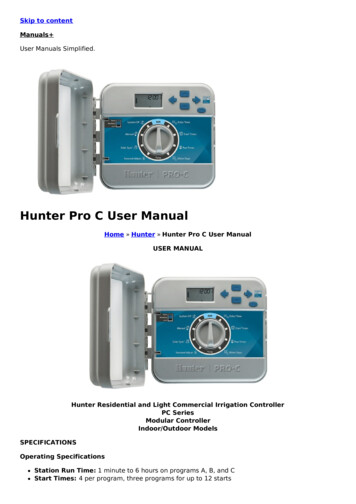

WebSAMSUser ManualVersion 1.91.3.3 Tax Return Flow DiagramThis diagram illustrates the workflow of preparing employer’s tax return.Begin PreparingTax ReturnUnfreeze Taxation YearNOTaxation YearIs under review?YESR-FSC015 -EInterfaceTransaction LogTax ReturnStaff ListYESTransfer StaffRecordsIdentical Staff MasterRecord exists in STF/STD?Staff Not in TaxReturn Staff List?NOYESCreate Staff forTemporary TaxReturnNOR-FSC013 -EUnselect Staff forTax ReturnSelect Staff for TaxReturnPayrollSummary forTax ReturnSynchronize StaffMaster Data fromSTF/STD ModulesMaintain Staff BasicInformation and TaxReturn InformationRequest to GenerateIR56BYESError List for Staff/ R-FSC025 -ESupply Teacher/Others withIncomplete Data inGenerating IR56BSoftcop

15. Users can generate bank-specified autopay file of staff payroll information in Staff Cost Module and then incorporate the file generated into the autopay programme provided by the bank. 16. Users can issue system-printed cheque to staff for staff payroll payment. 17. Users can generate provident fund voucher for three types of provident fund