Transcription

Ferguson plcBaird Global Industrial ConferenceKevin Murphy, Group CEO

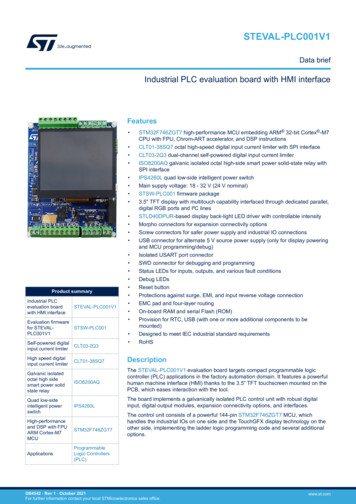

Baird Industrial ConferenceFerguson is a leading value added distributor ofplumbing and heating productsGeographic presenceOngoing revenue ( 2.0%) 19,940mOngoing revenue*Canada5%Ongoing underlying trading profit ( 4.1%) 1,595mRevenue by customer groupFacilitiesFire and Supply, %HVAC, 10%USA95%Ongoing underlying trading profit*Canada3%Headline EPS (-1.1%)Waterworks,18%Underlying operating cash flow ( 18.3%)USA97%Ferguson plc* UK revenue of 1,879m and underlying trading profit of 8m in 2020 non-ongoing operations.Commercial,14%Revenue by end marketCivil/Infrastructure,7%511.6c 1,904mResidentialTrade, 19%Industrial,7%Continuing adjusted EBITDA ( 0.5%) 1,797mUSA key segments and end marketsCommercial,32%Industrial , 7%Residential,54%2

Baird Industrial ConferenceOur specialist products and services are used inalmost every stage of building and infrastructuredevelopmentCommercialFacilities supplyProvides commercial contractors withproducts and services includingbidding and tendering support to assistwith their projectsProvides products, services andsolutions to enable reliablemaintenance of commercialfacilities across multiple RMImarketsResidential tradeServes the residential RMI and newconstruction sectors providingplumbing and sanitary supplies, tools,repair parts and bathroom fixtures toplumbing contractorsFerguson plcResidential showroomeBusinessDisplay products and assistcustomers by providing adviceand project managementservices for their homeimprovement projectsSells home improvementproducts directly to consumersand trade customers onlinethrough various websitesHVACProvides HVAC andrefrigeration equipment, partsand supplies to specialistcontractors.Fire and FabricationFabricates and supplies theprotection products, fireprotection systems and bespokefabrication services tocommercial contractorsIndustrialWaterworksDistributes pipe, values andfittings (“PVF”), hydrants, metersand related water managementproducts alongside relatedservicesSupplies PVF and industrialmaintenance, repair and operations(“MRO”) specializing in deliveringautomation, instrumentation,engineered products and turn-keysolutions3

Baird Industrial ConferenceUSA: a diversified but connected business withattractive market structure#330 50bn25#6#3 90bn#1#2#4Market size ( bn)2015#1#1553105Home Depot57644MRC18%12%21%25%FergusonFerguson plcResidentialShowroomsCommercialMarket Leader if not FergusonWaterworks6HD Supply4%5%22%1%9%HVACIndustrialFire & FabricationFacilities SupplyStandalone eBusiness(formerly B2C)Residential TradeAmazon#1WatscoNumber of other large competitors 1%Other small competitors#1 Ferguson Market Position4

Baird Industrial ConferenceWe connect thousands of suppliers and customerswith a unique business modelKey resourcesand relationshipsSourceSellDistributeHow our customers buyHow we fulfilorders2% through centralOur people50%39,000SuppliersDelivered frombranchesOur customers18% viaaccount managementand call centrese-commerceOur suppliers15Distributioncenters25%Collected frombranchesChannels tomarket10% inshowrooms 1 millionCustomers16%Delivered twork70%9%Delivered fromdistributioncentersCapitalin branchesWhat makes us different?Best associatesFerguson plcCustomers value scaleDifferentiated service offering5

Baird Industrial Conference with supportive structural characteristicsRMI revenue accounts for 59% of total revenueHighly fragmented industry7%11%34%Organic sales growth culture58%Bolt-on acquisition opportunitiesBenefits of scale31%Customer relationships are local2008RMIFerguson plcThe RMI marketnow represents59% of USrevenue59%2020New constructionCivil infrastructure6

Baird Industrial Conference 19.9bnGreat growth opportunities:Consistent revenue, gross margin and profit growth30.0% 1.6bn 9.1bn27.5% 0.3bn‘10‘11Group ongoing revenueFerguson plc‘12‘13Group ongoing gross margin‘14‘15‘16‘17‘18‘19‘20Group ongoing trading profit7

Baird Industrial ConferenceStrategic updateKey strategic themes – ‘How Tomorrow Works’ Value added distributor As trusted supplier and partner, we provide innovative products and solutions to make our customers’ projects better Ensuring scale delivers customer benefits where and when they need Investing in technology to drive productivity for our business and our customers Innovating and always reimagining our business to serve our customersOur strategy is delivering – we’re firmly focused on executionFerguson plc8

Baird Industrial ConferenceAs trusted advisers, we provide innovative productsand solutions to make our customers’ projects better.StrategyWhere we investWe will expand our role in the value chain to build durable competitiveadvantages to achieve profitable growthWe will focus on key capabilities that lay the groundwork forour path to tomorrowChanging landscapeChanging customer expectationsShifting channelsIndustry disruptorsLabor shortageVertical integrationPeopleFerguson plcSafetyCulture of bestassociatesInnovation andFerguson VenturesOmni channel anddigital capabilitiesTechnology and datacapabilitiesSupply chain and valueadded servicesSalesforce evolutionRunning a great businessFirst in safetyCustomer serviceStrategic growthGross margin improvementOperational leverageCapital disciplineEnvironmental, social and governanceIntegrityInnovationServiceResults9

Baird Industrial ConferenceStrategy: Expanding our role in the value chainFerguson plc10

Baird Industrial ConferenceSummary: Why invest in Ferguson?Great returnsGood trading profit margins*Excellent returns on capital**Dependable ordinary dividends*8.0%24.9%208.2cOngoing underlying trading marginReturn on gross capital employedTotal ordinary dividend* Figures are for the year ended 31 July 2020** On a pre-IFRS 16 basisFerguson plc11

Ferguson plc 2 Ferguson is a leading value added distributor of plumbing and heating products Geographic presence Ongoing underlying trading profit ( 4.1%) Continuing adjusted EBITDA ( 0.5%) Ongoing revenue ( 2.0%) Headline EPS (-1.1%) 19,940m 1,595m 1,797m 511.6c USA key segments and end markets Ongoing revenue* USA 95% Canada 5%