Transcription

Competition With Captive CustomersMark Armstrong & John VickersCRESSE: July 2018Armstrong & Vickers ()Captive CustomersCRESSE: July 20181 / 19

Introduction“Captive” customers can only buy from a particular seller; othersconsider several sellers and choose cheapest oneInterpretations:consumers di er in awareness of sellers (Varian, Burdett & Judd, etc.)horizontal di erentiation, where only subset of consumers nd a seller’sproduct suitablechain stores face competition in some locations but not othersconsumers di er in default bias or willingness to switch supplierconsumers di er in ability to compare deals, and confused consumersbuy randomly (Piccione & Spiegler 2012, Chioveanu & Zhou 2013)advertising as shifter of awareness (Honka et al 2017)Armstrong & Vickers ()Captive CustomersCRESSE: July 20182 / 19

Pricing regimesUniform pricing:a seller must charge the same price to all its customersHere, Bertrand competition typically involves mixed strategies(inter- rm price dispersion)Price discrimination:a seller knows whether a consumer is captive or not, and can priceaccordinglye.g., a customer who calls her existing supplier to say she’s consideringswitching may be o ered a “special discount”, while inert consumersremain on the “standard tari ”Bertrand competition then involves pure strategies (but with intra- rmprice dispersion)paper also studies an extension where sellers see a noisy signal ofwhether customer is captivecurrent policy issue is whether to ban this form of price discriminationArmstrong & Vickers ()Captive CustomersCRESSE: July 20183 / 19

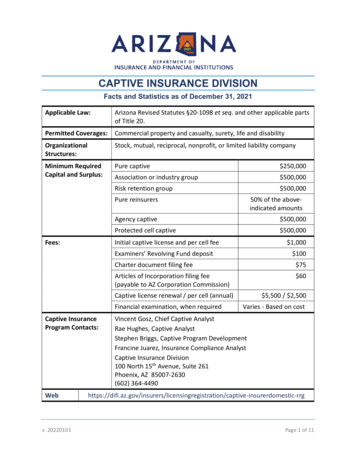

Price dispersion onlineArmstrong & Vickers ()Captive CustomersCRESSE: July 20184 / 19

Price discrimination by energy rms in UKArmstrong & Vickers ()Captive CustomersCRESSE: July 20185 / 19

A frameworkn sellers with costless productionexogenous fraction of consumers aware of any given subsetS f1, ., n g of sellersconsumer buys from seller she sees with the lowest price and hasdemand function q (p )pro t function π (p ) pq (p ) single-peaked up to monopoly price pGeneral features of equilibrium with uniform pricing:equilibrium exists (Dasgupta & Maskin 1986)each rm’s pro t is at least equal to the number of its captivecustomers times π (p )if a price is sometimes chosen, at least two rms sometimes choose itthere are no gaps in the set of prices sometimes chosen: if p0 isminimum price ever chosen, all prices [p0 , p ] are sometimes chosenduopoly is special: rms have same price support which is an intervalArmstrong & Vickers ()Captive CustomersCRESSE: July 20186 / 19

Particular patterns of awarenessDuopoly [Narasimhan 1988]Consumers either know all sellers or one random seller [Varian 1980]Symmetric sellers [Burdett & Judd 1983]Independent reach [Butters 1977, Ireland 1993, McAfee 1994]Nested reach:Armstrong & Vickers ()Captive CustomersCRESSE: July 20187 / 19

Talk addresses two issuesPrice discrimination in duopolyUniform pricing with more than two sellers:rich possibilities depending on patterns of competition“perverse” e ects of entry possible(Longer talk would relate to Bertrand-Edgeworth competition withcapacity constraints)Armstrong & Vickers ()Captive CustomersCRESSE: July 20188 / 19

The impact of price discriminationConsider a duopoly marketLeft-hand picture has equal numbers of captivesIn right-hand picture the smaller seller has no captivese.g., smaller seller is an entrant who is able to serve those customers ofthe incumbent with low switching costsArmstrong & Vickers ()Captive CustomersCRESSE: July 20189 / 19

The impact of price discriminationPrice discrimination:contested consumers get competitive price p 0captive consumers get monopoly price p peach seller obtains its captive pro tUniform pricing:both sellers choose price in interval [p0 , p ]larger seller obtains its captive pro tsmaller seller obtains more than its captive pro tComparison:industry pro t lower with discrimination (equal if market symmetric)distribution of pro t across consumers is more dispersed withdiscrimination (a mean-preserving spread if market symmetric)a ban on discrimination helps captive customers and harms contestedcustomers, but overall impact?Armstrong & Vickers ()Captive CustomersCRESSE: July 201810 / 19

The impact of price discriminationUseful perspective is “expected utility theory”regard a consumer’s surplus v (π ) as a (decreasing) function of thepro t π she generates“competition in utility space” [Armstrong & Vickers 2001]v (π ) is concave if elasticity pq 0 (p )/q (p ) increases with priceunit demand [q (p ) 1 if p 1] corresponds to “risk neutrality”In symmetric market, distribution of pro t has same mean but greaterdispersion with discriminationso consumers in aggregate are harmed by discrimination(they are indi erent with unit demand)In asymmetric market, distribution of pro t has lower mean withdiscriminationso with unit demand consumers bene t from discriminationunder mild conditions [eg., q (p ) log-concave] with nested con gurationconsumers bene t from discriminationArmstrong & Vickers ()Captive CustomersCRESSE: July 201811 / 19

Uniform pricing with more sellersFor simplicity assume unit demand [q (p )1 if p1]makes little di erence to equilibrium strategies, but makes welfareanalysis [too] easyWe describe a few interesting equilibria:independent reachnested reach“perverse” entryThen solve triopoly marketArmstrong & Vickers ()Captive CustomersCRESSE: July 201812 / 19

Independent reachFirm i 1, ., n is seen by independent fraction σi of consumersIreland 1993, McAfee 1994Suppose rm j uses CDF Fj (p ) for its price rm i’s demand with price p isσ i [1σj Fj (p )]j 6 iif π i is rm i’s pro t, for a price in rm i’s support we requireσ i [1pj 6 iσj Fj (p )] π iThis system is easily solved:each rm chooses price from an intervalall rms have the same minimum price p0so pro t of rm i is σi p0maximum price is lower for smaller rmsArmstrong & Vickers ()Captive CustomersCRESSE: July 201813 / 19

Independent reachIndependent reach scenario is easy to analyze, despite asymmetryexplicit formulas for industry pro t, total welfare and consumer surpluse.g., if rm n is largest, consumer surplus in equilibrium is1n 1n 1i 1i 11 σi (1σi )[akin to the “Her ndahl index” in Cournot oligopoly]Consider entry by a new rm, also with independent reachexpands total reach and so boosts total welfarereduces minimum price p0 and so impact on incumbents is negativenecessarily boosts consumer surplusArmstrong & Vickers ()Captive CustomersCRESSE: July 201814 / 19

Nested reachRadical departure from independence is nested reacha smaller rm’s reach lies inside a larger rm’s reachonly the largest rm has any captive customersExample: n 3 sellers with nested reach, where seller i 1, ., nreaches i consumersequilibrium takes the form of “overlapping duopoly”threshold prices p1 . pn 1 pn 1 such that only rms 1 and 2choose prices in [p1 , p2 ], only 2 and 3 choose prices in [p2 , p3 ], ., only rms n 1 and n choose prices in [pn 1 , 1]pi 1 pi pi 1 , so threshold prices proportional to Fibonaccisequencepro t of rm i is pismall rms only choose low prices, large rms only choose high pricesArmstrong & Vickers ()Captive CustomersCRESSE: July 201815 / 19

“Perverse” impact of entry into contested marketSuppose a third rm enters a symmetric duopoly market, which isconsidered only by the contested consumersa natural scenario with the “switching cost” interpretationThe number of captives and total reach is unchangedminimum price p0 unchangedtotal pro t rises and consumers in aggregate are harmed by entrycaptive consumers surely harmed, as entry induces incumbents to focusmore on their captive consumersbut even the contested consumers can be harmedArmstrong & Vickers ()Captive CustomersCRESSE: July 201816 / 19

TriopolyIndependent and nested cases have rms in obvious “order” rms with large reach also have high proportion of captive customersBut, say, a “niche” rm might have limited reach and high proportionof captivesGeneral solution seems unavailableWe have solved the model with triopolysolution depends on the seven parameters in the Venn diagramequilibria take just three formsArmstrong & Vickers ()Captive CustomersCRESSE: July 201817 / 19

TriopolySolution depends on the parameters:ti Prfsee at least i gPrfsee at least j and k gwith independent reach t1 t2 t3 σ1 σ2 σ3with nested reach largest rm has a larger ti than othersIf ti close together equilibrium looks like independent case:“3 then 2”: all rms have same minimum price, then one rm drops outIf ti moderately di erent:“3 then 2 then 2”: all rms have same minimum price, one rm pricesin the whole range, one rm only prices low, and one rm hasdisconnected support and does not choose intermediate pricesIf ti far apart:“2 then 2”, or overlapping duopoly: one rm prices throughout wholerange, one rm only prices low, and one rm only prices highArmstrong & Vickers ()Captive CustomersCRESSE: July 201818 / 19

Concluding themesCompetitive outcomes depend not only on the number and sizes of rms, but also on the patterns of their interactions with customersE ects of entry may be non-standardNatural forms of price discrimination induce “mean-preserving spread”“Risk averse” consumers are then harmed if rms are symmetric (butnot in general)Armstrong & Vickers ()Captive CustomersCRESSE: July 201819 / 19

captive consumers get monopoly price p p each seller obtains its captive pro-t Uniform pricing: both sellers choose price in interval [p0,p] larger seller obtains its captive pro-t smaller seller obtains more than its captive pro-t Comparison: industry pro-t lower with discrimination (equal if market symmetric)