Transcription

2012 Micro Captive Update1

What is a “Captive”?1. Must be an “Insurance Company”2. Insureds are related or affiliatedBasic Captive DiagramShareholdersInsurance PremiumsCaptiveBusinessInsurance Coverage2

3

4

The growth in middle market captivesMiddle Market 106,000 CompaniesLess than 5%Fortune 500Over 80%5

Why Form a Captive?Risk ManagementTax SavingsCash Flow6

Reduce insurance costCapture underwriting profitPricing stabilityPurchase based on needMinimizeInsurance CostControlRiskImproveCash FlowRetain premium dollarsTax benefitsInvestment incomeAdditional profit centerGreater control over claimsIncrease coverageIncrease capacityUnderwriting flexibilityAccess reinsurance marketIncentives for loss controlWealthAccumulationEstate planningAsset growthAsset protection7

Who is a Candidate?Business with Substantial RiskMay be insured or self-insuredKey Industries:Real Estate Developers / BuildersManufacturersProfessional Services FirmsFranchiseesRestaurant / Hotel ChainsPhysicians / Groups8

Who is an Ideal Candidate?Good candidates generally meet oneor more of the following criteria*: 20M gross revenue Pre-tax profits of at least 1M Substantial self-insured / uninsuredbusiness risk 50 employees*Smaller businesses with at least 3M revenue canwork for some captive programs.9

Top Risk Concerns Facing Companies TodayEconomic slowdownRegulatory / legislative changesIncreased competitionDamage to reputation / brandFailure to innovate / meetcustomer needs1231,2,3Failure to attract or retain toptalentBusiness interruptionCommodity price riskTechnology failure / system failureCash flow / liquidity riskAon Corporation, Global Risk Management Survey 2011Respondents reported number of occurrences in each of these risk areas within the past year, with occurrence rates ranging between 8% to 67%Number of respondents reported feeling adequately prepared for these risks: 69%10

Insured RiskTraditionalCaptiveHidden RisksMicroCaptiveWorkers Comp Property Auto General LiabilityUninsured RiskDeductiblesExclusionsOperating RisksA/R ConcentrationConstruction DefectCredit DefaultDisabilityAdministrative ActionsD&O/E&OLegal Defense ReimburseMold and PollutionProduct Warranty11

831(b) CaptiveNo tax on underwriting profit if premium under 1.2MInvestment Income taxed as regular “C-Corp”Basic Captive DiagramShareholdersInsurance PremiumsCaptiveBusinessInsurance Coverage12

Case #1: Manufacturer 50M gross revenueSignificant self insured ve13

Case #2: DeveloperBuilder ( 170M gross revenue)Residential/commercial constructionUnable to purchase construction defect or mold insurancePartner 133%Partner 233%Partner 333%Partner 1CaptiveQuota ShareInsuranceAgreement 1,200,000 PremiumsPartner 2CaptivePartner 3Captive14

Case #3: Trucking CompanyQuota Share InsuranceAgreement 2,400,000 Premiums 1.2m PremiumsSelf Insured Risk (SIR)Litigation DefenseDeductible CoverageEPLIChild Trust#1Mom / Dad 1.2m PremiumsChild Trust#2Mom / DadLLCLLCCaptiveCaptive15

Case #4: PhysicianOwns other businessesSelf Insured Risk (SIR)Employment PracticesLitigation Defense ReimbursementLoss of LicensePropertyMgmt. Co.MedicalPracticeSurgeryCenterCaptive 1,200,000 PremiumsInsurance Policies16

Case #5: Group CaptiveGroupBusiness 1Business 2PremiumsBusiness 3Business 4Business 5Business 6CaptiveInsurancePoliciesBusiness 717

Case #6: Cell CaptivesCaptiveCell 1Cell 2Cell 4Cell 3Cell 5Cell 7Cell 6Cell 818

Case #7: Saving Insurance Costwith IRC §831(b) CaptiveLarge insurance program stays in placeLarge InsuranceCompanyShareholdersPays premiums related to retention layerCaptiveBusinessUnderwrites risks19

Ownership eFamilyEstate PlanTrust

Estate Planning With a Captive(Including Life Insurance)Child Trust#1Mom / DadMom / Dad1%99%LLC 1.2 M P&C PremiumsBusinessLife insurance purchased pre-taxDeath benefit outside estateCaptive provides cash flow for annual lifepremiumsCaptive 500K Life InsurancePremiums AnnuallyLife Insurance21

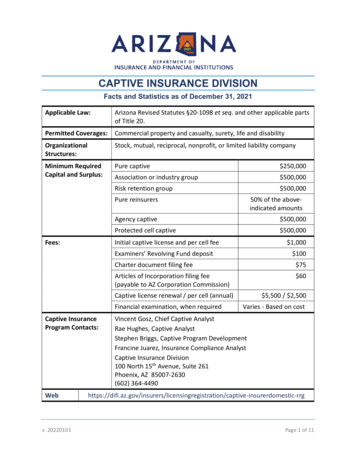

Where is the Captive Formed?OffshoreExamples:Anguilla, Bermuda, BVI, Cayman IslandsLower capital requirementsExpedited formationsInvestments stay in U.S.Foreign Captives File U.S. tax return(if 953(d) election made)

Where is the Captive Formed?OnshoreExamples: Delaware, Utah, Nevada, Vermont, MontanaMore states adding captive insurance lawDelaware competitive with offshore “benefits”Note: Whether foreign or U.S., the tax benefits are the same

Leading Captive DomicilesCaptivesRankLocation(as of 12/31/2010)1Bermuda8452Cayman outh Carolina16012Isle of 917District of Columbia10218Delaware97Source: Business InsuranceMarch, 2011

U.S. Domestic Captive CGAFLAKHICaptive statutesNo specific captive statutesCT

Then why doesn’t every business have a captive?

Key QuestionDoes the captive qualifyas an insurancecompany under USFederal Tax law?27

Tax Law and CaptivesInsurance RiskOperate as an insurance companyRisk shifting and risk distribution28

A valid captive requires“Risk Distribution”Risk distribution is a spreading of risk that allows theinsurer to reduce the possibility that a single costly claimwill exceed the amount available to the insurer for thepayment of such a claim.

Multiple SubsidiariesUnrelated ptiveUnrelated risk

How to meet risk distribution1.Group Captive (Rev Rul 2002-91)2.3.4.5.Multiple Subsidiaries (Rev Rul 2002-90)Warranty Captive (Rev Rul 2002-89)ArtexExchange (Rev Rul 2002-89)Artex Pool (Rev Rul 2002-89)6.Employee Benefit Captive (Rev Rul 2002-89)31

Safe Harbor Revenue Ruling 2002-91GroupBusiness 1Business 2PremiumsBusiness 3Business 4Business 5Business 6CaptiveInsurancePoliciesBusiness 732

Safe Harbor Revenue Ruling 2002-9012 Brother / Sister subsidiariesNo single Brother / Sister subsidiary can constitutegreater than 15% or no less than 5% of the riskBusiness / ach SubComprises5-15% of Risk33

1,000,000 999,999 ExcessInsurance 250,000High Deductible Retained Layer 100,001 100,000AEX Pooling Layer 0Business

PremiumAEXQuotaShare %X PremiumQuotaSharedPremiumUnrelatedPremium 0.50 3 x 18 18 3 1.00 3Captive 6Captive 9Captive 1.50TotalPremium 18 1.00 6 x 18 18 6 2.00 3.00(TrustAccount) 9 1.50 9 x 18 18 3.00 4.50

Warranty CaptiveBusinessCustomerCaptive37

Example: HVAC Contractor Cost of new A/C Unit: 5,000 Contractor sells 2,000 units per year Allocate 500 (of the 5,000) to a 3-yearService Contract Premium to Captive: 500 x 2,000 1M What is the net benefit?38

Pro FormaAssumptions: 1,000,000 annual premium30% claims (3% per year for 10 yrs)10-year periodCaptive costs included40% tax rate6% investment growth per year39

Pro Forma - 1 million premiumYear 1Year 2Year 3Year 4Year 5Year 908(300,000)1,228,431Net Value of ,748,941Net Value of Fundswithout ins. 9,334Net Benefit303,200635,152974,3011,321,079 1,675,944 3,589,60640

Safe Harbor Revenue Ruling 2002-89More than 50% of risk exposure from unrelated partiesBusiness49% of RiskCaptiveUnrelatedParties51% of Risk41

Artex PoolLow / high frequency claims (paid by captive)49% of risk / premiumLow frequency / high claims (paid by risk pool)51% of risk / premiumFrequency of ClaimBusinessPremiumAgency49%Tranche of riskretained by captiveReinsurance contractfor pooled risk250,000500,000InsurancePoolCaptive1,000,00042

Employee Benefits Captive43

Types of Employee Benefit CaptivesFortune 500 DOL Approval ERISA Exemption (PTE) Can use EE Risk Distribution: yes Group Health, life,disability, other Under 30 captivesMiddle Market No DOL Approval ERISA Exemption– No EE Can only use ER Risk Distribution: noGroup HealthSize: 50-1,000 EEscovered Big growth area44

Driving down the cost ofemployer health care

VantageRecipe1. Self Funding Layer2. Captive Layer3. Stop Loss Insurance4. Risk Management

Self-Insured Structure with Medical Stop LossStop Loss Policy 350,000Carrier Retained Excess(for example)Sentinel CaptiveLoss Fund 100,000(for example)Self-Insured Employer Retention(Per Individual Per Year)Employee Cost Sharing(i.e., deductibles, coinsurance, etc.)Private & ConfidentialRisk TransferCarrier retains the portionabove the floating layerRisk SharingCarrier reinsures premium andlosses for the 1st 250,000above each Employer’s SIR(floating layer) to the CaptiveRisk Retention

Rated A (Superior) by A.M. BestNYSE: WRBSubsidiary of W.R. Berkley Co., est 1967All 50 states

Micro Captive Example OptionEmployer 400,000Berkley StopLoss Policy 790,000Direct PremiumDeductiblesExcess & SurplusEnterprise Risks 340,000SentinelCaptive 340,000Q/SReinsurance(unrelated risk)MicroCaptive 1,130,000total

Stop Loss InsuranceCaptive LayerSelf Funding LayerPrivate & Confidential50

51

Contact:Jim TeheroJim Tehero@artexrisk.com480-553-62401635 N. Greenfield Rd., Suite 127Mesa, AZ 85205www.captiveadvisors.com

Pricing stability Purchase based on need Estate planning Asset growth . Product Warranty Traditional Captive Micro Captive Hidden Risks . 12 831(b) Captive . Example: HVAC Contractor Cost of new A/C Unit: 5,000 Contractor sells 2,000 units per year