Transcription

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson Controls Strategic Review and 2016 OutlookCEO SectionAlex MolinaroliChairman, President and Chief Executive OfficerDecember 1, 2015 – PublicForward looking statementStatements Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks anduncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forwardlooking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regardingfuture financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels andplans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,”“estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identifyforward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties,assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results todiffer materially from those expressed or implied by such forward-looking statements. These factors include potential impacts of the plannedseparation of the Automotive Experience business on business operations, assets or results, required regulatory approvals that are materialconditions for proposed transactions to close, currency exchange rates, strength of the U.S. or other economies, automotive vehicleproduction levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, and cancellationof or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent AnnualReport on Form 10-K for the year ended September 30, 2015. Shareholders, potential investors and others should consider these factors inevaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statementsincluded in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims anyobligation, to update forwardlooking statements to reflect events or circumstances occurring after the date of this document.2Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

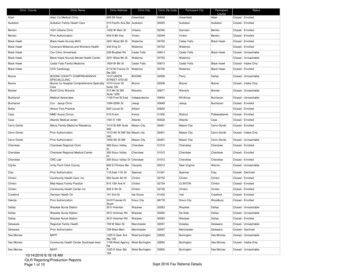

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Delivering on our Commitments2015: Record performance**Excludes FX and Interiors JVRevenue3Johnson Controls, Inc. — PUBLICDelivering on our Commitments2015: Record performanceFY2015*FY2015*11.6%120 bpsSegment Margin*Excludes separation / integration / transaction and other one-time or unusual items.4Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Delivering on our Commitments2015: Record performance**Diluted earnings per share from continuing operations excluding separation / integration / transaction and other one-time or unusual items.5Johnson Controls, Inc. — PUBLICDelivering on our CommitmentsDriving Value for Shareholders as We ExecuteEBIT Increase(1)Total Shareholder Return1 Year3 Year1 Year3 Year 83% 35% 52% 28% 4% 12% 8%(3%)Johnson Controls6Johnson Controls, Inc. — PUBLICMulti-Industrial Peers(2)Source:FactSet as of October 27, 2015.(1)Johnson Controls figures based on reported segment income.(2)Peer set includes 3M, Danaher, Dover, Eaton, Emerson, Honeywell, Illinois Tool Works, Ingersoll-Rand, Tyco and United Technologies.#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Delivering on our CommitmentsTremendous Progress on Portfolio Transformation7Johnson Controls, Inc. — PUBLICMuch has changed, but Johnson Controls Vision andCore Enterprise Plan Remain ConstantGROWTH COMPANYOPERATIONALLY EXCELLENTStronger growth than our peers,competitors and marketsBenchmark companyfor multi-industrialsCustomer-focused, market-driven,account-oriented, service-mindedand responsiveQuality, cost and productivitywith speedENGAGED EMPLOYEESLeadership and employee engagementabove our peers, competitors and marketsLeader-led, coaching-disciplined, diverse,accountable and decisive8Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Vision and Enterprise PlanOur Strengths – Deliberate and Explicit Choices9Johnson Controls, Inc. — PUBLICVision and Enterprise PlanOur Strengths – Deliberate and Explicit ChoicesTechnical products that enable followon and value-added servicesTechnology leader in ourcore businessesSustainable operationsand offeringsRelatively long and stable productcyclesInnovation embedded capabilities10Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Vision and Enterprise PlanOur Strengths – Deliberate and Explicit ChoicesContinuous and relentlessimprovement culture11Johnson Controls, Inc. — PUBLICVision and Enterprise PlanOur Strengths – Deliberate and Explicit ChoicesBusinesses with scaleApplied engineeringand technologiesGood, trusted and capablepartner12Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Vision and Enterprise PlanOur Strengths – Deliberate and Explicit ChoicesStrategic customer relationshipsExpanding channelsSuperior brands13Johnson Controls, Inc. — PUBLICVision and Enterprise PlanJohnson Controls Operating SystemThe “JCI Way”Embedded in how wecreate opportunity anddrive performanceacross every aspect ofour businessIntegral to ourCulture14Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Our Path to Multi-IndustrialKey Metrics15Johnson Controls, Inc. — PUBLICOpportunityA bright future aheadfor two leading companies16Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Opportunity for growth inAsia-PacificAsia-PacificChina Remains Large Opportunity for Both CompaniesSignificant China Revenue GrowthRequires inorganicinvestment 21.0 bn 2.9 bnBE / PSAE2015Aligned with Market Trends Real GDP per capita doublesfrom 2010 to 2020 Urbanization to continue Chinato represent 40% of globalHVAC market by 2020 World’s largest automotivebattery market by 2020 Highest growth commercialbuilding and HVAC market in theworld 10.3 bn2010Johnson Controls2020EOver Long-term Leadership in China is Essential to Being a Global Leader in our Markets18Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Asia-PacificChina Remains Large Opportunity for Both CompaniesSignificant China Revenue GrowthRequires inorganicinvestment 21.0 bnJohnson ControlsAdvantaged positioning Local-market relevant products,channels, processes, tooling China corporate citizenship Focus on strategic relationships– History of successful auto JVs– Hitachi JV Maintain flexible investingpolicy; seize opportunities topartner / consolidate the market 10.3 bn 2.9 bnBE / PSAE201020152020EOver Long-term Leadership in China is Essential to Being a Global Leader in our Markets19Johnson Controls, Inc. — PUBLICAsia-PacificCurrently Planned Investments Through 2020Johnson Controls Automotive 1B JV capacity M&A Metals20Remaining Johnson Controls 1B HitachiM&AChannel expansionProduct investmentJohnson Controls, Inc. — PUBLIC#JCIAnalystDay 1B Manufacturingcapacity M&A Channel expansion Lead recycling

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Opportunity for growth inJohnson Controls AutomotiveAutomotiveWell-Positioned in World’s Largest Growth MarketsJohnson Controls Automotive Market Share by RegionTotal Market Size 2015: 60 Billion22Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015AutomotiveKeys to Our Plan to Win in AutoJanuary 13, 2016: Detroit Auto Show analyst conference Presentation on post-spin Automotive business23Johnson Controls, Inc. — PUBLICAutomotiveInvestment Thesis for SpinCoWhy should I continue to invest in Auto as a standalone business?1Leading, pure play automotive supplierin its space with focused strategy2Differentiated product value propositionfor customers3Positioned for growth and improvedprofitability4Commitment to smart investment asindependent business5Solid FCF supporting consistent returnof capital to shareholders24Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Opportunity for growth inJohnson ControlsJohnson ControlsWill Be A More Focused Global Multi-Industrial% of Sales17%SLIPower SolutionsBuildingAutomation &Controls28% 7bn FY15 revenue26%4%AGM/EFB*Building Efficiency1%Li-Ion 1% 14bn FY15 revenue15%(pro forma for Hitachi JV)CommercialHVAC9%HitachiResidential HVAC& IndustrialRefrigeration*Include Optima26Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson ControlsWill Be A More Focused Global Multi-IndustrialBuilding Efficiency(1)Power Solutions Leadership position in battery energystorage solutions Advantaged manufacturing scale andPowerprocess technologySolutions 74% of sales from stable, profitableautomotive after-market Emerging energy managementplatform utilizing battery technology51%32% Diverse product portfolio Global leader in complex buildingautomation and controls andcentrifugal chillersCommercial JCI-owned direct sales channelHVAC North America branch contracting andservice network VRF technology through Hitachi57%10% 7%North AmericaEMEAAsia Pacific19%20% 4%Latin AmericaLeading Global Businesses in Attractive End Markets Exposed to Important Mega Trends(1) Geographic breakdown is not pro forma for Hitachi JV.27Johnson Controls, Inc. — PUBLICJohnson ControlsGrowth in our Large, Global Core MarketsGlobal HVAC Equipment Market1 2014-20 BillionsCAGRGlobal Energy Storage Market Billions2014-20CAGR 6% tialControls7% 7% id40539%2014Global 240B market by 20202833Johnson Controls, Inc. — PUBLIC#JCIAnalystDay202015%5%

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson ControlsInvestment ThesisWhy should I be excited about the New JCI?1Attractive topline growth opportunitiesboth organic and inorganic2Leadership positions in markets alignedwith mega trends where we can win3JCOS driving improved ways to dobusiness4Clear margin runway—differentiatedopportunity for margin expansionversus multi-industry peer group5Commitment to shareholder-friendlycapital allocation29Johnson Controls, Inc. — PUBLICWhat’s next forJohnson Controls?#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015What’s next for Johnson Controls?New Market Opportunity at the Intersection of our Businesses31Johnson Controls, Inc. — PUBLICWhat’s next for Johnson Controls?Distributed Energy Storage 19B market by 2020Investing in product businesses that are core to our multiindustrial portfolio and growth objectives Leverages Johnson Controls world-class battery technology, building systemsexpertise and intelligent controls for energy storage at the lowest lifecycle costIn-building system32Johnson Controls, Inc. — PUBLIC#JCIAnalystDayContainerized modular system

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015What’s Next for Johnson Controls?Further Growth & Transformation PotentialHorizon 3Horizon 2Invest in future platformsHorizon 1Expand the coreStrengthen the coreBuildingEfficiency Core HVACproducts Global growth –China Controls and smartdevices Smart buildings IoT connectivityand integration Hitachi & ADT ExpandingchannelsPowerSolutions Global growth China Motiveadjacencies AGM capacity Growth in otheremerging markets Li ion participation Distributedenergy storage –incubator33 Compellingadjacencies inbuildings and energyplatforms Rising emergingmarkets – India,ASEAN, Africa Technology and dataanalytics to drivecore offerings andevolving value-addedservices First objective isalways drivingshareholder returns Not pursuingchange for its ownsake Investing in placeswhere JCI can winPursuing logical andstrategic investmentopportunities—nosurprisesJohnson Controls, Inc. — PUBLICWhat’s Next for Johnson Controls?Disciplined Metrics Guide Our DecisionsComprehensive Framework Focused on Driving Long-term Value Core revenue growth exceeding our markets Deal economics supported by cost synergies Accretive to EPS in year 3Growth Margin Expansion Leading Position inAttractive Spaces Return above our weighted average cost ofcapital in year 2 Outperformance supported by JohnsonControls operating system Attractive incremental investments Complementary to existing platforms Consistent with multi-industry vision Supports premium trading multipleFramework balances our investment returns with market realities34Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Aligned with the Characteristics of a Multi-Industrial Leadership toDrive Increasing Shareholder ValueMI PeersCharacteristics of Leading Multi-Industrial BusinessesRemainCo Businesses in attractive growingmarketsStrategic Leading #1 or #2 market position Active portfolio managementOperational Competitively advantaged scaleposition Effective and well-developedoperating system Mid-to-high single digit revenuegrowthFinancialPeer Average P/E: 15.7xTop peer P/E: 18.8x Strong margins Strong cash flow and conversion Balanced capital allocation Planning to be top-tier MI peer with consistent double-digit EPS growth and premium multiple;strong strategic positioning; executing on plan to improve margins and cash flow35Johnson Controls, Inc. — PUBLICOpportunityA Bright Future Ahead Execution – Continue to deliver on strategic and financial commitments Transformation - Significant portfolio progress with Auto spin-off on track Acquisitions – Strong balance sheet to support future growth Operational Excellence – JCOS delivering tangible results with more to come Growth - Strong portfolio post-Auto spin-off; well-positioned and reinvesting for growth andimproved profitability Shareholder Value - On clear path to establishing a leading multi-industrial company withsignificant opportunity to drive increasing shareholder valueFocused Multi-industrial Leader Positioned for Sustainable Growth and ReturnsPUBLIC36 36Johnson Controls, Inc. —PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Today’s PresentationsKim Metcalf-KupresVice President andChief Marketing OfficerWilliam C. JacksonPresidentBuilding EfficiencyJoseph WalickiPresidentPower SolutionsJeff WilliamsVice PresidentEnterprise Operations and EngineeringBrian StiefExecutive Vice President andChief Financial Officer37Johnson Controls, Inc. — PUBLIC#JCIAnalystDayMega TrendsBuilding EfficiencyPower SolutionsJohnson ControlsOperating SystemFinancial OutlookUpdate on Auto Spin

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson Controls Strategic Review and 2016 OutlookMega TrendsKim Metcalf-KupresVice President and Chief Marketing OfficerDecember 1, 2015 – PublicForward looking statementStatements Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks anduncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forwardlooking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regardingfuture financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels andplans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,”“estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identifyforward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties,assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results todiffer materially from those expressed or implied by such forward-looking statements. These factors include potential impacts of the plannedseparation of the Automotive Experience business on business operations, assets or results, required regulatory approvals that are materialconditions for proposed transactions to close, currency exchange rates, strength of the U.S. or other economies, automotive vehicleproduction levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, and cancellationof or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent AnnualReport on Form 10-K for the year ended September 30, 2015. Shareholders, potential investors and others should consider these factors inevaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statementsincluded in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims anyobligation, to update forwardlooking statements to reflect events or circumstances occurring after the date of this document.2Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Managing across multiple time horizonsLong-term vision guides mid-and short-term planning1-year budget3-year business plan5-year strategy horizon10-year market view031310 5Johnson Controls, Inc. — PUBLICMega TrendsMost Relevant to Johnson ControlsClimate ChangeDemographicsEnergyGovernmentPolicies4 Environmental Regulations Pollution Concerns Water Scarcity Management Emerging ConsumerE-Mobility Shared EconomyHuman CapitalIndividualism / CustomizationRising Middle Class sQuality Currency ShiftsCyber SecurityEconomic ChangeEmissions ReductionRegulationStandardization / GovernanceHealth andWellnessNatural ResourcesTechnologyUrbanizationJohnson Controls, Inc. — PUBLIC#JCIAnalystDay Changing Physiology Personal Environmental Quality Safety and Security Commoditization of Resources Commodity Scarcity Commodity Security Additive ManufacturingAutomationDigital Economy / e-CommerceMachine Learning Big DataSmart Connectivity / IoT Commercial / InstitutionalInfrastructureMobility / Movement of PeoplePersonal SecuritySharing EconomiesTransportationUrban Living Spaces

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Four AnchorsInteract with Key Enablers and Disruptorsfor Johnson Controls, we believe there are fourprimary theme anchors sQuality Demographicsthere are also four key Enablersand Disruptors to consider ConsumerSupply ergyClimateChangeTechnology Built rityTransportationQuality of Life Data AnalyticsDigital B2BInformation SystemsIoT & ConnectivityManufacturingProductTheme Anchors5SocialImplicationsEnabler / DisruptorJohnson Controls, Inc. — PUBLICDemographicsConsumer and workforce implications help guide our investments 97% of 1B population growth by 2030 fromemerging markets 2 billion people join expanding middle classby 2030 Spending will rise from 21T to 56T by 2030,41% from China and India alone The world will be challenged by laborimbalances:– Global migration 97% of 1B population growth by 2030 from emergingmarkets 2 billion people join rising middle class by 2030 Consumer spending will rise from 21T to 56T by2030, 41% from China and India The world will be challenged by labor imbalances:– Shortages for high-skill workers– Global migration– Over-supply of low-skill workers– Shortages for high-skill workers– Over-supply of low-skill workers6Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015UrbanizationRates and challenges create opportunities where we can help Urbanization in developing world - 100K people/day By 2025 emerging market cities 75% of global GDP Cities are centers of global GDP growth – creatingcurrent / future challenges.Cities today – are home to 50% of the global population – consume 60% drinking water supply – consume 75% of global energy capacity – produce 80% of global greenhouse emissions. Infrastructure implications result––––7Building investments 57T through 2030Public-Private partnerships will evolveEnergy supply/demand tensions will emergeIncreasing environmental pressureJohnson Controls, Inc. — PUBLICEnergyRegulations are driving demand where Johnson Controls can helpEnvironmental regulations driving needs for: Energy efficiency– China: 50% of new construction is “green” by 2020 Fuel economy– US: CAFE standards to double by 2025 CO2 reductions– US: 26-28% emissions reduction by 2025 (COP 21) Alternative forms of energy– US: Clean Energy Incentive Program doublesemissions credits for renewable energy projects inlow-income communities operational by 2020 Grid stability and energy resiliency– US: coastal geographies incentivizing and fundingenergy resiliency investments8Johnson Controls, Inc. —#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015EnergyIncreasing energy demand means new opportunities Emerging consumers drive increased energy demand Renewables dominate power capacity additions Wind and solar in developing countries 1.1T market by 2023 As solar & wind approach 30% of global energy capacity by 2030Supply intermittency will cause grid instability issuesCreating opportunity for energy storage to level supply and demandEnergy Storage 19B market by 20239Johnson Controls, Inc. — PUBLICTechnologyTransforming offerings, applications and supply chainsConnectivity and smart applications Internet of things (IoT) will be #1 form of connectivity by 2018Operations will drive B2B opportunities 5% cost savingsGrowing demand for smart building applications – 90Bmarket by 2020Advanced manufacturing and materials 10Distributed manufacturing models transform supply chainsand laborDigital development and verification significantly speeddevelopment cyclesAdditive manufacturing and advanced automation transformproductionPredictive analytics drive efficiency and qualityNanostructured and bio-engineered materials consolidatedesign and assemblyJohnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015DigitalizationTransforming business models and customer-centricity End to end supply chain integration– Up to 2T in process optimization by 2025 Digital & Social media– 2B people globally, 900B-1.3T value E-Commerce– 27% of B2B sales by 2020 New Business Models– Building IoT market opportunity expected toeclipse consumer electronics by 2020 Cybersecurity– Up to 1T estimated global losses todayDetected incidents over 42.8M11Johnson Controls, Inc. — PUBLICMega TrendsImplications for Johnson ControlsEnergy Storage &DistributionBuildings & UrbanEnvironments-Increasing demandEmerging marketsDifferent HVAC systemsUrban business models- Diverse building types- Other building technologies- Related infrastructure12-Increasing demandEmerging marketsNew stationary and gridEvolving business models- Adjacent applications- Advanced materials/systems- Nascent new marketsJohnson Controls, Inc. — PUBLIC#JCIAnalystDayChanging Transportation-Shifting auto industryGeographic footprintsDifferent consumer valueElectrification- Cars vs. alternatives- Sharing economy- New technologies

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Growth PlatformsMega Trends inform our platforms and investments for growth 400 billion of opportunity for strategic growth across current platforms13Johnson Controls, Inc. — PUBLICGrowth PlatformsMega Trends inform our areas of focus and investments for growthHorizon 3Horizon 2Horizon 1Explore future platformsExpand the coreStrengthen the coreBuildingEfficiency Core HVAC products Global growth – China Controls and smartdevices Smart buildings Hitachi & ADT IoT connectivity andintegration Expanding channelsPowerSolutions Global growth - China Motive adjacencies AGM capacity Growth in otheremerging markets Li ion participation Distributed energystorage – incubator Compelling adjacenciesin buildings and energyplatforms Rising emergingmarkets – India,ASEAN, Africa Technology and dataanalytics to drive coreofferings and evolvingvalue-added servicesPursuing logical and strategic investment opportunities14Johnson Controls, Inc. — PUBLIC#JCIAnalystDay Create value forcustomers Drive shareholderreturns Not pursuingchange for its ownsake Investing in placeswhere JCI can win

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015TechnologyMega Trends inform our technology priorities Smart Connectivity / IoT Accelerated product development cycles Advanced Materials Smart buildings, campuses and cities Advanced Manufacturing Advanced battery technologies Digitalization Distributed Energy Storage15Johnson Controls, Inc. — PUBLICStrategic CapabilitiesMega Trends inform our investments in strategic capabilities Johnson Controls Operating System Global presence & brands Innovation Corporate Development16Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Summary 17Multiple time horizons with mid to long-term vision guiding planningGlobal macro trends are generally favorable for Johnson ControlsBusiness plans address most attractive near and mid-term opportunitiesSignificant growth opportunities exist – organic and inorganicWe are investing in technology and building capabilities to pursue aggressive growthJohnson Controls, Inc. —PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson Controls Strategic Review and 2016 OutlookJohnson Controls Operating SystemJeff WilliamsVice President, Enterprise Operations and EngineeringDecember 1, 2015 – PublicForward looking statementStatements Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks anduncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forwardlooking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regardingfuture financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels andplans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,”“estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identifyforward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties,assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results todiffer materially from those expressed or implied by such forward-looking statements. These factors include potential impacts of the plannedseparation of the Automotive Experience business on business operations, assets or results, required regulatory approvals that are materialconditions for proposed transactions to close, currency exchange rates, strength of the U.S. or other economies, automotive vehicleproduction levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, and cancellationof or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent AnnualReport on Form 10-K for the year ended September 30, 2015. Shareholders, potential investors and others should consider these factors inevaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statementsincluded in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims anyobligation, to update forwardlooking statements to reflect events or circumstances occurring after the date of this document.2Johnson Controls, Inc. — PUBLIC#JCIAnalystDay

Johnson Controls Strategic Review and 2016 OutlookDecember 1, 2015Johnson Controls Operating SystemOur vision 3Most operationally capableStandardize enterprise approachSpan all areas of businessEstablish and leverage best practicesConsistent, repeatable processesIncrease speed and agilityJohnson Controls, Inc. — PUBLICJohnson Controls Operating SystemWhat is the Johnson Controls Operating System? Integrates frameworkPerformance-basedLeadership commitmentEnterprise-wideBusiness SystemsProcurementLeader LedMarketing & SalesManufacturingEngineeringFunctional Excellence

Johnson Controls Strategic Review and 2016 Outlook December 1, 2015 #JCIAnalystDay 3 Johnson Controls, Inc. — PUBLIC Delivering on our Commitments 2015: Record performance Revenue *Excludes FX and Interiors JV * 4 Johnson Controls, Inc. — Segment Margin FY2015* 11.6% FY2015* 120 bps PUBLIC Delivering on our Commitments 2015: Record performance

![JOHNSON AND JOHNSON (PHILIPPINES), INC. [recombinant]), Grand River .](/img/36/eua-janssen-website.jpg)