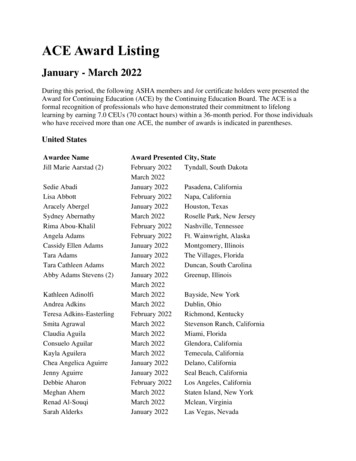

Transcription

l real estatel infrastructurel agriculturel forestryrealassets.ipe.comGlobal market intelligencefor institutional real assets investorsmediainformation2022

media information 2022Intelligence for DecisionMakers in Institutional RealAssets InvestmentDELIVERED DIGITALLY, IN PRINT AND IN PERSONIPE Real Assets continuesto reinforce its position asan indispensable sourceof intelligence for theglobal community of seniorinstitutional real assetsinvestors. Delivering highlyrelevant, topical, andactionable information digitally,in print and through in personevents.The challenges we havefaced because of Covid-19have given real assets addedimportance as a source of newopportunities in industries. Lifesciences and healthcare, whosesignificance has been throwninto sharp relief by Covid-19,and in the reconfiguration ofthe traditional sectors, such asresidential and office, as the“new normal” of more flexibleand environment-ally consciousliving and working takes shape.In other parts of the real assetsuniverse, infrastructure is seenby governments aroundthe world as an importantdriver of recovery; forestryand agriculture will play anincreasingly important role inachieving net zero economiesand ensuring food security.Not surprisingly these topicswere a huge draw for the17th IPE Real Estate GlobalConference & Awards 2021 inCopenhagen. Over 250 peopleattended in person, a massiveendorsement and a great voteof confidence in the return tophysical, face-to-face events in2022.IPE Real Assets continues toinvest to ensure it delivers theintelligence and platform youneed to thrive in the yearsahead. Drawing on an awardwinning editorial team, a globalnetwork of journalists and theknowledge and connectionsof the IPE group, IPE RealAssets has built close contactswith pension funds, insurancecompanies, sovereign wealthfunds and other institutionalinvestors around the world.These close contacts are ourhallmark and provide a uniqueinside track on the thinking andactions of this highly influentialgroup, for the benefit of theindustry as a whole.8,752MAGAZINE READERSGLOBALLY23,680DAILY NEWSEMAIL RECIPIENTSrealassets.ipe.com

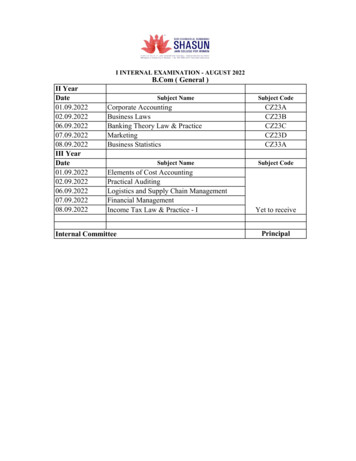

media information 2022IPE Real AssetsMagazine CirculationGEOGRAPHIC DISTRIBUTIONEurope 6,741 77%North America 1,366 16%Asia & other regions 538 6%Total Circulation 8,752IPE Real Assets’s current audited Audit Bureau of Circulations (ABC)average net circulation is 8,752 (July 2020 to June 2021). The ABCwas launched in 1931 in response to a demand from advertisers forindependent verification of the claims made by advertising sales teamsand so provides further transparency for readers and advertisers. IPE RealAssets is published bi-monthly and is additionally distributed extensivelyat leading real estate conferences and exhibitions internationally,providing advertisers with additional key readers throughout the year.COPIES/EUROPE107 Austria173 Belgium207 Denmark158 Finland547 France1,081 Germany17 Greece21 Iceland396 Italy61 Luxembourg626 Netherlands68 Norway76 Portugal112 Republic of Ireland173 Spain212 Sweden424 Switzerland2,125 United Kingdom157 Other EU countriesTotal circulation 8,752COMPANY TYPESBUY SIDESUPPLY SIDE62% CAPITAL OWNERSPension funds, endowments, charities,foundations, endowments, sovereign fundsFinancial institutions, Insurance companiesInvestment Managers, asset managers(including fund- of- funds)Real estate investment managers (marketing) 1,560Banks & investment banks262Property companies & developers3766% KEY INFLUENCERSPension fund consultantsAcademics, real estate associations,government, regulators68% TOTAL BUY SIDE3,1944211,8424101696,036PROFESSIONAL SERVICESProperty agents/consultants310Legal, accountancy, management consultancy65Data and information providers, indexproviders, exchanges78Financial Communications40Other2532% TOTAL SUPPLY SIDE2,716realassets.ipe.com*All figures based on the audited May/June 2020 issue of IPE Real Assets

media information 2022IPE Real AssetsEditorial Outline 2022INVESTOR/MANAGERSURVEYS & RANKINGSJan/FebESG & ImpactInvestingMarch/AprilMIPIMMay/JuneTop 100 GlobalMACRO THEMESGloball Renewableenergyl Affordable &social housingl Agriculture &forestryl Private debtl Emergingmarketsl Net-zerotargetsl Fund-of-funds,secondaries &multi-managersl Technology &sciencel Digitalinfrastructure,data centresl Lifesciencesl Smart buildingsl Secure incomel Proptechl Real estateinvestor surveyl Demographicsl Multifamily,PRS, care/retirementhomes, studenthousingl Core realestate fundsl Performancebenchmarkingl Infrastructurefund managerssurveyl Retail & onlinecommercel Shoppingcentres, highstreet retail,supermarkets,leisurel Logisticsl Infrastructurel ESGl Infrastructureinvestors surveyl Offices &urbanisationl Officesl Value-add realestatel Listed marketsl Real estatemanagers surveyl Transport &tourisml Airports &aviationsl Rail, roads &bridgesl Ports & shippingl Hotels & resortsl Opportunisticreal estate fundsl Diversity &inclusionInfrastructureManagersSept/OctEXPO Real /FEATURESl Climate change& social impactforestryinvestors &managersInvestorsTop 100FUNDS & STRATEGIESl Agriculture &Real EstateJuly/AugustMARKETS, SECTORS,ASSET CLASSESTop 100 GlobalInfrastructureInvestorsNov/DecTop 100 GlobalReal EstateManagersrealassets.ipe.com

media information 20222022 Print Advertising& SpecificationsPRINT ADVERTISING RATESMECHANICAL DATARATE 1X Full page corporate/thought leader9,000Double page corporate/thought leader10,500Junior page5,750Half page5,500Quarter page3,250Half page spread10,200Outside back cover10,800Inside front cover9,750Multiple insertion discounts3 6 Per page booked5%10%DIMENSIONSHEIGHT(MM) WIDTH(MM)335Double page spread245x 2 full pages plus 10mm bleed each335245Junior page200160Half page - horizontal140210Half page - verticalFull pageplus 10mm bleed290100Quarter page - strip65210Quarter page - box140100Advertisement material to be provided as a press optimised PDFfile. Please add crop marks indicating trim and bleed and makesure all files are CYMK and pictures are 300 dpi.PUBLISHING SCHEDULEISSUE 2022THOUGHT LEADER DEADLINEDISPLAY ADVERT DEADLINEJanuary 14January 21February 11February 18April 15April 22Jan/Feb: ESG & Impact Investing SpecialMarch/April: MIPIMMay/June: Top 100 Global Real Estate InvestorsJuly/August: Top 100 Global Infrastructure ManagersSept/Oct: EXPO Real/Top 100 Global Infrastructure InvestorsNov/Dec: Top 100 Global Real Estate ManagerTHOUGHT LEADERJune 10June 17August 26September 2November 4November 11Sponsored articlesTHOU GHT LEADERSHIPWhy cities? Whyglobal?Nuveen Real Estateexplains why an investmeto create a diversifient approach for globald portfolio of resilientcities needsassets positionedfor the long term.Alice Breheny,Head of Research,Nuveen Real EstateSponsored articles are an idealopportunity for companies toprovide the readership of IPEReal Assets with promotional,educational or other editorial,research or corporate profiles.Text should be sent as a Wordfile. Approximately 1,100 wordsper page (inclusive of title andcompliance.) Images/logos etc.should be sent as separate highresolution (300 dpi) images.These can be sent as: TIF,JPEG or EPS files. Charts to besent complete in Excel or PDF.Figure 1: Cities andthe global economyThe viability of acities-based realestate strategy appearsquestionable inthese challengingtimes. Our day-to-dayactivities in citiesaround the worldhave been alteredways few of us wouldinhave imagined justa few months ago.The spread of thecoronavirus, the disruptionto our daily lives, and the tollon health and humanlife are alarming.But we are adapting.Hygiene and healthcare are a greaterpriority than ever.Many of us are working,shopping andeven socialising online.City life, however,seems diminishedamid restrictionsmovement and travel.onBut we expect thatover the mediumto long term, thegreater economicopportunities anddynamism of thetheworld’s cities willcontinue to makeattractive places tothemlive and work. Alreadymore than half ofthe world’s populationlive in urban areas,according to theUnited Nations, andthis is predicted toSource: Nuveen Realcontinue to rise.Estate, Q1 2019Urbanisation, however,will be far from uniform.why selecting citiesThat isfor a diversified, cities-basedreal estate Whystrategy needs a rigorousglobal?and comprehensive approach.All cities have uniquePersonality andcharacteristics, whichperformance:Why cities, not countries?means in- oppositesvesting across arange of cities withinattractRural-to-urban migrationa single economywill provide someGlobal gateway citiesin North Americadiversification benefits.and Europe realhas slowed, butshould form a componentBut historic reit continues at paceestate performancesilient, city-basedof adata shows that,in Asia Pacific. Ledstrategy, but manyby China and India,in most cases,cities within countriesof these cities areAsia Pacific is expectedstrongly correlated.are highly correlated.to account forPerformance volatilitynearly half of theDiversifying regionallyworld’s output bycould be lowered by investing2030, with moreshould improve thisacross different50% of the world’sthan has its challenges.but it also kets,sectors and sub-marurban populationbringing differentIt is easier to dogrowth and almostcity personalitiesin some regionsof the top 50 globalall pared withcominto the mix.cities by size (in GDPothers. Major U.S.Regionally and domesticallyterms).1cities, whose fortunesCities, unlike countriesdriven cities tendto some extent tiedare better diversifiersor regions, will likelyto beto one national economy,and should be includedshare of global realsee their correlatedare highly gatewaysalongside globalestate investmentwitheachother.in a portfolio. Strategiesgrow to reflect moreFigure 1 illustratesclosely their newthe return ancingto do this includevolatility for citieseconomic statusbalinvestments in citiesand how they correlateand share of theeconomy. This willglobal economicdriven by financialwith global nessopen the door toactivity. With Europeand busiservices with energynewandmoreorAsia Pacific comprisedticated real estatesophis- of so manyor education-basstrategies, givinged markets ordifferent economies,adding structurallysuch cities a pivotaldriven markets toachieving diversificationrole in a portfolio.is naturally muchhighly cyclical cities.easier than in theU.S.When looking forWhen performanceresilient real estateConclusionis broken downopportunities – assets that will remainby sector type, adifferent picturerelevant throughUltimately, a portfolioalso emerges. Lookingmarket cycles – wecomprising a teamvour investmentsat prime officefa- market data,that benefit fromof cities whosefortune and futurewe find that globalbeing a part of thesuccess dependsgateway cities areof a winning city,fabric closelyon a range of differentmore driversand even contributecorrelated with each– be it inward migration,to that city’s success.other. London’s primeWe estimate thatproductivity, qualitymarket has a strongeroffice life, infrastructurefewer than 100 citiesofcorrelation withglobally have sufor innovation – shouldficient scale andNew York (0.74)and Paris (0.76)stability, and areenjoy the benefits of diversificationthan with the U.K.’swell positioned to.efit from long-termBirmingham (0.31),ben- even thoughstructural driversLondon and BirminghamDiversification isofdemandfurtherestate. These driversfor real relatedare very neatly corenhanced by takingwhen looking at– demographic megatrends,approach. After all,a globalaverage all-propertyreal estate marketslogical innovationtechno- mancetype perfor- arearound the worldand sustainability(0.89).at different levelsmatters – are rapidlyof maturity, differentchanging the natureSector diversificationof demand for realstages of thecycle and have differenthas a role to playestate, and so oughtto be the foundationgrowth rates.as well. It iswell known thatof any long-termA diversified andthe office sectorinvestment strategy.global approachis more volatileThe successful citiesretail,shouldthanbutincreasevolatility variesresiliency of a realof tomorrow’s worldthemore by city thanestate portfolio.will grow sector.their share of theirit does by difficultIn challenging andVolatile office marketsrespective regions’times, it’s naturaloutput throughtend to have volatiletheir ability to attractand often appropriatemarkets. Dublin,retail on thetalent and tenants,to focusfor example, is theshort term, howeverand in turn enjoyimproved productivity.most volatile cityif investors canEurope for bothin their long-termConversely, the citiesmaintainsectors accordingvision, especiallythat will see exceptionsto our research.their position infor their real estateA few investments,the global economicare tech-driventhey will increasehierarchy comprooffice markets, namelymised over comingtheir chances ofJose or San Francisco,San ment success.decades should beinvestwhich have seenavoided by investorspursuing resilientvery volatile officemarket performancestrategies.through the lastcycle yet relativelystable retail performance.Source:You can download1this article at: www.ipe.com/Nuveen-IPERA-MayJuneOxford Economics2020realassets.ipe.com

media information 2022REIM Reference Guide& IPE Real EstateReference Hub OnlineIN PRINTThe REIM Guide is mailed to a circulation of 8,002 withadditional copies distributed at key industry events. Presentyour company information across a double-page spread inthe regions where you invest. The Guide is divided into fourregions: Europe, Asia Pacific, North America and Latin America.ONLINEREIM GUIDE 2022The IPE Reference Hub enables your firm to engage withover 15,000 institutional investors. An investment managerprofile on the IPE Reference Hub is a versatile brandingand content marketing tool that provides scope and flexibility:LISTINGS COSTPER REGIONlllllUpload unlimited white papers/researchUpload your videos and links to social mediaPublish your company news and announcementsHyperlinks from IPE Real Assets email newsletters drive trafficto your profileWeekly Reference Hub digest emails sent to our investor database1 listing 7,0002 listings12,2003 listings14,2004 listings15,500 VAT where applicableIPE INFRASTRUCTURE REFERENCE HUBINFRASTRUCTUREThe IPE Reference Hub now has its own dedicated section forInvestment Managers in Infrastructure, Agriculture and Forestry.RATE CARDProfile listing 6,600You can take an online profile in the Infrastructure section ofthe IPE Reference Hub in combination with a print profilein our June 2022 Top 100 Global Infrastructure Managers Issue.MAKE YOUR EXPERTISE KNOWNIN THE PENSIONS MARKETrealassets.ipe.com

O6media information 2022realassets.ipe.comOnline AdvertisingLEADERBOARDOFFERS:A highly effectivedigital platform toreach global investorsand managers.HALFPAGEMPULeaderboard,MPU and Half pageMPU formats plusexpandable MPU.MPUKEY ANALYTICS82,66410,011171,911AVERAGE MONTHLYUSERSAVERAGE MONTHLYLOYAL UNIQUEUSERS*AVERAGEMONTHLY PAGEIMPRESSIONS1m 12s25%AVERAGE VISITDURATIONOF VISITS WEREMADE VIA MOBILEAll figures based across a 12 month period (Jul 1st 2020 - Jun 30 2021) * Four or more visits per month.realassets.ipe.com

media information 2022IPE Real Assets Daily NewsEmail Advertising18%Deliver your messagedirectly into the inbox ofyour target market onthe IPE Real Assets DailyNews Email service thatreaches 23,680 recipients.Choose either the top andbottom banner packageor a Sponsored link topromote your message.AVERAGEOPEN RATE23,680 13%AVERAGE NO.OF RECIPIENTSPER DAYAVERAGECLICK THRURATE (CTR)IPE Real Assets Webcastsl For each webcast, IPE Real Assets appoints anindependent moderator to chair and host the eventand help the client manage the Q&A interaction plusopen and close the webcast.l A minimum six-week lead-time is required on allwebcasts to to help IPE Real Assets achieve the bestpossible audience.l The webcast can be hosted either remotely frommultiple locations or centrally from one office location.l The webcast format is a live-recorded ‘session’ of nomore than one hour.l Each webcast is streamed live via a custom-brandedplayer which features the speaker’s photograph, voice,slides and customisable tabs including Q&A/feedback,the facility to ask your own pre-agreed questions ofthe audience and user support.l A recording of the webcast is available for anyoneIPE webcasts are an increasinglypopular and innovative way ofshowcasing manager expertise withan engaged online audience. IPEmarkets the client webcast via emailand captures the registered subscriberdetails that are delivered back to thewebcast client post event. The capturedwebcast subscriber details include jobtitle, phone number and email addresses(subject to data protection rules).IPE WEBCAST EVENTSAN AVERAGES OF 625REGISTRATIONS PERWEBCASTunable to attend the live broadcast and is available onthe platform for 12 months following the live broadcast.realassets.ipe.com

media information 2022IPE Real Assets OnlineAdvertising RatesONLINE ADVERTISINGllllRun of site leaderboard and MPUHalf page MPU and expandableFloor AdSite takeover (inc 1 email promotion) 50 cpm 70 cpm 100 cpm 7,000 per dayTECHNICAL SPECIFICATIONSLeader Boardl MPUl Half Page MPUl Expandable MPUl Expandable Leader Boardl Floor Advertisement728 x 90300 x 250300 x 600300 x 250l(expanding to 600 x 250). Must expand left.728 x90(expanding to 728 x 180). Must expand down.Accepted formats728 x 90JPG, GIF, FLASH, HTMLIPE REAL ASSETS DAILY NEWS EMAILllTop and Bottom bannerSponsored Link 700 per daily email 1,500 per daily emailTECHNICAL SPECIFICATIONSTop and Bottom bannerSponsored Linkll468 x 60 or 728 x 90logo (125 x 35)100 characters of text plus linking urlWEBCASTlEach webcast includes pre event marketing;event and post event subscriber registration details 13,500realassets.ipe.com

media information 2022EventsIPE REAL ESTATE GLOBALCONFERENCE & AWARDS 2022Now in its 18th year, the IPEReal Estate Global Conference& Awards is firmly establishedin the Real Estate eventcalendar and has become thepremier event for institutionalinvestors.The full-day conference inAmsterdam on Thursday 19May, is a forum for investors toexamine the key issues facingthe industry. The eveningAwards ceremony will recogniseand reward best practice,outstanding performance andinnovation among real estateinvestors.For more information please contactJanet Pearch T: 44 20 3465 9303 E: janet.pearch@ipe.comrealassets.ipe.com

media information 2022BREAKFAST SERIES 2022REAL ASSETS BREAKFAST SERIESJANUARY 2022An exciting high-level informalmarketing and networkingopportunity with decision makersat pension funds and otherinstitutional investors in selectedkey European regions.25 Jan Copenhagen26 Jan Amsterdam27 Jan Munich28 Jan LondonREAL ASSETS & INFRASTRUCTUREGLOBAL INVESTOR CONFERENCE 2022IPE’s Real Assets andInfrastructure Global InvestorConference in September2022 will explore these fastgrowing asset classes.This event will bring togetherinvestment decision makers atglobal pension funds, expertsfrom the asset managementcommunity’ leadingconsultants and academics.realassets.ipe.com

l real estatel infrastructurel agriculturel forestryrealassets.ipe.comContactsCOMMERCIAL EUROPEJanet Pearch/PublisherT 44 (0)20 3465 9303 E janet.pearch@ipe.comEliza Abel Smith/Sales ManagerT 44 (0)20 3465 9347 E eliza.abel.smith@ipe.comSam Smith/Production ManagerT 44 (0)20 3465 9332 E sam.smith@ipe.comSaravanan Subburam/Online Reference HubT 44 (0) 20 7397 5291 E saravanan.s@ipe.comCOMMERCIAL NORTH AMERICAErik Vander Kolk/Head of North American BusinessT 1 203-550-0385 E erik.vanderkolk@ipe.comCOMMERCIAL ASIA PACIFICTerry Rayner/Head of Asia Pacific BusinessT 61 402 433 222 E terry.rayner@ipe.comEDITORIALRichard Lowe/EditorT 44 (0)20 3465 9323 E richard.lowe@ipe.comRazak Musha Baba/News EditorT 44 (0)20 3465 9312 E razak.baba@ipe.com

2022 Print Advertising & Specifications RATE 1X Full page corporate/thought leader 9,000 Double page corporate/thought leader 10,500 Junior page 5,750 Half page 5,500 Quarter page 3,250 Half page spread 10,200 Outside back cover 10,800 Inside front cover 9,750 Multiple insertion discounts 3 6 Per page booked 5% 10% PUBLISHING SCHEDULE