Transcription

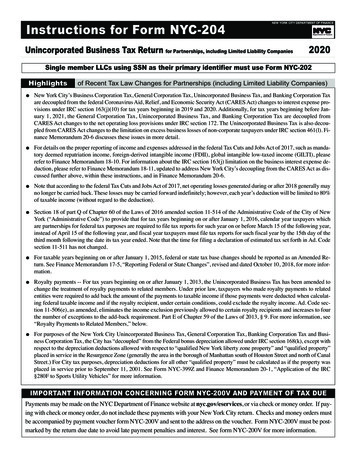

Instructions for Form NYC-4S-EZGeneral Corporation Tax ReturnFor fiscal years beginning in 2021 or for calendar year2021IMPORTANT INFORMATION REGARDING THE FILING OF NYC CORPORATE TAX RETURNSPursuant to section 11-602.1 of the Administrative Code of the City of New York as enacted by section 3 of Part D of Chapter 60 of the Laws of 2015, for taxable years beginningon or after January 1, 2015, the General Corporation Tax is only applicable to Subchapter S Corporations and Qualified Subchapter S Subsidiaries. Therefore, only these types ofcorporations should file this return. All other corporations should file a return on Form NYC-2 or Form NYC-2S or, if included in a combined return, on Form NYC-2A.IMPORTANT INFORMATION CONCERNING FORM NYC-200V AND PAYMENT OF TAX DUEPayments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If paying with check or money order, do notinclude these payments with your New York City return. Checks and money orders must be accompanied by payment voucher form NYC-200V and sent to the addresson the voucher. Form NYC-200V must be postmarked by the return due date to avoid late payment penalties and interest. See form NYC-200V for more information.Highlightsof Recent Tax Law ChangeslNote that according to the federal Tax Cuts and Jobs Act of 2017, net operating losses (NOL) generated during or after 2018 generally may no longerbe carried back. These losses may be carried forward indefinitely; however each year’s NOL deduction will be limited to 80% of taxable income (without regard to the deduction).lFor taxable years beginning on or after January 1, 2015, federal or state tax base changes should be reported as an Amended Return. See FinanceMemorandum 17-5, “Reporting Federal or State Changes”, revised and dated October 10, 2018, for more information.GENERAL INFORMATIONNOTE: This form may be used by federalSubchapter S Corporations and QualifiedSubchapter S Subsidiaries only. If any instructions appear to apply to C Corporations, theyshould be read to apply only to S corps and qualified S subsidiaries.S CORPORATIONSAn S Corporation is subject to the GeneralCorporation Tax and must file either Form NYC4S, NYC-4S-EZ or NYC-3L, whichever is applicable. Under certain limited circumstances, an SCorporation may be permitted or required to file acombined return (Form NYC-3A). See FinanceMemorandum 99-3 for information regarding thetreatment of qualified subchapter S subsidiaries.The income, gains, losses, deductions and capitalof a qualified subchapter S subsidiary may not beincluded in the report of the parent S Corporation.A QSSS must file a separate report if it is subjectto tax.Federal S corporation taxpayers must completethe form NYC-ATT-S-CORP, Calculation ofFederal Taxable Income for S Corporationsand include it with their GCT filing. For moreinformation see Form NYC-ATT-S-CORP.ENTITIES TAXED AS CORPORATIONSUnincorporated entities electing to be treated asassociations taxable as corporations for federalincome tax purposes pursuant to the federal“check-the-box” rules under IRC §7701(a)(3) aretreated as corporations for City tax purposes andare not subject to the Unincorporated BusinessTax. Eligible entities having a single owner disregarded as a separate entity under the “check-thebox” rules and treated as either a sole proprietorship or a branch for federal tax purposes will besimilarly treated for City tax purposes. SeeFinance Memorandum 99-1 for additional information.FORM FOR TAXPAYERS CLAIMING ANET OPERATING LOSS DEDUCTIONTaxpayers claiming a deduction for a NetOperating Loss must complete Form NYCNOLD-GCT, Net Operating Loss Computationand include it with their GCT filing. For moreinformation see Form NYC-NOLD-GCT.FIXED DOLLAR MINIMUM TAX BASED ONRECEIPTSFor tax years beginning after 2008, there is a sliding scale fixed dollar minimum tax based onreceipts allocated to New York City. The amountof City receipts for this purpose is the same as theamount used for determining the taxpayer’s business allocation percentage. See Ch. 201, § 17, ofthe Laws of 2009. For taxpayers who use FormNYC-4S or NYC-4S-EZ, and, accordingly, allocate 100 percent of their income to the City, theamount of receipts used for this purpose is thetotal amount of all receipts the taxpayer hasreceived in the regular course of business.ADDBACK OF NEW MTA PAYROLL TAXThe law was amended in 2009 to add back theMetropolitan Commuter Transportation MobilityTax (“MTA Payroll Tax”) under the Article 23 ofthe New York State Tax Law. General CorporationTax (“GCT”) taxpayers must add this tax back tothe extent it was deducted in computing federaltaxable income. See Ad. Code § 11-602(8)(b)(19)as added by section 17 of Chapter 25 of the Lawsof 2009.SPECIAL TREATMENT AFFECTINGCERTAIN SMALL CORPORATIONSFor tax years beginning on or after January 1,2007, corporations that meet certain requirementsare not subject to the alternative GeneralCorporation Tax bases measured by business andinvestment capital or by entire net income pluscompensation paid to certain shareholders. Thus,eligible corporations will compute their tax usingonly the entire net income base or the fixed-dollarminimum tax, whichever is greater.Corporations that qualify under these provisionsmay be able to compute their General CorporationTax liability on Form NYC-4S-EZ. Corporationsrequired to file a General Corporation Tax returnthat are not eligible to file Form NYC-4S-EZ mustfile Form NYC 3L or Form NYC-4S. To determine which corporations are eligible to file FormNYC-4S, see the instructions to that form.CORPORATIONS THAT MAY FILEFORM NYC-4S-EZCorporations (as defined in Section 11-602.1 ofthe New York City Administrative Code) doingbusiness, employing capital, owning or leasingproperty in a corporate or organized capacity, ormaintaining an office in New York City must filea General Corporation Tax return. Corporationsmeeting certain criteria may be eligible to use thesimplified Form NYC-4S-EZ (and not be requiredto use either Form NYC-3L or NYC-4S). To useForm NYC-4S-EZ, the corporation must meet thefollowing requirements:1. The corporation has a business allocation percentage of 100% for the taxable year, as determined under section 11-604.3.(a) of theAdministrative Code.2. The corporation has no investment capital orincome and no subsidiary capital or income atany time during the taxable year.3. The corporation’s gross income, as defined inInternal Revenue Code §61, is less than 250,000 for the taxable year.

Instructions for Form NYC-4S-EZ - 20214. The corporation does not modify its federaldepreciation deduction as provided on FormsNYC-399 and NYC-399z.In addition, certain types of corporations and corporations with certain modifications to taxableincome or claiming New York City tax creditscannot file Form NYC-4S-EZ or NYC-4S andmust file Form NYC-3L.CORPORATIONS REQUIREDTO FILE FORM NYC-3LA corporation must file Form NYC-3L and notForm NYC-4S or Form NYC-4S-EZ if:1)it carries on business both inside and outsideNew York City.2)it has subsidiary and/or investment capital;3)it claims an optional deduction for expenditures relating to air pollution control facilities, as provided in Section 11-602.8(g) ofthe NYC Administrative Code;Form NYC-3A;e)Insurance corporations.f)14) It claims the Beer Production Credit available under Ad. Code section 11-604(22);A Housing Development Fund Company(HDFC) organized and operating pursuant tothe provisions of Article Eleven of the PrivateHousing Finance Law.g)15) any portion of its business interest expensededuction would have been disallowedunder IRC section 163(j) if it had not madean election under Subchapter S of the IRC;Organizations organized exclusively for thepurpose of holding title to property asdescribed in Sections 501(c)(2) or (25) of theInternal Revenue Code.h)An entity treated as a Real Estate MortgageInvestment Conduit (REMIC) for federalincome tax purposes. (Holders of an interestin a REMIC remain taxable on such interestor on the income therefrom.)i)Corporations principally engaged in the conduct of a ferry business and operatingbetween any of the boroughs of the Cityunder a lease granted by the City.j)A corporation principally engaged in the conduct of an aviation, steamboat, ferry or navigation business, or two or more such businesses, provided that all of the capital stockof such corporation is owned by a municipalcorporation of New York.k)Bank holding corporations filing on a combined basis in accordance with Section 11646(f) of the NYC Administrative Code.13) it is required by Ad. Code section 11602.8(n) to add back royalty payments madeto related members; or16) for federal purposes, it has income underIRC Sections 951A or 965;17) it would have been eligible for a deductionpursuant to IRC section 250(a)(1)(A), i.e.,FDII, if it had not made an election underSubchapter S of the IRC;18) it claims a modification with respect toamounts excluded from the definition of“contribution to the capital of the taxpayer”under IRC 118(b)(2), as provided in section11-602.8(a)(14) of the NYC AdministrativeCode; or4)it claims a modification with respect to gainarising on the sale of certain property, as provided in Section 11-602.8(h) of the NYCAdministrative Code;5)it entered into a “safe harbor” lease transaction under provisions of Section 168(f)(8) ofthe Internal Revenue Code as it was in effectfor agreements entered into prior to January1, 1984;19) For New York City purposes, it is required tomodify federal taxable income with respectto amounts invested in Qualified OpportunityFunds under IRC section 1400Z-2. See Ad.Code sections 11-602(8)(a)(15) and 11602(8)(b)(22).it claims a credit for increased real estate taxpayments made to a landlord in connectionwith the relocation of employment opportunities to New York City, as provided in Section11-604.13 of the NYC Administrative Code;The following are NOT required to file aGeneral Corporation Tax Return:6)7)8)9)it claims a credit for certain costs or expenses incurred in relocating employment opportunities to New York City, as provided inSection 11-604.14, 11-604.17 or 11-604.19of the NYC Administrative Code;it claims a modification with respect to wagesand salaries disallowed as a deduction for federal income tax purposes (work incentive/jobscredit provisions), as provided in Section 11602.8(a)(7) of the NYC Administrative Code;a)A nonstock corporation organized and operated exclusively for nonprofit purposes andnot engaged in substantial commercial activities, that has been granted an exemption bythe New York City Department of Finance.c)Corporations subject to taxation under Part 4of Subchapter 3 of Chapter 6, Title 11(Banking Corporations), or under Chapter 11,Title 11 (Utility Corporations) of the NYCAdministrative Code, are not required to fileGeneral Corporation Tax returns. However,corporations that are subject to tax underChapter 11 as vendors of utility services aresubject to the General Corporation Tax inaccordance with Section 11-603.4 of theNYC Administrative Code and must file areturn.10) it is a Domestic International SalesCorporation (DISC) or a Foreign SalesCorporation;12) it will be included in a combined report,A dormant corporation that did not at anytime during its taxable year engage in anyactivity or hold title to real property locatedin New York City.b)either separately or as a member of a partnership, it is engaged in an insurance business as a member of the New York InsuranceExchange;11) it claims a credit for New York CityUnincorporated Business Tax paid by a partnership in which it is a partner as provided inSection 11-604.18 of the NYC AdministrativeCode;Page 2d)A limited profit housing corporation organized and operating pursuant to the provisionsof Article Two of the Private HousingFinance Law.l)Corporations principally engaged in the operation of marine vessels whose activities in theCity are limited exclusively to the use ofproperty in interstate or foreign commerce.m) Foreign corporations that are exempt underthe provisions of Public Law 86-272. (See 19RCNY Section 11-04 (b)(11).)NOTE:A corporation that has an officer, employee, agentor representative in the City and that is not subjectto the General Corporation Tax is not required tofile a Form NYC-3L, NYC-4S or NYC-4S-EZ butmust file a Form NYC-245 S-Corp (Section 11605 of the NYC Administrative Code).WHEN AND WHERE TO FILEThe due date for filing is on or before March 15,2022, or, for fiscal year taxpayers, on or before the15th day of the third month following the close ofthe fiscal year.All returns, except refund returns:NYC Department of FinanceP.O. Box 5564Binghamton, NY 13902-5564Remittances - Pay online with Form NYC-200Vat nyc.gov/eservices, or Mail payment and FormNYC-200V only to:NYC Department of FinanceP.O. Box 3933New York, NY 10008-3933

Instructions for Form NYC-4S-EZ - 2021Returns claiming refunds:of carryback allowance.NYC Department of FinanceP.O. Box 5563Binghamton, NY 13902-5563For more information on federal or state Tax BaseChanges, including a more expansive explanationof how taxpayers must report these changes aswell as samples of tax worksheets to be includedwithin the amended return, see FinanceMemorandum 17-5, revised and dated10/10/2018.Certain short-period returns: If this is NOT afinal return and your Federal return covered a period of less than 12 months as a result of your joining or leaving a Federal consolidated group or as aresult of a Federal IRC §338 election, this returngenerally will be due on the due date for theFederal return and not on the date noted above.Check the box on the front of the return.FEDERAL OR NEW YORK STATECHANGESFor taxable years beginning on or after January 1,2015, changes in taxable income or other tax basemade by the Internal Revenue Service (“IRS”) and/or New York State Department of Taxation andFinance (“DTF”) will no longer be reported onform NYC-3360. Instead, taxpayers must reportthese federal or state changes to taxable income orother tax base by filing an amended return. Thisamended return must include the DOF tax worksheet that identifies each change to the tax base(“Tax Base Change”) and shows how each such TaxBase Change affects the taxpayer’s calculation ofits New York City tax. The DOF tax worksheet isavailable on the DOF website at nyc.gov/finance.This amended return must also include a copy ofthe IRS and/or DTF final determination, waiver, ornotice of carryback allowance. Taxpayers that havefederal and state Tax Base Changes for the same taxperiod may report these changes on the sameamended return that includes separate tax worksheets for the IRS Tax Base Changes and the DTFTax Base Changes. Note that for taxable yearsbeginning on or after January 1, 2015, DTF TaxBase Changes may include changes that affectincome or capital allocation.The Amended Return checkbox on the return is tobe used for reporting an IRS or DTF Tax BaseChanges, with the appropriate box for the agencymaking the Tax Base Changes also checked.Taxpayers must file an amended return for TaxBase Changes within 90 days (120 days for taxpayers filing a combined report) after (i) a finaldetermination on the part of the IRS or DTF, (ii)the signing of a waiver under IRC §6312(d) or NYTax Law §1081(f), or (iii) the IRS’ allowance of atentative adjustment based on a an NOL carrybackor a net capital loss carryback.If the taxpayer believes that any Tax Base Changeis erroneous or should not apply to its City tax calculation, it should not incorporate that Tax BaseChange into its City tax calculation on its amended return. However, the taxpayer must attach: (i)a statement to its report that explains why itbelieves the adjustment is erroneous or inapplicable; (ii) the tax worksheets that identify each TaxBase Change and show how each would affect itsCity tax calculation; and (iii) a copy of the IRSand/or DTF final determination, waiver, or noticeTo report changes in taxable income or other taxbase made by the Internal Revenue Service and /orNew York State Department of Taxation andFinance for taxable years beginning prior toJanuary 1, 2015, the Form NYC-3360 should stillbe used.ACCESSING NYC TAX FORMSBy Computer - Download forms from the Financewebsite at nyc.gov/financeBy Phone - Order forms by calling 311. If callingfrom outside of the five NYC boroughs, pleasecall 212-NEW-YORK (212-639-9675).OTHER FORMS YOU MAY BEREQUIRED TO FILEFORM NYC-EXT - Application for Automatic 6Month Extension of Time to File Business IncomeTax Return. File it on or before the due date of thereturn.FORM NYC-EXT.1 - Application for AdditionalExtension is a request for an additional threemonths of time to file a return. A corporation witha valid six-month extension is limited to two additional extensions.FORM NYC-222 - Underpayment of EstimatedTax by Corporations will help a corporation determine if it has underpaid an estimated tax installment and, if so, compute the penalty due.(Corporations filing Form NYC-222 cannot useForm NYC-4S-EZ)FORM NYC-245 - Activities Report of GeneralCorporations must be filed by a corporation thathas an officer, employee, agent or representativein the City, but which disclaims liability for theGeneral Corporation Tax.FORM NYC-399 - Schedule of New York CityDepreciation Adjustments is used to compute theallowable New York City depreciation deductionif a federal ACRS or MACRS depreciation deduction is claimed for certain property placed in service after December 31, 1980. (Corporations filingForm NYC-399 cannot use Form NYC-4S-EZ).FORM NYC-399Z - Depreciation Adjustmentsfor Certain Post 9/10/01 Property may have to befiled by taxpayers claiming depreciation deductions for certain sport utility vehicles or "qualifiedproperty," other than "qualified New York LibertyZone property", "qualified New York LibertyZone leasehold improvements" and “qualifiedresurgence zone property” placed in service afterSeptember 10, 2001 for Federal or New York StatePage 3tax purposes. See Finance Memorandum 21-1,“Application of IRC §280F Limits to Sport UtilityVehicles". (Corporations filing Form NYC-399Zcannot use Form NYC-4S-EZ)FORM NYC-400 - Declaration of Estimated Taxby General Corporations must be filed by any corporation whose New York City tax liability canreasonably be expected to exceed 1,000 for anycalendar or fiscal tax year.FORM NYC-3360 - General Corporation TaxReport of Change in Taxable Income made by theU.S. Internal Revenue Service and/or New YorkState Department of Taxation and Finance is usedfor reporting adjustments in taxable income resulting from an audit of your federal corporate taxreturn and/or State audit of your State corporatetax return for tax years beginning prior to January1, 2015 only.FORM NYC-CR-A - Commercial Rent TaxAnnual Return must be filed by every tenant thatrents premises for business purposes in Manhattansouth of the center line of 96th Street and whoseannual or annualized gross rent for any premisesis at least 200,000.FORM NYC-RPT - Real Property Transfer TaxReturn must be filed when the corporationacquires or disposes of an interest in real property,including a leasehold interest; when there is a partial or complete liquidation of the corporation thatowns or leases real property; or when there istransfer of a controlling economic interest in acorporation, partnership or trust that owns or leases real property.FORM NYC-ATT-S-CORP - Calculation ofFederal Taxable Income for S Corporations mustbe included in the GCT filing of every federal SCorporation.FORM NYC-NOLD-GCT - Net Operating LossComputation must be included in the GCT filingof every GCT taxpayer claiming a net operatingloss deduction.ESTIMATED TAXIf the tax for the period following that covered bythis return is expected to exceed 1,000, a declaration of estimated tax and installment paymentsare required. Form NYC-400 is to be used for thispurpose. If the tax on this return exceeds 1,000,submit Form NYC-400 which is available on theDepartment of Finance’s website.If, after filing a declaration, your estimated taxsubstantially increases or decreases as a result of achange in income, deduction or allocation, youmust amend your declaration on or before the nextdate for an installment payment. Mail the amended declaration, using Form NYC-400, along withyour check to:NYC Department of FinanceP.O. Box 3922New York, NY 10008-3922

Instructions for Form NYC-4S-EZ - 2021If the amendment is made after the 15th day of the9th month of the taxable year, any increase in taxmust be paid with the amendment.These payments can also be made online atnyc.gov/eservices.For more information regarding estimated taxpayments and due dates, you may call 311. If calling from outside of the five NYC boroughs, pleasecall 212-NEW-YORK (212-639-9675).AUTOMATIC EXTENSIONSAn automatic extension of six months for filingthis return will be allowed if, by the original duedate, the taxpayer files with the Department ofFinance an application for automatic extension onForm NYC-EXT and pays the amount properlyestimated as its tax. See the instructions for FormNYC-EXT for information regarding what constitutes a proper estimated tax for this purpose.Failure to pay a properly estimated amount willresult in a denial of the extension.A taxpayer with a valid six-month automaticextension filed on Form NYC-EXT may requestup to two additional three-month extensions by filing Form NYC-EXT.1. A separate Form NYCEXT.1 must be filed for each additional threemonth extension.PENALTY FOR UNDERSTATING TAXIf there is a substantial understatement of tax (i.e.,if the amount of the understatement exceeds thegreater of 10% of the tax required to be shown onthe return or 5,000) for any taxable year, a penalty will be imposed equal to 10% of the amount ofthe understated tax. The amount on which you paythe penalty can be reduced by subtracting any itemfor which (1) there is or was substantial authorityfor the way in which the item was treated on thereturn, or (2) there is adequate disclosure on thereturn or in a statement attached to the return.CHANGE OF BUSINESS INFORMATIONIf there have been any changes in your businessname, identification number, billing or mailingaddress or telephone number, complete FormDOF-1, Change of Business Information.FINAL RETURNSIf a corporation ceases to do business in New YorkCity, the due date for filing a final GeneralCorporation Tax Return is the 15th day after thedate of the cessation (Section 11-605.1 of theNYC Administrative Code). Corporations mayapply for an automatic six-month extension for filing a final return by filing Form NYC-EXT on orbefore that date. Any tax due must be paid withthe final return or the extension, whichever is filedearlier.SIGNATUREThis report must be signed by an officer authorized to certify that the statements contained in itare true. If the taxpayer is a publicly-traded partnership or another unincorporated entity taxed as acorporation, this return must be signed by a personduly authorized to act on behalf of the taxpayer.TAX PREPARERSAnyone who prepares a return for a fee must signthe return as a paid preparer and enter his or herSocial Security Number or PTIN, see FinanceMemorandum 00-1. Include the company or corporation name and Employer IdentificationNumber, if applicable.Preparer Authorization: If you want to allowthe Department of Finance to discuss your returnwith the paid preparer who signed it, you mustcheck the "yes" box in the signature area of thereturn. This authorization applies only to the individual whose signature appears in the "Preparer'sUse Only" section of your return. It does notapply to the firm, if any, shown in that section. Bychecking the "Yes" box, you are authorizing theDepartment of Finance to call the preparer toanswer any questions that may arise during theprocessing of your return. Also, you are authorizing the preparer to:l Give the Department any information missingfrom your return,l Call the Department for information about theprocessing of your return or the status of yourrefund or payment(s), andl Respond to certain notices that you haveshared with the preparer about math errors,offsets, and return preparation. The noticeswill not be sent to the preparer.You are not authorizing the preparer to receiveany refund check, bind you to anything (includingany additional tax liability), or otherwise representyou before the Department. The authorizationcannot be revoked; however, the authorization willautomatically expire no later than the due date(without regard to any extensions) for filing nextyear's return. Failure to check the box will bedeemed a denial of authority.SPECIFIC INSTRUCTIONSPeriod CoveredFile the 2021 return for calendar year 2021 andfiscal years that begin in 2021 and end in 2022.For a fiscal or short tax year return, fill in the taxyear space at the top of the form. The 2021 FormNYC-4S-EZ also can be used if:lYou have a tax year of less than 12 monthsthat begins and ends in 2022, andlThe 2022 Form NYC-4S-EZ is not availableat the time you are required to file the return.You must show the 2022 tax year on the 2021Form NYC-4S-EZ and take into account any taxlaw changes that are effective for tax yearsbeginning after December 31, 2021Special Condition CodesCheck the Finance website for applicable specialPage 4condition codes. If applicable, enter the two character code in the box provided on the form.SCHEDULE AComputation of TaxLINE 1See the instructions for Schedule B for those corporations that are eligible to use their New YorkState entire net income for purposes of computingthe tax due under this method.LINE 2MINIMUM TAXEnter the New York City Gross Receipts andMinimum Tax amount from the following table.The amount of New York City receipts for thispurpose is the total amount of all receipts the taxpayer has received in the regular course of business from such sources as sales of personal property, services performed, rentals of property androyalties. This receipts amount would be thesame as the amount that would have to be shownon Form NYC-3L, Schedule H, Column A, Line6 if the taxpayer had filed Form NYC-3L andcompleted that schedule.For taxpayers who use Form NYC-4S-EZ, and,accordingly, allocate 100 percent of their incometo the City, the amount of receipts used for thispurpose is the total amount of all receipts the taxpayer has received in the regular course of business.TABLE - FIXED DOLLAR MINIMUM TAXFor a corporation with New York City receiptsof:Not more than 100,000:. 25More than 100,000but not over 250,000: . 75More than 250,000but not over 500,000: . 175More than 500,000but not over 1,000,000: . 500More than 1,000,000but not over 5,000,000: . 1,500More than 5,000,000but not over 25,000,000: . 3,500Over 25,000,000: . 5,000SHORT PERIODS - FIXED DOLLARMINIMUM TAXCompute the New York City receipts for shortperiods (tax periods of less than 12 months) bydividing the amount of New York City receipts bythe number of months in the short period and multiplying the result by 12. Once this annualizedamount is calculated (do not replace your NYCreceipts on Line 2 with this annualized amount)use the table above to determine the fixed dollarminimum tax based on the annualized amount.The resulting fixed dollar minimum tax may bereduced for short periods as indicated below.Enter the reduced amount on line 2 (If applicable).

Instructions for Form NYC-4S-EZ - 2021PERIOD REDUCTIONNot more than 6 months.50%More than 6 months butnot more than 9 months.25%More than 9 months .NoneLINE 4bFIRST INSTALLMENT PAYMENTDo not use this line if an application for automatic extension (NYC-EXT) has been filed. The payment of the amount shown at line 4b is required aspayment on account of estimated tax for the 2022calendar year, if a calendar year taxpayer, or forthe taxable year beginning in 2022, if a fiscal yeartaxpayer.LINE 6PREPAYMENTSEnter the sum of all estimated tax payments madefor this tax period, the payments made with theextension request, if any, and both the carryovercredit and the first installment recorded on theprior tax period’s return.LINE 9aLATE PAYMENT / INTERESTIf the tax is not paid on or before the due date(determined without regard to any extension oftime), interest must be paid on the amount of theunderpayment from the due date to the date paid.For information as to the applicable rate of interest, see the Finance website at nyc.gov/finance orcall 311. If calling from outside of the five NYCboroughs, please call 212-NEW-YORK (212-6399675).LINE 9b - LATE PAYMENT OR LATEFILING/ADDITIONAL CHARGESa) A late filing penalty is assessed if you fail tofile this form when due, unless the failure isdue to reasonable cause. For every month orpartial month that this form is late, add to thetax (less any payments made on or before thedue date) 5%, up to a total of 25%.b) If this form is filed more than 60 days late,the above penalty will not be less than thelesser of (1) 100 or (2) 100% of the amountrequired to be shown on the form (less anypayments made by the due date or creditsclaimed on the return).c)A late payment penalty is assessed if youfail to pay the tax shown on this form by theprescribed filing date, unless the failure isdue to reasonable cause. For every month orpartial month that your payment is late, addto the tax (less any payments made) 1/2%, upto a total of 25%.d)The total of the additional charges in a and cmay not exceed 5% for any one month exceptas provided for in b.If you claim not to be liable for these additionalcharges, attach a statement to your return explaining the delay in filing, payment or both.LINE 9c - PEN

a General Corporation Tax return. Corporations simplified Form NYC-4S-EZ (and not be required to use either Form NYC-3L or NYC-4S). To use Form NYC-4S-EZ, the corporation must meet the following requirements: 1. The corporation has a business allocation per-centage of 100% for the taxable year, as deter-mined under section 11-604.3.(a) of the