Transcription

THEPHOENIXTECHSTORYHow talent, a pro-businessenvironment and quality oflife are shaping the Phoenixtech scene

TABLE OFCONTENTS010305The PhoenixTech StoryThe TechSector andPhoenix RootsPopulation

071113171921WorkforceEducationCost of DoingBusinessQuality ofLifeTaxesRegulatoryPolicy

THE PHOENIXTECH STORY01 2018 GPEC & CBRE, INC.

This report examines the Phoenix value proposition to tech companies and how Phoenix compares tosome of the most dynamic tech cities in the country. Although companies continue to operate—andin some cases, expand—in established markets such as the Bay Area, New York, Washington, D.C.,and Seattle, rising costs and intense competition for talent have continued to motivate businessleaders to consider alternative locations. The most competitive alternative locations are generallysmaller, have a strong talent pool and business-friendly environment and also offer a high qualityof life. Phoenix is an attractive place, not just because of its competitive advantage with regardto cost, but because of its deep talent pool; existing and growing portfolio of tech companies,universities and tech resources; and quality of life.Testimonials“Fueled by a diverse, motivated talent pooland an excellent transportation hub.”Bruce HoechnerCEO, Rogers Corporation“The excitement behind the Phoenixtechnology scene is contagious The valueproposition of starting and scaling a businessin Phoenix is clear and has the attentionof our friends in Silicon Valley, who areinvesting their dollars and creating jobs inour community.”Anthony KaennadaCMO, Gainsight“For nearly two decades, Universityof Advancing Technology (UAT) hasbeen committed to producing the bestcybersecurity talent in the world. This nextgeneration of cyber warriors is ethicallytrained and thoughtfully prepared to thwartcrime and protect our nation’s assets.”Jason PistilloPresident, UAT“The talent pool in Phoenix is as robustas anywhere in the country It’s theperfect place for startups—a supportive,unpretentious community with no existingstatus quo—so you don’t get lost in the crowd,and everyone plays a role in shaping it.”“Arizona is a wonderful state, ripe withtalented people and a favorable businessenvironment. We are excited for the future.”Brad JannengaCEO, SaaS IndustriesPat HurleyVP Sales, Acronis“Incredibly diverse, LGBTQ friendly, and asurplus of tech and support talent.”“Greater Phoenix is the only metropolitan[area] in America without natural disasters,which makes it perfect for data centers andfighting cyber crime. This is just one of themany reasons I chose to start and grow mybusiness here.”Ben HindmanCEO, SplashOri EisenFounder & CEO, TrusonaTHE PHOENIX TECH STORY 02

THE TECHNOLOGYSECTOR HAS DEEPROOTS IN PHOENIXGreater Phoenix’s tech sector emerged followingWorld War II, as the federal government spreadoutposts throughout the U.S. Phoenix quicklybecame a hotbed for aerospace and defenseand semiconductor industries as companiesservicing military operations started investingin research and development labs in theregion. The region evolved with the rise of theinternet age, becoming home to several largeenterprise software development and webhosting companies. Today, Greater Phoenixis attracting expanding companies from NewYork to California due to its ability to attract toptalent outside of high-cost markets. In recentyears, the tech ecosystem has progressed intoa highly desirable market for next-generationtechnologies focused on cybersecurity,autonomous vehicles, fintech, medtech and otherindustries related to the internet of things.Companies with Large Tech PresenceIntel Chandler11,000 EmployeesHeadquartered in Santa ClaraInfusionsoft Chandler550 EmployeesHeadquartered in ChandlerCharles Schwab Phoenix3,650 EmployeesHeadquartered in San FranciscoNorthern Trust Tempe500 EmployeesHeadquartered in ChicagoGeneral Motors Chandler700 EmployeesHeadquartered in DetroitCarvana Tempe479 EmployeesHeadquartered in TempeUber Phoenix600 EmployeesHeadquartered in San FranciscoJDA Software Scottsdale314 EmployeesHeadquartered in ScottsdaleSource: Maricopa Association of Governments (2016); Phoenix Business Journal,Book of Lists (2017-2018).03 2018 GPEC & CBRE, INC.Phoenix Tech TimelineMotorola starteda research anddevelopmentlaboratory in Phoenix,AZ to research newsolid-state technologyMicrochip foundedGoDaddy foundedInfusionsoft foundedYelp expands salesoffice toScottsdale, AZGeneral Motorsestablishes ITInnovation Center inChandler, AZUber and Waymo testautonomous drivingtechnology in thePhoenix metro areaArizona StateUniversity’s FultonSchool of Engineeringenrollment tops20,000, making it thelargest engineeringschool in the nationIntel initial expansionto Chandler, AZBoeing establisheshelicoptermanufacturing facilityin Mesa, AZOn Semiconductorspins off fromMotorolaWebPT foundedSilicon Valley Bankexpands backoffice functions todowntown Tempe, AZGlobal cybersecuritycompany KudelskiGroup relocatescorporate HQ toPhoenix, AZIntel announces 7Binvestment in Fab 42on Chandler CampusNikola Motor Co.announces 1Binvestment for newHQ in Buckeye, AZSource: Greater Phoenix Economic Council.

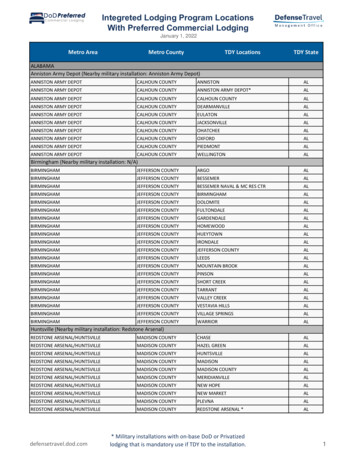

THE PHOENIX TECH STORY 04Recent Tech Job s Towers WatsonOrbital ATKEndurance Intl. GroupZenreachAmazonIndeedUpgrade Inc.VixxoDexcomGeneral MotorsNextiva IncOscar HealthZipRecruiterBenchmark ElectronicsClearlinkFreshlyHouzzMST SolutionsSAP SEValor Global ServicesGabriel PartnersRingSitelockUpgrade Inc.Microchip TechnologyOpenDoorSolera HealthPivotal nufacturingSoftware Development, Data Scientist, ITSoftware Engineers, Customer ServiceManufacturingSales/Customer Service, Software DevelopersSales/Customer ServiceSoftware DevelopmentSales/Customer ManagementCustomer SeviceWeb Developer, Analysts, TechniciansManufacturingSoftware Devs, Database Admins, System AnalystsSoftware Developers, Customer SupportCustomer SupportSales/Customer ServiceHeadquartersSales/Customer SupportCustomer support/ EngineersSales/Client ServicesManagers, Analysts, Architects, DevelopersSales/ManagementCustomer SupportSales SupportCustomer SupportSales/Customer Service, Software EngineersCustomer Service, Credit Operations, CollectionsSoftware Developers, Hardware/Product EngineersSales, Support, OperationsEngineers, Account ManagersSales/Customer Service, Software DevelopersSecurity AnalystsNetwork Operations Engineers, Applications OperatorsSecurity Analysts, Network EngineersSales/Management/Support dler/GilbertTempePhoenixTempeDowntown empeTempeTempeDowntown ScottsdaleDowntown PhoenixTempeChandlerTempeScottsdaleDowntown PhoenixGlendaleScottsdaleDowntown PhoenixChandlerScottsdaleDowntown wn ScottsdalePeoriaSource: Greater Phoenix Economic Council, CBRE Research.ExpectedNew JobsTotalOccupied 007,500*10,0007,500*6,2995,000*Estimate based on 125 sq. ft./person**Aggregate of all locations in Phoenix metro

POPULATIONPhoenix is one of the fastest-growing regionsin the nation. The metro is home to more than4.7 million people, and its growth is fueled bynet migration. Over the last two decades, themetro has grown on average by 92,000 peopleannually. In 2017, the region added an averageof 100 new households each day. Furthermore,metro Phoenix has a relatively youngpopulation with a median age of 35.8 years,falling below the national median of 38.2.Median Age by MetroSalt Lake City32.1Austin34.0Phoenix35.8Los Angeles36.0Denver36.9Chicago37.05-19San Jose37.321.6%Charlotte37.4Seattle37.9U.S.38.2New York38.6San Francisco39.2Boston39.4Phoenix Population by Age7.0%Less than 520.2%20-3419.0%35-4917.2%50-6414.9%65 Source: Esri, U.S. Census Bureau, 2017.05 2018 GPEC & CBRE, INC.Source: Esri, U.S. Census Bureau, 2017.

THE PHOENIX TECH STORY 06Change in Population of 20-34 Year OldsPhoenixAustinCharlotteAtlantaDenverSeattleLos 2018-2023*8.0%12.7%6.9%6.5%6.8%5.1%1.0%Salt Lake CityBostonSan JoseSan FranciscoNew 023*1.4%3.5%4.9%3.6%1.3%-1.3%Source: Esri, U.S. Census Bureau, 2017.*ForecastPhoenix’s Robust Population Growth Driven By Net MigrationNet Migration160,000Natural IncreaseHistorical 1200019991998199719961995Source: Moody’s Analytics, 2018.*Forecast

WORKFORCEPhoenix isthe placeto scaleGreater Phoenix is one of the most rapidlyexpanding high-tech job markets in thenation. With more than 83,000 high-techemployees, metro employment has grown33.5% over a five-year period. Phoenix techemployment not only surpasses many of itstech peers, such as Denver and Austin, butit also provides labor at a relatively lowercost than its competitive markets. Beyondits existing supply of high-quality talent, itsfuture labor pipeline is bolstered by one ofthe largest universities in the nation—ArizonaState University—in addition to other majoruniversities and college systems, ensuringemployers will have access to talent thatmeets their future labor needs.Phoenix High-Tech Employment Breakdown43,71012,900Computer SystemsComputerProgrammersElectrical &Electronics Drafters 2018 GPEC & CBRE, INC.5,730Network and Computer8,260Software Developers,490072,870Comp. NetworkArchitectsSystems AdministratorsAnalystsSource: BLS, May 2016.CoSuSystems Software5,52,540WebDevelopersComputer aSystem

THE PHOENIX TECH STORY 085504,650omputer NetworkComputer HardwareEngineersupport Specialists2,130Elec. EngineeringTechnicians570and Informationms Managers2,33010,980DatabaseAdmin.12,190Computer UserSupport Specialists2,2802,670ElectricalEngineersInfo SecurityAnalysts3102,980Comp. Jobs(other)Electro-MechanicalTechniciansSoftware Developers,Applications

Workforce vs. Other Tech MarketsMetroLabor ForceUnemployedUnempl. Rate2016 Tech Jobs% Change (2011-2016)New York7,069,200276,2003.9%246,18032.9%Los 8,900229,5004.7%143,19032.8%San Francisco Bay 00126,2004.1%133,81047.6%Washington, 028.3%Salt Lake City663,10017,9002.7%31,75045.3%Source: CBRE Scoring Tech Talent, 2017; U.S. Bureau of Labor Statistics, November 2017.09 2018 GPEC & CBRE, INC.*Aggregate of San Francisco, Oakland and Silicon Valley

10THE PHOENIX TECH STORY Tech talent density measures the number of computer and mathematical workers ina market relative to the market’s total population. The number of tech workers in thePhoenix metro as a percentage of its population has increased an average of 28.2%over the last 5 years, outpacing growth in markets such as San Francisco and New York.Tech Talent Density (5-Year Change)(15%)ChicagoAtlantaPhoenixSan FranciscoSan JoseSalt Lake CityNew YorkCharlotteLos AngelesDenverAustinSeattleBostonWashington, D.C.Source: CBRE Labor Analytics, 2017.(10%)(5%)0%5%10%15%20%25%30%35%

EDUCATIONArizona State University is home to thelargest engineering school in the nationwith 20,000 students currently enrolled.Over 68% of graduates since 2010 stayin the Greater Phoenix region aftergraduation. The region also draws talentfrom the other major state universities aswell as a system of public and private twoand four-year schools.Ranked MostInnovative School inthe Nation by U.S.News and WorldReport for the 3rdStraight Year.Enrollment and Graduates:Phoenix Area Universities (2017)SchoolTotal Enrollment2017 U29,5247,267246,69658,392TOTALGraduate Students by Major (2010-2017)SchoolEngineering GradsMBA 1,173TOTALASU Arizona State UniversityNAU Northern Arizona UniversityUA University of ArizonaGCU Grand Canyon UniversitySource: ASU (2016), NAU (2017) and U of A Alumni Databases (2016),Maricopa Association of Governments (2016).11 2018 GPEC & CBRE, INC.Sample of HigherEducation Offerings inGreater Phoenix Allen School-PhoenixArgosy UniversityArizona Christian UniversityArizona CollegeBenedictine University at MesaBrookline CollegeBryan UniversityCarrington CollegeDevry UniversityDunlap Stone UniversityFortis CollegeGrand Canyon UniversityHarrison Middleton UniversityNorthern Arizona University at the Biomedical CampusOttawa UniversityPark University at Luke Air Force BasePenn Foster CollegeThunderbird School of Global ManagementUniversal Technical InstituteUniversity of Advancing TechnologyUniversity of ArizonaUniversity of PhoenixWest Valley Arts & Technology Academy

CODING BOOT CAMPSWoz UUA Coding Boot CampLocationScottsdaleLength of Course33 weeksSubject MaterialFull-stack Web Development, Data Science,Data Security, Cyber Security and MobileApplication.Notable FeaturesIn addition to online curriculum, Woz U willalso provide school districts with K-12 STEAMprojects. In 2019, Arizona will become hometo the Woz Accelerator, an immersivein-person training program.GalvanizeLocationLength of CourseChandler/Gilbert12 & 24 weeksSubject MaterialHTML5, CSS3, JavaScript, jQuery, Java,Bootstrap, Express.js, React.js, Node.js,Database Theory, Bookshelf.js, MongoDB,MySQL, Command Line, Git and others.Notable FeaturesPortfolio reviews, resume and social mediaprofile support, workshops, mock interviews,sample coding tests, and one-on-one careercoaching.Dev MountainLocationPhoenixLength of Course12 & 24 weeksSubject MaterialWeb Development, Data Science, Python,JavaScript and others.LocationPhoenixLength of Course12 weeksSubject MaterialWeb Development.Notable Features120 companies working on site.Notable FeaturesFree housing for students on a first-comefirst-serve basis, one-on-one mentoring.Tech Talent SouthCoder CampsLocationLength of CoursePhoenix4, 8, & 12 weeksLocationLength of CourseScottsdale12 & 24 weeksSubject MaterialJavaScript, Ruby on Rails, Domain Modeling,HTTP and “RESTful” Design, HTML/CSS, iOS,Google Analytics, and AJAX.Subject MaterialFull Stack Web Development and Coding fromScratch. Languages include JavasScript, .Netand Ruby.Notable FeaturesLifetime access to Coder Camps onlinecurriculum to maintain current expertise.Notable FeaturesLifetime career services and access to allcourses.THE PHOENIX TECH STORY 12

COST OF DOING BUSINESS:A Comparison of Major Tech HubsSEATTLE* 33.79 128,898N/A*SALT LAKE CITYSAN FRANCISCO 72.76 126,726 23.79 98,3875.0%8.8% 26.54SAN JOSE (SILICON VALLEY) 57.42 134,3818.8%PHOENIX 25.49 95,298LOS ANGELESLEGEND 40.44 111,8808.8%- Average Office Asking Rents (Q4 2017, FSG per sq. ft.)- Labor Cost: Software Engineer- Average Corporate Tax Rate*Texas and Washington do not have a corporate income tax but do have a gross receipts tax.Source: CBRE Research, Q4 2017; Bureau of Labor Statistics, Tax Foundation, 2017.13 2018 GPEC & CBRE, INC.DENVER4.9% 112,8154.6%

14 1.00 16.64PER HOURPSF/YRSource: CBRE Labor Analytics.THE PHOENIX TECH STORYTwo Waysto Save 1M*Small ChangeCreates HUGEImpact*Based on 500 employees at 125 sq. ft. eachBOSTON 35.40 111,085CHICAGO 30.22 100,794NEW YORK9.5% 75.25 114,5426.5%WASHINGTON, D.C. 38.56 117,300CHARLOTTE 25.93 103,802ATLANTA 26.16 101,833AUSTIN* 34.39 101,7516.0%N/A*RENT SCALELeast Expensive( 20 PSF)Most Expensive( 80 PSF)3.0%9.0%8.0%

HOTTEST PHOENIX TECH SUBMARKETSDowntown Tempe4.0M SFTotal Base0.9%Vacancy RateChandler Price Corridor 41.53/SFLease Rate (FSG)3.0M SFTotal Base6.9%Vacancy RateLease Rate (FSG)Downtown Tempe was the top techsubmarket in the nation for rent growth andnet absorption growth from Q2 2015 to Q22017.1 The submarket is successfully attractingcompanies due to the presence of ArizonaState University’s main campus, a large andtalented workforce and a walkable urbanenvironment that provides an abundance ofamenities. Additionally, Class A developmentalong Tempe Town Lake has attracted techcompanies seeking high-quality space atreduced costs, including Zip Recruiter, LifeLockand Limelight.The Price Corridor in Chandler is a highdemand submarket for fintech and high-techmanufacturing companies. Notable techemployers in the submarket include Intel,PayPal and General Motors. High collegeattainment and availability of skilled labormake the area attractive to employers.Additionally, an abundance of low-costland has resulted in a significant amount ofoffice construction over the last few years,providing users with numerous and qualityspace options. Furthermore, the submarketis surrounded by affordable housing anda thriving shopping and dining scene thathelps attract and retain top talent.Downtown PhoenixSouth Scottsdale6.4M SFTotal Base15.3%Vacancy Rate 31.13/SFLease Rate (FSG)Downtown Phoenix is a vibrant, diverseneighborhood that offers a genuinelive-work-play lifestyle. Major draws todowntown include Arizona State University’sDowntown Phoenix Campus, light rail, alarge and educated workforce and walkablestreets lined with restaurants, retail andentertainment options. An increasingnumber of technology companies—suchas Uber, DoubleDutch and Gainsight—aremoving from coastal markets to downtownPhoenix. This shift has diversified thesubmarket’s employer base, which washistorically dominated by financial andgovernment services firms.2.3M SFTotal Base19.9%Vacancy Rate 2018 GPEC & CBRE, INC. 34.67/SFLease Rate (FSG)Tech employers are drawn to SouthScottsdale due to its high concentrationof millennials, educated workforce andamenities that attract top talent. Thesubmarket offers numerous and walkableattractions, including Scottsdale FashionSquare (the largest mall in the Southwest),a growing culinary scene, unique shops andboutiques and vibrant nightlife. Technologycompanies (including Yelp, Weebly andZocDoc) have expanded in the area overthe past several years. Currently, vacancy iselevated due to McKesson’s recent relocationto a build-to-suit just outside the submarket.115 29.05/SFCBRE Research, 2017 Tech-30 Report.Source: CBRE Research, Q4 2017.

QUALITY OF LIFEGreater Phoenix offers an array of amenities and attractions expected of a bustling urbanand suburban region. From unique art and hip eateries to major sporting events andbreathtaking hiking spots, the region offers something for everyone.ARTS AND CULTUREArizona OperaArtLink First FridaysBallet ArizonaDesert Botanical GardensGammage AuditoriumHeard MuseumMesa Arts CenterMusical Instrument MuseumOrpheum TheaterPhoenix Art MuseumPhoenix SymphonyPhoenix ZooScottsdale Museum of Contemporary ArtSouth Mountain ParkTempe Beach ParkWestWorldMAJOR SPORTS EVENTS6 professional sports teams including the NFL,MLB, NHL, NBA, WNBA and USLFiesta BowlMLB Spring TrainingNCAA Final Four (2017)Super Bowl (2015)College Football Playoffs/National ChampionshipLOCAL COFFEE SHOPSCartel Coffee LabCopper StarFair Trade CaféGiantHob NobsJobotLolaLuxMornin’ MoonshineNamiOne Coffee Co.Press Coffee RoastersRed Hut CoffeeRoyal Coffee BarShineSongbirdThe RefugeUrban BeansLOCAL BREWERIES8 Bit Brewing CompanyArizona Wilderness Brewing Co.Beer Research InstituteBlasted Barley Beer CompanyBold Barley BrewingDesert Eagle Brewing CompanyDubina Brewing Co.McFate Brewing CompanyFour Peaks Brewing CompanyFreak’N Brewing CompanyGoldwater Brewing Co.Huss Brewing Co.Mother Bunch BrewingNorth Mountain BrewingO.H.S.O. Brewery DistilleryPeoria Artisan BreweryThe PerchSaddle Mountain Brewing CompanySanTan Brewing CompanyScottsdale Beer CompanySleepy Dog BrewingSonoran Brewing Co.SunUp Brewing Co.The Phoenix Ale BreweryUncle Bear’s BreweryWestward Brewing Co.Wren House Brewing Co.OTHER EVENTSArizona Jazz FestivalBarrett-Jackson Classic Car AuctionMcDowell Mountain Music FestivalLost Lake Music FestivalRock ‘n’ Roll MarathonScottsdale Arts FestivalViva PHXWickenburg Gold Rush DaysWaste Management Phoenix OpenLOCAL RESTAURANTSBarrio CaféBinkley’sBlanco Tacos TequilaBourbon & BonesChestnutChurnCitizen Public HouseCrudoCulinary DropoutDoughbirdFamous 48Fat OxFederal PizzaFlower ChildForno FabbriFour PeaksGallo BlancoGarcia’s Mexican RestaurantHot Noodles Cold SakeJoe’s Farm GrillJoyride Taco HouseKaiLiberty MarketLittle Cleo’s Seafood LegendLo-Lo’s Chicken & WafflesMorning Glory CaféNorth ItaliaOlive & IvyOtro CaféPizzeria BiancoPomo PizzeriaPostinoQuiessenceThe Arrogant ButcherThe Breadfruit and Rum BarThe Farm KitchenThe GladlyThe Greene HouseThe HenryThe House BrasserieThe MissionTrattoTrue Food KitchenVincent on CamelbackVirtùWasted GrainWindsorZinburger Wine & Burger BarZinc BistroTHE PHOENIX TECH STORY 16

COST OF LIVINGThe cost of living index measures relative price levels for consumer goods and services.The national average is 100, and each index is read as a percentage of the national average.95.097.197.5112.0149.0198.9PhoenixSalt Lake CityAustinDenverSeattleSan FranciscoSource: C2ER Cost of Living Index Calculator Q3 2017.Rent to Income RatioMetroMedian Household Income ( )Average Rent ( , monthly)Rent to Income Ratio75,4192,76143.9%San Francisco101,5553,38640.0%Los Angeles68,5992,24239.2%San Diego72,8801,94232.0%Boston87,1302,15029.6%San 3%Salt Lake City72,7761,07517.7%New YorkSource: Moody’s Analytics, CBRE EA, Q3 2017.*Based on average rent for a one bedroom apartment (CBRE EA) and median household income (Moody’s)17 2018 GPEC & CBRE, INC.

HOUSING AFFORDABILITYThe Housing OpportunityIndex (HOI) for eachmarket is defined as thepercent of homes sold inthat area that would havebeen affordable to a familyearning the metro areamedian income, basedon standard mortgageunderwriting criteria.Nationwide, 59.6% of newand existing homes sold inQ4 2017 were affordableto families earning the U.S.median income of 68,000.Percentages of Homes That Are Affordable68.7% 67.3% 65.7%CharlotteMedian Price 227,000AtlantaMedian Price 217,000ChicagoMedian Price 230,00063.1% 62.1% 57.6%PhoenixMedian Price 255,000Salt Lake CityMedian Price 307,000AustinMedian Price 293,00050.3% 48.2% 45.3%DenverMedian Price 381,000DallasMedian Price 287,000BostonMedian Price 430,00039.3% 32.7% 18.2%SeattleMedian Price 501,000New York*Median Price 440,00015.0% 9.6%Source: National Association of HomeBuilders, Q4 2017.*New York-Jersey City-White Plains, NY-NJSilicon ValleyMedian Price 945,000Los AngelesMedian Price 575,000San DiegoMedian Price 530,0006.3%San FranciscoMedian Price 1,257,000THE PHOENIX TECH STORY 18

TAXESArizona maintains its pro-business climate through a simplified tax system andcomparatively low corporate and personal income taxes. Following a multi-year phasedownin 2015, the state’s corporate income tax rate fell from 5.5% to 4.9% in 2017—one of thelowest rates in the country and significantly below coastal and competitive markets.Corporate Income TaxPersonal Income Tax (Single Filer)ARIZONAARIZONABracketTax RateAll4.90%TEXASBracketTexas Margin TaxTax RateN/ATexas does not have a corporate income taxbut does have a gross receipts tax* that rangesfrom .331% to .75%COLORADOBracketTax FORNIAWASHINGTONBracketWashington Business & Occupation TaxTax RateN/AWashington does not have a corporate incometax but does have a gross receipts tax* thatranges from .13% to 3.3%UTAHBracketTax RateBrackets 0 10,179 25,445 50,890 152,668All4.63%CALIFORNIABracketTax RateRates2.59% 2.88% 3.36% 4.24% 4.54% All5.00%Rates4.63% of federal taxable incomeRates1.00% 2.00% 4.00% 6.00% 8.00% 9.30% 10.30% 11.30% 12.30% 13.30% Brackets 0 8,015 19,001 29,989 41,629 52,612 268,750 322,499 537,498 1,000,000WASHINGTONRatesNone*Gross receipts taxes are business taxes imposed at a low rate but on awide base of transactions, resulting in effective tax rates that can varyby industrySource: Tax Foundation 2017 Facts and Figures.19 2018 GPEC & CBRE, INC.BracketsNoneUTAHRates5.00 Brackets 0

Relevant Tax Credit Programs in ArizonaRESEARCH & DEVELOPMENT TAX CREDITProvides an Arizona income tax credit for increased research and development activities conducted inthe state, including research conducted at a state university and funded by the company. It applies toboth corporations and individuals and is equal to 24% of the first 2.5 million in qualifying expensesplus 15% of the qualifying expenses in excess of 2.5 million.QUALITY JOBS TAX CREDITProvides tax credits to employers creating a minimum number of net new quality jobs and makinga minimum capital investment in Arizona. The program offers up to 9,000 of Arizona income orpremium tax credits spread over a three-year period for each net new quality job.ANGEL INVESTOR TAX CREDITProvides tax credits to investors who make investments in targeted small businesses certified by theArizona Commerce Authority (ACA). The ACA can authorize 10 million in tax credits against qualifiedinvestments made in qualified small businesses through June 30, 2021. No more than 2.5 million intax credits may be authorized per calendar year.MICROENTERPRISES FUND DEDICATIONRequires the ACA to reserve up to 1 million of the Arizona Competes Fund (ACF) for grants toadvance microenterprise development (companies based in Arizona with 10 or fewer employees,including start-up, home-based and self-employed businesses).THE PHOENIX TECH STORY 20

REGULATORY POLICYArizona Works to Enable New Technology AdoptionArizona’s regulatory environment is intentionally pro-business, fostering a culture of innovation andgrowth in the state. Whether encouraging research and development into autonomous vehicles orworking to make sure that ride-share drivers have protections under the law, Arizona is embracingthe future. The reduction of regulatory burdens on existing and prospective companies in Arizona willcontinue to attract new companies and create jobs in the state.Self-Driving Testing and Piloting in the State of Arizona (2015)In 2015, Governor Ducey signed Executive Order 2015-09, which allows for the testing of autonomousvehicles in Arizona. The order explicitly encouraged state agencies to support the developmentof autonomous vehicles and set basic safety parameters under which testing should occur. It alsoestablished the Self-Driving Vehicle Oversight Committee, which is charged with advising relevantstakeholders on the matter.It should come as no surprise that in the years following the implementation of this Executive Order,Greater Phoenix has developed a robust autonomous vehicle development environment. Companieslike Uber, Waymo, Cruise Automation and Local Motors are all testing and developing autonomousvehicle technology in Greater Phoenix.Establishing New Insurance Financial Limits and Requirements for TNCs (2015)House Bill 2135, which was signed into law in 2015, was designed to provide a basic, safety-orientedregulatory framework for Transportation Network Companies (TNCs). The law created insurancefinancial limits and requirements for TNCs and required TNCs to conduct background checks ondrivers, mandated TNC vehicle identification, and set requirements on what is and is not acceptablefor drivers to have been cited for. This legislation legitimized the industry and gave TNCs a clear setof rules under which to operate. Notably, these rules were not written in a way that would inhibit theindustry from actively functioning in Arizona.Short-Term Rentals (2016)Senate Bill 1350, which was signed into law in 2016, prohibits banning of short-term rentals. It alsoestablishes a straightforward regulatory framework in which some taxation is enacted for onlinelodging services. It also limits the ways in which cities and towns can regulate short-term rentals.These regulatory avenues are largely aimed at the protection of public health and safety.Enabling Electronic Transactions Utilizing Blockchain Technology (2017)HB 2417 recognizes smart contracts, which are secured through blockchain, as valid forms ofcontracts in Arizona. Governor Ducey and the State Legislature, through this bill and others, areworking to show that Arizona recognizes and embraces new technologies. This forward-thinkinglegislation places Arizona among a handful of states that have enacted legislation that recognizes andutilizes the security benefits of blockchain technology.Regulatory Sandbox for Fintech (2018)In 2018, Governor Ducey signed H.B. 2434 which is intended to spur the development of fintech,blockchain and cryptocurrencies in the state by removing regulatory barriers for innovators. Arizonais the first in the U.S. to adopt a “regulatory sandbox” which will take effect in late 2018. Under themeasure, companies will be able to test their products for up to two years and serve as many as10,000 customers before needing to apply for a formal license.21 2018 GPEC & CBRE, INC.

Report CreditsAUTHORSJessica GlickSenior Research AnalystCBREMatt VanceDirector of Research and Analysis, EconomistCBREMaureen HowellVice President of Research and StrategyGreater Phoenix Economic CouncilDESIGNChris BennettSenior Graphic DesignerCBRE

ContactsChris CamachoPresident & CEOGreater Phoenix Economic Council 1 602.262.8603ccamacho@gpec.orgThomas M

autonomous vehicles, fintech, medtech and other industries related to the internet of things. Phoenix Tech Timeline Source: Maricopa Association of Governments (2016); Phoenix Business Journal, Source: Greater Phoenix Economic Council. Book of Lists (2017-2018). Motorola started a research and development laboratory in Phoenix, AZ to research new