Transcription

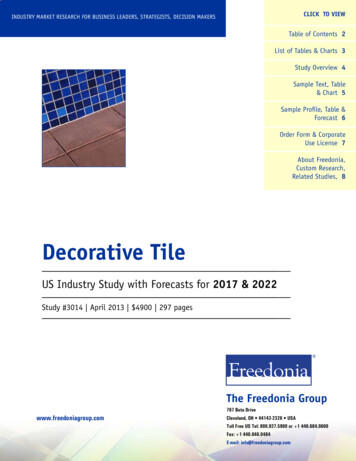

CLICK TO VIEWINDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERSTable of Contents 2List of Tables & Charts 3Study Overview 4Sample Text, Table& Chart 5Sample Profile, Table &Forecast 6Order Form & CorporateUse License 7About Freedonia,Custom Research,Related Studies, 8Decorative TileUS Industry Study with Forecasts for 2017 & 2022Study #3014 April 2013 4900 297 pagesThe Freedonia Group767 Beta Drivewww.freedoniagroup.comCleveland, OH 44143-2326 USAToll Free US Tel: 800.927.5900 or 1 440.684.9600Fax: 1 440.646.0484E-mail: info@freedoniagroup.com

Study #3014April 2013 4900297 PagesDecorative TileUS Industry Study with Forecasts for 2017 & 2022Table of ContentsExecutive SummaryTile Adhesives. 105Mortar. 106Grout & Other Adhesives. 108Market EnvironmenTAPPLICATIONSGeneral.4Macroeconomic Environment.4Demographic Trends.7Consumer Trends. 12Personal Income & Expenditures. 12Consumer Financing. 15Building Construction. 18Residential Buildings. 20Housing Completions. 23Housing Stock. 28Improvements & Repairs. 32Nonresidential Buildings. 34New. 34Improvements & Repairs. 36Nonbuilding Construction. 38Transportation Equipment. 40Historical Market Trends. 44Pricing. 47Environmental Issues &Regulatory Considerations. 49Foreign Trade. 53World Market. 59Western Europe. 61Asia/Pacific Region. 63Other Regions. 64PRODUCTSGeneral. 66Value Outlook. 68Area Outlook. 71Installation Costs. 74Ceramic Tile. 77Characteristics. 80Suppliers. 84Porcelain Tile. 85Characteristics. 88Suppliers. 90Stone Tile. 91Characteristics. 94Suppliers. 98Other Tile. 99Concrete. 100Glass. 102Metal. 104General. 109Flooring. 114Flooring Outlook. 114Tile Demand. 117Demand by Market. 118Demand by Product. 120Characteristics. 122Competitive Materials. 125Wall Coverings. 127Wall Coverings Outlook. 127Tile Demand. 129Demand by Market. 131Demand by Product. 133Characteristics. 134Competitive Materials. 137Countertops. 139Countertops Outlook. 139Tile Demand. 142Demand by Market. 144Demand by Product. 146Characteristics. 147Competitive Materials. 149Other Applications. 152Demand by Market. 154Demand by Product. 154MARKETSGeneral. 156Residential. 158New. 159Demand by Room & Housing Type. 160Demand by Product & Application. 163Improvements & Repairs. 166Demand by Room & Housing Type. 167Demand by Product & Application. 171Nonresidential. 175New. 178Demand by Product. 180Demand by Application. 181Improvements & Repairs. 182Demand by Product. 183Demand by Application. 185Click here to purchase onlinePage Building Type. 187Office & Commercial. 187Institutional. 189Industrial. 191Other Nonresidential. 192Nonbuilding & Transportation. 194Demand by Product. 197Demand by Application. 198INDUSTRY STRUCTUREGeneral. 199Industry Composition. 203Market Share. 205Competitive Strategies. 210Research & Development. 212Manufacturing. 213Distribution. 215Specialty Retailers. 216Big-Box Retailers. 218Direct Distribution. 220Marketing. 221Mergers, Acquisitions, &Cooperative Agreements. 225Company ProfilesArtflor Incorporated. 228Azuvi SA. 229Berkshire Hathaway. 230Cecrisa Revestimentos Ceramicos. 232Ceramica Saloni. 233Crossville Incorporated. 235Ege Seramik Sanayi ve Ticaret. 238Eliane Revestimentos Ceramicos. 239Emser Tile. 241Etex Group. 242Fireclay Tile. 243Florida Brick & Clay. 245Florim Ceramiche SpA. 247Grupo Industrial Saltillo. 249Grupo Lamosa. 251Guangdong Bode Fine Building Material. 253Hakatai Enterprises. 254Ilva SA. 256Internacional de Ceramica. 258Iris Ceramica. 261Ironrock Capital. 263Mannington Mills. 265(continued on following page)Order now, click here!

Study #3014April 2013 4900297 PagesDecorative TileUS Industry Study with Forecasts for 2017 & 2022Table of ContentsCompany Profiles15 Tile Pricing. 4916 Decorative Tile Foreign Trade. 57(continued from previous page)PRODUCTSMohawk Industries. 267Oceanside Glasstile. 275Pamesa Ceramica. 276Panariagroup Industrie Ceramiche. 278Porcelanosa Grupo. 281Quarry Tile. 283Roca Corporacion Empresarial. 285Seneca Tiles. 287Sonoma Tilemakers. 290Summitville Tiles. 291Walker & Zanger. 292Wausau Tile. 295Ziyang Ceramics. 296List of TablesExecutive Summary1 Summary Table.3Market EnvironmenT1 Macroeconomic Indicators.72 Population & Households. 113 Personal Consumption Expenditures. 144 Consumer Financing Environment,2002-2012. 185 Building Construction Expenditures. 206 Residential Building ConstructionExpenditures. 237 New Housing Indicators. 288 Housing Stock by Type. 319 Residential Improvement& Repair Expenditures. 3310 Nonresidential Building ConstructionExpenditures. 3611 Nonresidential Building Improvement& Repair Expenditures. 3812 Nonbuilding Construction Expenditures 4013 Transportation Equipment Shipments. 4314 Decorative Tile Market, 2002-2012. 461234567Tile Demand by Type in Value Terms. 70Tile Demand by Type in Area Terms. 73Ceramic Tile Demand. 80Porcelain Tile Demand. 88Natural Stone Tile Demand. 94Other Tile Demand. 100Tile Adhesives Demand. 106APPLICATIONS12345678Tile Demand by Application. 112Flooring Outlook. 117Tile Demand in Flooring. 122Wall Coverings Outlook. 129Tile Demand in Wall Coverings. 131Countertops Outlook. 142Tile Demand in Countertops. 144Tile Demand in Other Applications. 153INDUSTRY STRUCTURE1 US Decorative Tile Salesby Company, 2012. 202List of ChartsMARKET ENVIRONMENT1 Year of Construction ofHousing Stock, 2012. 312 Decorative Tile Market, 2003-2012. 473 Tile Imports by Source, 2012. 584 Tile Exports by Destination, 2012. 585 Global Tile Demand, 2012. 61MARKETSPRODUCTS1 Tile Demand by Market. 1572 Residential Tile Demandby Market & Product. 1593 New Residential Tile Demandby Room & Housing Type. 1634 New Residential Tile Demandby Product & Application. 1665 Residential Improvement & Repair TileDemand by Room & Housing Type. 1716 Residential Improvement & Repair TileDemand by Product & Application. 1747 Nonresidential Tile Demandby Market & Product. 1788 New Nonresidential Tile Demand. 1799 Nonresidential Improvement& Repair Tile Demand. 18310 Nonresidential Tile Demandby Building Type. 18711 Office & Commercial Tile Demand. 18912 Institutional Tile Demand. 19113 Industrial Tile Demand. 1921 Tile Demand by Type inValue Terms, 2012. 712 Tile Demand by Type inArea Terms, 2012. 74Click here to purchase onlinePage 14 Other Nonresidential BuildingConstruction Tile Demand. 19415 Nonbuilding Construction &Transportation EquipmentTile Demand. 196APPLICATIONS1 Tile Demand by Application,2012: Value & Area. 113INDUSTRY STRUCTURE1 US Decorative Tile Market Shareby Company, 2012. 205Order now, click here!

Study #3014April 2013 4900297 PagesDecorative TileUS Industry Study with Forecasts for 2017 & 2022Gains will be driven by a rebound in new housing, office and commercial construction and theincreasing use of tile as a durable, low maintenance flooring alternative to carpets and rugs.US demand to rise 5.1%annually through 2017US demand for decorative tile is forecastto rise 5.1 percent per year through2017, reaching 3.0 billion square feet,valued at 5.3 billion. Gains will bedriven by a rebound in building construction spending. The new housing marketwill see double-digit annual demandgrowth as housing completions rise fromtheir low 2012 base. Nonresidentialdemand will also rise at a robust pace,spurred by strong growth in office andcommercial construction spending andincreasing use of tile as a durable, lowmaintenance flooring alternative tocarpets and rugs.Dominant ceramic tileto lose market shareCeramic tile accounted for the largestshare of decorative tile demand in 2012and is expected to remain the leadingproduct type in 2017. Ceramic tiledemand is supported by its low cost, andperception as a modern, fashionablesurfacing material. However, ceramic tilewill lose market share going forward tostone and porcelain tile, which are seenas having better aesthetic and performance properties.Natural stone to overtakeporcelain as second largestNatural stone tiles are expected toovertake porcelain tiles as the secondUS Decorative Tile Demand, 2017(3.0 billion square feet)Stone15%Porcelain & OtherMaterials14%largest type in area demand terms by2017. Gains will be spurred by strongresidential demand for natural stoneflooring. Homeowners are increasinglyopting for granite tile flooring becausegranite is an attractive, durable materialthat improves the appearance of a roomand increases home values. Moreover,natural stone flooring can also beinstalled in such structures as hotels,high end resorts, and shopping malls tocreate

Dominant ceramic tile to lose market share Ceramic tile accounted for the largest share of decorative tile demand in 2012 and is expected to remain the leading product type in 2017. Ceramic tile demand is supported by its low cost, and perception as a modern, fashionable surfacing material. However, ceramic tile