Transcription

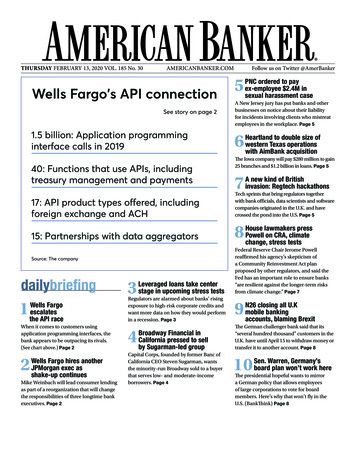

THURSDAY FEBRUARY 13, 2020 VOL. 185 No. 30AMERICANBANKER.COMWells Fargo's API connectionSee story on page 21.5 billion: Application programminginterface calls in 201940: Functions that use APIs, includingtreasury management and paymentsFollow us on Twitter @AmerBanker5 NC ordered to payPex-employee 2.4M insexual harassment caseA New Jersey jury has put banks and otherbusinesses on notice about their liabilityfor incidents involving clients who mistreatemployees in the workplace. Page 56 eartland to double size ofHwestern Texas operationswith AimBank acquisitionThe Iowa company will pay 280 million to gain25 branches and 1.2 billion in loans. Page 57 new kind of BritishAinvasion: Regtech hackathons17: API product types offered, includingforeign exchange and ACHTech sprints that bring regulators togetherwith bank officials, data scientists and softwarecompanies originated in the U.K. and havecrossed the pond into the U.S. Page 515: Partnerships with data aggregators8 ouse lawmakers pressHPowell on CRA, climatechange, stress testsSource: The companydailybriefing3L everaged loans take centerstage in upcoming stress testsFederal Reserve Chair Jerome Powellreaffirmed his agency’s skepticism ofa Community Reinvestment Act planproposed by other regulators, and said theFed has an important role to ensure banks“are resilient against the longer-term risksfrom climate change.” Page 7Regulators are alarmed about banks’ risingexposure to high-risk corporate credits andwant more data on how they would performin a recession. Page 39When it comes to customers usingapplication programming interfaces, thebank appears to be outpacing its rivals.(See chart above.) Page 24The German challenger bank said that its“several hundred thousand” customers in theU.K. have until April 15 to withdraw money ortransfer it to another account. Page 82Capital Corps, founded by former Banc ofCalifornia CEO Steven Sugarman, wantsthe minority-run Broadway sold to a buyerthat serves low- and moderate-incomeborrowers. Page 41Wells Fargoescalatesthe API race ells Fargo hires anotherWJPMorgan exec asshake-up continuesMike Weinbach will lead consumer lendingas part of a reorganization that will changethe responsibilities of three longtime bankexecutives. Page 2 roadway Financial inBCalifornia pressed to sellby Sugarman-led group 26 closing all U.KNmobile bankingaccounts, blaming Brexit10 en. Warren, Germany’sSboard plan won’t work hereThe presidential hopeful wants to mirrora German policy that allows employeesof large corporations to vote for boardmembers. Here’s why that won’t fly in theU.S. (BankThink) Page 8

THURSDAY FEBRUARY 13, 2020APIsWells Fargoescalates theAPI raceBy Penny CrosmanFebruary 11, 2020Big banks are in a race to have the mostused application programming interfaces, andWells Fargo says it’s off to a fast start.Its APIs were called 1.5 billion times lastyear, according to Imran Haider, head of openAPIs for Wells Fargo.“For me personally, this validates the ideathat APIs are a viable method for distributingbank services,” Haider said. “This isn’t ascience experiment. There’s real potential withAPIs to create customer value.”Until Tuesday, the bank had not previouslyshared a number for its API calls, whereasothers such as Citigroup have. In September,Citi said it had handled 157 million API callsglobally and was getting 15 million a month.The majority of the API calls are fromconsumer apps pulling Wells Fargo customers’account data through aggregators, Haider said.Wells Fargo has signed 15 agreements withdata aggregators like Plaid and accountingsoftware providers like Intuit (covering Mint,QuickBooks Online, and TurboTax) and Xero.They all use the Financial Data Exchange’sstandard for data sharing.The bank was one of the first to sign suchagreements with aggregators. Wells Fargo hassaid for years that it wants to put an end to thepractice of screen scraping, where third partiessuch as personal financial management appproviders and online lenders obtain bankcustomers’ usernames and passwords, login as them and copy and paste their bankingtransaction information into their ownsoftware.Screen scraping can cause technical andsecurity problems, and some experts say it isunsafe for consumers to hand out their privatecredentials to third parties.At Wells, account information is sent —with customer consent — directly from thebank to aggregators through APIs; the data setis often limited.Once customers are migrated to an API,PAGE 2AMERICANBANKER.COM“the credential sharing stops,” said BenSoccorsy, head of digital payments at WellsFargo Virtual Channels.But besides being an antidote to screenscraping, APIs are also a way to work moreclosely with customers and tie the apps andsoftware they use in their daily lives to thebank, Soccorsy and Haider said.“You’ve got a particular workflow that acustomer has, be it a commercial customeror consumer retail customer, and banking isa couple of steps in that broader flow,” Haidersaid. “If we can get bank products and servicesembedded in the digital experiences that arevaluable and relevant to customers and makebanking a part of that customer’s workflow,we create value for our customers. That’s theultimate story on APIs and these numbersreally begin to validate that strategy.”All told, Wells Fargo has about 40 use casesfor APIs. These include treasury managementsolutions, credit card products, brokerage andpayments. In each case, a banking function —say, a payment or an account validation — canhappen quietly behind the scenes using anAPI, rather than requiring users to exit theirapplication, go into a banking app or site andreturn to what they were doing.“If you think about the history of ourindustry, we’re on a constant journey to bringconvenience of our products to our customers,especially on the consumer side, where ourfocus and our distribution strategy startedwith branches in a way, went to ATM machinesand it went to online banking, then it went tomobile banking,” Soccorsy said. “I think this isthe next logical phase of the industry as we’rebringing your banking to you via APIs.”APIs play an important role in Wells’ ControlTower, a tool within the bank’s mobile app andonline banking site that lets customers seerecurring payments being made from a bankaccount or card. Millions of customers use theapp, mostly to remind themselves of all thesubscriptions they have. Control Tower has adata sharing controls feature that is API-driven;it lets customers turn off or back on thirdparty app access to their Wells Fargo accountinformation and control at the account levelwhich data is shared; for instance, a thirdparty app might be allowed to use all accountdata or just credit card information.WELLS FARGOWells Fargohires anotherJPMorganexec asshake-upcontinuesBy Allissa KlineFebruary 11, 2020Wells Fargo is adding yet another NewYork-based JPMorgan Chase alum to its topexecutive ranks. The 1.9 trillion-asset bankEstablished 1836One State Street Plaza, 27th floor, New York, NY 10004Phone 212-803-8200 AmericanBanker.comEditor in Chief Alan Kline 571.403.3846Managing Editor Dean Anason 770.621.9935Executive Editor Bonnie McGeer 212.803.8430Washington Bureau Chief Joe Adler 571.403.3832Editor at Large Penny Crosman 212.803.8673BankThink Editor Rachel Witkowski 571.403.3857Community Banking Editor Paul Davis 336.852.9496Technology Editor Suleman Din 212.803.8738Contributing Editor Daniel Wolfe 212.803.8397Digital Managing EditorChristopher Wood 212.803.8437Copy Editor Neil Cassidy 212.803.8440Reporters/ProducersLaura Alix 860.836.5431, Kate Berry 562.434.5432Jim Dobbs 605.310.7780John Heltman 571.403.3847Hannah Lang 571.403.3855Ken McCarthy 724.996.2188, Andy Peters 404.500.5770John Reosti 571.403.3864, Gary Siegel 212.803.1560Jackie Stewart 571.403.3852Kevin Wack 626.486.2341For up to date and complete coverage go to AmericanBanker.com

THURSDAY FEBRUARY 13, 2020said Tuesday that Mike Weinbach will becomeCEO of consumer lending, a newly createdposition, as part of its latest organizationalshake-up.Wells also announced that it will split itswholesale banking unit in two and create a newgroup that will be responsible for corporatestrategy and the bank’s digital teams. Thelatest moves come less than four months afterCharlie Scharf became the bank’s CEO.Weinbach previously worked at JPMorganas CEO of its home lending division. He isscheduled to join Wells Fargo in May. Hewill have responsibility for home lending,auto loans, personal loans, credit cards andmerchant services.Much of that portfolio previously fell underthe purview of Mary Mack, the bank’s headof consumer banking for the last three-plusyears. Under the reorganization that wasannounced Tuesday, Mack is now CEO ofconsumer and small-business banking, withnew responsibilities for deposits and in digitalbanking, according to the San Franciscobased financial giant.Two other top executives at Wells Fargo alsosaw their responsibilities change as part of areorganization that expands the bank’s lines ofbusiness from three to five.Perry Pelos, who previously led wholesalebanking, now serves as CEO of commercialbanking, which is one of the two units that arebeing carved out of what used to be wholesalebanking. He is in charge of commercial capital,treasury management, business banking,middle-market banking and government andinstitutional banking.Jon Weiss, who previously headed thebank’s wealth and investment managementunit, has become CEO of corporate andinvestment banking, the other unit that isbeing carved out of wholesale banking. Henow oversees services provided to the bank’scorporate, government and institutionalclients, as well as commercial real estate andthe bank’s international client businesses.Wells Fargo said that it plans to conduct asearch for Weiss’ successor as head of wealthand investment management. Weiss willcontinue to serve in that role until that hire ismade.The company also plans to search for anexecutive to lead its newly created group forstrategy, digital platform and innovation,which will report to Scharf. Chief OperatingOfficer Scott Powell is leading this group on aninterim basis.AMERICANBANKER.COM“These changes create the right structureto build our businesses over the long termand increase our ability to successfullyexecute on our top priority, which is the risk,regulatory and control work,” Scharf saidin a press release. “I am confident that thisorganizational model and our strengthenedrisk and control foundation will bring greaterfocus and accountability to this company.”Scharf, a former top executive at JPMorgan,Visa and Bank of New York Mellon, is seekingto revamp the nation’s fourth-largest bank,which in recent years has been plagued by aseries of scandals.The bank’s regulatory woes led to thedeparture of two previous CEOs, John Stumpfand Tim Sloan, both of whom had been withthe bank for decades.Scharf has moved quickly to shake up theleadership ranks at Wells Fargo. In December,the bank hired Powell, who once worked withScharf at JPMorgan, as its chief operatingofficer. And last week, Wells announced thatMichael Cleary, another former JPMorganexecutive, had joined the team to lead salespractice oversight and management.Weinbach worked at JPMorgan for 16 years,where he held roles in consumer banking,business banking and auto finance in additionto home lending.COMMUNITY BANKINGLeveragedloans takecenter stagein upcomingstress testsBy Jim DobbsFebruary 11, 2020Leveraged lending is the boogeymanlurking in the latest round of stress testing forlarge banks.The leveraged loan market, spurred by arise in collateralized loan obligations and lowinterest rates, has swelled in recent years andnow tops 1 trillion, according to the FederalReserve. Leveraged loans often get bundledPAGE 3into CLOs.That rise in popularity has drawn theattention of regulators, to the point thatleveraged loans will play a key role in the Fed’sannual Comprehensive Capital Analysis andReview test.The Fed will use CCAR to pull in moredata on how leveraged loans and CLOswill perform in a recession. The research isimportant because leveraged loans can be anearly indicator of deteriorating credit quality,which in turn could hurt banks’ profitabilityand usher in an economic slump, industryexperts said.“This kind of lending does often involvecompanies with questionable credit,” saidKevin Jacques, a finance professor at BaldwinWallace University who previously worked onrisk management matters at the Office of theComptroller of the Currency.“We need to have a better understanding ofwhat happens with these loans in a recessionand, for instance, if rates change course andsuddenly go up,” Jacques added. “That wouldraise the cost of borrowing and could triggerdefaults.”This year’s CCAR includes a scenariowhere heightened stress on highly leveragedmarkets causes CLOs and private equityinvestments to endure notably larger marketvalue declines than last year.Banks will also be required to look at whatwould happen if there is a spike in shortterm interbank lending rates. The 2019 CCARevaluated a decline in those rates.CLOs have been on the Fed’s radar forseveral months.Randy Quarles, the Fed’s vice chairmanof supervision, said late in 2019 that theregulator was analyzing CLO exposure,particularly leveraged loans to companieswith high debt levels. U.S. nonfinancialcorporate debt reached a record high ofnearly 50% of gross domestic product lastyear, according to the Fed.In a recent report, the Financial StabilityBoard warned about the heighted risk thatleverage lending poses to the internationalfinancial system.The report stated that vulnerabilities in theleveraged credit markets had expanded sincethe financial crisis. The global watchdogpointed to increased debt levels, lower qualitycorporate debt, and increased complexity inleveraged loans and CLOs.The FSB said big, international banks havethe largest direct exposures to leveragedFor up to date and complete coverage go to AmericanBanker.com

THURSDAY FEBRUARY 13, 2020loans — more than other types of financialcompanies — and, collectively, the exposurecomes with “significant cross-borderdimension.”Those findings suggest that banks arepartnered in syndicated loans, which couldmean that one bank’s problems could spreadto others, creating systemic challenges,Jacques said.“This is a potentially really large issue,”Jacques said. “I’m not trying to sound alarmbells. Credit conditions overall are very goodstill. But this is an area where it is smart to getway ahead of any problems.”While the biggest banks have the mostexposure, smaller banks are the onesreporting early struggles with leveragedloans.Texas Capital Bancshares in Dallas, forone, said it worked to run off leveraged loanslast year after enduring increased chargeoffs.The 32.5 billion-asset company aims “tominimize downside impact” and is “activelymonitoring all portfolios” for any possiblecredit cracks, Chief Financial Officer JulieAnderson said during a recent earnings call.Cadence Bancorp. in Houston said its creditdeteriorated further in the fourth quarter —following problems in each of the two priorquarters — as the 18 billion-asset companydealt with leveraged loans. Cadence is cuttingback its exposure aggressively, Chairman andCEO Paul Murphy Jr. said during Cadence’searnings call.“Every time we look at a credit that hashigher leverage, we are scrubbing it extrahard,” Murphy said. “We’re either workingin a way to strengthen the structure [of loanterms] or we’re asking them to refinance andfind a different lender.”Problems at smaller banks appear mostlyisolated to date, but they do raise cautionaryflags and support the Fed’s increased focuson leveraged lending, said Lawrence White,an economist and professor at New YorkUniversity’s Stern School of Business.“It’s much better to identify problems earlyand find fixes, rather than wait for things tobust and have all sorts of messes to clean up,”White said.The other elements of the severely adversescenario that big banks face under CCAR arerelatively consistent with 2019’s parameters:10% unemployment, plummeting homevalues, sinking stock prices and fallinginflation. The hit to GDP is more severe.AMERICANBANKER.COMEvercore ISI analysts Glenn Schorr andJohn Pancari, in a recent note to clients,described this year’s scenario as being“slightly worse” than in 2019.“To be clear, we don’t think any of thesewill be devastating to capital return, justworse on relative terms to last year, so likelyless excess capital and lower payouts,” theanalysts said.COMMUNITY BANKINGBroadwayFinancial inCaliforniapressedto sell bySugarman-ledgroupBy Paul DavisFebruary 12, 2020Steven Sugarman has taken on the role ofactivist investor.Sugarman, a former CEO at Banc ofCalifornia, is part of a group pressuringBroadway Financial in Los Angeles to be sold.Capital Corps, an Irvine, Calif., companySugarman founded in 2017, wrote in a Feb. 10letter to Virgil Roberts, Broadway’s chairman,and Wayne-Kent Bradshaw, the company’sCEO, that a sale could fetch a 20% premiumto Broadway’s recent closing price.“We congratulate the board andmanagement team of Broadway for theirstewardship of the company over the pastdecade,” the group said in its letter, noting thatthe bank’s leadership successfully avoidedfailure in the wake of the financial crisis.“However, Broadway is once again at acrossroads and shareholders are at risk,” thegroup added.Bradshaw wasn’t immediately available tocomment.Capital Corps said in the letter that itowns about 9% of Broadway’s voting stock.PAGE 4The investor said it faces challenges to buymore shares because the minority-runbank adopted a shareholder rights plan inSeptember. Capital Corps claims the movehurt Broadway’s stock price and tradingliquidity and “will limit Broadway’s ability toaccess the capital markets in the future.”Capital Corps, which bought shares inBroadway from the Treasury Department aspart of the unwinding of the Troubled AssetRelief Program, said it has been unable tosecure a meeting with the bank’s directors todiscuss its concerns.The investor also expressed concernsthat Broadway was straying from a missionof serving minority groups and otherunderserved communities. It pointed to aninterview Bradshaw gave in September witha Los Angeles-area radio station in which hesaid the bank’s average borrower had a networth of 7 million.“Tomaximizeshareholdervalue,Broadway should recommit itself to servingall Angelinos in need of its banking services,”Capital Corps said.Though pushing for a sale, Capital Corpssaid it wants Broadway sold to a buyer thatwould keep the bank’s designations as acommunity development financial institutionand a minority depository institution. Theinvestor also wants Broadway to expand itsCDFI certification to include black, Latino/Hispanic and low-income borrowers.Sugarman led the 2010 recapitalization ofFirst PacTrust Bancorp, which later rebrandedas Banc of California. He eventually becamethe company’s chairman and CEO.Sugarman, a well-known proponentof lending to low- and moderate-incomecommunities, led the 2010 recapitalization ofFirst PacTrust Bancorp, which later rebrandedas Banc of California. He eventually becamethe company’s chairman and CEO.Banc of California faced criticism for a2016 stadium naming rights deal with aprofessional soccer franchise that listedSugarman’s brother among its investors.The Securities and Exchange Commissionalso conducted a probe into certain Banc ofCalifornia disclosures tied to questions raisedabout related-party transactions.Sugarman abruptly resigned as Banc ofCalifornia’s leader in January 2017, shortlyafter the SEC began its investigation. The SECnotified Banc of California in December thatit had concluded the investigation and wouldnot recommend an enforcement action.For up to date and complete coverage go to AmericanBanker.com

THURSDAY FEBRUARY 13, 2020SEXUAL HARASSMENTIN THE PROFESSIONALWORKPLACEPNC orderedto pay exemployee 2.4M insexualharassmentcaseBy Jon PriorFebruary 12, 2020PNC Financial Services Group must pay 2.4 million to a former employee who suedthe bank for allegedly failing to protect herfrom being sexually harassed by a customer, aNew Jersey jury ruled 8-0 on Tuesday.Damara Scott, who was a wealth managerat the bank, claimed a client, PatrickPignatello, sexually harassed her as she lefther Glen Ridge, N.J., branch in October 2013,according to the lawsuit. Several complaintshad been made to PNC’s corporate officeabout Pignatello, who was previously allegedto have groped other employees, according toScott’s suit.PNC’s bans of Pignatello from the premiseswere temporary, and the bank did not closehis account because it wanted to keep doingbusiness with him, Scott claimed.The case brought in the Superior Courtof New Jersey in Essex County will put morebusinesses on notice about their liabilityfor sexual harassment committed in theworkplace by clients, Nancy Erika Smith, anattorney for Scott, said in an interview. Thedamages awarded to Scott include lost pastand future wages as well as emotional distress.Smith said after the verdict was announcedTuesday that she planned to file anothermotion against the bank for fraudulentconcealment, claiming PNC failed to turnover the bank’s security footage of the 2013incident.PAGE 5AMERICANBANKER.COMThe filing could lead to a new trial andfurther damages awarded to Scott if a courtfinds PNC hid evidence.“It’s really time for corporate America totake this seriously,” Smith said. “Everybodyknows there is a way to do this. PNC did notdo it.”The 410.3 billion-asset bank plans toappeal the verdict, a spokesman said in anemailed statement Tuesday.“PNC does not condone harassment of anykind,” the spokesman said. “We have a longstanding history of providing a safe workplacefor our employees, and robust policies andprocedures to help ensure that we continueto do so. We are disappointed by the verdict,even though the jury expressly found that thiswas not a case where punitive damages wereappropriate. We intend to appeal based onerrors made by the court.”Pignatello was a wealthy business ownerof a construction company. He died shortlyafter allegedly assaulting Scott and before thecriminal case against him could be brought totrial, according to the New Jersey Law Journal.COMMUNITY BANKINGAimBank has 25 branches, 1.2 billion inloans and 1.5 billion in deposits in westernTexas and New Mexico. Heartland enteredwestern Texas in 2018 when it boughtFirstBank & Trust.“We are highly impressed with the peopleand performance of AimBank and the solidcommunity banking franchise they havebuilt,” Lynn Fuller, Heartland’s executiveoperating chairman, said in the release. “Westrongly believe in the growth prospects ofthe Texas market, and I am confident thatAimBank will be an outstanding addition tothe Heartland organization.”Scott Wade, AimBank’s chairman andCEO, will become vice chairman of FirstBank& Trust and president of the bank’s southdivision.Heartland said it expects the acquisitionto be 10% accretive to its earnings per sharein the first year of combined operations. Itshould take less than four years for Heartlandto earn back any dilution to its tangible bookvalue.Heartland plans to cut about 30% of AIMBancshares’ annual noninterest expenses.Heartland and AIM Bancshares expectto incur 12.9 million in merger-relatedexpenses.Panoramic Capital Advisors and Dorsey &Whitney advised Heartland, while Stephensissued a fairness opinion. Hillworth BankPartners and Fenimore, Kay, Harrison & Fordadvised AIM Bancshares.Heartland todouble size ofwestern Texasoperationswith AimBank A new kindof HBy Paul DavisFebruary 11, 2020Heartland Financial USA in Dubuque,Iowa, has agreed to buy AIM Bancshares inLevelland, Texas.The 13.2 billion-asset Heartland said in apress release Tuesday that it will pay 280.4million in cash and stock for the 1.8 billionasset parent of AimBank. The deal, which isexpected to close in the third quarter, pricedAIM as 210% of its tangible book value.It is the 17th bank acquisition Heartlandhas announced since 2012.By Penny CrosmanFebruary 11, 2020It’s no Beatles invasion, but an importantphenomenon has crossed the pond to theUnited States — regulatory hackathons, or“tech sprints” in Brit-speak.For up to date and complete coverage go to AmericanBanker.com

THURSDAY FEBRUARY 13, 2020In these get-togethers, data scientists,developers and other experts at banks,tech companies and regulatory agenciesbrainstorm on ideas for compliancetechnology. They write actual code together.Bankers are embracing the effort.“We need to try and be more collaborativeand active with regulators who correctly areasking for this input,” said Scott Essex, chiefcompliance officer at Citizens Financial inProvidence, R.I., who participated in a techsprint last summer.“I think the best use of a sandbox is a techsprint, where you bring a bunch of peopletogether with diverse skills and ideas and dosome development on a real use case that’simportant to the regulator and then you startto get feedback,” he said.The concept and term “tech sprint” wereinvented by the United Kingdom’s FinancialConduct Authority, which held the first suchevent in 2018.“They don’t like to use the word hacker,”explained Jo Ann Barefoot, founder of thenonprofit Alliance for Innovative Regulation.Last year, the FCA tried to organize ahackathon with U.S. regulators but theagencies couldn’t get the needed approvalsin time to put it together. The FCA askedBarefoot’s group to do it. AIR broughtbankers, techies and government officialstogether. Ernst & Young hosted the event inits D.C. office, and Amazon and Microsoftprovided free use of Amazon Web Servicesand Azure. More tech sprints are planned for2020.Five teams worked for three days onanswers to this question: Can the financialindustry and government use newtechnology, including privacy-enhancingencryption tools, to enable truly safe sharingof information and detection of big-datapatterns that are red flags for crime — andcould they do so across corporate andgovernmental boundaries?The United Nations estimates that 2trillion is laundered every year. Less than 1%of this activity is caught, even though banksspend billions of dollars on anti-moneylaundering tech.“The methods we’re using are noteffective,” Barefoot said.Representatives of the Federal DepositInsurance Corp., the Federal TradeCommission and the Consumer FinancialProtection Bureau participated in the hackerteams, alongside officials from Cross RiverAMERICANBANKER.COMBank, JPMorgan Chase, Wells Fargo, Square,Microsoft and regtech firms.“This was a unique opportunity to bridgethe gap between agencies and industryparticipants and foster a partnership that canensure a more sound regulatory structure asfintech evolves,” said Uriel Ashe, senior vicepresident of engineering and infrastructureat Cross River Bank, of Teaneck, N.J., whoparticipated in the event.FDIC chair Jelena McWilliams was akeynote speaker at the event and acted as ajudge.More than 65 regulatory officials from 17agencies observed the process.The slogan for the tech sprint was, “It takesa network to defeat a network.”While criminals share information freelyamong each other in networks, the financialindustry and law enforcement usually onlysee part of the picture because they have toprotect people’s privacy, Barefoot said.One thing that would help would bea shared dataset everyone could use toexperiment with, Essex suggested.“This would be an anonymized or evensynthetic set of data that was curated andprovided in these regulatory sandboxes,” hesaid. Then all developers could work withthat common dataset.“It could be really helpful,” Essex said.Essex brought data-science experts in antimoney-laundering efforts from Citizens tothe hackathon. There were four teams in totalthat came up with solutions.The groups came up with ways for theFinancial Crimes Enforcement Network,a unit of the Treasury Department, toshare data trends from suspicious activityreports without sharing any SAR data that isstatutorily illegal to share.“There are a lot of new technologies thateither encrypt information or share partialinformation that can’t be reverse-engineeredto identify who people are,” Barefoot noted.The winning team was given theopportunity to present its idea to theinnovation group at the FDIC, and all sprintparticipants got to visit Fincen’s offices.“The thing that’s kind of exciting about thisis that at the end of it, they don’t just havea white paper,” Barefoot said. “They haveactually written code that they can downloadand they can say, here is the start of a solutionto a problem.”Citizens is slated to participate in moreregulatory hackathons, Essex said.PAGE 6“I particularly like the ones focused AMLand consumer protection,” he said.Do hackathons lead to real change?Regulators in Washington often talk aboutwanting to encourage banks to innovate.Examiners who actually assess banks do notalways share this ideal. Could hackathonshelp?Barefoot acknowledged there is atechnology-knowledgegapbetweenregulators in Washington and field examiners.“But that is closing,” Barefoot said.Regulators are participating in and observinghackathons. They are starting to encouragepiloting and experimentation of technology,she said.Ashe said efforts like this fosterunderstanding between fintech companiesand the agencies regulating them.“By working together, we can educate eachother and develop new tools that can enhanceregulatory compliance while keeping pacewith the evolving fintech ecosystem,” he said.“Events like this encourage dialogue anddiscussion, and Cross River is always eager toparticipate.”Essex said that it is still early days,especially in the tricky area of AML.“We need more feedback so that we canfocus in the areas that law enforcement areinterested in,” he said. “It’s complicatedbecause the banking regulators are reallyfocused on keeping illegal activity out of the

data or just credit card information. WELLS FARGO Wells Fargo hires another JPMorgan exec as shake-up continues By Allissa Kline February 11, 2020 Wells Fargo is adding yet another New York-based JPMorgan Chase alum to its top executive ranks. The 1.9 trillion-asset bank Established 1836 One State Street Plaza, 27th floor, New York, NY 10004