Transcription

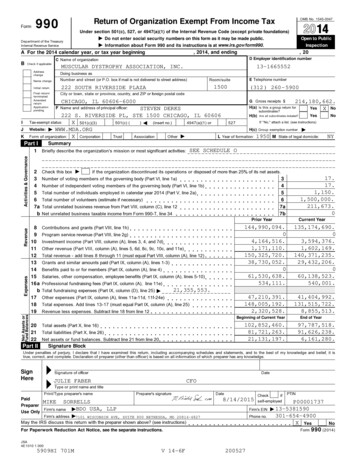

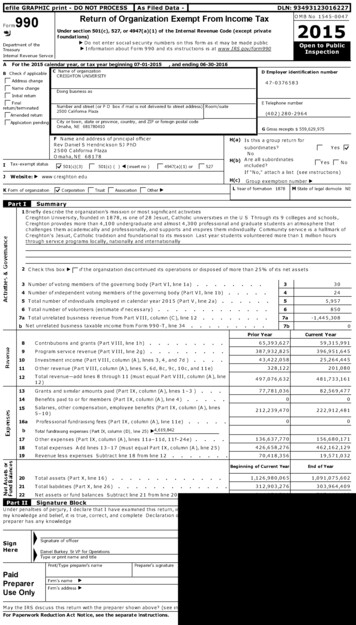

l efile GRAPHIC p rint - DO NOT PROCESSFormijI As Filed Data - IDLN: 93493123016227OMB No 1545-0047Return of Organization Exempt From Income Tax9902 15Under section 501(c ), 527, or 4947(a)(1) of the Internal Revenue Code ( except privatefoundations) Do not enter social security numbers on this form as it may be made public Information about Form 990 and its instructions is at www IRSgov/form990Department of theTreasury0Internal Revenue ServiceAFor the 2015 calendar y ear, or taxeai07-01-2015,and ending 06-30-2016C Name of organizationCREIGHTON UNIVERSITYB Check if applicableD Employer identification numberAddress change47-0376583F Name changeDoing business asInitial returnE Tele Ip VNumber and street (or P 0 box if mail is not delivered to street address) Room/suite2500 California Plazareturn/tterminatedFTAmended returnCity or town, state or province, country, and ZIP or foreign postal codeOmaha, NE 681780410F-Application PendingG Gross receipts 559,629,975F Name and address of principal officerRev Daniel S Hendrickson SJ PhD2500 California PlazaOmaha, NEH(a)Is this a group return forsubordinates?No68178Tax-exempt statusIWebsite : 501(c)(3)F501(c) () 1 (insert no )F 4947(a)(1) or[Are all subordinatesincluded ?H(b)IV(402) 280-2964 527YesPYesP NoIf "No," attach a list (see instructions)www creighton eduK Form of organization[ CorporationH(c)[ Trust F-AssociationGrou p exem p tion number 00,L Year of formation[ Other 1878M State of legal domicileNESummary1 Briefly describe the organization's mission or most significant activitiesCreighton University, founded in 1878, is one of28 Jesuit, Catholic universities in the US Through its 9 colleges and schools,Creighton provides more than 4,100 undergraduate and almost 4,300 professional and graduate students an atmosphere thatchallenges them academically and professionally, and supports and inspires them individually Community service is a hallmark ofCreighton's Jesuit, Catholic tradition and foundational to its mission Last year students volunteered more than 1 million hoursthrough service programs locally, nationally and internationallyti2 Check this box F- if the organization discontinued its operations or disposed of more than 25% of its net assets3 Number of voting members of the governing body (Part VI, line la).4 Number of independent voting members of the governing body (Part VI, line 1b)Va5 Total number of individuals employed in calendar year 2015 (Part V, line 2a).3.6 Total number of volunteers (estimate if necessary)7a Total unrelated business revenue from Part VIII, column (C), line 12b Net unrelated business taxable income from Form 990-T, line 34.3042455,95768507a-1,445,3087bPrior Year89atLLJContributions and grants (Part VIII, line Ih).Program service revenue (Part VIII, line 2g).10Investment income (Part VIII, column (A), lines 3, 4, and 7d ).11Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and Ile)12Total revenue-add lines 8 through 11 (must equal Part VIII, column (A), line12)13Grants and similar amounts paid (Part IX, column (A), lines 1-3 ).14Benefits paid to or for members (Part IX, column (A), line 4)15Salaries, other compensation, employee benefits (Part IX, column (A), lines5-10)16aProfessional fundraising fees (Part IX, column (A), line 33,16177,781,03682,569,47700212 , 239 , 470222 , 912 , 48100Total fundraising expenses (Part IX, column (D), line 25)17Other expenses (Part IX, column (A), lines h18Total expenses Add lines 13-17 (must equal Part IX, column (A), line 25)a-Ild, 1if-24e).19Revenue less expenses Subtract line 18 from line 128 ,418,35619,571,032Beginning of Current Year20Total assets (Part X , l i n e 1 6 )21Total liabilities (Part X, line 26)22Net assets or fund balances Subtract line 21 from line 20WMMM.Si g nature BlockUnder penalties of perjury, I declare that I have examined this return, imy knowledge and belief, it is true, correct, and complete Declarationpreparer has any knowledgeSignHereSignature of officerDaniel Burkey Sr VP for OperationsType or punt name and titlePrint/Type preparers namePaidPreparerUse Only0Current YearFirm's namePreparer's signature Firm's address May the IRS discuss this return with the preparer shown above? (see itFor Paperwork Reduction Act Notice, see the separate instructions.End of 09

Form 990 (2015)Page 2Statement of Program Service Accomplishments1Check if Schedule 0 contains a response or note to any line in this Part IIIBriefly describe the organization's mission.Creighton University is a Catholic and Jesuit comprehensive university committed to excellence in its selected undergraduate, graduate andprofessional programs As Catholic, Creighton is dedicated to the pursuit of truth in all its forms and is guided by the living tradition of theCatholic Church As Jesuit, Creighton participates in the tradition of the Society of Jesus which provides an integrating vision of the worldthat arises out ofa knowledge and love of Jesus Christ As comprehensive, Creighton's education embraces several colleges andprofessional schools and is directed to the intellectual, social, spiritual, physical and recreational aspects of students' lives and to thepromotion ofjustice Creighton exists for students and learning Members of the Creighton community are challenged to reflect ontranscendent values, includinq their relationship with God, in an atmosphere of freedom of inquiry, belief and religious worship2Did the organization undertake any significant program services during the year which were not listed onthe prior Form 990 or 990-EZ7Eyes[NoEYes[NoIf "Yes," describe these new services on Schedule 03Did the organization cease conducting, or make significant changes in how it conducts, any programservices?If "Yes," describe these changes on Schedule 044aDescribe the organization's program service accomplishments for each of its three largest program services, as measured byexpenses Section 501(c)(3) and 501(c)(4) organizations are required to report the amount ofgrants and allocations to others,the total expenses, and revenue, ifany, for each program service reported(Code) (Expenses 209,452,456including grants of 82,569,477 ) (Revenue 332,493,013Higher Education Instruction - Creighton University, founded in 1878, is a private Catholic, Jesuit educational institution with more than 8,300 students of diversefaiths, races and ethnic backgrounds from across the United States and 57 countries The University provides its more than 4,100 undergraduate and almost 4,300professional and graduate students a balanced educational experience, a ngorous academic agenda and a broad range of disciplines Creighton's distinctiveapproach to education instills not just information but ideals, imbues not just technical skills but critical and creative thinking, and inspires not just competence butprofessional distinction and faith-based leadership and service In addition to the College of Arts and Sciences, the University's oldest and largest school or college,Creighton University includes the Heider College of Business, the College of Nursing, the Graduate School, the Schools of Dentistry, Law, Medicine, Pharmacy andHealth Professions, and University College4b(Code) (Expenses 33,838,017including grants of ) (Revenue 10,964,293Higher Education Health Care Services - Creighton University's four health sciences schools-dentistry, medicine, nursing, and pharmacy and health professionseducate healthcare professionals who are highly trained in healthcare delivery In addition, Creighton University's School of Medicine's southwest campus at StJoseph's Hospital and Medical Center in Phoenix offers two years of clinical training to 84 medical students after they have completed their first two years of medicalschool in Omaha Creighton's health sciences schools provide healthcare education for almost 2,700 dental, medical, nursing, pharmacy and occupational andphysical therapy students4c(Code) (Expenses 64,143,531including grants of ) (Revenue 37,523,700Student Life Programs Auxiliary Services - Guided by Jesuit, Catholic values and in support of the Creighton University mission, the Division of Student Life providesprograms and services enhancing all student experiences In partnership with the campus, Student Life fosters holistic student development in the Ignatian tradition,to produce students engaged in their communities with compassion, confidence and character Student Life programs include Residential Life, Student CounselingServices, Student Health Services, Student Integrity, Wellness and Assistance, Creighton Intercultural Center, the student life function of the Encuentro Dominicanostudy abroad program, Student Leadership and Involvement Center including Welcome Week, Summer Preview (new student orientation), Creighton StudentsUnion (student government), Fraternity and Sorority Life, and over 200 registered student organization, Campus Recreation and Wellness including intramurals,housing services (approximately 2500 students live in one of the 9 residence halls on campus), dining services, Student Center, and Centralized ReservationsSee Additional Data4dOther program services (Describe in Schedule 0(Expenses 4e19,187,277Total program service expenses 00,including grants of 0 ) (Revenue 15,846,871326,621,281Form 990(2015)

Form 990 (2015)Page 3OTIVY Checklist of Re q uired SchedulesYes1Is the organization described in section 501(c)(3) or4947(a)(1) (other than a private foundation)? If "Yes,"complete Schedule A . .12Is the organization required to complete Schedule B, Schedule of Contributors (see instructions)?23Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition tocandidates for public office? If "Yes," complete Schedule C, PartI3Section 501(c )( 3) organizations.Did the organization engage in lobbying activities, or have a section 501(h) election in effect during the tax year?If "Yes, " complete Schedule C, Part II 11 .4456789IJ .NoYesYesNoYesIs the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues,assessments, or similar amounts as defined in Revenue Procedure 98-19?If "Yes, " complete Schedule C, Part IIINoDid the organization maintain any donor advised funds or any similar funds or accounts for which donors have theright to provide advice on the distribution or investment of amounts in such funds or accounts?If "Yes, " complete Schedule D, Part I.6NoDid the organization receive or hold a conservation easement, including easements to preserve open space,the environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part II7NoDid the organization maintain collections of works of art, historical treasures, or other similar assets?If "Yes, " complete Schedule D, Part III.8NoDid the organization report an amount in Part X, line 21 for escrow or custodial account liability, serve as acustodian for amounts not listed in Part X, or provide credit counseling, debt management, credit repair, or debtnegotiation services?If "Yes, " complete Schedule D, Part IV.9No10Did the organization, directly or through a related organization, hold assets in temporarily restricted endowments,permanent endowments, orquasi- endowments? If "Yes," complete Schedule D, Part V Ij .10Yes11If the organization's answer to any of the following questions is "Yes," then complete Schedule D, Parts VI, VII,VIII, IX, or X as applicablellaYesDid the organization report an amount for investments-other securities in Part X, line 12 that is 5% or more of.its total assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VII . .11bYesDid the organization report an amount for investments-program related in Part X, line 13 that is 5% or more ofits total assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VIII.llcNoDid the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assetsreported in Part X, line 16? If "Yes, " complete Schedule D, Part IX.lidNoeDid the organization report an amount for other liabilities in Part X, line 25? If "Yes," complete Schedule D, PartXijlleYesfDid the organization's separate or consolidated financial statements for the tax year include a footnote thataddresses the organization's liability for uncertain tax positions under FIN 48 (ASC 740)?If "Yes, " complete Schedule D, Part X ijlitY esabcd12abDid the organization report an amount for land, buildings, and equipment in Part X, line 10?If "Yes, " complete Schedule D, Part VI Ij .Did the organization obtain separate, independent audited financial statements for the tax year?If "Yes, " complete Schedule D, Parts XI and XII.Is the organization a school described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E14aDid the organization maintain an office, employees, or agents outside of the U nited States?1516.Was the organization included in consolidated, independent audited financial statements for the tax year?If "Yes,"and if the organization answered "No" to line 12a, then completing Schedule D, Parts XI and XII is optional13b.Did the organization have aggregate revenues or expenses of more than 10,000 from grantmaking, fundraising,business, investment, and program service activities outside the United States, or aggregate foreign investments. Ij.valued at 100,000 or more? If "Yes," complete Schedule F, Parts I and IV .12aNo12bYes13Yes14aYes14bYesDid the organization report on Part IX, column (A), line 3, more than 5,000 of grants or other assistance to orfor any foreign organization? If "Yes," complete Schedule F, Parts II and IV .15NoDid the organization report on Part IX, column (A), line 3, more than 5,000 of aggregate grants or otherassistance to or for foreign individuals? If "Yes, "complete Schedule F, Parts III and IV .16No17No17Did the organization report a total of more than 15,000 of expenses for professional fundraising services on PartIX, column (A), lines 6 and Ile? If "Yes," complete Schedule G, PartI (see instructions) .18Did the organization report more than 15,000 total offundraising event gross income and contributions on Part.VIII, lines Ic and 8a? If "Yes," complete Schedule G, Part II .Ij1819Did the organization report more than 15,000 ofgross income from gaming activities on Part VIII, line 9a? If"Yes," complete Schedule G, Part III .19No20aDid the organization operate one or more hospital facilities? If "Yes, " complete Schedule H20aNob.If "Yes" to line 20a, did the organization attach a copy of its audited financial statements to this return?Yes20bForm 990(2015)

Form 990 (2015)Page 4Checklist of Required Schedules (continued)21Did the organization report more than 5,000 ofgrants or other assistance to any domestic organization ordomestic government on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II .2122Did the organization report more than 5,000 ofgrants or other assistance to or for domestic individuals on Part. .IX, column (A), line 2? If "Yes,"complete Schedule I, Parts I and III .22Yes23Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the organization'scurrent and former officers, directors, trustees, key employees, and highest compensated employees? If "Yes,"complete Schedule J .Ij23Yes24aDid the organization have a tax-exempt bond issue with an outstanding principal amount of more than 100,000as of the last day of the year, that was issued after December 31, 2002? If "Yes,"answer lines 24b through 24dand complete Schedule K If "No,"go to line 25a .ij24aNoYesbDid the organization invest any proceeds oftax-exempt bonds beyond a temporary period exception?24bNocDid the organization maintain an escrow account other than a refunding escrow at any time during the yearto defease any tax-exempt bonds?24cNoDid the organization act as an24dNo25aNo25bNoDid the organization report any amount on Part X, line 5, 6, or 22 for receivables from or payables to any currentor former officers, directors, trustees, key employees, highest compensated employees, or disqualified persons?If 'Yes, 'complete Schedule L, Part II .26NoDid the organization provide a grant or other assistance to an officer, director, trustee, key employee, substantialcontributor or employee thereof, a grant selection committee member, or to a 35% controlled entity or familymember of any ofthese persons? If "Yes," complete Schedule L, Part III .tj27don behalf of issuer for bonds outstanding at any time during the year?25a Section 501(c )( 3), 501 ( c)(4), and 501 ( c)(29) organizations.Did the organization engage in an excess benefit transaction with a disqualified person during the year? If "Yes,"complete Schedule L, Part I .b262728Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prioryear, and that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ?If "Yes, " complete Schedule L, Part I .YesWas the organization a party to a business transaction with one of the following parties (see Schedule L, Part IVinstructions for applicable filing thresholds, conditions, and exceptions)aA current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L,Part IV .b A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete ScheduleL,Part IV .c28aNo28bNoA n entity of which a current or former officer, director, trustee, or key employee (or a family member thereof) was 4 an officer, director, trustee, or direct or indirect owner? If "Yes," complete Schedule L, PartIV28cYes29Did the organization receive more than 25,000 in non-cash contributions? If "Yes," complete Schedule M29Yes30Did the organization receive contributions of art, historical treasures, or other similar assets, or qualifiedconservation contributions? If "Yes, " complete Schedul e M .30No31NoDid the organization sell, exchange, dispose of, or transfer more than 25% of its net assets?If 'Yes, 'complete Schedule N, Part II .32NoDid the organization own 100% of an entity disregarded as separate from the organization under Regulationssections 301 7701-2 and 301 7701-3? If "Yes," complete Schedule R, Part I .33No34Was the organization related to any tax-exempt or taxable entity? If "Yes," complete Schedule R, Part 11, III, or IV,and Part V, line 1 .I34Yes35aDid the organization have a controlled entity within the meaning of section 512(b)( 13)?35aYesIf'Yes'to line 35a, did the organization receive any payment from or engage in any transaction with a controlledentity within the meaning of section 512(b)(13)? If "Yes," complete Schedule R, Part V, lme2 .31Did the organization liquidate, terminate, or dissolve and cease operations? If "Yes," complete Schedule N, Part I3233b36373835bNoSection 501(c )( 3) organizations . Did the organization make any transfers to an exempt non-charitable relatedorganization? If "Yes," complete Schedule R, Part V, line2 .36NoDid the organization conduct more than 5% of its activities through an entity that is not a related organizationand that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R, Part VI37NoDid the organization complete Schedule 0 and provide explanations in Schedule 0 for Part VI, lines 11b and 19?Note . All Form 990 filers are required to complete Schedule 0.38YesForm 990(2015)

Form 990 (2015)Page 5Statements Regarding Other IRS Filings and Tax ComplianceCheck if Schedule 0 contains a res p onse or note to an y line in this Part VYesla Enter the number reported in Box 3 of Form 1096 Enter -0- if not applicablela11,496lb0bEnter the number of Forms W-2G included in line la Enter -0- if not applicablecDid the organization comply with backup withholding rules for reportable payments to vendors and reportablegaming (gambling) winnings to prize winners?.2a Enter the number of employees reported on Form W-3, Transmittal of Wage andTax Statements, filed for the calendar year ending with or within the year coveredby this return .b 2aIf at least one is reported on line 2a, did the organization file all required federal employment tax returns?Note .Ifthe sum of lines la and 2a is greater than 250, you may be required to e-file (see instructions)3a Did the organization have unrelated business gross income of 1,000 or more during the year?Yes2bYes5,9573aYes.3bYes4a At any time during the calendar year, did the organization have an interest in, or a signature or other authorityover, a financial account in a foreign country (such as a bank account, securities account, or other financialaccount)?.4aNo5aNo5bNobb.1cNoIf"Yes," has it filed a Form 990-T for this year?lf "No"toline3b, provide an explanation in Schedule 0.If "Yes," enter the name of the foreign country See instructions for filing requirements for FinCEN Form 114, Report of Foreign Bank and Financial Accounts(FBA R)5a Was the organization a party to a prohibited tax shelter transaction at any time during the tax year?bDid any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?cIf "Yes," to line 5a or 5b, did the organization file Form 8886-T?Sc6a Does the organization have annual gross receipts that are normally greater than 100,000, and did theorganization solicit any contributions that were not tax deductible as charitable contributions?.b76aIf "Yes," did the organization include with every solicitation an express statement that such contributions or giftswere not tax deductible?.No6bOrganizations that may receive deductible contributions under section 170(c).aDid the organization receive a payment in excess of 75 made partly as a contribution and partly for goods andservices provided to the payor?7aYesYesbIf "Yes," did the organization notify the donor of the value of the goods or services provided?7bcDid the organization sell, exchange, or otherwise dispose of tangible personal property for which it was required tofile Form 8282?.7cdIf "Yes," indicate the number of Forms 8282 filed during the yeareDid the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?fDid the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?gIfthe organization received a contribution ofqualified intellectual property, did the organization file Form 8899 asrequired?7ghIfthe organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file aForm 1098-C?.7h8.Ib10.Sponsoring organizations maintaining donor advised funds.Did a donor advised fund maintained by the sponsoring organization have excess business holdings at any timeduring the year?.9a Did the sponsoring organization make any taxable distributions under section 4966?11No7d.Did the sponsoring organization make a distribution to a donor, donor advisor, or related person?7eNo7fNo89a9bSection 501(c )( 7) organizations. EnteraInitiation fees and capital contributions included on Part V III, line 12bGross receipts, included on Form 990, Part VIII, line 12, for public use of clubfacilities11.10a10bSection 501(c )( 12) organizations. EnteraGross income from members or shareholdersbGross income from other sources (Do not net amounts due or paid to other sourcesagainst amounts due or received from them ) .11a11b12a Section 4947 ( a)(1) non - exempt charitable trusts .Is the organization filing Form 990 in lieu of Form 1041?b13If "Yes," enter the amount of tax-exempt interest received or accrued during theyear12a12bSection 501(c)(29) qualified nonprofit health insurance issuers.aIs the organization licensed to issue qualified health plans in more than one state?Note . See the instructions foradditional information the organization must report on Schedule 0bEnter the amount of reserves the organization is required to maintain by the statesin which the organization is licensed to issue qualified health plans13bcEnter the amount of reserves on hand13c14ab13aDid the organization receive any payments for indoor tanning services during the tax year?14aIf "Yes," has it filed a Form 720 to report these payments?lf 'No,' provide an explanation in Schedule O14bNoForm 990(2015)

Form 990 (2015)LiQL Page 6Governance, Management , and DisclosureFor each "Yes" response to lines 2 through 7b below, and for a "No" response to lines 8a, 8b, or 10b below,describe the circumstances, processes, or changes in Schedule 0. See instructions.Check i f Schedule 0 contains a response or note to any l i n e i n t h i s Part V ISection A. Governina Bodv and ManaaementYesla Enter the number of voting members of the governing body at the end of the taxyearla30lb24INoIf there are material differences in voting rights among members of the governingbody, or if the governing body delegated broad authority to an executive committeeor similar committee, explain in Schedule 0bEnter the number of voting members included in line la, above, who areindependent2Did any officer, director, trustee, or key employee have a family relationship or a business relationship with anyother officer, director, trustee, or key employee?3Did the organization delegate control over management duties customarily performed by or under the directsupervision of officers, directors or trustees, or key employees to a management company or other person?42No3NoDid the organization make any significant changes to its governing documents since the prior Form 990 wasfiled?4No5Did the organization become aware during the year ofa significant diversion of the organization's assets?5No6Did the organization have members or stockholders?6No7aNo7bNo7a Did the organization have members, stockholders, or other persons who had the power to elect or appoint one ormore members of the governing body?.b Are any governance decisions of the organization reserved to (or subject to approval by) members, stockholders,or persons other than the governing body?8Did the organization contemporaneously document the meetings held or written actions undertaken during theyear by the followingaThe governing body?8aYesbEach committee with authority to act on behalf of the governing body?8bYes9Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at theorganization's mailing address? If "Yes,"provide the names and addresses in Schedule 0 .Section B. Policies9NoThis Section B re q uests information aboutpolicies not re uired b y the Internal Revenue Code. )Yes10ab11ab12aDid the organization have local chapters, branches, or affiliates?10aIf "Yes," did the organization have written policies and procedures governing the activities ofsuch chapters,affiliates, and branches to ensure their operations are consistent with the organization's exempt purposes?10bHas the organization provided a complete copy of this Form 990 to all members of its governing body before filingthe form?11aYesDescribe in Schedule 0 the process, if any, used by the organization to review this Form 990Did the organization have a written conflict of interest policy? If "No,"go to line 1312aYesWere officers, directors, or trustees, and key employees required to disclose annually interests that could giverise to conflicts?12bYesDid the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes,"describein Schedule 0 how this was done .12cYes13Did the organization have a written whistleblower policy?13Yes14Did the organization have a written document retention and destruction policy?14Yes15Did the process for determining compensation of the following persons include a review and approval byindependent persons, comparability data, and contemporaneous substantiation of the deliberation and decision?bcNoNoaThe organization's CEO, Executive Director, or top management official15aYesbOther officers or key employees of the organization15bYesIf "Yes" to line 15a or 15b, describe the process in Schedule 0 (see instructions)16abDid the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement with ataxable entity during the year?16aIf "Yes," did the organization follow a written policy or procedure requiring the organization to evaluate itsparticipation in joint venture arrangements under applicable federal tax law, and take steps to safeguard theorganization's exempt status with respect to such arrangements?16bNoSection C. Disclosure17List the States with which a copy of this Form 990 is required to be18Section 6104 requires an organization to make its Form 1023 ( or 1024 if applicable ), 990, and 990-T ( 501(c)(3)s only ) available for public inspection Indicate how you made these available Check all that apply1920F Upon requestF- Own websiteF- Another' s websiteF- Other ( explain in Schedule O )Describe in Schedule 0 whether (and if so, how ) the organization made its governing documents, conflict ofinterest policy , and financial statements available to the public during the tax yearState the name, address, and telephone number of the person who possesses the organization ' s books and recordsK Madsen 2500 California Plaza Omaha , NE 681780410 ( 402)280-2964Form 990(2015)

Form 990 (2015)Page 7Compensa

professional programs As Catholic, Creighton is dedicated to the pursuit oftruth in all its forms and is guided by the living tradition ofthe . Creighton University includes the Heider College of Business, the College of Nursing, the Graduate School, the Schools of Dentistry, Law, Medicine, Pharmacy and .