Transcription

SEPTEMBER 2020 – EDF ECONOMICS DISCUSSION PAPER SERIES – EDF EDP 20–02Wholesale Electricity MarketDesign for DecarbonizationResearch OpportunitiesChristopher Holt

About Environmental Defense FundGuided by science and economics, Environmental Defense Fund (EDF) tackles our most urgentenvironmental challenges with practical solutions. EDF is one of the world's largestenvironmental organizations, with more than 2.5 million members and a staff of 700 scientists,economists, policy experts and other professionals around the world.EDF Economics Discussion Paper SeriesEDF Economics Discussion Papers represent unrefereed works-in-progress by researchers whoare solely responsible for the content and any views expressed therein. Any comments on thesepapers are welcome and should be sent to the author(s) by email. EDF’s Office of the ChiefEconomist manages the series.Sharing Our Discussion PapersOur Discussion Papers (the “Materials”) are available for sharing and adaptation under anAttribution-NonCommercial-NoDerivatives 4.0 International (CC BY-NC-ND 4.0) license (the“License”). You can copy and redistribute the Materials in any medium or format; provided,however: (i) you must give appropriate credit to us through recognition of our authorship of theMaterials (generally by citing to the Materials); (ii) you must provide the link to the License asper the below; (iii) If you remix, transform, or build upon the Material, you may not distributethe modified Material without our prior written consent; (iv) you may not apply any additionalrestrictions to any third party that you distribute the Material to other then as specified herein,except that you may not permit any third party to remix, transform or build upon the Materials,without our prior written consent; and (v) you may not reproduce, duplicate, copy, distribute,transmit, sell, trade, resell or exploit for any commercial purpose any portion of theMaterials. Images, trademarks, service marks, logos and icons used in the discussion papers areour property and may not be used without our prior written consent. License information can befound by visiting: https://creativecommons.org/licenses/by-nc-nd/4.0/ 2020 Environmental Defense Fund. All rights reserved.

Wholesale Electricity Market Design forDecarbonization: Research OpportunitiesChristopher HoltPhD candidate, Department of Agricultural and Resource Economics, University of Maryland,cholt16@terpmail.umd.eduAbstractI review several prominent wholesale electricity market design challenges presently facing policymakers, explain their importance with respect to decarbonization of the energy system, andidentify a number of areas where economic research can inform policy to facilitatedecarbonization. I draw from the experience of the deregulated electricity markets in the U.S.and a large economics literature to illustrate these challenges. Market designs that incentivizeprice-responsive demand have the potential to improve efficiency and help accommodateintermittent renewable generation resources. Utility-scale storage technologies promise todramatically change how supply and demand are balanced in the short run. Designs promotingefficient long-run investment, such as capacity markets and scarcity pricing, must contemplatetechnological complementarities and other generator attributes if they are to achieve reliabilitystandards and decarbonization at lowest cost. Long-run contracts mitigate risk and marketpower, and are instrumental in deploying renewable energy, yet their role in future marketdesigns is not clearly defined. Internalizing the social cost of carbon is crucial to both short- andlong-run market design objectives.KeywordsEnergy, environmental economics, market structure, market pricing, industrial policyJEL classification numbersQ42, Q50, D47, L50

AcknowledgmentsThis report was written as part of a summer predoctoral fellowship program at EnvironmentalDefense Fund (EDF) with Kristina Mohlin acting as my EDF advisor. I am grateful to SylwiaBialek, Dallas Burtraw, Steve Capanna, Peter Cramton, Benjamin Dawson, Liz Delaney, RicardoEsparza, Brian George, Geoffrey Heal, Paul Joskow, Suzi Kerr, Joshua Linn, Kristina Mohlin,Juan-Pablo Montero, Karen Palmer, Kim Rainwater, Matthew Schwall, Beia Spiller, RamaZakaria, participants at the NBER Economics of Electricity Markets and Regulation Workshop(May 2019), and participants at the Harvard Electricity Policy Group 95th Plenary Session (June2019), for engaging conversations and useful comments that informed this report. The viewsand opinions expressed herein are solely my own and do not necessarily reflect those of EDF orothers.

ContentsContents. 51.Introduction . 62.Short-run efficiency . 73.Unlocking price-responsive demand . 73.1 Finding the Holy Grail .73.2 Impediments to price-responsive demand .93.3 One evolving wholesale design solution .103.4 Research opportunities related to price-responsive demand .124.Storage . 135.Long-run efficiency . 166.Capacity markets . 166.1 Design implications for new generation .176.2 Complementary generation .186.3 Research questions: Capacity markets .197.Scarcity pricing. 207.1 Research questions: Scarcity pricing .208.The changing role of forward energy and capacity contracts . 218.1 Research questions: Long-term contracts for renewable energy .229.Carbon emissions mitigation policies . 229.1 Research questions: Carbon mitigation policies in the context of wholesale electricity markets .2410.Conclusions . 25References. 285

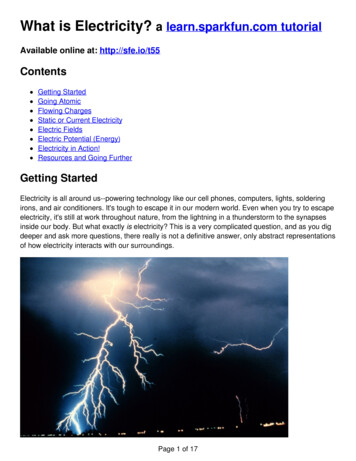

EDF Economics Discussion Paper 20-021. IntroductionDecarbonization of the U.S. economy to meet climate policy goals will require fundamentalchanges in the electricity sector, which is responsible for approximately 32% of energy-relatedcarbon emissions and 37% of primary energy use (EIA 2020b). Large-scale electrification ofenergy use in transportation, industry, and commercial and residential buildings willsignificantly increase electricity consumption, adding to the importance of reducing carbonemissions from electricity generation. Fortunately, the economics of a transition to low andzero-carbon electricity production are favorable in several ways. Renewable energy sources suchas wind and solar are cost competitive with fossil-based generation. Utility-scale and distributedstorage technologies are developing apace and promise to play an important role in balancingelectricity supply and demand. Cheap natural gas, while presenting its own set of challenges forcontinued decarbonization of the energy system, has hastened the exit of coal plants, the worstpolluters among power generators. Original electricity market designs coordinated one-waypower flows from generators (mostly fossil based) to consumers, whose demand was treated asperfectly inelastic. These designs did not internalize the social costs from greenhouse gasemissions. New market designs require accommodating the unique characteristics of renewableenergy and storage technologies, facilitating price-responsive demand, enabling two-way powerflows for consumers with distributed energy resources and internalizing the social cost ofcarbon.In this paper, I define an economic research agenda for facilitating decarbonization throughwholesale electricity market design, drawing from the experience of deregulated markets in theU.S. — those administered by independent system operators or regional transmissionorganizations. Because this topic is very broad in scope, I limit my discussion to severalprominent areas of study, focusing on topics where conversation among policy makers andeconomists is the most animated. Several recent overview papers outline emerging issues inelectricity market design, including Cramton (2017), Peterson and Ros (2018), Helm andHepburn (2019), Joskow (2019), Wellinghoff (2019) and Wolak (2019). This article is intendedto complement these works by offering a series of specific research questions for economists toaddress through future academic study or policy analysis. Accordingly, I refer the reader to theseand other works where appropriate for more thorough explanations of institutional details andunderlying economic theory.6

Wholesale Electricity Market Design for Decarbonization2. Short-run efficiencyShort-run efficiency means balancing supply and demand optimally using available resources.In a perfectly competitive market, this typically results in a price that is equal to marginal cost.In electricity markets, the marginal cost of production varies continually, but consumers areusually exposed to retail prices that are time invariant and based on average costs. Economistshave long posited that economic efficiency would be improved if downstream (retail) prices weremore reflective of marginal cost (Borenstein and Holland 2005; Joskow and Wolfram 2012).This assertion is based on the reasoning that price variation will allow consumers to respond attimes when marginal cost exceeds their willingness to pay.These potential efficiency gains are intimately connected to decarbonization. Time-variantelectricity pricing can help encourage consumption during times when electricity is abundant,cheap and clean, rather than scarce, expensive and polluting. It can also help smooth out pricevolatility induced by intermittent supply from renewables. In addition, reducing the number ofpeak-pricing events can defer the need to invest in new generation capacity at a time when muchof this capacity derives from burning fossil fuels.Electricity markets are indeed already evolving toward enabling price-responsive demand. Inthis section, I describe the current state of electricity market design with respect to efforts toengage demand-side participation in wholesale markets. I suggest that retail-side (downstream)questions of consumer behavior, technology adoption and rate design must be complementary,with research addressing how wholesale-side (upstream) market design changes can stimulateprice-responsive demand. To illustrate this, I use the policy experience of so-called “demandresponse” programs, which are a mechanism for enabling demand-side participation inwholesale electricity markets. I conclude with a list of research questions pertaining to largescale battery storage, which also has great potential to help balance supply and demand moreefficiently. Battery storage is both a demand- and supply-side resource, and therefore hasprofound implications for wholesale electricity market design.3. Unlocking price-responsive demand3.1 Finding the Holy GrailFor economists, liberating the price-responsive portion of the demand curve is analogous tosearching for the Holy Grail (see, e.g., Puller and West 2013). Although elusive, the social7

EDF Economics Discussion Paper 20-02welfare gains from price-responsive demand are potentially large (Borensten and Holland2005). Electricity generators sell through three channels: self-supply arrangements, bilateralcontracting and spot markets. Spot markets (which I also refer to here as “energy markets”) arecleared via auction on a day-ahead and real-time basis, and the clearing price reflects the cost ofthe marginal generator — the most expensive unit to be called upon for dispatch. As such, anincremental reduction in demand by even a small price-sensitive contingent can obviate theneed to dispatch generation from an expensive price-setting unit, and therefore has the potentialto reduce costs for all spot market consumers.The demand side of electricity markets is brokered through load serving entities (LSEs), whichbuy electricity on the wholesale market and sell it to residential, commercial and industrialcustomers. LSEs include competitive electricity supply companies (ESCOs) in retail-deregulatedmarkets, and regulated or not-for-profit entities, including utilities and cooperatives. Howmarginal cost-based variations in the wholesale price of electricity are passed along toconsumers depends on how prices are set at the LSE level — either competitively or through aregulatory process.In addition to introducing demand response programs, system operators have taken otheradministrative steps to enable price-responsive demand in wholesale electricity markets. (I referto consumers’ shifting their consumption of electricity according to price signals as “priceresponsive demand.” I use the phrase “demand response” to refer to a specific type of programadministered by system operators, explained in greater detail below. These programs are one ofmany ways to facilitate price-responsive demand through wholesale electricity market design.)LSEs can, for example, bid into spot markets using a demand schedule that specifies a quantitythey are willing to purchase at a given price. This schedule could thus be used to reflect the priceresponsiveness of end-use customers facing time-variant prices.Figure 1 illustrates demand in the day-ahead spot market in ISO-NE (the independent systemoperator for New England) in the 17th hour of July 23, 2018. The solid black line shows theactual aggregate demand bid into the market by LSEs. These bids reveal some degree of pricesensitivity, mostly at higher price levels that are well above the market clearing price of 48. Atthis price, indicated by the blue line in the figure, demand remains extremely inelastic.Presumably, this aggregate demand curve — submitted by LSEs on behalf of consumers — is notfully reflective of the price sensitivity of some consumers. For example, only 4.5% of residentialconsumers used time-variant pricing in 2017 (EIA 2020a). This group most likely representsonly a small portion of all price-sensitive demand. As more price-sensitive demand is “unlocked”8

Wholesale Electricity Market Design for Decarbonizationthrough market design and technological advances, one would expect a shift to a more elasticdemand curve, represented hypothetically by the dotted line in the figure.FIGURE 1Demand bids in day-ahead market, ISO-NE, hour ending 5 p.m.,July 23, 2018Source: ISO-NE.3.2 Impediments to price-responsive demandAchieving welfare gains from price-responsive demand has been impeded by a variety of factors(Wolak 2013). One commonly cited barrier has been the lack of advanced meter infrastructure(AMI) — so-called “smart meters” and other technologies that enable detailed measurement ofelectricity consumption and two-way communication between the customer and the utility.Indeed, an LSE cannot charge time-variant prices without information on customers’ timevariant consumption. Due largely to state and federal initiatives, however, AMI penetration isnow greater than 50% in the U.S. (FERC 2018). In ERCOT (the independent system operator inTexas), virtually all load (demand) is cleared using smart meter infrastructure that measures9

EDF Economics Discussion Paper 20-02consumption by end users in 15-minute intervals. ERCOT’s deregulated retail market allowsESCOs to charge the real-time price, if they are so inclined.Such developments raise questions about whether innovations in retail price offerings havefollowed from AMI deployment, the extent to which they have made retail rates more reflectiveof marginal cost, and what the attendant social welfare gains have been. There is a vast literatureexamining retail rate design and consumer behavior that is outside of the scope of this paper.1This research must be complemented by an understanding of how well the wholesale market isdesigned to accommodate, or indeed encourage, price-responsive demand. In other industries,retailers compete for market share by lowering prices vis-à-vis their rivals. Presumably, timevariant pricing can be used to offer price discounts to some customers, thus offering acompetitive dimension that allows retailers to capture rents (Borenstein and Holland 2005).Such a competitive edge need not require a behavioral response to be elicited directly from theconsumer. Rather, customers can agree to participate in programs passively, where a third partyadjusts their consumption for them (say, by cycling programmable appliances on and off inresponse to price signals).2Even with the promise of programmable technologies and customer aggregation, ESCOs haveevidently been unable to use time-variant pricing competitively. This raises the question of whyretailer incentives to implement time-variant pricing remain weak while the gains to consumerwelfare are large. Below, I explore whether wholesale market design can yet encourage retailcompetition along this dimension.3.3 One evolving wholesale design solutionThe evolution of “demand response” programs offers some insight into how wholesale marketdesign can facilitate price-responsive demand. Demand response is a term of art referring toprograms administered by system operators, where a market participant agrees to curtail loadrelative to a baseline in return for compensation from the system operator. Depending on themarket, participants may include approved individual load resources (such as large industrial1Hortaçsu et al. (2017), for example, examine consumer inertia in the Texas retail electricity market, which hasencouraged retail competition since 2002. The authors posit that search frictions and a behavioral bias toward theincumbent provider inhibit retailers from effectively competing for market share using price discounts. Schneider andSunstein (2017) lay out an elegant framework for future behavioral research by developing an analytical modeldemonstrating that, contrary to the classical literature, the most reflective rates may not be the most efficient due tobehavioral consumer biases. Ito 2014 suggests that consumers are responsive to average, rather than marginal,prices, providing empirical evidence from consumer response to nonlinear pricing in California.2 Wolak 2019 discusses automated technologies and retail pricing.10

Wholesale Electricity Market Design for Decarbonizationcustomers) or aggregated load. While demand response programs have existed in some marketsroughly since deregulation, they continue to evolve and grow.3The fundamental design of demand response programs presents interesting challenges foreconomists. Most demand response programs are administered through capacity markets ratherthan energy markets.4 In this setting, firms are called upon an independent system operator(ISO) to reduce load in anticipation of a capacity-constrained emergency. Demand responseprograms can also take the form of negative supply bids in energy markets. Both types ofprogram require estimating a necessarily imperfect baseline — a counterfactual consumptionprofile based on historical load patterns. Participants may be rewarded for demand reductionsthey would have undertaken in the absence of a policy; others may intentionally inflate theirbaseline to be rewarded an artificially high level of compensation.5 Despite these challenges,demand response programs are gaining traction. In the PJM ISO interconnection, for example,demand response resources totaled 6.5% of peak load in 2017 (FERC 2018).One reason for the success of demand response programs may be that the market design allowssomething that cannot be achieved through retail rate design: a wholesale incentive to keepprices low. Through retail rate design, the individual consumer can accrue cost savings bybuying less electricity when prices are high. For any number of reasons, individual response tothis incentive may be limited, thus constraining a retailer’s ability to capture rents by offeringtime-variant pricing. In contrast, demand response programs allow participants directcompensation for reducing marginal demand that would otherwise have raised prices for allconsumers in the energy market. Demand response payments to participants are ultimatelyborne by consumers, but if implemented properly this cost burden is small relative to savings.6Consider a market where 20,000 MW are being consumed in an hour. In a situation where asmall increase in demand leads to an increase in the wholesale price of 5 in that hour, avoidingthe small demand increases saves 100,000 in consumer surplus. What demand responseprograms do is effectively channel a portion of the 100,000 in savings to the demand responseparticipants. This incentive exists only by market design and, importantly, is only loosely tied tothe individual customer savings. Indeed, a consumer may be indifferent to the amount of cost3Some programs were delayed by a period of legal and regulatory uncertainty. ISO-NE implemented a new demandresponse program only recently, on June 1, 2018. ERCOT’s demand response program expanded by approximately19% between 2016 and 2017 (FERC 2018).4 See Blumsack (2018) and Gagne et al. (2018) for useful overviews and case studies.5 See Bushnell et al. (2009) for an overview.6 Walawaker et al. (2008) find empirically that social welfare gains were larger than the losses from payments toparticipants in PJM.11

EDF Economics Discussion Paper 20-02savings they achieve from responding to price signals, but a third-party aggregator will be ableto capture rents if they can shift the demand of a large enough contingent of consumers. As longas the aggregator can induce enough participation, demand response programs enable bothconsumers and aggregators to be better off.3.4 Research opportunities related to price-responsive demandWhat are the potential social welfare gains from price-responsive demand?Before examining how to design markets to stimulate price-responsive demand, it is importantto understand how much of a difference this will make. Imelda et al. (2018 extend) a strand ofliterature that addresses this question. They employ a sophisticated linear programming modelto estimate potential social welfare gains from dynamic pricing in Hawaii. While this analysis islimited to the experience of Hawaii and its unique energy profile, the open source model, knownas Switch 2.0, is “widely adaptable to other settings,” offering a promising avenue of research.Future applications may explore, for example, how efficiency gains vary across electricitysettings with different characteristics such as storage and generation portfolios, or demandprofiles. Future analyses may consider both short- and long-run effects (Borenstein 2005). Masselectrification, which promises to bring increased demand and the potential for coordinatedresponse, is an important consideration for future research that uses models like Switch 2.0.Examining social costs of pollution as a component of time-variant pricing also represents anongoing area for new research. Borenstein and Bushnell (2018), for instance, compare electricityprices to social marginal costs (which account for pollution externalities) to understanddeadweight losses from time-invariant pricing.Do wholesale market structures impede retail competition and price-responsivedemand? What wholesale market design reforms could help stimulate priceresponsive demand?The most commonly cited impediments to price-responsive demand focus on retail rate design,behavioral responses and the market rules that dictate retail competition. For any combinationof these reasons, LSE incentives to stimulate price-responsive demand — to find the “HolyGrail” portion of the demand curve — are evidently weak. Can wholesale market design also bean impediment? Although they are perhaps not as obvious as retail-side issues, wholesale-sideimpediments can arise in a number of ways. Hogan (2013) observed that the existing price capson generator supply offers dampen the price signal to LSEs. Bilateral contracting may also play arole — LSEs with predetermined load and price commitments may not have an incentive tostimulate an active demand side.12

Wholesale Electricity Market Design for DecarbonizationTechnological advances that facilitate automated load management, coordination andaggregation may yet provide a tipping point for enabling price-responsive demand. If consumersremain indifferent to small changes in their electricity costs, third parties may still beincentivized to offer demand management services (without requiring active participation onbehalf of the contracting customer) if certain technological capabilities — such as programmableappliances — are available to them (Wolak 2019). Policy interventions that spurred the build-outof AMI may provide a framework for the deployment of programmable devices.How well are demand response programs performing?Demand response programs are one way in which LSEs or other third parties are incentivizedthrough market design to capture efficiencies from price-responsive demand. Walawakar et al.(2010) examine the early experiences of system operators PJM and NYISO. These programspreceded Federal Energy Regulatory Commission (FERC) Order 745, which required thatdemand response participants be compensated at the locational marginal price. The matter ofcompensation was the subject of a long debate (King et al. 2015).7 Against this backdrop, newempirical work may examine how programs have played out in practice.An empirical analysis of wholesale bidding by LSEs may be informative to the extent that timevariant pricing programs are reflected in energy market bids. Similarly, data on LSE electricitysales and prices can be used to measure elasticities (Miller and Alberini 2016).4. StorageIn general, the economics literature underpinning electricity markets is premised on the uniquefeature that electricity is not storable. A gap in this literature emerges once storage technologiesbecome a reality — how might the foundational literature be amended to account for thischange? The literature dealing with pumped hydro storage provides a starting point forextensions dealing with battery technologies (see, e.g., Anderson 1972). For brevity, I discusshere only a few of many relevant economic issues that may be promising areas of futureresearch. While the discussion pertains mostly to large-scale battery storage directlyparticipating in the wholesale markets, many questions are relevant to storage deployment inother segments of the market (such as behind-the-meter storage).7See also Brief of Stanford Economics Professor Charles D. Kolstad as amicus curiae in support of petitioners,Federal Energy Regulatory Commission v. Electric Power Supply Association, 577 U.S. (2016).13

EDF Economics Discussion Paper 20-02What are the social welfare gains from energy arbitrage? How much will storagetechnologies reduce emissions?Energy arbitrage refers to the opportunity for market participants to profit from buying andselling electricity based on price fluctuations. While this is not the only service storagetechnologies can provide, it has the unique potential to smooth price variation, with significantimplications for how intermittent supply can be accommodated and how marginal generationcosts are passed through to consumers. The Switch 2.0 model presented by Imelda et al. (2018)may prove useful in modeling these effects. Sioshansi (2010) offers an overview of storagetechnological developments in the U.S. and outlines a research agenda.Bringing storage onto the grid may not lead to unequivocal reductions in carbon emissions fromdisplaced generation, especially in the absence of a sufficiently high carbon price. Indeed, energyarbitrage facilitated through storage may amplify the effects of carbon pricing policies byincreasing system responsiveness to price signals. Linn and Shih (2019) present a model thatillustrates how the amount of emissions reductions achieved from storage depends on theresponsive generation mix and the price imposed on carbon emissions.How do pricing and investment incentives change when storage is considered?How can classical models be extended?Joskow (2019) notes that energy arbitrage will encourage entry of storage capacity to an extent,although incentivizing efficient investment in storage fo

Defense Fund (EDF) with Kristina Mohlin acting as my EDF advisor. I am grateful to Sylwia Bialek, Dallas Burtraw, Steve Capanna, Peter Cramton, Benjamin Dawson, Liz Delaney, Ricardo . Kim Rainwater, Matthew Schwall, Beia Spiller, Rama Zakaria, participants at the NBER Economics of Electricity Markets and Regulation Workshop (May 2019), and .