Transcription

COREMetadata, citation and similar papers at core.ac.ukProvided by Research Papers in EconomicsThe Changing Competition Between CommercialBanks and Thrift Institutions for DepositsJEAN M. LOVATICtAOMMERCIAL banks and thrift institutions (savings and Joan associations and mutual savings banks)compete in various ways for deposits of customers.Commercial banks offer a full range of services andattract customers with “one-stop” banking. One ofthese services is the checking account, This type ofaccount provides depositors with a convenient andwidely accepted means of making third party payments, but because of Federal regulations, deposits inthese accounts do not explicitly bear interest.the institutions to compete more effectively with commercial banks for customers’ deposits. Innovations atsavings and loan associations and mutual savingsbanks are discussed in the first sections of the paper.The impact of the changes on competition betweencommercial banks and thrifts is examined in the nextsection, The response of connnercial banks and theirregulators to the challenge posed by the increasedcompetition is then described.Thrift institutions, on the other hand, historicallyhave not been able to offer checking accounts. If depositors of a thrift institution desire to make paymentsto third parties, they either withdraw cash from theirsavings accounts or withdraw funds in the form ofchecks written by the thrift institution on its demanddeposit account at a commercial bank. While the depositors may find this method of payment less convenient than using a checking account, they earninterest on their deposited funds. Moreover, the rateof interest that thrift institutions are allowed to payon savings deposits is somewhat higher than thatpermitted for commercial banks.NEW SERVICES ATTHRIFT INSTITUTIONSRecent competition for deposits between commercial banks and thrift institutions has been undergoingrapid change and intensification. Thrift institutions(thrifts) have started to offer new services which remove much of the inconvenience associated with making payments from savings accounts. As a consequence, savings accounts at thrifts are now becomingmore like checking accounts at commercial banks,This article describes changes occurring at somesavings and loan associations and mutual savingsbanks which, by making deposit accounts at these institutions more attractive for making payments, enablePage2Savinss & Loan AssociationsThe Federal Home Loan Bank Board (FFILBB),which regulates Federally chartered savings and loanassociations (S & Ls), has encouraged greater competition between S & Ls and commercial banks by allowing Federal S & Ls to offer a number of new servicesto their customers. In January 1974, the FHLBBadopted a temporary regulation which permits Federal S & Ls to operate experimental place-of-businessfunds transfer systems, These systems allow customersto conduct financial transactions through the use ofelectronic signals generated by on-line computer terminals as well as off-line automated teller machines.1The terminals, which are called remote service units,allow depositors to conduct transactions with theirS & Ls at places of business other than the as’sociations’ offices. The remote service units, which may he1Traasactions initiated through the use of on-line computerterminals are instantly comnumicated to and verified by theS & L’s central computer. Off-line facilities generally are notconnected directly to the computer of the S & L; transactionsinitiated at these temiinals are recorder! on magnetic tape ora like medium which is subsequently delivered to and read bythe S & L’s computer.

FEDERAL RESERVE RANK OF ST. LOUISshared with other Federally insured financial institutions, are not treated as branch or satellite offices ofthe S & Ls by the FHLBB.Also, in January 1974 the funds transfer systeminitiated by the First Federal Savings. indLoan Association, Lincoln, Nebraska was approved under thenew regulation.2 This place-of-business system allowsdepositors of First Federal to make deposits to orwithdrawals from their interest-bearing savings accounts at two Funky Dinky supermarkets in Lincoln.Transactions are made with the use of plastic cardson which account information is encoded on magneticstripes. At the supermarket, Hinky Dinky employeestransmit transaction data to First Federal’s centralcomputer which records the actions. Settlement isaccomplished electronically by entries to the accountsof depositors and Hinky Dinky at First Federal. Atthe supermarket, money is accepted from or disbursedto the customer-depositor by the employees throughcash drawers maintained by Hinky Dinky for completion of the physical part of the transactions.Within two months after the installation of the system, legal action interrupted this service. The state ofNebraska first brought suit against Hinky Dinky onthe grounds that the supermarket was offering banking services without a license. The Nebraska BankingAssociation also brought suit, charging that First Federal was violating the state’s anti-branching laws. Withlitigation still pending, the savings and loan servicesin the two Hinky Dinky stores resumed operation inSeptember of last year. Since resumption of the service, First Federal has installed its funds transfer unitsin three additional Junky Dinky stores in Lincoln andhas received FHLBB approval to expand the serviceto 19 of the supermarket chain’s stores in easternNebraska.JULY 197 An electronic facility began operation in July 1974on a 24-hour basis in Bellevue, Washington.3 In thiscase, the unit is shared by four mutual savings banks,ten Federal savings and loan associations, and twostate-chartered S & Ls. Unlike the Hinky Dinky terminal, tins automated teller machine is unmanned andis operated by tIme depositor, independent of any business. Cash disbursements are made through the useof automatic cash dispensers \vhich are activated bythe depositor’s magnetic card. Deposits are handledin a manner similar to that used for night depositories.Other S & Ls across tie country have also initiatedfunds transfer systems, implementing place-of-businessterminals and automated teller machines similar tothose just described. Because of the rapid development and implementation of these systems in manystates, only two have been described here in detail, Alist of the savings and loan associations which havereceived Fl-ILBB approval for electronic transfersystems is presented in Exhibit I.In addition to these electronic innovations, otherchanges have taken place which permit savings andloan associations to compete more effectively for deposits. One such change involves the bill paymentservices which S & Ls are able to offer. At the depositor’s request, Federal S & Ls may honor nontransferable orders to transfer funds, periodically orotherwise, from the depositor’s savings account tothird parties. In the past, such payments were limitedto housing-related items and loans on these items,such as payments on mortgages, rent, taxes, utilities,and home improvements. The FHLBB recently removed the housing-related restriction, thus allowingFederal savings and loan associations to offer afull range of bill payment services.In April of last year, the state of Washington enacted legislation which allows state chartered commercial banks, mutual savings i)aflks, and S & Ls toestablish any number of unmanned facilities throughout the state, provided that those operating the facilities share the costs and operation of the terminalswhen asked to do so by the state authorities. Coininercial banks are required to share facilities withother commercial banks and have the option ofsharing with thrift institutions. Thrifts are permitted,but not required, to share facilities. These facilitiesare not considered branches under Washington law.In December of last year, the FHLBB also adopteda regulation which gives depositors traveling morethan 50 miles from their home access to their savingsaccount balances through any other Federally-insuredsavings and loan association by means of a TravelersConvenience Withdrawal. The S & L at which a customer has requested such a withdrawal notifies, bywire or telephone, the S & L at which the customerhas ‘a deposit account to deduct the amount of thewithdrawal from that account. Funds are then disbursed by the cooperating savings and loan association, and the S & Ls which have chosen to offer thisservice make settlements among themselves.1”Nebraska S & L Begins Point-of-Sale liFTS,” AmericanBanker, January 16, 1974. “15 Washington State Thrifts to Test Electronic Teller,”American Banker, February 21, 1974.Page 3

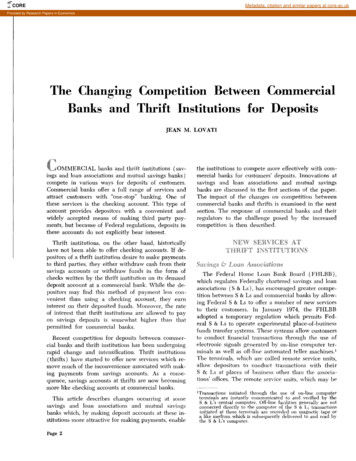

FEDERAL RESERVE BANK OF ST. LOUISJULY1975Exhibit ICa s orniaCalifo sue Federal Say ng &Loon Association, Los Ang los5 Msupermo ketsFin, nci U institutions in New Englandhave attracted x idcspretd attention byoffering Negotiablc Order of WitIdraival (NO\V) accounts. Unlike coni ention’rl s’n ings accountsNOW accounts p rmit depositors to make check-Glendal Federal Saving &Loan Assac aflon70 POSsupermarketslikeEElS ApplIcatIons Approved by ERLSB(May 2, 1975)Number and TypeInstitutionSan Diego F deal Saving & LoanA sedationJornt Denver Proie t(4 Federal 5ev ogs & LoanA auctions 6 5 ate Savings & LoanA ersationsiFloridaBoca Raton Federal Savings & LoanAs ociotsonJoint Prote tLocation-4 Aairportsii lthdlr’nvals lrom then interehc’uinn savings iccounts for makingpai ments to third parties. The with-I Afree standing build ngcirass alf rcilmtics b mc’rns of special outingnumber which are assigned to the thrift7 A2 Ashopping rentersupermarketsWe t Palm Beach19 & LoanUnited Federal So ing & Loan7 nsr” Arsociatson Fort touderdaleIllinois.Iroquois Federal Say ngs & LoanAssociation, WetsekaloweFirst Federal Soy ngs 8, LoanAssociation of Coun ii BluffKansa.Capital Federal Saving & LoanAssocotien TopekaMinnesotaTwin C ty Fede aI Say ngs & LoanAssociation, Minneapolis4 A2 Mupermarket4 Mupe nsa kets OflSrtis,tOncnnisource F ePage 41 Ins type of account w’rs first offemedin 1972 by th Consumers Saving Bankof Worce ter Mass’rchusetts and wasrapidly initiated at other savings banksin \las, achusetts ‘md New lI’rmpshrre.4At th tune comm reid b’mnks in tho estates opposed the use of NOWTs andurged a ban on them by Congre s. Legislation w, s suhsec1uently enacted whichlimits thu use of isOW accousits to the eP o states hut ‘illow not only mutualsavmnus b’mnks hut also commercial banksnd savings mdl lo tn ussociation withinthesc st’mtcs to off r such accounts,superma ketThis legi lat on, which permitted anmclditional 427 dlepositor) financial institutions to offer NOW a counts affe ‘ted1Mthe competiti e brIm icc ‘imong instituupermarke.27 M3 Msupermarketsdepartment toresLion in ts c two stat ‘s. 0! thesc ncwlieligible institutios s comnme ciii banksintioduced the in mjority of thu nest2 Ashopping cenl rsNOW ‘iccounts. I he OO mutual sat in5 Mit hEr b inks in M mssachusetts andl ‘sesv IL mp1slnre is Isich xvcpm circus ) the onl financial institutions pemmitterl to) offersupermarkets2 Ahopping centerNOW mccoussts e pcincnced a declinei s the’is NOW account deposits duringthe snitial implementation of tIsu legisl’ttion, As more fin tnci’rl institutions be3 Mira 5 r 4.)-o C eountehoairportuperma ketdeportment stores24 M’alpS bet’ allyciIIiso is a o sal.rorn n an Ii nin, tttutions.‘AssociationPennsylvaniaFir t Federal Savings & LoonAssociat on of Pitt burghWashingtonBellevue Prole I, Seattle(10 Fed ral Savings & LoanAssociations, 4 Mutual Sav’ng Banks2 State Saving & La n As a olsonWi consinFir t F derol Sayings & LoonAssociation of Madisoneshopp’ng centerA7 M6 MAs ocietson, Egg HarborOhioBuck ye Fede al Savings & LoanAsso ration Columbusok a som adealSaving & Loaenamel Sr beat ciCS herermsnal s op atronal.V tesmin I arope fl anal.hepp’ng cent rsI ANebra haFir t Fed rot Saving & oanAssociation of Lincoln(sho ed with First Federal Say ngs& Loan Association of Omaha and 3State Saving ond Loan As ocsotionslClItF derol Saving & Loanin tiI porders are cle’t ccl through theFederal Resem i e S stem s check clearingupermarket/discountdepartment storesasa C oici C rnI (MI. P0an to offemNOWiccountssen icecha gus on drafts from the ‘iccountsii crc reducedoi climin itedi bs mans’-StuIt Early His ory as d Initial Impact of NOWAccounts ‘ New En”?and Economic Revsrw(January/February 1975), pp. 17-26,

FEDERAL RESERVE DANK OF ST. LOUISinstitutions and, in addition, some commercial banksbegan to offer free checking accounts.JULY 1975IMPACT OF THE. ChANGESAdvantages of Thrifts in Competing forThrift institutions have also been involved in a newsystem for making payments, called “pay-by-phone,”which was initiated last fall by a savings bank inConnecticut and one in Minnesota. Under this system,depositors at these savings banks who open specialinterest-bearing accounts may make payments to thirdparties without writing checks or negotiable orders ofwithdrawal. Depositors use their telephones to makepayments to utilities, merchants, and other organizations which participate in the systemApproval by state banking authorities is necessarybefore such a system can be put into effect. Althoughthe pay-by-phone system was judged to be illegalunder Connecticut’s existing statutes, the People’s Savings Bank, Bridgeport, has been permitted to continue its pay-by-phone operations on a test basis untilthe end of 1975. At the same time, it was ruled thatunder the current provisions no other Connecticutmutual savings bank should be permitted to initiatesuch a system.At the People’s Savings Bank, depositors who opena special account are given a personal identificationcode number in addition to an account number. Thecnstomer can then dial a special telephone numberand give these numbers to the operator who is toldwhich companies and what amounts to pay. Thisinformation is transcribed by the operator, who talliesthe total amount paid and informs time customer of thebalance left in

inercial banks are required to share facilities with other commercial banks and have the option of sharing with thrift institutions. Thrifts are permitted, but not required, to share facilities. These facilities are not considered branches under Washington law. 1”Nebraska S & L Begins Point-of-Sale liFTS,” American Banker, January 16, 1974. JULY 197