Transcription

Konecranes Annual Report 2017

PERFORMANCE DRIVEN onecranes has made excellentKprogress in the past 12 months, and ourorganization is currently in the processof a transformation which will leave usprimed for growth.The synergies of our acquisition ofMHPS are worth up to EUR 140 million,and to realize them we will deliver ontwo fronts.We are striving to make the acquisitiona model one for the industry, in everyconceivable aspect – from processintegration to company culture. We willpursue this success with dedication,commitment, and accountability.At the same time, we will maintainfocus on our core business. Itscontinued strength is the foundationof these dramatic and far-reachingdevelopments, and the basis of thegrowth to come.Thanks to our future-focusedinvestments in recent years, we arethoroughly capable of executing thischange – harmonizing processes andsystems across the organization.We are motivated both by thetremendous potential benefits, and thefact that they are well within our grasp.CONTENTS2 Konecranes in a snapshot68 Report of the Board of Directors4 2017 highlights81 Consolidated statement of income – IFRS6 CEO's letter82 Consolidated balance sheet – IFRS8 Company narrative84 Consolidated statement of changes in equity – IFRS10 Business environment12 Business Area Service85 Consolidated cash flow statement – IFRS86 Notes to the consolidated financial statements15 Business Area Industrial Equipment128 Konecranes Group 2013–201718 Business Area Port Solutions129 Calculation of key figures21 Regional facts and figures130 Company list22 Research & Development133 Parent company statement of income – FAS24 Product overview134 Parent company balance sheet – FAS28 Corporate responsibility136 Parent company cash flow – FAS44 GRI content index137 Notes to the parent company’s financial statements46 Corporate Governance139 Board of Directors’ proposal to the Annual General Meeting57 Risk management140 Auditor’s report62 Board of Directors145 Shares and shareholders64 Group Executive Board152 Investor information66 Senior Management153 Contact detailsThis publication is for general informational purposes only. K onecranes reserves the right at any time, without notice, to alter ordiscontinue the products and/or specifications referenced herein. This publication creates no warranty on the part of K onecranes,express or implied, including but not limited to any implied warranty or merchantability or fitness for a particular purpose. 2018 Konecranes. All rights reserved. ‘ Konecranes’, ‘Lifting Businesses’,, ‘TRUCONNECT’, ‘Agilon’, 'BOXPORTER','Konecranes Gottwald', 'Konecranes Noell' and ‘Konecranes Liftace’ are either registered trademarks or trademarks of K onecranes.

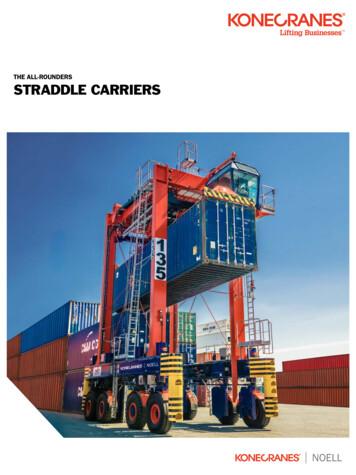

Konecranes in a snapshotKonecranes in a snapshotUnmatched customer offering in Service,Industrial Equipment and Port SolutionsSales by BusinessArea, 2017Adjusted EBITA byBusiness Area, 2017Service19%19%With 600 service locations in 50 countries, Konecranes provides specialized maintenance services and spare parts for all types and makes ofindustrial cranes and hoists – from a single piece of equipment to entireoperations. Our objective is to improve the safety and productivity of ourcustomers’ operations.Konecranes is the market leader in crane service, with the world’s mostextensive crane service network.More than 600,000 pieces of equipment are covered by Konecranesservice agreements. The majority of this equipment has been manufactured by other companies; Konecranes can provide expert maintenancefor any brand of equipment from any manufacturer. Leveraging the Demaginstalled base and agreement base is expected to be a significant sourceof growth.30%36%44%14%67%37%34%Service 1,178.0 MEURService 160.9 MEURService 7,206Industrial Equipment1,118.7 MEURIndustrial Equipment 34.6 MEURIndustrial Equipment 6,024Port Solutions 44.7 MEURPort Solutions 3,067Port Solutions 976.0 MEURIndustrial EquipmentBusiness Area Industrial Equipment offers hoists, cranes and materialhandling solutions for a wide range of customers, including industries likeWaste-to-Energy and Biomass, Paper and Forest, Automotive and MetalsProduction. Products are marketed through a multi-brand portfolio thatincludes K onecranes and the brands Demag, SWF Krantechnik, Verlinde,R&M, Morris Crane Systems, and Donati.Konecranes is one of the world’s largest suppliers of industrial cranes,producing thousands of industrial cranes annually, tens of thousands ofwire rope hoists and trolleys and electric chain hoists, as well as hundredsof engineered-to-order (ETO) cranes.Personnel by BusinessArea, 2017The world'smost extensivecrane service networkOne of thelargestsuppliersIndustryleadingtechnologyof port cranesand lift trucksand global modularproduct platformsMore than3,13616,371600,000Sales andservicelocations in50 countriesHead officein FinlandListedon NasdaqHelsinkiEURmillion of net salesin 2017employeesin 2017units in the maintenanceagreement basePort SolutionsBusiness Area Port Solutions offers a complete range of containerhandling equipment (both manned and automated), shipyard handlingequipment, mobile harbor cranes and heavy-duty lift trucks, supportedby a complete range of services. Products are marketed under the Konecranes brand, with some product groups marketed under the labels Konecranes Gottwald, K onecranes Noell and Konecranes Liftace.Konecranes is a global leader in shipyard gantry cranes, and a prominent global supplier of cranes and lift trucks for container handling, heavyunitized cargo, and bulk material unloading.2Konecranes Annual Report 2017Konecranes Annual Report 20173

2017 3 %16893.5156.914Order book, 7.416125.42,118.41,920.715Adjusted EBITA, MEUR/Adjusted EBITA margin, %5.92,126.21,965.52,011.41,903.51417SalesAdj. EBITA pre-MHPSOrder intakeAdj. EBITA margin pre-MHPS131417Comparable adj. EBITAComparable adj. EBITA margin141516171314151623.715.417Earnings per share, basicReturn on capital employed, %Dividend per shareAdjusted return on capitalemployed, %* The Board’s proposal to the AGMNet 203.244.6532.341.1131,380.217Year-end marketcapitalization*, MEUR1,495.414149.533.316187.342.115Year-end net debt,MEUR/Gearing, %325.2Year-end net workingcapital, 510.90.641.051.281.05140.531.0513ROCE, %/Adjusted ROCE, %10.319.2Return on equity, %2.881.20*Earnings & dividendper share, EUR263.7grew across the product portfolio suggesting thatthe cross-promotion of the extended offering seemsto work well. The order book for most of our new Konecranes Gottwald and K onecranes Noell products continued to strengthen.The order intake in Business Area Service andBusiness Area Industrial Equipment was lower thana year ago on a comparable combined companybasis as they prioritized focus on laying the foundation for the combined operations. This meantconsolidation of operations in several countries andeven discontinuation of some underperforming businesses. Moreover, the appreciation of the EUR/USDaffected the reported orders to some extent.In 2017, Group sales were 4.3 percent belowthe previous year on a comparable combinedcompany basis. The decrease in Business AreaPort Solutions’ sales related to the timing of deliveries and exceptionally high sales of certain products in the comparison period. The sales in Business Area Service and Business Area IndustrialEquipment were affected by similar factors as theorder intake, prioritizing the margin improvementthrough integration activities over the growth.The adjusted EBITA margin improvement wasstrong during 2017. The comparable combinedcompany adjusted EBITA margin expanded by 1.3percentage points on a year-on-year basis, despitethe sales that were lower than a year ago. Theprofitability improvement continued in BusinessArea Service, while the turnaround progressed inIndustrial Equipment. This indicates that the integration of MHPS is proceeding successfully andtherefore improves our efficiency. The focus ofthe management and the Board has been on theimprovement in EBITA margin, in particular.304.3The comparable combined company orders receiveddecreased by 0.6 percent on a year-on-year basis in2017. Business Area Port Solutions' orders received13317.4Comparable combined company orderintake was stable, profitability improvedComparable combined companyadjusted EBITA margin expanded by0.851.05On January 4, 2017, Konecranes completed theacquisition of Terex Corporation’s (Terex) Material Handling & Port Solutions (MHPS) business. Konecranes paid EUR 796 million in cashand issued 19.6 million new K onecranes classB shares to Terex related to the acquisition. Theacquisition of MHPS improved Konecranes’ position as a focused global leader in the industriallifting and port solutions market. Konecranesachieved a truly global footprint and is now able tooffer comprehensive solutions based on a highlycomplementary set of products and services. Withthe acquisition, Konecranes will achieve substantial growth opportunities as well as critical scalefor further technological development.Out of the total of EUR 140 million p.a. synergiestargeted at the EBIT level by the end of 2019, EUR56 million was implemented on a run-rate basis bythe end of 2017. One-time integration expenses areexpected to be EUR 130 million during 2017–2019of which EUR 66 million was booked in 2017.The integration of MHPS ran ahead of theinitial expectations throughout 2017. BusinessArea Service moved fastest in terms of the execution of the planned cost savings. The US servicebranch network consolidation was mostly implemented and the integration is now moving to otherregions. In Business Area Industrial Equipment,actions were focused on designing and launchinga new go-to-market model in different countries.Also, product platform harmonization work wasstarted. Business Area Port Solutions’ customeroffering was extended through the MHPS acquisition so it focused on packaging and managing thenew complimentary and wide range of products,services and software to its customers. In 2017, Konecranes made progress in optimizing manufacturing operations in several countries, mostnotably in China, India, Italy, and the US.On January 31, 2017, K onecranes completedthe divestment of STAHL CraneSystems. Konecranes received cash proceeds of EUR 232million from the transaction. K onecranes reporteda pre-tax capital gain of EUR 218 million from theSTAHL divestment in 2017. Integration workahead of initialexpectations.289.4MHPS acquisition – definingmoment in 20172099.61,920.8Sales/orders, MEUR124.02017 HIGHLIGHTS17* Excluding treasury sharesGearing4Konecranes Annual Report 2017Konecranes Annual Report 20175

CEO's letterThe ways, tools and means for growthDear shareholders,Our main objective is to serve our customers and continueproviding excellent technologies that perfectly answer theirneeds. I am happy to say that during an extremely dynamic year,day-to-day operations have not been too much distracted by thehuge number of integration activities which have taken place.This is the third year in which the company has continued toperform very well under significant pressure. Still our supremeobjective has been well fulfilled.The year began with us closing the largest deal in our history,thus welcoming over 6,000 new colleagues into the Group. Theintegration procedure has included over 3,000 distinct activities, with hundreds of people participating. These have beenperformed with a rigorous agility, allowing us to successfullyrealize most of our plans for 2017. All in all, we can congratulate ourselves on a job well done.Each of the business areas within this new group achievedstrong performance. I am especially happy that Business AreaService has been able to perform the majority of their integration work, Industrial Equipment has undergone the first phaseof its turnaround, and Port Solutions showed a satisfying orderintake. These achievements are already ample demonstrationof our underlying task – preparing a solid base upon which todevelop our next phase, which will be one of growth.During the year, we have seen the two legacy organizationsmeld into a single united front. In terms of corporate culture,it has been easy to work together. In the beginning of theprocess, we set out to gather facts from across the organization, building a comprehensive view before making the critical decisions that would govern our collective future. From thecurrent vantage point, we can see that this was a wise strategy,and a well executed one in practice.But the process was not one without difficult decisions.Overlapping functions and operations naturally gave rise to acertain number of redundancies, and as part of the rightsizing,personnel has decreased by approximately 730 employees.These unfortunate necessities were carried out to ensure ourfuture competitiveness.Today, our company has the ways, tools and means tocommence growth.The renewed organization situates our support functions (procurement, marketing and communications, finance,HR, legal, and strategy) in service to our businesses, thussupporting profitability. The emphasis here is on providing clearresponsibilities, explicitly avoiding the tendency to create siloes.Renewal is also underway in terms of our internal policies,as we harmonize our actions globally, across all territories and6Konecranes Annual Report 2017markets. We believe that sustainable growth is only achievedby nurturing responsible business practices and acting withintegrity.It is no longer enough for companies to focus only on theirdirect footprint, they need to define what kind of value theyare creating, both for their stakeholders and for the widerworld. We want to support a more all-encompassing societyby creating a diverse and inclusive work environment and byfostering equality.In terms of financial performance, the year has seen aspecial focus on developing EBITA margin, and, as a consequence, we were even ready to give up certain underperforming businesses. This resulted in a final figure of 6.9 percentadjusted EBITA margin and an increase of 17 percent, with eachbusiness area playing their part admirably.After an acquisition costing EUR 1.5 billion, of which EUR 686million was financed with a share issue, we have net debt of onlyEUR 525 million and a solid balance sheet with a gearing of 41percent.As shares were used to bridge the valuation and finance theacquisition, Terex became our largest shareholder, achievingtheir target and completely exiting in September. The use ofshares as parcel payment was thus another successful aspectof a smooth, well-executed acquisition.In our interactions with customers, partners and stakeholders,we have heard only positive comments about joining forces inthis way. Two powerful brands have combined, becoming vastlymore than the sum of their parts, and we are very happy to havearrived at such an excellent market position. On the technologyside, we have been able to balance our road maps, and establisha strong direction built on our shared heritage.We see our advantages especially in circular-economy business models. Digitalization, demand for low-carbon productsand the opportunities of rental services are certainly having animpact on our stakeholders and our business.In our conjoined product offering, we are able to provide innovative power sources like hybrid technology and other energy-saving solutions such as regenerative braking. Our aim is toinspire and challenge the market and support our customers byoffering innovative, eco-efficient solutions.I would like to warmly thank all our stakeholders for theircontinued faith in our capabilities, and for the parts they themselves have played in our success. While there remains much tobe done, this represents an excellent start to the journey."We are preparing a solid base uponwhich to develop our next phase,which will be one of growth."Panu RoutilaPresident and CEOKonecranes Konecranes Annual Report 20177

company narrativeMISSION –WHAT WE DOWe are not just lifting things, but entire businesses.VISION –WHAT WE WANT TO ACHIEVEIN THE LONG TERMWe know in real time how millions of lifting devicesperform. We use this knowledge around the clock to makeour customers’ operations safer and more productive.VALUES –OUR GUIDE TO DAILYDECISION MAKINGcompany narrativeSTRATEGY –HOW WE GET THERETECHNOLOGYLEADERSHIPREAL TIME VISIBILITYTO CUSTOMERS’EQUIPMENTEND TO ENDPROFITABILITYSHARED &HARMONIZEDPROCESSESSERVICEEQUIPMENTLifecycle Care in Real TimeService for all types and makes of cranes and hoistsGlobal service networkImprove the safety and productivity of our customers'operationsCore of LiftingDirect and Indirect channels inIndustrial EquipmentMulti-brand strategyNeed based customer offeringTACTICAL FOCUS AREAS – WHAT WE WILLFOCUS ON DURING THE NEXT 2–3 YEARSTrust in PeopleWe want to be known for our great people.GROWTHCustomer experiencePROFITABILITYRealizing potentialTotal Service CommitmentWe want to be known for always keeping our promises.TECHNOLOGYEngineering capabilitiesPEOPLELifting peopleSustained ProfitabilityWe want to be known as a financially sound company.VALUE PROPOSITION – BRAND PROMISE: LIFTING BUSINESSES 8Konecranes Annual Report 2017Konecranes Annual Report 20179

Business environment onecranesKglobal marketpositions:A market leaderin industrial cranes and components,as well as crane serviceGlobal manufacturing industry andcontainer traffic growth acceleratedThe J.P. Morgan Global Manufacturing PurchasingManagers’ Index (PMI) signaled a solid and steadyimprovement in manufacturing operating conditions in 2017. At the end of the year, global manufacturing production expanded at the quickestpace since early 2011. There was also a bouncein international trade flows, as growth of newexport business hit a near seven-year high. Developed countries, on average, tended to outperformemerging markets.The euro area remained a bright spot within theglobal manufacturing sector. Its PMI rose to a nearrecord high level, with the growth improving acrossthe countries. Outside the Eurozone, the performance of the UK and particularly Swedish manufacturing sectors remained strong in 2017, aswell. Correspondingly, the European Union manufacturing capacity utilization rate continued toimprove and was near its ten-year high at the endof 2017.10Konecranes Annual Report 2017Similar to Europe, the economic activity inthe US manufacturing sector, measured by thePMI, expanded clearly in 2017. However, the UStotal industrial capacity utilization rate improvedonly marginally after having declined since theend of 2014 and it indicated that slack capacityremained in the industry.Compared to the previous year, PMIs alsorose in the BRIC countries, but the rate of expansion remained more modest than in Europe orthe US. Brazil saw a clear positive turnaround,and it emerged from its two-year long recessionin 2017. On the other hand, Chinese, Indian andRussian manufacturing sector operating conditions improved only at a marginal pace.The recovery of the world’s containerized tradein 2017 turned out to be much bigger than whatwas the expectation in the beginning of the year.The global container throughput increased byapproximately 6 percent on a year-on-year basisin 2017.Among top 3in container handling equipmentRegionally, volumes in Asia, which representmore than a half of the global container traffic,rebounded on most of the trade routes aftertwo weak years. Container volumes from Asiato East Coast North America grew particularlystrongly, as the widening of the Panama Canalhas supported traffic above expectations. In addition, the volumes in the Mediterranean portsincreased clearly thanks to the improved economicgrowth in Southern Europe. The container trafficin the Middle East suffered from low oil prices andtensions in the region.The average raw material prices, includingsteel, copper, and oil were above the previousyear’s level in 2017. The EUR/USD exchange ratewas volatile during the period as it depreciated inthe first half, but then appreciated in the secondhalf compared to the previous year.Approximately6% increase inglobal containerthroughput on ayear-on-year basis.Konecranes Annual Report 201711

Business area serviceBusiness area serviceThe Business Area’s mission to create acustomer experience that drives growth is fulfilledin large part by this systematic change. In practice, this means Lifecycle Care in Real Time,utilizing customer consultation in combination withmaintenance and usage data to deliver safety andproductivity improvements.This way of operating is underpinned by a disciplined sales model and dedicated roles for all salesresources and assignments. The importance ofanalytics to the entire model cannot be overstated,with its role as one of our daily management toolsbringing about increased transparency (with positive ramifications) in both customer operations andwithin the K onecranes sales organization.The BusinessArea’s mission tocreate a customerexperience thatdrives growth isfulfilled in largepart by digitaltransformation.Diverse marketsIntegration. Transformation. Growth.Business Area Service provides specialized maintenanceservices and spare parts for all types and makes of industrialcranes and hoists, from a single piece of equipment toentire operations. Our objective is to improve the safety andproductivity of our customers' operations.Business Area Service began 2017 with acontinued long-term focus on transformation ofthe business model – namely through a productized offering, systematic processes and digitalization – as well as the beginning of integration ofthe MHPS Service units. These endeavors rolledout generally as planned and the year ended witha pivot to a focus on growth heading into thenew year.Integration, of course, refers to the acquisitionof MHPS and the addition of its Demag brand tothe Business Area offering, promising the opportunity to strengthen the service business on a widescale. The front line service business was fullyintegrated in the US, Canada, Brazil, India, UK andDenmark. Integration of the remaining countrieswill continue in 2018 and 2019.12Konecranes Annual Report 2017The installed base of Demag products bringssignificant potential for the service agreementbase, with further synergies to be achieved byleveraging the Konecranes service model, systemsand infrastructure, integrating our e-commerceplatforms, incorporating a variety of our products,as well as sharing and spreading best practicesacross the newly combined talent pool.More broadly, the Business Area intends tocapture further market share by focusing on sixcore trends: safety, productivity, outsourcing, regulations and compliance, the aging industrial workforce, and digitalization.Digital transformation is a particularly vitalcomponent, representing both an ongoing, longterm project as well as one of the acquisitionsynergy benefits already being realized.The weakening dollar had negative translation effects on US orders and sales. The oil andgas sector and other commodity-based industries bottomed and some signs of recovery wereevident. Industrial production turned positiveduring the year. We continued to make good progress in segments such as automotive. However,severe weather did negatively affect orders andsales in the latter part of the year.Similarly, western Canada’s oil and gas andother commodity sectors stabilized. The centraland eastern parts of the country continued tobenefit from their industrial base.Mexico, Chile, Peru and Brazil declined whileour relative position in those markets remainsstrong, and our position in Brazil has significantlystrengthened due to the MHPS acquisition.In Europe, our strong performance in theUK and Spain continued and were furtherstrengthened by the acquisition. We attained solidbusiness volumes in France and Italy. In Germany,the K onecranes business is now clearly benefitingfrom the processes of business and digital trans-formation, and with the MHPS business we arenow in good shape to capture more of the sizeableexisting market for service; the same can be saidfor Austria and Switzerland.In Russia, the market situation was varied andoverall the business has slightly declined. EasternEuropean states have performed moderately. OurNordic home market has performed well, althoughScandinavia has been challenging.The Middle East and Africa remained troublingenvironments, geopolitically speaking, but onceagain Saudi Arabia performed well thanks to thelarge installed base we have built up over theyears. South Africa continued to show good growthand benefited from early integration actions.In China, we have done well in our legacy Konecranes business, and customers areincreasingly receptive of the improvements insafety and productivity we offer. We continuedto find stronger awareness and openness tooutsourcing and increased interest in and demandfor our consultation services. The MHPS businesswill add to these opportunities.Key figuresOrders received, MEUROrder book at end of period, MEURNet sales, MEURAdjusted EBITA, MEURAdjusted EBITA, %Operating profit (EBIT), MEUROperating margin (EBIT), %Personnel at the end of 8%7,2061–12/16 comparable981.4200.31,214.1153.412.6%Change, %-1.5-2.1-3.04.91–12/16 necranes Annual Report 201713

Business area industrial equipmentThe installed base ofDemag products bringssignificant potentialfor the serviceagreement base.Australia has seen some leveling in thecommodity-based industries, but our transformation here is yielding very tangible results. We nowhave a solid business in India, bolstered by indications of recovery in the process industries. Ourmodest business in Japan continues to grow, withother Asian countries remaining steady.Appetite for growthWith integration and transformation well underway(and to a large extent executed), Business AreaService will now pivot its energies toward growth.Capturing the synergies of the MHPS acquisition,increasing service agreement retention, improvingthe bundling of service products in service agreements, and expanding the customer maintenancespend to deliver safety and productivity enhancements will be the main growth drivers.Online sales of parts, light lifting equipmentand accessories will continue to increase, asstores are now active in the US, Canada, China,Singapore, Australia, Germany, the UK, Finland,and France.Leveraging the Demag installed base andagreement base is expected to be a significantsource of growth. This entails both expandingagreement base coverage, increasing agreementvalue and service sales per asset, and harmonizing the combined offering and pricing.Finally, leverage and assimilating Demag serviceproducts – such as light-lifting products, generaloverhaul packages, and below-the-hook productsand inspections – will be another crucial step.14Konecranes Annual Report 2017Systematic integrationBusiness Area Industrial Equipment offers industrial cranes, theircomponents and lifting equipment solutions for a wide rangeof customers, including industries like General Manufacturing,Waste-to-Energy and Biomass, Paper, Power, Automotive, Aviationand Metals Production. Products are marketed to crane endusers and through a multi-brand portfolio to independent cranemanufactures and distributors. The business area includes thebrands K onecranes, Demag, SWF Krantechnik, Verlinde, R&M,Morris Cranes Systems and Donati.The year 2017 was the first year of integrationof the acquired Demag operations into BusinessArea Industrial Equipment. Besides Demag, theintegration includes also Donati’s crane components business.In March, Konecranes divested the ChineseSanma Hoists & Cranes Co. Ltd. to JingjiangHongcheng Crane Components ManufacturingWork. With this divestment, the company streamlined its product and brand portfolio in theChinese market.The year was also one of profitability improvement for Business Area Industrial Equipment.This was the result of the cost-saving actionsinitiated in 2016, which are now paying dividends, in addition to general improvements toproject execution and the dismantling of thematrix to a product-line based organization withdirect P&L responsibilities.With the integration of the acquired MHPS business units ongoing throughout 2017, a workingprinciple was established to separate integrationproject work from customer-related operations asmuch as possible in order to secure full focus onall customer-serving operations, whether sales ororder execution issues.Konecranes Annual Report 201715

Business area industrial equipmentThis has allowed the business area to concentrate on upholding and improving customer excellence without any undue distractions, while, likewise, integration actions could be executed diligentlycompletely independent of external-facing work.Market overviewTo look to Europe first, the Nordic countriesdemonstrated growth both in orders and sales, asdid Germany, Spain and Austria, while the UK andFrance showed a slight decrease in orders.In Russia, orders received grew, but in theMiddle East a decline in orders and sales wasin evidence especially due to oil prices, and thismarket now awaits an oil price recovery and thereduction of various tensions in the area. SouthAfrica continued to be slow in order intake.In APAC, market orders and sales grew nicelyin India, while China’s orders grew in several keyindustry segments, and we expect sales growth tofollow in tandem. In Southeast Asia and Australiathere is optimism in the market and orders havebeen growing.In the Americas, larger project orders grew in theUSA towards the end of the year, while standardcrane and component orders grew across thewhole year. Markets in Ca

Konecranes is a global leader in shipyard gantry cranes, and a promi-nent global supplier of cranes and lift trucks for container handling, heavy unitized cargo, and bulk material unloading. Port Solutions: 2: Konecranes Annual Report 2017: 3: KonA EcR nES In A SnAPSH oT KonA EcR nES In A SnAPSH oT: