Transcription

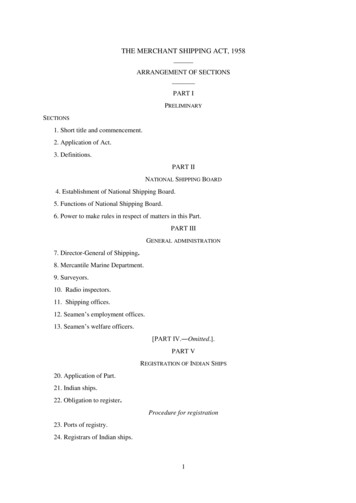

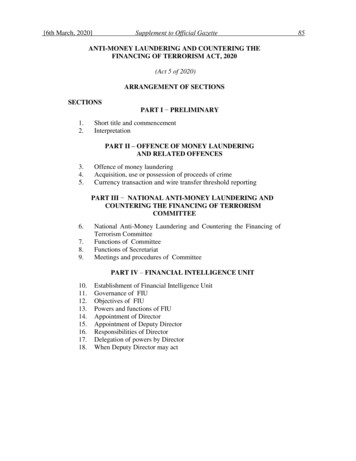

[6th March, 2020]Supplement to Official GazetteANTI-MONEY LAUNDERING AND COUNTERING THEFINANCING OF TERRORISM ACT, 2020(Act 5 of 2020)ARRANGEMENT OF SECTIONSSECTIONSPART I PRELIMINARY1.2.Short title and commencementInterpretationPART II – OFFENCE OF MONEY LAUNDERINGAND RELATED OFFENCES3.4.5.Offence of money launderingAcquisition, use or possession of proceeds of crimeCurrency transaction and wire transfer threshold reportingPART III NATIONAL ANTI-MONEY LAUNDERING ANDCOUNTERING THE FINANCING OF TERRORISMCOMMITTEE6.7.8.9.National Anti-Money Laundering and Countering the Financing ofTerrorism CommitteeFunctions of CommitteeFunctions of SecretariatMeetings and procedures of CommitteePART IV – FINANCIAL INTELLIGENCE UNIT10.11.12.13.14.15.16.17.18.Establishment of Financial Intelligence UnitGovernance of FIUObjectives of FIUPowers and functions of FIUAppointment of DirectorAppointment of Deputy DirectorResponsibilities of DirectorDelegation of powers by DirectorWhen Deputy Director may act85

86Supplement to Official Gazette19.20.21.22.23.24.25.26.[6th March, 2020]Appointment of staffOath of confidentialityConstitution of fundsAnnual estimatesFinancial year, accounts and auditAnnual ReportRemoval of Director or Deputy Director from officeResignation of Director or Deputy DirectorPART V – FUNCTIONS OF FIU27.28.29.Functions and duties of FIUAccess to information and analysis functionCooperation with foreign counterpart agenciesPART VI – PREVENTIVE 44.45.46.47.48.49.50.51.Result of national risk assessmentObligation to register with FIUObligation to identify and assess money laundering and terroristfinancing risksObligation to establish and maintain internal control systems andproceduresObligation to appoint compliance officerObligation to apply customer due diligence measuresPolitically exposed personsCorrespondent banking relationshipShell BanksTiming of customer due diligenceSimplified customer due diligenceEnhanced due diligenceReliance on regulated personsObligation to cease transactionObligation to maintain accounts in true nameObligation to record and retain identification details in wire transfersObligation to monitor customer activities and transactionsObligation to maintain recordsObligation to report suspicious activitiesApplication of customer due diligence measuresTipping offMisrepresentation

[6th March, 2020]52.53.54.Supplement to Official GazetteMalicious reportingSecrecy obligation overriddenProtection of information and informantsPART VII – SUPERVISION AND ENFORCEMENT OFCOMPLIANCE55.56.57.58.59.60.61.62.Responsibility for supervisionWritten memorandum of understanding amongst supervisoryauthoritiesPowers of supervisory authoritiesMonitoring of reporting entitiesReporting obligations of a supervisory authority and its staffAdministrative sanctionsAppeals BoardAppealsPART VIII – INVESTIGATION63.64.65.66.67.Investigation powersObtaining information etc.Search warrantProduction orderPower to arrestPART IX – RESTRAINT, SEIZURE AND ces in which court may make restraint orderRestraint orderNotice of restraint order to be given to Registrar GeneralImmunity of ReceiverRestraint order when company is in liquidationEffect of restraint orderSearch and seizure of cashDeclaration of cashCourt proceedings for forfeiture of cash seizedDeposit of cash seizedPART X – PECUNIARY PENALTY ORDER78.79.Pecuniary penalty orderCalculation of benefit from criminal conduct87

88Supplement to Official niary penalty order to be confined to realizable amountRevision of pecuniary penalty orderFurther determination leading to increased pecuniary penalty orderProcedure for filing statements to assist court in calculating thebenefit from criminal conductMatters to be taken into account in determining the level of apecuniary penalty orderMaking pecuniary penalty order where the accused has died orabscondedAppeals and compensationReduction in amount of pecuniary penalty order when realizableproperty is inadequateIncrease in amount of pecuniary penalty order when the value ofrealizable property increasesEnforcement of pecuniary penalty orderAppointment of receiver for enforcement of pecuniary penalty orderInterest on unpaid sumsDisposal of proceeds of pecuniary penalty orderPART XI – ASSET RECOVERY FUND93.94.Establishment of Asset Recovery FundReceipts and disbursement from the Asset Recovery FundPART XII – MISCELLANEOUS PROVISIONS95.96.97.98.99.100.[6th March, 2020]Amendments to First ScheduleAmendments to Second ScheduleRegulationsProtection of action taken in good faithSharing of information with Seychelles Revenue CommissionRepeal and savingsFIRST SCHEDULESECOND SCHEDULETHIRD SCHEDULEFOURTH SCHEDULEFIFTH SCHEDULESIXTH SCHEDULE

[6th March, 2020]Supplement to Official Gazette89ANTI MONEY LAUNDERING AND COUNTERING THEFINANCING OF TERRORISM ACT, 2020(Act 5 of 2020)I assentDanny FaurePresident6th March, 2020AN ACT for the prevention, detection and combating of money launderingand terrorist financing activities; for collection, analysis and managinginformation on suspicious financial transactions and activities; to createand empower institutions to suppress money laundering and the financingof terrorism and for matters connected therewith or incidental thereto.ENACTED by the President and the National Assembly.PART I - PRELIMINARY1.This Act may be cited as the Anti-Money Laundering andCountering the Financing of Terrorism Act, 2020 and shall come into operationon such date as the Minister may, by notice in the Gazette, appoint anddifferent dates may be appointed for different provisions of the Act.Short title andcommencement.

90InterpretationSupplement to Official Gazette2.[6th March, 2020]In this Act, unless the context otherwise requires—―account‖ means any facility or arrangement by which afinancial institution or a designated non-financial business orprofession does any of the following—(a)accepts deposits or funds;(b)allows withdrawal or transfer of funds;(c)pays negotiable or transferable instruments or otherinstruments;(d)orders or collects negotiable or transferable instrumentsor payment orders on behalf of any other person; or(e)makes any facility or arrangement for a safety depositbox or for any other form of safe deposit;―affected gift‖ means a gift given at any time to a third party inthe form of movable property or immovable property,immovable property acquired from the proceeds of movable orimmovable property gifted to such third party or from theproceeds arising in connection with an offence committed bythe person who gifted the movable or immovable property inthe name of a third party or in the name of some other person;―authorised officer‖ means—(a)a law enforcement officer of the Seychelles PoliceForce;(b)an officer of the Anti-Corruption Commission ofSeychelles; and(c)an officer of the Seychelles Revenue Commission;―beneficiary‖ includes a natural person or a legal entity orarrangement, who receives money or benefits from abenefactor;

[6th March, 2020]Supplement to Official Gazette―beneficial owner‖ means a natural person or persons whoultimately owns or controls a customer or the natural person onwhose behalf a transaction is being conducted and includesthose persons who exercise ultimate effective control over alegal person or arrangement;―benefit from criminal conduct‖ means money or propertyderived, obtained or realized, directly or indirectly, by anyperson from criminal conduct;―business relationship‖ means the arrangement between aperson and a reporting entity whose primary purpose is tofacilitate an occasional or regular course of business dealingsbetween them;―cash‖ includes notes and coins of Seychelles or of any othercountry which is a legal tender and accepted as a medium ofexchange in the country of its issue, postal orders, bearercheques which passes title thereto upon delivery includingtravelers’ cheques, bank drafts and bearer bonds;―Commissioner‖ means the Commissioner of Police;―Commissioner General‖ means the Commissioner Generalappointed under section 4 of the Seychelles RevenueCommission Act (Cap. 322);―Committee‖ means the National Anti-Money Laundering andCountering the Financing of Terrorism Committee establishedunder subsection (1) of section 6;―country‖ includes any state or territorial unit as the contextmay require;―court‖ means the Supreme Court of Seychelles;―Court of Appeal‖ means the Court of Appeal of Seychelles;―customer‖ in relation to a transaction or an account, includes—91

92Supplement to Official Gazette[6th March, 2020](a)the person in whose name a transaction or account isarranged, opened or undertaken;(b)a signatory to a transaction or account;(c)any person to whom a transaction has been assigned ortransferred;(d)any person who is authorised to conduct a transaction;or(e)such other person as may be prescribed by regulations;―data‖ means the representation in any form of information orconcepts;―designated non-financial businesses or professions‖ means thebusinesses and professions included in Part C of the FirstSchedule;―Deputy Director‖ means the deputy director appointed undersection 15;―digital currency or crypto currency‖ means currency that isexclusively stored and transferred electronically, and whosevalue is determined by the market in which it is traded;―Director‖ means the director appointed under section 14;―exported‖ in relation to cash, includes cash being brought toany place in the Republic for the purpose of being exported andthe terms ―export‖ and ―exporting‖ shall be construedaccordingly;―false declaration‖ means the misrepresentation of the value ofcash being transported, or misrepresentation of other relevantdata which is required to be submitted in the declaration orotherwise requested by the authorities and includes the failure tomake a declaration as required;

[6th March, 2020]Supplement to Official Gazette―financial institution‖ means any institution that conducts abusiness in one or more of the following activities or operationsfor or on behalf of a customer—(a)acceptance of deposits and other repayable funds fromthe public, including private banking;(b)lending, including but not limited to, consumer credit,mortgage credit, factoring,with or without recourse, andfinancing of commercial transactions, includingforfeiting;(c)financial leasing other than with respect to arrangementsrelating to consumer products;(d)money or value transfer services;(e)issuing and managing means of payment, including, butnot limited to, credit and debit cards, cheques,travellers’ cheques, money orders, banker’s drafts andelectronic money;(f)issuing financial guarantees and commitments;(g)trading in —(h)(i)money market instruments, including, but notlimited to, cheques, bills, certificates of depositand derivatives;(ii)foreign exchange;(iii)exchange, interest rate and index instruments;(iv)transferable securities; and(v)commodity futures trading;participating in securities issues and the provision offinancial services related to such issues;93

94Supplement to Official Gazette[6th March, 2020](i)individual and collective portfolio management;(j)safekeeping and administration of cash or liquidsecurities on behalf of other persons;(k)investing, administering or managing funds or moneyon behalf of other persons;(l)underwriting and placement of life insurance and otherinvestment-related insurance, including insuranceintermediation by agents and brokers;(m)money changing; and(n)carrying on such other activity, business or operation, asmay be prescribed by regulations;―FIU‖ means the Financial Intelligence Unit established undersection 10;―funds‖ means assets of any kind, whether corporeal orincorporeal, tangible or intangible, movable or immovable,however acquired, and legal documents or instruments in anyform, including electronic or digital, evidencing title to, orinterest in, such assets;―law enforcement agency‖ means the Financial CrimeInvestigation Unit or any other Unit as may be designated bythe Commissioner of Police within the Seychelles Police Force;the Anti-Corruption Commission of Seychelles; the Departmentof Immigration; the Seychelles Revenue Commission or anyother Agency as may be specified by the Minister by noticepublished in the Gazette to carry out criminal investigation inSeychelles, and the terms ―law enforcement officer‖ or ―lawenforcement authority‖ refers to a duly authorised officer of thelaw enforcement agency;―legal arrangement‖ means a partnership of persons, a trust orsimilar arrangement or any person holding assets in a fiduciarycapacity and any other similar entity or arrangement;

[6th March, 2020]Supplement to Official Gazette―legal person‖ means any entity other than a natural person thatcan establish a customer relationship with a financial institutionor otherwise own property and the term legal entity shall beconstrued accordingly;―legal privilege‖ means the confidentiality accorded to anycommunication between a lawyer and a client for the purposesof obtaining or providing legal advice or legal representation inrespect of any criminal matter but does not extend to anyconduct of the lawyer or material in the possession or control ofthe lawyer for the purposes of aiding and abetting, assisting,attempting, counseling, conspiring, concealing or procuring thecommission of criminal conduct by the client or any otherperson;―Minister‖ means the Minister responsible for Finance and theterm ―Ministry‖ shall be construed accordingly;―monetary instruments‖ includes—(a)notes and coins of Seychelles or of any other countrywhich is a legal tender and accepted as a medium ofexchange in the country of its issue;(b)travellers’ cheques, personal cheques, bank cheques,money orders or securities;(c)any currency that is stored or transferred electronically,which is commonly referred to as digital currency orcrypto currency;(d)any other negotiable instrument through which titlepasses upon delivery;―Non-Profit Organisation (NPO)‖ refers to a legal person orarrangement or organisation that primarily engages in raising ordisbursing funds for the purposes of charitable, religious,cultural, educational, social or fraternal purposes, or forcarrying out any other good works;95

96Supplement to Official Gazette[6th March, 2020]―offence‖ means violation of any law in Seychelles, orviolation of any law in a foreign state, which, if it occurred inSeychelles, would constitute an offence in Seychelles;―pecuniary penalty order‖ means an order passed under Part Xof this Act;―person‖ means any natural or legal person, and includes a bodyof persons whether it has legal personality or not;―proceedings‖ includes the hearing before any court, tribunal,commission or any committee appointed by the Government;―proceeds of crime‖ means any property or economic advantageor income, capital or other economic gain or benefit or partthereof derived or realized directly or indirectly from, or as aresult of —(a)the commission of an offence in Seychelles;(b)any act committed outside Seychelles, which, if it hadbeen committed in Seychelles, would constitute anoffence;and includes property that has been converted or transformed,in full or in part, into other property;―production order‖ means an order issued under section 66;―property‖ includes money and all property, real or personal,heritable or moveable, including tangible or intangible orincorporeal property or a virtual asset and any reference to theproperty shall be construed as including reference to anyinterest in property, and includes property outside the Republicwhere by virtue of its domestic jurisdiction generally, in rem orin personam or by virtue of an arrangement with any othercountry or territory, the Court might be in a position to enforceor secure compliance with any order it might make or where itmight otherwise exercise jurisdiction in relation to that property

[6th March, 2020]Supplement to Official Gazetteto comply with an arrangement or a request from anothercountry or territory;―realizable property‖ means property liable to be taken intopossession and disposed of under this Act and includesproperty in the custody or possession of a person other than thebeneficial owner;―regulated business‖ means a business for which a license isrequired under the corresponding Act;―regulations‖ means the regulations made under this Act;―reporting entity‖ means an entity or person specified in theFirst Schedule;―Republic‖ means the Republic of Seychelles;―restraint order‖ means an order referred to in section 69;―revenue‖ means taxes, duties, contributions, fees, levies,charges, penalties, fines and other monies collected under theActs specified in the Schedule to the Seychelles RevenueCommission Act (Cap 322);―revenue laws‖ means any law or regulation relating to any tax,including the revenue laws as specified in the Schedule to theSeychelles Revenue Commission Act (Cap 322);―Selection Committee‖ means the Selection Committeeappointed by the President under section 14(5);―Seychelles Revenue Commission‖ means the SeychellesRevenue Commission established under section 3 of theSeychelles Revenue Commission Act (Cap 322);―supervisory authority‖ means the supervisory authoritiesspecified in the Second Schedule;97

98Supplement to Official Gazette[6th March, 2020]―Suspicious Transaction Report‖ means a report on an activityor a transaction or series of transactions made, to be made orattempted to be made, by a reporting entity under section 48;―terrorist financing activities‖ means the provisioning ofmaterial support in the form of funds to terrorist acts, terroristsand terrorist organisations and covered under section 5 of thePrevention of Terrorism Act (Cap 179), and the expression―financing of terrorist activities‖ shall be construed accordingly;―tax‖ means any tax, duty, levy or charge under the care andmanagement of the Seychelles Revenue Commission includingbut not limited to business tax, contributions to the SocialSecurity Fund, stamp duty and any other levy by way oftaxation;―virtual asset‖ means a digital representation of value that canbe digitally traded or transferred and can be used for payment orinvestment purposes and does not include digital representationof fiat currencies, securities and other financial assets.PART II – OFFENCE OFMONEYLAUNDERING ANDRELATED OFFENCESOffence ofmoneylaundering3.(1)A person is guilty of money laundering if, knowing or believingthat property is or represents the benefit of criminal conduct or being recklessas to whether the property is or represents such benefit, the person, withoutlawful authority or excuse (the proof of which shall lie on the person) —(a)converts, transfers or handles the property, or removes itfrom the Republic;(b)conceals or disguises the true nature, source, location,disposition, movement or ownership of the property orany rights with respect to it; or(c)acquires, possesses or uses the property.(2)Removing property from the Republic shall include referencesto removing it from another country or territory and moving property within the

[6th March, 2020]Supplement to Official GazetteRepublic or a country or territory in preparation for or for the purpose ofremoving it from the Republic or the country or territory in question.(3)Any person who participates in such conduct as described insubsections (1)(a), (1)(b) or (1)(c) of this section including but not limited to,aiding, abetting, assisting, attempting, counselling, conspiring, concealing orprocuring the commission of such conduct commits the offence of moneylaundering as a principal offender and shall be liable to be tried and punishedaccordingly.(4)(a)a person guilty of money laundering is liable onconviction to a fine not exceeding SCR5,000,000 or to imprisonment for a termnot exceeding 15 years or to both;(b)a person other than a natural person guilty of moneylaundering is liable on conviction to a fine not exceeding SCR10,000,000.(5)Where a person —(a)converts, transfers, handles or removes from theRepublic any property which is or represents the benefitfrom criminal conduct;(b)conceals or disguises the true nature, source, location,disposition, movement or ownership of the property orany rights with respect to it; or(c)acquires, possesses or uses the property,in such circumstances that it is reasonable to conclude that the person —(i)knew or believed that the property was orrepresented benefit of criminal conduct, or(ii)was reckless as to whether it was or representedbenefit from criminal conduct,that person shall be taken to have so known or believed or to have been soreckless, unless the court is satisfied having regard to all the evidence that there99

100Supplement to Official Gazette[6th March, 2020]is a reasonable doubt as to whether the person so knew or believed or was soreckless.(6)For the purposes of this Act —(a)a person is reckless if the person disregards a substantialrisk that the property in question is or represents benefitof criminal conduct, and for those purposes ―substantialrisk‖ means a risk of such a nature and degree thathaving regard to the circumstances in which the personbecame involved with the property and the extent of theinformation then available to the person, the disregardof that risk involves culpability of a high degree;(b)references to converting, transferring, handling orremoving property include references to the provision ofany advice or assistance in relation to converting,transferring, handling or removing the property.(7)This section does not apply to a person in respect of anythingdone by that person in connection with the enforcement of any law.(8)This Act shall apply to criminal conduct occurring after thecommencement of this Act and whether it was or is attributable to the personfirst mentioned in subsection (1) or another person.(9)In this Act, ―criminal conduct‖ means conduct which—(a)constitutes any act or omission against any law of theRepublic including the financing of terrorism as referredto in the Prevention of Terrorism Act, and for theavoidance of doubt includes the offence of moneylaundering established by section 3 of this Act andwhether committed in the Republic or elsewhere;(b)where the conduct occurs outside the Republic, wouldconstitute such an offence if it occurred within theRepublic and also constitutes an offence under the lawof the country or territorial unit in which it occurs;

[6th March, 2020](10)Supplement to Official Gazette(c)includes any act or omission against any law of anothercountry or territory whether committed in that othercountry or territory or elsewhere, unless the AttorneyGeneral certifies in writing that it would not be in thepublic interest to take action in the Republic in relationto an act or omission as defined in this sub-section; and(d)includes participation in such conduct, including but notlimited to, aiding, abetting, assisting, attempting,counselling, conspiring, concealing or procuring thecommission of such conduct;For the purposes of this Act —(a)references to believing that any property is or representsbenefit of criminal conduct include references to havingreasonable grounds to suspect that the property wasprobably, or probably represented, such benefit in wholeor in part;(b)references to any property representing benefit ofcriminal conduct include references to the propertyrepresenting that benefit in whole or in part directlyor indirectly, and cognate references shall be construedaccordingly;(c)the standard of proof to be applied in deciding whetherproperty is the benefit of criminal conduct shall be thestandard of proof applicable in civil proceedings;(d)in determining whether property is or represents benefitof criminal conduct, a court shall have account of all thesurrounding circumstances of the connection of thedefendant and any other relevant person with theproperty including but not limited to the financial abilityof the defendant or that other person to have or possesssuch property, the explanation, if any given by thedefendant or that other person as to his or herconnection with the property and the conduct of thedefendant or that other person in relation to the property101

102Supplement to Official Gazette[6th March, 2020](11)(a)As soon as the Court determines that the evidenceadduced in the case gives rise to a reasonable inference that the property is orrepresents benefit of criminal conduct, the property shall be deemed to bebenefit of criminal conduct unless the defendant by evidence establishesotherwise to the satisfaction of the Court. The burden of proof shall rest uponthe defendant to prove that the property was not derived from criminal conduct;(b)It shall not be necessary in any event for the prosecutionto prove that the property in question is or represents the benefit of anyparticular criminal conduct or that any person was convicted of criminalconduct in relation to the property.(c)Where it is necessary in the case of a money launderingoffence alleged to have been committed by a body corporate, to establish thestate of mind of the body corporate, it shall be sufficient to show that a director,officer, employee or agent of the body corporate, acting in the course of hisdirectorship, office, employment or agency as the case may be, had the requiredstate of mind to satisfy the element of mens rea required to ground aconviction.(d)Where a body corporate commits an offence of moneylaundering, whether convicted of that offence or not, and where the offence iscommitted with the consent, connivance, or in any other way with theassistance or omission to act of any director, secretary, manager, auditor oraccountant of the company or any person directing or person controlling suchperson, he or she shall be guilty of the offence and capable of being tried andpunished as a principal offender.(12)For the purposes of this Act —(a)a person handles property if that person, without a claimof right made in good faith —(i)receives such property;(ii)undertakes or assists in its retention, removal,disposal or realisation by or for the benefit ofanother person; or(iii)arranges to do any of the things specified insubparagraphs (i) or (ii).

[6th March, 2020]Supplement to Official Gazette(b)(i)a document purporting to be signed by a lawyerpracticing in the country or territorial unit inwhich the criminal conduct concerned is allegedto have occurred and stating that such conduct isan offence under the law of that country orterritorial unit; and(ii)a document purporting to be a translation of adocument mentioned in subparagraph (i) andcertified as correct by a person appearing to becompetent to so certify, shall be admissible inany proceedings, without further proof, asevidence of the matters mentioned in thosedocuments, unless the contrary is shown.103(13) Where a person who has failed to comply with directions of theFIU in relation to property, is subsequently charged with a money launderingoffence or another offence under this Act it shall be presumed —(a)that the property is the benefit of criminal conduct;(b)that the defendant knew or believed that the propertywas or represented benefit of criminal conduct or wasreckless as to whether it was or represented suchbenefit,until the defendant proves otherwise to the satisfaction of the Court on the civilstandard of proof.4.(1)A person who—(a)acquires;(b)uses; or(c)has possession ofproperty and who, at the time of acquisition, use or possession of such property,knows or has reasonable grounds to believe that the property forms part of theproceeds of a crime committed by him or by another person, commits anoffence of money laundering and is liable on conviction—Acquisition,use orpossession ofproceeds ofcrime

104Currencytransactionand wiretransferthresholdreportingSupplement to Official Gazette[6th March, 2020](a)to a fine not exceeding SCR5,000,000 or toimprisonment for a term not exceeding 15 years or toboth; and(b)to a fine not exceeding SCR10,000,000 in case of aperson other than a natural person.5.(1)All reporting entities executing a cash transaction or wiretransfer in the amount specified in the Third Schedule shall retain the detailsand report the particulars concerning such transactions to the FIU.(2)For the purposes of subsection (1), a reporting entity may applyfor a reporting exemption on behalf of their customer in the manner as may bespecified by the FIU.(3)A reporting entity, which fails to report a cash transaction orwire transfer under subsection (1) or materially misrepresents the amount ofsuch transaction, commits an offence and is liable to a fine not exceeding SCR200,000 for each such failure.(4)The Minister may by notice in the Official Gazette amend theThird Schedule from time to time.PART III – NATIONAL ANTI-MONEY LAUNDERING ANDCOUNTERING THE FINANCING OF TERRORISM theFinancingofTerrorismCommittee6.(1)A National Anti-Money Laundering and Countering theFinancing of Terrorism Committee is hereby established.(2)The Committee shall consist of the following—(a)a senior official from the Ministry of Finance not belowthe rank of Principal Secretary nominated by theMinister, who chairs the Committee;(b)the Attorney-General;(c)the Governor of the Central Bank of Seychelles;(d)the Commissioner of the Seychelles Police Force;

[6th March, 2020]Supplement to Official Gazette(e)the Registrar General;(f)the Commissioner General of the Seychelles RevenueCommission;(g)the Chief Executive Officer of the Financial ServicesAuthority;(h)the Chief Executive Officer of the Anti-CorruptionCommission of Seychelles; and(i)the Director of the FIU.105(3)The Committee shall appoint a Deputy Chairperson fromamongst its members.(4)The FIU shall act as the Secretariat of the Committee.(5)The Committee may co-opt such

12. Objectives of FIU 13. Powers and functions of FIU 14. Appointment of Director 15. Appointment of Deputy Director 16. Responsibilities of Director 17. Delegation of powers by Director 18. When Deputy Director may act