Transcription

11/22/2010Cohort Default RatesAnalysis and IncorrectData ChallengesWhat to do? How to do it?How is the Rate Calculated?Borrowers in the NumeratorCohort FiscalYearBorrowers in the Denominator2009Borrowers who entered repayment in 2009and defaulted in 2009, 2010 or 2011Borrowers who entered repayment in 20092010Borrowers who entered repayment in 2010and defaulted in 2010, 2011 or 2012Borrowers who entered repayment in 20102011Borrowers who entered repayment in 2011and defaulted in 2011, 2012 or 2013Borrowers who entered repayment in 20112-Year Time Period(Numerator)1-Year Time Period(Denominator)10/01/2008 to 09/30/201110/01/2008 to 09/30/200910/01/2009 to 09/30/201210/01/2009 to 09/30/201010/01/2010 to 09/30/201310/01/2010 to 09/30/20111

11/22/2010When are Rates Sent to Schools? The Department sends draft rates to schools in February.– shcdreop (Extract file; uploaded in Excel).– shcdrrop (Loan record detail report; open in notepad).– shdrlrop (Cover letter summary; open in notepad). Schools are provided an opportunity to identify andcorrect any inaccuracies by submitting an incorrect datachallenge within 45 calendar days.The Department calculates and releases the official rates.– Official rates generally are released to schools and the publicapproximately six months after the release of the draft rates.– Official rates must be released no later than Sept. 30 every year.What Benefit will a School Gain fromSubmitting an Incorrect Data Challenge? Contesting inaccurate data helps maintain data integrityand accuracy.Contesting inaccurate data may lead to a reduction in theschool’s CDR that would make the school eligible for thebenefits available to schools with low CDRs.Contesting the accuracy of the data may help prevent aschool from becoming provisionally certified based solelyon the school’s official CDR.2

11/22/2010How Does a School Determine if there isInaccurate Data on the LRDR? Review the LRDR by comparing the school’s records tothe information on the LRDR.Simplify the process by creating a spreadsheet ordatabase using information from the school’s records.Questions to ask:– Is each data element on the school’s spreadsheet the same as thecorresponding element on the LRDR (incorrectly reported)?– If there are differences between the school’s data and the data onthe sources mentioned, the school should examine its records andthe other sources (For example, the NSLDS borrower enrollmenthistory) to determine the possible causes for each difference.– Are there loans on the school’s spreadsheet that are not on theLRDR (incorrectly excluded)?LRDR Extract File Uploaded in Excel3

11/22/2010Enrollment Detail Screen NSLDSHow Does a School Submit an IncorrectData Challenge? https://ecdrappeals.ed.gov/ecdra/index.html.– You can access the IDC User Guide or online demonstration.– Beginning with challenges submitted in 2011, schools must usethe eCDR process (no paper submissions permitted). Federal Student Aid also offers short onlinedemonstration sessions of the system as a training aid:– Registration for eCDR Appeals.– Preparing and submitting an incorrect data challenge.– CPS/SAIG technical support at (800) 330-5947.4

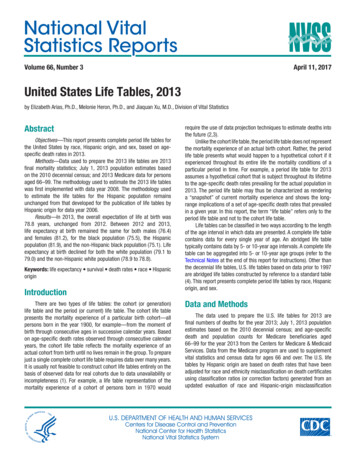

11/22/2010How Does a School Submit an IncorrectData Challenge? A school must list separate incorrect data challengeallegations for each loan record believed to containinaccurate data.– If one data manager is responsible for all of the loans, the schoolmust list all allegations in one incorrect data challenge.– If there are multiple data managers involved, the school mustsubmit a separate incorrect data challenge to each data manager. Link to look up the data manager(s) in order to send allnecessary documentation.– tacts.html.What Supporting Documentation Needsto be Submitted When Contesting Data? A copy of the student’s Last Date of Attendance (LDA) atthe institution, available from the school’s Registrar.– School must have documentation to prove the lender was notifiedof the LDA at the time the borrower withdrew or graduated. In NSLDS:– Print the “Enrollment Detail” screen for each borrower’s loanrecord that will be challenged to show the borrower’s last date ofattendance or less-than-halftime date recorded by NSLDS. Enrollment Detail is located under the ENROLL tab.– Print the “Loan History” screen for each borrower’s loan recordthat will be challenged.– Make a screen print from the SSCR function that confirms theborrower’s last date of attendance or less-than-half-time date asrecorded within NSLDS, or a letter on the school’s letterhead.5

11/22/2010What Supporting Documentation Needsto be Submitted When Contesting Data?[Insert date]ATTN: Bruce BementOPEID [Insert your school OPEID]Manager, Compliance and InvestigationsUSA Funds9998 Crosspoint Blvd.Suite 400Indianapolis, IN 46256-3307Subject: Cohort FY [Insert cohort year] Incorrect Data ChallengeDear Mr. Bement:[Insert school name], OPEID [Insert ID], is challenging the cohort FY [Insert cohort year] draft cohort defaultrate data found in our loan record detail report for the draft cohort default rates. Please see theenclosed spreadsheet, pages from the loan record detail report for the draft cohort default rates, andsupporting documentation.I, the undersigned, certify under penalty of perjury, that all information submitted in support of this incorrectdata challenge is true and correct.Thank you for your consideration.Sincerely,[Insert school President’s name]PresidentEnclosurescc: U.S. Department of EducationDefault ManagementWhat are the Roles of the Departmentand the Data Managers? Data manager is required to review a school’s incorrectdata challenge allegations if the incorrect data challengeallegations are submitted in a timely manner and the datamanager has responsibility for the loans.Data manager must respond to the school’s incorrect datachallenge allegations within 30 calendar days of receipt.The Department is the data manager for all Direct Loans.6

11/22/2010 Chris Miller – USA FundsConsultant, School and Student Services(866) 329-7673, Ext.0210christopher.miller@usafunds.orgUSA Funds is the nation’s leading education loan guarantor.A nonprofit corporation, USA Funds works to enhancepostsecondary education preparedness, access and successby providing and supporting financial and other valued services.7

In NSLDS: -Print the "Enrollment Detail" screen for each borrower's loan record that will be challenged to show the borrower's last date of attendance or less-than-halftime date recorded by NSLDS. Enrollment Detail is located under the ENROLL tab. -Print the "Loan History" screen for each borrower's loan record