Transcription

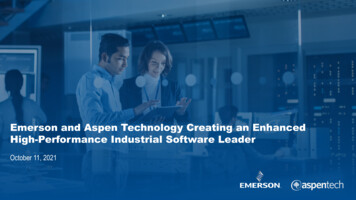

Emerson and Aspen Technology Creating an EnhancedHigh-Performance Industrial Software LeaderOctober 11, 2021Emerson Confidential1

Today’s PresentersLal KarsanbhaiFrank DellaquilaAntonio PietriChantelle BreithauptPresident andChief Executive OfficerSr. Executive Vice President andChief Financial OfficerPresident andChief Executive OfficerSr. Vice President andChief Financial Officer2

Agenda1Emerson Strategic Vision and Transaction Overview2Strategic Rationale for New AspenTech3Financial Highlights for New AspenTech4Financial Highlights for Emerson and Next Steps3

Emerson StrategicVision andTransactionOverviewLal KarsanbhaiPresident andChief Executive Officer4

Accelerating Emerson’s Software Strategy Emerson is acquiring a controlling interest in Aspen Technology (“AspenTech”), a leading global industrialsoftware company, by contributing cash and complementary software businesses Emerson has been advancing our industrial software portfolio for more than a decade, building on ourEmerson andAspenTech Creatingan Enhanced HighPerformance IndustrialSoftware Leaderstrong foundation in intelligent devices and advanced control systems Our customers are accelerating their investment in software as workflow automation helps to driveimprovement in safety, reliability, emissions and productivitySignificant ValueCreation forEmerson andAspenTechShareholders The transaction creates an enhanced high-performance industrial software leader bringing a highlycompetitive offering to Emerson and AspenTech customers across diversified industries Transaction is structured as a “win-win” for Emerson and AspenTech shareholders creating significantvalue enabled by the strength of the combined platformDrivingDouble-DigitTop-Line Growth5

A Win-Win Transaction StructureEmerson acquires majority stake in highly strategic business to accelerate Emerson’s software growth strategyCash value to AspenTech shareholders plus continued ownership of new, more valuable, well-diversified company Strong platform for growth for both AspenTech and EmersonAspenTechShareholdersEmersonshareholders across diversified end markets New AspenTech is 55% owned by Emerson and 45% ownedby existing AspenTech shareholders New AspenTech maintains a strong balance sheet that iswell-positioned for future acquisitionsAspenTech SharesAssets 6B Cash55%NewAspenTech45% 6B Cash Software-focused culture with ability to incentivize talent inline with industry standards New AspenTech is a publicly traded company trading onNASDAQ under AZPN tickerEmerson OSIand hAssets6

Emerson Is a World Leader in Industrial AutomationTwo GlobalPlatformsPurpose DrivenCompanyAutomation67% SolutionsCommercial & 33%ResidentialSolutionsInnovation Leader ServingEssential Industries21,000 PatentsWe drive innovationthat makes the worldhealthier, safer, smarterand more sustainable11,000 Engineers54 Global Engineering CentersLife Sciences, Power, EnergyHistorically Strong ValueCreation and OperationalExecutionLeading Gross MarginsFree Cash Flow Conversion 100% of Net IncomeOn Track to Meet 2023 MarginCommitments 18.4B 23% 87,000RevenueAdj. EBITDA MarginEmployeesNote: Financials as of 2021. ¹ Non-GAAP operating marginNote: Based on Emerson 2021 guidance for fiscal year ended 30-Sep-20217

High-Growth 60B Industrial Software OpportunityENGINEERING & DESIGNCONTROLPRODUCTION MANAGEMENTASSET RELIABILITYArchitectural Engineering& ConstructionAdvanced Process Control& OptimizationManufacturing Execution SystemsPlant Asset ManagementQuality Management SystemsEngineering Design ToolsOperator Training SimulatorsEnterprise Asset ManagementAnalytics and VisualizationProduct Lifecycle ManagementAlarm ManagementGeology & GeophysicsHuman Machine InterfaceEnvironmental, Health & SafetyProcess Simulation & OptimizationAsset IntegrityField Service ManagementLab Information Management SystemsPower Transmission & DistributionSoftware8

Customer Software Adoption Is Driving InvestmentIndustrial Software Growth Outpacing PP&E by 2.5xDriven by Pursuit of Top Quartile PerformanceU.S. Manufacturing Annual Investments ( B) 150SAFETYRELIABILITYPRODUCTIONENERGY & EMISSIONS 10%CAGRSoftware 4%CAGRPP&E 01990200020102020Source: Bureau of Economic Analysis and Bank of America analysis9

Emerson Is Contributing 0.3B of Standalone Software toNew AspenTech While Retaining 1.0B of Control-Related Software2020 Automation Solutions Pro Forma Revenue Including OSI Inc. 1.3BDataManagement 1.4BControlCONTRIBUTEDSTANDALONESOFTWARE( 0.3B)OSI Inc.Geological SimulationSoftware TODAY 8.7BCONTROLRELATEDSOFTWARE( 1.0B)IntelligentDevicesTIED TO CONTROLSYSTEMS ANDSALES CHANNELDeltaV Application Ovation Application Automation SystemSoftwareSoftwareManagementUse strategicalliance with AspenTechfor expansion10

New AspenTech Will Be a High-PerformanceIndustrial Software LeaderNew AspenTech:High-Performance Industrial Software LeaderOSI Inc. and Geological Simulation Software Pure-play software leaderin asset optimization Enables digital transformation forcapital-intensive industries Mission-critical products withcomplete end-to-end solutions Well-positioned todeliver on Industrial AI Significant scale OSI Inc.– Leading transmission and Diversified end markets– Digitizes and modernizes Complementary softwaredistribution platformelectric grid Geological Simulation Software– Leading subsurface modelingand dynamic simulationsoftware Combined differentiated softwaresuites 1BPro Forma RevenueMid TeensAnnual Spend Growth1 Leading software platformfor industrial automation endmarkets Commercial benefitsfrom Emerson ecosystemand domain expertise Strong platform for growththrough acquisitions 490MPro Forma Adj. EBITDA 360MPro Forma AnnualFree Cash FlowNote: Emerson figures reflect fiscal year ending 30-Sep-2022; AspenTech figures reflect fiscal year ending 30-Jun-2022; before synergies 111 Reflects 2021 – 2026 Annual Spend CAGR, before synergies

New AspenTech Will Have Transformational Asset LifecycleOptimization Opportunities Across Diverse IndustriesENGINEERING / MODELINGAND DESIGNGeologicalSimulationOPTIMIZE PRODUCTION ANDOPERATIONSProcessing irEngineeringASSET PERFORMANCEMANAGEMENTProductionModeling &OptimizationProcessHybrid1SCADAPower Transmission& DistributionOSIInc.DERMSOutageManagement¹ Includes Life Sciences, Metals & Mining, Food & Beverage, and Pulp & onAutomationDistributionManagement12

Transaction HighlightsCompelling combination structured to position Emerson and New AspenTech for long term success Emerson contributes industrial software businesses (OSI Inc. and Geological Simulation Software) and 6.0B cash to New AspenTechAdvantagedStructure New AspenTech fully diluted ownership at closing: 55% Emerson, 45% current AspenTech shareholders Consideration to AspenTech: 871 per share in cash and 0.42 shares of New AspenTech per share of current AspenTech stock Represents value of 160 per AspenTech share before synergies; implies a premium of 27%2; 40%2 including synergies3 1B pro forma revenue and 490M pro forma adjusted EBITDA, 45% margin (before synergies)4High-PerformanceSoftware Leader Double-digit annual spend growth CAGR to 2026, strong recurring revenue and cash flow 110M EBITDA from revenue and cost synergies to be realized by 2026, 1x cost to achieve Additional 45M of EBITDA synergies at Emerson Well-diversified with exposure to high-growth end markets Comprehensive governance agreementGovernance andManagementTiming andNext Steps Antonio Pietri, current President and CEO of AspenTech, will be President and CEO of New AspenTech 9-member Board, Emerson to nominate Board majority consistent with ownership;Jill Smith, current AspenTech chair, to serve as chair of New AspenTech Arms-length commercial and operating term sheets in place New AspenTech is an independent public company that will trade on NASDAQ under the ticker AZPN Transaction subject to customary closing conditions, including a shareholder vote at AspenTech Expected closing in calendar Q2 2022¹ Based on fully diluted share count of 69.1M as of signing, including shares underlying retention programs; actual cash per share payment will be calculated at closing based on the fully diluted share count at that time2 Based on unaffected stock price as of 06-Oct-20213 Estimated synergy value of 2.4B4 Emerson figures reflect fiscal year ending 30-Sep-2022; AspenTech figures reflect fiscal year ending 30-Jun-202213

Transaction Unlocks Substantial Value for Emerson ShareholdersVALUE CREATION FOR EMERSON OVER TIMEOwn a Highly ValuedPure-Play IndustrialSoftware Leader Accelerates and unlocks value ofEmerson’s software strategy andbuilds a higher growth, morediversified and sustainableportfolio 6.0B in Cash55% New AspenTech 2.5B in AssetsCombined 2022 Adj. EBITDA1OSI Inc. 490MGeologicalSimulation Software@ 27x – 34x2022 Adj. EBITDA Multiple2 8.5B 9B – 11B3VALUE DRIVERS Creates meaningful value from1.synergies and business modeltransformation with significant upsidefrom acquisition opportunitiesOptimize performanceof contributed assetsas part of a pure-playsoftware company2.Access tocomplementary portfoliothat enables significantgrowth opportunities3.Platform with strongequity currency topursue diverseopportunity setCombined Adj. EBITDA before synergies; Emerson figures reflect fiscal year ending 30-Sep-2022, AspenTech figures reflect fiscal year ending 30-Jun-2022Represents range of average of peer median multiple over last 3 years (27x) to current peer median multiple (34x); peers include ANSYS, Autodesk, AVEVA,Bentley Systems, Dassault Systemes and PTC; market data as of 06-Oct-20213 Includes 55% of 2.4B synergy value at New AspenTech and 100% of 600M synergy value at Emerson1214

Strategic Rationalefor New AspenTechAntonio PietriPresident andChief Executive Officer15

AspenTech Is a World Leader in Industrial Asset Optimization SoftwareComprehensive AssetOptimization SoftwareGlobal and DiversifiedCustomer BaseEngineeringManufacturing & Supply ChainAsset Performance Management /AIoT Hub2,400 total customersincluding 80%-100% of thelargest 20 companiesacross our key industriesMission-Critical,High ValuePowerful SecularTrends 59B Annual Value CreatedDigitalization100:1 Value to Cost RatioSustainabilityEnabling SustainabilityEnd Market Dynamics 720M7% 380M 280MRevenueAnnual Spend Growth (2016-2021)1Adj. EBITDAFree Cash FlowNote: Financials as of 2021. ¹ Non-GAAP operating marginNote: Reflects estimated AspenTech financials for fiscal year ending 30-Jun-2022¹ AspenTech 2016 – 2021 results (Jun-FYE)16

AspenTech Is Receiving High-Quality Software BusinessesServing Complementary End MarketsOSI Inc.Geological Simulation Software Real-time management and optimization of Power Transmission andDistribution networks ensuring grid robustness and efficiency Well-positioned to capitalize on Transmission & Distribution megatrends: decarbonization, digitization, and decentralization 2022E Revenue: 220M; double-digit growth Paradigm and Roxar software solutions Subsurface characterization of geological formations from seismic todynamic simulation connecting reservoirs to operational activities tooptimize production 2022E Revenue: 130M; single-digit growth 350M 11% 110M 80MRevenueYoY Revenue GrowthAdj. EBITDAFree Cash FlowNote: Reflects estimated OSI Inc. and Geological Simulation Software financials for fiscal year ending 30-Sep-202217

Accelerating Scale and Diversification for aGlobal Industrial Software LeaderBest-in-class, global industrial software companyMission-critical software products span entire capital asset lifecycle – design, operate, maintainDeep domain expertise, leadership serving energy, chemical, power & utilities, EPC,pharmaceuticals, and other asset-intensive process end marketsExpanded commercial relationship with Emerson provides powerful go-to-market, expansivecustomer base, and domain expertise in existing and new end marketsStrong financial profile – highly recurring revenue, high margin, and strong free cash flowSignificant synergy opportunity – revenue, costs, and value through business model transformationOSI Inc. and GeologicalSimulation SoftwareStrong platform and capabilities to increase growth through strategic acquisitions18

New AspenTech Is Aligned With Customers’ Sustainability Needs inCurrent and New Energy Transition MarketsReducedEmissionsElectrical GridModernizationCarbonCaptureAspen DMCOSI EMS / ADMSDow Chemical has achieved 700M in cumulative savings and80% emissions reductions over 9 years by increasing energyefficiency by 9% across 15 sitesSalt River Project, the 3rd largest U.S. public utility, leveragesOSI EMS and ADMS to help reach goal of 65% carbonemission reduction by 2035 while serving 2 million customersAspen Plus Geological Simulation Aspen Plus with ACM simulates thermal process with carboncapture while Emerson Geological Simulation Softwareprovides carbon storage optimizationTypical Results 30% CO2 reduction 15% energy savings 10% decrease in water usageTypical Results System resilience and efficiency Distributed energy resource management (DERMs) Demand responseTypical Results Carbon capture and process simulation Logistics supply chain planning and scheduling Subsurface sequestration flow modelingand optimizationCircularEconomyAspen SupplyChain PlannerWaste reduction, recycling, renewable feedstocks, innovation– supply chain visibility reduced waste and enabled CO2emission reduction by 135,000 MT at FP CorporationTypical Results Reduction in waste Improving material efficiencies Reusing of existing materials and products19

AspenTech Will Transform the OSI Inc. andGeological Simulation Software Business ModelsNEW AspenTechOSI Inc. and Geological Simulation SoftwareTodayOSI Inc. today is primarily a solution salecomprised of perpetual licenses withannual maintenance and significantimplementation servicesGeological Simulation Software today isprimarily a term license with annualmaintenance selling modelTransforming OSI Inc. and Geological Simulation SoftwareHigh-Performance IndustrialSoftware LeaderBusiness and Commercial TransformationLong-term contracts (5 years) and tokenbased recurring revenue model, featuresannual payments in advance with annualprice escalationsAnnual spend represents an estimate of theannualized value of our portfolio of termlicense agreementsToken-model ensures customers can easilyincrease usage of software; enablesaccess / exchange between products andimproved customer insightMore Software, Higher Adoption, More Recurring Business Model20

Significant Revenue and Cost SynergyOpportunities at New AspenTechSynergy opportunities across the combined businessRevenueDeliver Higher Valueto Customers WithJoint PlatformDrive differentiated T&D asset management offering on a unified platformEnable “Big Loop” asset modeling and optimizationCostCapture ScaleEfficienciestotal EBITDA fromsynergies by year 5Best-in-class digital transformation portfolio for the automation end marketExpanded strategic alliance between Emerson and AspenTechBusiness ModelTransformationLeveraging AspenTechExpertise 110MExpand recurring sales through flexibility provided to customers bytransitioning OSI Inc. and Geological Simulation software to token modelsCommercialize recurring value of certain service offerings into token supportfeatures through standardizationLeverage joint R&D and SG&A organizations 40Mof total from costsaving opportunities 2.4Bestimated value ofnet synergiesOptimize spend through rationalization at greater scale21

New AspenTech Is an Enhanced Platform forFuture Industrial Software AcquisitionsAdjacent Areas ofOpportunity ( 13B)Strategic BenefitWider Access to TargetsFinancial BenefitAbility to Complete More / Larger Deals Enterprise AssetManagement Environment, Health, Broader industry expertise Larger scale and financial capacity Comprehensive portfolio of software High-multiple equity currency attractive to Global sales channel and access to 120BEmerson installed base Access to additional diversified, high-growthindustry verticals Acceleration of transformative M&A in endmarkets and product adjacenciestargets Leverage Emerson M&A expertise in endmarkets and integration capabilities Enhanced financial platform with increasedaccess to capitalSafety & Quality Field ServicesManagement Lab InformationManagement Manufacturing ExecutionSystems22

Accelerating AspenTech Strategic RoadmapTransaction addresses strategic priorities from 2021 AspenTech Investor Day Penetrate existing customerbaseGeological Simulation Softwareproducts into AspenTech base Grow APM and AIoTinto existing and newcustomer baseT&D highly attractive end marketwith significant growth potential Drive increased usage andadoption into the existingcustomer baseUsage of Geological Simulation /AspenTech products intorespective base Increase Total AddressableMarket through organic andinorganic innovationOSI Inc. adds large new end market/ Geological Simulation adds newend market in energy Leverage existing capabilitiesfor energy transition andcircular economyOSI Inc. adds leading, high-growthplay on electrificationExpand to adjacent industriesand market segmentsOSI Inc. adds large new end market/ Geological Simulation adds newend market in energyThen (2025 Target)Now (Pro Forma 2026 Target) 1B Annual Spend 1.5B Annual Spend23

FinancialHighlights forNew AspenTechChantelle BreithauptSr. Vice President andChief Financial Officer24

New AspenTech Will Have Greater Scale and Faster GrowthWith Sustained High Margins and Cash FlowNew AspenTechHigh-Performance IndustrialSoftware LeaderOSI Inc. and Geological Simulation SoftwareRevenue 350M 720M 1,070MAnnual Spend 140M 660M 800M5 Year GrowthOutlookLow TeensLow TeensMid TeensWith Synergies 110M 380M 490MAdj. EBITDA (%)Low 30s %Low 50s %Mid 40s %Free Cash Flow 80M 280M 360MAdj. EBITDANote: Emerson figures reflect fiscal year ended 30-Sep-2022; AspenTech figures reflect fiscal year ended 30-Jun-2022; for AspenTech figures, 2022 Annual Guidance assumes 6% growth (midpoint of 5-7% 2022guidance) off 2021A Annual Spend; 2022 Adj. EBITDA based on midpoint of GAAP Operating Income guidance with management adjustments for D&A (ex. Amort. of Cap. Software) and SBC adjustments; combinedRevenue, Annual Spend, Adj. EBITDA, Adj. EBITDA margin and Free Cash Flow are before synergies25

New AspenTech Will Have a Consistent Target Model With GreaterIndustry Diversification and Investment OpportunitiesAspenTech Target Model3New AspenTech Target 6%4%Chemical 18%Power22% Transmission& Distribution20% Midstream /20%UpstreamDownstream 12% Software Mix87-90% Non-GAAPOperating Margin47-50% Free Cash FlowMargin441-44% Americas2Asia, Middle 26%East & Africa2 1.5BAnnual SpendGrowth2026 Target Annual Spend¹ Software includes license and maintenance revenue² Revenue by geography based on 2021A (June) financials for AspenTech and 2021E (September) financials for OSI Inc. and Geological Simulation Software³ As presented in February 2021 AspenTech Investor Day4 Defined as free cash flow divided by annual spend26

Transaction Unlocks Substantial Value for AspenTech ShareholdersTransaction Equity ValueValue Per AspenTech Share B BPer ShareAspenTech Equity Value 8.5Cash 6.0 871OSI Inc. and Geological Simulation Software 2.5 45% of New AspenTech Before Synergies 4.9 73Transaction Value (Before Synergies) 11.0 45% of Synergies 1.1 16Total Transaction Value 12.0 176( ) Synergy Value 2.4Total Transaction Value 13.4Premium Offered(vs. Unaffected Stock Price As of October 6th, 2021) 160 per share before synergies 27% 176 per share including synergies 40%Note: Market data as of 06-Oct-20211 Based on fully diluted share count of 69.1M as of signing, including shares underlying retention programs; actual cash per share payment will be calculated at closingbased on the fully diluted share count at that time27

Financial Highlightsfor Emersonand Next StepsFrank DellaquilaSr. Executive Vice President andChief Financial Officer28

Financial Highlights for EmersonVALUE CREATION Significant value for Emersonshareholders from New AspenTechownership share and synergies inboth companies Partnership history with AspenTechGAAP REPORTINGFINANCIAL STRENGTH New AspenTech will be fully Emerson maintains its strong investment Adjusted EPS1 accretion after year one Commitment to increasing dividendconsolidated in Emerson’s financialstatementssupports quick ramp-up ofcommercial activitygrade balance sheet and capitalallocation flexibility Value-accretive M&A will continue Strong cash flow enables growthinvestments and rapid deleveraging¹ Adjusted EPS excludes restructuring, amortization, and first year purchase accounting related items29

Enhanced Commercial Alliance to Drive 45M ofEBITDA Synergies at EmersonExpanded StrategicAllianceNext Generation DigitalTransformation PortfolioEnhanced ApplicationsAccelerate delivery of AspenTech software through Emerson channelsBest-in-class data analytics platform for the automation marketCo-develop suite of next generation control technologies across value chainBusiness ModelExpand use of subscription models and cloud delivery for Emerson control softwareCost SavingsCapture efficiencies enabled by separation of OSI Inc. and Geological Simulation Software30

Substantial Value Creation for Emerson ShareholdersBenchmarkingVersus Peers1Value Creation for Emerson Over Time ( B)2021E-2023E Revenue CAGR11% 9- 11 0.610% 8.5New AspenTech Peer MedianOSI Inc. andGeologicalSimulationSoftware 2.5Own 55% of NewAspenTechcompany Higher growth andmargins than peers Organic and 1.3 Leverage existinginstalled base Tangibleopportunities More valuableAdj. EBITDA MarginOwn 55% of NewAspenTech SynergiesOwn 100% ofEmerson Synergies100% of 600MEmerson Synergies55% of 2.4B NewAspenTech Synergies Expand strategicalliance Complementaryproducts Track record ofworking together 7.3- 9.155% of New AspenTechBefore Synergies @ 27-34x Multiple2inorganic runway45%35%New AspenTech Peer MedianCash 6.0Today's InvestmentIllustrative FutureValue to Emerson¹ Peer revenue and Adj. EBITDA figures reflect IBES consensus estimates; peers include ANSYS, Autodesk, AVEVA, Bentley Systems, Dassault Systemes and PTC; market data as of 06-Oct-20212 Represents range of average of peer median multiple over last 3 years (27x) to current peer median multiple (34x)31

Transaction Expected to Close in2nd Calendar Quarter of 2022Key outstanding items to closeNEXTSTEPSFOR CLOSINGAgreementscompletedat signingKey outstanding items to close Customary regulatory approvals Effectiveness of Registration Statement on Form S-4 AspenTech shareholder approval32

Additional Information and Where to Find ItIn connection with the proposed transaction between Emerson Electric Co. (“Emerson”) and Aspen Technology, Inc. (“AspenTech”), a subsidiary of Emerson, Emersub CX, Inc. (“new AspenTech”), will prepare and filewith the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a combined proxy statement/prospectus of new AspenTech and AspenTech (the “Combined ProxyStatement/Prospectus”). AspenTech and new AspenTech will prepare and file the Combined Proxy Statement/Prospectus with the SEC, and AspenTech will mail the Combined Proxy Statement/Prospectus to itsstockholders and file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or otherdocuments AspenTech and/or new AspenTech may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS, SECURITY HOLDERSOF EMERSON AND SECURITY HOLDERS OF ASPENTECH ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE COMBINED PROXY STATEMENT/PROSPECTUS WHEN IT BECOMESAVAILABLE AND THE OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED BY ASPENTECH OR NEW ASPENTECH WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESEDOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION, BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONAND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Combined Proxy Statement/Prospectus and other documents filed with the SEC by AspenTech and/or new AspenTechwithout charge through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Emerson or AspenTech"Emerson8000 West Florissant Avenue, P.O. Box 4100St. Louis, MO 63136Media n-us/investorsInvestor Relations: Colleen Mettler, Vice President,Investor RelationsAspenTech20 Crosby DriveBedford, MA 01730Media Relations:Andrew Cole / Chris Kittredge / Frances JeterSard Verbinnen & om/Investor Relations: Brian Denyeau ICRBrian.Denyeau@icrinc.comNo Offer or SolicitationThis communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation tosubscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance ortransfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, asamended, and otherwise in accordance with applicable law.Participants in the SolicitationEmerson, Aspen, Newco and certain of their respective directors and executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies inconnection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction,including a description of their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth in the Combined Proxy Statement/Prospectus and other relevant materials when it is filedwith the SEC. Information regarding the directors and executive officers of Emerson is contained in Emerson’s proxy statement for its 2021 annual meeting of stockholders, filed with the SEC on December 11, 2020,its Annual Report on Form 10-K for the year ended September 30, 2020, which was filed with the SEC on November 16, 2020 and certain of its Current Reports filed on Form 8-K. Information regarding the directorsand executive officers of Aspen is contained in Aspen’s proxy statement for its 2021 annual meeting of stockholders, filed with the SEC on December 9, 2020, its Annual Report on Form 10-K for the year ended June30, 2021, which was filed with the SEC on August 18, 2021 and certain of its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above.continued33

Additional Information and Where to Find ItCaution Concerning Forward-Looking StatementsThis communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the PrivateSecurities Litigation Reform Act of 1995. All statements, other than historical facts, are forward-looking statements, including: statements regarding the expected timing and structure of the proposed transaction; the ability ofthe parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced revenues and cash flow, synergies,growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of new AspenTech following completion of the proposed transaction; legal, economic and regulatoryconditions; and any assumptions underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by thewords “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “plan,” “could,” “would,” “project,” “predict,” “continue,” “target” or other similarwords or expressions or negatives of these words, but not all forward-looking statements include such identifying words. Forward-looking statements are based upon current plans, estimates and expectations that are subjectto risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipatedby such forward-looking statements. We can give no assurance that such plans, estimates or expectations will be achieved and therefore, actual results may differ materially from any plans, estimates or expectations in suchforward-looking statements.Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others: (1) that one or more closing conditions to the transaction, including certain regu

5 Accelerating Emerson's Software Strategy Emerson is acquiring a controlling interest in Aspen Technology ("AspenTech"), a leading global industrial software company, by contributing cash and complementary software businesses Emerson has been advancing our industrial software portfolio for more than a decade, building on our strong foundation in intelligent devices and advanced .