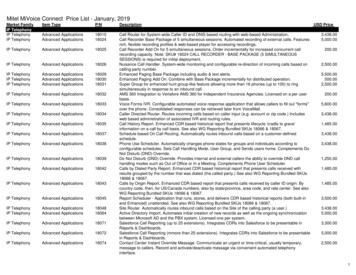

Transcription

GSA OVERVIEW

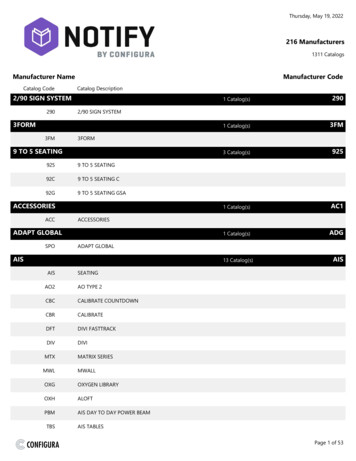

GSA MissionAccelerate the growth and increase the return on invested capitalof the global semiconductor industry by fostering a more effectiveecosystem through collaboration, integration, and innovation GSA is the only organization that brings together the entiresemiconductor ecosystem in order to represent industrywide interests and thoughts. GSA provides a neutral environment forexecutives within the semiconductor industry tomeet and collaborate on ways to improveefficiencies and address industry wide topicsand concerns. GSA identifies and discusses emergingtrends & opportunities, and how ourmembership can best participate andimpact change.EDAFoundryIP GSA encourages and supports entrepreneurshipthrough various Leadership Councils, Working Groups andResources. GSA promotes the visibility of our members and theircontributions to our industry.SemiconductorCompaniesBackEnd

GSA Success ModelMembershipGSA represents nearly 400 leading companies in 30 countrieswith more than 100 executives participating in a GSA leadershiproleGroups, Councils,and CommitteesGSA organizes multiple working groups, councils, round tables,and committees to discuss common issues and concerns as wellas accelerate the adoption of specific technology and ideasEventsGSA hosts the most widely recognized global and regional eventstailored specifically for the semiconductor industryResearchGSA provides numerous resources, surveys, and reports uniqueto GSA membership

400 Member Companies

Board and Council Groups“GSA provides independent think-tanks where key decision makers bring theirexperience, problems, and perspectives, to discuss and debate” Dr. Tien Wu, ASEGSA Board ompanyCEO APACLeadershipCouncil(appointed) Discuss regional and global topics impacting the semiconductor ecosystem Represent company interests while helping shape the direction of the industry Discuss emerging opportunities and encourage entrepreneurship Provides opportunity for pre-competitive discussions and collaboration Promotes encouragement and stimulation

Technology Steering Committee“Ensuring that GSA focuses on the areas of interestthat are most important to our members”Jodi Shelton, President & Co- Founder GSA Vision Encouraging the advancement and adoption of leading technology andpractices for the betterment of GSA constituentsMission Provide general oversight and guidance to GSA’s working groups,committees, research, and events, as it pertains to key technologicaltrends and their implications on the semiconductor ecosystem.Objectives Ensure GSA’s focus is aligned with the key technologies and practicesthat can have the most positive impact on its members Accelerate industry adoption of the emerging technologies and practicesthat are most significant to GSA members Support GSA’s efforts to encourage and promote entrepreneurship byproviding counsel and guidance to nascent start-upsMembers A cross section of senior and executive management from GSA’smembership representing the semiconductor ecosystem

CxO RoundtablesGSA provides its members with non-competitive, neutral forums forleading executives in the semiconductor ecosystem to discusstopical issues that affect the entire industry and explore resolution Congregation of like executivesfrom the same discipline Designed to stimulate discussionand exchange ideas on subjectmatter uniquely specific toindividual disciplines within thesemiconductor industry Each discipline meets on a biannual to quarterly basis Roundtables may result inestablishing a specific Panel, Forum,Working Group or Peer AdvisoryCommitteeCEOHRGSARoundtablesCIOCFO

Working GroupsIndustryQualityIPSupply ChainGSA provides an opportunity for our members to formindividual working groups to address the technical andbusiness challenges unique to their specific ecosystem. Discuss common issues and concerns Accelerate technology Increase efficiencies3D ICAMSTechnologyMEMS

Corporate MarketingGSA provides various ways to enhance our members Corporate Marketing campaignsby providing increased exposure through our events, Web site, and periodicals Company Exposure 125 x 125 banner ad on GSA Web site Member spotlight on GSA home page Member spotlight in monthly GSA e-newsletter Member news feedGSA Forum - Quarterly Magazine Featured articles Executive interviews Private Showing and Innovator Spotlight Print advertising opportunitiesEvent Sponsorship Leverage leading global and regional events to that complements yourmarketing strategy and increases your companies visibility and brand exposureEvent Participation Numerous keynote speaking opportunities Moderate or participate on a wide variety of panels Host and/or participate in a Working Group meeting

GSA EventsGSA provides its members with opportunities to participate incontent rich programs that focus on senior level involvement Address the evolving technologies and end markets that are mostimportant to our members. Promote the global advancement of, and collaboration within thesemiconductor industry Provide uniquely exclusive networking opportunities for global leaderswithin the semiconductor ecosystem Address key GSA initiatives and regionally specific topics

2015 Global EventsNorth AmericaGSA Silicon Summit (Technology Conference)Computer History MuseumMtn. View, CAThursday, APR 16US Executive Forum (Invitation-only)Silicon Valley, CAWednesday, SEP 24Awards Dinner CelebrationSanta Clara, CAConvention CenterDecember TBDCouncil MeetingsSan Jose, CAThroughout the yearTechnology Steering Committee (slide 6)San Jose, CAThroughout the yearCxO Roundtables (slide 7)San Jose, CAThroughout the yearWorking Group Meetings (slide 8)San Jose, CAThroughout the yearEMEAEMEA Dinner SeriesTBDGSA European Executive ForumMunich, GermanyWednesday and Thursday, MAY 6-7Israel Executive ForumHerzliya, IsraelNovember TBDEMEA Council MeetingsRegional rotationThroughout the yearASIAGSA Memory ConferenceTokyo, JapanTuesday, MAR 3Semiconductor Leaders Forum TaiwanTaipei, TaiwanTuesday, OCT 28CEO Roundtables (slide 7)Regional rotationThroughout the year

SemisMatter.comThe goals of SemisMatter.com are to raise the profile of the semiconductor industry toincrease general awareness amongst other business sectors, the media, students, andgovernment, to enhance the image of the industry in order to promote interest andencourage STEM participation at all levels of the education system and to create a betterunderstanding of the contribution of the industry to help influence policy makers,regulators, and investors. Hosts the 2013 GSA Board of Directorscommissioned Oxford Economics whitepaper“Enabling the Hyperconnected Age.” Evaluates the economic and societal impact ofthe semiconductor industry.Available for download in English, TraditionalChinese and Simplified Chinese Features dozens of GSA Member contributedvideos, articles and reports. Includes Students page with career testimonialvideos and employment data.

Resources Available to You!GSA provides its members with Comprehensive reports regarding industry issues and technologyBusiness tools to improve efficienciesFinancial analysis to enable semiconductor companies to track performance via industrypeers, spot trends, and forecast market healthComprehensive directory and abstract for all known public and private semiconductorcompaniesQuarterly and annual industry news magazines and resource guidesFinancial AnalysisReports & Surveys Analysts’ IndustryForecasts CEO SentimentIndex Quarterly EconomicReview by Dan Niles IP Licensing Financial Tracker GSA Market Watch Wafer Fabrication &Back-End PricingReportsDirectories & PublicationsTools Semiconductor A/MS Checklists Supplier & ServicePartner IP Source SelectionTool GSA Forum IP ROI Calculator IC Foundry Almanac 3DIC Packaging BestPractices 3D IC Tour Guide Supply Chain M&ADue Diligence

Dan Niles’ Quarterly Economic ReviewDan Niles, Chief Investment Officer at Alpha One Capital Partners, has partnered with GSAsince 2009 to provide a series of webcast sessions that allow our most important globalCEOs, CFOs and other executives to monitor the industry’s position in the cycle.Each quarter he provides updates on his economic outlook for the technology industry,providing a number of issues affecting the semiconductor market and where we are in termsof a cycle. Each webcast covers the following: Trends in U.S. unemployment, homesales/ownership, retail sales, personal savings,GDP growth, industrial production, moneysupply, etc. Monthly Semiconductor Industry Sales Total Semiconductor Revenue vs. Total CapitalExpenditure % Growth Predictions for the following quarter and al-analysis/dan-niles-quarterly-economic-review/

GSA Financial TrackerReport & SpreadsheetTRACKS MORE THAN 6,000 DATA POINTS FOR 270 COMPANIESThis quarterly downloadable Excel spreadsheet and executive summary includes over 6,000financial data points, such as revenue, net income and market capitalization, for more than270 semiconductor companies (fabless and IDM). Tracks 35 different financialmetrics for every publicly tradedsemiconductor company on aquarterly basis 29 different avenues of data sortcapabilities. Included in GSA membership Available to all GSA membercompany l-analysis/global-semiconductor-financial-tracker/

GSA Market WatchGSA provides the industry with timely data onsemiconductor investment activity in the private andpublic sector and releases a monthly update and adownloadable, sort-able Excel spreadsheet of all funding,initial public offering (IPO), and merger andacquisition (M&A) activity for fabless companies, IDMsand semiconductor suppliers.Semiconductor Fundingsortable by: DateCompanyCompany TypeLocationAmount RaisedRoundInvestorsSemiconductor IPOssortable by: Date Priced/FiledCompanyLocationAmount Priced/Price RangeShares OfferedUnderwritersStock ExchangeTickerAnnual RevenueSemiconductor M&Assortable by: Type of Entity Acquired Entire Company, CompanyDivision/Product Line orFoundry Facility Announcement Date Acquirer Entity Acquired/Merged Amount Paid Payment ysis/gsa-market-watch/

Wafer Pricing & AssemblySurvey & ReportsThe Wafer Fabrication Pricing Report providesthe user thousands of price data points for wafer andmask sets, from fabless semiconductor companies,and integrated device manufacturers (IDMs). Thedata is collected confidentially and tabulated inaggregate by an audit firm using a weighted industryaverage approach.The Assembly Pricing Report is available as astand-alone report or as a section to the WaferFabrication Pricing Report. This Report provides theuser thousands of price data points that fabless and IDMsare paying for outsourced assembly services. Thedata is collected confidentially and tabulated inaggregate by an audit firm.The Wafer Fabrication Pricing Report includes awritten analysis of the survey results as well asinteractive, online results showing rolling average,min, max, and median wafer and mask set prices forfour consecutive quarters by:The Assembly Pricing Report includes a writtenanalysis of the survey results as well as interactive,online results showing rolling average, min, max,and median assembly prices for four consecutivequarters by: Process GeometryProcessWafer SizeCompany TypeFoundry LocationMetal LayersPoly LayersMask Layers Epitaxial Development Stage Volume of WafersPurchased Pricing by LeadingRevenue-ProducingFabless CompaniesParticipants receive the report(s) for free. Theinteractive reports are available to subscribers online,allowing users to easily and quickly find the exactpricing information needed. Company TypeManufacturing LocationPackage FamilyLeadsUnits Per WeekDrop-In Heat Spreader UsedSubstrate CostSubstrate TechnologySubstrate LayersWafer Size (for WLP -fabrication-back-end-pricing/

JP Morgan/GSASemiconductor Index of Leading Indicators Monthly survey gauging thetemperature of the industry.Index began in January 2009and closely mirrors overallindustry sentiment. Survey consists of 10 tenmultiple-choice questions whichare sent via e-mail around the7th of each month. Totalsurvey takes roughly 1 minuteto complete. Only participating CEOs andCFOs will have access to theresults each month. All datacollected is kept strictlyconfidential and results will bereleased only in aggregatenumbers. As a further safeguard and foryour convenience, the data willbe collected via a secure ors/

GSA ForumThe industry’s premier publication delivers a combination ofbusiness, technology and financial news, as well as importantindustry trends and market forces that impact operations andproduct development throughout the semiconductor supplychain.Each quarterly issue contains: Featured Articles — contributed articles by industry experts onvarious technical- and business-related topics Industry Reflections — interviews with leading industryexecutives Private Showing — featured private semiconductor membercompanies GSA Forum Archives2014 Editorial Calendar : March – IP/EDAJune – FoundrySeptember – Fabless/IDMDecember – Overall Technology / Ecosystem Perspectiveswww.gsaglobal.org/forum

IC Foundry AlmanacGSA and IC Insights have collaborated to produce a comprehensive guide to the global ICfoundry market. This resource combines IC Insights’ analysis of market growth and capacitytrends with GSA's wafer pricing trends, comprehensive company tracking information and itsglobal reach across semiconductor companies and the foundry sector.Report includes a foundry-segment analysis, five-year forecasts, wafer-pricing trends fromoutsourcing semiconductor suppliers and supplier-profile data.IC Foundry Analysis IC Foundry Industry Analysis IC Foundry Sales Analysis IC Foundry CapacityWafer Fabrication Pricing & MaskCost Trends Average and median wafer pricingand mask cost by: 150mm, 200mm, 300mmwafers Manufacturing process Process geometry Metal layers Poly layers Development stage Epitaxial Volume purchasedIC Foundry Service ProviderCompany Profiles Company Contact InformationPercent Manufacturing CapabilityTechnologies OfferedGeometriesMetal LayersWafer SizesWafer Output per MonthDesign Services OfferedBack-end Services OfferedIP Cores OfferedCustomers and ns/ic-foundry-almanac/

Semiconductor ProfilesThis directory contains comprehensive profiles of more than 1,000 emerging andestablished fabless and IDM semiconductor companies worldwide. Profiles include acompany description, the company’s market and product detail, industry type, and keymanagementOnline sorting features and downloadable excel spreadsheet include: Year Founded and Number ofEmployees Financial Detail Company Description Industry Type Market Type Product Detail Key profiles/

Supplier & Service Partner ProfilesGSA’s Supplier and Service Partner Profiles cover more than 1,300 industry suppliers andpartners, segmented by service offerings (e.g., wafer foundry, intellectual property (IP),electronic design automation (EDA), etc.). Profiles include Year Founded and number ofemployees, company description, service offerings and key management.Sort by: Year Founded &Number of Employees Company Description Service Offerings Key profiles/

Tools & ChecklistsAMS PDK Quality Checklist & User’s GuideThis checklist provides the analog / mixed signal designer a quality check on all elements of the foundryProcess Design Kit. This drives enhanced communication between foundries and design teams, allowing bothto obtain a better understanding of the source data, completeness and quality of the PDK. The checklistaddresses everything from contact information to document version control, including software releasenumbers.Intellectual Property (IP) Source Selection ToolIP blocks are a standard part of most designs. IP can be acquired from multiple sources: Internal Design, Internal Existing, orfrom a Third Party. Whatever the source, there are inherent risks. This tools allows the team to analyze Risk, Performance,and Cost; and thereby mitigate the risk.Supply Chain Merger & Acquisition Due Diligence and Integration ChecklistThis checklist defines a broad spectrum of items that must be considered by Supply Chain management in a merger oracquisition. This initial release is targeted toward the Supply Chain Professional and is not yet all encompassing. Future workwill extend the checklist to include Legal, Financial, Human Resources, and IT aspects.Quality Monitors ChecklistThis checklist provides the quality framework for semiconductor testing before product is shipped. Defines tests andparameters required to minimize the level of bad product shipped to an end customer.This is not meant to be a comprehensive list, but can be useful to:Analyze gaps in testingProvide the top 3-5 test areas for each line of defense against shipping low quality productImprove Customer Awareness, by providing a guideline for customers to better understand the test environmentwww.gsaglobal.org/gsa-resources/tools

How do members benefit?Exposure GSA hosts the largest cross section of executives from the semiconductorecosystem Speaking engagements at targeted forums and events Exchange ideas and network with the global leaders of the semiconductorcommunityDiscussion Commercial and technical trends in the semiconductor & technologyindustries Challenges and issues unique to the semiconductor industryResources Public and Investor Relations Services Resource Portals Leadership, working group, and committees Forums and events Research: public & private financial analysis, reports, surveys, profiles

GSA represents nearly 400 leading companies in 30 countries with more than 100 executives participating in a GSA leadership role Events GSA hosts the most widely recognized global and regional events tailored specifically for the semiconductor industry Research GSA provides numerous resources, surveys, and reports unique to GSA membership