![Welcome [southernfinance ]](/img/28/2021-sfa-program.jpg)

Transcription

1

1

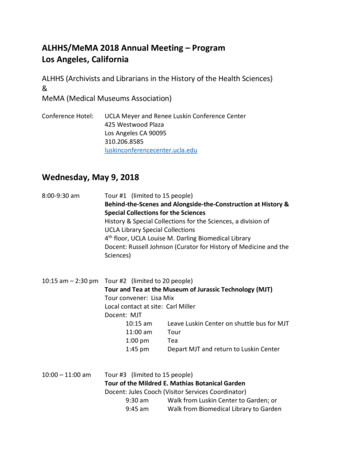

General Information and AnnouncementsSFA Registration4:00 p.m. – 5:30 p.m. Captiva Ballroom Foyer7:30 a.m. – 5:00 p.m. Captiva Ballroom Foyer7:30 a.m. – 5:00 p.m. Captiva Ballroom FoyerWednesday, November 17Thursday, November 18Friday, November 19Exhibits8:00 a.m. – 5:00 p.m.8:00 a.m. – 5:00 p.m.Thursday, November 18Friday, November 19Captiva Ballroom FoyerCaptiva Ballroom FoyerWednesday, November 17th6:00 p.m. – 7:30 p.m.President’s Membership ReceptionSponsored by the University of Central FloridaKings CrownLawnThursday, November 18th8:00 a.m.–10:00 a.m.SFA Board of Directors MeetingFlorida Cone8:00 a.m.–9:00 a.m.Continental Breakfast10:00 a.m.–10:15 a.m.Coffee Break12:00 p.m.–1:00 p.m.Program Committee Luncheon3:00 p.m.–3:15 p.m.Coffee BreakSponsored by Stock-TrakCaptiva SanibelFoyers5:00 p.m. – 6:00 p.m.Membership ReceptionSponsored by the Southern Finance AssociationAltitudes /Latitudes BeachCaptiva SanibelFoyersCaptiva SanibelFoyersSand DollarPlazaFriday, November 19th7:15 a.m.–8:15 a.m.Women’s Networking Breakfast8:00 a.m.–9:00 a.m.Continental Breakfast10:00 a.m.–10:15 a.m.Coffee Break3:00 p.m.–3:15 p.m.6:00 p.m. – 7:00 p.m.7:00 p.m. – 9:30 p.m.Coffee BreakSponsored by Stock-TrakMembership ReceptionSponsored by the Southern Finance AssociationSFA Membership DinnerSponsored by the Southern Finance AssociationSand DollarPlazaSalon BCaptiva SanibelFoyersCaptiva SanibelFoyersGolf CourseGolf CourseSaturday, November 20th8:00 a.m.–9:00 a.m.Continental Breakfast10:00 a.m.–10:15 a.m.Coffee Break2Captiva SanibelFoyersCaptiva SanibelFoyers

Table of ContentsWelcome . 4Outstanding Paper Awards . 5Track Chairs and Program Committee . 6-72019 Distinguished Scholar . 8Outstanding Paper Awards . 72019 SFA Officers and Directors . 9Exhibitors . 10Past Presidents and Founders. 11SFA Statement of Professional Ethics .12-15SFA & JFR Statement on Coercive Citations . 16Notes . 17Session Summary .18-19Sessions .20-57Sponsors . 58Index of Participants .59-62Notes .63-643

SFA 2021 Welcome LetterNovember 2021Dear SFA participants,Welcome to Captiva Island and the 61st Annual Meeting of the Southern FinanceAssociation. Despite some challenges and uncertainty, this year’s programincludes many exciting papers and special sessions. I hope you find somethingon the program that is of interest and valuable to you.This program would not have been possible without many people who contributedto its success, and I am very grateful for their help. Thank you to all of you whosubmitted papers or volunteered as discussants or session chairs; yourparticipation is key to the program’s success. I wish to thank the members of theprogram committee who reviewed over 500 papers and sent theirrecommendations to the track chairs. A special thank you to the track chairs:Katsiaryna Bardos (Corporate), Brian Blank (Special Topics), Rose Liao(International), Andy Puckett and Eric Kelley (Investments), and John Sedunov(Institutions and Markets). I thank the support of sponsors and exhibitors and amindebted to Honghui Chen and Ronnie Clayton for their help and support.The program includes 187 papers, 71 sessions, including two special sessionscovering topics that include machine learning applications and impact investing,and a Women’s Networking Breakfast. In addition, this year we have includedthree “Top paper” sessions, with papers selected by the track chairs.As usual, Friday will mark a highlight in the conference, with the SFA DinnerBanquet, where we will present best paper awards. We are also privileged to haveG. Andrew Karolyi, Dean of the Cornell SC Johnson College of Business, as the2021 Distinguished Scholar and our keynote speaker.Lastly, I hope you enjoy the conference and your time in Captiva Island. I hopethat presenters receive valuable feedback on their work and that everyone makestime to reconnect and greet old friends and make new ones.Welcome to the 2021 SFA Annual Meeting!Sincerely,Alvaro G. TaboadaSFA Vice President - ProgramBancorpSouth Associate Professor of FinanceMississippi State University4

2021 Outstanding Paper AwardsCategoryAward Winning PaperCorporateThe Revolving Door and Insurance SolvencyRegulationAna-Maria Tenekedjieva, Federal Reserve Board ofGovernorsAward Sponsored by the Southern Finance AssociationEmpiricalFlattening the Curve: Pandemic-Induced Revaluationof Urban Real EstateArpit Gupta, New York UniversityVrinda Mittal, Columbia UniversityJonas Peeters, New York UniversityStijn Van Nieuwerburgh, Columbia UniversityAward Sponsored by Wharton Research Data Services (WRDS)Financial InstitutionsIs a Friend in Need a Friend Indeed? HowRelationship Borrowers Fare during the COVID-19CrisisAllen N. Berger, University of South CarolinaChrista Bouwman, Texas A&M UniversityLars Norden, Getulio Vargas FoundationRaluca Roman, Federal Reserve Bank of PhiladelphiaGregory F. Udell, Indiana UniversityTeng Wang, Board of the Gov. of the Federal ReserveAward Sponsored by the Southern Finance AssociationInvestmentsIdentity, Diversity, and Team Performance: Evidencefrom U.S. Mutual FundsRichard Evans, University of VirginiaMelissa Prado, Nova School of Business and EconomicsEmanuele Rizzo, Nova School of Business and EconRafael Zambrana, University of Notre DameAward Sponsored by the American Association of Individual Investors (AAII)International FinanceDollar Dominance in FX TradingFabricius Somogyi, University of St.GallenAward Sponsored by the Southern Finance AssociationDoctoral Student Papers Better Things to do or Doing Nothing at all? TheImplications of Incomplete Share RepurchaseProgramsJulian U. N. Vogel, San Jose State UniversityExternalities of the Sharing Economy: Evidencefrom Ridesharing and the Local Housing MarketRachel(Jiqiu) Xiao, Georgia State UniversityDeterminants on ETF Launching DecisionsXinrui Zheng, Cambridge Judge Business SchoolAward Sponsored by the Southern Finance Association5

2021 Track ChairsCorporate FinanceKatsiaryna Bardos, Fairfield UniversityInvestmentsAndy Puckett, University of TennesseeEric Kelley, University of TennesseeInternationalRose Liao, Rutgers UniversityInstitutions and MarketsJohn Sedunov, Villanova UniversitySpecial TopicsBrian Blank, Mississippi State University2021 Program CommitteeSamuel Adams, University of TennesseeAnna Agapova, Florida Atlantic UniversityStylianos Asimakopoulos, University of BathLezgin Ay, Iowa State UniversityAzadeh Babaghaderi, University of WindsorAlexander Barinov, University of CaliforniaRiversideLaura Baselga-Pascual, Deusto UniversityMeera Behera, Georgian Court UniversityLee Biggerstaff, Miami UniversityMatteo Binfare, University of MissouriJeff Black, University of MemphisSeong Byun, Virginia Commonwealth UniversityDavid Carter, Oklahoma State UniversityHaodong Chang, Mississippi State UniversityZhongdong Chen, University of Northern IowaJun Chen, UC San DiegoJiawei Chen, Mississippi State UniversityChelsea Chen, Ohio UniversityMd Shahedur Chowdhury, Arkansas TechUniversityRebel Cole, Florida Atlantic UniversityJared DeLisle, Utah State UniversityCianna Duringer, University of ConnecticutAsli Eksi, Salisbury UniversityZifeng Feng, Frostburg State UniversityJonathan Fluharty-Jaidee, West Virginia UniversityPouyan Foroughi, York UniversityKeith Gamble, Middle Tennessee State UniversityArup Ganguly, University of MississippiLin Ge, University of MississippiThomas Griffin, Villanova UniversityFotis Grigoris, Indiana UniversityBrandy Hadley, Appalachian State UniversityMohammad Hashemi Joo, North Carolina A&TState UniversityM. Kabir Hassan, University of New OrleansMichael Highfield, Mississippi State UniversityMd Noman Hossain, University of Texas RioGrande ValleyMiran Hossain, University of North CarolinaWilmingtonKershen Huang, Nova Southeastern UniversityJianning Huang, St Francis Xavier UniversityDobrina Jandik, University of ArkansasArati Kale, Providence CollegeDevendra Kale, University of Rhode IslandConnor Kasten, University of Tennessee, KnoxvilleKristopher Kemper, Ball State UniversityKristina Lalova, University of ConnecticutAsjeet Lamba, University of MelbourneShari Lawrence, Nicholls State UniversityAllissa Lee, Georgia Southern UniversityAdam Lei, Midwestern State UniversityXinming Li, Nankai University, School of FinanceHuihua Li, Saint Cloud State UniversityZhuo Li, Mississippi State UniversityYili Lian, California State University StanislausLeng Ling, Georgia College & State UniversityRui Liu, Duquesne UniversityYueliang Lu, University of North Carolina atCharlotteHaowen Luo, Purdue University Fort WayneArtem Malinin, Florida Atlantic UniversityNomalia Manna, Fairfield University, DrexelUniversityEleni Mariola, Iona CollegeAbdullah Al Masum, University of Texas RioGrande ValleyTom Miller, Mississippi State UniversityQuentin Moreau, Université Paris-Dauphine, PSLAnh Ngo, Norfolk State UniversityYuka Nishikawa, College of CharlestonXu Niu, Sacred Heart UniversityAmanda Olsen, University of TennesseeStephen Owen, University of North Texas6

Bhavik Parikh, St. Francis Xavier UniversityJames Pawlukiewicz, Xavier UniversityStefano Pegoraro, University of Notre DameLouis Piccotti, Oklahoma State UniversitySamuel Piotrowski, University of ConnecticutMarcel Prokopczuk, Leibniz University HannoverYankuo Qiao, Rutgers UniversityHuan Qiu, Millsaps CollegeMonika Rabarison, University of Texas Rio GrandeValleyDavid Rakowski, University of Texas at ArlingtonLakshmi Shankar Ramachandran, Case WesternReserve UniversityBlake Rayfield, Northern Arizona UniversityLouie Ren, University of Houston at VictoriaRobinson Reyes-Pena, Florida InternationalUniversityTitos Ritsatos, Fairfield UniversityRaluca Roman, Federal Reserve Bank ofPhiladelphiaWei Rowe, University of Nebraska at OmahaPatricia Ryan, Colorado State UniversityNadia Saghi-Zedek, University of Rennes 1Nilesh Sah, University of Tennessee at ChattanoogaAthanasios Sakkas, University of NottinghamGary Sanger, Louisiana State UniversityLee Sanning, Colorado State UniversityAtul Saxena, Georgia Gwinnett CollegeYu Shan, Concordia UniversityDanjue Shang, Utah State UniversityJaideep Shenoy, University of ConnecticutSara Shirley, Middle Tennessee State UniversityThomas Shohfi, Rensselaer Polytechnic InstituteFlorina Silaghi, Universitat Autònoma de BarcelonaAmanjot Singh, Deakin UniversityTatyana Sokolyk, Brock UniversityW. Paul Spurlin, Mississippi State UniversityMeridianJeffrey Stark, Middle Tennessee State UniversityAnna-Leigh Stone, Samford UniversityChih-Huei Su, University of New MexicoJerome Taillard, Babson CollegeTih Koon Tan, University of the District ofColumbiaThomas Thompson, University of Texas at ArlingtonGreg Tindall, Palm Beach Atlantic UniversityJason Turkiela, University of Minnesota DuluthOmer Unsal, Merrimack CollegeEmilia Vähämaa, Hanken School of EconomicsSami Vähämaa, University of VaasaTyson Van Alfen, Southern Illinois UniversityCarbondaleRaisa Velthuis, Villanova UniversityBuvaneshwaran Venugopal, University of CentralFloridaChing-Chang Wang, Southern Taiwan University ofScience and TechnologyWei Wang, Cleveland State UniversityMengchuan (Kitty) Wang, University of MelbourneWentao Wu, Clarkson UniversityIan Xue, Duke UniversityToshiaki Yamanaka, Formerly of the University ofTokyoQing Yang, Louisiana Tech UniversityRustin Yerkes, Samford UniversityJie Ying, Southern Illinois University EdwardsvilleShen Zhang, Troy UniversityLei Zhao, Beijing Normal University Stylianosz7

2021 SFA Distinguish ScholarAndrew KarolyiAndrew Karolyi is Professor of Finance and holder of the Harold Bierman Jr.Distinguished Professorship in Management at the Cornell SC Johnson College ofBusiness. He currently serves as Dean of the College, which includes the JohnsonGraduate School of Management, Dyson School of Applied Economics andManagement, and the newly-named Nolan School of Hotel Administration.His research specializes in the area of investment management with a focus on thestudy of international financial markets. He has published extensively in peerreviewed journals in Finance and Economics and has published several books andmonographs. His book, Cracking the Emerging Markets Enigma, was published in2015. The research has garnered a number of prizes and recognitions. He is a pastrecipient of the Michael Jensen Prize for Corporate Finance and Organizations, theFama/DFA Prize for Capital Markets and Asset Pricing, and the William F. SharpeAward for Scholarship in Finance. In 2017, he was elected as a Fellow of theFinancial Management Association International.Professor Karolyi served as Editor and then Executive Editor of the Review ofFinancial Studies from 2011 to 2018, one of the top tier journals in Finance. He is apast president of the Western Finance Association, past president and trustee of theFinancial Management Association, and currently a member of board of directors ofthe American Finance Association. He also serves on several not-for-profit boardsand councils, including HRH The Prince of Wales’ Accounting for SustainabilityProject, Pacific Center for Asset Management, Responsible Research in Businessand Management Network, and the United Way of Tompkins County.Professor Karolyi received his Bachelor of Arts (Honors) in Economics from McGillUniversity in 1983 and worked at the Bank of Canada for several years in theirResearch Department. He subsequently studied for his MBA and PhD degrees inFinance at the Graduate School of Business of the University of Chicago.8

Previous SFA Distinguished 10Subra SubrahmanyamH. Kent BakerRalph WalkingJimmy HilliardBill MegginsonDonald J. MullineauxAnnette B. PoulsenDavid YermackJennifer ConradAllen N. BergerWilliam G. 99Sheridan TitmanDavid DenisMark FlanneryEd DylLaura StarksEdward AltmanBurton MalkielCampbell HarveyJay RitterClifford SmithRichard Roll2020 – 2021 Southern Finance Association OfficersPresidentHonghui ChenUniversity of Central FloridaVice President - ProgramAlvaro G. TaboadaMississippi State UniversityVice President for AdministrationBill H. SchmidtJacksonville State UniversityVice President for FinanceWalter J. ReinhartLoyola University MarylandSecretaryKathleen FullerUniversity of Mississippi2020 – 2021 Southern Finance Association DirectorsMichael HighfieldMississippi State UniversityKristina MinnickBentley UniversityHunter HolzhauerUniversity of Tennessee-ChattanoogaAdam YoreUniversity of MissouriBrandon ClinePast President – 2019Mississippi State UniversityMelissa WoodleyPast President – 2020Creighton UniversityExecutive DirectorRonnie J. ClaytonJacksonville State University9

The Southern Finance AssociationIs Pleased to Welcome the Following ExhibitorsCeriFiETF GlobalStock-Trak Global Portfolio SimulationsWharton Research Data ServicesBe sure to stop by their exhibitsand welcome these valued exhibitors!!!They have products and services that supportresearch, teaching and learning.10

Southern Finance AssociationPast Presidents and FoundersPast PresidentsLewis E. DavidsBenjamin U. RatchfordWilliam D. RossClifton H. KrepsHoward S. GordmanC. Arnold MatthewsOlin S. PughCharles T. TaylorStanley W. PrestonRobert D. DinceClaude A. CampbellHarry BrantDavid A. WestCharles E. EdwardsDavid F. Scott Jr.Avery B. CohanRichard H. PettwayGeorge E. PinchesRichard F. WachtRodney RoenfeldtJohn J. PringleBruce F. FielitzJ. William PettyPhilip L. CooleyO. Maurice JoyWilliam L. SartorisRoy L. CrumEdward A. MosesJames W. WansleyMichael C. WalkerJimmy E. 7-881988-891989-901990-91FoundersJames Caldwell (GA)Claude Campbell (FL)James Carney (FL)Lewis Davids (GA)Leslie Davis (MS)W.M. Davis (GA)Arthur Dietz (GA)Herman Ellis (KY)Robert Felton (KY)Joe Floyd (NC)William Greer (AL)Howard Gordman (GA)Jackson Grayson (LA)James Green (GA)Albert Griffin (GA)Charles Haywood (MS)Hiram Honea (GA)Marshall Kinchen (LA)Arnold Matthews (FL)Stephen McDonald (LA)H.H. Mitchell (VA)Murray Polakoff (TX)Stanley Preston (LA)Olin Pugh (SC)William C. HunterCharles R. MoyerRobert L. SchweitzerG. Rodney ThompsonAnnette B. PoulsenJeff MaduraAndrea HeusonDavid BlackwellBradford JordanDouglas EmeryScott BesleyTim KochM. Cary CollinsPamela Peterson-DrakeW. Brian BarrettThomas F. GosnellKen B. CyreeMichael S. PaganoGary C. SangerH. Kent BakerRobert DeYoungKathleen P. FullerMelissa B. FryeW. Scott FrameGreg FilbeckAngela MorganTao-Hsien Dolly KingBrandon ClineMelissa 18-192019-20Benjamin Ratchford (VA)William Ross (LA)Leon Schur (LA)Aubrey Snellings (TN)Curtis Tate (GA)Charles Taylor (GA)Zachary Taylor (GA)Theodore Whitesel (LA)Edward Winn (SC)Ervin Zingler (TX)

Statement of Professional EthicsSouthern Finance AssociationDecember 2011PreambleOur academic world is defined by three chief institutions: our workplaces, theprofessional conferences we attend, and academic journals in which we publish.In the workplace, our professional and ethical behaviors are monitored and discipline canoccur. If we perform poorly or behave badly, we can be denied tenure, promotion,raises, resources and even employment.Our behavior at conferences and journals is more difficult to monitor. Minormisbehaviors typically go undisciplined—but the collective consequences of suchbehavior can substantially reduce the efficacy and even the viability of these institutions.As leaders of an organization of researchers and practitioners who benefit fromprofessional meetings and academic journals, the directors of the Southern FinanceAssociation and the editors of the Journal of Financial Research ask members topractice the behaviors outlined below, and to encourage their colleagues and PhDstudents to do so as well.I.Professional conduct and ethical behavior at professionalmeetingsA. Submitting a conference paper Submitting a paper to a conference creates an implicit contract that, should thepaper be accepted, the submitting author or a co-author will attend theconference. It is crucial for all parties to recognize that submitting a paper setsresource allocation in motion—rejecting other worthy papers, enlistingdiscussants, printing programs, etc.The submitting author should have a high degree of certainty that travelsupport is in place (whether employer- or participant-paid) before submittingthe paper.All co-authors should be aware of and in agreement with the paper beingsubmitted to the conference.Session discussants and chairs are essential to the success of a conference.When you submit a paper, always volunteer to discuss a paper and/or chair asession at the conference.B. When your paper is accepted Immediately volunteer to serve as a discussant. At large regional and nationalconferences, discussants are often scarce—in these circumstances,presenting a paper without volunteering to discuss a paper is free-ridingbehavior.Your discussant needs time to do a useful and professional job. Deliver yourpaper to your discussant and other session participants by the deadlineindicated.12

Send your visual presentation files (e.g., PowerPoints) to the session chairbefore he or she must leave home to travel to the conference.Should you have to cancel due to unavoidable circumstances, you remainobligated to prepare your presentation visuals and to find a replacement topresent them. Ideally, this would be a co-author or some other colleagueattending the conference. If this is not possible, you might turn to othersession participants or the session chair.C. At the session Arrive at the session at least five minutes before it begins. Introduce yourselfto the chairperson and make sure that your presentation file has been loaded.If time permits, introduce yourself to the other presenters and discussants.As a backup, bring your presentation file to the session on a jump drive.The session time is a zero sum game. Deliver your presentation within theassigned time limit. When you take extra time, the other authors, discussants,and audience participants get less time.D. At the conference Attend additional sessions beyond just those in which you are participating,and contribute to the general discussion of papers at the sessions you attend.Attend conference social events. These events provide opportunities toexchange ideas and information with many more people than you will meet atyour paper sessions. There are real network economies that increaseexponentially with increased attendance—by attending and activelyparticipating you are providing an important public good.Conferences provide a chance to meet new people and develop newcolleagues. Mingle, schmooze, network. Invite your new acquaintances tojoin you and your friends for dinner.E. Chairing a session Being a session chair is often considered the “easiest way to participate” at aconference. But the chair is more than just a time-keeper. The chair isresponsible for everything that happens at, and leading up to, the session.Before the conference, communicate early and often with the sessionparticipants. Make sure that everyone has committed to attend theconference, and the authors get their papers to their discussants in plenty oftime for a high quality discussion.You are responsible for the bringing a laptop computer to the session; forloading all presentations onto the laptop before the session starts; for havingthe computer and projector running before the session starts; and for runningthe laptop during the session.Introduce yourself to all of the presenters and discussants as they arrive.Be polite, but strict, about time limits. A suggested procedure: provide a fiveminute warning, a two-minute warning, and send a clear signal when time hasexpired.Make sure to save significant time for question and answer periods. This isthe audience’s chance to participate, and this feedback is often invaluable tothe authors.F. Serving as a discussant13

It is far too easy to criticize a paper without adding any real value. A gooddiscussant helps the authors improve their paper by avoiding negativity,providing constructive criticism, and by proposing doable solutions.Time is short for the discussant. Do not spend time re-stating what the authorhas presented. A good discussant brings new ideas and alternativeperspectives to the session.Despite being allocated less time than a paper presenter, session discussantsare not in any way subordinate to the presenting authors. Discussants areheld to the same professional and ethical standards as authors, as notedabove.G. Faculty with graduate students participating in conferences II.Conference participation, either as a paper presenter or a discussant, is anexcellent learning by-doing experience for PhD students.Graduate students are held to the same professional and ethical standards asseasoned academics. As a faculty mentor, you are ultimately responsible forthe conference behavior of your graduate students.Professional conduct and ethical behavior at academicjournalsA. Submitting a paper to a journal All co-authors should be aware of and in agreement with the paper beingsubmitted to the journal.Never submit a paper to a journal just to get some good comments.Nothing frustrates a referee more than having to read a paper that is poorlywritten. If English is not your first language, hire a native-speaking person toedit your paper before submitting it to a journal.Response time from journals can be long and variable. It is acceptable tocontact the journal to inquire about the progress of your manuscript, but exhibitsome patience. For example, if the journal states that its typical turn-aroundtime is “three-to-six months,” then you should wait at least six months beforeinquiring about the status of your submission. Then wait another three monthsbefore making a second inquiry.B. Re-submitting a paper If the editor invites you to revise and re-submit your paper, make all attemptsto do so quickly. This makes the tasks of the editor and the referees mucheasier, as the paper will still be relatively fresh in their minds.When re-submitting a paper, include carefully crafted letters to the editor andthe referees to explain how, and exactly where, you address their concerns inyour new manuscript.Do not re-submit the paper unless the revised version addresses substantiallyall of the concerns of the editor and the referees.If you decide against re-submitting your paper (i.e., if you send it to a differentjournal, or if you abandon the effort), you should inform the journal editor ofthis decision.C. When your paper gets rejected14

Never argue with the editor or the referees. Letters or emails sent to the editoror the referees complaining about why they made a mistake are impolite, willcome across as antagonistic, and do not make you any new friends.Before submitting a rejected paper to a new journal, revise the manuscript toaddress the valuable comments made by the referees and editor who rejectedyour paper at the previous journal. Do not simply submit the paper to a newjournal unchanged. By doing this, you are disrespecting the referee whomay very well be asked to review your paper by the editor of the next journal.D. When invited to referee a journal submission Respond quickly to the request. If you cannot do it, the journal editor will wantto search for a replacement referee as quickly as possible.If you cannot referee the paper, always suggest another qualified referee.If the paper lies in your area of expertise, you owe it to the profession toaccept the assignment. You are one of the true experts, so you will be one ofthe best to judge.If the paper is not in one of your areas of expertise, recognize that you willhave to do some reading of the cited literature to come up to speed. Acceptthe assignment only if you are willing to do this extra work.If you are running behind and are about to miss the deadline for submittingyour report, contact the journal and let them know. This gives the editoroptions, e.g., make a decision based on just a single report, find a differentreferee, or re-contract with you.A good referee report informs the journal editor: The report summarizes thepaper, identifies the strengths and weaknesses of the paper, and makes aclear recommendation (in a separate cover letter) for rejecting, revising, oraccepting the paper.A good referee report helps the author: It is far too easy to criticize a paperwithout offering good solutions. Always provide feasible solutions for theauthors so that they may improve their paper.15

Southern Finance Association and the Journal of FinancialResearch Endorsement of Statement on Coercive CitationsOver the past few years, we have witnessed a troubling developmentat academic finance journals. Increasingly, editors at some journalsrequire submitting authors, as a condition for acceptance or review, toadd additional citations to articles that were published in past issues oftheir journals.This practice is known as “coercive citation.” When applied in asystematic fashion, coercive citation renders journal quality rankingsmeaningless, as it artificially inflates the impact factors of journalsusing this practice. Perhaps more important, coercive citation exploitsassistant professors who have little choice but to cave-in to thepressure and add often irrelevant citations to their papers.The editors of the Journal of Finance, Journal of Financial Economics,Review of Financial Studies, Journal of Financial and QuantitativeAnalysis, Review of Asset Pricing Studies and Review of CorporateFinance Studies have issued a joint statement condemning thepractice of coercive citation. To read that statement, go tohttp://www.jfqa.org/EditorsJointPolicy.html.The Board of Directors of the Southern Finance Association andthe editors of the Journal of Financial Research fully endorse thejoint statement of the editors of the JF, JFE, RFS, JFQA, RAPSand RCFS on coercive citation.From the webpage link above, you can access the results of a recentsurvey on coercive citation practices (Whilhite and Fong, Science,2012), including a separate supporting file that contains twelve tablesthat display the quantitative findings of the study.On behalf of the officers and directors of the SFA and the editors of theJFR,Robert DeYoungUniversity of KansasPresident, 2011-2012, Southern Finance AssociationJune 7, 201216

NOTES17

Session SummaryThursday8:30 a.m. – 10:00 a.m.RoomSession A.1Session A.2Session A.3Session A.4Session A.5CoquinaMurexJunoniaSea PearlSession A.6Session A.7Session A.8CEO BehaviorESGIndividual Investors / BehavioralMutual Funds IReal Estate Pricing, Market Dynamics andInvestor CostsRepurchasesBank Lending and RiskContemporary Iss

7 Bhavik Parikh, St. Francis Xavier University James Pawlukiewicz, Xavier University Stefano Pegoraro, University of Notre Dame Louis Piccotti, Oklahoma State University Samuel Piotrowski, University of Connecticut Marcel Prokopczuk, Leibniz University Hannover Yankuo Qiao, Rutgers University Huan Qiu, Millsaps College Monika Rabarison, University of Texas Rio Grande