Transcription

Unapplied Loan Balance NoticePFSUnapBalNotice.dnaxDNAapp ID: 70387ec3-5f95-4169-94e2-a28a8127a698Fiserv Confidential: Distribution restricted to: Clients using or considering purchase of the product described in this document Fiserv associates

Unapplied Loan Balance NoticeFiserv 2014- 2022 Fiserv, Inc. or its affiliates. All rights reserved. This work is confidential and its use is strictlylimited. Use is permitted only in accordance with the terms of the agreement under which it was furnished. Anyother use, duplication, or dissemination without the prior written consent of Fiserv, Inc. or its affiliates is strictlyprohibited. The information contained herein is subject to change without notice. Except as specified by theagreement under which the materials are furnished, Fiserv, Inc. and its affiliates do not accept any liabilities withrespect to the information contained herein and is not responsible for any direct, indirect, special, consequentialor exemplary damages resulting from the use of this information. No warranties, either express or implied, aregranted or extended by this document.http://www.fiserv.comFiserv is a registered trademark of Fiserv, Inc.Other brands and their products are trademarks or registered trademarks of their respective holders and shouldbe noted as such.Unapplied Loan Balance Notice04/27/20222

Unapplied Loan Balance NoticeFiservOverview:The Unapplied Balance Notice is a notice to notify the Borrower that his or her partialpayment has not been applied to the loan account’s typical balances (interest, principal, etc.)and instead has been applied to an unapplied balance on the loan account. The UnappliedBalance Notice batch application is designed to produce a notice whenever a payment ismade to a loan account where partial payments are not allowed and the funds are thenapplied to the unapplied balance on the loan account, as opposed to going to late charges,interest, principal, etc. The Unapplied Balance Notice batch application will also generate asummary report for the Financial Institution listing all loan accounts where a notice wasgenerated.Key Benefits:The Unapplied Balance Notice application provides the Financial Institution with severalbenefits, including: Ability to generate a notice to send to Borrowers notifying them that their partialpayment is in an unapplied balance until a full payment amount is made.Ability to generate notices for delinquent loan accounts exclusively or both delinquentand non-delinquent loan accounts.Capacity for adjusting date ranges to accommodate a business practice of generatingnotices daily, weekly, or any date range specified by the Financial Institution.Ability to exclude the application for a specific loan product or account.Processing:The Unapplied Balance Notice batch application allows the Financial Institution to generatenotices to Borrowers to inform them of payments that were not applied to their loan accountsexpected balances (i.e. interest, principal, etc.). In addition, the batch application alsogenerates a report to summarize all the notices generated. The Unapplied Balance Noticeapplication is a batch application that can be run daily or weekly, or with any dates defined bythe Financial Institution.In order to use the Unapplied Balance Notice application, the following setup items must bereviewed by the Financial Institution: Partial Payments Allowed setting. The loan account must not allow partial paymentswhen the Partial Payment Allowed YN batch parameter is set to ‘Y’. The partialpayments option must be unchecked for the loan account.Unapplied Loan Balance Notice04/27/20223

Unapplied Loan Balance Notice FiservExclude Application setting. The Unapplied Balance Notice must be set to ‘Available’for the account by setting the Exclude Application setting.Note: The Unapplied Balance Notice can be excluded for specific products and/or accounts.If it should be excluded for a product, the navigation path to exclude the Unapplied Noticebatch application for the product can be found at:(Navigation: Services System Product and Pricing Manage Product (choose Majorand Minor) Associate Exclude Applications Unapplied Balance Notice)Unapplied Loan Balance Notice04/27/20224

Unapplied Loan Balance NoticeFiservIf the Unapplied Balance Notice batch application should be excluded for an account, thenavigation path to exclude the Unapplied Balance Notice batch application for the accountcan be found at:(Navigation: Services Relationships Maintenance Loan Accounts Additional Exclude Applications Unapplied Balance Notice)As an alternative, if the Financial Institution would like to exclude a product from receiving thisnotice, the Financial Institution can input the product minor code into the Product Minor toExclude batch parameter (EMNR) during the batch application queue setup and would nothave to use the Exclude Application setting for the product minor.The Unapplied Balance Notice can be generated for products with the CML, CNS, and MTGMajor types, and can also be excluded for certain products within those Major types. TheUnapplied Balance Notice can also be excluded at the Account Level. For example, if aBorrower’s loan account is in bankruptcy and should not be receiving the notice, the ExcludeApplication option can be set at the account level to prevent the notice from generating.The Unapplied Balance Notice batch application will generate notices for account types thathave a status of Active (ACT) or Non-Accrual (NPFM), and the User can further filter whatnotices can be generated by selecting whether notices are generated for delinquent accountsonly or for both delinquent and non-delinquent accounts. The notices are always generatedfor the Tax Reported for Owner.The batch application will generate a notice for an account if:Unapplied Loan Balance Notice04/27/20225

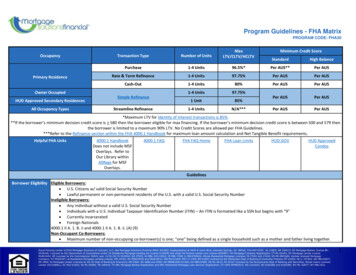

Unapplied Loan Balance Notice FiservThe Allow Partial Payment indicator must be set to No. The partial payments optionmust be unchecked for the loan accountANDOne or more unapplied receipt transactions have been posted within the Start andThru Dates batch application parameters specified by the Financial InstitutionANDThe Unapplied Balance is greater than zero.The Unapplied Balance Notice batch application will always generate a report and this reportis a summary of all the notices generated. If there are no notices generated, the report willproduce with no data displayed. If notices are generated, the report will produce with theaccounts listed.If there is an address data issue for a selected account, a notice will not be generated for thataccount and the LIS report will show the account number followed by the message “Anexception has occurred gathering address information. Notice cannot be created.”.Note: The Unapplied Balance Notice batch application can work with the Payment GeneratedFrom Excess Principal (LN PMTGN) batch application if the Financial Institution does usethe LN PMTGN batch application. When the Payment Generated From Excess Principalbatch application processes unapplied disbursements, the Unapplied Balance Notice batchapplication will include the disbursements in the unapplied balance calculation and the noticewill be produced if the unapplied balance is greater than zero.Parameters:The Unapplied Balance Notice (UNAP BAL NOTICE.sqt) batch application has the followingparameters:ParameterCodeDescription (how used)RequiredDefaultMajorAccountType CodeMJCDComma-delimited list of major accounttype codes.YesCNS,CML,MTGAll accounts within the major accounttypes listed will be included in theselection criteria.ProductMinors toExcludeEMNRComma-delimited list of minor accounttype codes to be excluded from theselection criteria.Unapplied Loan Balance Notice04/27/2022No6

Unapplied Loan Balance NoticeFiservParameterCodeDescription (how used)RequiredDefaultAccountStatuses toIncludeDRSTComma-delimited list of account statuscodes (AcctStatCd) to be considered forinclusion in the selection criteria.YesACT,NPFMYesYIf a valid Account Status Code(s) isentered in this parameter, then only loanswith those account status codes areincluded in the selection criteria unlessotherwise specified by the otherparameters of the extract.DelinquentAccounts YNDQYNIf no value is entered, all loans withdefault account statuses of ACT andNPFM are included in the selectioncriteria unless otherwise specified by theother parameters of the extract.This parameter will determine if theaccounts included must be delinquentbased on the accounts current due dateplus the account grace days.Y The notice will be generated fordelinquent accounts only. An account isconsidered delinquent when the account’scurrent due date plus the account’s gracedays is less than the current postdate (asdefined in the Current System Post Date(PDAT) institution option.Start DateSDN The notice will be generated for bothdelinquent and non-delinquent accounts.Enter the start date of the period toretrieve the Unapplied Receipt (URCT)transactions and positive UnappliedBalance records.YesNote: If run for a period of time otherthan daily, the URCT will be based on thesum of the URCT transactions postedduring the period of time specified by theStart Date and Thru Date parameters.Unapplied Loan Balance Notice04/27/20227

Unapplied Loan Balance NoticeFiservParameterCodeDescription (how used)RequiredThru DateTDEnter the thru date of the period toretrieve the Unapplied Receipt (URCT)transactions and positive UnappliedBalance records.YesPartialPaymentAllowed YNPPAINote: If run for a period of time otherthan daily, the URCT will be based on thesum of the URCT transactions postedduring the period of time specified by theStart Date and Thru Date parameters.This parameter will determine if the PartialPayments Allowed indicator on the loanaccount will be considered in the selectioncriteria.DefaultYYesIf this batch parameter is set to ‘Y’, thenthe loan account is required to have thePartial Payments Allowed indicator set to‘N’.If this batch parameter is set to ‘N’, thenthe loan account Partial PaymentsAllowed indicator is ignored.Variables:New institution level calculation variables have been added for the “Unapplied Balance Notice(UNBL)” calculation type. These calculation variables are used to control the format of thenotice produced with the Unapplied Balance Notice (UNAP BAL NOTICE) batch application.VariableCodeDescription (how used)Address ColumnADCLAddress LineDate ColumnDate IndicatorADLNDTCLDTINDate LineDate TextDTLNDTTXDate TypeInput file columnDTTPIFCLInput file line lengthIFLEThe column to begin printing theaddress.The line to begin printing the address.The column to begin printing the date.Indicates whether the date is printed.Y Yes, print the date.N No, do not print the date.The line to begin printing the date.The institution defined text placed infront of the date.The format used for printing the date.The column to begin printing the inputfile.The length (number of characters) perline in the input file.Unapplied Loan Balance ESINTGCHAR11CHARNUM21NUM728

Unapplied Loan Balance NoticeVariableCodeDescription (how used)Input file print lineInst name/addresscolumnInst name/addressIndicatorIFLNBNCLInst name/addresslineMax instname/address linesBNLNPage NumberColumnPage NumberIndicatorPNCLPage Number LinePNLNPage Number TextPNTXThe line to begin printing the input file.The column to begin printing theInstitution’s name and address.Indicates if the Institution’s name andaddress will be printed in the file.Y Yes, print the Institution’s name andaddress.N No, do not print the Institution’sname and address.The line to begin printing theInstitution’s name and address.Maximum number of address lines toprint for the institution’s name andaddress.The column to begin printing the pagenumber.Indicates if the page number should beprinted.Y Yes, print the page number.N No, do not print the page number.The line to begin printing the pagenumber.The institution defined text printed priorto the page NNoNUM1NUM5INTG65YNNoNUM4CHARPage Number:Scheduling and re-run information (for batch applications): The Unapplied Balance notice batch application can be run on a daily or weekly basis,or with any other inputted date parameters. If there are no notices generated, the report will still generate but with no recordsdisplayed. The batch application should be scheduled to run after the completion of all nightlyupdate processing to prevent notices being generated in error. The batch application can be re-run for any date in the past. For example, the batchapplication has already been run in the past for a specific date range and notices weregenerated. In the present, if the Financial Institution runs the batch application withthe same dates, duplicate notice(s) will be produced. Note: It is not recommended tore-run the batch application for a previous date in the past when notices have alreadybeen generated, as duplicate notices may be sent to the Borrower.Notices:The Unapplied Balance Notice batch application uses a text file (UNAP BAL NOTICE.TXT)to produce a notice with the name of UNAP BAL NOTICE.STM. Variables under theCalculation Type of Unapplied Balance Notice define the content and layout of the notices.Unapplied Loan Balance Notice04/27/20229

Unapplied Loan Balance NoticeFiservPlease see the DNA Core Batch Letters documentation for further information about usingtext files, including standard text markers.A default notice is required in the text file. If using the \\When command to designate a noticefor specific products, there must also be a default notice in the UNAP BAL NOTICE.TXT file.Below is an example of an UNAP BAL NOTICE.TXT file that must be created and saved inthe TEXT file folder.Unapplied Loan Balance Notice04/27/202210

Unapplied Loan Balance NoticeFiservBelow is an example of a notice:Markers:The following are the new custom markers that are available for use in the UnappliedBalance Notice.MarkerDescription accd Account Description. This is the description of the account. (Navigation: Services Relationships Maintenance Loan Accounts Additional Mail)Account Number. This is the Loan Account Number. (Navigation: Services Relationships Inquiries Relationship Profile) acct pbad Borrower Address (Tax Reported For). This is the primary address for the Tax Reportedfor Organization or Person. (Navigation: Services Relationships Maintenance Organization; Services Relationships Maintenance Person/ Member)Unapplied Loan Balance Notice04/27/202211

Unapplied Loan Balance NoticeFiserv pbor Borrower Name (Tax Reported For). The name of the Tax Reported for Person.(Navigation: Services Relationships Maintenance Loan Accounts Additional Roles) brch Branch Name for Loan Account. This is the Branch Name on the Loan Account.(Navigation: Services Relationships Maintenance Loan Accounts) dlpm Date of Last Payment. This is the date the last regular payment (SPMT) was processed.If no transaction was processed, the value will display as null.(Navigation: Services Relationships Maintenance Loan Accounts Inquiries Balance and Interest) cdue Current Due Date. The current due date of the loan account.(Navigation: Services Relationships Maintenance Loan Accounts Inquiries Balance and Interest) salu Person Salutation. This is the salutation for the account’s primary owner.(Navigation: Services Relationships Maintenance Person/Member) sysd System Date. mjrd Major Description. (Navigation: Services Relationships Maintenance LoanAccounts) mird Minor Description. (Navigation: Services Relationships Maintenance LoanAccounts) pdue Past Due Amount. The Past Due Amount is defined as the active and partially paid(ACT,PPD) receivables based on the current payment row where the receivable due dateis less than the current postdate minus the account grace days.Note: The current postdate is defined in the Current System Post Date (PDAT) institutionoption. curd Current Amount Due. The Current Amount Due is defined as the active and partially paid(ACT,PPD) receivables based on the current payment row where the receivable due dateis greater than or equal to the current postdate minus the account grace days.Note: The current postdate is defined in the Current System Post Date (PDAT) institutionoption. tamd Total Amount Due. Total Amount Due is defined as the SUM of all active and partiallypaid (ACT, PPD) receivables that exist on the loan account as of the current postdate.Note: The current postdate is defined in the Current System Post Date (PDAT) institutionoption.Unapplied Loan Balance Notice04/27/202212

Unapplied Loan Balance NoticeFiserv urct Unapplied Receipt Transaction(s). The amount of the Unapplied Receipt Transaction. Ifthe Unapplied Balance Notice batch application is run for a period of time defined by theStart and Thru Date batch parameters, this value would be the SUM of the UnappliedReceipt (URCT) transactions with a post date within that time period. ubal Unapplied Balance. This is the current Unapplied Balance for the loan account.(Navigation: Services Relationships Maintenance Loan Accounts Inquiries Balance and Interest)Additional Selection Criteria:MarkerDescriptionMajorA notice can be produced for a specific Major by including the Major Code in thecommand line of the text file. A comma delimited list of Major codes can be used.Example: \\When Major CML, CNS, CML;Note: If using the \\When command to designate a notice for specific products, theremust also be a default notice in the UNAP BAL NOTICE.TXT file.MinorA notice can be produced for a specific Minor by including the Minor Code in thecommand line of the text file. A comma delimited list of Minor codes can be used.Example: \\When Minor FIXR, 1ARM;Note: If using the \\When command to designate a notice for specific products, theremust also be a default notice in the UNAP BAL NOTICE.TXT file.Report:The Unapplied Balance Notice batch application produces notices to be sent to the Borrowerand also produces a report that summarizes all notices generated. The Unapplied BalanceNotice (UNAP BAL NOTICE.STM) will be generated along with the report named UnappliedBalance Notice (UNAP BAL NOTICE.LIS).Unapplied Loan Balance Notice04/27/202213

Unapplied Loan Balance NoticeFiservBelow is an example of the report:Field Listing:FieldDescriptionAccount NumberThe loan account number.Borrower NameName of the Tax Reported For owner of the loan account. This should be lastname, first name, and middle initial concatenated.MajorThe loan account major.MinorThe loan account minor.Unapplied ReceiptThe amount of the Unapplied Receipt Transaction. If the Unapplied BalanceNotice batch application is run for a period of time defined by the Start and ThruDate batch parameters, this value would be the SUM of the Unapplied Receipt(URCT) transactions with a post date within that time period.Unapplied BalanceThis is the current Unapplied Balance for the loan account.Note: The Unapplied Balance Notice will generate if there is a positiveUnapplied Balance greater than 0.00 based on the time period defined in theStart and Thru Date parameters. If no notice is generated for an account, thereport will still generate, but with no records displayed in the report for thatUnapplied Loan Balance Notice04/27/202214

Unapplied Loan Balance NoticeFieldFiservDescriptionaccount.Total Amount DueThe Total Amount Due is defined as the SUM of all active and partially paid(ACT, PPD) receivables that exist on the loan account as of the currentpostdate.Note: The current postdate is defined in the Current System Post Dateinstitution option (PDAT).Current Due DateCurrent Due Date of loan account.Number ofAccounts:Total number of Unapplied Balance Notices generated.Additional Requirements:The installation of DNA 4.7.1 or higher is required.For notices to be produced, a text file named ‘UNAP BAL NOTICE.TXT’ must be createdand placed in the text directory defined by the ‘TEXT’ institution option.The completion of all the Financial Institution’s nightly update processing is required prior tothe Unapplied Balance Notice batch application being run.A default notice is required in the text file. If using the \\When command to designate a noticefor specific products, there must also be a default notice in the UNAP BAL NOTICE.TXT file.Configuration Create the UNAP BAL NOTICE.TXT FileEnsure compliance department approves any selected textfor the Unapplied Balance NoticeSave the UNAP BAL NOTICE.TXT File in the TEXTfolder (typically G:\OSI\Bank\Bat Exe\Text\)Set up Notice Variables (Navigation: System Institution Variables Unapplied Balance NoticeEnsure UNAP BAL NOTICE.sqt application is in the DNACreator batch application directory (typicallyG:\OSI\Bank\Bat exe\EXTNS\)Setup the Unapplied Balance Notice(UNAP BAL NOTICE.sqt) batch application with theapplicable parameters.Check that the loan product(s) and/ or loan account(s) donot have partial payments allowed (if notices are to begenerated for the loan accounts or loan products)Check that the Unapplied Balance Notice is available withthe Exclude Application setting for the product(s) and/ orfor the loan account(s).Unapplied Loan Balance Notice04/27/202215

Unapplied Loan Balance NoticeRevisionsDateAppVersion #04/2022 iservChangeAdded additional data exception handling for bad address dataconditions and updated code performance. Updated User Manualformat to adhere to current DNA Appmarket documentationstandards.Updated code so the custom markers would work and print outputcorrectly if multiple payments were made to a partial paid loanaccount receivable situation.Added new Partial Payment Allowed YN batch parameter to allow theFinancial Institution to decide if the partial payments allowed indicatoron the loan account should be considered.Initial SubmissionUnapplied Loan Balance Notice04/27/202216

Yes CNS,CML,MTG Product Minors to Exclude EMNR Comma-delimited list of minor account type codes to be excluded from the selection criteria. No. Unapplied Loan Balance Notice Fiserv Unapplied Loan Balance Notice 7 04/27/2022 Parameter Code Description (how used) Required Default Account .