Transcription

CITY AND COUNTY OF DENVER2022EMPLOYEEBENEFITSGUIDE

Table ofContentsWELCOME LETTER 2BENEFITS ELIGIBILITY 3BENEFITS ENROLLMENT 4HEALTH CARE BASICS 5MEDICAL PLANS 6BENEFIT PLAN PREMIUMS 11BUDGETING FOR YOUR HEALTH CARE12DENTAL PLANS 15VISION PLAN 16EMPLOYEE HEALTH AND WELL-BEING17LIFE INSURANCE 19DISABILITY INSURANCE 20LEGAL SERVICES 21ADDITIONAL BENEFITS 22RETIREMENT PLANNING 23BENEFICIARY DESIGNATION 24WORK-LIFE BALANCE 25CALCULATE YOUR MEDICAL LIABILITY26This is a summary of benefits drafted in plain language to assist you in understanding what benefits are offered and does not constitutea policy. Detailed provisions are contained in each provider’s plan document. If there is a discrepancy between what is presented hereand the official plan documents, the plan documents will govern.

A MESSAGE FROM THEOFFICE OF HUMAN RESOURCESDear City Colleague,The City and County of Denver’s remarkably resilient workforce—all ofyou—remain steadfast in continuing to provide essential services for allDenver residents, as well as your fellow colleagues. Whether it’s fromyour frontline workstation, remote workstation or a hybrid of both, youcontinue to excel and keep Denver moving forward. We commend youfor being an important and integral part of the city that you love!Open Enrollment is your annual opportunity to reassess which benefitplans you and your family will need in the new year. We encourageyou to actively participate in this year’s Open Enrollment period:» October 11-October 29, 2021 by 11:59 p.m.Submit your 2022 benefit selections in Workday by Friday, October 29,2021. You will not be able to make changes to most of your 2022 benefitplans without a qualified life event in 2022 after this Open Enrollmentperiod closes.This guide is a starting point for learning what benefit plans areavailable to you and your dependents, and how to compare whichplans will work best for you and your family. Visit DenverHub.org to getbenefit plan information.What’s new in 2022?Not much will be changing with Denver employee benefits from 2021 to 2022. However, Denver’s dental planswill have some changes in 2022. See details below.» Denver's medical and vision plans all remain the same in 2022—including premiums paid for theseplans!» Delta Dental benefit plan enhancements include:» Implants will be covered under the PPO High and PPO Low plans with one implant per tooth in a60-month period (increased from one implant in a 60-month period).» PPO High plan offers an increased lifetime orthodontic maximum of 2000 (up from 1000).» PPO High and PPO Low plans’ diagnostic and preventive services no longer count towards theseplans’ annual maximum benefit ( 1250/person in the Low & 2000/person in the High).» PPO High plan premiums see a slight increase in 2022, but both the PPO Low and EPO plan premiumssee slight decreases in 2022.» EPO copay schedule sees increased costs for some services.Log into Workday to access all 2022 Denver employee benefit plans through the Open Enrollment actionin your Workday inbox. Confirm each plan is: selected/waived, applicable dependents are enrolled, 2022spending and/or savings accounts have 2022 contribution pledges and beneficiaries for your StandardInsurance life insurance plan(s) have been designated before you submit. Print or save a copy of theconfirmation form once you have submitted your 2022 elections.Your OHR Benefits & Wellness team are ready to assist you with any questions. Contact usat benefits@denvergov.org or 720-913-5697.Sincerely,OHR Benefits & Wellness2

WHO IS ELIGIBLE FOR BENEFITS?As a full-time (30-40 hours per week) or half-time (20-29 hours per week) unlimited,limited or Sheriff employee, you are eligible for City and County of Denver employeebenefits. If you are an on-call/seasonal employee, you may become eligible formedical coverage under the Affordable Care Act. You will be notified by the OHRBenefits & Wellness team when you become eligible.BenefitsEligibilityWHAT IF I'M MARRIED TO, OR A PARENT/CHILD OF, ANOTHER CITY ANDCOUNTY OF DENVER EMPLOYEE?You can enroll in medical and dental coverage as an employee or as a dependentonly. You and your dependents cannot have dual coverage as both an employeeand a dependent under the City and County of Denver’s employee benefit plans.WHAT DEPENDENTS ARE ELIGIBLE FOR HEALTH CARE COVERAGE?Your eligible dependents include:» Your spouse (including legally married and common-law) or your Colorado State Civil Union spouse (premiums are paid on anafter-tax basis)» Your children to age 26 (including a stepchild and adopted child)» Your dependent children of any age who are physically or mentally unable to care for themselvesWhen adding dependents, supporting documents must be provided. A list of acceptable dependent documents can be found onDenverHub.org.WHEN ARE MY BENEFITS EFFECTIVE, WHO PAYS FOR MY COVERAGE AND WHEN CAN I CHANGE MY ELECTION?BENEFIT TYPEEFFECTIVE DATEH Hire Date1st 1 st of the MonthFollowing Your HireDateENROLLMENTRESPONSIBILITYE Enrollment RequiredA Auto EnrollCOSTC City PaidS Shared ExpenseEE EmployeeCHANGES WHEN?A Auto EnrollOE Open EnrollmentQLE Qualified Life EventMedical1stESOE & QLEDental1stESOE & QLEVision1stEEEOE & QLEFlexible SpendingAccounts (FSA)1stEEEOE & QLEHealth Savings Account(HSA)1stES2Anytime & OEShort-Term Disability:Sick and VacationPaid Time Off (PTO)1st1stEAEE3COEAAdditional Life Insurance11stEEEAnytimeARAG Legal1stEEEOE & QLEDeferred Compensation1stEEEAnytimeRTD EcoPassHESMonthlyBasic Life InsuranceHACALong-Term Disability1stACAEmployee AssistanceHACAPensionHASAPaid Time Off (PTO)HACA(1) Includes spouse life, dependent children life and accidental death and dismemberment.(2) If you enroll in the high-deductible health plan (HDHP), the city will match contributions to your health savings account up to 300 for individualcoverage, and 900 for all other coverage tiers.(3) Employees hired prior to January 1, 2010, who remained on the sick and vacation leave plan can elect short-term disability and pay the entire cost.3

When can I enroll orchange my benefitelections?BenefitsEnrollmentAT OPEN ENROLLMENTAS A NEW HIRE OR REHIREDURING THE YEARDuring Open Enrollment you arechoosing your plans for the upcomingcalendar year (January 1-December 31).When newly hired into a benefit-eligibleposition you will have 30 days from yourhire date to choose your plans for theremainder of the calendar year in whichyou are hired.During the calendar year you mayexperience a qualified life event. Youwill have 30 days from the event date tosubmit your plan changes in Workday.All your benefit plan elections/changesare processed through Workday. ForOpen Enrollment, the benefit electionevent is automatically generated andwaiting in your Workday inbox ready foryou to take action choosing plans andsubmitting your elections. You can findthe link for Workday on the OHR Benefits& Wellness webpage at denvergov.org/benefits.All your benefit plan elections/changesare processed through Workday. For newhire or rehire, the benefit election event isautomatically generated and waiting inyour Workday inbox ready for you to takeaction choosing plans and submittingyour elections. You can find the link forWorkday on the OHR Benefits & Wellnesswebpage at denvergov.org/benefits.For qualified life events, you will haveto create your own benefit electionevent in Workday, applicable to thetype of event: marriage/divorce, gain/loss of other coverage, etc. Supportdocumentation of the event will berequired prior to approval of changes.If you do not have Workday access,contact OHR Benefits & Wellness prior tothe October 29, 2021 open enrollmentdeadline.WE ARE HERE TO HELPYOU ENROLL ANDMAKE THE BENEFITSELECTIONS THAT ARERIGHT FOR YOU.web: denvergov.org/benefitsphone: 720-913-5697email: benefits@denvergov.orgtext: 720-515-64574

Health CareBasicsUnderstand your options.Before you can truly begin to evaluate the health care options available to you, hereare some basic concepts and terms to get you started.MEDICAL PLAN TYPESThe city offers three types of medicalplans from three providers: a healthmaintenance organization (HMO),deductible HMO (DHMO) and highdeductible health plan (HDHP).The HMO option offers you a wide arrayof health care services all within a selectnetwork of Denver Health MedicalCenter doctors and hospitals with aset copay for services and no annualdeductibles to be met.A DHMO option offers you a widearray of health care services, all withina select network of local Coloradodoctors and hospitals depending on theplan provider. It also offers set copaysfor some services, but can requirean annual deductible be met andcoinsurance payments after deductiblefor other services. The higher annualpaycheck costs and higher out-ofpocket maximums make the DHMOoptions the most costly for you and yourfamily.An HDHP option offers you the samewide array of health care services as anHMO or DHMO plan, but within a selectnetwork of local or national doctorsand hospitals depending on the planprovider. And UnitedHealthcare caneven offer out-of-network coverage.HDHP enrollment also allows for healthsavings account (HSA) contributions.The lowest paycheck costs and lowestout-of-pocket maximums make HDHPless costly for you and your family. Youcan lower these costs even further bytaking advantage of a generous HSAcontribution from the city through HSAmatching.NETWORKYour network is where you can gofor covered services and insurancediscounts.5» In-network includes doctors, hospitalsand pharmacies you can visit toreceive your insurance discount.» Closed network means a limitedand specific list of doctors, hospitalsand pharmacies you can visit forcovered services and insurancediscounts. Denver Health MedicalPlan and Kaiser Permanente plansare both closed networks.» Out-of-network typically includesdoctors, hospitals and pharmaciesyou might not be able to go tofor covered service or insurancediscounts. UnitedHealthcare’s HDHPoffers this coverage at higher coststo you.To minimize your costs, try to utilize innetwork services.COSTSCosts include what you are payingfor your insurance and any servicesthroughout the year.» Premiums are what you (and thecity) pay for your health care plans.Premiums are what you see deductedfrom your paychecks for your benefitplans.» Copayment or copay is a fixed dollaramount that you pay for a coveredhealth service. In an HMO, all copaysare set. In a DHMO, some copaysare set for certain services. And inan HDHP, copays aren't set until theannual deductible is met.» Coinsurance is your share of servicecosts after the annual deductible ismet, typically a percentage.» A deductible is the amount you mustpay each calendar year for coveredhealth services before the insuranceplan will begin to pay.» The out-of-pocket maximum is themost you will pay for covered healthservices during the calendar year. Allcopay, deductible and coinsurancepayments count toward the outof-pocket maximum. Once you’vemet your out-of-pocket maximum,your insurance plan will pay 100% ofcovered health services.TAX ADVANTAGESThe type of medical plan you choosealso comes with different tax-advantagedspending accounts.» A health savings account (HSA) isa bank account that you can use topay your HDHP out-of-pocket healthcare costs with pre-tax dollars fromyour paycheck or with employercontributions. Money deposited inan HSA stays with you, regardless ofemployer or health plan, and unusedbalances roll over year to year.» A health flexible spending account(FSA) is a spending account that youcan use to pay for health care costs(medical, dental and vision) withpre-tax dollars. Funds deposited intoa health FSA will be forfeited if you donot use them by the IRS deadline. Ifyou fund an HSA, you are not eligibleto contribute to a traditional healthFSA; however, you can fund a limiteduse FSA, which can only be used topay for qualified dental and visionexpense. Medical expenses areexcluded.

Choose the right plan.MedicalPlansThe city offers six medical plan options through three carriers: Denver Health MedicalPlan, Kaiser Permanente and UnitedHealthcare. All three carriers offer a highdeductible health plan (HDHP). Kaiser Permanente and UnitedHealthcare also offera deductible HMO (DHMO) plan, with UnitedHealthcare's DHMO called the ColoradoDoctors Plan. Denver Health Medical Plan offers an HMO plan.HIGH-DEDUCTIBLE HEALTH PLANDEDUCTIBLE HMO (DHMO) PLAN» Lowest premium paycheck cost» Highest premium paycheck cost» Affordable premium paycheck cost» Generally, you pay the full cost of allcare until the annual deductible isreached» You will pay for some services in the formof a copay and the full cost of otherservices until the annual deductible isreached» You will pay for most services in the formof a copay» Highest deductible» After the annual deductible is reached,you will pay coinsurance or copay untilthe annual out-of-pocket maximum isreached» Lowest out-of-pocket maximumHMO PLAN» Lowest deductible» After the annual deductible is reached,you will pay either copay orvs. coinsurance until the annual out-ofpocket maximum is reached» You can budget for your out-of-pocketexpenses by funding a health savingsaccount (HSA) through Optum Bank » The city contributes to your HSA» For every 1 you deposit into your HSA,the city will match 2 up to 300¹ per yearfor individual coverage, or up to 900¹per year for all other coverage tiers» No deductible» High out-of-pocket maximum» You can budget for your out-of-pocketexpenses by funding a health flexiblespending account (FSA)vs.» Highest out-of-pocket maximum» You can budget for your out-of-pocketexpenses by funding a health flexiblespending account (FSA)» No city contribution to your FSA» If you contribute to an FSA, your wholepledge amount for the plan year isavailable for use on qualified expenseson the day your plan starts» No city contribution to your FSA» If you contribute to an FSA, your wholepledge amount for the plan year isavailable for use on qualified expenseson the day your plan starts» If enrolled in the Denver Health MedicalPlan HMO you must obtain all servicesfrom a Denver Health provider.NUMBERS TO KNOWDEDUCTIBLEHDHP in-network deductible:Individual deductible: 1,450²Family deductible: 2,900²DHMO in-network deductible:Individual deductible: 500Family deductible: 500 per memberup to 1,000HDHP in-network out-of-pocketmaximum:Individual out-of-pocket max: 2,900²Family out-of-pocket max: 5,800²DHMO in-network out-of-pocketmaximum:Individual out-of-pocket max: 4,500Family out-of-pocket max: 4,500 permember up to 9,000HDHP in-network coinsurance:Denver Health Medical Plan: 10%Kaiser Permanente: 20%UnitedHealthcare: 20%DHMO in-network coinsurance: 20%HMO in-network deductible:Individual deductible: 0Family deductible: 0OUT-OF-POCKET MAXIMUMHMO in-network out-of-pocketmaximum:Individual out-of-pocket max: 3,000Family out-of-pocket max: 3,000 permember up to 6,000COINSURANCEHMO in-network coinsurance: 20%CONTRIBUTION LIMITSHSA contributions limits:Individual coverage: 3,650 per year(employer employee contributions)Health FSA contribution limits:Up to 2,750 per yearFamily limits: 7,300 per year(employer employee contributions)(1) The city HSA match is made twice per month. Employees covering just themselves, must contribute at least 6.25 per paycheck starting January 1, 2022 to receive the full 300 citycontribution. Employees covering family members, must contribute at least 18.75 per paycheck starting January 1, 2022 to receive the full 900 city contribution.(2) Individual deductible and out-of-pocket max apply only for employee only HDHP coverage. Family deductible and out-of-pocket max apply only for employee dependent(s) HDHPcoverage.6

2022 Denver Health Medical Plan (DHMP)comparisonsDHMP ELEVATE HMODHMP ELEVATE HDHPIn-NetworkIn-NetworkSummary of Covered ServicesDenver HealthFacilities OnlyDenver HealthFacilities OnlyColorado OnlyColorado OnlyDeductibleOut-of-Pocket MaximumSingle/FamilyOffice VisitsPrimary Care PhysicianSpecialistNetworkPreventivePrescription Drugs 0 3,000 per individual/ 6,000 familySingleFamily 1,450 2,900 2,900 5,800 25 copay after first three visits1 40 copay10% after deductibleDenver Health Facilities OnlyDenver Health Facilities Only 0 010% after deductibleSee plan summary for details as costs vary by pharmacy location,Rx tier and length of supply (30-day or 90-day).Inpatient Hospital(per admission, including birth) 500 copay10% after deductibleOutpatient Hospital/AmbulatorySurgery 200 copay10% after deductible 0 copay10% after deductible 200 copay10% after deductibleLab and X-RayMRI/CAT/etc.Emergency Care20% coinsurance110% after deductibleUrgent Care 50 copay10% after deductibleMental HealthInpatientOutpatient 500 copay 25 copay10% after deductible10% after deductibleAlcohol/Substance AbuseInpatientOutpatient 500 copay 25 copay10% after deductible10% after deductible 50 copay(max 30 visits/year)10% after deductible(max 30 visits/year)Vision Exam 25 copay (one exam every 24 months)Not coveredChiropractic 50 copay2(max 20 visits/year)10% after deductible2(max 20 visits/year)Phys/Occ/Speech Therapy(1) HMO includes coinsurance for Emergency Care, Durable Medical Equipment, Home Health care, Skilled Nursing Facility, Outpatient Surgery/Physicianservices, all with no deductible to meet first and only up to out-of-pocket maximum.(2) Services must be provided by Columbine Chiropractic in order to be covered.DENVER HEALTH MEDICAL PLANBoth Denver Health Medical Plans (HDHP and HMO) are limited to onlyDenver Health facilities. Denver Health members can use the Cofinitynetwork for outpatient behavioral health services only.7To learn more about Denver Health MedicalPlan, visit denverhealthmedicalplan.org orcall 303-602-2100.

2022 Kaiser Permanente medical plancomparisonsSummary of Covered ServicesKAISER HDHPIn-Network OnlyIn-Network Only (Colorado Only)(Colorado Only)SingleFamily 500 per individual/ 1,000 family 1,450 2,900 4,500 per individual/ 9,000 family 2,900 5,800DeductibleOut-of-Pocket MaxSingle/FamilyKAISER DHMOOffice VisitsPrimary Care PhysicianSpecialist 0 copay1 75 copay120% after deductible20% after deductibleAlternative VisitsPhone/Video/Chat with DoctorNo charge20% after deductible - phone/video 15- 62 per chat - 0 after deductibleKaiser Permanente facilities onlyKaiser Permanente facilities only 0 030-day retail 10/ 35/ 60 copay ( 100 Specialty)90-day mail 20/ 70/ 120 copay30-day retail 10/ 35/ 60 copay after deductible90-day mail 20/ 70/ 120 copay after deductible20% after deductible20% after deductibleNetworkPreventivePrescription DrugsGeneric/Formulary/Non-formularyInpatient Hospital(per admission, including birth)Outpatient HospitalLab and X-Ray20% after deductible20% after deductible 25 lab copay/ 25 X-ray copay20% after deductible 250 copay20% after deductible20% after deductible20% after deductibleMRI/CAT/etc.Emergency CareUrgent Care 0 copay (Kaiser designated facility)20% after deductible (Kaiser designated facility)Mental HealthInpatientOutpatient20% after deductible 0 copay/visit120% after deductible20% after deductibleAlcohol/Substance AbuseInpatientOutpatient20% after deductible 0 copay/visit120% after deductible20% after deductible20% after deductible(max 20 visits/year)20% after deductible (max 20 visits/year)Vision Exam 0 copay20% after deductibleChiropractic 30 copay (max 20 visits/year)20% after deductible (max 20 visits/year)1Phys/Occ/Speech Therapy(1) The annual deductible and the 20% coinsurance apply for procedures performed during copay office and urgent care visits.CHOOSE THE RIGHT DOCTOR FOR YOUThe Kaiser Permanente plans provide in-network coverage only (except in the case of a medical emergency). If you enroll in theKaiser Permanente HDHP or DHMO, you must select a primary care physician who is responsible for overseeing your health care.With Kaiser Permanente medical offices across the front range area, it can be easy to find a doctor who is close to your home orworkplace. Most Kaiser Permanente medical offices house primary care, laboratory, X-ray and pharmacy services under one roof,which means you can visit your physician and manage many of your other needs in a single trip.CALL THE APPOINTMENT AND ADVICE LINETo learn more about Kaiser Permanente,If you have an illness or injury and you’re not sure what kind of care youvisit my.kp.org/denvergov or call 303need, Kaiser Permanente advice nurses can help. With access to your338-4545.electronic health record, they can assess your situation and direct you to theappropriate facility, or even help you handle the problem at home until yournext appointment. For advice, call 303-338-4545, 24 hours a day, seven days a week. For appointment services, call Monday throughFriday, 7:00 a.m. - 6:00 p.m.8

2022 UnitedHealthcare medical plancomparisonsUNITEDHEALTHCARE DHMOSummary of Covered ServicesIn-Network OnlyColorado Doctors Plan (CDP)DeductibleOut-of-Pocket MaxSingle/Family 500 per individual/ 1,000 family 4,500 per individual/ 9,000 familyUNITEDHEALTHCARE HDHPIn-Network (Nationwide)SingleFamilyOut-of-Network (Nationwide)SingleFamilyIn- and out-of-network ded. and out-of-pocket maximum do not cross apply 1,450 2,900 3,000¹ 6,000¹ 2,900 5,800 6,000¹ 12,000¹Office VisitsPrimary Care PhysicianSpecialist 0 copay2 75 copay220% after deductible20% after deductible50% after deductible50% after deductibleAlternative VisitsPhone/Email/Virtual VisitNo charge20% after deductible50% after deductibleColorado Doctors Plan (CDP)Choice PlusOut-of-Network 0 0Not covered 10/ 35/ 60/ 100 copay 10/ 35/ 60 copayafter deductible 10/ 35/ 60 copayafter deductibleInpatient Hospital(per admission, including birth)20% after deductible20% after deductible50% after deductible3Outpatient Hospital20% after deductible20% after deductible50% after deductible3 25 lab copay/ 25 X-ray copay20% after deductible50% after deductible3 250 copay20% after deductible50% after deductible320% after deductible20% after deductible20% after deductible 0 copay20% after deductible50% after deductibleMental HealthInpatientOutpatient20% after deductible 0 copay220% after deductible20% after deductible50% after deductible250% after deductible2Alcohol/Substance AbuseInpatientOutpatient20% after deductible 0 copay20% after deductible20% after deductible50% after deductible250% after deductible2 75 copay(max 20 visits/year)20% after deductible(max 20 visits/year)50% after deductible2(max 20 visits/year)Vision Exam 50 copay(one exam every 24 months)20% after deductible(one exam every 24 months)50% after deductibleChiropractic 75 copay(max 20 visits/year)20% after deductible(max 20 visits/year)50% after deductibleNetworkPreventivePrescription DrugsTier 1/Tier 2/Tier 3/Tier 4Lab and X-RayMRI/CAT/etc.Emergency CareUrgent CarePhys/Occ/Speech Therapy2(1) Out-of-network services reimbursed at the Centers for Medicare and Medicaid Services (CMS) rates and CMS rate applies to deductible and out-ofpocket max, not billed cost. (2) The annual deductible and the 20% coinsurance apply for procedures performed during copay office and urgent carevisits. (3) Prior authorization required for certain services.UNITEDHEALTHCARE COLORADO DOCTORS PLAN DHMO (CDP)If you enroll in the UnitedHealthcare CDP, you must:» See Centura Health or New West Physicians doctors, specialists andhospitals.» Choose a PCP within Centura Health or New West Physicians network.To learn more about UnitedHealthcare,visit whyuhc.com/denver or call 855828-7715 (CDP members) or 800-8425520 (HDHP members).» Go to whyuhc.com/denver to select a PCP. Click Benefits, then Find a Doctor orFacility and then Colorado Doctors Plan. Once you find a PCP, email their 14-digit Physician ID number toCCDenrollment@uhc.com. You do not need a referral before seeing another network PCP or specialist.UNITEDHEALTHCARE HDHPThe UnitedHealthcare HDHP provides in- and out-of-network coverage, allowing you the freedom to choose any provider nationwide.However, you will pay less out of your pocket when you choose a UnitedHealthcare in-network provider.9

Mental health benefitsDenver’s medical carriers all provide exceptional mental health care benefits. See how to access below. Copays,deductibles, coinsurance will apply. Refer to page 18 to learn more about Denver’s Employee Assistance Program, whichalso offers professional counseling at no charge for up to six sessions per issue.DENVER HEALTH MEDICAL PLANYou can obtain mental health andsubstance use disorder services fromany in-network provider, no referralnecessary. Members can self-referin-network. Individual and groupsessions are covered. Find a provider atdenverhealthmedicalplan.org/find-doctor.KAISER PERMANENTEKaiser Permanente offers a spectrum ofmental health services. The online, selfdirected, therapy program myStrengthis available to all members for no-cost.Members can also access free wellnesscoaching by calling 1-866-862-4295or going to kp.org/wellnesscoach. Forspecialty care, members can contact theBehavioral Health Access Center at 303471-7700. Members can also always usethe online Chat with a Doctor or email theirprimary care doctor through kp.org formental health advice.UNITEDHEALTHCAREUnitedHealthcare offers its membersmultiple options to access mentalhealth care. Members can access aself-directed therapy app, Sanvello, withguided tools for reducing stress, anxietyand depression. Members also haveaccess to tele-mental health throughTalkspace Online Therapy or may set upappointments with an in-person in-networkmental health specialist by callingcustomer service at 800-842-5520, orgoing online to myUHC.com and lookingfor a health provider. UnitedHealthcarealso offers its members a substance usedisorder helpline at 855-780-5955.ON-DEMAND HEALTH CARE - DISPATCHHEALTH: BRINGING THE HOUSE CALL BACK TO YOUR HEALTH CARECity and County of Denver employees and dependents in any of the city medical plans can avoid unnecessary expenses and tripsto the ER by using DispatchHealth. DispatchHealth is covered as an urgent care visit and can treat pains, sprains, cuts, wounds,high fevers, upper respiratory infections and much more. Their medical teams are equipped with all the tools necessary to provideadvanced medical care in the comfort of your home, workplace or location of need. DispatchHealth is open seven days a week,8:00 a.m.-10:00 p.m., including holidays. Service areas include Castle Rock to Boulder/Longmont, Denver and Colorado Springs.For every house call, DispatchHealth sends a physician assistant or nurse practitioner along with a medical technician. An on-callphysician is also available at all times via phone to treat:Common AilmentsRespiratory» Splinting» Fever - Flu - Nausea» Asthma attacks» Advanced on-site blood testing» Headaches - Migraines» Bronchitis» Urinary catheter insertion» Urinary tract infectionSkinEar, Nose and Throat» Sore throat» Hives - Allergic reactions» Ear infection or pain» Skin abscess (boil)» Sinus infection» Cuts that need stitches» Nosebleeds» RashesGastrointestinal» Diarrhea» HeartburnNeurological» WeaknessMusculoskeletal» Joint or back pain» Nausea and vomiting» Strains or sprains» Eye infection» Object in the eyeThese services and more are availablefrom DispatchHealth with just a callor click.» Call 303.500.1518» Go online to dispatchhealth.com» Vertigo (dizziness)» ConstipationEye» Infectious disease testing (flu, strep)» Minor bone breaksAdditional Procedures» IV placement» IV fluidsEmployees may usetheir health savingsaccount (HSA) or flexiblespending account (FSA)to cover expenses. Moreon HSAs and FSAs startingon page 12.» Stitches10

Benefit PlanPremiumsListed below are the monthly premiums for medical insurance for full-time employees. The amount you pay for coverage isdeducted from your paycheck on a pre-tax basis. Deductions are taken from the first two paychecks each month. For the monthlypremiums for half-time employees, contact OHR Benefits & Wellness.MEDICALEmployee onlyEmployee spouseEmployee eeCityEmployeeDHMP HMO 514.16 97.94 1,030.17 316.46 967.13 257.08 1,449.46 509.27DHMP HDHP 467.38 27.20 946.62 141.45 885.30 103.86 1,337.34 245.31Kaiser DHMO 511.17 97.36 1,024.15 314.61 961.48 255.58 1,440.99 506.30Kaiser HDHP 482.05 28.06 976.34 145.89 913.09 107.12 1,379.10 252.97United DHMO (CDP) 619.92 118.08 1,242.05 381.54 1,166.03 309.96 1,747.58 614.01United HDHP 672.32 39.13 1,361.71 203.47 1,273.49 149.40 1,923.76 352.88Listed below are the monthly premiums for dental insurance. The amount you pay for coverage is deducted from your paycheck ona pre-tax basis. Deductions are taken from the first two paychecks each month. For the monthly premiums for half-time employees,contact OHR Benefits & Wellness.DENTALEmployee onlyEmployee spouseEmployee eeCityEmployeeDelta PPO Low Plan 25.24 4.25 51.07 14.39 47.50 11.46 79.26 25.70Delta PPO High Plan 25.24 15.05 51.07 38.39 47.50 33.08 79.26 64.18Delta EPO Plan 25.24 5.40 51.07 16.95 47.50 13.78 79.26 29.82Listed below are the monthly premiums for vision insurance. The amount you pay for coverage is deducted from your paycheck ona pre-tax basis. The monthly premium is deducted from the first paycheck each month.VISIONVSP11Employee onlyEmployee spouseEmployee child(ren)Family 5.72 11.64 10.73 19.61

Budgetingfor YourHealth CareHealth savings accountvs. health flexiblespending account.HEALTH SAVINGS ACCOUNTThe City and County of Denver will help youby matching your contributions up to thefollowing amounts to your HSA in 2022:IRS 2022 ANNUAL MAXIMUM HSA CONTRIBUTIONS:DHMO ORHMO?Enrolled in theIndividual: 3,650All other tiers: 7,300Catch-up contribution (if age 55 ): 1,000Enrolled in theyour previous year’s health FSA by December 31, 2021.HDHP?A health savings account (HSA) is an individually

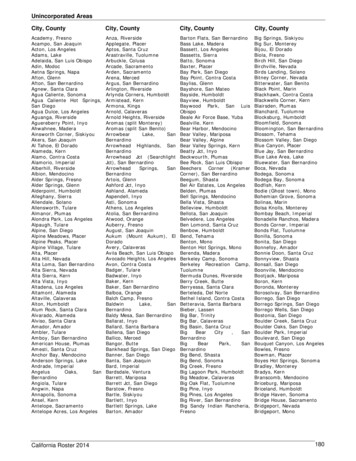

Not much will be changing with Denver employee benefits from 2021 to 2022. However, Denver's dental plans will have some changes in 2022. See details below. » Denver's medical and vision plans all remain the same in 2022—including premiums paid for these plans! » Delta Dental benefit plan enhancements include: