Transcription

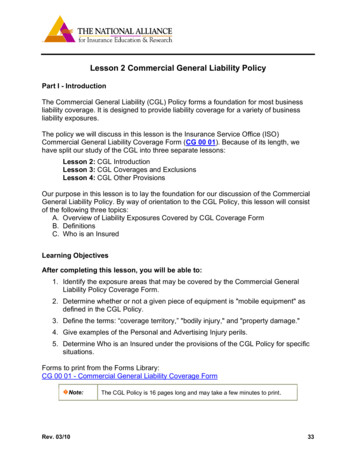

Lesson 2 Commercial General Liability PolicyPart I - IntroductionThe Commercial General Liability (CGL) Policy forms a foundation for most businessliability coverage. It is designed to provide liability coverage for a variety of businessliability exposures.The policy we will discuss in this lesson is the Insurance Service Office (ISO)Commercial General Liability Coverage Form (CG 00 01). Because of its length, wehave split our study of the CGL into three separate lessons:Lesson 2: CGL IntroductionLesson 3: CGL Coverages and ExclusionsLesson 4: CGL Other ProvisionsOur purpose in this lesson is to lay the foundation for our discussion of the CommercialGeneral Liability Policy. By way of orientation to the CGL Policy, this lesson will consistof the following three topics:A. Overview of Liability Exposures Covered by CGL Coverage FormB. DefinitionsC. Who is an InsuredLearning ObjectivesAfter completing this lesson, you will be able to:1. Identify the exposure areas that may be covered by the Commercial GeneralLiability Policy Coverage Form.2. Determine whether or not a given piece of equipment is "mobile equipment" asdefined in the CGL Policy.3. Define the terms: “coverage territory,” "bodily injury," and "property damage."4. Give examples of the Personal and Advertising Injury perils.5. Determine Who is an Insured under the provisions of the CGL Policy for specificsituations.Forms to print from the Forms Library:CG 00 01 - Commercial General Liability Coverage FormNote:Rev. 03/10The CGL Policy is 16 pages long and may take a few minutes to print.33

Lesson 2 Topic A - Overview of Liability Exposures CoveredLearning Objective: Identify the exposure areas that may be covered by theCommercial General Liability Policy Coverage Form.In general, a policyholder can easily understand the exposure they have when theyoperate automobiles, tractor-trailer trucks, watercraft, or aircraft. They also understandthe exposure they have from job-related injuries or disease to their employees. When itcomes to the exposures covered by the CGL Policy, most understand the "slip and fall"type of exposure from a customer in their building, office, or store. They may, however,be unaware of other exposures they may have.As a customer service representative, you may have more communication with thepolicyholder than any other individual in the agency. For that reason, you should befamiliar with the various types of exposures covered by the CGL Policy. In this topic wereview: Exposures covered by the CGL Policy Vicarious LiabilityExposures Covered by the Commercial General Liability (CGL) Coverage FormSome exposures, similar to those we discussed in Lesson 1 Topic D - LiabilityExposures, are covered by the CGL Policy. The chart below is a summary of exposurescovered by the CGL.Liability ExposuresPremises LiabilityOperations LiabilityProduct LiabilityCompleted Operations LiabilityContractual LiabilityContingent LiabilityPersonal LiabilityInjury Arises Out of the InsuredLocationWorkGoods Made or SoldWork PerformedLiability Assumer Under A ContractA subcontractor doing work on behalf of the insuredOffenses such as Libel and SlanderAdvertising InjuryTrademark InfringementRev. 03/1034

Learning Objective: Identify the exposure areas that may be covered by theCommercial General Liability Policy Coverage Form.Vicarious LiabilityIn addition, the CGL Policy will afford coverage to the Named Insured for vicariousliability imposed because of those who may be acting on behalf of the Named Insured.Example The Named Insured's sub-contractor causes an injury to a third party, who thenbrings a claim against the Named Insured. The CGL Policy can cover the NamedInsured for this exposure.We will see how the CGL Policy covers these exposures for your insureds. Rememberthat not every exposure will be covered - either in whole or in part - by the CGL Policy.Note:Rev. 03/10If you would like to review our previous discussion regarding vicarious liability, pleasenavigate back to Lesson 1, Topic B.35

Lesson 2 Topic B - DefinitionsThroughout the CGL Policy form, defined words or terms are set apart by quotationmarks. Before beginning a discussion of the CGL Policy's coverages, exclusions, limits,and conditions, you need to understand these defined words or terms.The definition section of the CGL Policy, which begins on page 12 of the coverage form,defines 22 words or terms as they apply to the coverage form. Refer to this sectionwhen the meaning of a defined word is unclear.We will not review all of the definitions in this topic. Some will be discussed at the pointof their application to the CGL Policy. One example is "insured contract," which we willdiscuss later in Lesson 3: CGL Coverages and Exclusions. Definitions included in thistopic were selected because they are used in more than one section of the policy. Theyinclude: AutoMobile EquipmentProperty DamageCoverage TerritoryNote: EmployeeBodily InjuryPersonal and Advertising InjuryRefer to page 12 of the CGL PolicyLearning Objective: Determine whether or not a given piece of equipment is"mobile equipment" as defined in the CGL Policy.Note:Please follow along by turning to page 12 of your CGL Policy now.Auto"Auto" is defined as a land motor vehicle, trailer, or semi-trailer designed for travel onpublic roads, including any attached machinery or equipment. In most cases, the CGLPolicy does not provide coverage for "autos." The definition of "mobile equipment" isimportant and will be discussed shortly."Auto" is also defined as any other land vehicle that is subject to a compulsory orfinancial responsibility law or other motor vehicle insurance law in the state where it islicensed or principally garaged.Rev. 03/1036

Learning Objective: Determine whether or not a given piece of equipment is"mobile equipment" as defined in the CGL Policy.Mobile EquipmentRefer to 12.a through 12.f on page 14 of the CGL Policy.Note:There are six types of land vehicles that are considered "mobile equipment." Anymachinery or equipment attached to any of these vehicles is also considered "mobileequipment." We have summarized the six categories on the next pages. Please refer todefinitions 12. a. through 12. f. on page 14 of the policy as you study this material.Take note of the descriptive phrases that will be key to understanding "mobileequipment." "for use off public roads""moves on crawler treads""used primarily to service premises you own or rent""Self propelled or not self propelled""provides mobility to permanently mounted specific equipment""not other wise classified . used for purposes other than transport of personsor cargo"We will look at each individually, but first consider all six categories of "mobileequipment" identified by the CGL.1. Bulldozers, farm machinery, forklifts and other vehicles designed for useprincipally off public roads.2. Vehicles maintained for use solely on or next to premises you own or rent. Thekey words are “maintained for use solely on premises you own or rent.”3. Vehicles that travel on crawler treads.4. Vehicles, whether self-propelled or not, maintained primarily to provide mobility topermanently mounted specified equipment.5. Other vehicles that are not self-propelled and are maintained primarily to providemobility to specific types of permanently attached equipment.6. Vehicles not otherwise classified maintained primarily for purposes other than thetransportation of persons or cargo.Rev. 03/1037

Learning Objective: Determine whether or not a given piece of equipment is"mobile equipment" as defined in the CGL Policy.CGL Definition of Mobile Equipment lists six types of land vehicles which meet thedefinition of "mobile equipment:"1. Bulldozers, farm machinery, forklifts andother vehicles designed for use principallyoff public roadsExample: Think of the forklifts you see in alarge lumberyard, or the bulldozers you see on aconstruction site. If these are occasionally on apublic road, they still may be considered “mobileequipment.”2. Vehicles maintained for use solely on or nextto premises you own or rentExample: A golf cart is used by apartmentmanagers to drive around a large apartmentcomplex. The key words are “maintained for usesolely on premises you own or rent.”3. Vehicles that travel on crawler treadsExample: Construction equipment and othercommonly seen types of contractor's equipment4. Vehicles, whether self-propelled or not,maintained primarily to provide mobility topermanently mounted specified equipmentExamples: Vehicles with attached power cranes,shovels, loaders, diggers, or drills OR roadconstruction or resurfacing equipmentRev. 03/1038

Learning Objective: Determine whether or not a given piece of equipment is"mobile equipment" as defined in the CGL Policy.5. Other vehicles that are not self-propelled and aremaintained primarily to provide mobility to specifictypes of permanently attached equipment: air compressors pumps and generators spraying, welding, building cleaning, geophysicalexplorations, lighting and well servicing equipment.The key words here are “not self-propelled, primarily provide mobility to thespecified types of equipment.” Generally, these vehicles will be a trailer type ofvehicle with the specified equipment attached.6. Vehicles not otherwise classified maintained primarily for purposes otherthan the transportation of persons or cargo.Part f. of the definition of mobile equipment includesvehicles not described in a. through d. which aremaintained primarily for purposes other thantransporting people or cargo."Autos" not "Mobile Equipment"The policy then goes on to define specific self-propelled vehicles as "autos" and not"mobile equipment."The policy language says:However, self-propelled vehicles with the following types of permanently attachedequipment are not "mobile equipment" but will be considered "autos."There are three categories of vehicles that are considered "auto" and not "mobileequipment." We will list them all here, then look at all three individually.1. Equipment designed primarily for snow removal, road maintenance, (but notconstruction or resurfacing) or street cleaning2. Cherry pickers and similar devices mounted on an automobile or truck chassisand used to raise or lower workers3. Air compressors, pumps and generators, including spraying, welding, buildingcleaning, geophysical exploration, lighting and well servicing equipmentRev. 03/1039

Learning Objective: Determine whether or not a given piece of equipment is"mobile equipment" as defined in the CGL Policy."Autos" not "Mobile Equipment"1. Self propelled vehicles designed for: snow removal road maintenance (not road building orrepaving) street cleaning Example: Snow Plow2. Devices mounted on an auto or truck chassis and used to raise and lowerworkers Example: Cherry Pickers3. Self-propelled vehicles with the following types of permanently attachedequipment: Air compressors Pumps and generators Spraying, welding, building, cleaning, geophysical explorations, lightingand well servicing equipment Example: Crop Spraying EquipmentCaution: Even though the CGL defines item 2 and 3 above as "Autos", the policy givesback General Liability coverage to these while the attached equipment is beingoperated. We will discuss this later under Lesson 3 Topic C.Note:Rev. 03/10However, “mobile equipment” does not include any land vehicles that are subject to acompulsory or financial responsibility law or other motor vehicle insurance law in the statewhere it is licensed or principally garaged. Land vehicles subject to a compulsory orfinancial responsibility law or other motor vehicle insurance law are considered “autos.”40

Knowledge CheckDrag and drop each piece of equipment to the correct column.The correct answers are below:Mobile EquipmentSelf-propelled drillForkliftBulldozerSelf-propelled craneRev. 03/10Auto, not Mobile EquipmentStreet sweeperSnow plowPick-up truck with an attached cherrypicker41

Learning Objective: Define the terms: “coverage territory,” "bodily injury," and"property damage."Coverage TerritoryBecause our economy has become global, Coverage Territory is important and isdefined by three categories:US, Puerto Rico, & CanadaThe first part of the definition lists specific geographic locations that make up the"coverage territory:" the United States of America (including its territories andpossessions), Puerto Rico, and Canada.Note:Because of its proximity and because of the North American Free Trade Agreement, someindividuals think Mexico would be included in the “coverage territory.” Mexico is notautomatically included in the “coverage territory.”International Waters or AirspaceThe "coverage territory" also includes international watersor airspace during the course of transportation, providedthere is no transportation between points outside the listedgeographic locations in part a. of the definition. A planegoing from New Orleans, Louisiana to San Juan, PuertoRico is considered to be in the "covered territory."However, the same plane flying between New Orleans andMexico City would not be in the "covered territory."Rev. 03/1042

Learning Objective: Define the terms: “coverage territory,” "bodily injury," and"property damage."The third category of the definition of "coverage territory" is as follows:All Parts of the World under Certain CircumstancesAll parts of the world are considered as being in the "covered territory" if the injury ordamage arises out of goods or products made or sold by the insured in the territorydescribed in the first part of this definition.Example The insured makes a product in St. Louis, and ships it directly to their customerin Europe. The product was made in the "coverage territory."Business activities of persons whose home is located in the geographic location listed inpart a. of the definition, but are away from home for a short time (not defined) on theinsured's business.Example A factory representative who lives in Boston causes a covered loss whileattending a 10 day business show in Paris, France.The concept of worldwide coverage requires further explanation.Due to the internet's ability to cross all national boundaries, ISO has found it appropriateto expand the worldwide section in the "coverage territory" to include many internetactivities such as Personal and Advertising Injury offenses that occur through theinternet or other electronic means of communication.The second condition that must be met is that the insured's responsibility must bedetermined in a "suit" filed and decided in the geographic location listed in part a. of thedefinition or determined in a settlement the insurance company agrees to.Requirements that must be met before worldwide coverage applies:Tip:Goods must be made or sold in a. above or caused by a covered person residing in a. abovewhile traveling on business or be a Personal and Advertising Injury offense that occurs throughthe internet or other electronic means of communication.andLegal action brought in a. above or settlement agreed to by the insurance company.Rev. 03/1043

Learning Objective: Define the terms: “coverage territory,” "bodily injury," and"property damage."Covered TerritoryClick on a number see a Covered Territory example.1. The first part of the definition lists specificgeographic locations:The United States of America, (including its territoriesand possessions), Puerto Rico and Canada.2 The "coverage territory" also includes internationalwaters or airspace during the course oftransportation, provided there is no transportationbetween points outside the listed geographiclocations in part a. of the definition.3. All parts of the world are considered as being in the "covered territory" if both ofthe following apply:a)The injury arises out of either of:Goods or products made or sold by theinsured in the territory described in thefirst part of this definition.ORBusiness activities of persons whosehome is located in the geographiclocation listed in part a. of the definition,but are away from home or a short timeon the insured's business.ANDb)The second condition that must be met is that the insured's responsibilitymust be determined in a "suit" filed and decided in thegeographic location listed in part a. of the definition or determined ina settlement the insurance company agrees to.Rev. 03/1044

Knowledge CheckYour client manufactures machinery in the USA and sold a machine to a company inMexico. The machine injured a worker at the Mexican factory. Choose the statementthat best describes how your client's Commercial General Liability (CGL)Coverage Form will respond.A. There is no coverage provided by the CGL Policy under any circumstances forthis loss.B. The CGL Policy extends worldwide coverage for products made or sold in theUSA, its territories and possessions, Puerto Rico, and Canada if theresponsibility for damages is determined by a suit in the previously describedterritory.The correct answer is B. The CGL Policy extends worldwide coverage for productsmade or sold in the USA, its territories and possessions, Puerto Rico, and Canada ifthe responsibility for damages is determined by a suit in the previously describedterritory.Learning Objective: Define the terms: “coverage territory,” "bodily injury," and"property damage."Bodily InjuryBodily injury means physical harm to the body,sickness, or disease, including resulting death. The intentof the CGL Policy is that "bodily injury" is defined assome type of physical manifestation that must besustained by an injured person. However, "bodily injury"has been expanded by case law in some states toinclude things such as mental anguish, emotional trauma,loss of companionship, and other claims where there isno actual physical harm to the body tissue.Rev. 03/1045

Learning Objective: Define the terms: “coverage territory,” "bodily injury," and"property damage."Property DamageThis definition includes damage to tangible property as well as the loss of use of thatdamaged property. It also includes the loss of use to tangible property that does notsuffer actual damage.Example While digging, an insured accidentally cuts anelectrical cable. The cost to repair and/or replace thedamaged cable is covered as damage to tangibleproperty. The power company loses income becauseit could not sell electricity while the cable is beingrepaired and/or replaced. This loss of income iscovered as loss of use of that damaged property.Business owners in the area suffered loss of income because they were withoutpower. Although their property did not suffer direct tangible loss, the loss ofincome because they were without electricity is an example of loss of use oftangible property that does not suffer actual damage.EmployeeThe CGL Policy does not actually define employee. The definition only tells us thatemployee does include "leased worker" (one leased by a labor leasing firm), but doesnot include "temporary worker" (a substitute for a permanent employee).Rev. 03/1046

Learning Objective: Give examples of the Personal and Advertising Injury perils.False arrest, detention, or imprisonment: Example: Wrongfully detaining a suspected shoplifterMalicious prosecution Example: Filing charges and making false statements against someone withoutcause and with maliceWrongful eviction from, wrongful entry into, or invasion of the right of privateoccupancy of a room, dwelling or premises that a person occupies by or onbehalf of its owner, landlord, or lessor. Example: A landlord wrongfully evicts a tenant in order to lease out the premisesat a higher rental rateOral or written publication of material that violates a person's right of privacy. Example: Releasing privileged and/or protected personal information such as aSocial Security number or medical condition.Oral or written publication of material that slanders or libels a person ororganization or disparages their goods, products, or services. Slander is spoken;libel is printed. Example: Making false statements about the quality of a competitor'sworkmanship to improve your chances of getting a production contract.The use of another's idea in your advertisement. Example: An individual opens a fast-food establishment, using the same buildingplans, color schemes, uniform design, menu offerings and layout of anestablished fast-food chain. Although the new establishment uses a differentname and logo, they used the ideas of the established chain.Infringing upon another's copyright, trade dress, or slogan in your"advertisement". Example: Using gold colored, arched Ms to advertise McCales Burgers andFries.Please refer to the end of Lesson 2 Topic B to complete Self Quiz 3.Rev. 03/1047

Lesson 2 Topic C - Who is Insured?The CGL Policy provides coverage for a number of different people and/or entities. Inthis section of the policy, you will learn whom the CGL Policy protects (covers) in theevent of a lawsuit or claim. Remember that these are the people and entities that theCGL Policy will defend if a claim occurs.In this topic, we cover the four major categories of insureds:1. Named insured2. Others with respect to business operations3. Newly acquired or formed entities4. TrustsPlease refer to the section Who is an Insured that begins on page 9 of the CGL.Note:Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.Named InsuredsThe CGL Policy gives coverage to the Named Insured shown in the Declarations. TheNamed Insured is defined as "you" or "your." Named Insureds have the broadestcoverage of any insured under the policy.Examples of Named Insureds include: Individuals Partnerships or Joint Ventures Organizations Limited Liability Company (LLC) TrustsRev. 03/1048

Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.The following named insureds provide automatic coverage for those who are "downline."IndividualsMany businesses consist of one person who owns theoperation. When these businesses are notincorporated, they are known as sole proprietorships.You will often see them named on an insurance policythis way: Margie Marvelous d/b/a Margie's InsuranceTraining Service. The d/b/a merely tell us what Margiedoes.The Named Insured is considered to be an individual. When the Named Insured is anindividual, both the Named Insured and a spouse (if one exists) are consideredinsureds, but only with respect to the conduct of a business which is solely owned bythe Named Insured.Rev. 03/1049

Knowledge CheckYes or No: Is the spouse of a sole proprietor considered an automatic insured withrespect to the conduct of the business insured by the CGL?The correct answer, “Yes.”Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.Partnerships or Joint VenturesA partnership is an agreement between two or moreindividuals to combine capital, labor, skill, and effort, inwhole or part, for the operation of a business. A partnershipis designed to continue for the life of the partners. A rule ofgeneral partnership law is that partners share profits andare responsible to pay losses. Partners are individuallyliable for debts, including those arising from liability lossesof the partnership.A joint venture operates like a partnership, with the exception that it has a limitedpurpose and operates for a limited time. Parties of a joint venture are commonlyreferred to as members. One example of a joint venture is building a strip shoppingcenter, with the intent of selling it at a specified time.When a partnership or joint venture is the Named Insured in the Declarations, then theindividual partners or members are automatically considered insureds. Spouses of eachpartner or member are also automatic insureds with respect to the conduct of thatpartnership or joint venture.Knowledge CheckYes or No: Is the spouse of a partner or member in a joint venture considered anautomatic insured under the CGL with respect to the conduct of that partnership or jointventure?The correct answer, “Yes.”Rev. 03/1050

Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.Organizations (corporations, municipalities, etc.)When the Named Insured is a business organization,other than a partnership, joint venture, or LLC; it iscategorized under Other Organizations. Examplesinclude corporations, associations, and municipalities.When the business falls into this category, the followingare automatic insureds under the CGL Policy: Executive officers and directors, but only with respect to their duties as officers ordirectors of the named business. Stockholders, but only with respect to their liability as stockholders.Knowledge CheckYes or No: Is the spouse of a corporate officer or executive director considered anautomatic insured with respect to the conduct of that corporation?The correct answer, “No.”Knowledge CheckYour insured is Green Grow, Inc. Which statement best describes "Who is anInsured" under Green Grow's unendorsed Commercial General Liability CoverageForm?A. Green Grow Inc., its executive officers, its directors, its stockholders and itsemployees.B. Green Grow Inc., its executive officers and their family members, its directors, itsstockholders and its employees.C. Green Grow Inc., its executive officers, its directors, its stockholders, employeesand an existing company in which Green Grow, Inc. has 25% ownership.D. Green Grow Inc. and its employees only.The correct answer is A, “Green Grow Inc., its executive officers, its directors, itsstockholders and its employees.”Rev. 03/1051

Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.Limited Liability Company (LLC)A Limited Liability Company is a type of business ownership that combines theattributes of a partnership and a corporation. Members and managers control itsoperation. Like a partnership, the members and managers share in the profits and aretaxed as individuals. Like a corporation, the members and managers are not at risk forcorporate debt, including liability losses of the company. Even though members andmanagers cannot be held individually liable for liability losses suffered by the LLC, theycan be named individually as a defendant in any law suit seeking such damages.When the Limited Liability Company is the Named Insured in the Declarations, themembers and managers are automatically considered insureds. Automatic coverage formembers and managers applies to their duties as a manager and their liability as amember.There is no automatic coverage for spouses of members or managers of a LimitedLiability Company.TrustsIn a Trust, you are an insured. Your trustees are also insureds, but only with respect totheir duties as trustees.Other Insureds with Respect to Business OperationsIn addition to the Named Insured, other people or entities are considered to be insuredsunder the CGL Policy. Each of the following five groups is also an insured under thepolicy. These five groups include:1. Employees2. Volunteer Workers3. Real Estate Managers4. Temporary Custodian of a Deceased Individual'sBusiness5. Legal RepresentativeRev. 03/1052

Knowledge CheckYes or No: Are spouses of members or managers of a Limited Liability Companyconsidered automatic insureds with respect to the conduct of the LLC?The correct answer, “No.”Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.1. EmployeesEmployees of the Named Insured are insureds while working for the NamedInsured, but only for acts related to the conduct of the Named Insured's business.For example, if a passer-by is injured at the insured's construction site, he or shecould sue the Named Insured and the individual employee who caused the injury.The CGL Policy will provide coverage for the employee in this situation.There are certain times when an employee will not be considered an insured forbodily injury, personal injury, or property damage. Coverage is not provided foran employee who causes: Bodily or personal injury to the Named Insured, partners, members of alimited liability company, or co-employees while doing their job. Property damage to property owned, occupied, or used by the NamedInsured, any employees, or any partner or member. Property damage to property rented to, in the care, custody or control of,or over which the Named Insured, its employees, any partner, or anymember are exercising physical control for any purpose.2. Volunteer WorkerVolunteer worker means a person who is not your employee, and who donateshis or her work and acts at the direction of and within the scope of dutiesdetermined by you, and is not paid a fee, salary or other compensation by you oranyone else for their work performed for you.Rev. 03/1053

Learning Objective: Determine who is an "insured" under the provisions of theCGL Policy for specific situations.3. Real Estate ManagersPersons (other than employees) or organizations such as a managementcompany acting as a real estate manager for the Named Insured are consideredinsureds under the CGL Policy.4. Temporary Custodians of a Deceased Individual’s BusinessWhen the person who serves as sole proprietor dies, so does the business. TheCGL Policy allows for a temporary custodian of the deceased’s property to betreated as an insured.5. Legal RepresentativeOnce a legal administrator or executor is appointed, then they become a NamedInsured with respect to the rights and duties of the CGL Policy.It is advisable to inform the company underwriter if an individual dies and that a temporarycustodian or permanent administer/executor is responsible for running the business. The CGLPolicy will only provide liability coverage to the legal representative for acts that arise out ofthe administration of the deceased's business.Tip:Newly Acquired or Formed OrganizationsIf the Nam

The Commercial General Liability (CGL) Policy forms a foundation for most business liability coverage. It is designed to provide liability coverage for a variety of business liability exposures. The policy we will discuss in this lesson is the Insurance Service Office (ISO) Commercial General Liability Coverage Form (CG 00 01). Because of its .