Transcription

Initial Margin for Non-CentrallyCleared OTC DerivativesOverview, Modelling and CalibrationJune 2016Dominic O'KaneAffiliate Professor of Finance, EDHEC Business SchoolInstitute

Table of AcronymsAcronym MeaningBCBSBasel Committee on Banking SupervisionBISBank for International SettlementsCCPCentral CounterpartiesCFTCCommodity Futures Trading CommissionDTCCDepository Trust CompanyDV01Dollar Change for a 1bp increase in interest ratesEBAEuropean Banking AuthorityEIOPAEuropean Insurance and Occupational Pensions AuthorityEMIREuropean Market Infrastructure RegulationESMAEuropean Securities and Markets AuthorityFCFinancial CounterpartiesFRTBFundamental Review of the Trading BookGFCGlobal Financial Crisis of 2007-2009IMInitial MarginISDAInternational Swaps and Derivatives AssociationIOSCOInternational Organization of Securities CommissionsMPRMargin Period of RiskNFCNon-Financial CounterpartiesOTCOver the counterRTSRegulatory Technical StandardsVMVariation MarginWGMRWorking Group on Margin RequirementsI would like to thank Jon Gregory, George Handjinicolauou, Lionel Martellini and David Murphy for their comments.Dominic O'Kane benefited from the support of the French Banking Federation (FBF) Chair on Banking regulation andinnovation under the aegis of the Louis Bachelier laboratory in collaboration with the Fondation Institut Europlace deFinance (IEF) and EDHEC.2The work presented herein is a detailed summary of academic research conducted by EDHEC-Risk Institute. The opinionsexpressed are those of the authors. EDHEC-Risk Institute declines all reponsibility for any errors or omissions.

About the AuthorDominic O'Kane is a specialist in credit modelling,derivative pricing and risk-management. Hespent over 12 years working in the financeindustry first at Salomon Brothers and thenLehman Brothers. When he left in 2006 he washead of quantitative research and led the teamof over 20 Ph.D. researchers. He has taught atthe London Business School and the Universityof Oxford. He wrote Modelling Single-Nameand Multi-name Credit Derivatives (publishedin 2008 by Wiley Finance) and has contributedto several major industry texts includingthe Handbook of Fixed Income Securities.He also publishes in international financejournals. He has a doctorate in theoretical physicsfrom the University of Oxford.3

Table of ContentsExecutive Summary. 51. Introduction . 82. The Non-Cleared OTC Derivatives Market . 123. Margin and Counterparty Risk. 154. The Regulatory Framework. 255. Regulations for Calculating Initial Margin. 316. Calibration of Asset Classes. 477. The ISDA Standard Initial Margin Model (SIMM). 568. Discussion . 61References. 63EDHEC-Risk Institute Position Papers and Publications (2009-2012). 644

Executive SummaryThis report provides a detailed overviewand analysis of the forthcoming newframework to be used by large financialinstitutions to determine initial margin (IM)and variation margin (VM) payments whentrading non-cleared over-the-counter(OTC) derivatives. Coming into effect inSeptember 2016, this new framework isbased on the recommendations of theBCBS/IOSCO Working Group on MarginRequirements (WGMR)1 which has been setout in [BIS2015].This framework has been in developmentsince it was first proposed following thePittsburgh G20 meeting in 2009. It was aresponse to the events of September 2008which saw the bankruptcy of LehmanBrothers, the bailout of AIG and the federaltakeover of Fannie Mae and Freddie Mac,all of whom had large exposures to theOTC derivatives market. In the US, theframework has been implemented by theCommodities Futures Trading Commission(CFTC) within the framework of the DoddFrank Act Title VII. In Europe the rules willbe implemented within the new EMIRdirective of the EU.Since Pittsburgh, new regulations haveaccelerated the separation of the OTCderivatives market into a cleared and noncleared market, with the former focusingon the standard' OTC derivatives. As of theend of 2013, the size of the non-clearedsegment of the interest rate derivativesmarket alone was approximately 123- 141trillion.2 The new margining regulationsfor the non-cleared OTC derivatives are themain subject of this report. Their purposeis to reduce systemic risk across financialmarkets. In this report we have providedan overview of these new regulations andsummarise our observations as follows:1. The significant growth in the use ofcentral clearing via CCPs has reducedthe non-cleared market to less standard,more exotic products or products inilliquid currencies. It also means that pricediscovery is not centralised and tradevaluation is model-based. A framework forVM and IM needs to take these factors intoaccount.2. The role of ISDA3 in creating a standardframework, the ISDA Master Agreement,for trading OTC derivatives, plus inclusionof the close-out netting mechanics, hasbeen key in reducing and simplifyingcounterparty risk.3. The new framework will enforce theuniversal use of variation margin (VM).Although VM has been fairly widely used,especially following the Global FinancialCrisis (GFC) of 2007-2009, its use has notbeen universal. This regulation will mainlyimpact smaller counterparties as most largecounterparties already post VM.4. The use of collateral for VM is one-way(towards the in-the-money counterparty).Both cash and non-cash collateral canbe used, although cash is preferred as itis faster to move. VM collateral can bereused, rehypothecated and does not needto be segregated. This means that therequirement to post VM collateral does notreduce overall market liquidity.5. Initial Margin (IM) is intended to protectthe non-defaulting party to a non-centrallycleared OTC trade from a loss incurredwhen replacing the trades due to marketmovements after the other party defaults,including bid-offer increases. The newframework mandates the use of IM for allnon-cleared OTC derivatives. Although theconcept of IM under the name independentamount' (IA) had existed previously underISDA, its usage was not widespread.6. IM requires a two-way posting ofcollateral, a change in rules since currentmarket practice has been for one-way(IA). In the event of default, the nondefaulting counterparty keeps enough of1 - The BCBS is the Basel Committee on Banking Supervision and IOSCO is the International Organization of Securities Commissions. The group responsible for the frameworkis the Working Group on Margin Requirements (WGMR).2 - See [ISDA(2014b)].3 - The International Swap and Derivatives Association (ISDA) is a trade association for OTC derivatives and their users.5

Executive Summarythe IM collateral posted by the defaultingcounterparty to cover any costs involved inreplacing its trades. This is the defaulterpays' principle. It means that the amountof collateral held will exceed the potentialloss to the financial system of a singlecounterparty default.7. IM margin collateral, which may be cashor non-cash, must be held in such a waythat it would provide the non-defaultingcounterparty immediate access. TheWGMR defines how this collateral is to besegregated and stipulate that it cannotbe rehypothecated or reused, except forstrictly defined hedging purposes.8. The first approach for calculating IM isthe standard schedule approach. This basedon a schedule of add-ons' - notionalweights linked to the type, and maturityof each asset. Based on historical prices,we find that the add-on weights areconsistent with a 10-day 99th percentileloss. However the approach is compromisedby its treatment of portfolio effects whichrely on the net-to-gross ratio (NGR). Weexamine the NGR and and conclude thatit does not capture diversification in thenetting set. Nor does this approach takeinto account the moneyness of options. Forthis reason we find the standard scheduleapproach significantly overestimates theIM amount, and is misaligned to the actualrisk. We cannot recommend it.9. The second WGMR approach tocalculating IM is based on the use of aninternal model where the IM should be the99th percentile of the 10-day potentialfuture exposure of the netting set.Although not a coherent risk measure, wedo not consider this to be a serious criticismprovided the risk-factors are Gaussian-like,which we show is the case for most of themarkets covered.10. The calibration period for the IM modelmust be 3 to 5 years (this may differbetween the EU and US regulations) and6must include a period of financial stress.We believe that this may pin the period toinclude the GFC of 2007-2009. This maynarrow the scope of calibration parametersand so remove issues of pro-cyclicality thata shorter and changing calibration periodcould create.11. The choice of a 99th percentileembeds an estimate about the size ofmarket movements expected following acounterparty default, and the probabilitythe IM will cover the realised loss. Wenote that determining the size of the IM isdifficult as there is very little empirical datafor such events. We describe the eventsfollowing the Lehman Brothers bankruptcyto give one example.12. We find that the WGMR modellingrequirement to split the netting set byprincipal asset type fails to recognise the factthat many OTC derivatives have exposuresto different risk types. Hence splitting byprincipal risk factor can penalise sensiblehedging. It could be avoided by calculatingthe portfolio-wide IM for each risk type andsumming the resulting risk type IMs.13. Two approaches to calculating the tailrisk are possible. One is to assume somejoint distribution whose 99th percentilecan be calculated analytically. This mayrestrict the choice of risk factor dynamics.A more commonly used approach is to useeither historical or Monte Carlo simulation.A delta-approach may be used to speed upthe calculation of IM. However given thehigh likelihood of non-linear products, adelta-gamma approach may be required.This may need to be checked on a case-bycase basis.14. The variety of products and pay-offs,the lack of a central price discovery venueand the need for valuation models meansthat disputes are likely. To minimise suchoccurrences we argue that as much of themodel as possible should be developed viaa shared industry-wide effort.

Executive Summary15. ISDA has developed a Standard InitialMargin Model (SIMM) that is very likelyto become the market standard. The ISDASIMM model is based on the SensitivityBased Approach which has been describedby the Bank for International Settlements(BIS), a fact which may assist its regulatoryapproval. It avoids a Monte Carlo framework,instead applying a set of asset specific riskweights and correlations.16. The WGMR does not permit the inclusionof the modelling of both netting set andcollateral in the IM calculation. In fact,EU regulations4 state that the value of thecollateral should not have any correlationwith the netting set of derivatives. We thinkthat this could restrict flexibility. It wouldperhaps make sense to incorporate collateralinto the IM model as it would permit anycorrelations (positive or negative) betweenthe two to be recognised.17. Differences in the implementationof the law between the US and Europeexist but do not appear to be so differentthat they would skew the playing field ineither direction. The main difference is theexclusion of non-financial entities fromthe list of covered entities, and options onsecurities from the covered products in theUS framework.18. We caveat this report with the commentthat some of these regulations may besubject to change and interpretation.Readers must not rely upon this report forregulatory guidance and must consult legaland regulatory professionals.4 - The EU Law Supplementing Regulation No. 648/2012 on OTC derivatives.7

1. Introduction8variation margin had been posted such thatreplacement costs were below the valueof margin that had been posted, resultingin no losses to market participants. Afourth reason was that the OTC derivativesmarket had begun in 2005 to reduce itsbacklog of unconfirmed CDS trades andto process them via the NY-based DTCCtrade repository, thereby creating a centralsource of market position information andeliminating a source of uncertainty.The global financial crisis of 2007-2009alerted political leaders to the risks posed bythe existence of the over-the-counter (OTC)derivatives market. This market connectsthe major dealer banks via hundreds ofthousands of individual contracts. Thescenario which political leaders feared wasone in which the default of a major dealercould, via this web of contracts, create acascade of defaults across the financialsystem. The events of September 2008created a severe test for the OTC derivativesmarket. First there was the federal takeoverof Fannie Mae and Freddie Mac on 7September, followed by the bankruptcy ofLehman Brothers on 15 September. Andone day later there was the bailout ofAIG and the federal takeover of FannieMae and Freddie Mac. All four of theseinstitutions had large exposures to the OTCderivatives market. For example, FannieMae and Freddie Mac had total derivativenotional positions of 1.2 trillion5 and 1.3 trillion6 respectively, AIG had soldprotection in Credit Default Swap form on 440bn of mortgage-backed securities, andLehman had derivative contracts with atotal notional of 35 trillion.Once the potential for systemic risk createdby the OTC derivatives market becameapparent to legislators, it was inevitablethat some form of regulation would ensue.This process began when the G20 Leadersmet one year later in Pittsburgh where theyagreed that:All standardised OTC derivative contractsshould be traded on exchanges or electronictrading platforms, where appropriate,and cleared through central counterparties by end-2012 at the latest. OTCderivative contracts should be reported totrade repositories. Non-centrally clearedcontracts should be subject to highercapital requirements.8Clearly Lehman presented the biggest risk.However, for a number of reasons, the cascade' scenario was not realised. Thesereasons included the fact that many ofLehman's counterparties were shielded fromLehman's default by the collateral thatLehman had posted within the frameworkof their ISDA7 Master Agreements. Second,the ISDA framework provides for the abilityto set-off exposures (discussed in detailbelow) and this reduces counterparty riskand simplifies the bankruptcy process. Athird mitigating factor was that some66,000 OTC contracts, with a total notionalexposure of 9 trillion, were interest rateswaps Lehman Brothers had cleared atLCH.Clearnet. For these, initial margin andSince then, regulators have imposed twogeneral requirements on OTC derivativesmarkets. The first has been to push asmuch of the OTC derivatives market ontocentral counterparties (CCPs) as possible.Using a CCP means that a trade initiallyconducted OTC between two marketparticipants is immediately split into twotrades, each facing the same CCP. The CCPthen manages payments between partiesand also performs netting of exposures.The intermediation of the CCP is intendedto create a more robust counterparty thana typical dealer as the CCP is required tobe well capitalised. It is also argued thatthe CCP should be able to benefit fromthe income and diversification effects of a5 - See rterly-annual-results/2008/form10k 022609.pdf6 - See http://www.freddiemac.com/investors/er/pdf/10k 031109.pdf7 - ISDA stands for the International Swap and Derivatives Association and is the trade body for users of OTC derivatives. It has been instrumental in creating the legalframework, known as the ISDA Master Agreement, to assist the trading of OTC derivatives.8 - rgh Declaration 0.pdf

1. Introductionlarge number of offsetting trades. The CCPis capitalised by its members and much ofthis capital is provided through the use ofinitial and variation margin. The secondrequirement pushed by regulators has beento require non-cleared OTC derivatives toalso post variation and initial margin.Over the past three years the BaselCommittee on Banking Supervision (BCBS)and the International Organization ofSecurities Commissions (IOSCO9) haveworked on developing a framework forthe margin requirements of non-centrallycleared derivatives through the WorkingGroup on Margin Requirements (WGMR).The purpose of this exercise has been toestablish minimum global standards thatlegislators can then translate into law.In the US, the rules on VM and IM fornon-cleared OTC derivatives fall under theDodd-Frank Act Title VII, and are to beestablished by the U.S. Commodity FuturesTrading Commission (CFTC). Indeed theyvery recently approved the final rules onmargin for uncleared swaps.10 In Europe,the rules governing non-cleared OTCderivatives fall under the framework of theEuropean Market Infrastructure Regulation(EMIR). These rules take the form ofRegulatory Technical Standards (RTS) andthe European Market regulator ESMA, theEuropean Banking Authority (EBA), and theinsurance company regulator EIOPA havebeen consulting on the latest version ofthese with the latest publication11 beingreleased in June 2015.As with CCPs, margin for non-cleared OTCderivatives will consist of initial margin (IM)and variation margin (VM). We notethat there is already an initial marginprovision built into the ISDA credit supportannnex (CSA) known as the independentamount or IA which has been in existencesince the 1980s. However, the failure ofLehman Brothers highlighted that oneproblem with this was that the collateralcould be rehypothecated and so was notsegregated from other assets. FollowingLehman's bankruptcy filing, those whohad overcollateralised their exposures atLehman then became general unsecuredcreditors and were not able to recover theirassets in full. The new regulations on IMcorrect for this shortcoming by imposingstringent limits on the segregation andrehypothecation of initial margin collateral.Unlike initial margin, variation margin hasbeen a risk-mitigation technique used by theOTC derivatives market since its inception.Through the work of ISDA, the market hasestablished common standards for legaldocumentation and dispute resolution inthe form of the ISDA Master Agreementand its various annexes. Of these, themost important is the aforementioned CSA,which determines the conditions underwhich initial and variation margin is postedbetween counterparties. It also specifiesthe close-out' procedures to be followedin the event of a counterparty default. Itis periodically updated so that some legacycontracts have been created under the 1992Master Agreement and others under theupdated 2002 Master Agreement. The ISDAMaster Agreement also establishes a legalframework for the set-off of derivativecontracts. This reduces the claim on thenon-defaulting counterparty to the netvalue of all derivative trades between eachpair of counterparties. From this we getthe concept of a netting set' of derivativecontracts.The purpose of variation margin (VM) is toensure that when a counterparty defaults,the in-the-money counterparty is holdingan amount of collateral sufficient to covertheir maximum loss assuming a recoveryrate of zero. Because of this, VM collateral9 - Based in Madrid, Spain, IOSCO is the international body for the world's securities regulators.10 - On December 16, 2015.11 - JC-CP-2015-002 JC CP on Risk Management Techniques for OTC derivatives .pdf9

1. Introductionposting is one-way, from the party that isout of the money to the party that is in themoney. The amount of VM is given by themarket value of the set of trades from theperspective of the in-the-money party. Thisis not always easy to determine and agreebetween counterparties as it will dependon factors such as whether OIS discountingis used, and the impact of CVA charges. Atany time only the in-the-money party to aset of trades will be holding any collateralfor those trades.Initial margin (IM) serves a differentpurpose. It is to protect the non-defaultingcounterparty against the risk that themutual contracts cannot be replaced attheir latest valuation amount after thedefault of the counterparty. The risk is thatthe value of the netting set of derivativeshas time to increase due to a delay.This delay can be due to a sudden lackof liquidity or other market disruption.Because this loss can impact the nondefaulting party whether they are in-themoney or out-of-the-money, initial margincollateral posting is two-way. Both partieswill therefore hold IM collateral.The WGMR has taken the view thatIM should follow a defaulter pays'principle. This means that any loss tothe non-defaulting counterparty shouldbe compensated by them keeping thecollateral they have received. At the sametime the defaulting party must return thecollateral they hold. If the replacementloss happens to the defaulted counterparty(which impacts the value of the bankruptcyestate) then both parties must receive backtheir deposited collateral. The loss incurredby the defaulting counterparty must beborne by the bankruptcy estate.The last sentence of the G20 Pittsburghstatement quoted above states that non10centrally cleared contracts should besubject to higher capital requirements,both higher than before and higher thanfor cleared swaps. Nevertheless, it shouldbe stated that the imposition of overly highcharges could damage the OTC derivativesmarket, which would not be desirable sinceOTC derivatives permit various parties tocreate, value and risk-manage certain risks.An exchange-based market, which mustfocus on maximising liquidity and hencestandardisation, cannot perform such afunction.The imposition of margin requirementson OTC derivatives presents a number ofdifficulties that do not exist in exchangetraded derivatives markets. First, there isthe very great variety in OTC derivativetrade types. Second, price discovery inthe OTC derivatives market does nothappen in one public venue. It happensin private, bilateral negotiations betweenparties. Third, product innovation in theOTC derivatives market is an ongoingprocess with new products becoming moreattractive and other products less so as themarket environment changes. Fourth andfinal, as there is no central third party likean exchange to perform the calculation ofvariation and initial margin, this task willhave to be performed by the counterpartiesthemselves. It is therefore important thatthe calculation methodology be reasonablysimple, transparent, easily implementableand truly reflective of the actual risk.Although we will discuss VM, our mainfocus in the rest of this report will beon the definition, mechanics, calibrationand calculation of IM. In Section 2 wecontinue with a brief survey of the OTCderivatives market. In Section 3 we discussthe mechanics of the ISDA close-out andexplain in detail the precise risks VMand IM are intended to neutralise. In

1. IntroductionSection 4 we discuss the new regulatoryframework. Section 5 focuses on the twomain approaches to determining the initialmargin amount. Section 6 presents somecalibration results for an initial marginmodel which follows the prescription setout by the WGMR. In Section 7 we presentan overview of the ISDA SIMM approach.In Section 8 we discuss our observations.11

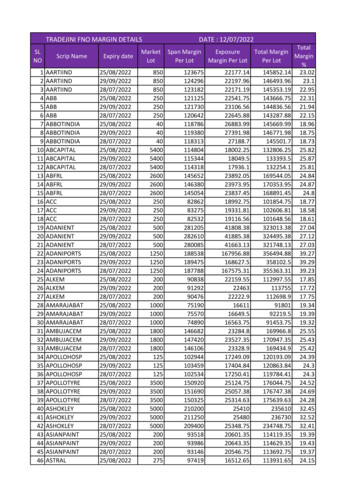

2. The Non-Cleared OTC Derivatives MarketOver-the-counter (OTC) derivatives aretrades that are executed bilaterallybetween two parties rather than with acentral exchange. Most trades are executedbetween dealers. A smaller percentage oftrades are executed between dealers andnon-dealers (also known as end-users'or customers'). Most trading in the OTCmarket is via telephone with an increasingamount via electronic platforms. In manycases brokers will intermediate betweendealers.Over recent years, the OTC derivativesmarket has split into two different sections.These are cleared and non-cleared OTCderivatives. Both are discussed below, anda more detailed description of the evolvingstructure of the market may be found in[Murphy (2013)]. However our focus in thisreport is on non-cleared OTC derivatives.We first consider the size and structureof the entire OTC derivatives market usingdata gathered by the Bank for InternationalSettlements shown in Table 1. It shows thechanging total notional outstanding ofOTC derivative contracts every two yearsfrom 2008 to 2014 broken down by assetclass. The numbers combine cleared andnon-cleared contracts. It is clear thatthe OTC market is extremely large witha gross notional outstanding of 630trillion in December 2014. As a reference,note that this is about ten times theamount of open interest on internationalderivative exchanges which in mid-2013was estimated to be 62 trillion.12Another important metric that indicatesthe size of the OTC derivatives market is thegross market value. This is the sum of theabsolute value of every position across alltrades without any netting. In the secondhalf of 2014, the gross notional value wasequal to 20.9 trillion.13 This is 3.2% of thegross market notional. Furthermore, as it1212131415-http://www.bis.org/publ/qtrpdf/r qt1312h.pdfSee http://www.bis.org/publ/otc /otc-interest-rate-derivatives/volumesThe CME Group has stated that it intends to add USD swaptions to central clearing.ignores netting, it is an upper bound on thesize of counterparty exposure across theOTC derivatives market. In addition, as ameasure of counterparty default exposure,it is also an over-estimate as it does nottake into account the collateral that hasbeen exchanged between counterparties.Over the past few years, the OTC derivativesmarket has been transformed by the rapidincrease in usage of CCPs, mainly due toregulatory pressure from US and Europeanlawmakers. Using a CCP means that a tradeinitially transacted between two dealersis immediately split so that both partiesface a CCP. The payments between thecounterparties are then cleared' via theCCP. To be cleared, a derivative must behighly liquid and conform to a marketwide standard. Examples include interestrate swaps in the major currencies. A listof products mandated for clearing at LCH.Clearnet is given in Table 2. Currently LCH.Clearnet clears over 50% of the globalinterest rate swap market14 and over90% of all cleared interest rate swaps. Asimplified schematic is shown in Figure 1.The dominating asset class in the OTCmarket is the interest rate market with atotal gross notional of 505 trillion. Table1 presents a breakdown of this marketby product. In 2014, around 79% of themarket was made up by interest rate swapsand these are mostly cleared. Interest rateoptions, consisting of caps and floors andswaptions, make up around 43 trillionand are not generally cleared.15 In termsof size, the next asset class is the FXmarket of which about 10.6 trillion areoptions which are not centrally cleared.The credit derivative market comes next.In this market the CDS indices are clearedbut only a limited fraction of 25.7 trillionin single-name CDS are cleared. The equityoptions market then makes up 4.8 trillion

2. The Non-Cleared OTC Derivatives MarketTable 1: Gross notional outstanding of OTC derivatives by risk category and instrument in bn at the end of 2008, 2010, 2012 and 2014.For each asset class of derivatives, a breakdown is provided of the main product types. Source: Bank for International Settlements (BIS).Dec 2008Dec 2010Dec 2012Dec 2014Total contracts598,147601,046635,685630,150Foreign exchange contracts50,04257,79667,35875,879Outright forwards and fx swaps24,49428,43331,71837,076Currency ,22014,600Interest rate contracts432,657465,260492,605505,454Forward rate agreements41,56151,58771,96080,836Interest rate 9548,35143,591Equity-linked contracts6,4715,6356,2517,941Forwards and 46Commodity contracts4,4272,9222,5871,868395397486300Other commodities4,0322,5252,1011,568Forwards and Credit default swaps41,88329,89825,06816,399Single-name instruments25,74018,14514,3099,041Multi-name instruments16,14311,75310,7607,358of which index allocatedTable 2: The list of standard fixed for floating interest rate products mandated for central clearing at LCH Clearnet.CurrencyIndexTermEUREuribor28 days to 50 yearsJPYLIBORUp to 40 yearsGBPLIBORBetween 28 days and 50 yearsUSDLIBORUp to 50 yearsFigure 1: A trade executed in the OTC derivatives market may be cleared bilaterally, in which case margining will begoverned by the new regulations on VM and IM based on the WGMR rules. A cleared OTC derivative will face a CCP forwhich initial and variation margin will be determined by the CCP's rules.13

2. The Non-Cleared OTC Der

institutions to determine initial margin (IM) and variation margin (VM) payments when trading non-cleared over-the-counter (OTC) derivatives. Coming into effect in September 2016, this new framework is based on the recommendations of the BCBS/IOSCO Working Group on Margin Requirements (WGMR) 1 which has been set out in [BIS2015].