Transcription

DEED IN LIEU OFFORECLOSURETRANSACTIONSFrank OliverOliver & Oliver, P.C.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions1

RESUME OF FRANK OLIVEROliver & Oliver, P.C.100 Congress Avenue, Suite 2100Austin, Texas 78701(512) 370-4050Fax (512) 370-4051foliver@oliverlawoffice.comFrank Oliver practices law in Austin, Texas, with the firm of Oliver & Oliver, P.C. He isa 1972 graduate of the University of Texas and a 1975 honors graduate of the University ofTexas Law School where he was an editor of the Texas Law Review. Following a federalappellate judicial clerkship, he has engaged in the private practice of law, principally in the areaof real estate litigation and transactions. He has represented title insurance companies, agents,and insureds in the defense of title claims for almost thirty years. He is the author of Garrett andMcDaniel, DTPA Liability for Issuance of a Title Insurance Commitment, published in 26 TexasTech Law Review 857 (1995) and previous TLTA Institute papers. He is an Associate Memberof the Texas Land Title Association and has served as a member of the Defense CounselCommittee and the Legal Issues Committee. He is a Life Fellow of the Texas Bar Foundation.He is listed in Best Lawyers in America and is a Texas Monthly Super Lawyer in Real Estate.

Deed in Lieu of ForeclosureApplicable Case Law Property Code § 51.006 Drafting Considerations Title Insurance Issues Tax Considerations 2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions2

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)Facts: Owner granted deed of trust lien to Lender No vendor’s lien Owner later deeded 1/2 minerals to thirdparty Owner then deeded property and allminerals to Lender in lieu of foreclosure2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions3

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)The Texas Supreme Court held that thedeed in lieu of foreclosure did notextinguish the intervening legal estate inthe 1/2 of the mineral estate created bythe prior conveyance to the third party.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions4

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)The Texas Supreme Court observed:“There is no such deed as a deed in lieu offoreclosure. A deed given in satisfaction ofa debt may serve as a convenient, efficienttransfer of title upon default of a debt.”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions5

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)“ It would be unfair to allow parties to makeprivate conveyances, although judiciallyefficient, to the detriment of unknowingparties by foreclosing their right to bid at atrustee’s sale; to redeem their interests; toinsist on marshalling of assets; or to setforth the affirmative defense of merger orextinguishment of the debt.”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions6

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)The Texas Supreme Court distinguishedprior cases holding that a voluntaryreconveyance operates as a foreclosure forthe mortgage holder and for both juniorcreditors and intervening purchasers.E.g., Jones v. Ford, 583 S.W.2d 821 (Tex.Civ. App. -- El Paso 1979, writ ref’d n.r.e.)2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions7

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)“ . . . [Here the Lender] held a deed of trustmortgage, not a vendor’s lien mortgage. . . .A deed conveying land but coupled with alien for the unpaid purchase money equatesto an executory contract that will ripen into atitle in the purchaser when the obligation topay the purchase money is met.”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions8

Flag-Redfern Oil Co. v. Humble ExplorationCo., Inc., 744 S.W.2d 6 (Tex. 1988)“ Default can lead to rescission of thecontract. This can be accomplished throughforeclosure, or privately when the vendeeexecutes a deed reconveying the property.But this is not the case here. [The Lender]held only a mortgage.”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions9

Martin v. Uvalde Savings and Loan Assn., 773S.W.2d 808 (Tex. App. -- San Antonio 1989)Facts: Owners granted deed of trust lien to Lender Following default, owners unilaterallyexecuted deed in lieu of foreclosure toLender with deed stating conveyance was insatisfaction of debt Lender then foreclosed and brought suit tocollect deficiency2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions10

Martin v. Uvalde Savings and Loan Assn., 773S.W.2d 808 (Tex. App. -- San Antonio 1989)The Court of Appeals held that effectivedelivery of a deed requires acceptance ofthe deed by the grantee, either expressly orimpliedly (such as by recording of the deedby the grantee).The unilateral deed from the owner/borrowerwas ineffective.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions11

Morrison v. Christie, 2008 WL 3877199 (Tex.App. -- Fort Worth 2008)Facts: After default Owner gave Lender deed in lieu offoreclosure with an agreement that net salesproceeds received by Lender upon resale would beapplied to debt Lender then sued for deficiency following sale Owner then asserted that deed in lieu of foreclosurewas actually intended as a mortgage requiringformal exercise of power of sale and application ofProperty Code § 51.0032008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions12

Morrison v. Christie, 2008 WL 3877199 (Tex.App. -- Fort Worth 2008)The Court of Appeals stated:“[W]e have found no law, and the[Borrowers] have not pointed us to any, thatholds that parties cannot agree to partialsatisfaction of a debt by conveyance ofproperty.”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions13

Morrison v. Christie, 2008 WL 3877199 (Tex.App. -- Fort Worth 2008)In response to the borrowers’ argument thatthe credit was required to be the fair marketvalue of the property, the Court of Appealsfurther stated:“We have found no law that would prohibitparties from agreeing to the method ofpayment reflected on the deed-in-lieu. . . .”2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions14

Morrison v. Christie, 2008 WL 3877199 (Tex.App. -- Fort Worth 2008)In response to the borrowers’ argument thatthe credit was required to be the fair marketvalue of the property, the Court of Appealsfurther held that Property Code § 51.003,providing a right to a credit for the fullmarket value of the property did not apply.In effect allowing the parties to override thestatute by contract in a deed-in-lieutransaction.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions15

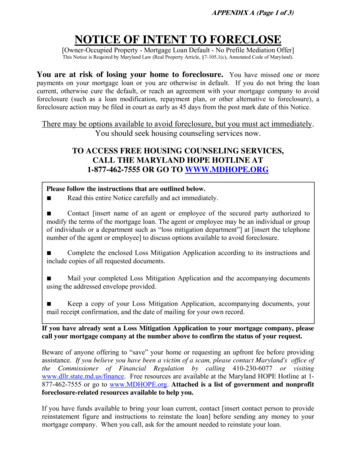

Texas Property Code § 51.006Applies to holder of a debt under a deed oftrust who accepts from the debtor a deed ofthe real property subject to the deed of trustin satisfaction of the debt.Allows the debt holder to void the deed inlieu of foreclosure until the fourthanniversary of the deed in lieu offoreclosure.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions16

Texas Property Code § 51.006Requirements for Use of Statute:Debtor fails to disclose a lien orencumbrance on the property beforeexecuting the deed in lieu of foreclosure.Lender had no personal knowledge of theundisclosed lien or encumbrance.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions17

Texas Property Code § 51.006If Lender elects to void deed in lieu offoreclosure, the priority of the deed of trustis not affected or impaired.After accepting deed in lieu of foreclosure,Lender may still foreclose the deed of trustwithout voiding the deed in lieu offoreclosure.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions18

Texas Property Code § 51.006Joiner v. PACTIV Corp., 2005 WL 1907780 (Tex.App. -- Corpus Christi 2005, pet. denied).Facts: Owner grants deed of trust to Lender Third party records abstract of judgmentagainst Owner Owner executes deed in lieu to Lender Lender acknowledges payment in full andreleases lien No disclosure to Lender of abstract of judgment2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions19

Texas Property Code § 51.006Joiner v. PACTIV Corp., 2005 WL 1907780 (Tex.App. -- Corpus Christi 2005, pet. denied).The Court of Appeals held that Property Code §51.006 was inapplicable.Lender had “personal knowledge” of theabstract of judgment because of theconstructive notice that resulted from recordingof the abstract of judgment.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions20

Texas Property Code § 51.006Cameron Life Ins. Co. v. PACTIV Corp., 2007 WL2388906 (Tex. App. -- Corpus Christi 2007, pet.denied).The Court of Appeals reaffirmed it prior holdingin Joiner that Property Code § 51.006 wasinapplicable, because the Lender had “personalknowledge” of the abstract of judgmentbecause of the constructive notice that resultedfrom recording of the abstract of judgment.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions21

Texas Property Code § 51.006Cameron Life Ins. Co. v. PACTIV Corp., 2007 WL2388906 (Tex. App. -- Corpus Christi 2007, pet.denied).The Court of Appeals denied equitablesubrogation to the Lender’s successor, holdingthat the deed in lieu transaction destroyed theLender’s equitable subrogation rights.When it accepted the deed in lieu the Lender’sposition became inferior to the abstract ofjudgment.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions22

Drafting Considerations Express non-merger language in the deed inlieu of foreclosure.Specify if the debt is fully or only partiallydischarged.Expressly reserve the right to pursuedeficiency if debt is not completely forgiven.Avoid granting debtor any retained rights inproperty (such as repurchase option) thatwould give rise to equitable mortgage claim.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions23

Title Insurance ConsiderationsMortgagee Policy - Continuation of CoverageThe coverage of this policy shall continue in forceas of Date of Policy in favor of an Insured afteracquisition of the Title by an Insured . . , but only solong as the Insured retains an estate or interest inthe Land, . . . .Post-policy claims relating to the subsequent deedin lieu transaction may not be covered.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions24

Title Insurance ConsiderationsTransamerica Title Ins. Co. v. Alaska Fed. Sav. and LoanAssn., 833 F.2d 775 (9th Cir. 1987)The Court held that the title insurance company had noduty to defend the insured lender against the borrower’sclaim that the deed-in-lieu transaction created an equitablemortgage because the lender granted the borrower arepurchase option.The Court held that the actions of the lender in structuringthe transaction had “created” the alleged equitablemortgage and the claim was therefore excluded under thepolicy.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions25

Title Insurance ConsiderationsAs counsel for the lender, advise your clientof the limitations on the continuation ofcoverage under the existing mortgagee’spolicy and the benefits of obtaining a newowner’s policy in connection with the deedin-lieu transaction.2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions26

Tax ConsiderationsGross income includes “gains derived fromdealing in property.”26 U.S.C. § 61(a)(3).Gross income includes “income fromdischarge of indebtedness.”26 U.S.C. § 61(a)(12).2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions27

Tax ConsiderationsThe transfer of property by deed in lieu offoreclosure is treated as a “sale orexchange” for federal income tax purposes.Allen v. Commissioner, 856 F.2d 1169, 1172(8th Cir. 1988).2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions28

Tax ConsiderationsIRC Section 61(a)(3) applies to thetransaction if (1) the borrower is relieved ofhis obligation to pay the debt, and (2) theborrower is relieved of title to the property.Allen v. Commissioner, 856 F.2d 1169, 1172(8th Cir. 1988).2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions29

Tax ConsiderationsFor federal income tax purposes, theamount realized includes the amount ofliabilities from which the transferor isdischarged as a result of the transfer.Commissioner v. Tufts, 461 U.S. 300, 306(1983)26 U.S.C. § 1001(b)2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions30

Tax ConsiderationsFor non-recourse debt, the amount realizedincludes the entire amount of the mortgageon the property.Commissioner v. Tufts, 461 U.S. 300 (1983)Yarbro v. Commissioner, 737 F.2d 479 (5thCir. 1984)2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions31

Tax ConsiderationsFor non-recourse debt, the amount realizedincludes the entire amount of the mortgageon the property.Commissioner v. Tufts, 461 U.S. 300 (1983)Yarbro v. Commissioner, 737 F.2d 479 (5thCir. 1984)2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions32

Tax ConsiderationsBASIC DEBT FORGIVENESS TRANSACTIONPurchase PriceDebt BalanceAdjusted Tax BasisFair Market Value 2,000,000 1,900,000 1,200,000 1,500,000Taxable Gain 2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions700,00033

Tax ConsiderationsNO DEBT FORGIVENESS TRANSACTIONPurchase PriceDebt BalanceAdjusted Tax BasisFair Market Value 2,000,000 1,900,000 1,200,000 1,500,000Taxable Gain 2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions300,00034

Tax Considerations2925 Briarpark, Ltd. v. Commissioner163 F. 3d 313 (5th Cir. 1999)Debt ForgivenDebtorLenderThird Party PurchaserArranged sale to third party with simultaneousagreed debt forgiveness2008 Texas Land Title InstituteDeed in Lieu of Foreclosure Transactions35

Page 2 of 3V.T.C.A., Property Code § 51.006Page 1Effective:[See Text Amendments]Vernon's Texas Statutes and Codes Annotated CurrentnessProperty Code (Refs & Annos)Title 5. Exempt Property and LiensSubtitle B. LiensChapter 51. Provisions Generally Applicable to Liens§ 51.006. Deed-of-Trust Foreclosure After Deed in Lieu of Foreclosure(a) This section applies to a holder of a debt under a deed of trust who accepts from the debtor a deed conveyingreal property subject to the deed of trust in satisfaction of the debt.(b) The holder of a debt may void a deed conveying real property in satisfaction of the debt before the fourth anniversary of the date the deed is executed and foreclosed under the original deed of trust if:(1) the debtor fails to disclose to the holder of the debt a lien or other encumbrance on the property before executing the deed conveying the property to the holder of the debt in satisfaction of the debt; and(2) the holder of the debt has no personal knowledge of the undisclosed lien or encumbrance on the property.(c) A third party may conclusively rely upon the affidavit of the holder of a debt stating that the holder hasvoided the deed as provided in this section.(d) If the holder elects to void a deed in lieu of foreclosure as provided in this section, the priority of its deed oftrust shall not be affected or impaired by the execution of the deed in lieu of foreclosure.(e) If a holder accepts a deed in lieu of foreclosure, the holder may foreclose its deed of trust as provided in saiddeed of trust without electing to void the deed. The priority of such deed of trust shall not be affected or impaired by the deed in lieu of foreclosure.CREDIT(S)Added by Acts 1995, 74th Leg., ch. 1020, § 1, eff. Aug. 28, 1995.HISTORICAL AND STATUTORY NOTES2007 Main VolumeSection 2 of Acts 1995, 74th Leg., ch. 1020 provides: 2008 Thomson Reuters/West. No Claim to Orig. US Gov. px?rs WLW8.11&destination atp&prft H.11/17/2008

Page 3 of 3V.T.C.A., Property Code § 51.006Page 2“This Act applies only to a holder of a debt who accepts a deed conveying property in satisfaction of a debt onor after the effective date [Aug. 28, 1995] of this Act.”LIBRARY REFERENCES2007 Main VolumeMortgages335.Westlaw Topic No. 266.C.J.S. Mortgages §§ 506 to 512, 579, 602, 604.RESEARCH REFERENCES2008 Electronic UpdateEncyclopediasTX Jur. 3d Deeds of Trust & Mortgages § 242, Deed of Trust Foreclosure After Deed in Lieu of Foreclosure.Forms14 West's Texas Forms § 10.114, Deed of Trust Foreclosure After Acceptance of Deed in Lieu of Foreclosure.Treatises and Practice AidsBaggett, 15 Tex. Prac. Series § 2.33, Section 51.006 of Property Code: Deed-Of-Trust Foreclosure After Deed inLieu of Foreclosure.Baggett, 15 Tex. Prac. Series § 2.35, Unilateral Reconveyance of Property by Mortgagor to Mortgagee Does NotRelease Secured Debt and Deed of Trust.Baggett, 15 Tex. Prac. Series § 17.16, Deed in Lieu of Foreclosure.Cochran, 27 Tex. Prac. Series § 7.15, Challenges to Foreclosure.V. T. C. A., Property Code § 51.006, TX PROPERTY § 51.006Current through the end of the 2007 Regular Session of the 80th Legislature(c) 2008 Thomson Reuters/WestEND OF aspx?rs WLW8.11&destination atp&prft H.11/17/2008

DEED IN LIEU OF FORECLOSURE TRANSACTIONS Frank Oliver Oliver & Oliver, P.C. 2008 Texas Land Title Institute Deed in Lieu of Foreclosure Transactions 1. RESUME OF FRANK OLIVER Oliver & Oliver, P.C. 100 Congress Avenue, Suite 2100 Austin, Texas 78701 (512) 370-4050 Fax (512) 370-4051