Transcription

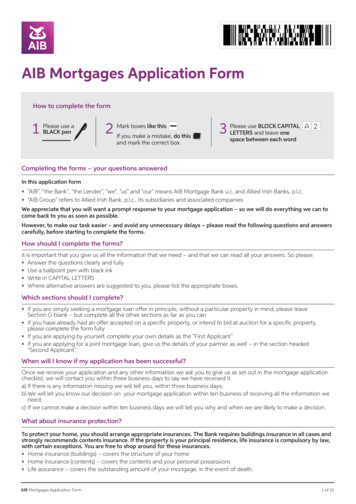

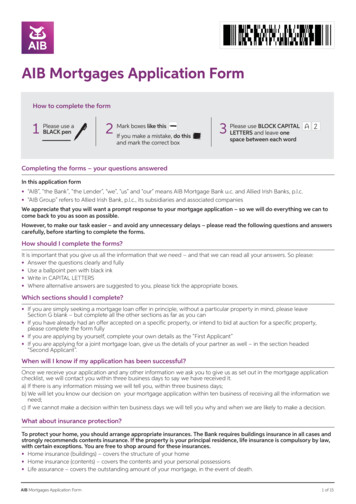

SHORT SALES,MORTGAGES AND DEEDSIN LIEU OF FORECLOSURE 2017 Seminar Material S0211.17New Jersey Institute forContinuing Legal EducationA Division of the State Bar AssociationNJICLE.com

cSHORT SALES, MORTGAGESAND DEEDS IN LIEU OFFORECLOSUREModerator/SpeakerRegina L. Gelzer, Esq.Regina L. Gelzer, Attorney-at-Law, LLC(Toms River)SpeakersCarl E. Guzman, CPAGreenback Capital Mortgage Corporation(Teaneck)Nicholas P. TimpanaroFortune Title Agency, Inc.(Roseland)S0211.17

2017 New Jersey State Bar Association. All rights reserved. Any copying of materialherein, in whole or in part, and by any means without written permission is prohibited.Requests for such permission should be sent to NJICLE, a Division of the New JerseyState Bar Association, New Jersey Law Center, One Constitution Square, NewBrunswick, New Jersey 08901-1520.

Table of ContentsPageShort Sales, Mortgages and Deeds in Lieu of Foreclosure1Mortgage Foreclosure and Deeds in Lieu of ForeclosurePowerPoint PresentationNicholas P. Timpanaro3Short SalesWhat You and Your Client Need to KnowPowerPoint PresentationRegina L. Gelzer, Esq.21Hope in the Aftermath for Distressed BorrowersPowerPoint PresentationCarl E. Guzman, CPA29About the Panelists 43

1

3Mortgage Foreclosure and Deedsin Lieu of ForeclosurePresented By:Nicholas P. Timpanaro, PresidentFortune Title Agency, Inc.

4Foreclosure vs. Deed in lieu Foreclosure– A judicial procedure when the mortgagor is indefault; an involuntary conveyance– 3 months to ? Deed in lieu– An optional procedure when the mortgagor is indefault, a voluntary conveyance– 60 days to ?

5Deed in Lieu Process Notice of IntentionTitle Search to determine creditorsFiling of Complaint (optional)Filing of Lis Pendens (optional)Evaluation of property valueIncentives to MortgagorRight of recession

6Mortgage Foreclosure Process Notice of IntentionTitle Search to determine creditorsFiling of ComplaintFiling of Lis PendensService on Creditors (Defendants)Affidavit of Amount DueFinal JudgmentWrit of ExecutionSheriff’s Sale

7Notice of Intention (NOI) Same Notice is filed for both Deed in Lieu and Foreclosure Sent to the borrower once the Mortgage is in default– Notice is sent by Regular and Certified Mail. Purpose of the notice is to provide the borrower with the followinginformation:– Inform the borrower of the intended action– The right to cure, including the sum of money needed to cure and when it isdue to avoid foreclosure proceedings.– The name and address and phone number of a person to contact.– The name and address of the lender and telephone number of arepresentative of the lender for the debtor to contact if they disagree with thelenders assertion. If the lender accepts a voluntary surrender of the property prior todefault the Notice of Intention does not need to be filed.

8Search of Property and Debtor Need to search the property and the debtor inthe County and State– Determine what liens or judgments are attached tothe property prior to accepting a Deed in Lieu or filinga Complaint for Foreclosure. Deed in Lieu– 60 Year Search required if insurance is requested Foreclosure– Present Owner Search sufficient– 60 Year search required if insurance is requested

9Complaints Optional for a Deed in Lieu Required for a Mortgage Foreclosure Content of Complaint– Explains why the lender is foreclosing the property.– States the Mortgage and Note terms and the default.– Sets up the ownership interest and any subsequentmortgages, judgments and liens.– Describes the property in question. Must be filed with the State– Docket No. is assigned to identify the filed action.

10Lis Pendens Optional for Deed in Lieu– Lis Pendens does not cutoff liens or judgments filed subsequentto the Lis Pendens. Required for Mortgage Foreclosure– Lis Pendens stops other judgment creditors from attaching a liento the property allowing the lender to continue to Sheriff’s Sale. Content of Lis Pendens– The Docket No. and the defendants are listed in the caption.– The Mortgage Book and Page and a legal description of theproperty are included in the body of the document. The filing of the Lis Pendens in the County Register/Clerk’sOffice gives Notice to the world that the action is takingplace.

11Evaluation of Property Deed in Lieu– Lender evaluates if the property is worth taking orif there are too many liens and judgments and aForeclosure is a better option.– If the property has no additional Liens orJudgments it is likely the lender would take a Deedin Lieu of Foreclosure. Mortgage Foreclosure Process– Proceeds regardless of the number of liens

12Incentives Deed in Lieu– Some lenders will make a monetary offer to thedebtor to entice them to give a Deed In Lieu ofForeclosure.– Since the cost of taking a Deed In Lieu is lessexpensive that proceeding to a Foreclosure Actionthe incentive has become an acceptable practice.

13Right of Recession The Fair Foreclosure Act states the following:– “If the lender receives a Deed in Lieu of Foreclosure, theconveyance shall be effective only if the Deed clearly andconspicuously provides: that the debtor may, withoutpenalty , rescind the conveyance within seven days,excluding Saturdays, Sundays and legal holidays; and thatsuch recession is effective upon delivery of a writtennotice to the lender or its agent or upon mailing of suchnotice to the lender or its agent by certified or registeredmail, return receipt requested.” Underwriters are rejecting deeds without this clause.

14Mortgage Foreclosure Service on Creditors (Defendants)Affidavit of Amount DueFinal JudgmentWrit of ExecutionSheriff’s Sale

15Other Optional Foreclosures Property Abandoned Property with no equity Strict Foreclosure

16Abandoned Property Under the Fair Foreclosure Act if the propertyis abandoned you can apply to the courts for aorder fixing the amount, time and place forredemption. An Affidavit or certification of knowledge theproperty is abandoned is filed with the courtsand an application is filed with court and theoffice or Court can set a time place andamount for redemption.

17Property With No Equity Shall be deemed to have no equity if the totalunpaid balance of ALL liens against theproperty is equal to or greater than 92 percentof the Fair Market Value. The value isdetermined by a Licensed appraiser. An amount, time and place of redemption willbe set by the courts

18Strict Foreclosure This action is used when there is anoutstanding lien or judgment not disclosed atthe time of the optional foreclosures, Deed inLieu, Abandoned Property and Property WithNo Equity.

19What To Look Out For Bankruptcy– Provides an automatic stay on the property and a order vacatingthe stay is required Estates– Make sure all heirs are included in the action Federal Liens– Any USA judgment or lien requires a Judicial Sale Taxes– Sometimes the Tax Liens can be worth more than the property Affordable Housing– There are restrictions in play if the property is subject toAffordable Housing.

21What you and your client need to knowRegina L. Gelzer, Esq.

22 Has no actual legal existence Product of negotiation between lender and seller Lenders will want 80% ‐ 85% of outstanding mortgage Some lenders will be more willing to bargain thanothers – commercial lenders will be more willing tonegotiate than governmental entities Driven by market conditions – a declining ordepressed market favors short sales Emphasize that this is a win‐win‐win situation – theseller unloads debt, buyer gets a bargain, lenderconverts a non‐performing loan

23 Process will take longer than a typical sale Sellers may need to make minor, essential repairs orbring cash to closing A poor financial picture works in the sellers’ favor –the worse the financial picture , the more likely to beapproved for a short sale A short sale may be consummated during thependency of a bankruptcy with Court approval Mortgage debt forgiveness ‐ enacted through the endof 2014, unknown going forward whether capital gainswill be taxable

24 Be prepared to wait Do not expect repairs or repair credits – this really willbe an “as is” sale! Check into the possibility of a 203Kloan, which will fund some repairs The lender will require its own appraisal The lender will have full control of the HUD No side deals or “seller’s concessions”

25 Check for an outstanding tax sale certificate If there is one, verify if there is a foreclosure actionpending If a foreclosure has begun, you will need Courtapproval for a short sale

26 Most lenders have short sale document packages online with all necessary formsBuyers will need to submit financial worksheets, IRS 4056Tforms, as well as hardship letters (handwritten is best!) andhardship affidavitsBank of America – all documents must be submittedthrough the Equator portal. Attorneys will need to createan account as an agentReal estate agents should be aware that commissions maybe cutSellers’ attorneys – this will require a great deal of work onyour part, so make sure to value your services accordingly

27802 Main StreetUnit 2AToms River, NJ 08753(732) 608‐0560gelzerlaw2@live.com

29Hope in the aftermath fordistressed borrowersCarl E. Guzman, CPACopyright 2014 Carl Edward Guzman All rights reserved. No part of this manual may be reproduced ortransmitted in any form or by any means, electronic or mechanical, including photocopying, recording or byany information storage and retrieval system without written permission from the publisher. This book maynot be reproduced in any form without the written consent of the Author

30What happened?The number of homeowners in mortgage distress situations has dwindled over thelast couple of years, but recent numbers show that millions of residential propertiesare still underwater. These homeowners need help and need the advice fromprofessionals to avail them of their options. It's important to make sure that theclients are steered in the right direction. You don’t want a client doing a short salewhen in fact they may be able to do a short refinance, Harp refinance, rent theirexisting home to cover their mortgage and rent for less elsewhere, OR maybe, afterall the time that’s passed, the property is worth more and they can refinance or sell atfull price.In the last several years we had borrowers doing loan modifications. The practicalimplementation of the home affordable modification program was a failure. Thefailure was due to a lack of federal enforcement. The strong support for modificationshas come from state and federal legislation who have come to issue a ruling that thosewho offer trial modifications must offer a permanent ones. We also had borrowersdoing Short refinances, filing Bankruptcy, Short sales, Deed in lieu of foreclosure, andproperties going into Foreclosure. All of these affect individual credit, equity, and networth and consequently the ability to borrow.

31Time HealsAs time has past, several important factors have changed opening uppossibilities that did not exist before.1.There has been significant property appreciation in the past fewyears so many owners can sell their homes at a greater price, orrefinance because of the higher value, and possibly qualify for areverse mortgage which requires substantial equity in a property.2. Those who had damage to their credit scores are now reachingseasoning periods ( a period of waiting time after occurrence) wheretheir credit has improved so that the combination of a better scoreand having the years pass after the event open up the possibility ofrefinancing or buying again.

32Segmented Borrower Challenges Millennials – Newbies looking to buy their first home. Need to build credit.Need to have a job. Need to compensate for lack of credit and savings.May look to co‐signers. Baby boomers – May have equity erosion, loss of job, loss of savings,weakened cash flow, credit damage from the past, parental supportobligations. Seniors – same as above with more potential medical problems as well asemployability issues.Assessing short term and long term needs is paramount in devising a strategy

33Agency waiting period Chart (Fannie and Freddie)

34How much time for forgivenessCaveat – waiting periods are taken into consideration along withcurrent history. Just because you met the waiting period does notmean its ok to be currently late on mortgage payments. For Fannie Mae products, if you have foreclosed on a loan, thewaiting period is 7 years from the completion date and 3 yearsfor extenuating circumstances (90% LTV). For a short sale or deed‐in‐lieu the waiting period is 4 years andfor Chapter 7 bankruptcy the waiting requirement is 4 yearsfrom the discharge or dismissal date and 2 years for extenuatingcircumstances. For Chapter 13 bankruptcy, there is a 2‐year waiting period fromthe discharge date, a 4‐year waiting period from the dismissaldate and a 2‐year waiting period for extenuating circumstances.

35How much time for forgiveness With Freddie Mac and LP Super Conforming loanproducts, the waiting period after a foreclosure is 7years from the completion date, and for a short saleor deed‐in‐lieu the waiting period is 2‐4 years. If you have filed for Chapter 7 bankruptcy, thewaiting period is 4 years from the discharge ordismissal date and if you have filed for Chapter 13bankruptcy the waiting period is 2 years from thedischarge date and 4 years from the dismissal date.

36How much time for forgivenessFHA loans are the most forgiving when it comes toderogatory credit events. The waiting period after aforeclosure is 3 years and for a short sale or deed‐in‐lieu the waiting period can be anywhere from 0‐3 yearsfrom the completion date. If you have filed for Chapter7 bankruptcy, the waiting period is 2 years and if youhave filed for Chapter 13 bankruptcy, one year of theprepayment period has to lapse in order to qualify.

37How much time for forgivenessFor VA loan products, the waiting period after a foreclosure,short sale or deed‐in‐lieu and Chapter 7 bankruptcy is 2 years fora loan less than 417,000 and 7 years for a loan greater than 417,000. If you have filed for Chapter 13 bankruptcy, thewaiting period is 7 years for a loan amount greater than 417,000, but it's mandatory to finish making all payments priorto qualifying.Finally for USDA loans, the waiting period after aforeclosure, short sale or deed‐in‐lieu and Chapter 7bankruptcy is 3 years and one year of repayment has tooccur for Chapter 13 bankruptcy.

38Mortgage Products & Options Standard mortgage products currently available –Fannie, Freddie, High bal jumbo, super jumbo, fha,FHA 203k, FHA “back to work,” Fannie home style,VA (100% cash out), USDA, HARP and alternativeproducts for self employed e.g. Asset depletion,pledged asset, reverse. Stated is gone unless non‐owner occupied. Non Qualified mortgage product or portfolio ‐whichMay be the direction to go for those who cannotwait it out.

39Strategies Fitting in “the box” is always going to give a borrower the best mortgagerate and choice. Therefore, those who had foreclosure, or gave their deed up etc. Willhave to wait and rebuild their financial weaknesses to get the bestopportunity for the “best rate.” The best rate, for anyone who has evertaken a mortgage, in and of itself, is not the be all or end all. Theopportunity has to factor into the decision. For example, and I’m notsuggesting this as an alternative, but hard money loans exist because theborrowers care more about the financial opportunity that exists than theydo the cost of the borrowed money. They want speed to close and theyare willing to pay for it. My point is, there is a pot for every cover, and the most importantimportant thing to do is know your reality and work with that reality tomake the best financial and/or financing decision.

40What can non prime borrowers do?1.2.3.Work on improving their credit scores while waiting it out if time is not of theessence. My suggestion is never wait to improve your credit to get the bestrate during a transaction. If the credit score is not high enough to qualify,then work on it to a point where you can get approved. If you score is goodenough to apply, move the process along and improve the score afterward.Look for programs that will increase equity such as a FHA 203 K. If theproperty is underwater, upgrading may build increased equity and allow arefinancing of the existing mortgage.Explore what would be known as Non‐qualified mortgages which areessentially, out of the box loans that can get a borrower where they need togo. Current segments of the market are not being served by the Agency andGovernment Programs. There are qualified, credit worthy borrowers whohave faced unique circumstances that have limited them from mortgagechoices that can meet their home financing needs. Known as a “fresh Start “program. Some programs offer:

41What can non prime borrowers do? Contin . No seasoning or mortgage pay history required for borrowers who haveexperienced a bankruptcy, foreclosure, deed‐in‐lieu of foreclosure, orshort sale Bank statement option for self‐employed borrowers FICO minimum 580 DTI up to 50% LTVs up to 80% Manually underwritten All occupancy types Purchase, Rate/Term, & Cash‐Out Refinance Loan Amounts 150,000 to 1,000,000

42What can non prime borrowers do?4. If Equity exists, but there is a shortage of liquidity and earnings, explorethe benefits of a reverse mortgage as a cash flow tool.5. Add a co signer/borrower6. Lease with an option to buy7. Take seller financing8. Utilize asset depletion programs and secured lines against liquid assets ascompensating factors.There are still many great options available today, and as the market changesmore and more programs are trickling in to accommodate those borrowerswho have past blemished histories and those short on liquidity currently havelow down payment purchase programs available.

43About the Panelists Regina L. Gelzer, Regina L. Gelzer, Attorney-at-Law, LLC, is a solo practitioner in Toms River,New Jersey. She has been practicing law in Ocean and Monmouth Counties since 1988,including several years as an Assistant Ocean County Prosecutor. Ms. Gelzer focuses herpractice in real estate, bankruptcy litigation, small business collections and distressed propertytransactions. She is one of the few New Jersey attorneys to successfully recover title in amortgage foreclosure rescue scam.President of the Ocean County Business Association, Ms. Gelzer has appeared on WABC-TV,CBS-TV, NPR’s Marketplace and Fox Network’s Mike and Juliet Show, and has consulted withthe FBI owing to her expertise in foreclosure rescue scams. She has served as SpecialCounsel to the Chapter 13 Bankruptcy Trustee and is Past Chair of the Affiliate Committee ofthe Ocean County Board of Realtors. She is a frequent lecturer for ICLE and other attorney andrealtor groups on distressed property transactions including short sales, foreclosures, deeds inlieu of foreclosure and bankruptcy.Ms. Gelzer is a cum laude graduate of the University of Pennsylvania and received her J.D.from American University, Washington College of Law.Carl E. Guzman, CPA is President and founder of Greenback Capital Mortgage Corporationand a Mortgage Broker/Banker in the firm’s Teaneck, New Jersey, office. A Certified PublicAccountant and New Jersey and New York State-Licensed Real Estate Broker specializing incomplex mortgage solutions, he has been assisting borrowers with financing needs for morethan two decades and has closed hundreds of millions of dollars in mortgage loans.Mr. Guzman has served as a board member of the New York Association of Mortgage Brokersand Chair of the Association’s Education Committee. He has been on the Board of Trustees ofthe Teaneck Economic Development Corporation and has served as its Treasurer. He hasserved as an arbitrator on large real estate cases for the American Arbitration Association.Mr. Guzman has developed, authored, and conducted mortgage seminars through numerousuniversities and educational providers, and has lectured on “The Pros and Cons of ReverseMortgages” for ICLE. He is frequently published and quoted in the news media and hasappeared on TV and radio.Mr. Guzman received his undergraduate degree from Queens College, City University of NewYork.Nicholas P. Timpanaro is the founder and President of Fortune Title Agency, Inc. in Roseland,New Jersey, and widely recognized as a “Foreclosure Specialist” in the State of New Jersey,having worked in the foreclosure industry for more than 25 years. He predominately deals withcomplicated title matters, speaks on the foreclosure industry and handles negotiations withunderwriters. In 2000 he opened Fortune Title Agency, Inc., where he expanded the businessto not only service mortgage foreclosures, but also tax sale foreclosures, REO Property Sales,purchases, refinances and settlement services. The company now handles more than 55% ofthe foreclosures in the State of New Jersey in addition to being a full-service title agency.

44Mr. Timpanaro is a member of the American, New Jersey and Pennsylvania Land TitleAssociations, and is Past President of Legal Vendors Network and Professional BusinessBuilders. He is a title expert as well and has been in the Title Industry for more than 35 years.Mr. Timpanaro’s career began in 1980 as a title searcher for Title Abstractor’s Co. and in 1990he was hired as Chief Title Examiner and Manager of the Foreclosure Department at FirstFinancial Title Insurance Company. He was then offered the position of President at CommerceTitle Agency, Inc., which he accepted in 1994 and proceeded to grow the company to producemore than 35% of all the foreclosures in the State of New Jersey.Mr. Timpanaro received his Producers License in Title Insurance from the Millburn School ofBusiness.

The Fair Foreclosure Act states the following: - "If the lender receives a Deed in Lieu of Foreclosure, the conveyance shall be effective only if the Deed clearly and conspicuously provides: that the debtor may, without penalty , rescind the conveyance within seven days,