Transcription

U.S. PUBLIC FINANCECREDIT OPINION1 September 2021Minot (City of) NDUpdate to credit analysisSummaryContactsMichael Armstrong 1.312.706.9975Associate Lead Analystmichael.armstrong@moodys.comRoger S Brown 1.214.979.6840VP-Senior Analyst/Managerroger.brown@moodys.comCLIENT SERVICESAmericas1-212-553-1653Asia 772-5454Minot (City of), ND's (Aa2) key credit characteristics include a large tax base anchored byMinot Air Force Base and Minot State University, healthy property wealth and residentincomes, strong finances, a moderate debt burden and manageable fixed costs. Additionally,sales tax revenue remained stable through 2020 and 2021 year to date revenue is outpacingthe previous year.Credit strengths» Stable tax base with institutional presence of the Minot Air Force Base» History of operating surpluses resulting in healthy reserves» Growing valuation trendsCredit challenges» Recent declines in state aid due to decreasing sales tax revenueRating outlookThe stable outlook reflects the expectation that finances will remain robust and stable.Additionally, the city's tax base will continue to be supported by the presence of Minot AirForce Base and Minot State University, both of which are major employers in the area.Factors that could lead to an upgrade» Continued diversification and expansion of the city's tax base» Substantial decrease in the city's debt burdenFactors that could lead to a downgrade» Significant erosion of the city's tax base, wealth and income levels» Material growth in debt and pension liabilities» Trend of declines in the city's reserves and liquidity

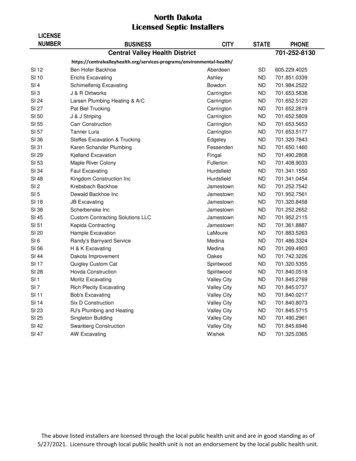

U.S. PUBLIC FINANCEMOODY'S INVESTORS SERVICEKey indicatorsExhibit 1Minot (City of) NDEconomy/Tax BaseTotal Full Value ( 000)PopulationFull Value Per CapitaMedian Family Income (% of US Median)FinancesOperating Revenue ( 000)Fund Balance ( 000)Cash Balance ( 000)Fund Balance as a % of RevenuesCash Balance as a % of RevenuesDebt/PensionsNet Direct Debt ( 000)3-Year Average of Moody's ANPL ( 000)Net Direct Debt / Full Value (%)Net Direct Debt / Operating Revenues (x)Moody's - ANPL (3-yr average) to Full Value (%)Moody's - ANPL (3-yr average) to Revenues (x)20162017201820192020 4,883,75847,338 103,168120.1% 4,852,64048,171 100,738119.5% 4,487,75848,304 92,907116.8% 4,348,48348,261 90,103113.6% 4,396,63748,261 91,101113.6% 38,203 31,207 29,09681.7%76.2% 38,612 31,232 29,60080.9%76.7% 43,027 36,298 35,79884.4%83.2% 57,158 47,671 48,10983.4%84.2% 76,661 102,367 99,858133.5%130.3% 73,874 107,4511.5%1.3x2.2%2.8x 66,593 113,8431.4%1.1x2.3%2.9x 62,009 109,1671.4%1.0x2.4%2.5x 57,918 107,9801.3%0.9x2.5%1.9x 64,086 116,5521.5%0.8x2.7%1.5xSources: US Census Bureau, Minot (City of) ND’s financial statements and Moody’s Investors ServiceProfileThe City of Minot is located in Ward County (A3) in north central North Dakota (Aa1 stable), approximately 100 miles north ofBismarck (Aa1), and encompasses an area of approximately 27 square miles. Population has grown considerably to nearly 50,000 sincethe 2010 census when it was just above 40,000. The largest industry sectors that drive the local economy are the military, energy andhealth services.Detailed credit considerationsEconomy and tax base: large tax base with institutional stabilityThe oil and gas sector is an important driver of the local economy, as employment in the sector is about 8x the national average inMinot’s home of Ward County. Despite this exposure, we expect the city’s large 4.4 billion tax base to remain healthy given theinstitutional stability provided by Minot Air Force Base and Minot State University. Minot Air Force Base, located 13 miles north ofthe city, employs 6,800 and is home to over 12,000 people. Minot Public School District 1 has an additional 1,000 employees. Finally,Minot State University, a member of the North Dakota University system, has an enrollment of over 3,500 and employs almost 500 inthe city.Development is still ongoing, with the consolidation and modernization of Trinity Health leading the way. The hospital is transitioningfrom several separate buildings to a single campus at an estimated construction cost of 350 million, a project that began in 2018 andis projected to be completed in 2022. Permit values have fluctuated year to year as a result of large projects in the city but signal thathealthy tax base growth will continue for the next several years. Activity through June 2021 has already greatly surpassed the previoustwo years combined.Despite the tax exempt status of large institutional employers, property wealth, measured by a full value per capita of just over 90,000, is solid but still slightly below similarly rated peers. Resident incomes are solid with median family income at 114% of theThis publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page onwww.moodys.com for the most updated credit rating action information and rating history.21 September 2021Minot (City of) ND: Update to credit analysis

U.S. PUBLIC FINANCEMOODY'S INVESTORS SERVICEnation. The county's June 2021 unemployment rate of 5.1% was lower than the nation (6.1%), in part because of the presence of severalstable institutions.Finances and liquidity: healthy and stable reservesThe city's financial profile is strong and will remain stable given conservative budgeting and maintenance of a five year capitalimprovement plan. The available operating fund balance (inclusive of general, debt service, sales tax and special revenue funds) atthe close of fiscal 2020 was 102 million, representing a robust 134% of operating revenue and officials have budgeted for balancedoperations in fiscals 2021 and 2022. The available operating fund balance increased significantly from 2019 to 2020 as a result of achange in classification of sales tax revenue funds that are no longer considered restricted.Sales taxes represent a significant revenue source for the city, and have stabilized in recent years following declines as the oil boom inNorth Dakota waned (see Exhibit 2). The city imposes a 2% sales tax on retail activity and the funds are dedicated for specific purposessuch as flood control, infrastructure and property tax relief. After declining to 20 million in 2017, sales tax revenue increased eachof the next two years to 22.2 million in fiscal 2019. Despite the economic slowdown in 2020, sales tax collections have remainedrelatively healthy at 20.7 million.Exhibit 2Sales tax collections declined in 2020 but remained solid with pledged revenues equal to 3.4x maximum annual debt serviceSales tax collections 30,000,000 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 : Minot (City of) ND’s financial statementsLiquidityThe city's liquidity is very strong. Across its operating funds, the city had a cash position of 100 million or 130% of operating revenueat the close of fiscal 2020.Debt and pensions: moderate debt and pension burdensThe city's net direct debt will remain moderate following planned issuances in September 2021. The city’s net direct debt will grow to 111 million after the sales, equal to 2.5% of full value and 1.5x operating revenue. Officials do not have additional borrowing plans asthe upcoming bonds will fund capital projects for the next two years. Fixed costs, comprised of debt service and pension and other postemployment benefit (OPEB) contributions, totaled 9.3 million in fiscal 2020, or a moderate 12% of operating revenue.Legal securityMost of the city's debt is payable from a general obligation unlimited tax (GOULT) pledge and the remainder is payable from a portionof sales tax collections. The city has 71 million in GOULT debt, although the ad valorem tax levy is only levied for 12.4 million ofthis debt and the remainder of debt service is paid from other sources. Water and sewer debt of 14.7 million is backed out of our netdebt figures for the city because the system is more essential and self supporting. Special assessment debt of 17.8 million and airportrevenue debt of 26.1 million are included in the city's net debt calculation, although the GOULT property tax is not levied for thesebecause dedicated revenue is sufficient to pay debt service.The city has 52 million in sales tax bonds (Aa3 stable) secured by a portion of sales tax collections. These bonds are secured by 50%of the city’s first penny sales tax revenue and 30% of the second penny sales tax revenue. The bonds benefit from a DSRF funded at31 September 2021Minot (City of) ND: Update to credit analysis

U.S. PUBLIC FINANCEMOODY'S INVESTORS SERVICEthe lesser of 10% of the principal amount of the bonds, maximum annual debt service or 125% of the average of annual debt service.Pledged revenue in fiscal 2020 provided a strong 3.4x coverage of maximum annual debt service (MADS).Debt structureAll of the city's debt is fixed rate and long term. The rate of GOULT principal repayment is moderate with 76% scheduled to be retiredwithin 10 years. Amortization of sales tax revenue debt is slow with only 23% of principal scheduled to be retired within 10 years,although all of the projects funded by sales tax revenue are large scale flood control projects with a long useful life that is in line withthe principal repayment schedule.Debt-related derivativesThe city is not party to any debt related derivative agreements.Pensions and OPEBThe city's pension burden and annual contributions are both moderate. The city operates a multiple employer cost sharing planwith Minot Park District (Aa2), although it was closed to new hires on January 1, 2014. Employees hired after that date participatein a defined contribution plan. The Moody's adjusted combined net pension liability (ANPL) for the city, under our methodology foradjusting reported pension data, was 146 million as of fiscal 2020. The ANPL over the past three years averaged 1.5x operatingrevenue and 2.7% of full valuation. The ANPL uses a market-based interest rate to value accrued pension liabilities. While contributionswill likely rise in the future given the trajectory of the plan, we do not foresee a material increase in contributions that would stress thecity's budget over the next several years.Contributions to city’s defined benefit plan amounted to 108% of the plan's ”tread water” indicator in 2020. Employer contributionsthat tread water equal the sum of current year service cost and interest on reported net pension liabilities at the start of the year, usingreported assumptions. If plan assumptions are met exactly, contributions equal to the tread water indicator will prevent the reportednet pension liabilities from growing.North Dakota statutes establish local government retirement contributions as a percent of covered compensation. The employercontribution rates are currently set a 7.12% of payroll for NDPERS. The city’s total fiscal 2020 pension contribution was 4.2 million, or5.5% of operating revenue.OPEB obligations do not represent a material credit risk for the city. The city does not offer explicit OPEB benefits, but allowed retiredemployees hired between December 31, 2018 and January 1, 2020 to stay on its healthcare plan, creating an implicit rate subsidy.Employees hired after January 1, 2020 participate in the North Dakota Retiree Health Insurance Credit Fund, a multiple employerdefined benefit OPEB plan. The city made a 136,000 prefunded contribution in fiscal 2020, equal to 0.2% of operating revenue. Thecity reported a net OPEB liability of 131,000 at the close of fiscal 2020.ESG considerationsEnvironmentalSimilar to the overall US local government sector, the City of Minot has low exposure to environmental risks. The city’s environmentalrisk exposure is based on Ward County, which is below average for the 3,142 municipalities tracked by Moody’s affiliate Four TwentySeven. Of the climate risks evaluated, heat and water stress and extreme rainfall present low risks to the county. Heat and water stresswill lead to energy and water demand shifts that will pressure infrastructure and have potential negative impacts on public health.Extreme rainfall measures the risk of increasing frequency and intensity of heavy rain events, which in turn lead to flooding.The risk of floods has been substantially mitigated by heavy investment since 2011. Following significant flooding in 2011, authoritiesat the federal, state and local levels engaged in a coordinated effort to relocate residents; move residential, commercial and industrialstructures out of flood zones; build concrete and earthen retention walls to protect against future flooding; improve flood diversionplans and avoid rebuilding in flood plains. As a result, the city has significantly reduced housing and population living in FEMAdesignated flood zones and therefore limited risk from extreme rainfall events.SocialSocial considerations that are material to the city's credit profile are discussed in the economy section above.41 September 2021Minot (City of) ND: Update to credit analysis

MOODY'S INVESTORS SERVICEU.S. PUBLIC FINANCEGovernanceNorth Dakota cities have an institutional framework score 1 of "Aa," which is strong. Property taxes, the cities major revenue source,tend to be relatively stable and predictable. Cities are subject to a cap of 105 mills, however have a strong ability to raise revenues ,as caps can be overridden at the local level with voter approval. Some cities with home rule charter status benefit from higher millageauthorization. Operating expenditures for cities tend to be moderately stable and predictable with minor fluctuations under 15%annually. Similar to revenues, though, cities ability to reduce expenditures is strong.51 September 2021Minot (City of) ND: Update to credit analysis

MOODY'S INVESTORS SERVICEU.S. PUBLIC FINANCERating methodology and scorecard factorsThe US Local Government General Obligation Debt methodology includes a scorecard, a tool providing a composite score of a localgovernment’s credit profile based on the weighted factors we consider most important, universal and measurable, as well as possiblenotching factors dependent on individual credit strengths and weaknesses. Its purpose is not to determine the final rating, but rather toprovide a standard platform from which to analyze and compare local government credits.Exhibit 3Minot (City of) NDRating FactorsEconomy/Tax Base (30%)[1]Tax Base Size: Full Value (in 000s)Full Value Per CapitaMedian Family Income (% of US Median)Finances (30%)Fund Balance as a % of Revenues5-Year Dollar Change in Fund Balance as % of RevenuesCash Balance as a % of Revenues5-Year Dollar Change in Cash Balance as % of RevenuesManagement (20%)Institutional FrameworkOperating History: 5-Year Average of Operating Revenues / Operating ExpendituresDebt and Pensions (20%)Net Direct Debt / Full Value (%)Net Direct Debt / Operating Revenues (x)3-Year Average of Moody's Adjusted Net Pension Liability / Full Value (%)3-Year Average of Moody's Adjusted Net Pension Liability / Operating Revenues (x)MeasureScore 4,467,699 aaAa1.0xAaBaa0.8%0.5x2.6%1.5xScorecard-Indicated OutcomeAssigned RatingAaAaAAAa2Aa2[1] Economy measures are based on data from the most recent year available.[2] Notching Factors are specifically defined in the US Local Government General Obligation Debt methodology.[3] Standardized adjustments are outlined in the GO Methodology Scorecard Inputs publication.Sources: US Census Bureau, Minot (City of) ND’s financial statements and Moody’s Investors ServiceEndnotes1 The institutional framework score assesses a municipality’s legal ability to match revenues with expenditures based on its constitutionally and legislativelyconferred powers and responsibilities. See US Local Government General Obligation Debt (July 2020) methodology report for more details.61 September 2021Minot (City of) ND: Update to credit analysis

MOODY'S INVESTORS SERVICEU.S. PUBLIC FINANCE 2021 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDITCOMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY,“PUBLICATIONS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUALFINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’SRATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’SCREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICEVOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOTSTATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK ANDRELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHEROPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHEROPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDITRATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR.MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDINGTHAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE,HOLDING, OR SALE.MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESSAND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENTDECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIEDOR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USEFOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTENCONSENT.MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM ISDEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as wellas other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information ituses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing its Publications.To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for anyindirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use anysuch information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses ordamages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of aparticular credit rating assigned by MOODY’S.To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatorylosses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for theavoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDITRATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (includingcorporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating,agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from 1,000 to approximately 5,000,000. MCO and Moody’sInvestors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regardingcertain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service and have also publiclyreported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading “Investor Relations — Corporate Governance —Director and Shareholder Affiliation Policy.”Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s InvestorsService Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intendedto be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, yourepresent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly orindirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as tothe creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’sOverseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a NationallyRecognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by anentity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registeredwith the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferredstock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and servicesrendered by it fees ranging from JPY125,000 to approximately JPY550,000,000.MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.REPORT NUMBER71 September 20211300442Minot (City of) ND: Update to credit analysis

U.S. PUBLIC FINANCEMOODY'S INVESTORS SERVICECLIENT SERVICES8Americas1-212-553-1653Asia 772-54541 September 2021Minot (City of) ND: Update to credit analysis

Water and sewer debt of 14.7 million is backed out of our net debt figures for the city because the system is more essential and self supporting. Special assessment debt of 17.8 million and airport revenue debt of 26.1 million are included in the city's net debt calculation, although the GOULT property tax is not levied for these

![Index [beckassets.blob.core.windows ]](/img/66/30639857-1119689333-14.jpg)