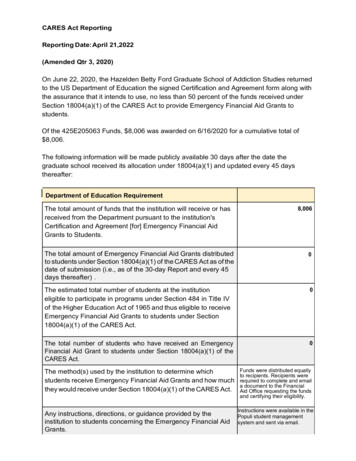

Transcription

CARES Act andHow it Affects your Student DebtPresented June 2020

President Lee Saunders3

LEE SAUNDERS, AFSCME PresidentHello, union family and welcome to this AFSCME student debt webinar. I want to take this chance to thank youfor the incredible work you're doing on the front lines of this public health crisis. When our communities needus most, that's when we bring our very best. Every time the nation confronts a challenge or crisis, AFSCMEmembers all across the country answer the call.During this time when you're working under greater pressure and with higher stakes than ever, the last thingyou need is anxiety about crushing student loan debt. This webinar is designed to give you some peace of mind– to ease your burden and give your family greater economic security during this difficult time.We’ll talk about different relief options that can help you reduce or even eliminate your debt. And we’lldiscuss new benefits you may qualify for under the CARES Act, a new coronavirus relief law passed in March.Thank you again for your service and sacrifice – especially now. We continue to fight every day to ensure thatpublic service workers get the respect they deserve – whether it’s on student debt, access to PPE, or aid tostate, cities and towns to maintain vital public services.Please visit our website at afscme.org for more resources and information on how to best do your jobs andprotect yourselves. Stay safe, and I hope you find this webinar helpful.

Welcome5

AgendaReview COVID-19 Relief Under the CARES ActUnderstand Student LoansExplore Other Federal Student Debt Relief Programs (IDR and PSLF)Examine Private Student Debt ReliefLearn How to Get Out of DefaultDiscover SUMMER – Student Debt Relief ToolAccess Student Debt and COVID-19 ResourcesQ&A with Student Debt Experts9

OUR PARTNERS10

AFSCME Code of ConductAFSCME is committed to providing an environment free from discrimination andharassment, regardless of an individual’s race, ethnicity, religion, color, sex, age,national origin, sexual orientation, disability, gender identity or expression,ancestry, pregnancy, or any other characteristic prohibited by law. As such, AFSCMEwill not tolerate discriminatory, harassing or otherwise unacceptable behavior atany of its activities, events or meetings, including virtual meetings. AFSCME expectseveryone who participates in any of its activities, events or meetings to abide bythis standard of conduct.There will be no retaliation or other adverse action taken against an individual whomakes a complaint. Complaints should be sent to the attention of Paula Caira,AFSCME Director of Human Resources at pcaira@afscme.org.

Student Loan Repayment During theCoronavirus PandemicPresented by the Student Borrower Protection CenterMay 2020

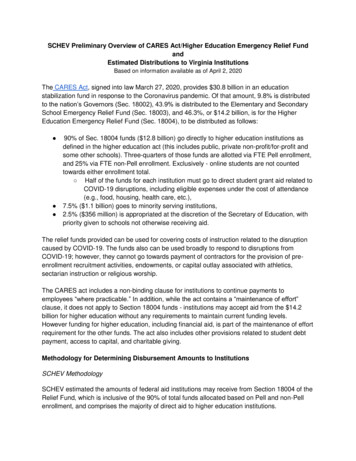

COVID-19 Relief Under the CARES ActCOVID-19 ReliefUnder the CARES Act17

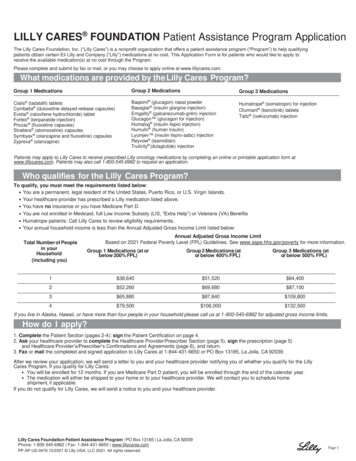

PROTECT B ORROWERS18New protections under the CARES ActThrough September 30, 2020: 0% interest Automatic payment suspension Qualified payments for PSLF and IDR forgiveness Suspension of all collection activity Wage garnishment Social Security benefits offset Tax refund offsetOnly for Covered Loans (DirectLoans & Some “FFELP” Loans)

PROTECT B ORROWERSWhat you need to know: Six tips if you’re covered by CARES1. Payment suspension and interest waiver are automatic2. Turn off autopay3. Check your credit4. Continue to enroll and recertify income-driven repayment plans5. Request a refund for payments auto-debited after March 13, 20206. Garnishment pause must be done via your employer, but *should be* automatic19

PROTECT B ORROWERS20Who is covered? Types of student loansCovered in CARES ActNot covered in CARES ActDirect LoansPerkins LoansFederal Family Education Loans(FFELP) owned by EDFederal Family Education Loans (FFELP)owned by private companiesPrivate Student Loans

Federal Loans vs. Private LoansFederal Loans vs.Private Loans21

PROTECT B ORROWERSHow to tell what type of federal student loan you haveStep 1: Log into studentaid.govStep 2: Under your student aid dashboard, navigate to“View Details”Step 3: On the top right, select “Download My AidData”22

PROTECT B ORROWERS23How to tell what type of federal student loan you haveDirect and ED-held FFELP Loans1. Determine FFEL or Direct2. Will state “Current EDServicer”123. Current Lender will be listed asU.S. Dept of Ed3

PROTECT B ORROWERS24How to tell what type of federal student loan you haveCommercially held FFELP Loans1. FFEL only2. Will state “Current GuarantyAgency”123. Current Lender will be a bankor other private company3

Options for Federal Student Loan BorrowersOptions for Federal StudentLoan BorrowersIncome Driven Repayment Plans&Public Service Loan Forgiveness25

PROTECT B ORROWERS26Multiple repayment optionsEXTENDED REPAYMENT PLANSTANDARD REPAYMENT PLANPay the same amount everymonth for 10 years (or longerwith Consolidation Loans)MonthlyPaymentAmountYearsYearsGRADUATED REPAYMENT PLANMonthlyPaymentAmountPayments start low andincrease every two years.Loans are paid off within 10years (or up to 30 years withConsolidation Loans)YearsPay the same amount everymonth for up to 25 years.Payments are lower thanstandard payments. Must owemore than 30,000.MonthlyPaymentAmountINCOME-DRIVEN REPAYMENT PLANMonthlyPaymentAmountMonthly payments are tied toyour income, not your loanbalance. Payments can be aslow as 0.

PROTECT B ORROWERSIncome-Driven Repayment (IDR) Plans IDR plans set monthly payments based on your discretionary income,rather than your outstanding loan balance. Unemployment or incomeshock could result in 0 payments. Remaining balance is forgiven after 20 or 25 years Remaining balance is forgiven after 10 years under PSLF. Types of IDR plans: Income-Contingent Repayment Plan (ICR)Income-Based Repayment Plan (IBR) Pay as you Earn (PAYE)Revised Pay as you Earn (REPAYE)27

PROTECT B ORROWERSPublic Service Loan Forgiveness – the basicsFour Requirements:1.Right type of loan – Direct Loans2.Right type of repayment plan – IDR or standard3.Right type of employment – work full-time in public service4.Right number of payments – 120 paymentsHow to check if you’re on track Submit an Employer Certification Form (ECF) FedLoan Servicing processes ECF forms for all borrowers and you *may*have your student loan company switch to FedLoan, but not alwaysBorrowers should submit an ECF annually and every time they changeemployers28

Options for Private Student Loan BorrowersOptions for Private StudentLoan Borrowers29

PROTECT B ORROWERS30Multistate agreement for relief (private and commercial FFEL) CA, CO, CT, DC, IL, MA, NJ, NY, VT, VA, WA\ 90 days of forbearance Waiving late payment fees No negative credit reporting Ceasing debt collection lawsuits for 90 days Aspire Resources, Inc. College Ave Earnest Operations Edfinancial Kentucky HESLC Lendkey Technologies, Inc. MOHELA Navient Nelnet SoFi Lending Corp. Tuition Options United Guaranty Services, Inc. Upstart Network, Inc. UHEAA VSAC

PROTECT B ORROWERSPrivate student loan payment relief Alternative repayment options Interest-only payments Economic hardship Often only temporary payment relief Confirm how your payments will be reported to credit bureaus Partial payment instructions If you’re denied an alternative repayment plan, ask why31

How do I get out of default on a federal or private student loan?How do I get out of default on afederal or private student loan?32

PROTECT B ORROWERS33What happens if your federal student loans default? Wage garnishment Social Security benefits offset Tax refunds offset Credit reportingBeginning October 1, 2020, borrowers in default will be subject to these collectionpractices

PROTECT B ORROWERS34Getting out of default on afederal student loan Consolidate “out of” default Must have eligible loanMust enroll in IDRCannot currently be in wage garnishment Rehabilitation 9 payments based on income/expensesAs low as 5 per monthGarnishment/offsets end after 5 paymentsFees (some can be waived)Source: Consumer Financial Protection Bureau (2016)

PROTECT B ORROWERSDefaulted private student loans Defaulted private student loan Negotiate with your collector Offer a monthly payment or lump sum amount Get the settlement in writing Confirm how it will be reported to credit bureausStatute of limitations on collections35

PROTECT B ORROWERS36How to get in touch with your student loan servicerServicerCall CenterEmailSocial oan.org@CornerStoneLoanFedLoan AAaidGranite AFGreat et@NelnetOSLA1-866-264-9762DLcustserv@osla.orgFB: 13-3797Live Chat@HeartlandHPY

Poll37

About SummerSummer’s mission is to improve borrowers’financial health by reducing their student debtburden.We simplify the student loan repaymentprocess and maximize savings for allborrowers.We’ve partnered with AFSCME to help youmanage your student debt today.38meetsummer.org/afscme

Advantages of CARES ActRemindersApplies student loan reliefretroactively from 3/13 to 9/30Coronavirus Aid, Relief, andInterest rates on eligible loans are setto 0% until 9/30Economic Security(CARES) Act is temporary federallegislation for economic relief but itdoes not cover every type ofstudent loan.Auto-debits should be suspended, andrecertification deadlines for incomedriven repayment (IDR) may beextended.If you’re already eligible, the monthsof March through September willcount toward Public Service LoanForgiveness (PSLF) and IDR even if youdon’t make paymentsThings to keep in mindAny payments you make for eligibleloans will go to outstanding interest first,and then to principal.Some FFEL, Perkins, Parent PLUS andPrivate loans are NOT covered andrequire actionSuspended payments should be reportedas on-time monthly payments for yourcredit score. but this has not alwaysbeen the case.39

Your loans and theCARES Actmeetsummer.org/afscme40

If you’re workingtoward Public ServiceLoan ForgivenessIf you qualify, you’re all set!Make sure your loans andrepayment plan qualifyYou don’t need to make paymentsuntil SeptemberContinue to submit employmentcertification formsmeetsummer.org/afscme41

If your income hasbeen reduced andyour loans qualifyYou don’t need to make paymentsPayments won’t be due andinterest won’t accrue on your loansYou can enroll in income-drivenrepayment to lock in a lowermonthly payment once paymentsresumemeetsummer.org/afscme42

If your incomehas been reducedand your loans don’tqualifyYou still have optionsRequest a forbearance or adeferment from your loan servicerYou can consolidate your loans(change the type) so they qualifyEnroll in income-driven repaymentto lock in a lower monthly paymentonce payments resumemeetsummer.org/afscme43

You can consolidate to qualifyIf you have ParentPLUS loans in yournameThey may qualify for CARES Actbenefits - some do and some don’tYou can consolidate them intoDirect loans so they’re eligible forIDR and PSLFThe monthly payment andforgiveness will depend on yourincome and employmentmeetsummer.org/afscme44

Is consolidating right for me?Consolidating your loans meanscombining them intoa new Direct Consolidation loan.Summer’s smart consolidationand IDR tool can do the hardwork for you.Advantages of consolidationNew loan will be eligible forCARES Act benefitsNew loans will be eligible for PSLFNew loan will be eligible for more IDRplans, and a potentially lower monthlypaymentThings to keep in mindOutstanding interest will capitalizeInterest rate will go up slightly(nearest eighth of a percent)If you’re working toward IDR forgiveness,you will lose payments you’ve madeCan take several months to processMultiple loans will be combinedinto one paymentmeetsummer.org/afscme45

Getting out of defaultIf your loansare in defaultIf you’re in the process of loanrehabilitation, these months will counttoward your payments.If you’re not, we’d recommendstarting the process of getting yourloans out of default.Once your loans are out of default,you can enroll in income-drivenrepayment for lower paymentsmeetsummer.org/afscme46

You have several optionsIf your income isstable and you wantto make paymentsYou can direct your savings to otherfinancial prioritiesYou can contact your loan servicerif you want to continue to makepaymentsYou can target payments towardloans with higher interest ratesmeetsummer.org/afscme47

Consider refinancingIf you have privatestudent loansInterest rates are at historic lows.You could lower your interest rateand your monthly paymentIf you’re already refinanced,you can also do it again for a lowerrateMany private lenders and stategovernments are also offering reliefon paymentsmeetsummer.org/afscme48

Getting startedis easy!meetsummer.org/afscme49

You’ll tell us somebasic informationmeetsummer.org/afscme50

And sync your loansall in one placemeetsummer.org/afscme51

Summer providespersonalized nextstepsmeetsummer.org/afscme52

Help with manyfederal and privateloan programsmeetsummer.org/afscme53

Easily compare youroptions beforemoving forwardmeetsummer.org/afscme54

Summer’s expertsreview eachapplicationmeetsummer.org/afscme55

AFSCME MEMBER RESOURCES

Thank youIf you have any other questions, please contact us at afscmestudentdebt@afscme.org

- to ease your burden a nd give your family greater economic security during this difficult time. We'll talk about different relief options that can help you reduce or even eliminate your debt. And we'll discuss new benefits you may qualify for under the CARES Act, a new coronavirus relief law passed in March.