Transcription

Public WorkshopJune 1, 2022FY 2022-23 Budget

Public WorkshopMichelle Aguirre, Chief Financial Officer&Kim Engelby, Budget & Finance Director2

Public WorkshopCounty Mission and Vision StatementsMission“Making Orange County a safe, healthy, and fulfilling place to live,work, and play, today and for generations to come, by providingoutstanding, cost-effective regional public services.”Vision Statement for Business ValuesVision Statement for Cultural ValuesWe strive to be a high-quality model governmental agency thatdelivers services to the community in ways that demonstrate:We commit to creating a positive, service-oriented culture which:Attracts and retains the best and the brightestExcellenceProvide responsive and timely servicesFosters a spirit of collaboration and partnership internally andexternallyLeadershipLeverage available resources as we partner with regionalbusinesses and other governmental agenciesSupports creativity, innovation, and responsivenessDemonstrates a “can-do” attitude in accomplishing timely resultsStewardshipSeek cost-effective and efficient methodsCreates a fun, fulfilling and rewarding working environmentInnovationUse leading-edge, innovative technologyModels the following core values in everything we do:Respect - Integrity - Caring - Trust - Excellence3

Public WorkshopStrategic Plan PrioritiesAdopted December 18, 2012 and Reaffirmed March 31, 2015 Stabilize the budget and prepare for contingencies Develop a competent and cost-effective technology model Succession plan and invest in workforce Simplify/increase flexibility of administrative policies andprocedures Address and fund agency infrastructure4

Public WorkshopStrategic Financial Plan (SFP) & BudgetDevelopment Process OverviewStrategic Financial Plan(August – December)Budget Reports(January &September)Expense & RevenueYear-End Forecasting(February & May)Budget(January – June))5

Public WorkshopSFP & Budget Development Process OverviewStrategicFinancialPlan5-YearForecastBase Budget &Augmentations CEO BudgetAssumptions Build Base Budget 5-Year DepartmentForecasts Identify Capital &IT Projects ( 150K) Strategic Priorities: Initiatives 1M in any oneyear of SFPBasis for next FYPlanningCollaboration &CEORecommendationsDepartmentRequests toCEOPublic BudgetHearing &AdoptionBudget HearingMarch & April Confirm BudgetRequest Aligned withSFP (Base Budget,Capital & IT Projects& Expands) Capital & IT ProjectRequests & ExpandAugmentationsConsistent with SFP CEO/Dept Meetings Augmentations: Analyze Revenue &Expense Forecasts& Trends/Resources Restore: BaseService Levels Expand: NewProgram, Unit,Project, or Increasein Current ServiceLevel ProgramRequirementsPrioritization County Department6 CEO Recommended Presentation byBudget Program Straw Votes (3/5) Non-Binding Base Budgets Augmentations: Restores Expands Changes to Clerk inWriting Prior to Closeof Budget HearingBudget Adoption

Public WorkshopSFP & BUDGET CALENDAR TIMELINE7

Public WorkshopBudget Development Process OverviewBudget Requirements: Counties are required to adopt a balanced budget The budget fiscal year begins on July 1 and ends June 30 Government Code Sections 29002 and 30200 require the StateController to prescribe uniform procedures Budget is presented by program and department Clearly defined expense and revenue categories Consistency and comparability8

Public WorkshopOverlapping Values Value of Financial Management Disciplined Approach to Fiscal Management Continue to Take Timely Action Value of Planning Long Term Forecast Capital Improvement & Information Technology Plans Strategic Priorities Value of Reserves Key Indicators of Financial Health and Resilience Provides Resources for Emergencies and/or Catastrophic Events Credit Rating Agencies Monitor the County’s Reserve balances Fitch: “Maintaining an operating reserve or rainy day fund is perhaps the most effectivepractice an issuer can use to enhance its credit rating.”9

Public WorkshopOverlapping Values (continued) Value of Policies Multi-Year Strategic Financial Plan Five-Year Capital Improvement Plan Five-Year Information Technology Plan Ten-Year Strategic Priorities Budget Development PoliciesReserve PoliciesInvestment PoliciesIT Governance PolicyPension Funding PolicyCredit and Debt Management PolicyPosition PolicyPolicies can be found on theCounty’s ncial-planValue of Committees Public Financing Advisory Committee Audit Oversight Committee Treasury Oversight Committee10

Public WorkshopCompeting Needs for General FundsSalaries & BenefitsMandated ServicesNon-MandatedServicesCapital ProjectsStrategic PrioritiesIT Projects11

Public WorkshopGeneral Purpose Revenues12

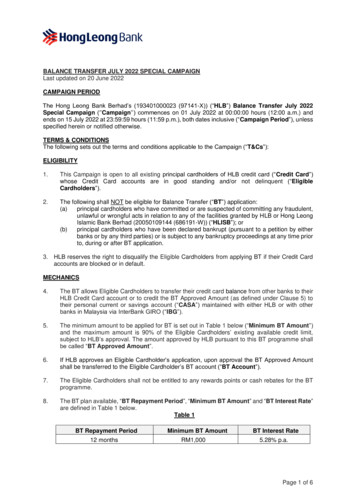

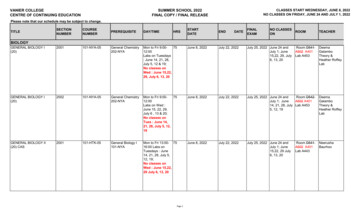

Public WorkshopCounty Appropriations & Positions by Program Amounts in millionsFY 2022-23 Recommended Budget Total 8.8 BillionNet County Cost (Discretionary)8,957 3,500.0Dedicated Revenue (Restricted) 3,000.0Positions 2,500.0 2,000.06,1771,266 1,500.0 1,000.01,4213570 500.00 0.0PublicProtectionDedicated Revenue(Restricted)Net County Cost(Discretionary)Total AppropriationsCommunityServicesInfrastruct &Env Res 1,241.5 3,191.4 1,636.4 616.9 318.4 196.4 619.6523.8171.836.6153.916.10.170.5 1,765.3 3,363.2 1,673.0 770.8 334.5 196.5 690.113GeneralGovtCapitalImproveDebtServiceIns, Res &Misc

Public WorkshopCounty Revenue BudgetFY 2022-23 Recommended Budget Total 8.8 BillionGeneral Purpose Revenue11.1%Dedicated Revenue45.6%(Restricted) 975.3M 4.0Be.g. JWA, OCWR, Road,Flood, Library, Parks, ISF,CFDs(Discretionary, includes fundingof County mandates) 3.8Be.g. State & Federal programs:SSA, HCA, CSS, Grants City ContractsOther General Fund43.3%(Specific purpose)14

Public WorkshopMajor Revenue Sources Property Tax – 922M Realignment – 764M 1991 Realignment – 207M 2011 Realignment – 550M Juvenile Justice Realignment – 7M Public Safety Sales Tax (Prop. 172) – 417M Mental Health Services Act (MHSA) – 269M15

Public WorkshopCounty Appropriations by Expenditure CategoryFY 2022-23 Recommended Budget Total 8.8 BillionIntangible Assets-Amortizable0.1%Other Financing Uses11.5%Structures &Improvements6.2%Special Items7.0%Contingencies1.0%Increases to Reserves0.3%Land1.1%Capital Assets1.6%Salaries &Benefits29.7%Other Charges16.6%Services & Supplies24.9%16

Public WorkshopAugmentations NCC Limits Restore Level of Service Established at the beginning of the SFP and budget process and set forongoing baseline operations (current levels of service)Requests for resources when the assigned NCC Limit is insufficient tomaintain current service levels. The NCC Limits plus restore level of servicerequests is the projected funding required to keep current operations andstaffing.Expand Level of Service Requests for resources above and beyond current funding and staffing levelswhich may involve new mandates related to existing services, increasingworkloads in existing programs or proposals for new services17

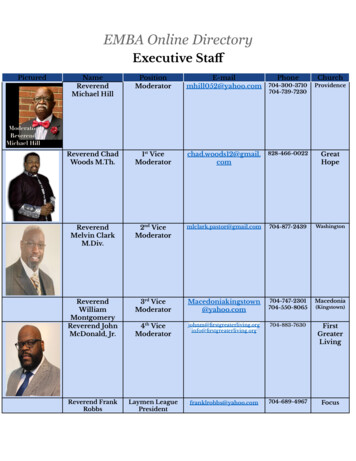

Public WorkshopRestore AugmentationsDepartmentDepartmentDistrict Attorney-Public AdministratorPos2RequestedNet County Cost 139,004CEO RecommendationOngoingNet County Cost 139,004One-Time [1]Net County Cost 0Total 0,00039,868,466Public Defender589,820,5336,020,5333,800,0009,820,533OC Public ,996,906County Counsel3776,920776,9200776,920Treasurer-Tax Collector61,121,5511,121,55101,121,551Internal Audit1115,714115,7140115,714219 54,062,682 34,262,682 19,800,000 54,062,682AssessorTotal – Restore[1] One-Time funds include OCERS Reserve ( 10M), Teeter ( 6M) and SB 90 Revenue ( 3.8M).18

Public WorkshopExpand AugmentationsDepartmentDepartmentPosCEO RecommendationRequestedNet County Cost00 1,197,675Public Defender152,992,1202,992,12002,992,120OC Community Resources121,283,405608,405675,0001,283,405Health Care Agency470000Social Services Agency100000OC Public Works230000John Wayne Airport30000OC Waste & Recycling30000Auditor-Controller70000County Executive Office20000County nternal Audit2252,828252,8280252,828157 6,954,102 4,907,028 1,522,062 6,429,09019 One-Time [1]Net County CostDistrict Attorney-Public AdministratorTotal – Expand OngoingNet County Cost 0

Public WorkshopCOVID-19 Overview Federal Emergency Management Agency (FEMA) funding forcertain COVID-19-related expenses, including most vaccinationrelated costs; County claimed 183M in eligible costs FEMA: Received to date: 88M Still outstanding: 95M Coronavirus Aid, Relief, and Economic Security (CARES) Actfunded a myriad of services to the community Epidemiology and Laboratory Capacity (ELC) funding fromCalifornia Department of Public Health to support COVID-19activities American Rescue Plan Act (ARPA) Additional ARPA/CARES Act information is available on the County’s ct-reports20

Public WorkshopAmerican Rescue Plan Act (ARPA) Overview American Rescue Plan Act signed into law on March 11, 2021 County of Orange scheduled to receive 616.8M in two tranches: First Tranche: 308.4M received May 21, 2021 Second Tranche: 308.4M not earlier than 12 months after First Tranche Funding eligibility period: March 3, 2021 through December 31, 2024 Obligated by December 31, 2024 Spent by December 31, 2026 Additional ARPA information is available on the County’s ct-reports21

Public WorkshopAmerican Rescue Plan Act (ARPA) – Continued Departmental COVID-19 Response Community COVID-19 Services: Meal Gap ProgramEconomic Support to Arts-Related Small Businesses and Non-ProfitsSupportive Services/Landlord Incentives – Emergency HousingVouchersBridge Digital DivideOC Hunger AllianceOC Human Relations CouncilTemporary Isolation Shelter Services Veterans Cemetery HCA Emergency Management Services and Public Health Lab22

Public WorkshopOC CARES (ARPA Funded) Be Well 2 Campus Juvenile Campus Coordinated Case Management/Homelessness HousingAdditional ARPA information isavailable on the County’s ct-reports23

Public WorkshopOC CARES Base Budget includes: Office of Care Coordination move to CEOCapital Projects & Initiatives funded byARPACoordinated Reentry Center ( 18M)System of Care Data Integration System( 2M)Augmentations: Recommendation to add 3 positions toexpand Behavioral Health Public SafetyResponse Team ( 1M)24

Public WorkshopHomelessnessThe County is working together with cities, non-profits, faith-basedorganizations and other community members to address the complexissue of homelessness Point-in-Time Homeless Population FY 2022-23 Recommended Budget includes: Be Well 2, South Campus ( 40M ARPA & 20M MHSA*)Coordinated Case Management/Homelessness ( 27M ARPA*)Permanent Supportive Housing and Outreach & Engagement ( 40M MHSA*)Operating Dedicated Shelters and Temporary Housing ( 42M VariousFunding)Implement Street Medicine Program ( 7M Cal Optima & 2.7M State)Additional information on available resources can be found on the County’s ctors-office/office-care-coordination*Mental Health Services Act25

Public WorkshopAffordable and Supportive Housing On June 12, 2018, the Board of Supervisors approved aPermanent Supportive Housing Plan with the goal ofdeveloping 2,700 supportive housing units over a six-yearperiod Since June 2018, a total of 680 affordable and supportivehousing units were completed/built As of May 2022, 816 units are under construction or closingon their construction loan and 772 units are in progress offunding A total of 2,268 units are in the current pipeline26

Public WorkshopAffordable and Supportive Housing (Continued) Since 2018, the County invested a total of 147M in variousongoing housing efforts Landlord incentives for 500 units and match commitmentsfor developing 200 units ( 27M ARPA) Develop Permanent Supportive Housing for individuals withemotional disturbance or mental illness and experiencinghomelessness ( 42M MHSA*)Note: Included in the MHSA* plan scheduled to be heard by the Board of Supervisors on 6/7/2022*Mental Health Services Act27

Public WorkshopState and Federal Earmarks FY 2022-23 Requests Submitted by the County: Behavioral Health Children’s and Families Campus ( 15M)Early Intervention for Custody Reduction Program ( 8M)Vocational and Mental Health Services Transition Center for At-RiskYouth ( 7.5M)Transitional Youth Housing Facility ( 5M)Orange County Intelligence Assessment Fusion Center ( 3.2M)FY 2021-22 Requests Received by the County: Coordinated Reentry Center ( 5M)Be Well 2 Campus ( 2M County 5M to Mind OC)System of Care Data Integration System ( 2M)28

Public WorkshopPublic Budget Hearing & Budget Adoption FY 2022-23 Public Budget Hearing: CEO presents the Recommended Budget by ProgramBoard of Supervisors cast non-binding straw votes to providedirection on base budgets and Restore and Expand augmentationsChanges to Clerk in Writing Prior to Close of Budget HearingFY 2022-23 Budget Adoption: Board of Supervisors adopt the budget on a simple majority voteAdopted budget reflects the Board of Supervisors approved Restoreand Expand augmentationsAdopted budget becomes the spending plan and spending limit forCounty departments29

Public WorkshopSFP & Budget Development Process OverviewJulyYear-EndClose30

Public WorkshopNext Steps FY 2022-23 Budget: Public Budget Hearings – June 14 & 15, 2022Final Budget Adoption – June 28, 2022Public Input Available during Board of Supervisors Meetings2022 Strategic Financial Plan: Kick-Off – August 2022Board Receive & File – December 20, 2022Public Input Available during Board of Supervisors Meetings31

Public Workshop32

Department Pos Department CEO Recommendation Requested Net County Cost Ongoing One-Time [1] . John Wayne Airport 3 0 0 0 0 OC Waste & Recycling 3 0 0 0 0 Auditor-Controller 7 0 0 0 0 County Executive Office 2 0 0 0 0 County Counsel 2 703,062 0 703,062 703,062 Clerk-Recorder 2 0 0 0 0