Transcription

Employee Benefit GuideJanuary 1, 2022, through December 31, 2022This Benefit Guide provides a brief description of plan benefits. For more information on plan benefits, exclusions, and limitations, pleaserefer to the Plan documents or contact the carrier/administrator directly. If any conflict arises between this Guide and any plan provisions, theterms of the actual plan document or other applicable documents will govern in all cases. Benefits are subject to modification at any time. 2020 Brown & Brown, Inc. All rights reserved.

Annual Open EnrollmentWe Make Your People Our BusinessDuring the annual open enrollment period, you may make changes to your benefit plan electionsand/or the family members you cover. Changes can only be made outside of the annualenrollment period if you experience a qualified family status change that permits changes in yourplan election. So now is the time to carefully review your plan options. Below is an overview ofthe changes for the 2022 Plan year.Open Enrollment for our benefit plans will be conducted December 6 through December 17,2021. Elections you make during open enrollment will become effective January 1, 2022. ThisGuide provides a brief description of the benefit plans available to you and your familymembers. Please read it carefully, since understanding the options available to you can helpensure that you choose the right benefit options for you and your family. 2020 Brown & Brown, Inc. All rights reserved.

Who is Eligible?We Make Your People Our BusinessFull time employees are eligible to participate in benefit plans on the first day of the monthfollowing/coinciding with 30 days of full-time service. Full time employment is defined as workinga minimum of 30 hours per week.Your spouse, spouse is an individual to whom the covered participant is civilly married under amarriage covenant between a man and a woman as described in Canon 1055 of the Code ofCanon Law for the Latin Rite of the Catholic Church.Your children, until your child turns age 26. The term child also refers to: Natural children of the first degree, Legally adopted children and children placed with you for adoption, Stepchildren, and Children whose parents are both deceased for whom you have legal custodyas determined by a court of competent jurisdiction.Children between 26 - 30Florida law also provides that an adult child is eligible for extended dependent coverage up to theend of the calendar year he or she reaches the age of 30, if the child: Is a resident of Florida or a full-time or part-time student; Is unmarried and does not have a dependent of his or her own; and Is not provided coverage under any other group, blanket or franchise health insurance policy orindividual health benefits plan and is not entitled to Medicare benefits.Your unmarried children, regardless of age who are physically or mentally disabled, provided thecondition started before the age when coverage would have normally ended. 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessMid-Year ChangesUnless you have a qualifying event, you cannot make changes to the benefits you elect until the next openenrollment period. If you experience a qualified “change in status,” you must make any associated enrollment orbenefit changes within 30 days of the event except for a Medicare or Medicaid entitlement event, in which case youmust make changes within 60 days of the event. You have the right to elect coverage during the plan year if your oryour dependent’s Medicaid/Children’s Health Insurance Program (CHIP) coverage terminates due to discontinuationof eligibility under the program or if you become eligible for a Medicaid/CHIP premium assistance subsidy (ifavailable in your state) providing you request enrollment within 60 days of the loss of coverage or eligibility forpremium subsidy.Qualified changes in status include: Change in legal marital status; Change in number of dependents; Change inemployment status of employee, spouse, or dependent; A dependent newly satisfies or ceases to satisfy eligibilityrequirements; Change in place of residence; Loss of certain other health coverage; Court judgment, decree, ororder; Medicare or Medicaid entitlement; Significant cost or other coverage changes; Family Medical Leave Act(FMLA) leave of absence; Reduction of hours; Exchange/Marketplace enrollment. Please note that there are severalconditions and/or limitations that apply to the events listed above.For changes after open enrollment closes, please contact Human Resources if you have any questions orbelieve that you may qualify for an election change. 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessOnline EnrollmentEMPLOYEE BENEFITS WEBSITEOnline Open enrollment will be available from December 6, 2021, through midnight on December17, 2021. You will need to access the BBMyBenefits.EmployeeNavigator.com site in order to makeyour elections for the next plan year. Eligible employees must enroll via the Employee Navigatorwebsite. You must elect or waive coverage by the deadline date provided, this is a mandatoryprocess only if making changes to the current benefit elections.Scan the QR code to access the enrollment siteREGISTERINGClick “Register as a new user.”You will need the following information First Name Last Name Company Identifier S.T.U PIN Last 4 digits of your SSN Birth DateHELPFUL TIP: Use an easy to rememberusername such as an email.Passwords require at least 6 characters,a special character (!, @, #, , %, *) anda number.Complete the registration by creating your username and password. Please be sure to write down your login information for future use.RETURNING USERSStep 1. Visit: BBMybenefits.employeenavigator.comStep 2. Enter your username and password created at last open enrollment orthroughout the year as a new hire:A. If you do not remember your username, please reach out to HumanResources.B. To Change your password, select “Reset a forgotten password andfollow the instructions on the page.Step 3. Once you’ve logged in, click the “Start Benefits” on the blue bar. 2020 Brown & Brown, Inc. All rights reserved.

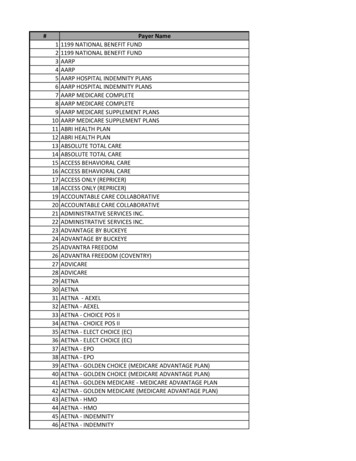

We Make Your People Our BusinessQuestions?Because the world of healthcare and insurance can be confusing and hard to navigate, we are pleased tointroduce your Account Management Team at Brown & Brown Insurance who will be able to assist you with allthings related to your benefits. Your Account Manager will be working in conjunction with the Human ResourcesDepartment so that benefit needs are addressed in a timely fashion.St. Thomas UniversityHuman Resources DepartmentJoseph BasultoAssistant HR DirectorDirect Line: (305) 628-6699jbasulto@stu.eduJohn PratsHR DirectorDirect Line: (305) 474-6871jprats2@stu.eduBROWN & BROWN INSURANCEYour Dedicated Employee Benefits Insurance Consultant TeamAida Rubio, HIAAccount ExecutiveDirect Line: (305) 246-7542arubio@bbinsfl.comEvelyn R. AlvarezExecutive VP & Managing Director,Employee BenefitsDirect Line: (305) 246-7541ealvarez@bbinsfl.comOffice Hours: Monday through Friday 8:00 am to 5:00 pm ESTPlanCarrierPhoneWebsiteMedicalCigna(866) 494-2111www.mycigna.comLife & AD&DAFLAC(800) 992-3522www.Aflac.comDentalCigna(800) 244-6224www.mycigna.comVisionCigna(877) 478-7557www.mycigna.comTelehealthCigna/MDLive(888) 726-3171www.mycigna.comGAPLoomis(866) 218-6020www.loomisco.comHealth SavingsAccountHSA Bank(866)494-2111www.hsabank.comLegal ServicesPreferred Legal(888) 577-3476www.preferredlegal.comLegal ShieldLegal Shield(800) 654-7757www.legalshield.com 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessMedical Plan - CignaPlan DetailsNetwork NameIn NetworkCalendar YearDeductibleIn NetworkOut of PocketMaximumCoinsurancePreventive CareReferrals RequiredPCP RequiredPhysician Office VisitSpecialist Office VisitDiagnostic LabDiagnostic X-raysAdvanced Imaging(MRI, CT, PET Scans)Emergency RoomUrgent CareOutpatient SurgeryInpatientHospitalizationOut of NetworkDeductibleCoinsuranceOut of PocketMaximumGenericsPreferred BrandNon-Preferred BrandMail Order (90-daysupply)CignaBronzeOpen AccessCignaSilverOpen AccessCignaGoldOpen AccessCignaSureFitSureFit 4,000 Individual 8,000 Family 3,000 Individual 6,000 Family 2,500 Individual 5,000 Family 4,000 Individual 8,000 Family 6,500 Individual 13,000 Family 6,350 Individual 12,700 Family 5,000 Individual 10,000 Family 6,350 Individual 12,700 Family80% / 20%80% / 20%80% / 20%80% / 20%Covered 100%NoNoCovered 100%YesYes 25 copay 20 copay 50 copay 55 copayPlan pays 100%Plan pays 100%Plan pays 100%Plan pays 100%Deductible 20% coinsuranceDeductible 20% coinsuranceDeductible 20% coinsurance 65 Copay 50 CopayDeductible 20% coinsuranceDeductible 20% coinsuranceDeductible 20% coinsuranceDeductible 20% coinsuranceCovered 100%Covered 100%NoNoNoNoDeductible 25 copay20% coinsuranceDeductible 45 copay20% coinsuranceDeductible Plan pays 100%20% coinsuranceDeductible Plan pays 100%20% coinsuranceDeductible Deductible 20% coinsurance20% coinsuranceDeductible 250 copay20% coinsuranceDeductible 50 copay20% coinsuranceDeductible Deductible 20% coinsurance20% coinsuranceDeductible Deductible 20% coinsurance20% coinsuranceOut-of-Network Benefits 8,000 Individual 16,000 FamilyTHIS PLAN DOES NOTHAVE OUT OF50% / 50%NETWORKBENEFITS 13,000 Individual 26,000 FamilyAfter Deductible 15After Deductible 45After Deductible 653x Retail Copays 5,000 Individual 10,000 FamilyTHIS PLAN DOES NOT50% / 50%HAVE OUT OFNETWORKBENEFITS 10,000 Individual 20,000 FamilyPrescription Drugs 15 45 653x Retail Copays 300 Copay 10 30 50 15 45 652x Retail Copays3x Retail CopaysMedical Plans Monthly DeductionsCoverage ployee Only 48.18 160.54 230.23 52.16Employee & Spouse 532.07 693.35 815.40 556.97Employee & Child(ren) 417.42 525.69 674.51 441.17Employee & Family 755.74 956.60 1,225.16 887.10 2020 Brown & Brown, Inc. All rights reserved.

Cigna ResourcesWe Make Your People Our Business 2020 Brown & Brown, Inc. All rights reserved.

High Deductible Health Plan(HDHP)We Make Your People Our BusinessWhat is a “High Deductible Health Plan” (HDHP)? A high-deductible health plan (HDHP) is a health plan with lower monthly contributions andhigher deductibles than a traditional PPO, HMO, or other Plan All eligible expenses apply to the deductible and co-insurance; there are no copays for officevisits, emergency room or prescription drugs If you enroll in the high-deductible health plan, you are eligible for a Health Savings Account(HSAEvery employee that enrolls in the HDHP will receive a Health Savings AccountA Health Savings account is a tax-free medical savings account HSA Funds can be used to pay for qualified medical, dental, and visionexpenses now and in retirement (e.g., Medicare premiums) Unused account balance rolls over year after year and continues to earninterest tax free. There is no “USE IT OR LOSE IT” rule The Health Savings Account is portable and belongs to you, similar to a 403(b) plan Annual Tax-free contribution limits are adjusted annually; in 2022 the individuallimit is 3,650 and the family limit is 7,300. Couples and single parents fallunder the family limit. If you are over age 55, you can make an additional contribution of 1,000 per year Contributions to your HSAEmployee Contributions to the HSA are Optional You can elect additional pre-tax contributions through payroll or change payroll deductions atany time You can make additional post-tax contributions online or by check 2020 Brown & Brown, Inc. All rights reserved.

High Deductible Health Plan(HDHP)We Make Your People Our Business 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessGap Plan - LoomisEmployer Paid only for those enrolled in the BRONZE Medical PlanBenefit Period Deductible 1,500 per Benefit Period (Per Covered Person) 3,000 per Benefit Period (Per Family)Supplemental Medical Coinsurance100% Supplemental Medical Coinsurance means themaximum percentage that We will pay under this Policy forCovered Expenses incurred by a Covered Person.Combined Hospital Expense Benefitand Outpatient Benefit 5,000 per Benefit Period (Maximum Benefit Per CoveredPerson) 10,000 per Benefit Period (Maximum Benefit Per Family)Hospital Expense BenefitWe will pay up to the Total Maximum Benefit per Benefit Period as stated in the Schedule of Benefitsif a Covered Person is Hospital Confined as a direct result of an Injury sustained in a CoveredAccident or Sickness and the expenses are covered by the Insured’s Major Medical Plan. HospitalConfinement must begin after the Policy Effective Date.All Hospital Expense Benefits are limited to out-of-pocket expenses incurred by the Covered Person,including:a. The Deductible the Covered Person is required to pay under the Insured’s Major Medical Plan.b. The Coinsurance amount the Covered Person is required to pay under the Insured’s MajorMedical Plan.This benefit provision is in lieu of all other benefits payable under the Policy. All benefits are paid onthe basis of the expenses actually incurred.Outpatient BenefitWe will pay up to the Maximum Benefit shown in the Schedule of Benefits for Outpatient treatmentof an Injury sustained in a Covered Accident or Sickness. Benefits are limited to the differencebetween the amount paid by the Insured’s Major Medical Plan and the actual Covered Expensesincurred, including any out-of-pocket expenses such as Deductibles and Coinsurance. Theseservices will be covered only to the extent that they are provided by, or under the supervision of, aDoctor at a Doctor’s Office or a Hospital, outpatient surgical facility, Hospital emergency room,diagnostic testing facility or similar facility that is licensed to provide outpatient treatment. Benefitsare not payable under this Outpatient Benefit for any expenses incurred for an examination by aDoctor in a Doctor’s Office. 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessGap Plan - LoomisEligible employees enrolled in the Silver, Gold or SureFit Medical PlanBenefit Period DeductibleNo DeductibleSupplemental Medical Coinsurance100% Supplemental Medical Coinsurance means the maximumpercentage that We will pay under this Policy for Covered Expensesincurred by a Covered Person.Combined Hospital Expense Benefitand Outpatient Benefit 3,000 per Benefit Period (Maximum Benefit Per Covered Person) 6,000 per Benefit Period (Maximum Benefit Per Family)Hospital Expense BenefitWe will pay up to the Total Maximum Benefit per Benefit Period as stated in the Schedule of Benefits if aCovered Person is Hospital Confined as a direct result of an Injury sustained in a Covered Accident or Sicknessand the expenses are covered by the Insured’s Major Medical Plan. Hospital Confinement must begin afterthe Policy Effective Date.All Hospital Expense Benefits are limited to out-of-pocket expenses incurred by the Covered Person, including:a. The Deductible the Covered Person is required to pay under the Insured’s Major Medical Plan.b. The Coinsurance amount the Covered Person is required to pay under the Insured’s Major Medical Plan.This benefit provision is in lieu of all other benefits payable under the Policy. All benefits are paid on the basisof the expenses actually incurred.Outpatient BenefitWe will pay up to the Maximum Benefit shown in the Schedule of Benefits for Outpatient treatment of anInjury sustained in a Covered Accident or Sickness. Benefits are limited to the difference between the amountpaid by the Insured’s Major Medical Plan and the actual Covered Expenses incurred, including any out-ofpocket expenses such as Deductibles and Coinsurance. These services will be covered only to the extent thatthey are provided by, or under the supervision of, a Doctor at a Doctor’s Office or a Hospital, outpatientsurgical facility, Hospital emergency room, diagnostic testing facility or similar facility that is licensed toprovide outpatient treatment. Benefits are not payable under this Outpatient Benefit for any expensesincurred for an examination by a Doctor in a Doctor’s Office.Gap Monthly Employee DeductionsEmployee Only 78.76Employee & Spouse 134.39Employee & Child(ren) 149.40Employee & Family 206.40 2020 Brown & Brown, Inc. All rights reserved.

How do I filea claim for myGAP plan?Insured InstructionsYou have two options for filing a GAP plan claim!Present Your ID Cardto the ProviderSubmit a Claim Directlyto the GAP CarrierAt the time of service, be sure to hand theprovider both your medical ID card and yourGAP plan ID card.If for any reason the provider cannot submitthe claim for you, you have the option ofsubmitting a claim directly to the GAP carrier.This will allow the provider to file the claim foryou by following the instructions on the ID cardand accepting the assignment of benefits, thesame way they would with any “secondary”insurance coverage.You will generally need certain informationand documents from your provider, such as anexplanation of benefits (EOB) or an itemizedbill, to complete the claim submission. Call thenumber below for more details.To access the member portal of your GAP plan administrator, visit:www.loomisco.comNeed further assistance?Call your GAP plan administrator at 1-866-218-6020.

We Make Your People Our BusinessDental Plan - CignaDental Health Maintenance Organization (DHMO) Plans offer the highest level of coverage. There are nodeductibles and there is no annual benefit maximum. If you choose to enroll in this Plan, you must select adentist participating in the Dental HMO Network. Should you require the care of a specialist, your PrimaryCare Dentist (PCD) will refer you to a specialist within the Dental HMO network. You will not be covered forany services provided by a non-network dentist except in the case of an emergency.Employer Paid BenefitBenefitsAnnual DeductibleAnnual Plan MaximumType I: Preventive ServicesD0999 Office VisitD0120 Periodic Oral ExamD0330 Panoramic X-raysD1110 ProphylaxisType II: Basic ServicesD3310 Root canal, anteriorD3320 Root canal, bicuspidD3330 Root canal, molarD4341 Periodontal scalingType III: Major ServicesD2740 Crown-porcelain/high substrateD5110 Complete denture-maxillaryD5120 Complete denture-mandibularType IV: Orthodontic ServicesD8660 RecordsD8080 Treatment—ChildD8090 Treatment—AdultD8680 RetentionCignaDHMO P6XV0In-NetworkNoneNone 0 copay 0 copay 0 copay 0 copay 90 copay 135 copay 275 copay 45 copay per quadrant 255 copay 185 copay 185 copay 125 copay 440 copay 440 copay 285 copay 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessDental Plan - CignaPreferred Provider Organization (PPO) Plans provide you with the freedom to use a dentist of your choice or accessthe PPO network of dentists. If you use a dentist participating in the PPO network, your out-of-pocket expenses willbe reduced, as fees are subject to a negotiated rate. If you use a non-network provider, you are responsible forpaying the difference in cost between the non-network provider’s charges and the allowed amount.Total Cigna DPPOBenefitsCigna DPPOAdvantage 100 per individual 300 per familyAnnual DeductibleAnnual Plan MaximumCigna DPPOOut-of-Network 150 per individual 450 per family 150 per individual 450 per family 1,500 per individual 2,000 per individualType I: Preventive ServicesRoutine ExamTeeth CleaningPlan pays 100%Plan pays 90%Plan pays 90%Plan pays 80%Plan pays 70%Plan pays 70%Plan pays 50%Plan pays 40%Plan pays 40%50% up to 1,00050% up to 1,00050% up to 1,000Routine X-raysEmergency Care to Relieve PainSealantsType II: Basic ServicesSimple ExtractionRoot Canal EndodonticPeriodontal ScalingRepairs, Crowns, Bridges & InlaysRepairs DenturesOral Surgery Simple ExtractionsOral Surgery All Except SimpleExtractionsType III: Major ServicesBridges and DenturesInlays, Onlays, CrownsType IV: Orthodontic ServicesOrthodontic Benefits (dependentchildren to age 19)Dental DPPO Monthly DeductionsCoverage LevelTotal Cigna DPPOEmployee Only 32.09Employee & Spouse 69.71Employee & Child(ren) 64.56Employee & Family 83.53 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessVision Plan - CignaThe vision plan provide you with the freedom to use an eye doctor of your choice or access the Cignavision network of providers. If you use a provider participating in the network, your out-of-pocketexpenses will be reduced. If you use a non-network provider, in-network benefits and discounts will notapply and benefits will be paid according to a set benefit reimbursement schedule.Extra Savings: In addition to the coverage below, the plan provides savings on additional pairs ofglasses and sunglasses, retinal screening, and laser vision correction.Cigna VisionBenefitsEye ExamsIn-NetworkOut-of-Network 10 copayUp to 45Materials Copay 20Single Standard LensesCovered in fullUp to 32Bifocal Standard LensesCovered in fullUp to 55Trifocal Standard LensesCovered in fullUp to 65Lenticular Standard LensesCovered in fullUp to 80Frames 130 AllowanceUp to 71Contact LensesConventional Lenses 110 AllowanceUp to 98Medically Necessary LensesCovered in fullUp to 210FrequencyEye ExamOnce every 12 monthsLenses—Eyeglass or ContactOnce every 12 monthsFramesOnce every 24 monthsVision Plan Monthly DeductionsCoverage LevelCigna VisionEmployee Only 6.18Employee & Spouse 12.09Employee & Child(ren) 11.83Employee & Family 17.75 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessLife and AD&D - AflacEmployer Provided Basic life and AD&DSt. Thomas University provides basic life and accidental death & dismemberment (AD&D) insurancewhich provide to you and your beneficiaries important financial protection if you are injured or diewhile covered under the plan. This policy is administered through AFLAC. Employees are coveredfor a benefit of 1 time their annual salary, maximum 50,000.Voluntary life and AD&DIn addition to Basic Life Insurance, you may also purchase Voluntary Life Insurance for yourself, yourspouse and your dependent children. However, you may only elect coverage for your dependentsif you enroll and are approved for Voluntary Life coverage for yourself.Voluntary Life/AD&DEmployeeCoverage in increments of 50,000Guaranteed issue amountThe lesser of 4 times annual salary or 300,000SpouseSpouse: You may choose one of the followingoptions for your spouse. 12,500 25,000 50,000*Spouse maximum cannot exceed 100% of yourcoverage amount. The guaranteed coverageamount for your spouse is 50,000.Child(ren)Your unmarried, dependent children: Units of 2,000 to a maximum of 10,000. Theguaranteed coverage amount for your childrenis 10,000. The maximum benefit for childrenunder six months of age is 500.Maximum benefit 1,000,000, when combined with the BasicMaximum Benefit AmountAge based reductions65% of the Life Insurance Benefit at age 7050% of the Life Insurance Benefit at age 75 2020 Brown & Brown, Inc. All rights reserved.

Disability Insurance - AflacWe Make Your People Our BusinessVoluntary Short Term Disability InsuranceGroup Short Term Disability (STD) Insurance is arranged through Aflac.Voluntary Short Term DisabilityWeekly Benefit66.7% of covered weekly salaryWeekly Benefit Maximum 1,500Accident/Sickness Elimination Period7/7 DaysMaximum Duration9 WeeksEmployer Provided Long Term Disability InsuranceGroup Long Term Disability (LTD) Insurance is arranged through Aflac.Employer Paid Long Term DisabilityMonthly BenefitMonthly Benefit MaximumElimination PeriodMaximum Duration60% of covered monthly salary 6,00060 DaysUp to age 65 or Social Security NormalRetirement Age (SSNRA) 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessAccident & Critical Illness - AflacAccident InsuranceAccident Insurance is arranged through Aflac.Accident BenefitsAD&D BenefitEmployee 50,000; Spouse 25,000; Child 10,000 (to age 26)Emergency Room Treatment 175Loss of Hand, foot or sightSee ScheduleDismemberment—Thumb/Index finger (samehand), four fingers (same hand), all toes (samefoot)See ScheduleWellness Benefit 50 per yearAmbulance or Air Ambulance 400 or Air Ambulance 1,200Coma 7,500Hospital Confinement 300 / day—up to 1 yearCritical Illness InsuranceCritical Illness Insurance is arranged through Aflac.Critical Illness BenefitsBenefit AmountEmployee: 20,000;Spouse: 10,000Benefit Waiting PeriodNone100% of Benefit:Base Benefits25% of Benefit:Heart Attack (MyocardialInfarction)Sudden Cardiac ArrestCoronary Artery Bypass SurgeryMajor Organ TransplantBone Marrow Transplant (Stem CellTransplant)Kidney Failure (End-Stage RenalFailure)Stroke (Ischemic or Hemorrhagic)Coronary Artery Bypass SurgeryHealth Screening 50; per calendar yearPre-Ex LimitationNoneCancerInvasive: 100% of benefit / Non-Invasive: 25% of benefit / Skin Cancer 250 per calendar year 2020 Brown & Brown, Inc. All rights reserved.

Flexible Spending Account (FSA)We Make Your People Our BusinessAdditional Features of our benefit planYou can contribute up to 5,000 pre-tax for a dependent care reimbursement account and/or up to 2,750 pre-tax per plan year for reimbursement of health care expenses that would otherwise be“out-of-pocket” expenditures. Please note that any amounts left in the dependent carereimbursement account at the end of the plan year are forfeited. The Plan shall provide for acarryover of up to 550 of any amount remaining unused in a health flexible spending account as ofthe end of the plan year. Such carryover may be used to pay or reimburse medical expenses underthe health FSA incurred during the entire plan year to which it is carried over. Once your electionsare made, they cannot be changed unless you have a qualifying family event.BenefitsHealthcare FSADependent Care FSALimited ied MedicalExpenses*Medical, Dental andVisionNot ApplicableDental and VisionMaximum AnnualContribution 2,750 5,000 2,750RolloverUp to 550 maximumNot ApplicableUp to 550 maximumDependent CareAccountNot Applicable 5,000Not Applicable*HSA Participants wishing to participate must enroll in the Limited FSA Program, limited to Dental & Vision Expenses only 2020 Brown & Brown, Inc. All rights reserved.

We Make Your People Our BusinessLegal ServicesPREFERRED LEGAL PLANTMLegal ServicesThe Preferred Legal Plan (PLP) is a licensed legal expense organization providing its members withlegal advice and discounted fee representation on all types of legal services including:Traffic TicketsDivorceReal EstateWillsProbateBankruptcyImmigrationCredit Report IssuesChild Custody & SupportCriminal DefenseCivil LitigationPersonal InjuryLandlord Tenant DisputesDomestic ViolenceUnlimited free legal advice via phone consultationFree review of legal documentsFree face-to-face initial consultations with attorneysFree letters and phone calls on members’ behalfFree credit report analysis and repair and settling accounts in collectionFree simple wills for member and spouseFree notary servicesNo long-term contracts are required, and members can cancel at any time. Membership is portable ifyou are no longer a St. Thomas University employee and includes unlimited use of services.Identity Works - A Part of ExperianSMIdentity Works is pleased to partner with Preferred Legal PlanTM. Identity Works provides more thanidentity protection. We provide peace of mind. As a part of Experian, a leader in credit services anddecision analytics, we use world-class security and technology standards. When it comes to identityprotection, no one else has the backing of Experian. And no one else comes close.Comprehensive Features to Fight Identity TheftEarly Warning Surveillance Alert notifications via email or text inform members of new activity relatedto their identities through daily monitoring. Daily 3-Bureau Credit Monitoring tracks 50 leadingindicators of identity theft Internet Scan monitors online sources where personal data is sold Change ofAddress Monitoring reported by USPS NCOA and credit bureau Lost Wallet Protection with monthlyemail notifications of “all clear” or other status 1,000,000 Identity Theft Insurance to cover items likeillegal electronic fund transfers, lost wages, legal fees and private investigator costs Identity TheftResolution Agents help resolve potential identity theft from start to finish. With a highly trained,dedicated agent, members aren’t left on their own to contact creditors, close fraudulent accounts,place fraud alerts on their Experian credit reports and more. A Complete Personal Experian CreditReport so members can check for inaccurate information that may be a sign of past identity theftAdditional Resources so consumers can learn more about identity protection. 2020 Brown & Brown, Inc. All rights reserved.

LegalShield and IDShield Legal BenefitsWe Make Your People Our BusinessHave You Ever?Needed your Will prepared or updatedBeen overcharged for a repair or paid anunfair billHad trouble with a warranty or defectiveproductSigned a contractReceived a moving traffic violationHad concerns regarding child support Worried about being a victim of identity theftBeen concerned about your child’s identityLost your walletWorried about entering personal informationonlineFeared the security of your medical informationBeen pursued by a collection agencyWhat is LegalShield?LegalShield was founded in 1972, with the mission to make equal justice under law a reality for all North Americans. The3.5 millionindividuals enrolled as LegalShield members throughout the United States and Canada can talk to a lawyer on anypersonal legal matter, no matter how trivial or traumatic, all without worrying about high hourly costs. LegalShield hasprovided identity theft protection since 2003 with Kroll Advisory Solutions, the world’s leading company in ID Theftconsulting and restorati

Your Dedicated Employee Benefits Insurance Consultant Team Aida Rubio, HIA Account Executive Direct Line: (305) 246-7542 arubio@bbinsfl.com Evelyn R. Alvarez Executive VP & Managing Director, Employee Benefits Direct Line: (305) 246-7541 ealvarez@bbinsfl.com Office Hours: Monday through Friday 8:00 am to 5:00 pm EST St. Thomas University