Transcription

f i n a n c i a l a n n u a l r e p o r t 2 0 112012

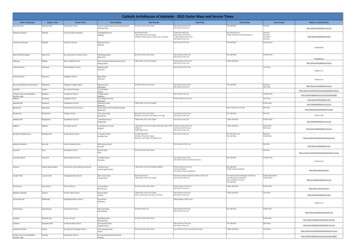

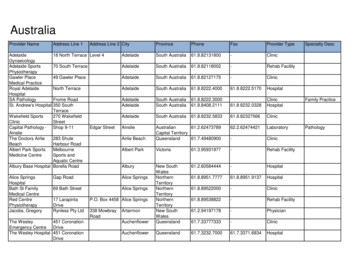

ChairmanDavid MuntManaging DirectorMark YoungDirectorsAlan MulgrewJames TolhurstJohn WardJay HoganAnne HoweChris McArthurSolicitorsAuditorsShareholdersThomsons LawyersPricewaterhouse CoopersUniSuper Ltd 49.0%Local Government Superannuation Board 19.5%Colonial First State 15.3%Industry Funds Management 12.8%Perron Investments 3.4%Subsidiaries100% Parafield Airport Limited100% Adelaide Airport Management Limited100% New Terminal Financing Company Pry Limited100% New Terminal Construction Company Pty LimitedRegistered Office1 James Schofield Drive, Adelaide Airport, South Australia, 5950ABN 78 075 176 653Phone 61 8 8308 9211Fax 61 8 8308 9311Email: airport@aal.com.auWebsite: www.adelaideairport.com.au

financial annual report 2011- 2012Directors’ report2Auditor’s Independence Declaration8Financial statements9Directors’ declaration47Independent auditor’s report to the members48Adelaide Airport Limited (AAL)Adelaide Airport is the majorCBD of Adelaide and two kilometresis an unlisted public companygateway to South Australia andfrom the shores of Gulf St Vincent,whose shareholders in the main areservices international, domesticwith Parafield Airport beingAustralian Superannuation Funds.and regional flights with a total19 kilometres to the north-eastAAL was the successful bidderpassenger throughput (unaudited)of the CBD adjacent the majorfor the rights to lease and operatein 2011/12 in excess of sevenAdelaide to Darwin railway lineAdelaide and Parafield Airport for(7.0) million passengers per annumand Main North Road.an initial term of 50 years, with aand 98,953 aircraft movements.Both airports are surroundedright of renewal for a further 49 yearsfrom the date of ef fect 28 May 1998.Adelaide Airport is locatedsix kilometres due west of theby recent residential, recreationaland light industry developments.

directors’ reportReview of operationsYour directors present their report on the consolidated entity(or the Group) consisting of Adelaide Airport Limited and the entitiesThe profit/(loss) before income tax amounted to 6.681 millionit controlled at the end of, or during, the year ended 30 June 2012.(2011: 21.084 million).Directorsare set out below:Comments on the operations and the results of those operationsThe following persons were directors of the Group during(a) Aeronautical servicesthe whole of the financial year and up to the date of this reportYear on year aeronutical revenue of 75.829 millionunless otherwise stated:(30 June 2011: 84.157 million) represented a decline of 10.0%, withDavid Cranston Munt(Chairman)the decrease in revenue principally due to lower aircraft movementsPhillip Andrew Baker(Managing Director,resigned 31 October 2011)and passengers, coupled with a lowering of the Passenger FacilitationMark Dennis Young(Managing Director,appointed 1 November 2011)Charge (PFC) by approximately 25% from 17 February 2011, which isone of the major components of aeronautical revenue in accordancewith contractual arrangements. The major contributing factor toAlan James Mulgrewthe 4.0% year on year decline in passengers was the withdrawalJames Leonard Tolhurstof Tiger Airlines from the Adelaide market from 1 July 2011.John Frederick WardJames (Jay) Brendan Hogan(b) Non-aeronautical servicesChristopher John McArthurCommercial trading revenue of 31.800 million (30 June 2011:Anne Dorothy Howe 31.823 million) was static year on year, and car parking revenueAlan Shang Ta Wu(Alternate forChristopher McArthur)Kent Ian Robbins(Alternate for John Ward,James Tolhurst and Anne Howe)declined due to the combined impact of lower passengers andthe construction of the Landside Infrastructure Project (LIP).Property revenue of 36.678 million (30 June 2011: 34.092 million)represented a 7.6% increase on prior year, principally dueto annual rental increases and the pass-through of higherPrincipal activitiesutility charges to tenants.The Group acts principally within the airport industryInvestment property fair valuations saw a 4.1% increase in value.in Australia by virtue of holding the leasehold interests inAdelaide and Parafield airports.Significant changes in the state of affairsThere were no significant changes in the state of affairs of theDividends - Adelaide Airport LimitedAn ordinary dividend for the year ended 30 June 2012 of 5.25 cents(2011 - 0 cents) per share was paid on the 28 June 2012, amountingGroup during the financial year.Matters subsequent to the end ofto 10.000 million (2011 - 0.000 million).Dividends on Redeemable Preference Shares, which are classifiedas finance costs, amounting to 28.284 million and were paid orthe financial yearEmirates announced the commencement of direct Adelaideservices as of November 2012.provided for during the year (30 June 2011: 28.284 million)Stage 2 of the Landside Intrastruture Project (LIP) representing a2012 ’0002011 ’000Ordinary Dividends10,000-Redeemable PreferenceShare Dividend28,28428,28438,28428,284state-of-the art Multi Deck Car Park facility was opened to the publicon the 6th August 2012. Stage 3 of the LIP, being developmentof a pedestrian plaza and precinct in front of T1, is expected tobe complete by December 2012.No other matters or circumstances have arisen since 30 June 2012that have significantly affected, or may significantly affect;a) the Group’s operations in future financial years, orb) the results of those operations in future financial years, orc) the Group’s state of affairs in future financial years.02RETURN TO CONTENTSadelaide airport limited 2011-2012

03financial annual report 2011- 2012Likely developments and expected resultsAirport Environment Officer (AEO). Furthermore, in the past year noof operationsactions by AAL operators or lessees have resulted in AuthorisationsFurther developments in the operations of the Group and theexpected results of operations have not been included in this annualor Environmental Protection Orders being issued by the AEO.A Directive handed to ExxonMobil by the AEO in 2008/09FY, inreport because the directors believe it would be likely to result inrelation to localised groundwater contamination, was carried overunreasonable prejudice to the Group.into the 2011/12FY and is being adhered to in the form of aremediation action plan.Environmental regulationAdelaide Airport Limited’s (AAL) approach to environmentalmanagement has continued to evolve towards holistic sustainableA Directive handed to Tasman Aviation Enterprises by the AEO in2009/10FY, also in relation to localised groundwater contamination,remains active.business practice, whilst ensuring its regulatory compliance record.As described in the company Sustainability Policy, AAL’s corporateInformation on Directorsvision and ongoing success is founded on building and maintainingDavid Cranston Munt LL.B (Hons). Chairmanthe three pillars of responsible business practice - sustainable financial,environmental and social management.In striving to meet the company’s committed objectives and goalsDavid was appointed on the 30 June 2004 as a non-executive directorand Chairman. David has over 30 years’experienceas a corporate andcommercial solicitor, primarily involved in representing parties in difficultin the 5-year Sustainability Plan for Adelaide Airport (2009-2014),and complex litigation. He has had long experience as a publicAAL has progressed in areas such as sustainable development, watercompany Chairman and as a director of private companies.management, waste recycling and energy management to name a few.David is immediate past Chairman of Partners of law firm ThomsonThe last year saw successful completion of the single largest runwayPlayford (now Thomsons Lawyers) and Deputy Chairman of Seeleyoverlay project in Australia. A total of 450,000 square metres of runwaysInternational Pty Ltd.and taxiways were resurfaced without any safety, environmental orSpecial responsibilitiescommunity incidents whilst maintaining the operational status of Chair of the BoardAdelaide Airport. Other sustainable development features included waste Member of the Property Development Committeeasphalt recycling, recycled pavement trials, LED taxiway light installation Member of the Aeronautical & Related Infrastructure Committeeand use of recycled water. AAL’s achievement in this project was recognised Ex-officio member of the Audit & Compliance Committeeby the industry and resulted in Adelaide Airport being awarded the title Ex-officio member of the Remuneration Committeeof Australian Airports Association’s Capital City Airport for 2011.Sustainable development principles have been incorporated intothe design of two major AAL projects nearing completion, namely, the5-star Green Star Australian Federal Police building and the Multi-DeckCar Park. The car park incorporates a number of sustainability featuresincluding rooftop stormwater capture and reuse, recycled water usefor irrigation, efficient lighting and state-of-the-art wayfindingtechnology to reduce vehicle circulation times.In a major step towards waterproofing Parafield Airport, the City ofSalisbury has expanded on the existing stormwater capture and re-usescheme and constructed a recycled water distribution network aroundthe airport perimeter to supply future developments with recycledwater from the on-airport aquifer storage and recovery scheme.AAL’s 3-year Clean Energy Partnership with the University ofAdelaide’s Centre for Energy Technology has continued with keyprojects aiming to identify energy efficiency gains through detailedmodelling and assessment of Terminal 1’s heating, ventilation andair conditioning system. Progress to date has identified significantopportunities for financial savings and energy efficiencies.AAL has met all legislative compliance obligations set under theAirports Act 1996 and Airports (Environment Protection) Regulations1997, monitored by the Department of Infrastructure and Transport’sMark Dennis Young B.Ec, FCPA, FAICD, FCIS, Managing DirectorAppointed on 1 November 2011 as Managing Director ofAdelaide Airport Limited.Prior to joining AAL, in July 2001, Mr Young was Finance Director forMacmahon Holdings Limited. Mr Young enjoyed a 20 year career withMacmahon gaining experience in all aspects of that ASX listed, diversifiedContract Mining, Civil Engineering and Building construction group, withoperations throughout Australia and a significant presence in Asia Pacific.Mr Young has played a key role in Adelaide Airport’s expansion andrapid passenger growth over the past decade and has also successfulyled multiple capital raising programs as part of AAL’s refinancing andexpansion strategy, maintaining the company’s strong credit rating.He has a Bachelor of Economics (Accounting) at the University ofAdelaide and is a Fellow of the Australian Society of Certified PracticingAccountants and a Fellow of the Australian Institute of CompanyDirectors. Mr Young recently completed an Advanced ManagementProgram at the Harvard Business School in the US.Special responsibilities Managing Director Member of the Property Development Committee Member of the Audit & Compliance Committee Member of the Remuneration CommitteeRETURN TO CONTENTS

directors’ reportInformation on Directors(cont)Phillip Andrew Baker FCILT, FAICD. Managing Director(Resigned 31 October 2011)Phil was appointed as Managing Director on the 24 April 1998James Leonard Tolhurst B.Comm, MBA, FCPA, FCIS, FAICD DirectorJim was appointed on the 29 September 2004 as a non-executivedirector nominated by UniSuper Ltd. Jim is currently the Chairof the Queensland Airports Ltd group of companies, a director ofof Adelaide Airport Limited and resigned from this position asLeichhardt Coal Pty Ltd and Blair Athol Coal Pty Ltd. Jim has hadof 31 October 2011.over forty years of experience in accounting and administration.At the date of his resignation Phil was the Chairman of theSpecial responsibilitiesAdelaide Convention Bureau (formerly Adelaide Convention and Member of the Remuneration CommitteeTourism Authority) and is a Fellow of the Chartered Institute of Chair of the Audit & Compliance CommitteeTransport and the Australian Institute of Company Directors, Member of the Property Development Committeea former Business Ambassador for South Australia and former Member of the Aeronautical & Related Infrastructure CommitteeManaging Director of Ringway Handling Services Limited(Manchester Airport - United Kingdom), former Director of theAustralian British Chamber of Commerce, former MD and Directorof Queensland Airports Limited Group and a former Director ofthe Tourism Task Force Limited. Phil has forty five years of experiencein the aviation industry, including airlines and handling agents.Special responsibilities Managing Director Member of the Property Development Committee Member of the Aeronautical & Related Infrastructure CommitteeAlan Mulgrew BA, GRAICD, JP DirectorAlan was appointed on the 6 September 2006 as a non-executiveJohn Frederick Ward BSc, FAICD, FAIM, FAMI, FCILT DirectorJohn joined the Board on the 28 August 2002 as a non-executivedirector nominated by UniSuper Limited. He is a professionalcompany director and corporate advisor. He retired as theGeneral Manager Commercial of News Limited in 2001. Prior tojoining News Corporation in 1994 he was Managing Director andChief Executive of Qantas Airways Limited culminating a 25 yearcareer with the airline in a variety of corporate and line managementroles covering Australia, Asia, Europe and North America. He is anHonorary Life Governor of the Research Foundation of InformationTechnology, Chairman of Wolseley Private Equity and Directorof Brisbane Airport Corporation Holdings.director. Alan has had over thirty years’ experience as a senior aviationSpecial responsibilitiesexecutive both within Australia and overseas, including responsibility Chair of the Remuneration Committeefor Perth and Sydney Airports. Since leaving Sydney Airport in 1997 Member Audit & Compliance CommitteeAlan has provided strategic advice to numerous major institutions and Member of the Property Development Committeeserved as a non-executive board member on a number of high profile Member of the Aeronautical & Related Infrastructure Committeeboards spanning Aviation, Energy, Construction, Infrastructure andTourism. Alan is currently a non-executive Director of Doric GroupHoldings Pty Ltd and Tesla Corporation Pty Ltd. He was formerlyChairman of Tourism Western Australia, Chairman of Western CarbonPty Ltd and a non-executive Director of Western Power Corporation.Alan has also served as Chairman or as a member on various AuditRisk Management Committees and as a member of Governanceand Remuneration Committees.Special responsibilities Chair of the Aeronautical & Related Infrastructure Committee Member of the Property Development Committee Member of the Remuneration CommitteeJames (Jay) Brendan Hogan MBA, AFAMI, JP DirectorJay was appointed on the 29 July 2009 as a non-executive directornominated by Local Super. Jay has over 35 years’ experience in theproperty development industry around Australia and overseas acrossa broad range of property asset classes. Jay is currently Chairman ofUrban Construct Pty Ltd, Bremerton Vintners Pty Ltd and SevenhillWines. He currently has personal interests in property development,wine and tourism ventures. He was previously Chairman of the LandManagement Corporation in South Australia from 1996 to 2004,Chairman of the South Australian Housing Trust Board, Chairman ofthe Torrens Catchment Water Board, Deputy Chairman of HomestartFinance Board and Past President of the Urban Development Instituteof Australia. In 1998 he was awarded Life Membership of theUrban Development Institute of Australia in recognition of hiscontribution and services to the development industry.Special responsibilities Chair of the Property Development Committee Member of the Aeronautical & Related Infrastructure Committee04RETURN TO CONTENTSadelaide airport limited 2011-2012

05financial annual report 2011- 2012Christopher John McArthur B.Eng., MBA, GAICD DirectorChris was appointed on the 30 March 2011 as a non-executiveAlan Shang Ta Wu M.Com, CFA, GAICD. Alternate DirectorAlan was appointed as an alternate director by Christopherdirector nominated by Colonial First State Managed Property LtdMcArthur on the 30 March 2011. Alan is Associate Director,as trustee of the CFS Global Diversified Infrastructure Fund.Infrastructure of Colonial First State Global Asset ManagementChris is Head of Asset Management, Australia - Infrastructure,(CFSGAM). Alan is responsible for the management of transportat Colonial First State Global Asset Management, having joined inand utilities infrastructure assets and evaluation of new investmentJuly 2007. Chris is a Director of Brisbane Airport and the UK utilityopportunities within the Infrastructure team. Alan has over 10 yearsInexus Group. He is a former Director of Perth Airport, and wasof experience in the investment, management and divestment ofinaugural Chairman of Airports Coordination Australia Ltd.infrastructure assets, as well as portfolio management. Prior to beingChris was previously the commercial head of Pacific National,appointed Associate Director, Alan was Head of Analytics and Assetthe former Toll/Patrick rail joint venture, and held a variety ofManager managing the Infrastructure Analytics Team. Alan was alsosenior management roles with Qantas in Sydney and London,actively involved in the establishment and growth of CFSGAM’sincluding as head of the QantasLink group of regional airlines.flagship infrastructure funds in Australia. Alan is a director ofSpecial responsibilitiesBankstown and Camden Airports. He has previously served Member of the Audit & Compliance Committeeas an alternate director of Perth Airport. Member of the Property Development Committee Member of the Aeronautical & Related Infrastructure CommitteeAnne Dorothy Howe MAICD DirectorAnne was appointed on the 29 June 2011 as a non-executiveKent Ian Robbins B. Bus (Property) Alternate DirectorHead of Property and Private Markets - UniSuper ManagementPty Ltd. Kent has over 20 years’ experience in the finance industry,predominantly in superannuation and property funds management,director nominated by UniSuper Ltd. In December 2010 Anne retiredhaving joined UniSuper in November 2009. Kent’s prior roles includedfrom SA Water, an organisation she successfully led as Chief Executiveboard representation on domestic and offshore property funds andfor ten years. For the last 20 years of a public sector career spanninga Superannuation Investment Committee. He is a current directorthirty years, Anne has held positions as Chief Executive or Deputyof AquaSure (Victoria’s Desalination Plant) and Plenary HealthChief Executive of several large, complex public sector agencies(Victoria’s Comprehensive Cancer Centre). Kent is responsible forincluding responsibility for a number of diverse governmentUniSuper’s 3.1B Property portfolio, 1.6B Infrastructure portfoliobusinesses. Anne has been State President of the Committee forand 0.8B Private Equity portfolio.Economic Development of Australia (South Australia), a member ofKent has a Bachelor of Business majoring in Property fromthe South Australian Government Financing Authority Advisory Board,RMIT and a Graduate Diploma in Applied Finance and Investmenta member of South Australia’s Economic Development Boardfrom the Securities Institute of Australia. He is an Associate of the(Projects Co-ordination Board), a member of the Construction IndustryAustralian Property Institute and Member of the Australian InstituteTraining Advisory Board and Deputy Commissioner representingof Company Directors.South Australia on the Murray Darling Basin Commission.As a Councillor of the SA Institute of Company Directors, Anne ledCompany Secretariesa group responsible for designing strategies to increase participationLen Goff FIPA, GRAICDof women on boards. In 1996 Anne became the first woman toLen was appointed Company Secretary on 29 March 1999.chair the Australian Procurement and Construction Council (APCC),Len has had over 20 years’ experience in the aviation industry andthe peak council of departments responsible for procurement,has a background of management and financial accounting inconstruction and asset management policy for the Australian,the manufacturing industry. Len is a Fellow Professional NationalState and Territory governments and the New Zealand government.Accountant and a Graduate Member of the Australian Institute ofSpecial responsibilitiesCompany Directors. Len resigned his position as Company Secretary Member of the Property Development Committeewith effect from 1 July 2012. Member of the Aeronautical & Related Infrastructure CommitteeCompany Secretaries continued next pageRETURN TO CONTENTS

directors’ reportCompany Secretaries(cont)Mark Young B.Ec, FCPA, FAICD, FCISShane Flowers BSc, MSc, ACAMark was appointed Chief Financial Officer on 23 July 2001 andShane joined Adelaide Airport in October 2008 as Finance ManagerCompany Secretary on 28 November 2001. Mark has over 30 years’and was appointed Chief Financial Officer on 21 February 2012 andexperience in the finance industry with a background of financialCompany Secretary on 28 March 2012. Prior to that Shane spentmanagement and accounting principally in a listed company10 years in private practice with PricewaterhouseCoopers acrossenvironment. Mark was appointed Managing Director onAudit and Transaction Services. Shane is an Associate of the1 November 2011 and vacated his position as Chief Financial OfficerInstitute of Chartered Accountants in Ireland and has Bachelorson 21 February 2012. Mark is a Fellow of the Australian Societyand Masters degrees in Economics.of CPA’s, a Fellow of the Australian Institute of Company Directorsand a Fellow of the Chartered Institute of Secretaries in Australia.Meetings of directorsThe numbers of meetings of the company’s board of directors and of each board committee held during the year ended 30 June 2012, and thenumbers of meetings attended by each director are shown below.Meetings of committeesFull meetingsof directorsMeetings HeldAudit yDevelopmentCommitteeAeronautical & RelatedInfrastructureDevelopment Committee10**10**10**7**3**David Munt86***388Phillip Baker[4] 4**[4] 4[4] 4Mark Young[6] 67*3*[6] 6[6] 6Alan Mulgrew9*299James Tolhurst10731010John Ward10731010Jay Hogan10**1010Anne Howe10**1010Chris McArthur107*1010Alan Shang Ta Wu[2] 2**[3] 3[3] 3Kent Ian Robbins[1] 1**[1] 1[1] 1Alternate Directors* denotes not a member ** denotes the number of meetings held in the course of the year *** denotes ex officio memberWhere a director was not eligible to attend all meetings of the Board or relevant committee, the number of meetings for which the directorwas eligible to attend is shown in brackets.06RETURN TO CONTENTSadelaide airport limited 2011-2012

financial annual report 2011- 201207Insurance of officersDuring the financial year, Adelaide Airport Limited paida premium to insure the directors and officers of the company andits controlled entities. The terms of the policy prohibit disclosureof the premiums paid.The liabilities insured are legal costs that may be incurred indefending civil or criminal proceedings that may be brought againstthe officers in their capacity as officers of entities in the Group, andany other payments arising from liabilities incurred by the officersin connection with such proceedings. This does not include suchliabilities that arise from conduct involving a wilful breach of dutyby the officers or the improper use by the officers of their positionor of information to gain advantage for themselves or someone elseor to cause detriment to the company. It is not possible to apportionthe premium between amounts relating to the insurance against legalcosts and those relating to other liabilities.Auditor’s independence declarationA copy of the auditor’s independence declaration as requiredunder section 307C of the Corporations Act 2001 is set out on page 8.Rounding of amountsThe group is of a kind referred to in Class Order 98/100, issued by theAustralian Securities and Investments Commission, relating to the‘’rounding off’’ of amounts in the directors’ report. Amounts in thedirectors’ report have been rounded off in accordance with thatClass Order to the nearest thousand dollars, or in certain cases,to the nearest dollar.This report is made in accordance with a resolution of directors:Mark Young (Director)Jim Tolhurst (Director)Adelaide, 25 September 2012RETURN TO CONTENTS

RETURN TO CONTENTS

financial annual report 2011- 201209financial report 30 june 2012Consolidated income statement10Consolidated statement of comprehensive income10Consolidated balance sheet11Consolidated statement of changes in equity12Consolidated statement of cashflow13Notes to the consolidated financial statements14Directors’ declaration47Independent auditor’s report to the members48These financial statements are the consolidated financial statements of the consolidated entity consisting of Adelaide Airport Limitedand its subsidiaries. The financial statements are presented in the Australian currency. Adelaide Airport Limited is a company limited by shares,incorporated and domiciled in Australia. Its registered office and principal place of business is: Adelaide Airport Limited - 1 James Schofield Drive,Adelaide Airport SA 5950. A description of the nature of the consolidated entity’s operations and its principal activities is included in the reviewof operations and activities in the directors’ report on pages 2 to 7, which is not part of these financial statements. The financial statements wereauthorised for issue by the directors on 25th September 2011. The directors have the power to amend and reissue the financial statements.

financial statementsConsolidated income statement for the year ended 30 June 2012ConsolidatedNotes2012 ’0002011 ’0003146,175152,061Increments/(Decrements) in fair value of Investment Properties5,9009,7134904831Employee benefits expense(13,249)(12,296)Services & Utilities(34,029)(31,586)Consultants & Advisors(5,251)(4,254)General administration(6,750)(6,730)Leasing & 744,509Finance costs(70,664)(71,191)Depreciation and amortisation 7)(4,791)Profit for the year4,64416,293Revenue from continuing operationsOther incomeProfit/(loss) on disposal of property, plant & equipmentEarnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA)Interest IncomeImpairment of property, plant & equipmentProfit before income taxIncome tax expenseThe above consolidated income statement should be read in conjunction with the accompanying notes.Consolidated statement of comprehensive income for the year ended 30 June 2012ConsolidatedNotes2012 ’0002011 ’000Profit for the year4,64416,293Other comprehensive incomeRevaluation gain on transfer to investment properties, net of tax25-757Changes in the fair value of cash flow hedges, net of tax25(17,685)2,326Other comprehensive income for the year, net of tax(17,685)3,083Total comprehensive income for the year(13,041)19,376The above consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.10RETURN TO CONTENTSadelaide airport limited 2011-2012

11financial annual report 2011- 2012Consolidated balance sheet as at 30 June 2012ConsolidatedNotes2012 ’0002011 ’000ASSETSCurrent assetsCash and cash equivalents788,60689,440Trade Receivables87,9098,221Current tax receivables5,1574,303Other Receivables97,0275,527Total current assets108,699107,491Non-current assetsProperty, plant and equipment10358,067303,101Intangible assets14183,433183,603Prepaid Operating Lease11119,849121,263Investment Properties12252,170242,230Total non-current assets913,519850,197Total assets1,022,218957,688LIABILITIESCurrent liabilitiesTrade and other payables1521,45720,178Borrowings165402Derivative financial r18425288Total current liabilities35,86328,089Non-current liabilitiesBorrowings19811,249747,458Deferred tax ative financial instruments2229,75111,004Other232,8611,772Total non-current liabilities929,508849,711Total liabilities965,371877,800Net )(7,157)Retained earnings25(b)79,78485,140Total equity56,84779,888EQUITYContributed equityRETURN TO CONTENTS

financial statementsConsolidated statement of changes in equity for the year ended 30 June 2012NotesConsolidatedContributedequityReserves ’000 ’000Retainedearnings ’000Totalequity ’000Balance at 1 July 20101,905(10,240)68,84760,512Total profit for the year as reported in the 2011 financial statements--16,29316,293Other comprehensive income25-3,083-3,083Total comprehensive income for the year-3,08316,29319,376Transactions with owners in their capacity as owners24----Balance at 30 June 20111,905(7,157)85,14079,888Total profit for the year as reported in the 2012 financial statements--4,6444,644Other comprehansive income for the year25-(17,685)-(17,685)Total comprehensive income for the nce at 30 June 20121,905(24,842)79,78456,847Transactions with owners in their capacity as ownersDividends provided for or paidThe above statement of changes in equity should be read in conjunction with the accompanying notes.12RETURN TO CONTENTSadelaide airport limited 2011-2012

13financial annual report 2011- 2012Consolidated statement of cashflow for the year ended 30 June 2012ConsolidatedNotes2012 ’0002011 ’000Receipts from customers (inclusive of goods and services tax)164,930170,609Payments to suppliers and employees (inclusive of goo

A Directive handed to ExxonMobil by the AEO in 2008/09FY, in relation to localised groundwater contamination, was carried over into the 2011/12FY and is being adhered to in the form of a remediation action plan. A Directive handed to Tasman Aviation Enterprises by the AEO in 2009/10FY, also in relation to localised groundwater contamination,