Transcription

What Providers Need toKnow About OutpatientQuality MeasuresThomas W. Wells, MD FACP

Disclosures I have no financial interests or conflicts to disclose.2

Objectives Understand the history of healthcare quality What are the likely directions to come related to healthcare qualityover next 2-5 years Understand the need to be successful for you and your patients Become familiar with several preventative health and at riskpopulation measures3

History of Quality Limitations of Measurement– Claims data– Clinicians want to see OUTCOMES data For meaningful outcomes (death, infections, complications) » That are RISK adjusted .(and show that my patients ARE sicker) Adequately sized sample .(but not require volume for credentialing – unless Iwant) That measure the part that I am responsible for AND are timely (like yesterday)– Left with what is “measureable and obtainable” for large volume diagnosismostly centered around HOSPITAL CARE – Hard for MDs to link causeand effect of their practice to reported metrics (limited attribution model,“yeah but what about ”)4

While MDs argue about non-validity Payers , employers and patients complain about continued COSTof care and inconsistent quality - with CMS driving the agenda 5

The United States continues to have pooreroutcomes and higher costs that otherdeveloped countries 6

All while health care spending continues togrow 7

and all payors are pushing for TRANSPARENCYinto provider quality and service8

Where does this all leave us What cant go on forever will eventually STOP” - Herbert Stein Pressure will continue to address increased costs of care, lack of access to carefor some, consistent care for all Will need to PROVE you are a good doctor with data Data Attributes will be defined for us (MIPPS, MACRA, etc)––––Expect multiple iterations with some justice and some injusticeVERY MESSYLOCUS of measurement move OUT of hospital to YOUR INDIVIDUAL PRACTICEMeasurement likely to focus on POPULATIONS of patients Patient voice growing LOUDER (paying for larger portion out of pocket)– Patient voice will be OUTSIDE of our control – twitter, yelp, facebook, etc– Ignore this AT YOUR PERIL– Expect to see LESS “VALID” measures of quality to be reported BY patients FORPATIENTS (think Amazon reviews) No longer able to hide behand “the data are flawed” as data moves fromOUTCOMES to PROCESS measures (you used the protocol yes or no)9

CMS and other payors are respondingACO – Accountable Care OrganizationAPM – Alternative Payment ModelMACRA –Medicare Access and CHIPReauthorization ActMIPS – Merit-Based Incentive Payment SystemQPP – Quality Payment ProgramMSSP – Medicare Shared Savings ProgramMACRA/ QPP ComponentsMIPSMIPS APMAPMACOMIPS APMAPMAPMMSSP, Tracks 2 and 3Comprehensive Primary Care Oncology Care ModelNextGen ACO, etc.MIPS APMMSSP, Track 1Etc.10

and increasing risk on physicianreimbursementQuality scores in can impact future Medicare Part B reimbursement by /- 5% in PY2018 and /7% in PY2019. This puts revenues at risk for the providers in the MSSP and providers in the MIPSprogram. In the final MACRA rule released by CMS in November 2016, all quality programs were integratedunder a single MACRA umbrellaPiedmont has committed to help ACO participants achieve success on the quality portion of theMSSP, which includes 23 patient-centric measuresMaximum Provider Penalties and Bonuses11

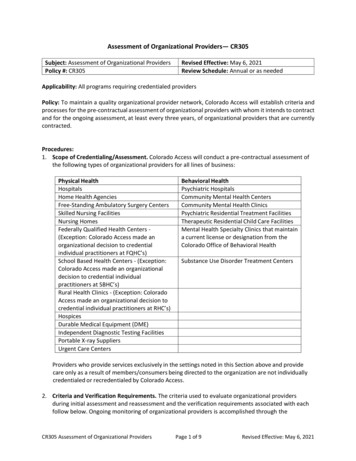

MSSP Program OverviewAreaDescriptionAttribution Original Medicare beneficiaries based on provider participationCMS looks at use of primary care services by primary care providers and byspecialistsRisk Costs and quality adjusted using HCC (hierarchical condition category) methodologyQuality 23 quality measuresQuality measured at population level – not provider specificAll providers in the ACO receive the same quality scoreCost “Cost” costs to CMS as paid through medical claimsCosts can occur both within and outside of Piedmont (SNFs, non-PHC hospitals)ACOs are rewarded when they are able to lower growth in Medicare Parts A and Bfee-for-service costs (relative to their unique target) while, at the same time, meetingquality performance standardsCurrent cost benchmark/target is in lowest 25th percentile in country 12

MSSP Program OverviewPatient-centric population health metricsDomainMeasures10 ACO CAHPS measures:1.Getting Timely Care2.How Well Providers Communicate3.Patients’ Rating of ProviderPatientCaregiver 4.Access to SpecialistsExperience 5.Health Promotion and Education6.Shared Decision Making7.Health Status/ Functional Status8.Stewardship of Patient Resources9.Courteous and Helpful Office Staff10. Care Coordination4 Care Coordination/Safety measures:1.Risk-Standardized, All Condition ReadmissionCareCoordination/ 2.All-Cause Unplanned Admissions for Patients with Multiple Chronic ConditionsPatient Safety 3.Ambulatory Sensitive Condition Acute Composite (AHRQ Prevention Quality Indicator (PQI) #91)4.Falls: Screening for Future Fall Risk6 Preventive Health measures:1.Preventive Care and Screening: Influenza Immunization2.Preventive Care and Screening: Tobacco Use: Screening and Cessation InterventionPreventive3.Preventive Care and Screening: Screening for Clinical Depression and Follow-up PlanHealth4.Colorectal Cancer Screening5.Breast Cancer Screening6.Statin Therapy for the Prevention and Treatment of Cardiovascular Disease3 At-risk Population measures:1.Depression Remission at Twelve MonthsAt-RiskPopulations 2.Diabetes Mellitus: Hemoglobin A1c Poor Control3.Hypertension (HTN): Controlling High Blood PressureMeasurementSurveyClaimsClaimsClaimsWeb InterfaceWeb interfaceWeb interface13BOLD Impact MIPS quality score

Measure can have quality and cost impacts MeasureDescriptionPatient BenefitsEconomic PositiveColorectal CancerScreeningPatient aged 50-75 withcolorectal cancer screening(FOBT, colonoscopy, FITDNA, flex sigmoidoscopy)Early detection of cancer Prevents downstream costs Bonus payments for MAcontracts Impacts Part B paymentadjustmentEarly detection of cancer Prevents downstream costs Bonus payments for MAcontracts Impacts Part B paymentadjustmentBreast Cancer Screening Patients 50-74 who had had amammogram between10/1/2017 and 12/1/2019Statin Therapy for thePrevention andTreatment ofCardiovascular DiseasePatients with ASCVD, LDL 190, or hypercholesterolemiawho received an order(prescription) for statin therapyat any point during the 2019Lower the risk of recurrentASCVD Prevents downstream costs Bonus payments for MAcontracts Impacts Part B paymentadjustmentHypertension (HTN):Controlling High BloodPressurePatients whose bloodpressure is adequatelycontrolled ( 140 systolic AND 90 diastolic) at their mostrecent visit in 2019By focused concentration onthe blood pressure lower therisk of end organ damage fromhypertension Prevents downstream coststhrough avoidablehospitalizations and otherhealth issues Bonus payments for MAcontracts Impacts Part B paymentadjustment14

Measure can have quality and cost impacts MeasureDescriptionPatient BenefitsEconomic PositiveScreening for FutureFalls RiskPatients who were screenedfor future falls risk at leastonce during 2019Intervening before falls. Asfalls are the leading cause ofboth fatal and nonfatalaccidents in older adults.Avoid downstream costs bylowering ED and HospitalcostsHave older adults maintaintheir productivityInfluenza ImmunizationPatients who received a fluvaccine OR who reportedprevious receipt of a fluvaccine between August 1,2018 and March 31, 2019Prevents potential severity offluAvoid downstream costs ofavoidable ED and HospitaladmissionsDiabetes Mellitus:Hemoglobin A1c PoorControl*Patients whose most recentHbA1c level in 2019 is 9.0%Focused concentration onHbA1c to lower this and avoidend organAvoid downstream costs bylowering risks of end organdamage15

Need to Accurately Reflect the Risk of the Patient In the ongoing world of Value Based contracting need tohave accurate diagnosis to adjust for the Total medical costin addition to closing care gapsWhat CMS thinks your patient looks like vs. what your patient actually looks like.16

MSSP Program OverviewMSSP Patient Origin1,450 providers – entireClinic primary carenetwork69,721 Medicarebeneficiaries10th largest ACO in thenationBottom 20th percentilefor patient risk17

Piedmont is already lower in cost ascompared to the marketPiedmont’s cost benchmark is lower than national FFS average. This benchmark wascalculated looking at historical spend of MSSP patients from 2014-2016.PMPY BenchmarkEarned 6.7M inshared savings in2017 10,462 10,291Earned 7.8M inshared savings in2017 10,133 9,500 9,257Piedmont National FFS Georgia FFSMSSP ACOAverageAverageEarned 4.4M inshared savings in2017 9,329Methodist Wellstar (GA)UW(TX) MSSP MSSP ACO (Wisconsin)ACOMSSP ACO18

Many common themes emerge Some success achieved in value-based arrangements, but lots of money left on the table Historic focus has been on quality, but costs are integral to picture Piedmont’s total cost/utilization has been lower relative to market, but must have strategies tomaintain Out-of-network utilization continues to be an opportunity across all contracts Coding is cited as an issue from all payors Limited provider awareness of and engagement in many of our value-based programs Opportunity to continue to streamline programs and enter into program designs that benefitPiedmont and partner19

Discussion&Questions20

Data Attributes will be defined for us (MIPPS, MACRA, etc) . Domain Measures Measurement Patient-Caregiver Experience 10 ACO CAHPS measures: Survey 1. Getting Timely Care . 9,500 10,291 10,133 9,329 Piedmont MSSP ACO National FFS Average Georgia FFS Average Methodist (TX) MSSP ACO Wellstar (GA)