Transcription

Medical & LifeInsurance PlanMissouri Department of TransportationandMissouri State Highway Patrol2022 Annual Benefit yee-benefits-0

MODOT/MSHP MEDICAL ANDLIFE INSURANCE PLAN2022 BENEFIT UPDATETABLE OF CONTENTSPAGE #Member Correspondence .2Reminders . . .3Medical Plan Highlights . .4Flu Shot Flyer . . . .6Benefits at a Glance for Non-Medicare Participants .7Medical Insurance Rate Chart .8Basic/Optional Life Insurance Highlights . .12Optional Life Insurance Rates . .13General Notices .14Cafeteria Plan Highlights . .15MCHCP Dental/Vision Highlights . .16Deferred Compensation Highlights . . .16Employee Assistance Program . .16MoDOT/MSHP Medicare Supplement Plan Benefits at a Glance .17Medicare Subscriber Updates. .18Shingles Coverage .18Flu Vaccine Coverage 18Member HIPAA Notification .19Disclaimer: Information provided in the 2022 Benefit Update is subject to change based uponrules and regulations related to Patient Protection Affordable Care Act (ACA) or otherlegislation.

Missouri Department of Transportation &Missouri State Highway PatrolMEDICAL AND LIFE INSURANCE PLANToll freeVoiceFax105 West CapitolPO Box 270Jefferson City, MO 65102All Subscribers and Dependents of the MoDOT/MSHPMedical and Life Insurance Plan r 15, 2021Inside you will find your 2022 Benefit Update brochure, which contains important information regarding thebenefits offered to you as an eligible member of the MoDOT and MSHP Medical and Life Insurance Plan. I amexcited to share with you some good news. There will be no changes to your medical and prescription plan forcalendar year 2022. This means your premiums, deductibles, and co-insurance will all remain the same. For afifth consecutive year, active employees will see no increase in premiums, an anomaly in this age of perpetualincreases in health care costs.Leadership from MoDOT and the MSHP in partnership with The Missouri Highways and TransportationCommission (Commission) take great pride in the medical insurance benefits provided for our Plan participants.They also recognize the peace of mind provided by offering comprehensive health care coverage to employeesand retirees alike.Below are some other important reminders and action items to keep in mind as we look ahead to the 2022 Planyear: October is open enrollment time! Active employees can enroll themselves, add or remove dependentcoverage with a January 1, 2022 effective date. Subscribers can use this opportunity to switch betweenthe PPO and HDHP plans. ALL HDHP subscribers must complete a new HSA contribution form for the 2022 calendar year. HSA annual employer contributions are remaining the same for 2022. Single individuals will receive 500 with all other categories receiving 1,000. ALL PPO subscribers, no action is required if wish to continue your current medical coverage. MCHCP has an open enrollment period in October, for active employees interested in making changesto their dental and/or vision coverage. Log on to your myMCHCP account to initiate those changes. Active employees participating in the FSA, don’t forget to log on to your account atasiflex.com/MoCafe/ and complete the ASI Cafeteria Plan open enrollment process between October 1 –December 1. The FSA is an annual election!If you have any additional questions regarding your benefits, please contact your local insurance representativeor the Employee Benefits’ staff toll-free at 1-877-863-9406.Sincerely,Ashley Halford, Board Chairman,MoDOT/MSHP Medical and Life Insurance Plan Board of Trustees2

Reminders for 20222022 Medical PremiumsDeductibles Start Over January 1Your medical premiums are paid one monthin advance. December paychecks will reflectyour premiums for January coverage changes.If no changes were made, your premiums willremain the same. Rate chart on page 9.Your medical and prescription deductiblesstart over January 1, 2022. PPO Medical: 600 per individual or 1,800 family. PPO Prescription 100 per participant. HDHP Medical and PrescriptionCombined: 1,700 for individual or 3,500 for family.Special Enrollment PeriodIf you are enrolled in the Cafeteria PlanPremium Only Category, you can onlyterminate coverage on yourself or yourdependents during the calendar year, if youhave a change of status. Such as: Death of spouse/dependent Divorce finalized Employment of yourspouse/dependent Gain/loss of dependent due to age,military status, marriage, divorce, etc. Your employment ends and/or youretireAnthem Replacement ID Cards: ID cards can be printed on the webportal at www.anthem.com. Call customer service at 833-290-2481to request a new or additional card.MedImpact Replacement ID Cards Non-Medicare members can log on toMedImpact’s website atwww.medimpact.com with yourlogin and password. All members can contact MedImpactCustomer Service for ID Cards:o Non-Medicare: 844-513-6005o Medicare: 844-513-6006You can also contact Employee Benefits at877-863-9406.Life Insurance PremiumsOur life insurance vendor will remainSecurian for 2022. Rates for 2022 willremain the same and are included on page 12of this mailing.Preventive CareAll preventive care services are covered 100%when utilizing an in-network provider.Preventive exams are limited to one percalendar year. Any preventive servicesreceived out-of-network will not be covered.COVID-19 testing will be covered at 100%through December 31, 2021. Future claimswill be paid according to plan guidelines(unless legislative action prompts anextension).Generic DrugsGeneric Drugs are as safe and effective asbrand-name drugs. The same activeingredients are used in the same dosage andstrength as brand-name drugs. Ask yourdoctor or pharmacist if generic drugalternatives available to treat your medicalneeds. You may see a decrease in the priceyou pay at the pharmacy.Plan CalculatorsThe Employee Health and Wellness webpagehas a Plan Comparison Calculator tool thatallows you to input data on your healthinsurance utilization to determine if the HDHPor the PPO plan is the best fit for you and yourdependents. Find out more atwww6.modot.mo.gov/premiumcalc/mainmenu.aspx.3

Medical Plan Highlights for 2022MEDICAL BENEFITSMoDOT & MSHP Total WellnessAnthemAnthem will continue as our plan administrator.They will provide both network and claimsadministration services for our Plan participants.Continue to use the same ID card you carry today.For account or coverage information, call theirtoll-free number at 833-290-2481 from 8:00AM 9:00PM CST.SydneyAnthem’s newest app is simple, smart – and allabout you. With Sydney you can find everythingyou need to know about your Anthem benefits –personalized and all in one place. Sydney makes iteasier to get things done; access your ID card,find providers, look up claims, and much more!The Plan’s wellness program boasts a variety ofhealth initiatives and activities designed toencourage and support a healthier lifestyle foryou and your family. Each month will have adifferent focus topic, with information providedby your local Wellness Champion. Informationwill include: Customized incentive programs Healthy recipes Facebook and Instagram page – MoDOT& MSHP Total WellnessPRESCRIPTION BENEFITSMedImpactWondr Health (Naturally Slim)During 2021, our digital weight loss benefitprogram rebranded to Wondr Health. Visit:https://enroll.wondrhealth.com/start?s modotmshp to learn more or to enroll in a class. Classesare free to all members enrolled onMODOT/MSHP Anthem medical insurance plan.MedImpact will continue to serve as ourpharmacy benefit manager. Their toll-freenumbers are listed below:LiveHealth OnlineNon-Medicare members can also log on towww.medimpact.comMedicare participants call: 844-513-6006Non-Medicare participants call: 844-513-6005All participants under Anthem medical plan, haveaccess to video visit with board-certified doctor24/7, by way of smartphone, tablet or computerwith webcam. Use LiveHealth Online forcommon concerns like colds, pink eye, flu, fever,allergies, rashes or common health issues.Visits are covered at 100% for PPO plan enrolleesand 100% after deductible for HDHP enrollees.In addition, a licensed therapist or board-certifiedpsychiatrist is available by appointment, to helpwith anxiety, depression, panic attacks, substanceabuse and overall mental health.Prescription Pricing ToolMedImpact offers members an enhanced drugpricing and inquiry feature to provide membersreal time pricing information in an effort to bettercontrol medication costs and receive qualityinformation.To access the pricing tool:Log on to http://www.medimpact.com and enteryour username and password. The first time youlog on, you will need your ID card, to create ausername and password.Go to: https://livehealthonline.comCall 1-888-548-3432 orDownload app from iTunes or Google Play store4

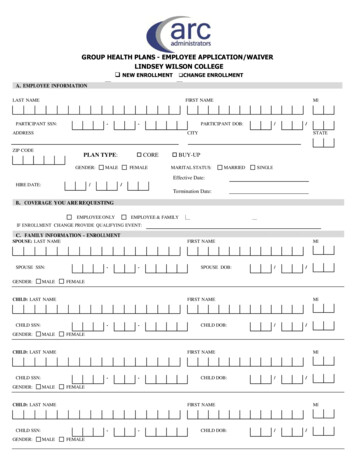

Medical Plan Highlights for 2022 Enrollment 0No action is required if you wish to remain oncurrent medical plan, for 2022.To terminate coverage or remove dependents duringthe calendar year, you must have a qualifying changeof status event, as outlined by the cafeteria plan.All HDHP members need to submit a new HSAcontribution form by October 31, 2021, to list your2022 amount, to the benefit formsSubscribers not paying premiums pre-tax through thecafeteria plan, can drop a dependent at any timeduring the calendar year without a qualifying changeof status event.Medical Open Enrollment PeriodForms and documentation may be mailed, faxed, orpersonally hand-delivered to:For all active employees, the Plan will hold aMedical Open Enrollment Period from October1 through October 31, 2021, with coverageeffective January 1, 2022.Employee Benefits105 W Capitol Ave, P.O. Box 270Jefferson City, Missouri 65102Fax: 573-522-1482benefits@modot.mo.govDuring open enrollment, active employees mayenroll themselves, their spouse, and eligibledependent children under the age of 26.To change coverage, the following must be receivedby the MoDOT Employee Benefits’ Office by closeof business October 31, 2021: If enrolling in the HDHP, you must also submit anHSA election form. This form can be found atHEALTH SAVINGS ACCOUNT (HSA)For HDHP participants, ActWISE will continue asyour HSA provider. You can login to access yourHSA at www.anthem.com.A-570 Medical Enrollment/Change form,obtained through the Employee Benefits websiteat www.modot.org/employee-benefit-forms or bycontacting your respective insurancerepresentative.Employer contributions for 2022:Single plan: 500Spouse/Family plan: 1,000Must provide one form of lawful presence foreach new applicantHSA Maximum Annual Contributions:Single plan: 3,650Spouse/Family plan: 7,300o Lawful presence would be a U.S.Birth Certificate, U.S. Passport, U.S.Passport Card, Certificate ofCitizenship, Certificate of BirthAbroad, Certificate ofNaturalization, Valid LawfulPermanent Resident Card, or driver’slicense.) Copies are acceptable.For question about your HSA call: 833-290-2481.5

A Flu Shot Is GoodPreventive CareKeep yourself from getting the flu by taking one simple step and gettinga flu shot; that way you can lower your chances of getting sick.Influenza (also called the flu) is a serious illness and it can affect peopledifferently. Some people with the flu become much sicker than others.A yearly seasonal flu vaccine is the best way to lower your chances ofcatching the seasonal flu and spreading it to others.1Who should getvaccinated?Everyone six months of age and older should get a flu vaccine every season. It’sespecially important for children under 18 months of age, adults over age 65 and otherswith low immune systems, since these people are at higher risk for developing seriousproblems caused by the flu.1The flu shot is covered under your preventive care benefits at 100% when you go toa health professional in your plan. Visit anthem.com or use the Sydney Health appto find an in-network doctor, urgent care facility or retail health clinic to get your flushot. You can also visit www.medimpact.com to search for an in-network pharmacythat offers flu shots.Do I need to geta flu vaccineearlier this year?Where can Iget a flu shot?September and October are good times to get vaccinated. However, as long as fluviruses are circulating, vaccination should continue, even in January or later.2As the pandemic continues to evolve, it's important to take steps to stay healthy.Be proactive and make plans now to get your flu shot as soon as possible.1 Centers for Disease Control and Prevention website: Who Needs a Flu Vaccine and When (accessed July 2020): cdc.gov/flu/prevent/vaccinations.htm2 Centers for Disease Control and Prevention website: Frequently Asked Influenza (Flu) Questions: 2020-2021 Season (accessed July 2020): cdc.gov/flu/season/faq-flu-season-2020-2021.htm.In Missouri, (excluding 30 counties in the Kansas City area) Anthem Blue Cross and Blue Shield is the trade name of RightCHOICE Managed Care, Inc. (RIT), Healthy Alliance Life Insurance Company (HALIC), and HMO Missouri, Inc. RIT and certainaffiliates administer non-HMO benefits underwritten by HALIC and HMO benefits underwritten by HMO Missouri, Inc. RIT and certain affiliates only provide administrative services for self-funded plans and do not underwrite benefits. Independentlicensees of the Blue Cross and Blue Shield Association. ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association.6MOENABCBS-MODOT FS 8/20

MoDOT & MSHP Medical PlanBenefits-at-a-Glance for Non-Medicare ParticipantsEffective January 1, 2022Listed below is a partial outline of health services covered under the MoDOT/MSHP Summary Plan Document (SPD). This should not be relied upon to fully determine coverage. See theMoDOT/MSHP SPD for applicable limits and exclusions to coverage for these health services. If differences exist between this document and the SPD, the SPD governs.Anthem PPO PlanMember's ResponsibiltyBenefitIn Network ProviderAnthem HDHP PlanMember's ResponsibiltyOut-of-Network Provider *In Network ProviderOut-of-Network Provider *Annual DeductibleIndividualFamilyCoinsurance (applies after deductible)Up to out-of-pocket maximumAnnual Out-of-Pocket Maximum Does notinclude cost above out-of-network rate. 600 1,800 maximum 600 1,800 maximum 1,700** 3,500 3,500** 7,00010%20%30%50%Includes copayments, coinsurance, anddeductible.Includes copayments, coinsurance, anddeductible.Includes coinsurance and deductible.Includes coinsurance, and deductible.IndividualFamilyLifetime Maximum 1,950 5,850 2,955 8,865 3,300** 6,600 5,000** 10,000UnlimitedUnlimitedUnlimitedUnlimitedOffice Visit 25 copayment for office visit only.Other services applied to deductible andcoinsurance.20% coinsurance of out-of-network rateafter deductible.30% (up to out-of-pocket maximum)50% (up to out-of-pocket maximum)Emergency Room Services 75 copayment then 10% coinsuranceafter deductible.If deemed emergency; 75 copaymentthen 10% coinsurance. If not deemedemergency; 75 copayment then 20%coinsurance of out-of-network rate afterdeductible.Copayment waived if admitted or accidental injuryNot covered30% (up to out-of-pocket maximum)50% (up to out-of-pocket maximum)Covered 100%Not covered20% coinsurance of out-of-network rateafter deductible.Pre-admission certification required.20% coinsurance of out-of-network rateafter deductible.30% coinsurance after deductible.Pre-admission certification required.50% coinsurance of out-of-network rateafter deductible.Pre-admission certification required.50% coinsurance of out-of-network rateafter deductible.ImmunizationsCovered 100%According to CDC Recommended SchedulesInpatient Hospital Care10% coinsurance after deductible.Pre-admission certification required.Maternity10% coinsurance after deductible.Preventive CareCovered 100%Not coveredCovered 100%Not coveredSurgeryInpatient and Outpatient10% coinsurance after deductible.Pre-admission certification required.20% coinsurance of out-of-network rateafter deductible.Pre-admission certification required.30% coinsurance after deductible.Pre-admission certification required.50% coinsurance of out-of-network rateafter deductible.Pre-admission certification required.Urgent Care 25 copayment for office visit only.Other services applied to deductible andcoinsurance.20% coinsurance of out-of-network rateafter deductible.30% (up to out-of-pocket maximum)50% (up to out-of-pocket maximum)30% coinsurance after deductible.* Out-of-Network Provider service insurance payments are subject to Out-of-Network Rate only. The Member will be responsible 100% for amounts above Out-of-Network Rate.** If you have other family members on the plan, the individual limits do not applyPharmacy Benefit - Available Through Participating Pharmacies OnlyDeductible 100 per participant per calendar year.Included in medical deductible.Coinsurance30% of costs after deductible is met (minimum 5).30% of costs after deductible is met.Annual Out-of-Pocket MaximumIncludes copayments, coinsurance, and deductible.Includes copayments, coinsurance, and deductible.IndividualFamilyStarter Quantity 5,000 8,40030 day starter quantity for new medication, including change in strength, or themedication has not been filled for the previous six months.Included in medical Annual Out-of-Pocket MaximumBrand over Generic PolicyIf a generic is available: 30% coinsurance of brand drug's cost plus the differencebetween the brand and generic after calendar year deductible at retail and mail orderpharmacy with 5 minimum copayment.If no generic is available: 30% coinsurance after calendar year deductible at retail andmail order pharmacy with 5 minimum copayment.If brand is medically necessary and approved by MedImpact Health Systems: 30%coinsurance after calendar year deductible at retail and mail order pharmacy with 5minimum copayment.If a generic is available: 30% coinsurance of brand drug's cost plus the differencebetween the brand and generic after calendar year deductible at retail and mail orderpharmacy with 5 minimum copayment.If no generic is available: 30% coinsurance after calendar year deductible at retail andmail order pharmacy with 5 minimum copayment.If brand is medically necessary and approved by MedImpact Health Systems: 30%coinsurance after calendar year deductible at retail and mail order pharmacy with 5minimum copayment.QuantityPurchase 90 days at participating retail pharmacies or the mail order pharmacy formaintenance medications.Purchase 90 days at participating retail pharmacies or the mail order pharmacy formaintenance medications.Prior AuthorizationSome drugs may require a prior authorization.Contact the pharmacy benefits number on your prescription drug card.Some drugs may require a prior authorization. Contact the pharmacy benefits numberon your prescription drug card.730 day starter quantity for new medication, including change in strength, or themedication has not been filled for the previous six months.

MoDOT/MSHP 2022 MEDICAL INSURANCE MONTHLY PREMIUMSEFFECTIVE JANUARY 1, 2022MoDOT/MSHP Anthem PPO PlanPremiumRate CategoryEmployer ShareSubscriber's CostACTIVE EMPLOYEE MEMBERS 511.00 417.00 94.00Subscriber/Family 1,553.00 1,267.00 286.00Subscriber/Spouse 1,123.00 916.00 207.00Subscriber/Child 715.00 583.00 132.00Subscriber/2 Children 918.00 749.00 169.00Subscriber OnlyNON-MEDICARE RETIREE MEMBERSSubscribers retiring effective 1/1/2015 and later will receive a state contribution of 2 percent per year of service, not to exceed 50 percent. 667.00 380.00 287.00Retiree - Subscriber/Family 2,027.00 892.00 1,135.00Retiree - Subscriber/Spouse 1,334.00 534.00 800.00Retiree - Subscriber/Child 1,334.00 587.00 747.00Retiree - Subscriber/2 ChildrenRetiree - Subscriber Only 1,518.00 607.00 911.00Retiree - Non-Medicare Subscriber/Medicare Child 999.00 460.00 539.00Retiree - Non-Medicare Subscriber/Medicare Spouse 999.00 450.00 549.00MEDICARE MEMBERSSubscribers retiring effective 1/1/2015 and later will receive a state contribution of 2 percent per year of service, not to exceed 50 percent.Retiree - Medicare Subscriber Only 332.00 189.00 143.00Retiree - Medicare Subscriber/Non-Medicare Spouse 999.00 400.00 599.00Retiree - Medicare Subscriber/Medicare Spouse 664.00 299.00 365.00Retiree - Medicare Subscriber/Non-Medicare Family 1,692.00 744.00 948.00Retiree - Medicare Subscriber/Medicare Family 1,240.00 608.00 632.00Retiree - Medicare Subscriber/Child 999.00 440.00 559.00Retiree - Medicare Subscriber/Medicare Child 664.00 305.00 359.00 1,183.00 473.00 710.00Retiree - Medicare Subscriber/2 Children 332.00 189.00 143.00Survivor - Medicare Subscriber/Non-Medicare Family 1,692.00 744.00 948.00Survivor - Medicare Subscriber/Medicare Family 1,240.00 608.00 632.00Survivor - Medicare Subscriber/Child 999.00 440.00 559.00Survivor - Medicare Subscriber/Medicare Child 664.00 305.00 359.00 1,183.00 473.00 710.00Survivor - Medicare Subscriber OnlySurvivor - Medicare Subscriber/2 Children8

MoDOT/MSHP Anthem PPO PlanPremiumRate CategoryEmployer ShareSubscriber's CostMEDICARE MEMBERS (continued)LTD - Medicare Subscriber Only 332.00 189.00 143.00LTD - Medicare Subscriber/Non-Medicare Spouse 999.00 400.00 599.00LTD - Medicare Subscriber/Medicare Spouse 664.00 299.00 365.00LTD - Medicare Subscriber/Non-Medicare Family 1,692.00 744.00 948.00LTD - Medicare Subscriber/Medicare Family 1,240.00 608.00 632.00 999.00 440.00 559.00 1,183.00 473.00 710.00WRD - Medicare Subscriber Only 332.00 271.00 61.00WRD - Medicare Subscriber/Non-Medicare Spouse 843.00 688.00 155.00WRD - Medicare Subscriber/Medicare Spouse 664.00 542.00 122.00WRD - Medicare Subscriber/Non-Medicare Family 1,374.00 1,121.00 253.00WRD - Medicare Subscriber/Medicare Family 1,094.00 892.00 202.00WRD - Medicare Subscriber/Child 536.00 437.00 99.00WRD - Medicare Subscriber/2 Children 739.00 603.00 136.00Vested - Medicare Subscriber Only 332.00 0.00 332.00Vested - Medicare Subscriber/Non-Medicare Family 1,374.00 0.00 1,374.00Vested - Medicare Subscriber/Medicare FamilyLTD - Medicare Subscriber/ChildLTD - Medicare Subscriber/2 Children 1,094.00 0.00 1,094.00Vested - Medicare Subscriber/Medicare Spouse 664.00 0.00 664.00Vested - Medicare Subscriber/Non-Medicare Spouse 843.00 0.00 843.00Vested - Medicare Subscriber/Child 536.00 0.00 536.00Vested - Medicare Subscriber/2 Children 739.00 0.00 739.00LTD Long Term DisabilityWRD Work Related Disability9

MoDOT/MSHP Anthem PPO PlanPremiumRate CategoryEmployer ShareSubscriber's CostOTHER PLAN CATEGORIESSubscribers retiring effective 1/1/2015 and later will receive a state contribution of 2 percent per year of service, not to exceed 50 percent. 511.00 0.00 511.00C.O.B.R.A. - Subscriber/Family 1,553.00 0.00 1,553.00C.O.B.R.A. - Subscriber/SpouseC.O.B.R.A. - Subscriber Only 1,123.00 0.00 1,123.00C.O.B.R.A. - Subscriber/Child 715.00 0.00 715.00C.O.B.R.A. - Subscriber/2 Children 918.00 0.00 918.00WRD - Subscriber Only 511.00 417.00 94.00WRD - Subscriber/Family 1,553.00 1,267.00 286.00WRD - Subscriber/Spouse 1,123.00 916.00 207.00WRD - Subscriber/Child 715.00 583.00 132.00WRD - Subscriber/2Children 918.00 749.00 169.00LTD - Subscriber Only 667.00 380.00 287.00LTD - Subscriber/Family 2,027.00 892.00 1,135.00LTD - Subscriber/Spouse 1,334.00 534.00 800.00LTD - Subscriber/Child 1,334.00 587.00 747.00LTD - Subscriber/2 Children 1,518.00 607.00 911.00LTD - Non-Medicare Subscriber/Medicare Child 999.00 460.00 539.00LTD- Non-Medicare Subscriber/Medicare Spouse 999.00 450.00 549.00 667.00 380.00 287.00Survivor - Subscriber/Family 2,027.00 892.00 1,135.00Survivor - Subscriber/Child 1,334.00 587.00 747.00Survivor - Subscriber OnlySurvivor - Non-Medicare Subscriber/Medicare ChildSurvivor - Subscriber/2 Children 999.00 460.00 539.00 1,518.00 607.00 911.00 511.00 0.00 511.00Vested - Subscriber/Family 1,553.00 0.00 1,553.00Vested - Subscriber/Spouse 1,123.00 0.00 1,123.00Vested - Non-Medicare Subscriber/Medicare Spouse 999.00 0.00 999.00Vested - Subscriber/Child 715.00 0.00 715.00Vested - Subscriber/2 Children 918.00 0.00 918.00Vested - Subscriber OnlyLTD Long Term DisabilityWRD Work Related Disability10

MoDOT/MSHP Anthem High Deductible PlanMoDOT/MSHP Anthem HDHPAvailable StatewidePremiumRate CategoryEmployer ShareSubscriber's CostACTIVE EMPLOYEE MEMBERS 464.00 417.00 47.00Subscriber/Family 1,411.00 1,267.00 144.00Subscriber/Spouse 1,020.00 916.00 104.00Subscriber OnlySubscriber/Child 650.00 583.00 67.00Subscriber/2 Children 834.00 749.00 85.00NON-MEDICARE RETIREE MEMBERSSubscribers retiring effective 1/1/2015 and later will receive a state contribution of 2 percent per year of service, not to exceed 50 percent. 605.00 380.00 225.00Retiree - Subscriber/Family 1,841.00 892.00 949.00Retiree - Subscriber/Spouse 1,211.00 534.00 677.00Retiree - Subscriber/Child 1,211.00 587.00 624.00Retiree - Subscriber/2 Children 1,379.00 607.00 772.00Retiree - Subscriber OnlyOTHER PLAN CATEGORIESSubscribers retiring effective 1/1/2015 and later will receive a state contribution of 2 percent per year of service, not to exceed 50 percent. 464.00 0.00 464.00C.O.B.R.A. - Subscriber/Family 1,411.00 0.00 1,411.00C.O.B.R.A. - Subscriber/SpouseC.O.B.R.A. - Subscriber Only 1,020.00 0.00 1,020.00C.O.B.R.A. - Subscriber/Child 650.00 0.00 650.00C.O.B.R.A. - Subscriber/2 Children 834.00 0.00 834.00WRD - Subscriber Only 464.00 417.00 47.00WRD - Subscriber/Family 1,411.00 1,267.00 144.00WRD - Subscriber/Spouse 1,020.00 916.00 104.00 650.00 583.00 67.00WRD - Subscriber/ChildWRD - Subscriber/2Children 834.00 749.00 85.00LTD - Subscriber Only 605.00 380.00 225.00LTD - Subscriber/Family 1,841.00 892.00 949.00LTD - Subscriber/Spouse 1,211.00 534.00 677.00LTD - Subscriber/Child 1,211.00 587.00 624.00LTD - Subscriber/2 Children 1,379.00 607.00 772.00 605.00 380.00 225.00Survivor - Subscriber/Family 1,841.00 892.00 949.00Survivor - Subscriber/Child 1,211.00 587.00 624.00Survivor - Subscriber/2 Children 1,379.00 607.00 772.00Survivor - Subscriber Only 464.00 0.00 464.00Vested - Subscriber/Family 1,411.00 0.00 1,411.00Vested - Subscriber/Spouse 1,020.00 0.00 1,020.00Vested - Subscriber OnlyVested - Subscriber/Child 650.00 0.00 650.00Vested - Subscriber/2 Children 834.00 0.00 834.0011

Basic/Optional Life Insurance Highlights for 2022Securian administers the following benefits; please contact them at 1-866-293-6047Beneficiary ChangesPortability and ConversionPlease remember to update yourbeneficiaries from time to time. It's veryimportant to review and update yourbeneficiary designations, especially whenyou experience a significant life event suchas marriage, divorce, birth, or adoption.Call Employee Benefits at 877-863-9406 toverify your current information and makechanges.MoDOT and MSHP employees havetwo options, or a combination of bothoptions, for continuing life insuranceafter their group term insurancecoverage ends due to employmentending or a change in employee status: Portability of coverage to a newterm insurance policy atportability rates, and/or; Conversion to a permanent lifeinsurance policy.Loss of CoverageThere are events that take place that cause aloss of coverage for your dependentchildren. You must notify us if yourdependents incur any of these events: PortabilityPortability is a benefit that provides theopportunity for employees to retaingroup life insurance regardless of healthstatus at the time when employmentstatus changes or employment ends.Child reaches age 26Child gets marriedChild joins the militarySpouse legally separatesConversionConversion is a benefit that provides theopportunity for employees to change thegroup life insurance to a whole lifeinsurance policy with a cash value,regardless of health status at the timeemployment status changes oremployment ends. Conversion rates aremuch higher than term insuranceavailable under portability, but yourpolicy builds cash value.Claims will not be paid if the above eventshave occurred.Additional Services AvailableSecurian offers special services to activeemployees only, at no additional costincluding: Legal Services Travel Assistance Beneficiary Financial Counseling Legacy Planning Accelerated Death BenefitTo apply for portability or conversion ofyour life insurance coverage, pleasecontact Securian at 1-866-293-6047.You must apply within 31 days from thedate your employment ends or youremployment status changes.For more information on the additionalservices available to you, please visitwww.modot.mo.gov/newsandinfo.benefits.htm12

MoDOT and MSHPOptional Life Insurance RatesEffective January 1, 2019 - December 31, 2023Employee, Long-Term Disability (LTD), Retiree, and Work Related Disability(WRD) Rates per Month:Age BracketRate per 1,000 Coverage Rate per 1,000 Coverage forfor Employee; LTD Recipient;Retiree; WRD RecipientWRD Recipient approvedapproved prior toafter July 1, 2004July 1, 2004Under Age 2525 *BLT 30 0.033 0.041 0.060 0.07030 *BLT 35 0.049 0.09035 *BLT 40 0.057 0.12040 *BLT 45 0.066 0.15045 *BLT 50 0.107 0.24050 *BLT 55 0.172 0.38055 *BLT 60 0.287 0.57060 *BLT 65 0.443 0.88065 *BLT 70 0.902 1.76070 *BLT 75 1.689 3.45075 *BLT 80 1.689 4.07280 and Over 1.689 4.470*But Less ThanSpouse Life Rates per Month:Rate is based on the policy holder's age

MEDICAL AND LIFE INSURANCE PLAN 105 West Capitol PO Box 270 Jefferson City, MO 65102 Toll free Voice Fax 877-863-9406 573-526-0138 573-522-1482 All Subscribers and Dependents of the MoDOT/MSHP September 15, 2021 Medical and Life Insurance Plan (Plan)