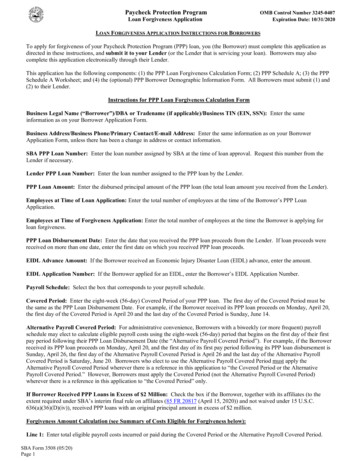

Transcription

Bench GuidesThe EIDLHandbook forBusiness Owners

EIDL Handbook For Business OwnersThe Economic Injury Disaster Loan(EIDL) contains some of the best loanterms you’ll find.But once you’ve been approved, there’s a lot of fineprint to keep track of. What can you spend the fundson? How do you track what you’ve spent the money on?Consider this your definitive guide to EIDL once you’vebeen approved.Guide toEIDLPart One:The rulesof the EIDLWe’ll outline the conditions of theEIDL and what you can and cannotspend the funds on. We’ll also walkthrough the bookkeeping andrecordkeeping requirements for goodEIDL financial hygiene.Part Two:How tobest useyour fundsWe’ll identify important areas a smallbusiness can invest in to build a rocksolid financial and strategicfoundation.1

EIDL Handbook For Business OwnersPart one: The rules of the EIDLHaven’t applied for EIDL yet?The EIDL is to be used as working capital. Working capital refers to funds you use to cover dayto-day operations. That may seem broad and vague, but it’s meant to be a versatile loan, whereyou can choose to spend the funds however you wish.Haven’t applied for EIDL yet? You canapply online through the SBA portal.https://covid19relief.sba.gov/#/Learn MoreExample: A restaurant’s day-to-day expenses would include their food ingredients and workerpayrolls. It would not include patio expansion or new signage.Allowed expensesAny of your day-to-day normal operating expenses can be drawn on these funds.Some example expenses include: web hostinginventoryoffice suppliesaccounts payablepayrollrent and utilitiesmerchant feesbookkeeping and accounting services2

EIDL Handbook For Business OwnersProhibited expensesInstead of listing everything you can use EIDL funds on, it mightbe easier to know what you cannot use EIDL funds for. Theserestrictions are adapted from the SBA’s Standard OperatingProcedures (SOP 50 30 9).You cannot use EIDL funds for: Dividends and bonuses of any type Disbursements to owners, except when directly related to performance ofservices This includes payments to partners, officers, directors, or stockholders. Repayment of stockholder / principal loans An exemption is allowed if the funds were added into the company on aninterim basis as a result of the disaster, and non-repayment of the loanwould cause an undue hardship on the stockholder Expansion of facilities or acquisition of fixed assets This includes equipment purchases such as a new video camera Repair or replacement of physical damages Refinancing long term debt Prohibited examples include refinancing credit card debt or a mortgage Paying down or paying off other loans provided by the SBA or anotherFederal agency Any repayment, even a regular installment payment, is not allowed Payment of any part of a direct Federal debt except IRS obligations Relocation Penalties due to noncompliance with a law, regulation, or order from anygovernment agency Contractor malfeasance Additional expenses due to contractor fraud is not covered by EIDL fundsA common question we receive is whether credit card payments are allowed.If you charge your day-to-day purchases to a credit card, it is acceptable topay the monthly credit card balance with EIDL funds. You may also makemonthly payments on outstanding loans (both the interest and principal areacceptable). You just cannot use EIDL funds to pay off any existing debtsfrom before the pandemic.3

EIDL Handbook For Business OwnersUsing EIDL with the PPPYou cannot use EIDL funds for the same expenses as PPP funds. For example, if youused PPP funds for July payroll, you should either wait until your PPP funds areexhausted before using EIDL funds for payroll, or just use EIDL funds on other workingcapital expenses. If an EIDL loan financed between January 31 and April 3 is used forpayroll costs, it will be refinanced into your PPP loan if you apply for one.We recommend trying tospend your PPP funds first,because eligible PPPexpenses must be incurredover your 24-week PPP loanperiod to be forgiven.Further reading: EIDL vs. PPP (A /eidl-vs-ppp/Recordkeeping and bookkeeping for the EIDLThere are a number of conditions that come with your EIDL. We want to highlight twoconditions in particular:TrackingreceiptsYou’re required to collect and itemize all receipts and contracts forexpenses paid with EIDL funds, and keep them for at least threeyears. Receipts refer to paid receipts, invoices, or cancelled checks.Bench clients, you can forward copies of your receipts to yourdesignated Bench email address. Your bookkeeper will file andstore them properly for you.FinancialrecordkeepingThe SBA requires that you keep financial records spanning themost recent five years, and up until three years after your loan ispaid off. These records include your financial and operatingstatements, your tax returns, and records of distributions anddividends.This means you’ll need to have the last five years of bookkeepingcompleted, and you’ll need to keep your bookkeeping up-to-date,right up until three years after your loan is paid off.Further reading: EIDL Recordkeeping ngRead Moreeidl-loan/4

EIDL Handbook For Business OwnersFinancial hygiene for the EIDLAfter you’ve received the EIDL, here’s a checklist of financial to-dos you’ll want totake care of:Notify your bookkeeper when the EIDL is deposited into your account,ensure you have the last five years of bookkeeping completedProvide your bookkeeper with a copy of your loan agreement andamortization schedule so your principal and interest payments areaccurately recordedFile your 2019 taxesNegotiate with vendors and landlords to come up with a payment planBuild out various financial scenarios to estimate if you’ll have enough cashDoing your own bookkeeping?Your books will have a new liability ledger for your EIDL. The initial transaction willdebit your cash or account ledger, and credit your loan payable ledger.After your automatic 12-month deferral period ends, you will begin makingrepayments on the loan. To account for this in your books, you will credit your cash oraccount ledger, and debit both the loan payable ledger as well as the interest expenseledger.If you need catch-up bookkeeping done for the EIDL, or you need ongoinghttps://bench.co/go/eidlbookkeeping, Bench can help.bookkeeping/You run your business. We’llkeep your books up to date.Bench gives you a dedicated bookkeeper tohelp you meet the conditions of your EIDLloan and take tedious financial admin off yourplate — for good.https://bench.co/go/eidlLearn Morebookkeeping/5

EIDL Handbook For Business OwnersPart two: How to best use your fundsYour EIDL funds should be used for your day-to-day business activities. But if you have somewiggle room in your operating budget, here are some areas we think are worth investing in now:Business financialsHaving reliable financial statements is critical both for filing your taxes, and forknowing exactly where your business stands. It’s hard to know how to makesmart business decisions if you’re not working with real, up-to-date numbers.Plus, getting caught up on your books will put you in compliance with the EIDLloan agreement conditions we mentioned earlier.Example expenses you can spend EIDL funds on: catch up bookkeeping, taxfiling consultation, payroll system, invoicing software.Digital presenceLook for ways to connect and engage with customers digitally during thepandemic. You can set up a basic website and social media presence in less thana day.If you’re already established online, you can launch a new marketing campaign,research how your competitors are doing, or update your website content.Example expenses you can spend EIDL funds on: website domain and hosting,social media advertising, photography and design services, mobile orderingsoftware.6

EIDL Handbook For Business OwnersClient relationshipsA personal touch can mean a lot more in these uncertain times. Building systemsto engage with your customers on a more personal level can help you stand outfrom the competition.Example expenses you can spend EIDL funds on: customer relationship software,referral program, gift card system, thank you cards.Free small business resourcesRunning a small business during a pandemic is no simple task. There are freeresources that business owners like you can take advantage of, including remotementorship, webinars, courses, and workshops. https://www.sba.gov/learning-centerSBA Learning Center SCOREhttps://www.score.org/Business Mentors SmallBusiness Development Centerhttps://www.sba.gov/sbdc/ Associationhttps://aeoworks.org/for Enterprise Opportunityhttps://bench.co/blog/ PPPand EIDL FAQ Blog by BenchNeed help with your EIDL bookkeeping?Bench can help. We’ll get you caught up from the last five years, and keep youcurrent for the next three years to perfectly comply with SBA ping/This guide is provided for informational purposes and does not constitute legal, business, or tax advice. Consultwith your own attorney, business advisor, or tax advisor with respect to matters referenced in this resource.7

capital expenses. If an EIDL loan !nanced between January 31 and April 3 is used for payroll costs, it will be re!nanced into your PPP loan if you apply for one. We recommend trying to spend your PPP funds !rst, because eligible PPP expenses must be incurred over your 24-week PPP loan period to be forgiven. Further reading: EIDL vs. PPP (A .