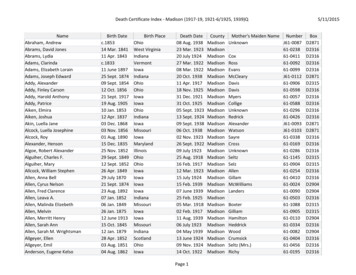

Transcription

COUNTY OF MADISON, VIRGINIADraft FY2020 BudgetPrepared May 1, 2019For Presentation during Public Hearings on May 7, 2019

ContentsCover PageTable of ContentsList of Madison County OfficialsA. Budget MessageB. Budget Overview Presentation (to be presented on May 7)C. Goals and PrioritiesD. Overview of General FundE. Overview of Other Operating FundsF. Capital Improvement PlanG. Financial PoliciesH. Use of Fund Balance/Reserve CalculationI. Employee Classification and Compensation PlanAppendices:1. Original Budget Development Schedule2. Madison County School Board Budget Request3. Madison County Social Services Board Budget Request4. Madison County Parks and Recreation Authority Budget Request5. Operating Expenditure Details6. Capital Budget Details7. Revenue Projection Details8. Public Noticesa. Budget Advertisementb. Tax Rate Advertisementc. Administrative Fees Advertisement9. Adoption Ordinances and Resolutionsa. Tax Rate Ordinance (To be presented for approval on May 14)b. Operating Budget Resolution (to be presented for approval on May 14)c. Capital Budget Resolution (to be presented for approval on May 14)d. Administrative Fees Resolutione. Appropriation Resolution(s) (to be presented for approval in June)3

COUNTY OF MADISON, VIRGINIA OFFICIALSBOARD OF SUPERVISORSR. Clay JacksonAmber FosterJonathon WeakleyCharlotte HoffmanKevin McGheeDEPARTMENT OF SOCIAL SERVICES BOARDNorris JohnJoseph GoodallCharlotte HoffmanTina WeaverJerry ButlerMADISON COUNTY SCHOOL BOARDBarry Penn HollarKaren M. AllenRobert ChappellArthur GreeneNita CollierOTHER OFFICIALSErik WeaverLeeta LoukClarissa BerryBrian DanielStephanie MurrayJack HobbsMary Jane CostelloAnna GrahamValerie WardSheriffClerk of the Circuit CourtCommonwealth’s AttorneyCommissioner of the RevenueTreasurerCounty AdministratorAssistant County Administrator/Finance DirectorSuperintendent of SchoolsDirector of Social Services5

Jack HobbsCounty AdministratorChairmanR. Clay JacksonVice-ChairmanAmber FosterBOARD MEMBERSJonathon WeakleyKevin McGheeCharlotte HoffmanMadison CountyBoard of SupervisorsDA:May 1, 2019TO:Madison County Board of SupervisorsBY:Jack Hobbs, County AdministratorRE:FY20 Budget MessageSean D. GreggCounty Attorney302 Thrift RoadP. O. Box 705Madison, Virginia 22727(540) 948-7500F(540) 948-3843As per customary practice and the requirements imposed on Madison County by the Code of Virginia, andfollowing its development via a series of public meetings and many hours of work by the County staff, aconsolidated budget proposal for Madison County’s July 1, 2019-June 30, 2020 fiscal year is herebytransmitted to the Board of Supervisors for consideration.This is a maintenance and catch-up budget, built around the premises that existing County services will beoffered next year and that the County will continue addressing a series of challenges that have faced thecommunity for several budget cycles. It does, however, endeavor to position the County to sustainoperations, take advantage of opportunities and meet challenges anticipated in the next few years.The proposal also continues the effort by the Madison County Board of Supervisors to be clearer and moretransparent its operations to the County’s residents and business operators in that information above andbeyond the minimum required by the Code of Virginia is included. As per recent practice, staff willendeavor to be timely in posting all relevant budget documents on the County web site.Everyone understands the County’s overall financial situation. To pay for everything that needs to be done,an increase in the real estate tax rate – on top of the increase in assessed values – and over 1,000,000 insavings is needed to balance next year’s budget. Further, next year we need to identify ways to begin closingthat gap as well as find monies to pay back loans for the planned school improvement and public safetyradio projects as well as other areas since cost increases have surpassed revenue growth.I offer the following as an “executive summary” of this proposal:Budget SynopsisOperating outlays (net interfund transfers of 12,417,901) total 41,808,989. Receipts of “new” moniestotal 40,731,807, and the proposed FY2020 budget is balanced using 1,077,182 accumulated from prioryear surpluses (fund balance).Capital spending in FY20 is budgeted at 3,517,388 and is financed using fund balance monies.7

Page 2 of 2May 1, 2019FY20 Budget MessageThe effect of the reassessment, growth in the tax base and higher rate is expected to yield an additional 955,000 in real estate tax revenue. The proposed budget contains no other changes to Madison Countytax levies or fees.No new debt is projected for FY20 although significant borrowing in FY21 should be anticipated.OperationsFollowing major changes to the operation budget are of note: 955,000 in additional real estate tax revenue 100,000 in additional personal property tax (based on trend) 100,000 in additional interest revenueAn expense reduction of 163,725 since the real estate reassessment project has been completed. 285,200 in increased Sheriff’s Department costs 351,071 in increased Emergency Medical Services costs 37,282 in additional funding for the Parks and Recreation Authority 691,182 in additional local tax-funded contributions to the school operating fund (6.91%)A provision of 1,187,781 has been included for contingencies. This amount includes monies tocover known items where information is current incomplete as follows:IT Initiative ImplementationCompensation Study ImplementationReserve for Development Services ReorganizationReserve for Increased EMS OperationsHealth Insurance Increases (County & DSS)Public Safety: Reserve for tactical gearFire Department: Match for Radio GrantUnspecified Administrative SupportReserve for Solid Waste ManagementAccrued leave payoutMiscellaneous adjustmentsTotal earmarked contingencyGeneral contingency per policy 124,167 100,000 50,000 241,801 141,069 8,000 40,000 25,000 81,605 40,000 86,419 938,061 249,720 1,187,781DonationsDiscretionary monies have been provided for the support of a series of agencies that provide discretionarybut important services to Madison County as follows:Donee Agency/DepartmentThomas Jefferson EMS CouncilJefferson Area Community CorrectionsServices to Abused FamiliesFoothills Child Advocacy CenterPiedmont Regional Dental ClinicGermanna Community CollegeBoys and Girls ClubSenior CenterFY20 Proposed 7,7438,2861,0002,4002,5005,0002,0005008 Change 149-% Change1.83%Page A-2

Page 2 of 3May 1, 2019FY20 Budget MessageMadison County FairMadison LibraryCentral Va Economic Development PartnershipFoothills Housing CorporationAging TogetherPiedmont Workforce NetworkSkyline CAPWater Quality Management ProgramNorthern VA 28-8.81%-Capital and One-time SpendingThe County is preparing for major outlays in the Madison Primary School renovation project and the publicsafety radio system replacement project that would be funded by a combination of fund balance and loanfinancing in FY21. Other capital work is planned during FY20. Monies have been provided to support aseries of projects and other significant one-time uses of funds as itiesCounty AdminDP & TechnologyComm AttyFacilitiesEmerg CommEMSEMSEMSEmerg CommEmerg CommFacilitiesFacilitiesSchool BoardSchool BoardSchool BoardSchool BoardSchool BoardSchool BoardDescriptionVehicle replacementEquipment replacementHVAC (allowance, various buildings)Parking Lot Paving (allowance, various sites)Master CIP/Asset Management PlanningRecords management softwareCase management systemSecurity at Clerk's officeNext Generation 911Ambulance (partially grant funded)Cardiac Monitor (partially grant funded)UltrasoundPub Safety Radio System-Design & BackbonePub Safety-Mobiles/Portables (partially grant funded)Thrift Road/Admin Complex ConsolidationCriglersville School RepurposingBus ReplacementMPS Primary School RenovationWYES Safety VestibuleMCHS Safety VestibuleWMS Asphalt (Playground/Basketball Area)WYES Flat Roof Section ReplacementProposed anges to the personnel portions of the budget include an array of pay adjustments that have already beenapproved, a 3% cost of living adjustment, and monies that would fund adjustments identified in thepersonnel study that will be presented for consideration in the near future.A Sheriff’s Department investigator and an employee that would focus on IT are envisioned for next year.9Page A-3

Page 2 of 4May 1, 2019FY20 Budget MessageScheduleTo meet the requirements of the Code of Virginia, the Madison County Board of Supervisors shouldconsider: Hold the required budget hearings as advertised on May 7.Adjust the budget and other documents if better ideas are presented between now and the plannedMay 14 adoption date.Authorize the implementation of the operating budget and certain portions of the capital budgetvia an appropriation resolution during a regular meeting before July.It is my opinion that the proposal presented under cover of this memorandum is responsible, realistic andachievable and it is the best the Board of Supervisors will be able to do due to the current state of affairs. Ilook forward to working with the Board, County staff and others to implement the work plan it represents.10Page A-4

The budget presentation will be available during the May 7, 2019 meeting of the Board of Supervisors.11

Madison County Goals and PrioritiesApril 27, 20191. Complete the recodification project2. Create a records management system for leases, charters, contracts, etc. that is integrated with acalendar that tracks major anticipated contract renewals, deadlines, or required actions3. Review and redevelop the emergency medical system program and relationships with the MadisonCounty Rescue Squad4. Implement accepted information technology recommendations5. Update the purchasing policy and institute improved processes in the areas of procurement practicesand record keeping6. Complete the personnel study and implement a new position classification and compensation plan andother accepted recommendations7. Evaluate and prioritize the following staffing issues and begin implementing approved realignmentand/or capacity additions:a. Transitioning the Emergency Services Coordinator to a full-time positionb. Developing an in-house information technology capability for better coordination and managementof IT hardware, software and contractors. In this context, IT includes areas such as the network/emailsystem, the accounting system, coordinating Lumos/Comcast services, desktop/laptop units, thetelephone system, security systems and website maintenance.c. Improving administrative and clerical support to assist with peak work flow and cover long-termabsencesd. Improving management services to assist the various department in grant writing, policy research,procurement, in-house document and plan preparation, project management, etc.e. Increasing human resources support assistance for supervisors in dealing with personnel issues suchas recruitment and disciplinef.Realigning community development functions to better coordinate the efforts of the building, zoningand economic development departments and the Planning Commission8. Establish an ongoing capital improvement planning program to involve all county-funded departmentsand agencies (including PRA, Social Services and school system). Projects that would be pursued duringthe planning period include:a. Resolving the Criglersville Elementary School situationb. Procuring and financing the public safety radio system replacementc. Deciding what is necessary and appropriate then financing the renovation of Madison CountyPrimary Schoold. Renovating the Administration Building and former Health Department building, relocating staff fromthe Thrift Road site to that campus and preparing the Thrift Road site for disposale. Resolving the Moore Building acquisition issuef.Studying the Courthouse security, building moisture/mold issues, and window replacement problems13Page C-1

Proposed FY20 General Fund BudgetEXPENDITURESGeneral government administrationJudicial administrationPublic safetyPublic worksHealth and welfare (excl. VPA & CSA)Education (excl. contrib. to School Board)Parks, recreation, and culturalEconomic developmentNondepartmentalTransfers to other funds Total General Fund expenditures ,8795,000453,522535,400317,89811,707,198 5,0945,000502,432545,5181,193,53112,362,901 8,91010,118875,633655,70322,763,843 24,971,959 2,208,116 19,754,6532,638,568138,117155,69576,810 21,048,1342,657,014134,62955,0001,077,182 1,293,48118,446(3,488)(100,695)1,000,372Total General Fund revenues 22,763,843 24,971,959 2,208,116REVENUESRevenue from local sourcesRevenue from CommonwealthRevenue from Federal GovernmentTransfer from other fundUse of accumulated fund ��2.53%‐64.67%1302.40%9.70%Page D-1

Proposed FY20 Non‐General Fund Operations BudgetEXPENDITURESTransient Occupancy Tax (TOT) FundTourismTransfer to other fundTotal TOT Fund expenditures 50,00047,50097,500 50,00055,000105,000 ‐7,5007,5000.00%15.79%7.69%School Operating Fund 20,437,141 21,079,959 642,8183.15%School Food Fund 875,000 885,000 10,0001.14%Virginia Public Assistance (VPA) Fund 2,778,429 2,997,564 219,1357.89%Children's Services Act (CSA) Fund 2,953,920 2,750,000 (203,920)‐6.90%County Capital Projects FundTransfer to other fund 108,195 (108,195)0.00% ��1.72%‐12.39%‐3.44%‐Debt Service FundPrincipal paymentsInterest expenseTotal Debt Serv. Fund expenditures 1,247,834240,8291,488,663Total expenditures 51,502,691 54,226,890 901 2,893 39,639,798 41,808,989 2,169,1915.47% 97,500 105,000 7,5007.69% 9,918,563878,386901,6548,738,53820,437,141 9,904,699888,386857,1549,429,72021,079,959 20,000452,000403,000875,000 20,000452,000413,000885,000 843,9891,439,083‐495,3572,778,429 882,3821,540,87479,089495,2192,997,564 Less transfers to other funds:Transfer from GF to School Operating FundTransfer from GF to VPA FundTransfer from GF to CSA FundTransfer from GF to Debt Service FundTransfer from Cap Proj to GFTransfer from TOT Fund to GFTotal transfers to other fundsTotal expenditures, net of transfers to other funds 79%4.68%REVENUESTransient Occupancy Tax (TOT) FundTransient occupancy taxSchool Operating FundRevenue from the CommonwealthRevenue from the Federal GovernmentOther revenueTransfer from other fundTotal School Op. Fund revenuesSchool Food FundRevenue from the CommonwealthRevenue from the Federal GovernmentOther revenueTotal School Food revenuesVirginia Public Assistance (VPA) FundRevenue from the CommonwealthRevenue from the Federal GovernmentOther revenueTransfer from other fundTotal VPA revenuesChildren's Services Act (CSA) FundRevenue from the CommonwealthTransfer from other fundTotal CSA revenues 4.55%7.07%N/A‐0.03%7.89% (219,834)15,914(203,920)‐11.16%1.62%‐6.90% (108,195)‐(51,255)‐3.44% 1,969,280984,6402,953,920County Capital Projects FundUse of accumulated fund balance 108,195 Debt Service FundTransfer from other fund 1,488,663 1,437,408 Total revenues 51,502,691 54,226,890 2,724,199 8,738,538 9,429,720 691,182 91,182642,818‐ 5.29%Less transfers from other fundsTransfer to School Operating Fund from GFTransfer to VPA Fund from GFTransfer to CSA Fund from GFTransfer to Debt Service Fund from GFTransfer to GF from Cap Proj FundTransfer to GF from TOT otal transfers from other funds 11,862,893 12,417,901 555,0084.68%Total revenues, net of transfers from other funds 39,639,798 41,808,989 2,169,1915.47%16Page E-1

27-Apr-19FY20 CIP onFY19 tedFY23ProjectedFY24TotalNot ApprovedSources of FundsGrant FundsPaygoFund BalanceSchool Uses of FundsGeneral FundVarious CountyVehicle replacementSheriffVehicle replacementDP & TechnologyAdministration telephone systemDP & TechnologyEmail and server storage/backup systemFacilitiesEquipment replacementFacilitiesHVAC system replacements in variousbuildingsFacilitiesParking Lot PavingCounty AdminMaster CIP/Asset Management PlanDP & TechnologyIT StudyDP & TechnologyAccounting hardware/software replacementEMSAdditional buildng spaceEMSERV/Bariatric Str/Heart MonitorEMSERV/Bariatric Str/Heart Monitor-GrantDP & TechnologyRecords management softwareComm AttyCase management systemFacilitiesSecurity at Clerk's officeEmergency CommunicationsNext Generation 911EMSAmbulanceEMSAmbulance-GrantEMSCardiac MonitorEMSCardiac Monitor-GrantEMSUltrasound2324252627County Capital Improvement FundEmerg Comm EmergPub Safety radio - Design & BackboneComm Comm EmergEmergPub Safety radio - Mobiles/PortablesCommEmerg Comm EmergPub Safety radio - Mobiles/PortablesCommFacilitiesThrift Road/Admin Complex ConsolidationFacilitiesCriglersville School Repurposing2829Transient Occupancy Tax (TOT) FundTourismWelcome SignsEcon Dev & TourismPurchase Moore buildingEcon Dev & TourismPurchase Moore 20,00010,000FFF60,00025,000FF25,000FPP20,000 F20,000 F10,000 F40,000229,805PP20,000 F20,000 F10,000 F229,805Debt Service YrsRate, %Pmts/yr512Sheriff vehicle rreplacment planPNo progressInstalled but not configuredNone purchased Allowance budgetReplacements underway Allowance budgetNo progress Allowance budgetProgrammed in 2018 for better planning & estimatesUnderway214,7671,000,000 F120,000249,805Reference/NotesCounty vehicle replacement plan 75,000 installation consulting 3 305,999 Postmodern Y1- 166,232 AnnualFUnderwayOn order See matching grant; supplemented with operating budget moniesOn order Grant 350,000FFGFFPriorities list; figures are best guessPriorities list; figure is best guess and for study onlyInitial installation to be funded by the stateContingent upon grant monies; might be 80% grant, 20% County3,275,000Assume 10y@5% w/monthly pmts:B 416,837 10Priorities listPriorities listPriorities list; 120/SF for 5,600SF Health Dept then 5,300SF Admin607,000 FPriorities list; engineer's estimate is 145,000 plus 300,000 asbestos contingencyUnderwayPriorities list; purchase price, funding with lodging tax monies and amout to finance TBD100,000 P195,000 PAssume lease-purchase 10y@5% w/monthly pmts: 24,819 10512 991,872 2052Ref lease/purchase contract for owner financing terms12345678910111213141516171819202122School Operating FundSchool BusesSchool Bus ReplacementSchool Capital Improvement FundWMSWindows ReplacementMPSPrimary School Planning StudyMPSPrimary School RenovationSBOSBO Boiler ReplacementMCHSFootball Field FenceMPSMCPS Gym HVAC ReplacementMPSHoover Ridge Softball Field InstallationMCHSParking Lot RepairMCHSTrack ResurfacingWMSSafety VestibuleWYESSafety VestibuleMCHSSafety VestibuleWMSAsphalt (Playground/Basketball Area)WYESFlat Roof Section ReplacementWYESFire, Intercom, & Clock Systems UpdateMCHSParking Lot Milling, Paving, StripingMPSParking Lot Milling, Paving, StripingWYESParking Lot Milling, Paving, StripingWMSParking Lot Milling, Paving, StripingSBOParking Lot Milling, Paving, StripingBus shopParking Lot Milling, Paving, StripingSchool CIPTotal CIP174,00087,000F87,000 F87,000F87,000 F87,000 F110,62965,000 F193,529 F64,900 F40,000 F30,815 F30,000 S18,800 F10,000 F40,000 F342,105 F45,00050,00040,00040,000CompletedCompleted Approppriated Sepember 25, 2018 13,050,000 project ; First approp on March 26, 2019 Assume 20y@5% w/semiannual pmts:Appropriated November 13, 2018Appropriated July 24, 2018Appropriated March 12, 2019Appropriated July 24, 2018Appropriated March 12, 2019Appropriated July 24, 2018Appropriated April 23, 2019Tentative estimate12,449,366 BFFFF53,665Due to significant changes in direct, appropriated funds areshown under "FY19 Budgeted" for the school CIP. Forreference, the original budget is 7,000 F140,665560,470497,000816,805FFFF1735,000 F75,000 F197,000426,805School Bus Replacement87,000HVAC Project (Primary school)Athletic Field Fence (MCHS)Track Resurfacing (MCHS)Light Soccer Field (Primary school)Softball Field Installation (Hoover Ridge)100,00025,00045,000100,00030,000387,000Page F-1

COUNTY OF MADISON, VIRGINIAFinancial PoliciesContentsA.Policy Objective and Goals . 2B.Operating Budget Policies . 2C.Capital Budget Policies . 4D.Asset Maintenance, Replacement and Enhancement Policies . 5E.Debt Policies . 7F.Fund Balance Policies . 7G.Summary of Key Financial Policy Ratios* . 10Page 1Approved March 27, 201818Page G-1

A. Policy Objective and GoalsThe County of Madison has a responsibility to carefully account for public funds, to manage its financesprudently, and to diligently and effectively allocate its resources to provide to its citizens thegovernmental services they desire. Fiscal integrity is critical and should form the basis of the County’smanagement and decision-making processes of its fiscal affairs. The primary objective of establishingFinancial Policies is to provide a framework within which sound financial decisions may be made for thelong-term betterment and stability of the County. The County’s financial policies will provide guidelinesand goals to guide its financial practices.The goals of the Financial Policies are to:oGuide the Madison County Board of Supervisors in reaching a consensus on the financialcondition it wants for the County.oProvide a link between long‐range financial planning and current operations.oPromote long- term financial stability by establishing clear and consistent guidelines.oProvide a framework for evaluating the fiscal impact of budgetary decisionsrelated to providing government services and programs.oReduce the risks to the County of experiencing fiscal crises.The Financial Policies shall be reviewed periodically by the Board of Supervisors.B. Operating Budget Policies1.The annual Madison County operating budget will be prepared consistent with guidelinesestablished by the Code of Virginia.2.The operating budget will be structured so that the Board of Supervisors and the public canunderstand the relationship between revenues and expenditures.3.The goal of the County is to fund all recurring expenditures with recurring revenues and to usenon‐recurring revenues only for non‐recurring expenses.4.The unassigned General Fund Balance in excess of the 18% target may be used for variousexpenditures as described in the Fund Balance Policies section below. The General Fund as usedin this Financial Policies document has the same meaning as it does in the County’s auditedfinancial statements. It includes primary governmental activities; unless otherwise noted, it doesnot include the County’s component units, i.e., the School Board and the Parks and RecreationAuthority.5.Revenues will be projected conservatively, but realistically, considering:Page 219Approved March 27, 2018Page G-2

ooooPast experience;The volatility of the revenue source;Inflation and other economic conditions; and,The costs of providing directly associated services.6.When revenue shortfalls are anticipated in a fiscal year, spending during the fiscal year shouldbe reduced sufficiently to offset current year shortfalls. When it is not practical to reduceexpenditures in an amount sufficient to offset revenue shortfalls, the unassigned General Fundbalance may be used to supplement expenditure reductions.7.The budget shall be prepared in a manner that reflects the full cost of providing services.8.Expenditures will be projected conservatively considering:ooooA conservative, but likely, scenario of events (versus “worst case scenario”);Specific, identified needs of the program or service;Historical consumption and trends; and,Inflation and other economic conditions.9.An unplanned operating contingency line item shall be included in the annual operating budgetto provide the ability to react to unforeseen circumstances in operations that arise during thefiscal year. A minimum of 1% of total General Fund expenditures (excluding expenditures fromthe Transient Occupancy Tax {TOT}, Virginia Public Assistance {VPA}, and Children’s Services Act{CSA} funds) shall be budgeted in the contingency line item and shall be an annual appropriationthat will not accumulate and carry forward from year to year. The County, at its discretion, shallincrease the 1% contingency for specific, estimable amounts not included in departmentalbudgets.10.The County will prepare the capital improvement budget in conjunction with estimates ofavailable revenues in order to assure that the estimated costs and future impact of a capitalproject on the operating budget will be considered prior to its inclusion in the CapitalImprovements Plan.11.The Madison County Board of Supervisors will communicate with the Madison County SchoolBoard and Madison County Parks and Recreation Authority as and when appropriate to discussbudget needs.12.The operating budget preparation process will be conducted in such a manner as to allowdecisions to be made regarding anticipated resource levels and expenditure requirements forthe levels and types of services to be provided in the upcoming fiscal year. The following budgetprocedures will ensure the orderly and equitable appropriation of those resources:oOperating budget requests are initiated at the department level within target guidelinesset by the County Administrator.Page 320Approved March 27, 2018Page G-3

13.oIn formulating budget requests priority will be given to maintaining the current level ofessential services. New services will be funded through identification of new resources,reallocation of existing resources, and defunding nonessential services identified by theBoard of Supervisors and County Administration.oProposed program expansions above existing service levels must be submitted as abudgetary increment requiring detailed justification. Every proposed program expansionwill be scrutinized on the basis of its relationship to the health, safety and welfare of theCounty and is to include an analysis of long-term fiscal impacts.oProposed new programs must also be submitted as budgetary increments requiringdetailed justification. New programs will be evaluated on the same basis as programexpansions and are to include an analysis of long-term fiscal impacts.The operating budget is approved and appropriated by the County Board of Supervisors at thedepartment level. The operating budget will be balanced with proposed expenditures notexceeding anticipated revenues.oUse of excess unassigned fund balances should be used to balance budgets only afterreview of the County's reserve and capital needs.oThe County Administrator will submit a balanced budget to the County Board ofSupervisors.oThe County Board of Supervisors will adopt the budget.14.Budget adjustments within a department involving transfers from one category – i.e., personnel(pay and benefits), capital and operations - to another shall be approved by the CountyAdministrator.15.Beginning in the first year subsequent to to the adoption of these policies, quarterly cash basisactual-to-budget financial reports prepared after bank statement reconciliation will be providedto the Board of Supervisors within 45 days after the end of the quarter to enable the Board ofSupervisors to monitor and control the budget.16.Any amendments to the budget “which exceed one percent of total expenditures shown in thecurrent adopted budget must be accomplished by publishing a notice of the meeting and apublic hearing once in a newspaper having general circulation” at least seven days prior to themeeting date (State Code Section 15.2‐2507).C. Capital Budget Policies1.The County will

Skyline CAP 47,585 - - Water Quality Management Program 1,000 - - . software and contractors. In this context, IT includes areas such as the network/email system, the accounting system, coordinating Lumos/Comcast services, desktop/laptop units, the telephone system, security systems and website maintenance.