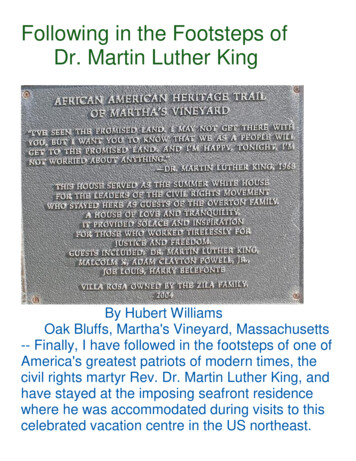

Transcription

LUTHER COLLEGE EMPLOYEEHEALTH PLANDECORAH IAHealth Benefit Summary Plan Description7670-00-412374Effective 01-01-2020BENEFITS ADMINISTERED BY

Table of ContentsINTRODUCTION . 1PLAN INFORMATION. 2BENEFIT CLASS DESCRIPTION . 4LOCATION DESCRIPTION. 5MEDICAL SCHEDULE OF BENEFITS . 6MEDICAL SCHEDULE OF BENEFITS .13TRANSPLANT SCHEDULE OF BENEFITS .19TRANSPLANT SCHEDULE OF BENEFITS .20OUT-OF-POCKET EXPENSES AND MAXIMUMS.21OUT-OF-POCKET EXPENSES AND MAXIMUMS.23ELIGIBILITY AND ENROLLMENT.25SPECIAL ENROLLMENT PROVISION.29TERMINATION .31COBRA CONTINUATION OF COVERAGE .33UNIFORMED SERVICES EMPLOYMENT AND REEMPLOYMENT RIGHTS ACT OF 1994.42PROVIDER NETWORK.43COVERED MEDICAL BENEFITS .46TELADOC SERVICES .57HOME HEALTH CARE BENEFITS .58TRANSPLANT BENEFITS.59PRESCRIPTION DRUG BENEFITS .61VISION CARE BENEFITS .62HEARING AID BENEFITS .63MENTAL HEALTH BENEFITS .64SUBSTANCE USE DISORDER AND CHEMICAL DEPENDENCY BENEFITS .66CARE MANAGEMENT.67COORDINATION OF BENEFITS .71RIGHT OF SUBROGATION, REIMBURSEMENT AND OFFSET.75GENERAL EXCLUSIONS.78CLAIMS AND APPEAL PROCEDURES .84FRAUD .93OTHER FEDERAL PROVISIONS .94HIPAA ADMINISTRATIVE SIMPLIFICATION MEDICAL PRIVACY AND SECURITY PROVISION.96STATEMENT OF ERISA RIGHTS. 100PLAN AMENDMENT AND TERMINATION INFORMATION . 102GLOSSARY OF TERMS. 103

LUTHER COLLEGE EMPLOYEE HEALTH PLANGROUP HEALTH BENEFIT PLANSUMMARY PLAN DESCRIPTIONINTRODUCTIONThe purpose of this document is to provide You and Your covered Dependents, if any, with summaryinf ormation in English on benefits available under this Plan as well as with information on a CoveredPerson's rights and obligations under the LUTHER COLLEGE EMPLOYEE HEALTH PLAN HealthBenef it Plan (the "Plan"). You are a valued Employee of LUTHER COLLEGE EMPLOYEE HEALTHPLAN, and Your employer is pleased to sponsor this Plan to provide benefits that can help meet Yourhealth care needs. Please read this document carefully and contact Your Human Resources orPersonnel office if You have questions or if You have difficulty translating this document.LUTHER COLLEGE EMPLOYEE HEALTH PLAN is named the Plan Administrator for this Plan. The PlanAdministrator has retained the services of independent Third Party Administrators to process claims andhandle other duties for this self-funded Plan. The Third Party Administrators for this Plan are UMR, Inc.(hereinaf ter "UMR") for medical claims, and Express Scripts for pharmacy claims. The Third PartyAdministrators do not assume liability for benefits payable under this Plan, since they are solely claimspaying agents for the Plan Administrator.The employer assumes the sole responsibility for funding the Plan benefits out of general assets;however, Employees help cover some of the costs of covered benefits through contributions, Deductibles,out-of-pocket amounts, and Plan Participation amounts as described in the Schedule of Benefits. Allclaim payments and reimbursements are paid out of the general assets of the employer and there is noseparate f und that is used to pay promised benefits. The Plan is intended to comply with and begoverned by the Employee Retirement Income Security Act of 1974 (ERISA) and its amendments.You may also contact the Employee Benefits Security Administration, U.S. Department of Labor at1-866-444-3272 or www.dol.gov/ebsa/healthreform. This website has a table summarizing whichprotections do and do not apply to grandfathered health plans.Some of the terms used in this document begin with a capital letters, even though such terms normallywould not be capitalized. These terms have special meaning under the Plan. Most capitalized terms arelisted in the Glossary of Terms, but some are defined within the provisions in which they are used.Becoming familiar with the terms defined in the Glossary of Terms will help You to better understand theprovisions of this Plan.Each individual covered under this Plan will be receiving an identification card that he or she may presentto providers whenever he or she receives services. On the back of this card are phone numbers to call incase of questions or problems.This document contains information on the benefits and limitations of the Plan and will serve as both theSummary Plan Description (SPD) and Plan document. Theref ore it will be referred to as both the SPDand the Plan document. It is being furnished to You in accordance with ERISA.This document became effective on January 1, 2016.-1-7670-00-412374

PLAN INFORMATIONPlan NameLUTHER COLLEGE EMPLOYEE HEALTH PLAN GROUPBENEFIT PLANName And Address Of EmployerLUTHER COLLEGE EMPLOYEE HEALTH PLAN700 COLLEGE DRDECORAH IA 52101Name, Address, And Phone NumberOf Plan AdministratorLUTHER COLLEGE EMPLOYEE HEALTH PLAN700 COLLEGE DRDECORAH IA 52101563-387-1415Named FiduciaryLUTHER COLLEGE EMPLOYEE HEALTH PLANEmployer Identification NumberAssigned By The IRS42-0680466Plan Number Assigned By The Plan505Type Of Benefit Plan ProvidedSelf -funded Health and Welfare Plan providing grouphealth benef its.Type Of AdministrationThe administration of the Plan is under the supervision ofthe Plan Administrator. The Plan is not financed by aninsurance company and benefits are not guaranteed by acontract of insurance. UMR provides administrativeservices such as claim payments for medical claims.Name And Address Of Agent ForService Of Legal ProcessLUTHER COLLEGE EMPLOYEE HEALTH PLAN700 COLLEGE DRDECORAH IA 52101Service of legal process may also be made upon the PlanAdministrator.Funding Of The PlanEmployer and Employee ContributionsBenef its are provided by a benefit Plan maintained on aself -insured basis by Your employer.Benefit Plan YearBenef its begin on January 1 and end on the followingDecember 31. For new Employees and Dependents, aBenef it Plan Year begins on the individual's Effective Dateand runs through December 31 of the same Benefit PlanYear.ERISA Plan YearJanuary 1 through December 31ERISA And Other Federal ComplianceIt is intended that this Plan comply with all applicablerequirements of ERISA and other federal regulations. Inthe event of any conflict between this Plan and ERISA orother f ederal regulations, the provisions of ERISA and thef ederal regulations will be deemed controlling, and anyconf licting part of this Plan will be deemed superseded tothe extent of the conflict.-2-7670-00-412374

Discretionary AuthorityThe Plan Administrator will perform its duties as the PlanAdministrator and in its sole discretion, will determineappropriate courses of action in light of the reason andpurpose for which this Plan is established and maintained.In particular, the Plan Administrator will have full and solediscretionary authority to interpret all Plan documents,including this SPD, and make all interpretive and factualdeterminations as to whether any individual is entitled toreceive any benefit under the terms of this Plan. Anyconstruction of the terms of any Plan document and anydetermination of fact adopted by the Plan Administrator willbe f inal and legally binding on all parties, except that thePlan Administrator has delegated certain responsibilities tothe Third Party Administrators for this Plan. Anyinterpretation, determination, or other action of the PlanAdministrator or the Third Party Administrators will besubject to review only if a court of proper jurisdictiondetermines its action is arbitrary or capricious or otherwisea clear abuse of discretion. Any review of a f inal decisionor action of the Plan Administrator or the Third PartyAdministrators will be based only on such evidencepresented to or considered by the Plan Administrator orthe Third Party Administrators at the time they made thedecision that is the subject of review. Accepting anybenef its or making any claim for benefits under this Planconstitutes agreement with and consent to any decisionsthat the Plan Administrator or the Third PartyAdministrators make, in their sole discretion, and, further,means that the Covered Person consents to the limitedstandard and scope of review afforded under law.-3-7670-00-412374

BENEFIT CLASS DESCRIPTIONThe Covered Person's benefit class is determined by the designations shown below:ClassClass DescriptionBenefit Network**PlanA01ALL ACTIVE EMPLOYEES WITH 750 DEDUCTIBLE0010L-XZA03ALL ACTIVE EMPLOYEES WITH HDHP SINGLE COVERAGE0030L-XZA04ALL ACTIVE EMPLOYEES WITH HDHP FAMILY COVERAGE0040L-XZC01ALL COBRA PARTICIPANTS WITH 750 DEDUCTIBLE0010L-XZC03ALL COBRA PARTICIPANTS WITH HDHP SINGLE COVERAGE0030L-XZC04ALL COBRA PARTICIPANTS WITH HDHP FAMILY COVERAGE0040L-XZR01ALL RETIRED EMPLOYEES UNDER 65 WITH 750 DEDUCTIBLE 0010L-XZR03ALL RETIRED EMPLOYEES UNDER 65 WITH HDHP SINGLECOVERAGE0030L-XZR04ALL RETIRED EMPLOYEES UNDER 65 WITH HDHP FAMILYCOVERAGE0040L-XZ**Note: See the Provider Network section of this SPD for network description.-4-7670-00-412374

LOCATION tingSub001LUTHER COLLEGE EMPLOYEE HEALTH PLAN700 COLLEGE DRDECORAH IA 521010010001-5-7670-00-412374

MEDICAL SCHEDULE OF BENEFITSBenefit Plan(s) 001All health benefits shown on this Schedule of Benefits are subject to the following: Deductibles, Co -pays,Plan Participation rates, and out-of-pocket maximums, if any. Refer to the Out-of-Pocket Expenses andMaximums section of this SPD for more details.Benefits listed in this Schedule of Benefits are subject to all provisions of this Plan, including anybenef it determination based on an evaluation of medical facts and covered benefits. Refer to theCovered Medical Benefits and General Exclusions sections of this SPD for more details.Important: Prior authorization may be required before benefits will be considered for payment. Failure toobtain prior authorization may result in a penalty or increased out-of-pocket costs. Refer to the CareManagement section of this SPD for a description of these services and prior authorization procedures.Note: Refer to the Provider Network section for clarifications and possible exceptions to the in-network orout-of-network classifications.If a benef it maximum is listed in the middle of a column on the Schedule of Benefits, it is a combinedMaximum Benefit for services that the Covered Person receives from all in-network and out-of-networkproviders and facilities.Annual Deductible Per Calendar Year: Per Person Per Family Individual "Embedded" DeductibleIN-NETWORKOUT-OF-NETWORK 750 1,500 750 750 1,500 75080%60% 3,000 6,000 3,000 3,500 7,000 3,50080%80%100%(Deductible Waived)60%Note: If You Have Family Coverage, AnyCombination Of Covered Family Members May HelpMeet The Maximum Family Deductible; However,No One Person Will Pay More Than His or HerIndividual Deductible Amount.Plan Participation Rate, Unless Otherwise StatedBelow: Paid By Plan After Satisfaction Of DeductibleAnnual Total Out-Of-Pocket Maximum: Per Person Per Family Individual "Embedded" Out-Of-PocketNote: If You Have Family Coverage, AnyCombination Of Covered Family Members May HelpMeet The Family Out-Of-Pocket Maximum;However, No One Person Will Pay More Than HisOr Her Individual Out-Of-Pocket Amount.Ambulance Transportation: Paid By Plan After In-Network DeductibleBreast Pumps: Paid By Plan After Deductible-6-7670-00-412374

IN-NETWORKOUT-OF-NETWORK80%60%100%(Deductible Waived)60%80%60% 40100%(Deductible Waived)Not Applicable60%True Emergency Room / Emergency Physicians: Paid By Plan After In-Network Deductible80%80%Non-True Emergency Room / EmergencyPhysicians: Paid By Plan After Deductible80%60% 20100%(Deductible Waived)Not Applicable60%Contraceptive Methods And ContraceptiveCounseling Approved By The FDA:For Men: Paid By Plan After DeductibleFor Women: Paid By Plan After DeductibleDurable Medical Equipment: Paid By Plan After DeductibleEmergency Services / Treatment:Urgent Care: Copay Per Visit Paid By Plan After DeductibleWalk-In Retail Health Clinics: Copay Per Visit Paid By Plan After DeductibleExtended Care Facility Benefits, Such As SkilledNursing, Convalescent, Or Subacute Facility: Maximum Days Per Calendar Year Paid By Plan After DeductibleHome Health Care Benefits: Maximum Visits Per Calendar Year Paid By Plan After Deductible90 Days80%60%45 Visits80%60%Hospice Services: Paid By Plan After Deductible80%60%Bereavement Counseling: Paid By Plan After Deductible80%60%Respite Care: Paid By Plan After Deductible80%60%Note: A Home Health Care Visit Will Be ConsideredA Periodic Visit By A Nurse, Qualified Therapist, OrQualified Dietician, As The Case May Be, Or Up ToFour Hours Of Home Health Care Services.Hospice Care Benefits:-7-7670-00-412374

IN-NETWORKOUT-OF-NETWORKPre-Admission Testing: Paid By Plan After Deductible80%60%Inpatient Services / Inpatient Physician Charges;Room And Board Subject To The Payment OfSemi-Private Room Rate Or Negotiated Room Rate: Paid By Plan After Deductible80%60%Outpatient Services / Outpatient PhysicianCharges: Paid By Plan After Deductible80%60%Outpatient Imaging Charges: Paid By Plan After Deductible80%60%Outpatient Lab And X-Ray Charges: Paid By Plan After Deductible80%60%80%60%Hospital Services:Outpatient Surgery / Surgeon Charges: Paid By Plan After DeductibleManipulations: Maximum Visits Per Calendar Year Copay Per Visit Paid By Plan After Deductible35 Visits 40Not Applicable100%60%(Deductible Waived)Visit Maximums Are Applied Based On ProviderDesignation And Procedure Code (If A ProviderBills For A Manipulation And A Therapy On TheSame Claim, Only One Visit Will Be Applied To TheManipulation Maximum Based On The Provider’sDesignation).Maternity:Routine Prenatal Services: Paid By Plan After DeductibleNon-Routine Prenatal Services, Delivery, AndPostnatal Care: Paid By Plan After DeductibleMental Health, Substance Use Disorder, AndChemical Dependency Benefits: Paid By Plan After DeductibleNursery And Newborn Expenses: Paid By Plan After Deductible100%(Deductible Waived)60%80%60%80%60%80%60%Note: Deductible And / Or Co-pay Will Be WaivedFor Preventive / Routine Well Newborn Charges,Initial Stay (Days 0-5).-8-7670-00-412374

Physician Office Services: Copay Per Visit Paid By Plan After DeductibleOffice Surgery: Paid By Plan After DeductibleAllergy Injections And Sublingual Drops: Co-pay Per Visit Paid By Plan After DeductibleAllergy Testing: Co-pay Per Visit Paid By Plan After DeductibleAllergy Serum: Co-pay Per Visit Paid By Plan After DeductibleDiagnostic X-Ray And Laboratory Tests: Co-pay Per Visit Paid By Plan After DeductibleOffice Advanced Imaging: Paid By Plan After DeductibleAcupuncture: Co-pay Per Visit Paid By Plan After DeductibleChemotherapy: Paid By Plan After DeductiblePreventive / Routine Care Benefits. See GlossaryOf Terms For Definition. Benefits Include:From Age 7Preventive / Routine Physical Exams AtAppropriate Ages: Paid By PlanThird Party Exams: Paid By PlanImmunizations: Paid By Plan-9-IN-NETWORKOUT-OF-NETWORK 40100%(Deductible Waived)Not Applicable60%80%No Benef it 20100%(Deductible Waived)Not ApplicableNo Benef it 20100%(Deductible Waived)Not ApplicableNo Benef it 20100%(Deductible Waived)Not ApplicableNo Benef itNot ApplicableNo Benef itNot ApplicableNo Benef it80%Not Applicable 40100%(Deductible Waived)Not ApplicableNo Benef it80%Not Applicable100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)7670-00-412374

Foreign Travel Immunizations: Paid By Plan After In-Network DeductiblePreventive / Routine Diagnostic Tests, Lab, AndX-Rays At Appropriate Ages: Paid By PlanPreventive / Routine Mammograms And BreastExams: Paid By PlanIN-NETWORKOUT-OF-NETWORK80%80%100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)Note: For In-Network, First Mammogram PerCalendar Year Covered At Preventive / RoutineBenefits Regardless Of Diagnosis.Preventive / Routine Pelvic Exams And Pap Tests: Paid By PlanPreventive / Routine PSA Test And ProstateExams: Paid By PlanPreventive / Routine Screenings / Services AtAppropriate Ages And Gender: Paid By PlanPreventive / Routine Colonoscopies,Sigmoidoscopies, And Similar Routine SurgicalProcedures Performed For Preventive Reasons: Paid By PlanPreventive / Routine Hearing Exams: Paid By PlanPreventive / Routine Tobacco Addiction: Maximum Benefit Per Calendar Year Paid By Plan1 Smoking Cessation Program100%100%(Deductible Waived)(Deductible Waived)Note: The Smoking Cessation Program IsConsidered A Discontinuance Of Any TobaccoProducts. This Coverage Does Not Apply ToCovered Persons Who Are In-Patient And AreGiven Any Type Of Deterrent During Their Stay,Unless They Have Been Taking The Drug(s) PriorTo Their Stay-10-7670-00-412374

Preventive / Routine Counseling For Alcohol AndSubstance Use Disorder, Tobacco Use, Obesity,Diet, And Nutrition: Paid By PlanIN-NETWORKOUT-OF-NETWORK100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)80%80%100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)100%(Deductible Waived)60%(Deductible Waived)80%60%100%(Deductible Waived)60%In Addition, The Following Preventive / RoutineServices Are Covered For Women: Treatment For Gestational Diabetes Papillomavirus DNA Testing Counseling For Sexually TransmittedInfections (Provided Annually) Counseling For Human Immune-DeficiencyVirus (Provided Annually) Breastfeeding Support, Supplies, AndCounseling Counseling For Interpersonal And DomesticViolence For Women (Provided Annually)Paid By PlanPreventive / Routine Care Benefits For ChildrenInclude:Preventive / Routine Physical Exams: Paid By PlanImmunizations: Paid By PlanForeign Travel Immunizations: Paid By Plan After In-Network DeductiblePreventive / Routine Screenings / Services AtAppropriate Ages: Paid By PlanPreventive / Routine Diagnostic Tests, Lab, AndX-Rays: Paid By PlanPreventive / Routine Hearing Exams: Paid By PlanSterilizations:For Men: Paid By Plan After DeductibleFor Women: Paid By Plan After Deductible-11-7670-00-412374

IN-NETWORKOUT-OF-NETWORKTeladoc Services:General Medicine: Copay Per Visit Paid By Plan 20100%(Deductible Waived)Telemedicine: Copay Per Visit Paid By Plan After DeductibleTherapy Services:Occupational / Physical / Speech OutpatientHospital Therapy Only: Paid By Plan After DeductibleOccupational / Physical / Speech Outpatient OfficeTherapy Only: Copay Per Visit Paid By Plan After Deductible 20100%Not Applicable60%80%60% 40100%(Deductible Waived)Not Applicable60%Note: Medical Necessity Will Be Reviewed After 25Visits.Vision Care Benefits:Eye Exam: Maximum Benefit Per Calendar Year IncludingRef raction Paid By PlanRefraction:Included In Eye Exam Maximum Paid By PlanAll Other Covered Expenses: Paid By Plan After Deductible-12- 50100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)80%60%7670-00-412374

MEDICAL SCHEDULE OF BENEFITSBenefit Plan(s) 003, 004All health benefits shown on this Schedule of Benefits are subject to the following: Deductibles, Co -pays,Plan Participation rates, and out-of-pocket maximums, if any. Refer to the Out-of-Pocket Expenses andMaximums section of this SPD for more details.Benefits listed in this Schedule of Benefits are subject to all provisions of this Plan, including anybenef it determination based on an evaluation of medical facts and covered benefits. Refer to theCovered Medical Benefits and General Exclusions sections of this SPD for more details.Important: Prior authorization may be required before benefits will be considered for payment. Failure toobtain prior authorization may result in a penalty or increased out-of-pocket costs. Refer to the CareManagement section of this SPD for a description of these services and prior authorization procedures.Note: Refer to the Provider Network section for clarifications and possible exceptions to the in-network orout-of-network classifications.If a benef it maximum is listed in the middle of a column on the Schedule of Benefits, it is a combinedMaximum Benefit for services that the Covered Person receives from all in-network and out-of-networkproviders and facilities.Annual Deductible Per Calendar Year: Single Coverage Family Coverage Individual "Embedded" DeductibleNote: If You Have Family Coverage, AnyCombination Of Covered Family Members May HelpMeet The Maximum Family Deductible; However,No One Person Will Pay More Than His Or HerIndividual Deductible Amount.Plan Participation Rate, Unless Otherwise StatedBelow: Paid By Plan After Satisfaction Of DeductibleAnnual Co-Pay Out-Of-Pocket Maximum: Single Coverage Family Coverage Individual "Embedded” Out-Of-PocketMaximumNote: If You Have Family Coverage, AnyCombination Of Covered Family Members May HelpMeet The Family Out-Of-Pocket Maximum;However, No One Person Will Pay More Than HisOr Her Individual Out-Of-Pocket Amount.Ambulance Transportation: Paid By Plan After DeductibleBreast Pumps: Paid By Plan After Deductible-13-IN-NETWORKOUT-OF-NETWORK 3,000 6,000 3,000 3,000 6,000 3,000100%100% 3,000 6,000 3,000 3,000 6,000 3,000100%100%100%(Deductible Waived)100%7670-00-412374

IN-NETWORKOUT-OF-NETWORK100%100%100%(Deductible Waived)100%100%100%100%100%100%100%Contraceptive Methods And ContraceptiveCounseling Approved By The FDA:For Men: Paid By Plan After DeductibleFor Women: Paid By Plan After DeductibleDurable Medical Equipment: Paid By Plan After DeductibleEmergency Services / Treatment:Urgent Care: Paid By Plan After DeductibleEmergency Services / Treatment: Paid By Plan After DeductibleExtended Care Facility Benefits, Such As SkilledNursing, Convalescent, Or Subacute Facility: Maximum Days Per Calendar Year Paid By Plan After DeductibleHome Health Care Benefits: Maximum Visits Per Calendar Year Paid By Plan After Deductible90 Days100%100%45 Visits100%100%Hospice Services: Paid By Plan After Deductible100%100%Bereavement Counseling: Paid By Plan After Deductible100%100%100%100%Pre-Admission Testing: Paid By Plan After Deductible100%100%Inpatient Services / Inpatient Physician Charges;Room And Board Subject To The Payment OfSemi-Private Room Rate Or Negotiated Room Rate: Paid By Plan After Deductible100%100%Outpatient Services / Outpatient PhysicianCharges: Paid By Plan After Deductible100%100%Note: A Home Health Care Visit Will Be ConsideredA Periodic Visit By A Nurse, Qualified Therapist, OrQualified Dietician, As The Case May Be, Or Up ToFour Hours Of Home Health Care Services.Hospice Care Benefits:Respite Care: Paid By Plan After DeductibleHospital Services:-14-7670-00-412374

IN-NETWORKOUT-OF-NETWORKOutpatient Imaging Charges: Paid By Plan After Deductible100%100%Outpatient Lab And X-Ray Charges: Paid By Plan After Deductible100%100%100%100%Outpatient Surgery / Surgeon Charges: Paid By Plan After DeductibleManipulations: Maximum Visits Per Calendar Year Paid By Plan After Deductible35 Visits100%100%100%(Deductible %Visit Maximums Are Applied Based On ProviderDesignation And Procedure Code (If A ProviderBills For A Manipulation And A Therapy On TheSame Claim, Only One Visit Will Be Applied To TheManipulation Maximum Based On The Provider’sDesignation).Maternity:Routine Prenatal Services: Paid By Plan After DeductibleNon-Routine Prenatal Services, Delivery, AndPostnatal Care: Paid By Plan After DeductibleMental Health, Substance Use Disorder, AndChemical Dependency Benefits: Paid By Plan After DeductibleNursery And Newborn Expenses: Paid By Plan After DeductibleNote: Deductible And / Or Co-pay Will Be WaivedFor Preventive / Routine Well Newborn Charges,Initial Stay (Days 0-5).Physician Office Visit. This Section Applies ToMedical Services Billed From A Physician OfficeSetting:This Section Does Not Apply To: Preventive / Routine Services Manipulation Services Billed By AnyQualifying Provider Dental Services Billed By Any QualifyingProvider Therapy Services Billed By Any QualifyingProvider Any Services Billed From An OutpatientHospital Facility Paid By Plan After DeductiblePhysician Office Services: Paid By Plan After Deductible-15-7670-00-412374

IN-NETWORKOUT-OF-NETWORK100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%100%100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)100%(Deductible Waived)Preventive / Routine Care Benefits. See GlossaryOf Terms For Definition. Benefits Include:From Age 7Preventive / Routine Physical Exams AtAppropriate Ages: Paid By PlanThird Party Exams: Paid By PlanImmunizations: Paid By PlanForeign Travel Immunizations: Paid By Plan After In-Network DeductiblePreventive / Routine Diagnostic Tests, Lab, AndX-Rays At Appropriate Ages: Paid By PlanPreventive / Routine Mammograms And BreastExams: Paid By PlanNote: For In-Network, First Non-RoutineMammogram Per Calendar Year Covered AtPreventive / Routine Benefits After Deductible.Preventive / Routine Pelvic Exams And Pap Tests: Paid By PlanPreventive / Routine PSA Test And Prostate Exams: Paid By PlanPreventive / Routine Screenings / Services AtAppropriate Ages And Gender: Paid By PlanPreventive / Routine Colonoscopies,Sigmoidoscopies, And Similar Routine SurgicalProcedures Performed For Preventive Reasons: Paid By PlanPreventive / Routine Hearing Exams: Paid By Plan-16-7670-00-412374

Preventive / Routine Counseling For Alcohol AndSubstance Use Disorder, Tobacco Use, Obesity,Diet, And Nutrition: Paid By PlanPreventive / Routine Tobacco Addiction: Maximum Benefit Per Calendar Year Paid By PlanIN-NETWORKOUT-OF-NETWORK100%(Deductible Waived)100%(Deductible Waived)1 Smoking Cessation Program100%100%(Deductible Waived)(Deductible Waived)Note: The Smoking Cessation Program IsConsidered A Discontinuance Of Any TobaccoProducts. This Coverage Does Not Apply ToCovered Persons Who Are In-Patient And AreGiven Any Type Of Deterrent During Their Stay,Unless They Have Been Taking The Drug(s) PriorTo Their StayIn Addition, The Following Preventive / RoutineServices Are Covered For Women: Treatment For Gestational Diabetes Papillomavirus DNA Testing Counseling For Sexually TransmittedInfections (Provided Annually) Counseling For Human Immune-DeficiencyVirus

LUTHER COLLEGE EMPLOYEE HEALTH PLAN DECORAH IA Health Benefit Summary Plan Description 7670-00-412374 Effective 01-01-2020 . Name, Address, And Phone Number Of Plan Administrator LUTHER COLLEGE EMPLOYEE HEALTH PLAN 700 COLLEGE DR DECORAH IA 52101 563-387-1415 Named Fiduciary LUTHER COLLEGE EMPLOYEE HEALTH PLAN