Transcription

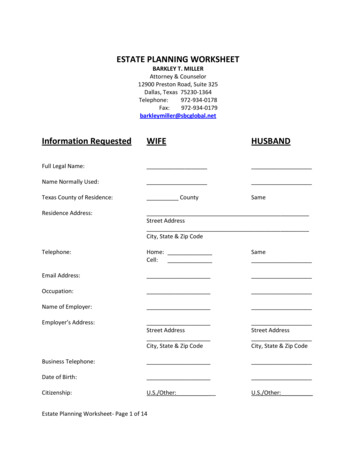

Estate Planning WorksheetUSING THIS ORGANIZER WILL ASSIST US IN DESIGNING AN ESTATE PLAN THAT MEETS YOUR GOALS.ALL INFORMATION PROVIDED IS STRICTLY CONFIDENTIAL.PLEASE BRING THESE FORMS WITH YOU TO YOUR VISION MEETING. PLEASE COMPLETE THESE FORMS TOTHE BEST OF YOUR ABILITY TO ENSURE A PRODUCTIVE AND INFORMATIVE MEETING.Heritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.com

Page 1Part IPersonal InformationSpouse #1 Legal Name(name most often used to title property and accounts)Home AddressCity State ZipCounty of Residence Home Phone Business PhoneCell PhoneCell phone number to text appointment confirmationsE-mail communication Yes NoE-mail AddressBirthdate Date of Marriage US Citizen? YesEmployer NoPositionSpouse #2 Legal Name(name most often used to title property and accounts)Home AddressCity State ZipCounty of Residence Home Phone Business PhoneCell PhoneCell phone number to text appointment confirmationsE-mail communication YesE-mail AddressBirthdate Date of Marriage US Citizen? YesEmployer No NoPositionFinancial Advisor Telephone NumberAccountant Telephone NumberYour ConcernsPlease rate the following as to how important they are to you:(H high concern, S some concerned, L low concern, N/A no concern or not applicable)ClientSpouseDesire to create a personalized, comprehensive plan to manage affairs in case of death or disability.SelectSelectAvoiding a conservatorship (“living probate”) in case of a disability (financial and medical).SelectSelectPlanning for a child with disabilities or special needs, such as medical or learning disabilities.SelectSelectProtecting children’s inheritance from the possibility of failed marriages, creditors or bad habits.SelectSelectProtecting the children’s inheritance from the surviving spouse’s remarriage (the pool boy).SelectSelectReducing administration costs and inconvenience to your loved ones at time of your death.SelectSelectPreserving the privacy of affairs in case of disability or at time of death.SelectSelectAvoiding will contests or other disputes upon death.SelectSelectAvoiding probate (attorney’s fees, public court proceedings, lengthy delays) upon your death.SelectSelectProtecting a healthy spouse from a long-term care crisis and/or nursing home poverty.SelectSelectProtecting assets from lawsuits and creditors.SelectSelectProtecting inherited IRAs/retirement assets from excess taxation and children’s poor choices.SelectSelectAvoiding or reducing your estate and inheritance taxes.SelectSelectOther Concerns:Heritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.com

Page 2Children(Use full legal name. Use “JT” if both spouses are the parents, “#1” if Spouse #1 is the parent, “#2” if Spouse #2 is the parent).NameBirth date1.Parent or RelationshipAddress PhSpouse’s Name2.Address PhSpouse’s Name3.Address PhSpouse’s Name4.Address PhSpouse’s NameImportant Family Questions(Please check “Yes” or “No” for your answer)Are you (or your spouse) receiving Social Security, disability, or other governmental benefits? DescribeIf married, have you and your spouse signed a pre- or post-marriage contract? Please furnish a copyHave you (or your spouse) ever filed federal or state gift tax returns?Please furnish copies of these returnsHave you (or your spouse) completed previous will, trust, or estate planning? Please furnish copies ofthese documentsDo you support any charitable organizations now, or are there any others in the future that you wish tomake provisions for at the time of your death? If so, please explain below.Are you (or your spouse) currently the beneficiary of anyone else’s trust? If so, please explain below.Do any of your children have special educational, medical, or physical needs?Do any of your children receive governmental support or benefits?Do you provide primary or other major financial support to adult children or others?Additional InformationHeritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.comYesNo

Page 3Part IIProperty InformationReal PropertyTYPE: Any interest in real estate including your family residence, vacation home, timeshare, vacant land, etc.General Description and/or AddressOwnerMarketValueTotalLoanBalanceValuable Personal EffectsTYPE: List separately only major personal effects such as jewelry, collections, antiques, furs, and all other valuable non-businesspersonal property (indicate type below and give a lump sum value for miscellaneous, less valuable items.).Type or DescriptionOwnerMarket ValueTotalAutomobiles, Boats, and RVsTYPE: For each motor vehicle, boat, RV, etc. please list the following: description, how titled, market value and encumbrance:Bank AccountsTYPE: (indicate type below ) Checking Account “CA”, Savings Account “SA”, Certificates of Deposit “CD”, Money Market “MM”.Do not include IRAs or 401(k)s hereName of Institution and account numberTypeOwnerAmountTotalNote: If Account is in your name (or your spouse’s name) for the benefit of a minor, please specify and give minor’s name.Heritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.com

Page 4Stocks and BondsTYPE: List any and all stocks and bonds you own. If held in a brokerage account, lump them together under each account.(indicate type below) (*ACCOUNT NUMBERS ARE NOT REQUIRED*)Stocks, Bonds or Investment AccountsTypeAcct. NumberOwnerAmountTotalLife Insurance Policies and AnnuitiesTYPE: (indicate type below) Term, whole life, split dollar, group life, annuity. ADDITIONAL INFORMATION: Insurancecompany, type, face amount (death benefit), whose life is insured, who owns the policy, the current beneficiaries, who pays thepremium, and who is the life insurance agent. (*ACCOUNT NUMBERS ARE NOT REQUIRED*)Life Insurance Policies or AnnuitiesTypeAcct. NumberOwnerAmountTotalRetirement PlansTYPE: (indicate type below) Pension (P), Profit Sharing (PS), H.R. 10, IRA, SEP, 401(K). ADDITIONAL INFORMATION:Describe the type of plan, the plan name, the current value of the plan, and any other pertinent information. (*ACCOUNT NUMBERSARE NOT REQUIRED*)Retirement AccountsTypeAcct. NumberOwnerTotalHeritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.comAmount

Page 5Business InterestsTYPE: (indicate type below) General and Limited Partnerships, Sole Proprietorships, privately-owned corporations, professionalcorporations, oil interests, farm, and ranch interests. ADDITIONAL INFORMATION: Give a description of the interests, who hasthe interest, your ownership in the interests, and the estimated value of the interests.TotalMoney Owed to YouTYPE: Mortgages or promissory notes payable to you, or other moneys owed to you.Name of DebtorDate ated Inheritance, Gift, or Lawsuit JudgmentTYPE: Gifts or inheritances that you expect to receive at some time in the future; or moneys that you anticipate receiving through ajudgment in a lawsuit. Describe in appropriate detail.DescriptionTotal estimated valueOther AssetsTYPE: Other property is any property that you have that does not fit into any listed category.TypeOwnerTotalHeritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.comValue

Heritage Elder Law & Estate Planning, LLC 318 South Main Street, Butler, Pennsylvania 16001 Phone: (724) 841-0004 Fax: (724) 841-0024 www.HeritageElderLaw.com Estate Planning Worksheet USING THIS ORGANIZER WILL ASSIST US IN DESIGNING AN ESTATE PLAN THAT MEETS YOUR GOALS. ALL INFORMATION PROVIDED IS STRICTLY CONFIDENTIAL.