Transcription

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Delancey Street Partners is pleased to present our Contract ResearchOrganization (“CRO”) Sector Review for Q4 2016. CROs providesupport to the pharmaceutical, biotechnology and medical deviceindustries through outsourced research and development servicesthat span drug discovery, preclinical research, clinical ,andpharmacovigilance. As the pharmaceutical industry has evolved andmatured, pharmaceutical companies are dedicating their resourcesand efforts to particular areas of the industry’s value chain and havedeveloped vendor relationships to perform non-core functions. CROshave benefited from this trend, capturing a growing share of the corefunctions that large pharmaceutical companies now seek to outsource.This CRO Sector Review identifies current trends affecting the CRO industry and a view of the ramifications for M&A activity inthe sector.Executive SummarySummary ObservationsToday’s pharmaceutical development process is characterizedby increased complexity, larger trial sizes, and changes inprotocol design to better manage data requirements and payordemands.These trends have created pressure onpharmaceutical companies to seek and exploit efficiencies in thedrug development and commercialization process. At the sametime, pharmaceutical companies are seeking to consolidate andsimplify the supply chain, concentrating sourcing among aselect number of multi-service providers. In response, largeCROs are actively expanding their offerings beyond core clinicalresearch services.Strong underlying pharmaceutical demand, coupled withincreasing complexity and regulatory burden, have created afavorable environment for CROs. Incremental outsourcing ofadditional processes to qualified CROs brings cost efficiency tothe process and improves quality control and speed to market.The most significant near-term opportunities for CROs are in theareas of data-driven development strategies, commercializationexpertise, and regulatory consulting. Differentiated expertise inthese areas is scarce in the market, and we have seen an increasein M&A among large CROs to acquire these capabilities. As aresult, the M&A market is favorable for smaller specialty serviceproviders that offer unique expertise. Spending on drug development is increasing Pharmaceutical companies are seeking to simplify thesupply chain and reduce their total number of vendors Role of CROs expanding to include a variety ofancillary services, creating a “one-stop” option forpharmaceutical companies and leading to strategicpartnerships Large CROs find it is often easier to “buy” rather than“build” specialized expertise The Quintiles IMS merger highlights migration oftraditional CRO model outside of core research services Active interest among private equity investors inbuilding differentiated CRO platforms M&A market is robust for specialty service providertargets with scale The CRO sector trades at a current and historicalpremium to the S&P 500About Delancey Street PartnersDelancey Street Partners is an independent, industry-focused investment bank. We serve CEOs, Entrepreneurs, Shareholders andBoards of Directors of high growth and middle market private and public companies. Our services include strategic advisory,capital raising and independent board advice. We advise on sell-side and buy-side M&A, growth capital financings andrecapitalizations. Our focus sectors include Business Services & Technology, Healthcare, Industrial & Industrial Technology, andInfrastructure.Learn more at:www.delanceystreetpartners.com Page 1

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Recent Delancey Street CRO ActivityDelancey Street Partners is pleased to announce that we served as financial advisorto ExecuPharm, Inc. (“ExecuPharm” or “the Company”), a leading globalfunctional service provider, in its sale to PAREXEL International Corporation(“PAREXEL”). ExecuPharm selected Delancey as its advisor for our M&Aexpertise and long-term partnership model. Over several years we partnered withthe Company to assess, evaluate and explore strategic alternatives within thecontext of the rapidly evolving and dynamic pharmaceutical industry. Wemanaged a highly selective and targeted sell-side M&A process and structured andnegotiated the terms of the transaction.About ExecuPharm, Inc.Established in 1995, ExecuPharm (www.execupharm.com) provides clients withqualified professionals across functional areas, such as clinical monitoring andstudy management. The Company also provides core operational activitiesincluding onboarding, training, line management, performance management andpolicy administration. The Company is headquartered in King of Prussia,Pennsylvania, and serves many of the top 20 pharmaceutical corporations, as wellas mid-sized and small biopharmaceutical companies.About PAREXEL International Corporation (NYSE: PRXL)PAREXEL (www.PAREXEL.com) is a leading global biopharmaceutical servicescompany, providing a broad range of expertise-based clinical research, consulting,medical communications and technology solutions and services to the worldwidepharmaceutical, biotechnology and medical device industries. Committed to providing solutions that expedite time-to-market andpeak-market penetration, PAREXEL has developed significant expertise across the development and commercializationcontinuum, from drug development and regulatory consulting to clinical pharmacology, clinical trials management andreimbursement. PAREXEL Informatics provides advanced technology solutions, including medical imaging, to facilitate the clinicaldevelopment process. Headquartered near Boston, Massachusetts, PAREXEL has offices in 84 locations in 51 countries around theworld, and has approximately 18,600 employees.Delancey Street Partners LeadershipAndrew SchmuckerWilliam FilipPatrick DolanDavid AllebachManaging ing Director484.533.6312wfilip@delanceyllc.comManaging 484.533.6315dallebach@delanceyllc.com Page 2

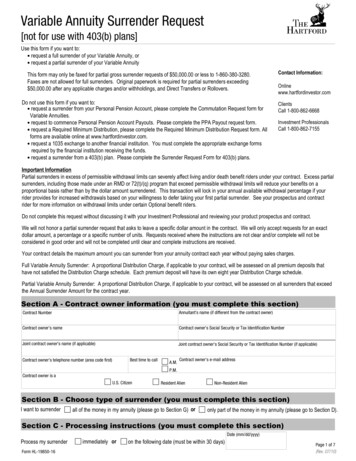

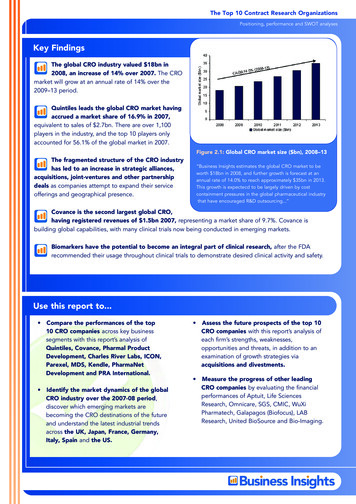

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016The CRO Landscape: Positive Outlook with Steady GrowthFDA new drug approvals FDA new drug approvals increasing, motivatinggrowth in pharmaceutical product pipelines 2015 approvals at the highest level in nearly 20 years Record approvals of orphan drugs, the development ofwhich relies heavily on CROs Continued steady growth in R&D spend supported byrobust market for new drugs The cost to develop a drug has increased 145% since2003 to more than 2.6 billion Only one FDA approval for every 5,000-10,000compounds evaluated CRO industry experiencing strong growth Clear benefit from outsourcing Specialty and expanded services providing attractivesource of incremental revenue Market remains highly fragmented with many small,specialty providers Large CROs compete for partnerships withpharmaceutical companies to bolster market share Active consolidation as leading CROs seek sources ofgrowthSource: FDA (CDER NME NDAs/BLAs Approvals).Pharmaceutical R&D spend( in billions)Source:EvaluatePharma.CRO Industry Revenue( in billions)Source: Zion Research.CRO Industry Market ShareSource: KPMG – CROs, convergence and commercial opportunities. Page 3

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Spotlight Trend: The Evolving CRO ModelWe see a pronounced trend of CROs expanding their traditionalmodels to include a variety of ancillary services, a strategy thathas changed the dynamic between pharmaceutical companyand CRO from purely “client/vendor” to that of “strategicpartnership.” Outsourcing of additional specialty servicesenables pharmaceutical companies to focus on their corebusiness of intellectual property development and portfoliomanagement. Increased outsourcing has led to a high volumeof consolidation among CROs, as large CROs seek to bolsterstrategic client partnerships and increase the share of totalservice revenue across the product lifecycle.Despite inherent growth in core clinical research spending,public companies serving the pharmaceutical industry find itchallenging to meet shareholder growth expectations throughorganic initiatives alone. For example, PAREXEL (NYSE:PRXL)has communicated a long-term revenue growth expectation of10-12% annually. While CROs can develop ancillary services inhouse, many turn to M&A to gain access to scale and expertisein these areas more rapidly. This has created an appetite forspecialty service providers, particularly in the areas of dataanalytics, laboratory services, commercialization services,regulatory consulting, and pharmacovigilance. The evolution ofQuintiles, culminating in the merger of Quintiles and IMSHealth (highlighted on page 5), is an example of a large CRO(Quintiles) seeking to differentiate itself through additionalservices in a competitive market.Expansion of CRO Service OfferingThe traditional model has evolved beyond core research to include avariety of ancillary services as large CROs seek to increase their strategicpartnerships and “share of wallet” with pharmaceutical companiesIllustrative Recent M&ADateNov 2016BuyerBracketTargetCLINappsTarget DescriptionClinical supply chain managementsoftwareOct 2016PAREXELExecuPharmFunctional Service ProviderApr 2016PRA Health Sciences NextrialsTrial management electronic data capturesoftwareFeb 2016PAREXELHealth AdvancesIndependent life sciences strategyconsulting servicesSep 2015BioClinicaSynowledgeDrug safety and regulatory affairsconsulting servicesJul 2015PRA Health Sciences Value Health SolutionsClinical software developerApr 2015PAREXELQuantum Solutions IndiaSpecialized pharmacovigilance servicesFeb 2015ICONMediMedia Pharma SolutionsMedical and scientific communicationstrategy consulting servicesM&A ImplicationsLarge CROs seek targets with sufficient scale that can deliver animmediate material impact on revenue and provide access tonew markets. The most attractive targets materially augmentthe buyer’s existing services and provide opportunity to solidifyclient partnerships. For smaller service providers without thisscale, private equity has emerged as a potential alternative, asfinancial sponsors seek to build high quality CRO platforms bycombining smaller, niche providers.As shown in the chart to the right, we have seen theconsolidation trend among CROs lead to historically high sectorvaluation multiples. Of 26 transactions reviewed since 2009, themedian EV/EBITDA multiple was 10.4x and every availabletransaction over the past 18 months was above the historicalmedian. We see this valuation momentum maintained intoday’s market.Source: CapitalIQ.Historical Sector M&A Multiples (EV/ LTM EBITDA)20.0x16.0x12.0x8.0x4.0x0.0xDec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16Exponential TrendlineEV / LTM EBITDA Transaction MultipleSource: CapitalIQ and Delancey Street Partners. Page 4

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Quintiles Case Study: Building a Multi-Function CRO Platform Through M&AQuintiles has historically been acquisitive, and provides a usefulcase study in examining the strategy of a large CRO using M&Ato achieve growth and augment services. As shown in ouranalysis, the market has largely rewarded this long-termgrowth, with Quintiles’ (NYSE:Q) stock price up more than 80%over the past three years. The following is a summary andrationale for Quintiles’ recent acquisition history. October 2011: Quintiles acquires Outcome Sciences for 177 million Market leader in registries, post-approval researchand quality-improvement initiatives for biopharma,medical device and governmentStrengthened Quintiles’ late-phase offerings Provider of genomic sequencing Expands Quintiles’ personalized medicine capabilitiesMay 2013: Quintiles raises 947 million as part of InitialPublic Offering August 2013: Quintiles acquires Novella Clinical Provider of preclinical to post-approval clinical trialmanagement services Additionally, provider of resourcingincluding FSP and contracting staffing 4,000.0 3,295.0 3,692.0 3,808.0 4,165.0 4,326.0 2,000.0 0.0201120122013201420152016EQuintiles Historical Trading PerformancesolutionsProvider of IT consulting services to healthcaremarket as well as clinical, strategy and physicianadvisory servicesMay 2015: Quintiles acquires Clio Science 5,611.9 6,000.0May 2014: Quintiles acquires Encore Health Resources ( in billions)Source: CapitalIQ.August 2012: Quintiles acquires Expression Analytics Quintiles Revenue GrowthFull service CRO in JapanNovember 2016: Quintiles merges with IMS Health.Rationale for the merger includes: Integration of IMS Health’s Real World Evidence(RWE) analytics, consulting, outsourcing andtechnology services to make Quintiles IMS an end-toend service provider for pharmaceutical clients Creation of the world’s largest portfolio of healthcareinformation, therapeutic & regulatory expertise, andproprietary technologies with presence in 100 countries Strengthening of client strategic partnerships throughdeep integration of data servicesSource: CapitalIQ.Market Reaction to the Merger Value of a “smarter CRO” is still to be demonstrated byQuintiles IMS, but the company has delivered to date onmerger expectations, with revenue estimates in line andcost synergies double what was anticipated Quintiles’ share price is up 17% since announcement of themergerSource: CapitalIQ. Page 5

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016The Role of Private EquityPrivate equity plays an important role in the consolidating CROsector. While there is a high level of strategic M&A among largeCROs, many smaller companies in the sector lack the size andscale to be attractive targets for strategic buyers. A number ofmiddle market private equity firms have made platforminvestments in the industry and are actively searching foradditional opportunities in keeping with this thesis.Sample Private Equity PlatformsPrivate Equity GroupPlatform CompanyCertain attributes make the CRO sector highly attractive forprivate equity investment, including the following: Strong pharmaceuticalend market growth High profitability Minimal cap exrequirements Highly fragmented withopportunities forconsolidation Clear exit alternatives Pathway to multipleexpansion on exitPrivate equity can represent an attractive interim step forsmaller CROs, providing capital and strategic direction forgrowth.Private Equity Platform Case StudyPrivate equity has demonstrated an ability to build leading CRO platforms through M&A and create substantial value over a multiyear period. PRA Health Sciences, which went public in 2014, represents the culmination of a successful private equity platformthat developed over nearly 15 years and included four separate private equity sponsors. Page 6

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Current Trading Performance of Select CROsEnterprise Value / EBITDA( in .0x0.0xCharles RiverEnterprise ValueRevenueThree-Year Revenue CAGREBITDA Margin 4,681.71,568.512.4%23.0%ICONINC ResearchPRA Health 4,404.61,634.77.8%22.6% 3,206.61,008.716.7%22.0% 4,251.51,528.723.6%17.5%PAREXELQuintiles 3,696.32,078.94.3%17.1% 10,878.14,540.113.8%18.7%Source: CapitalIQ.Year-to-Date Sector Trading Performance vs. S&P 500SectorPerformanceS&P 500111DSP CRO Index107DSP CRO IndexS&P 500Price (Indexed to 100)115110 Strong sector performance year-to-date in 2016105 U.S. presidential election provided support formultiple economic sectors, and S&P 500 hasoutperformed the CRO sector since the election General sentiment that the Trump administration willbe a positive for the pharmaceutical industry, and theproviders serving 6Aug-16Sep-16Oct-16Nov-1685Dec-16Source: CapitalIQ.5-Year Enterprise Value / EBITDA Trend20.0x17.5x15.0xDSP CRO IndexS&P rMinS&P 500Current5-Year CurrentMedian5-YearMaxSource: CapitalIQ. Page 7

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Comparable Company AnalysisCOMPANYSTOCK PERFORMANCE AND COMPANY DATAName12/8/1652-WeekLowHighMarketValue( mm)EnterpriseValue( mm)LTM MARGINSRevenueLTM( mm)GrossProfit% MarginGROWTHVALUATION DATAEBITDA% Margin5-YearEPSCAGR3-YearRevsCAGREV /RevenueLTM2016EV /EBITDALTM2016Price /Earnings20162017Clinical Research OrganizationsCharles River Laboratories International, Inc.ICON Public Limited CompanyINC Research Holdings, Inc.PRA Health Sciences, Inc.PAREXEL International CorporationQuintiles IMS Holdings, Inc.MeanMedianHighLow 73.5276.4949.8554.5765.2777.54 65.7062.3134.1935.6051.1655.01 89.1885.7457.1160.9671.1381.45 3,516.14,306.92,811.73,497.73,501.79,446.4 4,681.74,404.63,206.64,251.53,696.310,878.1 x14.6x17.1x18.7x16.0x17.2x 4,513.43,508.99,446.42,811.7 5,186.54,328.010,878.13,206.6 .4x16.6x18.7x14.6xRecent M&A and Strategic Commentary from Select CRO Executives“Clients increasingly rely on us because of the breadth of our portfolio and our scientific expertise. We believe it iscritically important that we continue to strategically expand our portfolio, both through internal development andtargeted acquisitions, so that we can continue to expand our ability to support our client's early-stage drug researchefforts.” (James Foster, Chairman and CEO, November 2, 2016)“We will continue to drive future revenue growth by further enhancing our service capabilities and entering newmarkets. As part of this strategy, we closed the clinical acquisition during the quarter. ClinicalRM brings to ICONdeep expertise in how to operate within the market for government and NGO-sponsored research, and they will leadICON's efforts to further penetrate this market segment. Alongside targeted M&A, we're deploying capital to returnvalue to shareholders through share repurchases. Last quarter, we received approval to buy back shares of up to circaUSD 400 million, and since commencing the current program on October 1, we have repurchased shares worthapproximately USD 28 million.” (Ciaran Murray, Chairman and CEO, October 20, 2016)“I love INC's position from a balance sheet perspective. Our leverage is close to 1.5x or 1.75x in that range. So ourbalance sheet gives us the flexibility to do a series of tuck-in acquisitions, which is probably our preference. And alsoobviously, do larger hundreds of millions of dollars of acquisitions. So we like the flexibility. We are not adverse to alarger acquisition, it's not necessarily our preference. But if the right deal came across, we would certainly be willingto do that. Acquisitions are our first priority in terms of capital deployment.” (Gregory Rush, CFO and EVP,November 8, 2016)“We continue to be encouraged by our strong levels of new business awards, which we believe will help drive arevenue recovery. We are executing on our growth strategy to expand our service offerings, and strategic acquisitionsare an important part of that strategy, and the ExecuPharm acquisition is a good example. We also remain committedto maximizing shareholder value through sustained margin improvement efforts.” (Josef von Rickenbach, Chairmanand CEO, October 30, 2016)“[raising cash and paying down debt is] does actually allow us to have a lot of dry-powder if something arises. Theteam and the board are pretty ambitious and are willing to make a bold move if the right opportunity arises and we'llkeep looking.” (Colin Shannon, President and CEO, November 3, 2016)“But in essence, we have a pipeline of ongoing small niche kind of things to acquire, again, capabilities or an accessto a market. And mostly, what we bought at IMS were technology capabilities. We moved the company from beingpurely a market research data-focused company to more of a full-service information technology and servicescompany providing a lot of analytical tools and software platforms to manage data.” (Ari Bousbib, Chairman andCEO, November 15, 2016) Page 8

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Recent CRO M&A ActivityActiveDateTargetAcquirorTarget Business Description11/17/16CLINapps Inc.BracketSoftware development & consulting services to pharmaceutical and biotechnology industries11/10/16inVentiv Health Clinical, Inc.Advent International CorporationContract drug development services for biopharmaceutical and medical device companies10/20/16BioClinica, Inc.CinvenIntegrated clinical research technology solutions for the biopharmaceutical industry10/03/16ExecuPharm Inc.PAREXEL International CorporationFunctional Service Provider services for the biopharmaceutical industry09/28/16Agilux Laboratories, Inc.Charles River Laboratories International, Inc.Metabolism and pharmacokinetic services for the pharmaceutical industry09/19/16ClinicalRM, Inc.ICON Public Limited CompanyResearch, regulatory and sponsor services for the biopharmaceutical industry09/01/16EVIDERAPharmaceutical Product Development, LLCHealth information and research services for life sciences organizations08/04/16IMS Health Holdings, Inc. (NYSE:IMS)Quintiles Transnational Holdings Inc.Information and technology services to healthcare industry worldwide08/03/16InClinica, Inc.Velocity Fund ManagementClincial research outsourcing services for the pharmaceutical industry07/25/16Compass Research, LLCBioClinica, Inc.Clinical research and trial services for the biopharmaceutical industry06/27/16Blue Stream Laboratories, Inc.Charles River Laboratories International, Inc.Contract analytical, formulations and development-support laboratory services05/31/16Medelis, Inc.WCCT Global, LLCOncology contract research services for the biopharmaceutical industry05/25/16Privacy Analytics Inc.IMS Health Holdings, Inc.Data anonymization software solutions for healthcare and related industries05/03/16eResearchTechnology, Inc.Nordic CapitalTechnology-driven services for the biopharmaceutical industry and medical devices04/04/16WIL Research Company, Inc.Charles River Laboratories International, Inc.Global contract research organization for the biopharmaceutical industry03/18/16Nextrials, Inc.PRA Health Sciences, Inc.Trial management electronic data capture software for the biopharmaceutical industry03/01/16Research Across America Inc.Synexus LimitedClinical research trial services for the pharmaceutical industry02/10/16Health Advances, LLCPAREXEL International CorporationStrategy consulting services for the healthcare industry02/08/16CRO Analytics, LLCBen Franklin Technology PartnersClinical research performance data collection, reporting and consulting services01/31/16AlphaImpactRx, Inc.IMS Health Holdings, Inc.Research-based insights, analytics and solutions to biopharmaceutical and other industries01/19/16Clinverse, Inc.BioClinica, Inc.Cloud-based clinical payments system for the pharmaceutical industry12/04/15PMG Research, Inc.ICON Public Limited CompanyClinical research and trial services for the biopharmaceutical industry11/18/15Oncotest GmbHCharles River Laboratories International, Inc.Preclinical pharmacological contract research services for the pharmaceutical industry10/23/15Neuro-Sys SASUndisclosedPreclinical drug discovery modeling services for the pharmacetical industry10/15/15Agenda1 Analytical Services LimitedConcept Life Sciences LimitedContract analytical support services to pharmaceutical industry09/30/15TFS Trial Form Support International ABRatos ABClinical contract research services for the pharmaceutical industry09/21/15Synowledge LLCBioClinica, Inc.Drug safety and regulatory affairs consulting services for the pharmaceutical industry09/02/15Clinical Professionals LtdCPL Resources plcPharmaceutical research and development recruitment services07/31/15Value Health SolutionsPRA Health SciencesClinical trial management software for the pharmaceutical industry07/24/15Celsis International Ltd.Charles River Laboratories International, Inc.Bacterial detection and microbial screening systems for the pharmaceutical industry07/22/15Healthcare Data Solutions, LLCIMS Health Holdings, Inc.Database information services for the healthcare industry07/06/15MediciGroup, Inc.BioClinica, Inc.Patient recruitment services for the pharmaceutical industry07/02/15Effektor A/SIMS Health Holdings, Inc.Data warehousing and business intelligence services for the healthcare industry07/01/15Rehfeld Partners A/SIMS Health Holdings, Inc.Information management and business intelligence services for the health industry06/30/15TRIALCAMP SLLEurofins Agroscience Services LimitedContract research services for the biopharmaceutical industry06/26/15WCCT Global, LLCMedivate Partners LLCEarly drug development and late phase services to biopharmaceutical industry05/19/15Clio ScienceQuintiles Transnational Holdings Inc.Contract research services for the biopharmaceutical industry05/05/15Dataline Software LimitedIMS Health Holdings, Inc.Rapid analysis and visualization services for the healthcare industry04/13/15Quantum Solutions IndiaPAREXEL International CorporationSpecialized pharmacovigilance services02/27/15MediMedia Pharma SolutionsICON Public Limited CompanyMedical and scientific communication strategy consulting servicesSource: CapitalIQ. Page 9

Contract Research OrganizationsM&A and the Evolving CRO ModelSector Review Q4 2016Information on Delancey Street PartnersFive Tower Bridge, Suite 420300 Barr Harbor DriveWest Conshohocken, PA 19428www.delanceystreetpartners.comSecurities offered through SSG Capital Advisors, LLCMember SIPC Member FINRAAll other transactions effectuated through Delancey Street Partners, LLCThe information and views contained in this report were prepared by Delancey Street Partners, LLC (“DSP”). It is not a research report, as such term is defined by applicable law andregulations, and is provided for informational purposes only. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instruments or toparticipate in any particular trading strategy. DSP makes no representation as to the accuracy or completeness of the information presented in this report. DSP may be a market maker orspecialist in, act as adviser or lender to, have positions in and effect transactions in securities of companies mentioned herein and also may provide, may have provided, or may seek toprovide investment banking services for those companies. In addition, DSP or its respective officers, directors and employees may hold long or short positions in the securities, optionsthereon or other related financial products of companies discussed herein. Opinions, estimates and projections in this report constitute DSP’s judgment and are subject to change withoutnotice. The financial instruments discussed in this report may not be suitable for all investors, and investors must make their own investment decisions using their own independentadvisors as they believe necessary and based upon their specific financial situations and investment objectives. Also, past performance is not necessarily indicative of future results. Nopart of this material may be copied or duplicated in any form or by any means, or redistributed, without DSP’s prior written consent. Page 10

Delancey Street Partners is pleased to present our Contract Research Organization ("CRO") Sector Review for Q4 2016. CROs provide support to the pharmaceutical, biotechnology and medical device industries through outsourced research and development services that span drug discovery, preclinical research, clinical research,