Transcription

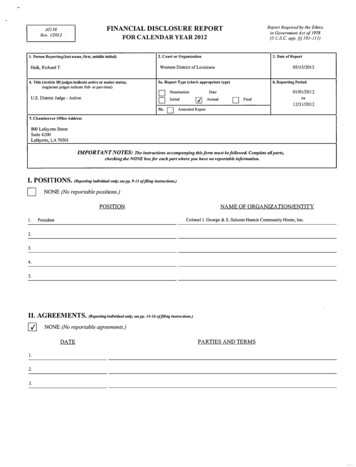

Comprehensive AnnualFinancial ReportBraswellHigh SchoolOpeningFall 2016BellElementaryOpeningFall 2016Fiscal Year Ended June 30, 20161307 N. Locust Street Denton, Texas 76201

Comprehensive Annual Financial Reportof theDenton Independent School Districtfor theFiscal Year Ended June 30, 2016Prepared by:Division of Administrative ServicesDeborah MonschkeAssistant Superintendent of Administrative Services1307 N. Locust Street · Denton, Texas 76201

DENTON INDEPENDENT SCHOOL DISTRICTCOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE YEAR ENDED JUNE 30, 2016TABLE OF CONTENTSINTRODUCTORY SECTIONLetter of Transmittal.ASBO Certificate of ExcellenceGFOA Certificate of AchievementOrganizational ChartElected OfficialsAppointed OfficialsConsultants and AdvisorsI8910111213FINANCIAL SECTIONIndependent Auditors' ReportManagement's Discussion and AnalysisBasic Financial Statements:Government-wide Financial Statements:Statement ofNet PositionStatement of ActivitiesFund Financial Statements:Balance Sheet - Governmental FundsReconciliation of the Governmental Funds Balance Sheet to theStatement of Net PositionStatement of Revenues, Expenditures and Changes inFund Balances - Governmental FundsReconciliation of the Governmental Funds Statement of Revenues,Expenditures, and Changes in Fund Balances to theStatement of ActivitiesStatement of Net Position - Proprietary FundsStatement of Revenues, Expenses, and Changes inFund Net Position - Proprietary FundsStatement of Cash Flows - Proprietary FundsStatement of Fiduciary Assets and LiabilitiesNotes to the Financial StatementsRequired Supplementary Information:Budgetary Comparison Schedule - General FundSchedule of the District's Proportionate Share of the Net PensionLiability - Teachers Retirement SystemSchedule of the District Contributions - Teachers Retirement SystemNotes to the Required Supplementary InformationSupplementary Information:Combining and Individual Fund Statements and Schedules:Combining Balance Sheet - Nonmajor Governmental FundsCombining Statement of Revenues, Expenditures andChanges in Fund Balances - Nonmajor Governmental FundsCombining Statement of Net Position - Nonmajor Enterprise FundsCombining Statement of Revenues, Expenses, and Changesin Fund Net Position - Nonmajor Enterprise FundsCombining Statement of Cash Flows - Nonmajor Enterprise FundsCombining Statement of Net Position - Internal Service FundsCombining Statement of Revenues, Expenses, and Changesin Fund Net Position - Internal Service 00101102

TABLE OF CONTENTS (CONTINUED)Combining and Individual Fund Statements and Schedules (Continued):Combining Statement of Cash Flows - Internal Service FundsBudgetary Comparison Schedule - Debt Service FundBudgetary Comparison Schedule - Child Nutrition FundStatement of Changes in Assets and Liabilities - Agency Funds103104105106STATISTICAL SECTION (Unaudited)Statistical ContentsNet Position by ComponentChanges in Net PositionFund Balances of Governmental FundsChanges in Fund Balances of Governmental FundsAssessed Value - Real and Personal PropertyProperty Tax Rates Direct and Overlapping GovernmentsPrincipal Property TaxpayersProperty Tax Levies and CollectionsRatio of Bonded Debt to Assessed Value and Bonded Debt per CapitaDirect and Overlapping Governmental Activities Debt.Legal Debt Margin InformationDemographic and Economic StatisticsCapital Asset InformationPrincipal EmployersOperating StatisticsStaff InformationTeacher Salary DataEnrollment and Attendance DataMiscellaneous Statistical 34136138139140SINGLE AUDIT SECTIONIndependent Auditors' Report on Internal Control Over Financial Reporting and on Complianceand Other Matters Based on an Audit of Financial Statements Performed inAccordance with Government Auditing StandardsIndependent Auditors' Report on Compliance for Each Major Program and on Internal Controlover Compliance Required by the Uniform GuidanceSchedule of Findings and Questioned CostsStatus of Prior Year FindingsSchedule of Expenditures of Federal AwardsNotes to Schedule of Expenditures of Federal Awards141143145146147149

Introductory Section

DENTON INDEPENDENT SCHOOL DISTRICTOffice of the Assistant SuperintendentAdministrative ServicesP.O. Box 2387Denton, Texas 76202December 16, 2016To the Board of Trustees and the Citizens of the DentonIndependent School District:The Comprehensive Annual Financial Report (CAFR) of the Denton Independent School District(“DISD” or the “District”) for the year ended June 30, 2016, is hereby submitted. Responsibility for boththe accuracy of the data and the completeness and fairness of the presentation, including all disclosures,rests with the District. To the best of our knowledge and belief, the enclosed data is accurate in allmaterial respects and is reported in a manner designed to present fairly the financial position and results ofoperations of the various funds of the DISD. All disclosures necessary to enable the reader to gain anunderstanding of the District’s financial activities have been included.The DISD is required to undergo an annual single audit in conformity with the provisions of the SingleAudit Act of 1984 as amended in 1996 and Title 2 U.S. Code of Federal Regulations Part 200,Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Awards(Uniform Guidance). Information relating to this single audit, including the schedule of expenditures offederal awards, findings and recommendations and independent auditors’ reports on internal controls andcompliance with applicable laws and regulations, is included in the single audit section.This report includes all funds of the Denton Independent School District. The DISD maintains a fullyaccredited early childhood through grade twelve program and is accredited by both the Texas EducationAgency and AdvancED. The District provides a full range of services. These services include generaleducation for grades pre-kindergarten through twelve, special education for students from birth throughtwenty-one years of age, accelerated education for students requiring remediation, a variety of technicalcourses and a number of elective and advanced placement courses for those students who wishadditional experiences or challenges.Generally Accepted Accounting Principles (GAAP) requires that management provide a narrativeintroduction, overview and analysis to accompany the basic financial statements in the form ofManagement’s Discussion and Analysis (MD&A). This letter of transmittal is designed to complementMD&A and should be read in conjunction with it. The District’s MD&A can be found immediatelyfollowing the report of the independent auditors.1

GOVERNING BODYThe seven members of the Board of Trustees serve - without compensation - a three-year term of office.On a rotating basis, two or three places are filled during annual elections held in May. Vacancies may befilled by appointment until the next election. Candidates must be qualified voters of the District.Regular meetings are typically scheduled the second and fourth Tuesdays of the month and are held in theDistrict’s administration building. Special meetings and study sessions are scheduled as needed andannounced in compliance with public notice requirements.The Board has final control over local school matters limited only by the state legislature, by the courtsand by the will of the people as expressed in school Board elections. Board decisions are based on amajority vote of the quorum present. Generally, the Board adopts policies, sets direction for curriculum,employs the Superintendent and oversees the operations of the District and its schools. Besides generalBoard business, Trustees are charged with numerous statutory regulations including appointing the taxassessor/collector, calling trustee and other school elections and canvassing the results, organizing theBoard and electing its officers. The Board is also responsible for setting the tax rate, setting salaryschedules and acting as a board of appeals in personnel and student matters, confirming recommendationsfor textbook adoptions and adopting and amending the annual budget.ECONOMIC CONDITION AND OUTLOOKThe Denton Independent School District is located in the city of Denton, in Denton County of NorthCentral Texas and encompasses approximately 180 square miles. While the major portion of the Districtboundaries includes the 97.411 square miles of the City of Denton, all or part of the following additionalcities, communities or major developments in Denton County comprise the 180 square miles: Argyle,Bartonville, Copper Canyon, Corinth, Cross Roads, Cross Oaks Ranch, Double Oak, Lantana, LincolnPark, Oak Point, Prosper, Providence, Paloma Creek, Robson Ranch, Savannah and Shady Shores.According to the U.S. Census Bureau and the City of Denton, Denton County’s population increased3.42 percent from 2014 to 2015 census estimate, which resulted in a population of 780,612 in 2015compared to 754,792 in 2014. The city of Denton reported a growth rate of 2.21 percent for the sameperiod of time with a population of 131,044, compared to 128,205 in 2014. Denton has a diverse laborpool of both skilled and professional workers. At June 30, 2016, the Texas Workforce Commissionreported an available workforce in the City of Denton of 71,213 with an unemployment rate of 3.60%.Denton is located 38 miles northwest of Dallas and 36 miles northeast of Fort Worth. Denton businesseshave easy access to air, rail and highways. The area has four airports: Alliance Airport, Dallas/Fort WorthInternational Airport, Dallas Love Field, and Denton Municipal Airport. The Kansas City Southern andUnion Pacific railroads also provide service to Denton. The Denton County Transportation Authority(DCTA) provides public transportation within the City of Denton and between Denton and Dallas.Transportation offerings include passenger rail via the A-Train (connects to Dallas Area Rapid Transit railin Carrollton), bus service via Connect, and a commuter vanpool program.Denton is home to two universities and one college: The University of North Texas, Texas Woman’sUniversity and North Central Texas College. This access to higher education enhances the quality of lifein Denton. These three institutions are a major source of public employment for Denton and thesurrounding area. In the private sector, more than 100 private companies distribute, manufacture, producegoods and provide employment to area residents.2

The student population has steadily increased over the past five years at an average growth rate ofapproximately 2.75 percent annually. The school district plans its budget based on estimated studentenrollment and state aid earned based on student attendance. Total enrollment for the year ended June 30,2016 was 27,296 with an average daily attendance rate of 94.33%. Enrollment was projected to be27,297 for the 2016-2017 school year.The Denton Independent School District continues to be the district of choice in Denton County. AsCharter Schools expand throughout the state, DISD enrollment has continued to rise with little effect fromthe Charter movement. In August 2016 actual student enrollment grew over 1,300 students. A smallpercentage of the 1,300 students were students returning to the district from local Charter schools for moreopportunity, access to rigor, and specialized programming. As the district of choice, Denton ISD has astable future, and an opportunity to contribute to the economic vitality of the community by providingspecialized, high-level education.The school district’s facilities are in excellent condition and its major maintenance plan continues toimprove all of its facilities and operations. The average age of instructional campuses in the District istwenty five years. Twelve of the twenty two elementary campuses have been built since 2001. Of thetwelve secondary campuses in the District, six campuses have been built since 2001, and both earlychildhood campuses were built since 2001. The district’s twenty third elementary school and fourthcomprehensive high school, Bell Elementary School and Braswell High School respectively, opened inAugust 2016. Construction of Rodriquez Middle School is in progress and scheduled for opening inAugust 2017. Renovations and an addition to Guyer High School, as well as the administrative supportservices building are in the planning phase. The 2016 total tax rate for the school district is 1.54/ 100valuation. The tax rate has two components: maintenance and operations and debt service. Themaintenance and operations portion funds the daily operations of the school district. The debt serviceportion funds the principal and interest on general obligation long-term debt.MAJOR INITIATIVESThe Denton Independent School District (DISD) continues to meet the standards of the TexasAccountability System outlined by the Texas Education Agency. In 2015-2016, all DISD campus metthese standards with many campuses receiving several distinctions. This assessment is more rigorous,and the accountability standards have risen with the rigor. In addition, the graduation rate of DISDstudents continues to be above 98%.Under the new assessment system the district and all of its campuses were rated by the Texas EducationAgency for the fourth year. While there is no comparative data for the newly developed assessment, theperformance of district students continues to outpace both the state and the region in all grade levels in allcontent areas.All of the schools in the Denton ISD are accredited by the Texas Education Agency. In addition, thehigh schools are accredited through AdvancED. The district and Board of Trustees are committed toproviding the best educational programs possible in the critical areas of Science, Technology,Engineering, Arts and Math. These content areas are integrated so students are better prepared for 21stcentu

Ratio ofBonded Debt to Assessed Value and Bonded Debt per Capita 124 Direct and Overlapping Governmental Activities Debt. 127 Legal Debt Margin Information 128 Demographic and Economic Statistics 130 Capital Asset Information 131 Principal Employers 132 Operating Statistics 134 StaffInformation 136 Teacher Salary Data 138 Enrollment and Attendance Data 139 Miscellaneous